Should a pensioner pay child support?

Important! Please keep in mind that:

- Each case is unique and individual.

- A thorough study of the issue does not always guarantee a positive outcome. It depends on many factors.

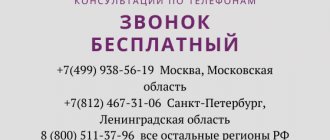

To get the most detailed advice on your issue, you just need to choose any of the options offered:

- Use the online chat in the lower corner of the screen.

- Call: Federal number: +7 (800) 511-86-74

Parents are obliged to raise and financially support their children - this is an indisputable rule. At the same time, it is absolutely not important for the legislator whether the child’s father works or not. Alimony is collected even from citizens who have ceased their working activity and been sent on a well-deserved rest. The above Resolution describes in detail from which types of pensions payments to minor children are withheld and from which ones are not. Pensioners pay alimony from the following types of benefits received:

| No. | Type of state benefit |

| 1. | Old age pension. |

| 2. | Disability pension. |

| 3. | Benefits for combat veterans. |

| 4. | Preferential pensions for work or service under circumstances involving risk to life and danger. For example, alimony is collected from a pensioner of the Ministry of Internal Affairs and other law enforcement agencies, which provide for the assignment of a pension on preferential terms. |

Old-age pensions in Russia are granted to women after reaching 55 years of age, and to men after reaching 60 years of age. A mandatory condition for applying for a subsidy is having at least 8 years of work experience. If a person’s duration of activity is shorter, then a pension will be assigned to him only 5 years after the generally established age, respectively - for a man at 65 years old, and for a woman - at 60 years old. From citizens receiving both a general and preferential pension, alimony is collected from two types of pensions.

Alimony is collected even from the pension of a disabled person. A citizen who has been diagnosed with a disability is required to undergo a medical examination every year to determine his or her health status and confirm his or her disability. Otherwise, payments are suspended.

With the onset of retirement age, some citizens do not intend to stop working. They continue to work either under a previously concluded employment contract with the same employer, or join a new organization. Alimony from a working pensioner must also be deducted from the benefits he receives. In addition, since the pensioner is officially employed, payments are also withheld from wages, vacation pay, sick leave and bonuses he receives. Thus, the law gives an unequivocal affirmative answer to the question of whether a pensioner pays alimony - yes, he does.

How to apply for alimony for a pensioner?

Alimony is collected from a pensioner in the standard ways provided for in Article 80 of the Family Code.

With the voluntary consent of the retired husband, help the child financially

The law allows the recovery of alimony from a retired husband with his own consent, without litigation, by drawing up a special agreement on payments. Such an agreement contains a voluntary obligation of the parent to provide financial assistance to his natural children. In the document, the parties independently establish the timing of the transfer of funds to support the child, the type of assistance provided and the amount. The agreement must be drawn up in the presence of a notary. This is a legal requirement and cannot be ignored. Otherwise, the concluded agreement will not have legal force.

If the retired husband refuses to help the child financially

If the party does not have a voluntary desire to provide financial support, child support from the pensioner is collected through the court. The procedure for going to court is the same as in all alimony cases with other categories of defendants. The law does not establish a special procedure for assigning payments to retired husbands. The mother raising and supporting the child must submit a statement of claim to the magistrate's court. If it is difficult to get to the defendant’s court site, then you are allowed to go to court within your residence. The magistrate considers child support cases if the claim does not make demands for recognition of paternity, and also when third interested parties are not involved in the process. If such moments occur, then the claim should be filed immediately in the district court.

Before filing a claim, you must collect the following package of documents:

- passport of the plaintiff mother;

- marriage or divorce certificate (alimony is taken from pensioners both during the period the plaintiff is married and after the official breakup of family relations);

- children's birth certificates;

- a certificate from the management company of a residential building or from the passport office about the residence of the mother and children;

- a certificate confirming the amount of income of the mother;

- a certificate confirming the amount of pension payments from the father.

In addition to the listed papers, other documents may be brought to the attention of the court. For example, papers confirming special, additional expenses for maintaining a child. When resolving the case, the judge tries to preserve the child’s usual standard of living as much as possible. If before filing the claim, the son or daughter attended an art school for a long time, then after its consideration, the monthly expenses for this child’s hobby will most likely be recovered from the father.

The statement of claim is drawn up in the usual way, setting out the requirement to collect alimony as a percentage (). Let us remind you that plaintiffs are exempt from paying state fees.

On what grounds are documents submitted for alimony payments?

The easiest way to prove in cases of separation and official divorce is that the ex-spouse does not fulfill his duties towards the child. And it is much more difficult to do this if the couple lives in a common area and manages their joint property . This fact usually provides for a general budget, when the money earned is spent on household needs, utility bills and the purchase of products rationally and by mutual agreement.

However, there are husbands who, due to greed or other reasons, forget about the law and do not fulfill their obligations to support the child . The provisions of the law establish the right to receive financial assistance to the following persons:

- children who have not reached the age of majority, despite the financial capabilities of the father;

- children over 18 years of age (child support is paid according to an agreement concluded with the father);

- a disabled child at any age due to disability;

- spouse during pregnancy;

- a spouse on parental leave to care for a small child;

- a wife who has received a disability;

- a wife caring for her husband’s brother or sister (children under 14 years of age);

- a spouse caring for a disabled child.

Who has the right to recovery?

Child support, if the father is a pensioner, can be collected by the following persons:

- the mother or father who actually lives with the child, raising and providing for him financially;

- guardians and trustees if blood parents are absent or deprived of their parental rights;

- guardianship authorities in situations where there is a clear fact that the child needs financial support, but his parents are unable to resolve the issue of financial support on their own.

If we are talking about collecting alimony for a disabled adult child, then the child himself or his legal representative can file a claim in court. The same applies to the issue of assigning payments to wives or ex-wives.

Controversial issues

The problematic issue when collecting funds for the maintenance of a spouse and child during marriage is proof of the fact that the man does not participate in the maintenance of family members.

In most cases, the court satisfies the women's demands.

In practice, there are situations when funds are collected from a man who lives with the recipient and pays wages to the family budget. The document can be challenged within a month from the date of the decision.

Divorce is not a prerequisite for the recovery of funds from a spouse for the maintenance of his wife and child. Spouses can resolve the issue voluntarily or through the court. The plaintiff must prove the need for funds and evidence of the lack of help from the husband.

Conditions for collecting alimony from a pensioner

Payment of alimony by pensioners is made according to general rules. When resolving a case in court, not only the financial situation of the mother raising the child is taken into account, but also the size of the father’s pension. If the amount of old-age benefits he receives is several times lower than the subsistence level in the region of residence, then the court may reduce the amount of required alimony. The court is also interested in the marital status of the parties and whether they have other dependents in need of financial support.

In addition to all that has been said, documentary evidence of the blood relationship between the child and the defendant father is required. In most cases, this document is the child's birth certificate. If it does not contain information about the father, then before applying for alimony, it is necessary to prove in court that this particular person is the father of the child. Also, the mandatory conditions for assigning payments include the confirmed fact of need of a minor child. The lack of financial resources is determined based on the information provided on the income certificates of the mother supporting the child.

In what cases is alimony from the pension not withheld?

Resolution No. 841 contains only one type of pension, from which it is not possible to collect alimony under any exceptional circumstances.

Alimony is not collected from a non-working pensioner if he receives a survivor's pension. Payments from all other types of pension subsidies are withheld.

In addition to federal monthly and lifetime payments to pensioners, most constituent entities of the Russian Federation have established other subsidies and compensations:

- provision of free seasonal cards for public transport;

- compensation for necessary medications;

- other payments operating at the local level.

Article 101 of the Federal Law No. 229 of 2007 states that alimony cannot be recovered from a number of such payments, namely:

- from various types of subsidies related to compensation for harm to health, in connection with the infliction of injury, concussion;

- from compensation of costs for the purchase of vouchers to sanatoriums and health holiday homes;

- with payment of travel to the sanatorium and back.

For all other pensioner benefits, alimony is withheld taking into account the annual indexations and increases.

How much alimony does a pensioner pay?

Do pensioners pay less child support? No, the same amounts are collected from them as from working citizens. Since a pension is a stable, regular source of income, alimony is always awarded in the form of interest. According to the RF IC, a quarter of the pension is paid for one child, a third for two, and half of the pension for three, four or more children. For example, if a father’s pension is 20,000 rubles, then for one child 5,000 rubles are due, for two – 6,600 rubles, and for three or more – 10,000 rubles.

According to the rules of enforcement proceedings for alimony, more than 70% of the money received by the defendant cannot be withheld. Practice shows that in relation to pensioners, cases of penalties in such percentages are rare.

Current questions and answers

- Question 1.

How is alimony calculated for the wife?

Answer 1.

The amount of alimony payment in respect of a spouse is established as a fixed amount. But here the husband’s income and the wife’s real expenses are taken into account, the amount of which should not exceed the permissible minimum.- Question 2.

Based on judicial practice, in what cases does the court most often refuse to grant alimony deductions in marriage?

Answer 2.

The court often refuses to collect alimony from a wife if there is a common household, when there is no concrete evidence or witnesses that the spouse does not spend money on buying clothes for the child and does not bear the costs of organizing his leisure time. What is important here is the testimony of witnesses that the family has a separate budget and the child is constantly in need.- Question 3.

What cases are regarded by the court as “failure to provide maintenance” to a child?

Answer 3.

By the phrase “failure to provide maintenance” to the child on the part of the father, the court means a categorical failure to provide funds for the needs of the child or very rarely providing money in insufficient quantities.