If the father dishonestly fulfills his duties to the child or directly refuses to support him after the divorce, then the mother’s only option is to file a claim in court. Based on the prevailing family circumstances, the court will make a decision. No one can refuse this mother’s request, since the obligation to support one’s children under 18 years of age is not just a desire, but a requirement that is regulated by law (Article 80 of the RF IC). The result of a positive decision by the judge to collect monthly payments for the child from the father will be a writ of execution for alimony. What is this document and how important is it?

What is a writ of execution

The writ of execution is considered an administrative document, the official form of which is specified in Decree of the Government of the Russian Federation No. 579 of July 31, 2008. The completed document is submitted to various authorities. When collecting alimony, such a sheet is obtained in a magistrate or federal court, or in a judicial body of general jurisdiction.

Decree of the Government of the Russian Federation of July 31, 2008 No. 579 “On forms of writs of execution”

Contents of the document

The writ of execution contains the following information:

- series and document number;

- information about the court - name, address, etc.;

- information about the day a specific court decision was made and entered into legal force;

- the essence of the court decision;

- passport information about the alimony payer;

- amount of financial assistance per child;

- payment procedure.

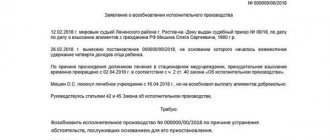

Sample writ of execution for alimony

Attention! Collection of child support is carried out only if a blank writ of execution is correctly drawn up. This form is stamped with the seal of the specific court and the signature of the judge.

To whom is the writ of execution issued?

The writ of execution is issued to the following persons:

- plaintiff-claimant of alimony;

- bailiff from the Federal Bailiff Service (FSSP).

A writ of execution is issued in 1 of 2 places - in the court office (during reception hours) or immediately in the courtroom. This document is sent to the bailiff from the FSSP in accordance with the procedure established by law.

Where do you get the document?

Before submitting to the FSSP or to the accounting department at the place of work of the alimony payer a specific writ of execution on the assignment of alimony, perform the following actions:

- Draw up and file a claim in the magistrate’s court at their registration or at the place of residence of the second parent-defendant;

- On a specific day they come to a court hearing;

- They study the judge’s decision and after such a document enters into legal force, they receive a writ of execution.

According to Art. 428 of the Code of Civil Procedure of the Russian Federation, the writ of execution is independently transferred to the regional branch of the FSSP or the assistant judge is asked to do this. Since 2015, such a document will be certified with an electronic digital signature (EDS) of the judge and sent to the final authority (FSSP).

Article 428 of the Civil Procedure Code of the Russian Federation “Issuance of a writ of execution by the court”

Checking the writ of execution by number

When searching for a specific writ of execution by its number, perform the following actions:

- Open the FSSP website - fssprus.ru;

- Go to the “Services” section, and then click on the “Database” tab;

In "Services" select "Data Bank..." - Click on the option “Search by ID number”;

- Select your region, enter the document number, select the “Writ of Execution” option and indicate the name of the authority that issued this paper;

O and select “Writ of Execution” - Click on the “Find” button.

When you find a writ of execution on the FSSP website, you will find out its number, the amount of debt, the name and address of a specific FSSP branch, as well as the name and contact details of the bailiff. When receiving additional information, call a specific FSSP employee.

When does the document come into force?

According to Art. 211 of the Code of Civil Procedure of the Russian Federation, after a specific court order is issued to collect alimony payments, such a document is subject to immediate execution. However, according to Art. 321 of the Code of Civil Procedure of the Russian Federation, this occurs within 30 days after the issuance of such an order. This is the time given to file an appeal.

Read also: Debt of alimony after the death of the debtor

Article 211 of the Civil Procedure Code of the Russian Federation “Court decisions subject to immediate execution”

Article 321 of the Civil Procedure Code of the Russian Federation “Procedure and deadline for filing appeals and presentations”

What is immediate execution?

According to Art. 211 of the Code of Civil Procedure of the Russian Federation, the issuance of a specific writ of execution, which is subject to immediate execution, is carried out when collecting various amounts of alimony and in the following situations:

- when workers are paid wages for 3 months;

- upon reinstatement to a specific previous job;

- when a Russian is included in the list of referendum participants.

Attention! In case of immediate execution of a specific writ of execution, alimony is collected immediately after the court order is issued, and not after it enters into legal force.

This is done for the entire period - from the date of filing the official statement of claim in the magistrate’s court until the document is received by the FSSP.

I filed for alimony, but what next?

After a person has filed a claim for alimony in court, he must wait for the date of the hearing and, preferably, be present at it or at least send his representative. Based on the results of the meeting, the court’s decision will be announced, and the parties will receive it in writing. From this moment, another 1 month must pass, which is given to the defendant to challenge the decision. If the defendant still does not react, then the decision comes into force. On its basis, a writ of execution is issued, which is used to ensure that the bailiff service begins its work and collects alimony.

What do they do with the writ of execution after receiving it?

Often the court is not informed about the procedure after the announcement of a child support order. As a result, after receiving a new writ of execution, many citizens of the Russian Federation do not know what to do next.

Where do they belong?

After receiving a new writ of execution for alimony, perform 1 of 3 actions:

- inactive. In this case, the deadline for paying alimony is monitored. Such money stops being paid when the child turns 18-21 years old;

- go to the accounting department of the employer of the alimony payer;

- visit the FSSP office at the debtor’s place of registration.

After the official court order is issued, the writ of execution is sent to the accounting department of the company where the debtor works. Also in this situation, a statement is drawn up indicating the details for the transfer of specific alimony amounts. If the alimony payer is unemployed or works unofficially, then in this case they go to the FSSP.

What is the deadline for submitting for execution?

The court order is executed immediately from the moment it is announced.

However, more often defendants file an appeal against such a court verdict. The court decision is challenged within 10 days. If the complaint is not drawn up, then this document enters into legal force.

A writ of execution for alimony is submitted for execution immediately after the court order is issued, and does not wait another 10 days. The validity period of the first document is equal to the entire time of payment of alimony payments. Another 3 years of limitation period are added to this period.

What to do if child support payments are delayed?

The first step in case of delay in alimony is to submit a written application addressed to the manager with a demand for payment of the penalty and the possibility of going to court or to the bailiffs. The deadline for submitting a response is also indicated.

If there is no response or systematic delays, it is recommended to immediately contact the bailiff leading the individual entrepreneur, since it is he who is responsible for collecting alimony. If the IL was provided by the claimant at the payer’s place of work independently, without the participation of the FSSP, enforcement proceedings are initiated.

The bailiff must take the following measures:

- send a resolution to withhold alimony from wages;

- If the alimony-paying person works unofficially, a search is made for his property and bank accounts.

If a large debt is accumulated, equal to the value of real estate or a car, the property may be seized for sale on electronic platforms in order to pay off alimony debt.

If the bailiff has accepted the documents but does not take action, the claimant files a complaint about inaction and submits it to the senior bailiff. If the answer is negative or there is no result, the complaint is sent to the senior bailiff of the subject, then to the chief bailiff of the Russian Federation.

What to do if the salary is “gray”?

Gray salary implies division into two parts - official and unofficial. Alimony is collected only from confirmed earnings, and in this case the claimant will have to prove the fact of receiving the second part. This is possible only after filing a complaint with the Federal Tax Service and conducting an inspection by inspectors.

Where to go if there is a long delay in child support?

Delay in alimony payments for a long time is the basis for recognizing the debtor as a willful defaulter and bringing him to justice under Art. 5.35 Code of Administrative Offenses of the Russian Federation. For this purpose, the recipient can contact the bailiff leading the individual entrepreneur by submitting a corresponding application.

If the payment terms are repeatedly violated, the alimony obligee is brought to criminal liability under Art. 157 of the Criminal Code of the Russian Federation. The initiative can come from the claimant or the bailiff:

- Documents are drawn up to initiate criminal proceedings.

- The case materials are transferred to the FSSP investigator.

- The investigator submits documents to the court.

Prosecution under Art. 157 of the Criminal Code of the Russian Federation is allowed only by court decision. To impose an administrative penalty, a resolution of the bailiff is sufficient; the case is not considered in court.

Procedure for collecting alimony payments

After receiving the writ of execution, it is independently transferred to the specific employer of the alimony payer.

If this is not available, this document is sent to the FSSP office at the defendant’s place of residence or to a local branch. An application for the collection of alimony is also submitted to this body.

Attention! The writ of execution is sent to the plaintiff—the child’s parent and the debtor—who is given 5 days to fulfill his child support obligations. In the absence of a positive result, compulsory collection measures are applied to the alimony payer.

How to carry out enforcement proceedings

After the FSSP receives the necessary documentation, an order is issued and enforcement proceedings on alimony payments are opened.

Photocopies of the document are sent to both the alimony payer and the claimant. If the 5-day deadline is missed and the debtor fails to fulfill his obligations, the FSSP performs the following actions:

- they are looking for the alimony payer - to the local police department;

- visit the debtor’s specific place of residence (according to registration);

- restrict the debtor’s travel abroad, etc.

When evading the payment of alimony, various administrative penalties are applied to the debtor. In this case, they perform 1 or more of the following actions - they charge a fine, seize the debtor’s real estate or car, write off funds from the card account, deprive the driver of a vehicle, etc.

Application at the place of employment

The simplest option for collecting alimony is to contact the employer of the alimony payer.

In this situation, after receiving a writ of execution, the company where the debtor works issues an official order to withhold a specific alimony amount from the employee’s monthly salary. When executing the order of the director of the company, a separate payment order is issued in the accounting department of the enterprise and a targeted monthly payment is drawn up for the child. The employer is prohibited from carrying out any manipulations with the amount of alimony contributions (for example, reducing or stopping them).

How is child support withheld?

According to Art. 98, 99 Federal Law No. 229 of October 2, 2007, when withholding and transferring alimony according to a writ of execution, the following actions are performed:

- They calculate alimony after deducting personal income tax from the monthly salary of the alimony payer;

- Specific alimony payments are calculated once a month;

- transfer a certain amount to the recipient's account. This operation is carried out through the mail (postal order is sent) or through a specific bank.

Important! According to Art. 109 of the RF IC, alimony is accrued to the recipient’s account within 3 days from the moment the salary is transferred to the alimony payer.

Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”

Read also: Maternity capital during divorce

Article 109 of the Family Code of the Russian Federation “Obligation of the organization’s administration to withhold alimony”

How much is alimony calculated?

According to Art. The RF IC, depending on the number of minor children, alimony is withheld in the following amounts:

- for 1 child - 25% of the debtor’s salary;

- for two children - 1/3 of monthly income;

- if there are 3 or more children - 50% of the salary.

Attention! Alimony is withheld from all types of official payments.

According to Art. 101 Federal Law No. 229 of October 2, 2007, in this situation the following are considered non-taxable income of the alimony payer - survivor pensions, funds from maternity capital, compensation for various vouchers, etc.

Article 81 of the Family Code of the Russian Federation “Amount of alimony collected from minor children in court”

Methods for transferring alimony payments

Alimony is listed as follows:

- when transferring money in person - by receipt;

- when making a transfer via mail, bank cash desk or terminals;

- when withholding money from the salary of the alimony payer - according to a payment order from the accounting department of the employing enterprise.

The receipt indicates basic information about the recipient and the alimony payer (including data from passports), the date of receipt of funds and their amount. This document also states the purpose of the “alimony” payment and provides information about the new writ of execution or agreement.

Payment order for alimony calculation

The payment order for the collection of alimony, which is drawn up in the accounting department of the employer of the alimony payer, indicates the following information:

- Document Number;

- Date of registration, transfer to the bank and debiting of funds from the alimony payer’s account;

- Information from the passport and other details of both parents;

- Amount to be paid (in words);

- Assignment of monthly payment (“alimony”);

- Sequence and type of payment.

Sample of filling out a payment order

Attention! Alimony is considered first priority payments. As a result, they are calculated before the deduction of personal income tax, payment of wages and other money transfers.

Purpose of payment

The purpose of payment is considered an important payment detail. This paragraph of the payment order for alimony indicates the following information:

- Purpose of money transfer (“alimony”);

- Grounds for transfer of alimony money (number of the writ of execution or agreement);

- The period for which alimony is transferred (specific month and year).

The payment order also indicates the fact that alimony payments are calculated after personal income tax is withheld from the alimony payer’s salary.

From what day is alimony calculated?

The start date for the transfer of alimony to the recipient’s card or other current account is considered to be the day the claim is filed in court.

The 3-year limit applies only to the initial claim for alimony payments. Attention! If the magistrate’s court has already made a specific decision on the collection of alimony, then if alimony payments are evaded, the entire amount of the debt is recovered from the alimony payer for the entire period of non-payment - for at least 3 years, at least for 11 years.

Monthly alimony payments are collected even after the teenager turns 18 years old. In this situation, they go to court within such a period - until the adult child reaches 21 years of age.

Terms and rules of accrual

The calculation of alimony payments begins immediately after the announcement of the court order.

In this situation, the alimony payer transfers to the recipient a certain amount for 1 month within 5 days. Further, alimony payments are deducted monthly from the debtor’s monthly salary. If there are various alimony debts, the amount of payments is increased by the amount of the penalty. According to Part 2 of Art. 115 of the RF IC, such a fine is equal to 0.1% of the total debt for each day of delay.

Alimony payments are stopped for the following legal reasons:

- when the teenager is 18 years old;

- when a child is abandoned and adopted by a new family;

- upon the death of a minor or alimony payer, etc.

On a note! Becoming disabled, taking a well-deserved rest (retirement) and entering into a second marriage are not considered legal grounds for canceling alimony payments.

The amount and procedure for calculating such money change, for example, if the alimony payer becomes ill with a serious illness (oncology, AIDS, etc.).

Article 115 of the Family Code of the Russian Federation “Responsibility for late payment of alimony”

Document validity period

The validity period of a writ of execution is 3 years from the date a certain court order enters into legal force. The same time is counted from the moment the child comes of age.

Read also: Car for a large family from the state in 2020

In the absence of a writ of execution, the FSSP does not initiate new enforcement proceedings. In this situation, the claimant goes to court and files a petition to restore such a document.

Duration of alimony payments according to agreement

An agreement to pay child support is an acceptable solution for both parents: they independently determine the amount, procedure and timing of transferring funds to the child. Only a notarized document has legal force; without a notary’s signature it is considered invalid.

The agreement may establish the following payment terms:

- Monthly on certain dates.

- Quarterly. The amount is indicated for 3 months.

- Every six months. Payments for 6 months are taken into account.

- Annually. Child support payments are taken into account per year.

- One time. For the calculation, the maximum possible amount is used for the period from the moment the agreement is concluded until the child reaches adulthood.

It is allowed to provide property as alimony. Its cost should be approximately equal to the amount of payments for a certain period specified in the agreement.

Important! If the amount of alimony under the agreement is lower than what can be established through the court, the document is declared invalid. According to the law, the interests of the child must be observed first and foremost, and money is spent exclusively on his maintenance.

Accruals begin from the moment the agreement comes into force - this nuance is specified in the document. Most often, he begins to act immediately after assurance. Termination of alimony obligations is possible at the initiative of the recipient, upon the death of the payer or child, reaching adulthood or emancipation before the age of 18.

What do bailiffs do after familiarizing themselves with the writ of execution?

After receiving a writ of execution from the court, the FSSP within 1 day opens a new proceeding for the collection of certain alimony payments. Then do one of the following:

- invite the alimony payer to an oral conversation;

- send a writ of execution to a specific company (debtor’s employer);

- if the alimony payer refuses to pay monthly alimony, they send written requests to various government agencies (IFTS of the Russian Federation, Pension Fund of the Russian Federation, traffic police, bank);

- when alimony debts arise, interest (penalty) is charged on alimony, the amount of which is indicated in the writ of execution. In this situation, they also seize card and other accounts and various property of the alimony payer;

- in the absence of information about the registration or other location of a citizen of the Russian Federation, the debtor is put on the federal wanted list and is prohibited from traveling abroad.

If alimony debts are not paid, the debtor's specific property is sold at a separate auction, and the funds received are transferred to the recipient of payments for the child. This money covers current debt, penalties and fines for late mandatory alimony payments.

The procedure and terms for transferring alimony by the employer

When receiving IL, the employer or accountant must be guided by the following algorithm:

- Determine the number of days to withhold for an incomplete period from the date specified in the IL until the receipt of wages. A personal income tax deduction is made in advance.

- Calculate wages several days before the date established by the company’s internal documentation. Payments are made every 15 days, but alimony is calculated once a month from the total amount, consisting of advance payment and salary.

- Calculate alimony as a percentage of earnings or as a fixed amount.

- Pay wages and transfer alimony to the recipient using his details within 3 days after payment of wages to the payer.

It is allowed to transfer alimony twice a month, but inconvenience may arise during the calculation, since the full amount of earnings is taken into account, and not just individual parts.

What is the accountant’s responsibility for withholding and transferring alimony payments?

If alimony is untimely withheld from an employee’s salary according to a specific writ of execution, the company’s accountant will be brought to criminal or administrative liability. According to paragraph 3 of Art. 17.14 of the Code of Administrative Offenses of the Russian Federation, if such a situation arises, they are fined the following amounts:

- citizens of the Russian Federation - by 2,000-2,500 rubles;

- officials - 15,000-20,000 rubles;

- legal entities - by 50,000-100,000 rubles.

Attention! In case of malicious violation of official duties regarding the withholding and transfer of alimony, the official is sent to prison for a maximum of 1 year (Article 315 of the Criminal Code of the Russian Federation).

Article 17.14 of the Code of the Russian Federation on Administrative Offenses “Violation of legislation on enforcement proceedings”

Article 315 of the Criminal Code of the Russian Federation “Failure to comply with a court sentence, court decision or other judicial act”

Storage and recording of judicial documentation in the payer’s organization

Writs of execution are stored in metal company cabinets, various safes or in special premises of the enterprise, where their safety is ensured. Such treatment of such documentation is established in clause 6.2 of the Regulations of the USSR Ministry of Finance No. 105 of July 29, 1983.

Regulations of the USSR Ministry of Finance No. 105 of July 29, 1983 “Regulations on documents and document flow in accounting”

What to do if a writ of execution is lost

According to the law, only the original writ of execution is considered the legal basis for calculating alimony payments.

If such a document is lost, recipients of alimony do not lose the right to receive it. According to Art. 12 Federal Law No. 229 of October 2, 2007, instead of the lost original writ of execution, a duplicate is received. As a result, the alimony payer has no problems with making alimony payments, and the claimant has no problems with receiving them.

If a writ of execution for alimony is lost, many parents do not know where to get a new form. When such a document is restored, they go to the same court as the first time and file a corresponding claim.

The statement of claim contains the following information:

- passport data about the payer and recipient of alimony;

- court decision (order) on the appointment of alimony payments;

- Full name and position of FSSP bailiff;

- a situation in which a document was lost.

Attention! The fact of loss of the original document is confirmed by a certificate from the FSSP bailiff.

How to make an application

The application is drawn up in any form, but it must include the following information and information:

- Name of the court that issued the original sheet, its address;

- Information about the applicant (full name, address, telephone);

- Information about the parties involved in the process of assigning alimony;

- Case number;

- Document's name;

- Date of application;

In the text of the document, the applicant must state:

- The circumstances of the issuance of the sheet (for what court case, on what date and under what number was the sheet issued; who is the claimant and the debtor, according to this sheet);

- If the sheet was presented to the bailiffs for execution, then information about this should also be included in the text of the document (what date the sheet was handed over, to which branch of the Bailiff Service; whether proceedings were initiated, etc.);

- The circumstances under which the writ of execution was lost, as well as evidence confirming the fact of loss);

- Request to the court to issue a duplicate of the sheet containing its number and date of issue;

- List of attached documents.

The application is drawn up and submitted to the court in writing, on paper. It is signed by the applicant himself or another person by proxy.