Please note: the amount of the penalty for non-payment of alimony has been reduced since August 10, 2020

As of August 10, 2018, the wording of clause 2 of Article 115 of the RF IC was changed: if previously, when a debt was formed due to the fault of a person obliged to pay alimony by a court decision, the guilty person was obliged to pay the alimony recipient a penalty in the amount of one-half percent (0.5%) of the amount of unpaid alimony for each day of delay, then from the specified date the alimony payer will be obliged to pay a penalty in the amount of one tenth of one percent (0.1%).

Thus, if the alimony arrears arose before August 10, 2018, then we calculate the penalty based on 0.5% of the amount of unpaid alimony, if the arrears arose after the specified date, then based on 0.1%.

Penalty amount

The law does not establish a fixed amount of the penalty for alimony in case of violation of the terms and conditions for alimony payments, defining only a percentage of 0.1%/day.

The final amount of the penalty is determined based on:

- total amount of debt;

- number of overdue days.

If the basis for collecting alimony is an agreement of the parties, the amount of the penalty is determined by the parties in a signed document.

When determining the amount of a fine for a violation, the existence of an agreement between the parties is decisive.

| Method of collecting alimony | Rules for assigning a penalty |

| Agreement | If the parents have drawn up an agreement on child support payments, it must indicate not only the amount of money to be transferred, but also what punishment may be imposed for failure to comply with their obligations. Therefore, if there is an alimony agreement, the amount of the penalty is determined in accordance with it. |

| The court's decision | If there is no such agreement between the former spouses, the amount of fines is determined by law. In accordance with paragraph 2 of Art. 115 of the RF IC, the defaulter is charged 0.1% of the total debt for each overdue day. |

Important! If the amount of the penalty is not specified in the agreement, just as such a sanction for violating the terms and procedure for paying alimony is not specified, the provisions of the RF IC on penalties cannot be applied to these legal relations. In this case, the provisions of Art. 395 of the Civil Code of the Russian Federation concerning penalties for failure to fulfill an obligation.

Alimony and fine for non-payment

Quite a lot of mothers in Russia, after a divorce, declare their rights to alimony. At the same time, the Family Code of the Russian Federation provides a choice of how to determine such payments:

- voluntary, that is, by independent agreement of the parties on all terms of deductions. At the same time, the agreement can be drawn up in notarial form and have the force of a writ of execution. The implementation of such an agreement is monitored not only by the parties concluding it, but by special government bodies, which, on the basis of an application for non-payment of alimony, open enforcement proceedings;

- forced, that is, the amount and form of payments are established by a court decision.

No matter how alimony is assigned, the parties receive a document that has equal legal force and its execution is considered mandatory. As a rule, such payments are regular. But sometimes payers intentionally or through the fault of third parties violate the established schedule, and then a debt arises. For violation of the terms of payment of obligatory amounts, the law provides for a financial sanction. A penalty, like a penalty, is a fine, the peculiarity of which is that it is paid not to the state, but in favor of the child. This measure motivates to regularly deduct established monthly amounts, thereby helping to support the child.

Who calculates the penalty for alimony?

During the trial, the presented grounds for charging a penalty are considered and the issue of their assignment is decided.

The amount of payments is determined before filing a claim and is reflected in the calculation, but based on the results of the hearing, it can be clarified at the time the decision is made.

Who should make calculations for the penalty? Either the applicant or the bailiff service.

The responsibility for determining the due amount of alimony to be paid actually lies with the bailiffs, but in terms of penalties, they can only help in determining the amount of the penalty based on the application of the alimony recipient.

Important! Bailiffs can also assist in calculating penalties if there is a notarized alimony agreement. In this case, the agreement drawn up by the parents is equivalent to a writ of execution, but in order to collect the penalty, in any case, you will have to go to court, especially if the terms on the amount of the penalty are not specified in the agreement.

An employee of the bailiff department also receives information about the size and regularity of the defaulter’s income, and calculates the penalty based on all the information received (Clause 2 of Article 113 of the RF IC) . The actual collection of the penalty is carried out by the court upon the application of the alimony recipient.

Valid reasons for missing the statute of limitations on alimony payments

The renewal of the procedural deadlines defined in the Civil Code, applied when considering disputes related to alimony payments, is carried out by the court if there are reasons for their omission. When considering each specific situation, the court makes a decision to recognize the validity of one or another reason. Among them:

- health indicators of the party (disease, completion of treatment);

- confirmation of legal ignorance;

- death of a close relative or the presence of a serious illness requiring care;

- being on a business trip for a long time;

- force majeure, etc.

How to correctly calculate the penalty for alimony

Independent calculations of the alimony recipient will be accepted by the court for consideration provided they are correct and relevant. However, it is worth doing them in order to understand what approximate amount you can expect when going to court.

Calculation formula

You can calculate the amount to be paid using two formulas.

Formula 1

SDm*KDm*PN=SD, where:

- SDM – amount of debt for the month;

- KDm – number of days in a month;

- PN – penalty percentage;

- SD – amount of debt.

Formula 2

SDM*OKDP*PN=SD, where:

- SDM – amount of debt for the month;

- OKDP – total number of days of delay;

- PN – penalty percentage;

- SD – amount of debt.

Sample and Example

Calculation methods will be discussed using an example.

The alimony payer did not pay the money for 3 months (April-June), after which the recipient applied for recovery of the penalty through the court.

During the trial, financial funds were also not transferred to the recipient, which is why the delay increased by another 1 month. As a result, the calculation of the penalty is made in 4 months.

The monthly payment amount is fixed and amounts to 12,000 rubles.

Below are two sample calculations for the situation discussed in the example.

Option 1

This method involves calculating the penalty separately for each month, after which the result is added up.

- 12000*30*0.1%=1296 RUR;

- 12000*31*0.1%=1296 rub.;

- 12000*30*0.1%=1296 RUR;

- 12000*31*0.1%=1383 rub.

1296+1296+1296+1383=5271 rub.

The amount of the penalty is 5271 rubles.

Option 2

In this calculation option, you need to know the total number of days during which no payments were made. In the example given, the delay is 122 days. Based on this, the calculation is made as follows:

12000*122*0.1%=5271 rub.

What does the law say about the timing of payment requirements?

Alimony payments are closely related to the concept of “statute of limitations”. This term defines a certain period of time during which one should declare one’s rights to something.

It is important to distinguish between the statute of limitations for filing an application for alimony payments, debt collection and penalties. Thus, you can apply for alimony while this right is in force, that is, until the child turns eighteen. It is worth noting that payments will be assigned only from the moment the application is submitted and the corresponding court decision is made.

For example: A wife and husband filed for divorce when their child was 3 years old. Citizen A announced her rights to receive alimony two years later. Payments will begin from the moment the corresponding application is submitted and she cannot demand payment for the past two years.

In this case, the statute of limitations for collecting debt payments is the last three years preceding the date of filing the corresponding application with the court.

In court, the plaintiff must also provide evidence that he took independent measures to collect alimony payments, which had no results.

As for the penalty, the statute of limitations for it is subject to the general rule, that is, compensation can be demanded for the last three years preceding the date of filing the application with the relevant authorities. This is evidenced by Art. 9 IC RF.

How to collect a penalty for alimony

In order to receive funds required by law that are not paid by the payer on time, you must follow all the nuances of filing for collection.

The algorithm and nuances of the necessary actions will be discussed in detail below.

To collect a penalty you need:

- Prepare documents confirming the debt and calculation of penalties.

- Prepare and submit an appeal to the bailiffs (both in the presence of an agreement on alimony and in the presence of a writ of execution) to calculate the penalty or calculate it yourself.

- Prepare and submit a claim.

- Justify the presented calculation in court.

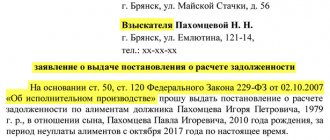

Application for payment of alimony penalty

The application does not have a set form and is drawn up at the discretion of the applicant.

Regardless of whether this is an appeal to the bailiff department or a lawsuit in court, the document must indicate:

- details of the applicant and respondent - full name, address;

- basis for the appeal: date of collection of alimony, details of the basis documents, date of initiation of enforcement proceedings, information about payments;

- the essence of the claim (the fact of lack of payments indicating the deadline);

- claims with recovery amounts;

- list of attached documents;

- date and signature.

Sample

The sample claim presented below for the recovery of a penalty for non-payment of alimony also additionally covers the recovery of moral damages and losses.

When drafting a claim based on your situation, it is recommended that you consult with an experienced lawyer.

Documentation

Along with the application you must submit:

- personal passport (copy);

- child's birth certificate (copy);

- divorce certificate (copy);

- grounds for assigning alimony: - writ of execution;

- — alimony agreement;

Statute of limitations

The collection of alimony penalties does not have a statute of limitations, since this concept does not apply.

In accordance with paragraph 1 of Art. 113 of the RF IC, there is a limit on the collection of alimony for past periods, which is three years.

Jurisdiction

If the issue of assigning a penalty is resolved in court, the claim is filed in the magistrate’s court at the plaintiff’s place of residence (clause 3 of Article 29 of the Code of Civil Procedure of the Russian Federation).

Also, a claim can be filed at the defendant’s place of residence: the plaintiff is free to choose the place for consideration of the claims.

In cases where an alimony agreement has been concluded between former spouses, territorial jurisdiction can be changed by agreement of the parties (clause 32 of the Code of Civil Procedure of the Russian Federation).

State duty

The amount of the state duty when collecting a penalty for alimony does not depend on the cost of the claim and is regulated by clause 14, clause 1 of Art. 333.19 Tax Code of the Russian Federation.

In accordance with it, cases of alimony are subject to a state duty of 150 rubles.

However, when filing a claim for alimony, in accordance with clause 2, part 1, article 1, article 333.36 of the Tax Code of the Russian Federation, plaintiffs are exempt from paying state duty. The amount of state duty will subsequently be collected from the defendant if the requirements are satisfied.

How to calculate?

A logical question arises: how is the penalty and its size calculated? In case of independent agreement, the agreement stipulates not only the amount of alimony, but also penalties in case of debt. If alimony is ordered in court, then the Family Code of the Russian Federation explains everything. More specifically, in Art. 115 states that the amount of penalties in case of debt is ½ percent of the amount for each day of delay.

It is worth noting that, according to the law, alimony arrears arise on the first day of the month following the month of payments. That is, on February 1, there is already a delay in alimony payments for January, if payment for this month has not yet been made.

But it is difficult to consider such a delay as a malicious violation of the instructions of the writ of execution. After all, it could arise not through the fault of the payer of “children’s” payments, but, for example, due to an error by representatives of the bank through which the payment was made, or by the employer who delayed the child support worker’s salary. And if this is proven, then it is unlikely that the penalty will be collected. It would be acceptable to start by issuing a warning to the violator and using available methods to stop further non-compliance with the terms of alimony payments.

Who's counting?

The calculation of the amount of the penalty is carried out by representatives of the bailiff department, which receives the relevant documents on the collection of all payments related to alimony. They have at their disposal all the necessary information and relevant information that will affect the increase or decrease in the amount of compensation. Although the independently calculated amount will not be taken into account by the court, the applicant should also know how, according to the RF IC, the penalty is calculated.

For example: alimony payer, citizen X, has a monthly income of 30,000 rubles. According to the court decision, he is required to pay 25% of his income as child support. The child's mother did not receive payments for 3 months, from January to March. Thus, the calculation of the penalty is carried out according to the following scheme:

- Calculating alimony debt for a month

30000 *0.25 = 7500 rub.;

- Calculating the amount of the fine

As of February 1, the penalty is

7500 * 0.5% * 31 days. = 116.25 rubles;

On March 1

(7500+7500) * 0.5% * 28 days. = 210 rub.;

On April 1

(7500+7500+7500) * 0.5% * 31 days. = 348.75 rub.

- Let's sum up the amount of the penalty

116.25+210+348.75=645 rub.

Judicial practice is faced with more advanced debt terms and much larger amounts of penalties.

How can the debtor respond?

The alimony payer has the right to provide documentation or other evidence of the reasons why the required payments were not made on time. These reasons are:

- severe prolonged illness;

- long delay in wage payments;

- difficult financial condition of the payer of contributions, etc.

Having considered all the facts provided by the defendant, the court may reduce the amount of debt and penalties or even cancel the latter.

How is it paid?

The penalty is paid by court decision or on the basis of an agreement concluded between the parents.

To receive payment of alimony penalties, you must obtain a writ of execution and present it to the FSSP for collection.

If for some reason the recipient does not apply for collection, then no payment is made.

Important! The fact of receiving a decision does not entail the actual transfer of money. If the payer has no source of income and property, the actual transfer of the penalty may be delayed indefinitely.

How to restore the statute of limitations

In cases where the statute of limitations for the collection of alimony has been missed, the party interested in collection must prove the valid reasons for such omission.

The existence of valid reasons serves as a reason for sending a corresponding application to the court, within the framework of which the applicant can ask the court to restore the missed period. The authority will be able to satisfy such an application only if each of the reasons is described and documented in the application itself.

Having considered the petition and determining the presence or absence of valid reasons, the judge grants the request specified in the petition or refuses to satisfy it.

A procedural decision declared by the court can be appealed to the appellate instance if the party disagrees with the opinion of the authority.

Responsibility for non-payment of penalties

The alimony recipient may demand not only payment of a penalty, but also compensation for losses incurred due to lack of timely payments. To do this, it is necessary to present evidence and demand compensation through the court.

Example . You can submit a check for prepayment of clothes or equipment for a child, the purchase of which did not take place due to a violation of child support obligations. You can also recover additional costs incurred for travel to court, the FSSP department, if such actions are associated with significant costs.

Otherwise, the defaulter of alimony penalties is subject to the same standards of liability as malicious evasion of child support.

- Art. 5.35.1 Code of Administrative Offenses of the Russian Federation - for prosecution for the first detected fact of malicious evasion;

- Art. 157 of the Criminal Code of the Russian Federation - for prosecution after the commission of an administrative offense and ongoing violation of the rights of the child.

Attention! A fine for non-payment may be imposed even if the defendant does not have a permanent job.

In this case, the following may be applied to the debtor:

- recovery from property;

- ban on leaving the country;

- restriction on the right to drive a vehicle.

Scope of limitation of actions

The use of statute of limitations is typical for those cases that, as a rule, involve the protection of property interests. Such restrictions are a kind of method of disciplining each of the parties to the relationship.

As a general rule, it is impossible to apply statute of limitations to family legal relations. Thus, the parties to legal relations have the opportunity to initiate proceedings until the time limit expires. One of the types of time limits is the statute of limitations for child support.

The application of the provisions on the suspended period most often extends to those legal relations that arise as a result of the use by the parties of their non-property rights.

Is it possible and how to cancel the alimony penalty?

You can challenge a claim for collection if you prove that the lack of payments is not the defendant’s fault.

This is possible if the fact is established:

- illness of the payer;

- material problems that do not allow payments and other reasons recognized by the court as positive.

An existing court decision can only be canceled by appealing it within the 30-day period established by law by filing an appeal through the magistrate's court.

The appeal will be considered by the district court and it must indicate:

- name of the court, its address, full names of the parties to the case and their addresses;

- circumstances of the case: when and on what basis the decision was made, the grounds for its adoption, the payer’s position on this issue;

- justification for the illegality of the court decision;

- evidence of this illegality;

- demand to the appellate court (to cancel, change the decision);

- signature, date.

To draw up a reasoned appeal, it is best to contact a competent lawyer.

Note: To cancel the accrual of penalties in the future, it is necessary to pay off all accumulated debts and no longer allow late alimony payments.