General information about Promagrofund

The NPF Promagrofond under consideration has been operating on the market for about 20 years.

During its activities, this organization was able to achieve high results, for example:

- Currently, the NPF has about two million clients;

- on reserve funds – 714 million;

- accumulation of pension value – 53 billion rubles.

The company has 56 billion worth of property and has 70 offices in the country. All crises by this organization were endured without consequences for citizens who invested in the fund, while the level of the organization’s rating was maintained.

About NPF "Promagrofond"

The organization we are considering is a non-profit pension fund.

It was recently merged with NPF Gazfond. All clients automatically came under the management of the partner fund. The main purpose of the personal page is to track financial transactions occurring with connected pension accounts. Another undoubted advantage is the ease of site management. The developers understand that the potential audience is elderly people who have difficulty understanding complex controls. Therefore, the site interface is as intuitive and understandable as possible for visitors. You can understand the capabilities of the service without instructions.

The office has the following functions:

- Displaying tooltips when hovering the cursor over control keys;

- Providing access to personal information. If necessary, users are able to make changes to personal data;

- Display transaction history. Statistics are available for download to your computer in several electronic formats;

- Writing statements. Completed applications can be sent to fund employees directly from the official website;

- Formation of a detailed schedule of pension savings;

- Using a special filter that allows you to sort financial transactions according to several parameters;

- Reading reference materials to learn about additional features of your personal account and learn how to manage the site.

Gazfond fulfills all obligations to clients. Renewal of contracts is not required.

All this is located very conveniently on the page; the simplicity is suitable even for those who have not previously dealt with technology. From the technical side there are no problems. The colors in the office are neutral, the menu is small. If you encounter any difficulties, you can always call the support line.

The advantage of having a personal account is that now you don’t have to go to the office once a month to check account movements. This makes it easier to keep your calculations and store documentation. All incoming receipts are signed.

There are actually a lot of advantages. A company representative can come to your home to formalize the contract. The necessary information is also provided by telephone. Attention! Due to the approval of the law on the abolition of paper correspondence in 2013, letters do not arrive to existing client addresses.

The company's reliability has been proven by satisfied customers who have been investing their money for decades. Everyone agrees that receiving a large amount is very nice. Based on the results of 2021, the fund’s funds increased - the amount was 451 billion rubles. Pension reserves amounted to 372 billion rubles.

Even the Expert RA agency confirmed the A rating that was assigned to the fund. In 2013, it was in 9th place in terms of savings among all non-state funds in Russia. The company has an official website, it is updated and filled with up-to-date information.

It contains complete information about the work of the organization, a map with the location of offices. Link to personal account, calculator. Thanks to it, future clients can view the interest rate by year and see the amount accumulated over several years.

The non-state pension fund Promagrofond (hereinafter referred to as NPF) has more than 20 years of experience.

During the period of pension activity, the NPF was able to achieve significant results, for example:

- The number of clients is more than 2 million people.

- Reserves – 714 million rubles.

- Pension savings – 53 billion rubles.

- Own property -56 billion.

- The number of offices throughout the country is 70 branches.

More on the topic Sibay Pension Fund official website personal account

The fund survived all crises without consequences for existing clients, thereby maintaining a high reliability rating.

In 2021, the NPF decides to merge with another large fund - Gazfond. The Gas Fund already includes such companies as Norilsk Nickel (Heritage), Kit-Finance.

Existing NPF clients have been transferred to the management of another fund, while the insured persons do not have to re-enter the contract with the new fund. That is, Gazfond is obliged to fulfill its obligations to NPF clients. Thus, Gazfond is one of the largest funds in the country.

The NPF Promagrofond under consideration has been operating on the market for about 20 years.

During its activities, this organization was able to achieve high results, for example:

- Currently, the NPF has about two million clients;

- on reserve funds – 714 million;

- accumulation of pension value – 53 billion rubles.

The company has 56 billion worth of property and has 70 offices in the country. All crises by this organization were endured without consequences for citizens who invested in the fund, while the level of the organization’s rating was maintained.

Each client of the organization in question has the right to register a personal account on the official website of the non-state pension fund "Promagrofond". If, before the merger of Promagrofond CJSC with Gazfond, a person used the capabilities of a personal account, then after that there will be no need to register on the site again.

This organization is located in the capital of the country on the street. S. Makeeva, 12. To obtain information about branches, you can use the telephone. You will be able to contact us when using the site.

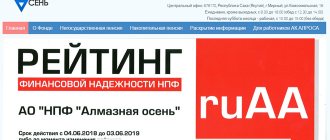

Reliability and profitability rating

It is worth paying attention to the fact that the rating level is set by different agencies, for example, Expert RA, which set the rating “A++” for the fund in question. This rating indicator is the maximum, which indicates that the company provides high quality services and investments in it are protected.

An increased level of reliability is ensured due to the fact that the organization’s activities are ensured through strict control by government agencies.

The work of the fund is subject to licensing, in addition, there is an indicator of the normative contribution of the founders in the aggregate, in addition, the placement of investment funds and reserves from pension savings. Similar rules apply to the formation of a reserve of insurance value.

Important! The funds accumulated in pension accounts cannot be subject to penalties that relate to the debt that is registered with the fund. If there is a negative return, then it can be covered using the funds of the fund.

Between 2005 and 2012 there was an increase in funds. Every 1000 in the account became equal to 2002 rubles. Over eight years of operation, the organization’s income was 73% . In this case, the average is 9.1%. In 2015, the profitability of the organization in question exceeded 16%.

It should be pointed out that during the crisis in 2008, the level of profitability of this fund did not fall below 5.2%. If we consider from the same point of view the activities of the official manager of the Pension Fund, then during the specified period of time the indicator had a negative value.

The fund in question has some advantages. Among the main ones, we can highlight the fact that there is transparency and openness in working with clients. For example, this concerns information about the distribution of incoming investments, which is publicly available. This means that every citizen has the right to familiarize himself with this information.

There are several main indicators that characterize the fund’s activities.

Funds are invested in financial instruments:

- government-developed securities;

- bonds issued by companies conducting economic activities;

- deposits in banking organizations;

- shares of enterprises that operate in a strategic direction;

- securities of companies.

In addition, this is documentation of mortgage relations and bonds of the municipality. You can obtain up-to-date information by contacting the fund.

Pension accumulation programs

Currently, the organization in question has developed several programs that focus on pension insurance.

These include:

- The classic program is used to subsequently receive pension payments on a lifetime basis. In this case, it is not provided that funds can be transferred on the basis of relations of hereditary significance. In order to calculate the redemption amount, you need to use the minimum period, which is represented by two years. You will need to deposit a minimum of 2000 rubles. Receipts must be monthly;

- free program. It is used to receive an urgent payment. A special feature of the program is that the schedule for depositing funds has an arbitrary value, that is, the citizen decides on his own how often the money should be credited to the account. The balance of funds in the account is transferred to legal successors upon the death of the owner. The accumulation period is 2 years and the minimum contribution is 500 rubles;

- guaranteed. It is also used to receive an urgent type of payment, while funds are deposited randomly. A citizen has the opportunity to independently determine the frequency of payment; this time cannot be less than a year. The minimum contribution is a couple of thousand rubles and a period of 2 years. The remainder is inherited;

- confident "S". In this case, the amount of contributions is agreed upon by the fund. The payment is made over an annual period and the entire account balance can be transferred to the heirs. The person independently decides how often to deposit funds;

- confident "P". A fixed lifetime payment is provided. It will not be possible to inherit funds; the savings period is a couple of years;

- caring. In this situation, the program makes it possible to transfer pension rights to a third party. You can use any periodicity, but not less than 12 months, with a minimum of 2 years. Every month you need to deposit at least a couple of thousand into your account;

- pension annuity. The citizen receives a pension and the period of contributions is not limited. Payment is made within a year, the remainder is inherited. Every month you need to deposit five thousand rubles.

Due to the fact that funds received from citizens are subject to investment, citizens receive profit. It is transferred to the account. You need to open a separate account for the program. Many of these programs provide a social deduction, which entitles you to a refund of 13% of transfers to NPFs.

Events Quarter

The company promised to connect me to my personal account, where I can monitor the movement of my funds. I hope this will be convenient. I’ll still think about switching to another fund, time will tell how the NPF will perform, although I think there will be many more pension reforms before our retirement. Of course, you can’t live one day at a time, but you don’t want to think about retirement just yet.

This is interesting: Certificate from the Governor of the Region What Gives

CJSC NPF Promagrofond was founded in 1994. The fund has more than 20 years of successful experience, during which the number of participants exceeded 55 thousand people, more than 35 thousand insured persons receive a pension here (based on the results of 2014).

Personal account on the fund website

Each client of the organization in question has the right to register a personal account on the official website of the non-state pension fund "Promagrofond". If, before the merger of Promagrofond CJSC with Gazfond, a person used the capabilities of a personal account, then after that there will be no need to register on the site again.

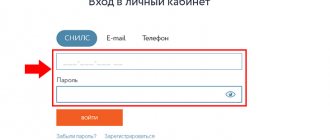

Algorithm of actions for registration

Using a personal account brings many positive aspects for a citizen. In particular, it is possible to control accumulated funds online.

Registration is done as follows:

- make a scanned passport and SNILS, a statement regarding joining a specific program (it can be drawn up during registration;

- click on the link with the name of the fund’s website;

- reflect SNILS and telephone number, email, residential address;

- attach scanned documents.

Then the citizen receives an identifier on his phone. 10 days are allotted for this. Next, the person will be able to log into his personal account. You will need to change the temporary password and set a permanent one.

What opportunities does LC provide?

The account can be used:

- to check pension savings;

- filling out an application for copies of papers;

- change of personal information.

Also, through your personal account, you will be able to analyze your personal savings and pay the contribution online.

Investing money in a non-state pension fund or pension fund: is it profitable?

Historically, many large pension funds arose in our country on the basis of large enterprises (Gazprom, Lukoil, Surgutneftegaz) - the reasons are not difficult to understand: a significant wage fund, loyal employees. The presence of a large company behind the fund is of course a plus, but when choosing a non-state pension fund, make sure that it has not yet been resold, since businesses tend to get rid of non-core assets.

Private, non-state pension funds are beginning to become increasingly popular among future retirees. To decide on such a step, it is worth assessing the structure of the organization, its reliability, and also familiarize yourself with all the necessary contracts. It will be important to calculate the level of probable income, as well as consult with a lawyer for additional guarantees for your contribution to the fund.

10 Jun 2021 lawurist7 427

Share this post

- Related Posts

- Can bailiffs impose two arrests on one share in an apartment?

- It is not registered anywhere where the bailiffs will come

- Benefits for working pensioners in the Tyumen region

- How People Often Refuse a Mortgage for Maternity Capital