The VTB Pension Fund is a collection of several financial organizations (VTB 24 Bank and others) that offer users numerous savings and standard pension programs. There are offers for private and corporate clients. Therefore, you don't have to work for the company that chooses it for retirement savings to take advantage of the opportunities it offers.

To gain access to the functions of the personal section, you need to register a personal account with the VTB Pension Fund. After this, the user will be authorized and will be able to track savings, as well as select new programs and switch to them.

Login to your personal account

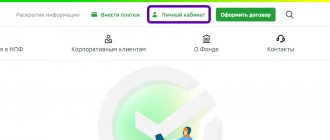

To log into your personal account of the VTB non-state pension fund, you must follow the following instructions:

- Go to the main page of the official website using the link: https://www.vtbnpf.ru/.

- Click the “Personal Account” button located in the upper right corner. For user convenience, it is highlighted in blue.

- A new page opens https://lk.vtbnpf.ru/main.

- Enter your login and password. The insurance certificate number is used as a login.

- Solve the captcha.

- Click “Login”.

Attention: users are also asked to log in to the site using an account on the State Services portal. This method is convenient for all individuals and legal entities who have a verified account. Otherwise, JSC NFP VTB Pension Fund does not provide full access to all offered functions.

Pension savings in Rosgosstrakh how to find out

A person who chooses the VTB fund to save his contributions will have the opportunity to:

- save and increase your money;

- decide on your own when the payment will be made and in what amount;

- participate in VTB group of companies programs designed for retirees;

- make voluntary contributions and return up to 13% back;

- form pension savings in ruble currency, and not in points.

The prospect of receiving additional funds for pension benefits attracts many investors, and each investor keeps their savings in a separate personal account.

The most advantageous difference is that it is possible to transfer the rights to its ownership to heirs. Official website - NPF Pension Fund Future clients can find detailed information about available pension programs on the VTB NPF website.

Each offer has its own conditions and certain features of the contract. NPF VTB 24 Pension Fund - logging into your personal account will help you calculate the amount of your future pension using a calculator.

On the organization’s website there is not only the entire list of services offered, but also a questionnaire is available for downloading.

Funded pension in VTB 24 In contrast to the non-state state fund, the state fund began to raise the issue of a moratorium on the withdrawal of the funded part of the pension. This is why pensioners began to “knock on the thresholds” of government institutions, fearing not to receive their money at all. Attention This can be easily prevented by contacting a bank or other organization that deals with these types of issues.

The report now contains detailed information on the history and movements of pension contributions, with detailed data broken down by year and employer. The information received can be saved and sent electronically.

This service is useful, for example, when providing data to a bank to obtain a loan. At the same time, the reliability of the information is guaranteed by the Pension Fund and confirmed by a special data format when creating messages.

6 Almost all non-state pension funds also give their clients the opportunity to check their pension contributions via the Internet. Detailed instructions on how to do this can be found, for example, on the websites of NPF Sberbank, Lukoil-Garant, VTB Pension Fund, Russian Standard, Kit Finance and many others.

Registration of a personal account

You do not need to register in the system yourself. The procedure for creating a personal section is performed exclusively by employees of the organization. It is also provided only to the company’s clients who not only entered into an agreement for services, but also wrote and submitted an application to use the remote service directly.

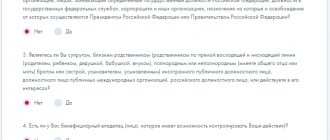

To gain access to the personal account of individuals, you must follow the following instructions:

- Choose a method for drawing up and signing a contract. There are two ways to do this. In the first case, the consumer goes to the offices and draws up/signs all the necessary documents in person. The second option is performed online, which is why most Russian citizens have recently chosen it.

- Go to the page https://www.vtbnpf.ru/privat/anketa/, where you need to fill out the form.

- Confirm your email address and phone number so that VTB Pension Fund employees can contact the potential client.

- Submit your application for consideration.

Attention: if a decision is made to personally contact the offices or branches of the fund, then the physical addresses can be found on the page https://www.vtbnpf.ru/vtbnpf/regional/. The schedule and operating hours are also indicated here in order to find a convenient time for visiting.

In almost 100% of cases, applications are approved. Since this is not a state Pension Fund, there is no need to work officially. All contributions are controlled by the citizen independently, and the company does not require official employment in order to contribute money and earn a pension. After approval, a contract is drawn up and sent to the client by email. It needs to be signed. Then the organization's employees independently create accounts and provide access to them to new clients.

Important: corporate clients will not be able to conclude contracts remotely. They definitely need to be personally present in the office and interact with operators.

Official site

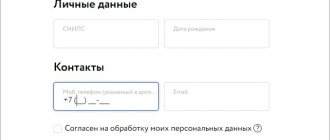

This VTB pension fund has an official website where you can open a personal account, where you can log in and access personal information.

It includes 3 main sections:

- "Private clients".

- "To corporative clients".

- "About the Foundation."

Instructions for registering a personal account

To gain access to your personal account, you need to enter into an agreement with NPF VTB 24 . This can be done both online and offline. In the latter case, you will need to visit a branch of VTB 24 Bank.

To log in, you will need to provide a login, which is the number of your pension insurance certificate. You also need to enter a password and go through a captcha. After that, click on the “Login” button.

Additional information about your personal account can be obtained by watching the video:

Is there an online calculator on the site and how to use it?

On the main page of the official website of the organization there is an online calculator through which you can calculate funded pension provision. To calculate, you will need to indicate your gender, age, year you started working, and monthly earnings.

Let's look at an example of what the size of pension payments will be under certain parameters:

- Gender – male.

- Age – 35.

- Year of start of work – 2000.

- The salary per month is 50,000 rubles.

Click on the “Calculate” button. The system shows that the funded pension with the given parameters will be equal to 17,035 rubles. monthly.

Personal account functionality

The main task of the personal section is to provide information to every citizen. An open financial policy is the key to customer trust. Therefore, the LC proposes:

- Receive information about your pension savings;

- Maintain several retirement accounts at the same time for insurance. Unlike the state program, here you can independently choose the amount of contributions in order to increase or decrease the efficiency of the funded part of the pension;

- View information about maternity capital, as well as about accruals on it, if the funds were not used immediately, but were invested;

- View the results of pension investment, control the level of pension increases.

In addition to the fact that deferred savings can be used by a person who is a client of the VTB Fund, after his death the money goes to his heirs. Such conditions are not offered by government programs.

Personal account features

By requesting permission to register in the VTB NPF personal account in the online service, the fund’s clients receive 24/7 access “from home” to detailed information:

- About your pension account for the funded portion of your pension.

- On the status of personal pension accounts of non-state pension provision.

- On the amounts of maternity capital allocated for the formation of the funded part of the pension.

- On the results of investing pension reserves and savings.

The online service also allows you to edit your mobile number, email and change your password.

Creating a personal account

To use your personal account on the official website of NPF VTB, you must register. Unfortunately, you cannot do this yourself remotely. To gain access to your personal account, several conditions must be met.

First, you need to draw up an agreement with a non-state pension fund on pension provision. Secondly, the company activates the personal account only after the original agreement is transferred to the Pension Fund of the Russian Federation. The document is submitted within a month from the date of signing.

The fund will inform you that the activation of your personal account was successful by sending a letter to your email address, which you specified when completing the agreement.

VTB Pension Fund - NPF personal account

By requesting permission to register in the VTB NPF personal account in the online service, the fund’s clients receive 24/7 access “from home” to detailed information:

- About your pension account for the funded portion of your pension.

- On the status of personal pension accounts of non-state pension provision.

- On the amounts of maternity capital allocated for the formation of the funded part of the pension.

- On the results of investing pension reserves and savings.

The online service also allows you to edit your mobile number, email and change your password.

The main task of the personal section is to provide information to every citizen. An open financial policy is the key to customer trust. Therefore, the LC proposes:

- Receive information about your pension savings;

- Maintain several retirement accounts at the same time for insurance. Unlike the state program, here you can independently choose the amount of contributions in order to increase or decrease the efficiency of the funded part of the pension;

- View information about maternity capital, as well as about accruals on it, if the funds were not used immediately, but were invested;

- View the results of pension investment, control the level of pension increases.

- You regularly deposit money into your account and do not spend it until you retire. The first contribution is at least 3,000 rubles, then there are no restrictions. It is NOT necessary to save every month. It all depends on your desire

- NPF VTB Pension Fund increases the amount of your savings every year due to the investment income earned for you

The VTB Pension Fund LC has a number of useful functions:

- obtaining information about the state of the pension account;

- displaying the results of invested funds of pension reserves;

- replenishment of a pension account and activation of automatic payment;

- receiving online consultations;

- ordering the necessary documents;

- making changes to the personal data of the pension recipient;

- obtaining data regarding the status of personal accounts that are opened with NPFs.

After creating a pension account, the client independently determines the amount of payment that it is convenient for him to make each month. This is all fixed in a formal contract. The accumulated money is invested, after which the bank accrues income. As a result of participation in the program, you can receive an additional pension regardless of the state pension. Payments begin 5 years earlier. The size of the pension is determined in accordance with the contract based on the volume of monthly investments.

Note: The VTB Pension Fund offers 10 programs, 6 of which are for individuals. They offer different pension payment schemes.

The bank client's money is completely safe. They are not charged in case of bankruptcy and are not divided in case of divorce. In the event of the death of the account owner, all savings are transferred to legal successors. This happens both at the accumulation stage and during the payment process.

How to make a first contribution to a VTB pension account?

This can be done through VTB 24 Internet banking, on the website of the Pension Insurance Fund through a personal account or through ATMs. The most convenient way is to set up auto payment to top up your account with a certain amount every month. You can also pay your monthly fee with bonuses from the Multibonus program.

What happens to my money in the Fund if I quit my job?

Nothing will happen. In accordance with the agreement, the Fund is personally responsible to its client.

The VTB Group includes more than 20 organizations, incl. VTB 24, BM-Bank, Zabsibkombank, VTB Pension Administrator, Business Finance LLC, etc.

NPF VTB Pension Fund is the legal successor of the Non-Profit Organization NPF VTB Pension Fund. Became a joint stock company in 2013.

This is a commercial organization operating under a license, not a charitable foundation. Therefore, each service will be paid for by the client (even if the invoice is issued implicitly).

First, an agreement is concluded with NPF VTB (you can do this on the official website). Then an application for transition is submitted to the Pension Fund, where NPF VTB is indicated as the new insurer.

You need to log into your personal account on the official website of NPF VTB. Please note that the return on the account is displayed by year, but is recorded once every 5 years from the date of account opening.