Only those who are clients of this non-state pension fund can register and log into the personal account of NPF Lukoil Garant. Otherwise, registration in your account will not take place. In order to become a client, you need to go to a branch of this fund and have your passport and SNILS with you.

Next, you will need to conclude an agreement with NPF Lukoil Garant on compulsory pension insurance and submit an application to the Pension Fund of the Russian Federation. In this case, you can submit an application to the Pension Fund through the MFC, going to your district pension fund, or submit an application through the online portal of the State Services. If you choose the latter option, you will need to have an account there.

At NPF Lukoil Garant you can choose two types of pension:

- Funded pension;

- Non-state pension.

What you need to do to apply for a funded pension is written above: enter into an agreement with a non-state pension fund and submit an application to the Pension Fund. To apply for an additional non-state pension at Lukoil Garant, you just need to write an application online on the NPF website. If you are not yet a client of this fund, click here. To submit an application and conclude a non-state pension agreement you need:

- Be a citizen of the Russian Federation;

- Be of legal age;

- Have a passport, SNILS, INN and have a valid mobile number.

Next, we go through the procedure of filling out your data. At the first stage, we enter our full name, passport data, SNILS, INN, enter the captcha from the image, and agree to data processing. If necessary, check that you are familiar with the rules (by default, these boxes are already checked), and click the CONTINUE button.

The second step is to enter your registration address and actual place of residence, zip code, email and phone number for SMS notification. Click the CONTINUE button to move to the third step.

At the third stage, the NO items are checked by default, if you agree with them, then just click CONTINUE. This will complete the procedure.

Personal account of NPF Lukoil Garant

The personal account of NPF Lukoil Garant is required to carry out the following actions:

- Monitoring the status of a personal pension savings account;

- Tracking the growth of your savings;

- Calculation of your pension savings;

- Submitting applications for non-state supplementary pension;

- Receive statements on your personal pension account;

- Confirming or updating personal data;

- Concluding an agreement on non-state pension provision;

- Request copies of necessary documents;

- Contact support for various issues;

- Receive an extended profile of your personal account using SMS confirmation during the registration procedure.

ADVANTAGES OF USING YOUR PERSONAL ACCOUNT

The individual page in your personal account is located on the company’s official website and is equipped with a very convenient panel for use and management. What are the amenities and what are the main advantages of this type of service?

Firstly. This is a very convenient opportunity for a client of the company and user of the account to be able to interact, use the functions and use the services of the company, being in any place and at any distance from it, learn all the news and see the status of their savings.

Secondly. Only the owner of the page has access to services and work with the system. Only he has the password received during registration, which is unique. You must use a password every time you log into the system, which is additional protection, since no one except you can use the company’s services on your behalf.

Third. All your personal data entered during registration is kept strictly confidential and reliably protected from third parties. The developers of the company's cabinet made every effort to ensure its functionality, ergonomics and ease of use. The client of the company has the opportunity to use the services you need.

NPF Lukoil-Garant has been operating for 23 years and, thanks to the development of Internet technologies, has been able to provide its clients with a convenient service.

The Lukoil-Garant personal account is a tool for convenient and prompt interaction between the fund and registered users. The capabilities of the service, security issues and other nuances of its functioning will be discussed below.

Key indicators

Among the advantages of the organization is its financial stability, thanks to which pension payments were consistently made throughout the existence of the Lukoil-Garant NPF (including during acute crisis downturns). That is why the rating agency “Expert RA” evaluates the organization’s activities as “A”.

The fund manages 250 billion rubles. The cumulative return on pension savings from 2005 to 2021 was 175.1%. According to the Bank of Russia, as of June 30, 2017, NPF Lukoil-Garant is trusted by more than 3.5 million depositors.

More on the topic Pension in Abakan in 2021, how to get the minimum amount of additional payment, registration when moving, addresses of branches of the Pension Fund of the Russian Federation where you can apply for and receive SNILS in Abakan

Personal account of NPF Lukoil-Garanta

Registration

Only those users whose data is available in the general database of the fund can register. The service is located at: https://lk.lukoil-garant.ru. After concluding a pension agreement and receiving funds from another NPF or Pension Fund, information about the client is fixed in the system.

Servicing of savings begins the next year after submitting the application (no later than March 31).

Each user has the right to choose the most convenient registration option - by passport or by SNILS.

Additional information is the date of birth of the person who intends to register.

If data is successfully recognized in the system, the client is prompted to enter an email address in the appropriate box. You should receive a letter confirming your registration and containing a password to log into your personal account.

Entrance

To log in to your Lukoil-Garant personal account, use your login and password. The login can be SNILS, and only numbers without spaces are entered into the field, as on the document itself. The password is specified during registration and is used in the future.

Shutdown

It is impossible to stop the work of your personal account through the website. Therefore, if you want to do this, you should contact the fund with an application, write a letter to the support service or call the hotline. NPF employees will be able to redirect you to a specialist if necessary.

Possible problems with logging into your personal account and how to resolve them

Sometimes problems happen and you can’t log into NPF Lukoil Garant. We will look at the most common options:

- An extended profile is registered, indicating the phone number, but the verification code is not sent to it. Most likely, when filling out the data, you made a mistake in your mobile number

- The system cannot find your data. The client’s personal page on the website is activated only after his savings are transferred to the Lukoil Garant personal account. This is most likely the case and you just need to wait a little longer. You will receive a notification about the receipt of funds in your account via SMS or email.

- The system does not accept passport data when registering in your personal account. This happens when the information in the Lukoil database does not match the information entered by the client. In this case, you should go through the registration procedure again, but using your SNILS number.

Important: after 5 unsuccessful attempts per day to enter the personal account of the non-state pension fund, the entrance to Lukoil Garant is blocked. And there is no possibility of recovering your login and password. Therefore, if they are lost, you can only re-register with the previous documents. The login and password will be new, but the client’s profile in the system will remain the same.

Features of the personal account of the Lukoil-Garant fund

After gaining access to the service, each client has the opportunity to evaluate the convenience and functionality of their personal account. Here you can:

- control the pension account and savings on it;

- use a special pension calculator;

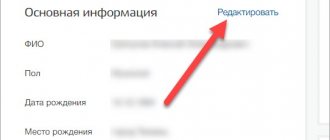

- update personal data;

- order account statements;

- see passport data (only with the extended version);

- receive online consultations from fund specialists.

Opportunities for an individual in the Lukoil personal account

By registering in the system, the client will be able to manage personal data remotely. Using an account, a subscriber can:

- monitor the state of your pension account;

- control the state of pension savings;

- calculate the size of your future pension;

- apply for a pension;

- update and confirm data;

- draw up an agreement on individual pension provision;

- contact support;

- get copies of documents.

Security and privacy rules

The personal account security system does not provide for a password recovery procedure. Every time it is forgotten or lost, you will have to register again. Then you will receive a password again via email that you can use.

Important! Incorrectly entered data in the authorization window will lead to account blocking after 5 attempts. It will be unblocked only the next day.

The data used to register and log into your account is kept strictly confidential. You can be sure that not a single person will be able to access the client’s personal account until the latter himself provides his own data to a third party. In accordance with the terms of the contract, this is prohibited.

Problems encountered during registration

Registration in the system may not be successful due to missing information in the database. This is due to the recent conclusion of the contract, when the information has not yet been loaded into the database. Registration may not be successful due to incorrectly entered data. As a rule, several more attempts for this reason bring the desired result.

If you cannot correct the situation and complete the procedure, it makes sense to contact a fund employee by calling the hotline.

Support

The contact center is available at 8-800-200-59-99. Calls within Russia are free of charge. For all questions regarding pensions and working with your personal account, you can contact the specified number.

Free help from a Pension Lawyer Legal advice

on deprivation of rights, road accidents, insurance compensation, driving into the oncoming lane, and other automotive issues.

Daily from 9.00 to 21.00

Moscow and Moscow region +7 (499) 653-60-72 ext. 945 St. Petersburg and LO+7 ext. 644 Free call within Russia 8-800-511-20-36 —> Consultation with a pension lawyer by phone In Moscow and the Moscow region + 7 St. Petersburg and the region + 7 NPF card

| Profitability: | -26,75 % |

| Assets: | 274435482.1712 thousand rubles. |

| Reliability: | |

| Official site: | www.lukoil-garant.ru |

| Personal Area: | |

| Telephone: | 8 |

Information is current as of 04/09/2018.

Important! Currently, the Fund is working to merge databases and create a new technological platform for a personal account with NPF Otkrytie. In this regard, the information on your contract on compulsory pension insurance is relevant as of 08/16/2018; it is also possible that the information on the contracts may not be displayed correctly.

Currently, a conscientious employer contributes 13% of income tax, and on top of that 22% to a retirement account. Of these, 16% is the insurance part, and only 6% is the savings part, which the Russian can dispose of at his own discretion: leave it in the Pension Fund or transfer it to another fund.

Personal account “Lukoil-Garant” (Non-state Pension Fund) - provides ample opportunities to manage your savings. The company has existed for more than 20 years and serves 3.5 million people. Every year, 250 billion rubles are involved in turnover, and the company’s income is 175%.

Registration and login to the personal account of the non-state pension fund “Lukoil-Garant”

Click on “Lock”

What you will need to register:

- Date of Birth.

- Optional: passport or SNILS.

To receive an Advanced Profile, you must enter a valid phone number to which an activation code will be sent. Registration will end here.

If the phone number has not been added in advance, this can be done using the State Services portal or the Individual’s Questionnaire.

In the future it can be changed:

- In your personal account with an extended version.

- On the Government Services portal, where you will need a verified account.

- Using the Questionnaire for an individual, available on the company page. It can be handed over in person at the Foundation's branches, where a prior appointment will be required, or sent by mail.

Next, to access the information, you must log in using your existing password and login.

Elena Smirnova Pension lawyer, ready to answer your questions. The system does not issue a new password if you lose the old one, the only way to restore it is to register again. Be careful about remembering your credentials: if you make 5 incorrect authorization attempts, your personal account will be blocked for a day. Do not share your login information with third parties. Hotline for all questions regarding pensions: 8 800 200 5 999.

It is worth remembering that current information must be confirmed at least once every three years.

Official site

The website of NPF "Lukoil-Garant" has currently lost its significance and is not working. Nowadays, the Otkritie Foundation website operates online, on the pages of which you can get all the necessary and complete information about the foundation itself, its current activities, as well as opportunities and methods of transferring to the foundation.

This Internet resource is official, in this regard, the information posted on it should be considered as a priority.

Attention! If you have any urgent questions, you can contact the hotline

- monitor the increase in cash savings;

- get help online;

- specify the amount accumulated over a certain period of time;

- receive an extract if necessary;

- use an option such as a pension calculator.

More on the topic Pension Fund Vyborg official website personal account

You can calculate your pension using points using an online calculator on the Pension Fund website. The portal will not require you to register or enter your passport data, which greatly simplifies the work on it and saves the user’s time.

The only thing required: correct answers to the questions asked. They take into account all the factors that may affect the calculation of pension on the online calculator in 2021 by points.

Expert opinion

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

The value of pension points is indexed every year, so the calculation cannot be made absolutely accurately. It will always only be approximate.

First of all, you will need to indicate your gender (male or female), as well as your year of birth. For example: female, born in 1992.

Men must also introduce a period of conscription for military service in the Russian army. Women do not need to do this.

For the greatest accuracy of calculations on the website, it is necessary to indicate the planned number of children (taking into account those already born) and the time that will be spent on maternity leave (no more than six years). Again, men do not need to fill out this column. For example, you plan to have two children and spend three years on parental leave.

As mentioned earlier, the retirement age has a great influence on the size of the pension. That is, if a woman plans to retire not at 55, but at 58, then she must indicate that she will not apply for old-age benefits for three years.

Contributions to the Pension Fund are paid only from “white” wages, and on the service you also need to indicate in what capacity the person is working. The site offers three options to choose from:

- employee;

- self-employed citizen;

- employee and self-employed citizen.

For example, it was indicated that a woman born in 1992 works as an employee.

The next field must be filled in with the planned number of years of work experience (taking into account existing ones). For example, I have already worked for two years and my plans are to continue working for another 32 years. That is, you need to enter the number 34.

In the last column you must write the amount of monthly wages before deduction of personal income tax. For example, 30,000 rubles.

So, the calculation was made for:

- women;

- Born in 1992;

- planned number of children: 2;

- time spent on parental leave: 3 years;

- retirement will take place at age 58 (three years later);

- 34 years of work experience will be earned over a lifetime;

- monthly salary before personal income tax is 30,000 rubles.

To perform the calculation, you need to click on the “Calculate” button.

The pension calculator will automatically calculate and display the following information:

- number of individual pension coefficients: 158.7;

- the amount of the insurance pension is 18,862 rubles 2 kopecks;

- total length of service: 37 years (maternity leave time is added to the length of service).

Features of the personal account of NPF "Lukoil-Garant"

The non-state pension fund "Lukoil" provides access to a personal account for individuals to use the following range of services:

- Monitor your pension account.

- Edit confidential information.

- Apply for a pension.

- Conclude an agreement on the provision of services.

- Monitor your savings growth and know their size.

- Pension calculator.

- Order copies of documents and pension account statements.

- Get answers to your questions.

To gain full access to the service, you will need an Advanced Profile.

How to register on the website of NPF "Lukoil Garant"

To do this, you must first become a client of the fund. To do this, you need to contact the NPF office, having your passport and SNILS card with you. You can either enter into a compulsory pension insurance agreement, under which your funded pension will be transferred to Lukoil-Garant, or enter into a non-state pension agreement, under which you will receive an additional pension.

Please note: you can conclude a non-state pension agreement directly on the online website without visiting the fund’s office - both if you are not yet a client of the fund, and if you are already a client.

After one of these agreements is concluded and the first payment is received by the fund, information about you will appear in the fund’s database, and you will be able to create a personal account (PA) on the fund’s website. To do this, just enter your passport or SNILS details on this page.

After that, a login and password will be sent to your email address, with which you will subsequently log in to your account.

Here are the screenshots (click to enlarge):

Registration by SNILSRegistration by passport

If you forget your login or password, you will simply have to go through the registration procedure again, after which you will be able to log in to your account again.

How to submit an application to NPF Lukoil-Garant for a pension

You can leave an application for appointment at the branches of the Foundation. Documents you will need: SNILS and passport.

The application shall indicate:

- FULL NAME;

- accounts;

- citizenship;

- addresses of residence and stay;

- contact number;

- passport details;

- some other points.

Where can you leave documents:

- personal contact at the service office;

- through the post office;

- using the State Services portal.

How to log into the personal account of NPF Otkrytie?

The instructions are simple:

- Visit the official website of the NPF.

- Click on the “Personal Account” button.

- Enter your login, which is your SNILS number, and password.

- Click the “Log in to your Personal Account” button.

You also have the opportunity to log into the personal account of NPF Otkritie through the State Services portal. But it is important that you have a verified account there!

How to transfer funds to NPF “Lukoil-Garant”?

You can transfer funds using a standard or early transfer application:

- By default, the transfer occurs 5 years after filing the application, and the risks are minimal.

- Early registration is made annually, once before March 31. That is, if the application was received this year, then next year, before the end of March, the funds will be transferred to the Lukoil-Garant account. This results in loss of investment income. If the company approves the application, a notification of receipt of funds is sent.

To provide services, an OPS agreement is concluded with the company. Before December 31 of the same year, you must send an application for transfer to the Pension Fund. This can be done through the MFC, by mail or using gosuslugi.ru. You will need a passport and SNILS. A third party needs a power of attorney to carry out transactions.

All of the above statements can be found in the Personal Accounts of the Pension Fund and Lukoil-Garant.

Important: the law does not prohibit transferring your funds from one fund to another, but investment income is lost during transfers more than once every 5 years.

Creating a personal account

Registration of your personal account is carried out independently online, but only after your application for transfer to NPF Otkrytie has been reviewed and a positive decision has been made on it. Therefore, first contact the company office and submit a request for pension transfer.

>

As soon as you receive a response to your request, you can proceed to registering your personal account:

- Open the official website of the fund.

- Click the “Personal Account” button in the upper right corner.

>

- Click “Register”.

- Select the registration method - by SNILS number or by passport data.

- Fill in the requested information.

- Click on the “Register” button.

Ready!

Possibility of calculating future pension using an online calculator

The website contains a calculator that allows you to calculate the amount of your pension. To get the result, you need to indicate at the bottom of the main page in the appropriate forms:

- floor;

- month and year of birth;

- salary per month;

- how much money is saved per month.

After entering, the total amount appears on the screen.

The calculator gives an impetus to understanding the required pension in the future and the parameters that can be changed to increase it now.

Application and registration for a pension

To register a Lukoil Garant personal account, go to the authorization page, following the algorithm proposed above, and select “Register”. After a couple of moments, a small questionnaire will appear on the screen, offering 2 ways to create an account:

- Using SNILS. To complete the procedure, you must enter your insurance number and date of birth. The day, month and year can be entered manually or selected in a special calendar;

- Using a passport. When choosing this option, you must indicate the details of the relevant document, specifying the time of receipt, as well as the day, month and year of birth. Both dates can be entered manually or set via the calendar.

When all fields are filled in, make sure the information entered is correct. If there are no errors, click “Register”. After completing the above steps, the questionnaire will be processed. The system will check the details specified by the user and generate a primary access key.

The combination will be sent to the applicant via email or text message, depending on what contact information was provided when concluding an agreement with the fund. After the first successful authorization, you can change your password by going to your personal account settings. When choosing a protective combination, consider safety requirements. We also advise you not to set passwords used to log into social networks, online games or forums.

How to receive the funded part of a pension from NPF “Lukoil-Garant”?

Main criteria for obtaining

Citizens of Russia with pension contributions can receive the funded part. As well as foreign persons who have a document certifying the possibility of receiving pensions. To purchase it you need a residence permit.

Currently, the funded portion is received upon reaching 60 years of age for the male population and 55 for the female population. The law provides for social and professional cases when this threshold is reduced: disability, work experience in the northern regions, workers employed in hazardous industries, and other persons.

The funded part must be at least 5% of the amount of the insurance and funded pension.

Documentation

Important: to receive it, you must submit an application for a funded pension, the form of which is presented on the official source. It is submitted by women over 55 years of age and men over 60 through a Personal Account with an Advanced Profile. Scanned images of the necessary documents are attached to it:

- completed pages of a Russian passport;

- SNILS;

- bank account details;

- if necessary, a document confirming the change of full name.

Important: a certificate with information from the territorial office of the Pension Fund about the pension is not required to be provided, but the application with it will be processed faster.

You can consult with branches of partner banks, information about which can be found in the “Contacts” section on the company page.

Let's sum it up

To increase comfort, the official websites of Lukoil and the Pension Fund provide access to services using Personal Accounts.

To register with Lukoil LC, you must enter your passport data or SNILS, date of birth and update or confirm current information every three years by providing supporting documents. You can apply for a pension when you reach retirement age and certain other factors.

Thus, any citizen can decide on a pension in advance and regularly invest funds to increase its size. To do this, he will need a Russian passport or SNILS, and for a foreign person - a document certifying the right to receive pensions.

Attention! Due to recent changes in legislation, the legal information in this article may be out of date! Our lawyer can advise you for free - write a question in the form below: Sources used:

- https://garantlukoil-lk.ru/

- https://ru-npf.ru/lukoyl-garant-lichnyy-kabinet/

- https://pfrf-kabinet.ru/lk/lukoyl-garant.html