How to enter your personal account into the Sberbank Pension Fund?

Instructions on how to log in to your personal account at NPF Sberbank:

- Visit the official website of the fund.

- Click on the “Personal Account” button.

- Choose a convenient access method for you - by cell phone number, by email address, by SNILS number.

- Enter your chosen login.

- Specify a password.

- Click the “Login to your personal account” button.

Ready!

When I forgot my password

If you have lost or forgotten your code word, you can easily recover it online. To do this, you need to go to the Sberbank NPF website, click on the “Forgot your password” link, it is located next to the field for entering the password.

Enter your email address and code from the picture shown. You will receive a notification in your mailbox in which you can change your password.

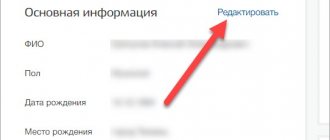

How to change your personal account password, personal data, contacts?

If you want to change the password for your personal account, log into your account and follow these steps:

- On the main page, under your full name, click “Profile Settings”.

- In the window that opens, in the “Create/change password” section, enter the new code.

- Click the "Change" button.

In the same section, you can upload a profile photo, change your email address, mobile phone number, passport details, and set up alerts.

www.npfsb.ru register in your personal account of Sberbank NPF

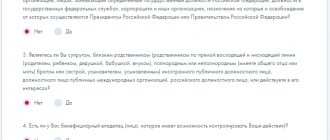

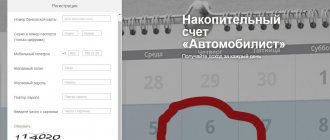

To register a personal section on this portal and control the funded part of your pension, you will need to perform the following steps:

- You go to the site and click on the profile tab.

- A small questionnaire will be opened, in which you will need to enter data such as a mailbox, personal initials, password and the answer to one of the security questions.

- The system will quickly move you to the secondary stage of the registration process. Here you need to enter information from your passport, personal mobile number, as well as SNILS.

- A check mark is placed regarding consent to the processing of the entered data.

- If you wish, you can check the box to agree that the system will send SMS messages.

- Enter the special code from the attached picture.

The user does not have any problems filling out the necessary information in his personal account on lk.npfsb.ru. Next to each line you can find a small question mark. These are certain clues that you need to rely on. If the registration process is successfully completed, the system will immediately notify you about this.

How to switch to NPF Sberbank from another fund?

To transfer a pension to the Sberbank Non-State Pension Fund, you need to complete two simple steps:

- Conclude an agreement on OPS. This is only possible in the company's offices. Have your passport and SNILS with you.

- Submit an application for a standard or early transfer to a non-state pension fund. This can be done at a fund branch or through the State Services portal. In the latter case, a verified account and a qualified digital signature key certificate are required. To fill out the application, prepare your passport and SNILS.

Next, all that remains is to track the status of the agreement in the NPF personal account.

You must submit a request to transfer your pension before December 1. If the Pension Fund of the Russian Federation approves the application, the savings will be transferred to the Sberbank fund. The duration depends on which transition is selected. If early, savings will be received before March 31 of the next year, if standard - after 5 years.

Personal account functionality

By registering an account in the online service system, the investor can:

- Contact authorized representatives of the non-state pension fund. A chat form integrated into the personal account allows the client to ask any question about the company’s activities and solve any problem with a deposit online.

- Monitor changes in pension legislation and the charter of non-state pension funds. Since the personal account contains a section with a news feed, the company’s client can use the system as a source of useful information.

- Monitor the status of your savings account. The personal account displays information about the current deposit amount and interest accrued for any period of time. Based on this information, the user can independently calculate the approximate amount of future pension payments.

- Request a certificate or any other document from Welfare. The system allows you not only to receive an electronic copy of the agreement between an individual and a non-state pension fund, but also to submit a request for the issuance of a particular certificate. It is worth noting that all documents sent via LC are confirmed using a digital signature.

- Receive information about additional company services. Thanks to the system, the client can take part in special programs that allow him to receive additional interest on his deposit.

Even people far from computer technology will be able to understand the LC interface: the system has not only a pleasant and minimalistic design, but also a relatively large font of text blocks.

How to submit a pension application?

To receive a pension you can apply through:

- bank branch;

- NPF office;

- through the user’s personal account online;

- by sending documents through the post office to a non-state fund.

The easiest and fastest way to submit an application is online through your personal account. The algorithm of actions is as follows:

- Log in to the Sberbank Non-State Pension Fund personal account.

- Go to the “Applications” tab.

- Click “Complete/Submit”.

- Click the button “Application for payment of a pension under a compulsory pension agreement.”

- Click "Fill".

- Enter the required information.

- Approve data processing.

The funded part of the pension is issued if the pensioner has reached retirement age. The payment request is processed within 2 weeks.

How to order an extract?

To find out your savings in NPF Sberbank under the agreement on compulsory pension insurance, follow these instructions:

- Log in to your personal account at NPF Sberbank.

- In the “Contracts” section, select OPS.

- Click on the green document icon.

- Select the access method - through the State Services portal and through Sberbank Online.

- Click the “Direct” button.

An email with an account statement will be sent to your email address.

Registration and login

Go to your personal account

To register a client account for the Bolshoi non-state pension fund, go to the main page of the official website:

https://www.bigpension.ru

In the upper right corner of the screen, click “Personal Account”.

On the login page that opens, click “Register”.

Select the registration method: by phone number or through the State service class=”aligncenter” width=”541″ height=”381″[/img]

In the first case, you must fill out the form by entering the following personal data of the client:

- FULL NAME;

- date of birth;

- SNILS;

- E-mail address;

- contact phone number for communication.

Check the two boxes below regarding consent to the processing of personal information and notification of information security risks. Click “Register”.

The system will check the correctness of the specified data and send an email with a link to activate your account. By clicking on it, you will complete the registration procedure for your personal account of the Bolshoi Pension Fund.

If you have a confirmed account in the unified identification and authentication system on the State Services service, select the second registration option.

Provide your email address and mobile phone number linked to your State Services account. Agree to the terms of processing of personal data by checking the appropriate box. Click “Register via State class=”aligncenter” width=”528″ height=”488″[/img]

Log in to your FPF personal account on the service and confirm the transfer of personal information to the website of the non-state pension fund. After checking the information, the system will automatically register the client profile.

To log into your NPF Bolshoi account, open the authorization page https://lk.bigpension.ru. Enter your login and password into the form and click “Login”.

What are corporate pension plans?

KPP is a type of agreement that the employer himself draws up for his subordinates. Within the framework of this agreement, it is possible to conclude a collective insurance plan for each employee of the company. The PPP differs from the PPP in that the contributions are paid by the employer, not the client himself.

In your personal account you can find out at any time the amount of savings under the checkpoint.

If an employee resigns, the corporate agreement with him is subject to termination.

How to terminate an agreement with PNF Sberbank?

If the policyholder wishes to withdraw funds from the individual savings account earlier than the period established by the agreement, the agreement will need to be terminated. To do this, you will need to contact a bank branch or fund office.

If the IPP agreement is terminated early, there is a risk of losing up to half of the contributions made. If you do not want losses, you will have to wait until the 5-year period has passed.

To terminate the OPS agreement, the following is required:

- write a corresponding request to the NPF;

- transfer to the Pension Fund of the Russian Federation;

- transfer the pension to another non-state pension fund.

An application to change the fund is reviewed within 2 weeks. The transfer of savings to the Pension Fund of the Russian Federation or a non-state institution is carried out in the first half of the next year.

Please note that if you switch to another fund within the first four years, all accrued interest will be forfeited. To receive all funds from the account, you must be an active client of the NPF for 5 years or more.

What are the advantages of Sberbank NPF?

The Sberbank non-state pension fund has the following positive aspects:

- Stability. The organization has been in good financial condition for several years. The profitability ratio under OPS agreements has been falling below 7.5% for 5 years.

- Availability. Clients can at any time receive all the necessary information about their contracts, the amount of savings and other important points. Each user has access to a personal account where all information is indicated.

- Opportunity for growth. Every year more and more Russian citizens are joining Sberbank NPF. As of 2021, the number of customers is 8.3 million.

- Registration of tax deductions online. Return of personal income tax for contributions to the individual entrepreneurial program is possible through online services. The deduction is calculated from an amount of no more than 120 thousand rubles, so the maximum you can get is 15.6 thousand rubles.

- Good status. Sberbank NPF is part of Sberbank, which has been a market leader for many years and has proven its reliability and financial stability.

On the Internet you can find many positive opinions about the work of Sberbank and its non-state pension fund.

Watch the video: Sberbank NPF accrued GOOD INCOME for savings. My Non-State Pension