It is worth noting the fact that not all citizens, but mostly older people, live in abundance and have all the things necessary for a normal existence. This is directly related to the fact that salaries in the country are not high, pensions are small, and the money received is barely enough to survive. For this reason, such a concept as a living wage was introduced.

It represents the amount of money needed to purchase things, products, and essential medicines. They represent an additional payment to your existing pension or salary. In this article we will look exclusively at the cost of living that pensioners are entitled to in 2019.

What does a pensioner's living wage include?

First you need to understand what the living wage is. This is a certain amount of money paid by the state to unsecured or needy pensioners whose income is below average.

Basically, these funds are used to purchase food, detergents, medicines, as well as those types of services that are needed.

It also consists of two components, namely:

- Physiological needs are those material items without which it is impossible to imagine the ordinary life of any person. They make up more than 80% of all money allocated for the cost of living.

- Social needs - it includes a full set of spiritual and mental values.

Important! It is worth noting that the amount of these payments is determined individually for each pensioner, since everyone has a different income. It also all depends on the region of residence of the elderly person.

Living wage from May 1, 2021 in Russia - general indicators

The direct cost of living in 2021 in Russia was fixed on January 1 and amounts to 10,326 rubles per capita in the Russian Federation as a whole. It should be remembered that the corresponding principles for calculating this indicator are established based on the results of the previous quarter and, until May 1, 2021, are regulated by the provisions of Decree of the Government of the Russian Federation No. 1490 of December 8, 2017.

Directly from May 1, 2021 in Russia, the cost of living will not change for now, since it will take time to analyze economic indicators and the consumer basket for the first quarter of this year. However, starting from the first day of May, another significant change will occur - from this moment on, the minimum wage in 2021 will be equal to the subsistence level and will subsequently change depending on this indicator.

In general, the cost of living indicators for the country are as follows:

- The cost of living for a child at the beginning of 2021 is 10,181 rubles.

- The cost of living for a pensioner at the beginning of 2021 is set at 8,726 rubles.

- For an adult able-bodied person, the cost of living is 11,160 rubles.

The living wage for pensioners is established by the provisions of a separate regulatory act, which in the case of 2021 is Federal Law No. 178 of July 17, 1999.

What is the cost of living for a pensioner in 2019?

As mentioned earlier, the cost of living depends on many factors and is determined according to several categories, namely:

- Place of residence of the pensioner.

- Amount of pension payments.

- Availability of an additional source of income.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

The main and key factor is still the region in which the elderly person lives. This is due to the fact that each of them has its own salaries and prices.

The cost of living for a pensioner in a constituent entity of the Russian Federation

We present to your attention a table with the regions, as well as the minimum amounts of cash payments that they are entitled to this year.

| № | The subject of the Russian Federation | Sum | NPA |

| 1 | Altai region | 8 669 | Law of November 2, 2018 No. 91-ZS |

| 2 | Amur region | 8 846 | Law of October 31, 2018 No. 256-OZ |

| 3 | Arhangelsk region | 10 258 | Law of October 26, 2018 No. 15-2-OZ |

| 4 | Astrakhan region | 8 352 | Law of October 26, 2018 No. 101/2018-OZ |

| 5 | Belgorod region | 8 016 | Law of November 27, 2018 No. 310 |

| 6 | Bryansk region | 8 523 | Law of October 24, 2018 No. 72-Z |

| 7 | Chechen Republic | 8 735 | Law of December 5, 2018 No. 59-RZ |

| 8 | Chelyabinsk region | 8 691 | Law of October 30, 2018 No. 804-ZO |

| 9 | Chukotka a.o. | 19 000 | Law of October 30, 2018 No. 65-OZ |

| 10 | Chuvash Republic | 7 953 | Law of October 19, 2018 No. 65 |

| 11 | Jewish Autonomous Region | 9 166 | Law of October 25, 2018 No. 316-OZ |

| 12 | Saint Petersburg | 8 846 | Law of November 30, 2018 No. 711-714 |

| 13 | Sevastopol | 8 842 | Law of December 17, 2018 No. 463-ZS |

| 14 | Khabarovsk region | 10 895 | Law of October 24, 2018 No. 371 |

| 15 | Khanty-Mansi Autonomous Okrug-Yugra | 12 176 | Law of October 16, 2018 No. 69-oz |

| 16 | Irkutsk region | 8 841 | Law of October 30, 2018 No. 82-OZ |

| 17 | Ivanovo region | 8 576 | Law of November 1, 2018 No. 51-OZ |

| 18 | Kabardino-Balkarian Republic | 8 846 | Law of September 27, 2018 No. 24-RZ |

| 19 | Kaliningrad region | 8 846 | Law of November 19, 2018 No. 224 |

| 20 | Kaluga region | 8 708 | Law of October 31, 2018 No. 397-OZ |

| 21 | Kamchatka Krai | 16 543 | Law of September 27, 2018 No. 250 |

| 22 | Karachay-Cherkess Republic | 8 846 | Law of October 29, 2018 No. 67-RZ |

| 23 | Kemerovo region | 8 387 | Law of October 29, 2018 No. 80-OZ |

| 24 | Kirov region | 8 474 | Law of September 27, 2018 No. 182-ZO |

| 25 | Kostroma region | 8 630 | Law of October 18, 2018 No. 469-6-ZKO |

| 26 | Krasnodar region | 8 657 | Law of October 30, 2018 No. 3882-KZ |

| 27 | Krasnoyarsk region | 8 846 | Law of November 23, 2018 No. 6-2201 |

| 28 | Kurgan region | 8 750 | Law of October 30, 2018 No. 118 |

| 29 | Kursk region | 8 600 | Law of October 31, 2018 No. 61-ZKO |

| 30 | Leningrad region | 8 846 | Law of December 20, 2018 No. 130-oz |

| 31 | Lipetsk region | 8 620 | Law of October 29, 2018 No. 214-OZ |

| 32 | Magadan Region | 15 460 | Law of November 1, 2018 No. 2305-OZ |

| 33 | Moscow region | 9 908 | Law of October 30, 2018 No. 180/218-OZ |

| 35 | Murmansk region | 12 674 | Law of October 26, 2018 No. 2295-01-ZMO |

| 36 | Nenets a.o. | 17 956 | Law of October 29, 2018 No. 6-oz |

| 37 | Nizhny Novgorod Region | 8 102 | Law of October 2, 2018 No. 88-z |

| 38 | Novgorod region | 8 846 | Law of October 29, 2018 No. 315-OZ |

| 39 | Novosibirsk region | 8 814 | Law of October 31, 2018 No. 304-OZ |

| 40 | Omsk region | 8 480 | Law of October 5, 2018 No. 2102-OZ |

| 41 | Orenburg region | 8 252 | Law of October 25, 2018 No. 1284/344-VI-OZ |

| 42 | Oryol Region | 8 730 | Law of November 6, 2018 No. 2283-OZ |

| 43 | Penza region | 8 404 | Law of September 25, 2018 No. 3243-ZPO |

| 44 | Perm region | 8 539 | Law of November 1, 2018 No. 299-PK |

| 45 | Primorsky Krai | 9 988 | Law of October 30, 2018 No. 365-KZ |

| 46 | Pskov region | 8 806 | Law of November 7, 2018 No. 1886-OZ |

| 47 | Republic of Adygea | 8 138 | Law of October 31, 2018 No. 177 |

| 48 | Altai Republic | 8 712 | Law of November 20, 2018 No. 74-RZ |

| 49 | Republic of Bashkortostan | 8 645 | Law of October 29, 2018 No. 1-з |

| 50 | The Republic of Buryatia | 8 846 | Law of October 31, 2018 No. 136-VI |

| 51 | The Republic of Dagestan | 8 680 | Law of October 30, 2018 No. 63 |

| 52 | The Republic of Khakassia | 8 782 | Law of December 10, 2018 No. 66-ЗРХ |

| 53 | The Republic of Ingushetia | 8 846 | Law of October 26, 2018 No. 43-rz |

| 54 | Republic of Kalmykia | 8 081 | Law of September 26, 2018 No. 6-VI-3 |

| 55 | Republic of Karelia | 8 846 | Law of October 22, 2018 No. 2286-ZRK |

| 56 | Komi Republic | 10 742 | Law of October 29, 2018 No. 77-RZ |

| 57 | Republic of Crimea | 8 370 | Law of November 1, 2018 No. 535-ZRK/2018 |

| 58 | Mari El Republic | 8 191 | Law of November 1, 2018 No. 53-Z |

| 59 | The Republic of Mordovia | 8 522 | Law of October 31, 2018 No. 80-З |

| 60 | The Republic of Sakha (Yakutia) | 13 951 | Law of October 19, 2018 2050-Z No. 11-VI |

| 61 | Republic of North Ossetia-Alania | 8 455 | Law of November 6, 2018 No. 84-RZ |

| 62 | Republic of Tatarstan | 8 232 | Law of September 25, 2018 No. 50-ZRT |

| 63 | Tyva Republic | 8 846 | Law of November 30, 2021 No. 448-ZRT |

| 64 | Rostov region | 8 488 | Law of November 1, 2018 No. 31-ZS |

| 65 | Ryazan Oblast | 8 568 | Law of October 31, 2018 No. 65-OZ |

| 66 | Sakhalin region | 12 333 | Law of December 11, 2018 No. 73-ZO |

| 67 | Samara Region | 8 413 | Law of October 31, 2018 No. 85-GD |

| 68 | Saratov region | 8 278 | Law of October 26, 2018 No. 99-ZSO |

| 69 | Smolensk region | 8 825 | Law of October 25, 2018 No. 105-z |

| 70 | Stavropol region | 8 297 | Law of November 2, 2018 No. 91-kz |

| 71 | Sverdlovsk region | 8 846 | Law of November 6, 2018 No. 126-OZ |

| 72 | Tambov Region | 7 811 | Law of November 6, 2018 No. 283-З |

| 73 | Tomsk region | 8 795 | Law of November 13, 2018 No. 128-OZ |

| 74 | Tula region | 8 658 | Law of October 25, 2018 No. 90-ZTO |

| 75 | Tver region | 8 846 | Law of October 26, 2018 No. 47-ZO |

| 76 | Tyumen region | 8 846 | Law of October 25, 2018 No. 101 |

| 77 | Udmurt republic | 8 502 | Law of September 28, 2018 No. 52-RZ |

| 78 | Ulyanovsk region | 8 474 | Law of October 29, 2018 No. 110-ZO |

| 79 | Vladimir region | 8 526 | Law of October 24, 2018 No. 94-OZ |

| 80 | Volgograd region | 8 569 | Law of October 23, 2018 No. 115-OD |

| 81 | Vologda Region | 8 846 | Law of December 5, 2018 No. 4450-OZ |

| 82 | Voronezh region | 8 750 | Law of October 29, 2018 No. 138-OZ |

| 83 | Yamalo-Nenets a.o. | 13 425 | Law of October 2, 2018 No. 60-ZAO |

| 84 | Yaroslavl region | 8 163 | Law of October 31, 2018 No. 51-z |

| 85 | Transbaikal region | 8 846 | Law of November 15, 2018 No. 1653-ZZK |

NLA - A normative legal act, in accordance with which the cost of living of a pensioner in a constituent entity of the Russian Federation is established

Based on the data in the table presented, it is clearly visible that the average cost of living is 8,726 rubles .

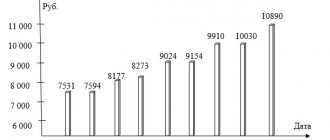

Living wage in Moscow by year

| Period | Living wage (rub.) | Base | |||

| per capita | for the working population | for pensioners | for children | ||

| for the fourth quarter of 2021 | 15397 | 17560 | 10929 | 13300 | Decree of the Moscow Government dated March 13, 2018 No. 176-PP |

| for the third quarter of 2021 | 16160 | 18453 | 11420 | 13938 | Decree of the Moscow Government dated December 5, 2017 No. 952-PP |

| for the second quarter of 2021 | 16426 | 18742 | 11603 | 14252 | Decree of the Moscow Government dated September 12, 2017 No. 663-PP |

| for the first quarter of 2021 | 15477 | 17642 | 10965 | 13441 | Decree of the Moscow Government dated June 13, 2017 No. 355-PP |

| for the fourth quarter of 2021 | 15092 | 17219 | 10715 | 12989 | Decree of the Moscow Government dated 03/07/2017 No. 88-PP |

| for the third quarter of 2021 | 15307 | 17487 | 10823 | 13159 | Decree of the Moscow Government dated November 29, 2016 No. 794-PP |

| for the second quarter of 2021 | 15382 | 17561 | 10883 | 13259 | Decree of the Moscow Government dated 09/06/2016 No. 551-PP |

| for the first quarter of 2021 | 15041 | 17130 | 10623 | 13198 | Decree of the Moscow Government of May 31, 2016 No. 297-PP |

How does the cost of living of a pensioner affect the size of the pension?

The first thing that every pensioner should know when applying for a living wage is that its amount directly depends on whether you are working or are an unemployed pensioner. Since in the first case the amount will be 10,573 rubles, and in the second - 8,078, which is significantly lower than the first amount.

Next, we will answer the most common answer regarding the connection between the size of the pension and the cost of living. These two units are in no way connected with each other and have different components. For example, for those whose pension is an amount equal to the minimum, no additional or preferential payments will be provided. And for those who need them, they will be assigned without fail.

Living wage from May 1, 2021 in Russia

Since most other significant indicators, such as the minimum wage and pensions, are tied to the cost of living in Russia from May 1, 2021, its size is of great importance for many Russians and foreigners working in the Russian Federation. It should be remembered that the cost of living for a child or pensioner differs from the stipulated size of the consumer basket of an adult able-bodied person. It is also necessary to remember that in different regions of the Russian Federation, these indicators may also differ significantly in accordance with the table of the cost of living from May 1, 2018 by region.

How is the social supplement to the subsistence level financed?

There are two types of social supplement:

- Federal surcharge.

- Regional surcharge.

The only differences between them are that they differ in the sources that provide them with money and the place where they apply for these payments.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

It is also necessary to know that the social supplement is assigned only if the entire income, which consists not only of the pension, but also of other additional payments, is less than the established amount.

It should also be noted that the amount of this additional payment is determined individually for each pensioner, since everyone’s income is different.

Where to go if your pension is below the subsistence level

The recipient of the benefit should find out the cost of living for a pensioner in the region of his residence. If the amount of social security accrued to him is lower than the PMP, he has the right to apply for additional payment to the authorized body at his place of residence:

- district department of social protection of the population;

- multifunctional center (hereinafter referred to as MFC);

- Pension Fund branch;

- through gosuslugi.ru - a portal of public services remotely.

Who is eligible to receive social benefits?

Any unemployed citizen who has the right to receive benefits can apply for a social supplement if the amount of his monthly financial support is below the minimum wage level established in the region at the time of application. The total income of a non-working pensioner consists of the following income:

- any type of government benefit;

- additional material support - benefits that include allowances for special services to the fatherland, Heroes of the USSR and the Russian Federation, veterans of the Second World War and other military operations;

- monthly cash payments, including the cost of a set of social services;

- financial compensation for travel on public transport;

- government subsidies for housing and communal services.

When calculating the income of a person receiving social benefits, one-time payments and government support measures expressed in kind are not taken into account. They cannot prevent a pensioner from claiming a bonus and serve as a reason for an employee of the authorized body to refuse to accrue it to the applicant - such actions violate his legal rights. There are 2 types of social surcharges:

| Monthly cost of living for pensioners: | |||

| By region | Around the country | ||

| Federal | Applicant's income (per month) | below | |

| Regional | higher | ||

Example 1: Ivanov lives in the Kemerovo region and has become entitled to receive old-age benefits. His monthly income is 6,578 rubles, the cost of living for pensioners in the region is set at 7,805.6 rubles, and in the country as a whole - 10,929 rubles. He may qualify for a federal supplement. Example 2: Sidorova lives in Moscow and has issued an accrual of old-age benefits. Its total monthly income does not exceed 11,500 rubles, which is higher than the cost of living for pensioners in the country, but lower than in its region - 12,320 rubles. She has the right to receive a regional supplement.

List of required documents

A person who has been assigned a benefit who has not previously received this type of additional payment should contact the territorial office of the Pension Fund or MFC in person or submit an application remotely online through a personal account on the State Services portal - gosuslugi.ru. He will need the following documents:

- passport of a citizen of the Russian Federation or any other document identifying the applicant;

- an application drawn up and filled out according to the appropriate template - as a rule, placed on a stand with information;

- pensioner's ID.