FSD or RSD

The federal social supplement is paid by the territorial bodies of the Pension Fund of the Russian Federation and is established if the total amount of cash payments to a non-working pensioner does not reach the pensioner’s subsistence level established in the region of residence, which, in turn, does not reach the pensioner’s subsistence level in the whole of the Russian Federation.

That is, FSD is paid when the regional PMP is lower than the federal one (living in the region is cheaper than the average in Russia).

A regional social supplement is paid by regional social protection authorities if the cost of living of a pensioner in a constituent entity of the Russian Federation is higher than the same figure in the Russian Federation, and the total amount of cash payments to a non-working pensioner is lower than the regional subsistence minimum.

That is, RSD is paid when the regional PMP is higher than the federal one (living in the region is more expensive than the average in Russia).

The Ministry of Labor has developed new rules for assigning pensions

Since the approval in 2014 of the current version of the rules for the payment of pensions, the legal regulation of the procedure for their payment has undergone numerous changes, which, in particular, is associated with the development of information technology. Therefore, the issue of a comprehensive review of the current procedure for paying pensions has become relevant.

The draft new rules propose to implement the provisions of Federal Law No. 153-FZ on new features of pension delivery. “Thus, payment of a pension, including its delivery, in the territory where a state of emergency has been introduced, regardless of its nature (federal, interregional, regional, intermunicipal, municipal, local) will become possible earlier than this month (clause 12 of the draft rules),” - stated in the explanatory note to the document.

Delivery of the pension to the citizen will be made on the basis of data on the chosen method of receiving it, specified in the submitted application.

According to general rules, delivery of pensions can be carried out through a credit institution, postal service organizations and other organizations involved in their delivery. And if for some reason a person’s pension is not delivered this month, then after applying, the payment must be transferred to him no later than three days from the date of receipt of such information.

When monitoring the payment of a pension by proxy, the territorial body of the Pension Fund will notify the citizen about the procedure for receiving the amount and work to clarify the fact of registration of the pensioner at the place of receipt of the pension or place of actual residence. The validity period of the power of attorney must exceed one year. Simply put, Pension Fund employees will need to periodically communicate with the direct recipient of the pension to understand whether the money is reaching him. This is necessary in order to prevent fraud.

The new rules include a provision regarding bankruptcy of individuals. If a pensioner has debts and is declared bankrupt, then deductions from the amounts he receives are suspended. As specified in the explanatory note, if bankruptcy proceedings are initiated, the Pension Fund will suspend the execution of the document and inform the claimant about this. Another innovation is that if the heirs of a deceased pensioner are sure that he has an unpaid pension, then a certificate about the amounts not transferred during his lifetime will be issued by the territorial body of the Pension Fund of the Russian Federation within three working days after receiving an application from possible heirs or receiving a request from a notary.

If a pensioner moves to a new place of residence, then his payment file must be registered in the new place no later than two working days from the date of receipt of the payment (pension) file.

Payment of the disability pension will be suspended if the recipient does not appear for re-examination at the federal institution of medical and social examination within the appointed time.

How is income calculated?

When calculating the total amount of material support for a non-working pensioner, the amounts of the following cash payments are taken into account:

- pensions, including in the event of a pensioner’s refusal to receive said pensions;

- urgent pension payment;

- additional material (social) support;

- monthly cash payment (including the cost of a set of social services);

- other social support measures established by the legislation of the constituent entities of the Russian Federation in monetary terms (with the exception of social support measures provided at a time).

In addition, when calculating the total amount of material support for a pensioner, the cash equivalents of the social support measures provided to him for paying for the use of a telephone, residential premises and utilities, travel on all types of passenger transport, as well as monetary compensation for the costs of paying for these services are taken into account.

Conditions for receiving a pension

Deposit "MEGA Online" Moscow Credit Bank, Person. No. 1978

up to 7.7%

per annum

from 1 thousand

up to 1100 days

Make a contribution

To receive minimum financial assistance at retirement age, you must be an official employee for at least five years. If there is no experience at all, then a social pension is issued. The minimum size increases when:

- a person turns over 80 years old,

- there are one or more dependent relatives,

- indexing has occurred.

The minimum pension in 2021 is 7.3% higher than in 2021. But this only affected pensioners who do not perform professional duties. The amount can also be increased if a person, having reached a certain age, does not apply for monthly payments, it continues to accumulate: the more a citizen does not apply to the Pension Fund, the more financial assistance for old age will be assigned.

Social pension deserves special attention. It is assigned not only to those who do not have experience, but also to other Russians, for example, disabled people, people who have lost their breadwinner. Its minimum amount in 2021 is 9.4 thousand rubles.

Indexing

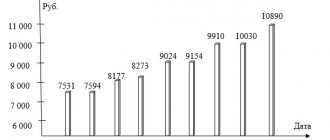

From January 1, 2021, old-age insurance pensions have been indexed by 6.6%.

Previously, the process of assigning a social supplement went like this: the pension was indexed. and if she did not reach the PMP, they gave an additional payment.

The rules have changed since 2021. Now they first calculate the additional payment (before indexation), and then index the pension and add the calculated additional payment to it. That is, now the minimum pension will always exceed the PMP. How much depends on the size of the pension.

In this article we will not dwell in detail on the issue of the new surcharge system. We will talk about this in detail in the next article.

Pension provision in Russia: varieties

Table of types of pensions in the Russian Federation:

| Type of pension | Description |

| Insurance | Provided when an insured event occurs. The formation of pension provision is carried out through payments made by employers for their own employees to the Pension Fund. |

| By old age | Provided to citizens who have reached old age, have accumulated a certain number of points and have worked for the legally established number of years. |

| By disability | It represents material compensation for Russians who have lost their own ability to work due to disability, their wages and other income. |

| Upon loss of a breadwinner | This is compensation for income that was lost by the disabled dependents of the insured citizen upon the death of the latter. |

| Cumulative | It is formed from pension savings, which are accounted for in a special part of the citizen’s personal account. Savings increase thanks to payments from employers to the Pension Fund and profits from the fund’s investments in any projects. The citizen himself can top up his personal account. |

| State | They are intended to compensate for lost income for certain groups of Russians. State pensions are financed from the Russian treasury. |

| Social | Assigned to Russians who have reached old age, but do not have the right to any other pension. |

| By old age | Provided to Russians who have suffered from radiation exposure. |

| By length of service | Provided to government officials, military personnel, astronauts, and test pilots. |

| By disability | It is given to people who participated in the Great Patriotic War; blockade survivors, astronauts with disabilities. |

| Upon loss of a breadwinner | Provided in the event of the death of a breadwinner who served in conscription, suffered from radiation exposure, or was an astronaut. |

How much pay

We have prepared for you a table that shows the cost of living of a pensioner for 2021, as well as (for comparison) its level last year and the year before.

From the table you will see how much the cost of living of a pensioner in your region has increased over 1 year (from 2021 to 2020) and over 2 years (from 2018 to 2020).

in your region for 1 year (from 2021 to 2020) and for 2 years (from 2021 to 2020).

| Name of the subject of the Russian Federation | The value of PMP in a constituent entity of the Russian Federation in 2021 | The value of PMP in a constituent entity of the Russian Federation in 2021 | The value of PMP in a constituent entity of the Russian Federation in 2021 | Increase in PMP for 1 year (from 2021 to 2020) | PMP growth over 2 years (from 2021 to 2020) |

| Overall for the Russian Federation | 9 311 | 8 846 | 8 726 | 465 | 585 |

| Central Federal District | |||||

| Belgorod region | 8 016 | 8 016 | 8 016 | 0 | 0 |

| Bryansk region | 9 120 | 8 523 | 8 441 | 597 | 679 |

| Vladimir region | 9 077 | 8 526 | 8 452 | 551 | 625 |

| Voronezh region | 8 750 | 8 750 | 8 620 | 0 | 130 |

| Ivanovo region | 8 978 | 8 576 | 8 460 | 402 | 518 |

| Kaluga region | 9 303 | 8 708 | 8 547 | 595 | 754 |

| Kostroma region | 8 967 | 8 630 | 8 549 | 337 | 418 |

| Kursk region | 8 600 | 8 600 | 8 600 | 0 | 0 |

| Lipetsk region | 8 620 | 8 620 | 8 620 | 0 | 0 |

| Oryol Region | 8 744 | 8 730 | 8 550 | 14 | 194 |

| Ryazan Oblast | 8 694 | 8 568 | 8 493 | 126 | 201 |

| Smolensk region | 9 460 | 8 825 | 8 674 | 635 | 786 |

| Tambov Region | 8 241 | 7 811 | 7 489 | 430 | 752 |

| Tver region | 9 302 | 8 846 | 8 726 | 456 | 576 |

| Tula region | 9 310 | 8 658 | 8 622 | 652 | 688 |

| Yaroslavl region | 8 646 | 8 163 | 8 163 | 483 | 483 |

| Moscow | 12 578 | 12 115 | 11 816 | 464 | 763 |

| Moscow region | 9 908 | 9 908 | 9 527 | 0 | 381 |

| Northwestern Federal District | |||||

| Republic of Karelia | 11 840 | 8 846 | 8 726 | 2 994 | 3 114 |

| Komi Republic | 11 534 | 10 742 | 10 192 | 792 | 1 342 |

| Arhangelsk region | 10 955 | 10 258 | 10 258 | 697 | 697 |

| Nenets a.o. | 17 956 | 17 956 | 17 956 | 0 | 0 |

| Vologda Region | 9 572 | 8 846 | 8 726 | 726 | 846 |

| Kaliningrad region | 9 658 | 8 846 | 8 726 | 812 | 932 |

| Saint Petersburg | 9 514 | 8 846 | 8 726 | 668 | 788 |

| Leningrad region | 9 247 | 8 846 | 8 726 | 401 | 521 |

| Murmansk region | 14 354 | 12 674 | 12 523 | 1 680 | 1 831 |

| Novgorod region | 9 423 | 8 846 | 8 726 | 577 | 697 |

| Pskov region | 9 529 | 8 806 | 8 726 | 723 | 803 |

| North Caucasus Federal District | |||||

| The Republic of Dagestan | 8 680 | 8 680 | 8 680 | 0 | 0 |

| The Republic of Ingushetia | 8 846 | 8 846 | 8 726 | 0 | 120 |

| Kabardino-Balkarian Republic | 9 598 | 8 846 | 8 726 | 752 | 872 |

| Karachay-Cherkess Republic | 8 846 | 8 846 | 8 618 | 0 | 228 |

| Republic of North Ossetia-Alania | 8 455 | 8 455 | 8 064 | 0 | 391 |

| Chechen Republic | 9 035 | 8 735 | 8 719 | 300 | 316 |

| Stavropol region | 8 297 | 8 297 | 8 135 | 0 | 162 |

| Southern Federal District | |||||

| Republic of Adygea | 8 138 | 8 138 | 8 138 | 0 | 0 |

| Republic of Kalmykia | 8 242 | 8 081 | 7 755 | 161 | 487 |

| Krasnodar region | 9 258 | 8 657 | 8 537 | 601 | 721 |

| Astrakhan region | 8 969 | 8 352 | 7 961 | 617 | 1 008 |

| Volgograd region | 8 569 | 8 569 | 8 535 | 0 | 34 |

| Rostov region | 8 736 | 8 488 | 8 488 | 248 | 248 |

| Republic of Crimea | 8 912 | 8 370 | 8 530 | 542 | 382 |

| Sevastopol | 9 597 | 8 842 | 8 722 | 755 | 875 |

| Volga Federal District | |||||

| Republic of Bashkortostan | 8 645 | 8 645 | 8 320 | 0 | 325 |

| Mari El Republic | 8 380 | 8 191 | 8 036 | 189 | 344 |

| The Republic of Mordovia | 8 522 | 8 522 | 8 194 | 0 | 290 |

| Republic of Tatarstan | 8 232 | 8 232 | 8 232 | 0 | 0 |

| Udmurt republic | 8 502 | 8 502 | 8 502 | 0 | 0 |

| Chuvash Republic | 7 953 | 7 953 | 7 953 | 0 | 0 |

| Kirov region | 8 511 | 8 474 | 8 474 | 37 | 37 |

| Nizhny Novgorod Region | 8 689 | 8 102 | 8 100 | 587 | 589 |

| Orenburg region | 8 252 | 8 252 | 8 059 | 0 | 193 |

| Penza region | 8 404 | 8 404 | 7 861 | 0 | 543 |

| Perm region | 8 777 | 8 539 | 8 503 | 238 | 274 |

| Samara Region | 8 690 | 8 413 | 8 413 | 277 | 277 |

| Saratov region | 8 278 | 8 278 | 7 990 | 0 | 288 |

| Ulyanovsk region | 8 574 | 8 474 | 8 474 | 100 | 100 |

| Ural federal district | |||||

| Kurgan region | 8 750 | 8 750 | 8 630 | 0 | 120 |

| Sverdlovsk region | 9 311 | 8 846 | 8 726 | 465 | 585 |

| Tyumen region | 9 250 | 8 846 | 8 726 | 404 | 524 |

| Chelyabinsk region | 8 691 | 8 691 | 8 586 | 0 | 105 |

| Khanty-Mansi Autonomous Okrug-Yugra | 12 730 | 12 176 | 11 708 | 554 | 1 022 |

| Yamalo-Nenets a.o. | 13 510 | 13 425 | 13 425 | 85 | 85 |

| Siberian Federal District | |||||

| Altai Republic | 8 753 | 8 712 | 8 594 | 41 | 159 |

| The Republic of Buryatia | 9 207 | 8846 | 8 726 | 361 | 481 |

| Tyva Republic | 8 846 | 8846 | 8 726 | 0 | 120 |

| The Republic of Khakassia | 8 975 | 8 782 | 8 543 | 193 | 432 |

| Altai region | 8 894 | 8 669 | 8 543 | 225 | 351 |

| Krasnoyarsk region | 10 039 | 8 846 | 8 726 | 1 193 | 1 313 |

| Irkutsk region | 9 497 | 8 841 | 8 723 | 656 | 774 |

| Kemerovo region | 8 387 | 8 387 | 8 347 | 0 | 40 |

| Novosibirsk region | 9 487 | 8 814 | 8 725 | 673 | 762 |

| Omsk region | 8 480 | 8 480 | 8 480 | 0 | 0 |

| Tomsk region | 9 546 | 8 795 | 8 561 | 751 | 985 |

| Transbaikal region | 9 829 | 8 846 | 8 726 | 983 | 1 103 |

| Far Eastern Federal District | |||||

| The Republic of Sakha (Yakutia) | 14 076 | 13 951 | 13 951 | 125 | 125 |

| 1 zone | 17 011 | 17 011 | 0 | ||

| 2 zone | 13 720 | 13 576 | 144 | ||

| Primorsky Krai | 10 775 | 9 988 | 9 151 | 767 | 1 604 |

| Khabarovsk region | 11 799 | 10 895 | 10 895 | 904 | |

| Amur region | 10 018 | 8 846 | 8 726 | 1 172 | 1 292 |

| Kamchatka Krai | 16 756 | 16 543 | 16 543 | 33 | 33 |

| Magadan Region | 15 943 | 15 460 | 15 460 | 483 | 483 |

| Sakhalin region | 12 333 | 12 333 | 12 333 | 0 | 0 |

| Jewish Autonomous Region | 11 709 | 9 166 | 9 013 | 2 543 | 2 696 |

| Chukotka a.o. | 19 000 | 19 000 | 19 000 | 0 | 0 |

| Baikonur | 9 311 | 8 846 | 8 726 | 465 | 585 |

Who received how much?

As can be seen from the table, in many regions low-income pensioners will not receive any increase. According to regional authorities, life has not become more expensive over the year and the cost of living for a pensioner in 2021 is set at the level of last year.

Moreover, in some regions the PMP has not increased for 2 years. At the same time, there are regions in which the living standard of a pensioner has been stagnant for 3–4 years.

For example, in Tatarstan the last time an increase in PMP was observed was in 2017. And in regions such as the Belgorod region, Adygea, Udmurtia, and Chukotka District, PMP has not been growing since 2021.

That is, in 4 years, life for pensioners there has not risen in price one iota?

Low-income pensioners of the Republic of Karelia will receive the largest supplement to their pension in 2021. In 2021, the PMP there immediately increased by almost 3,000 rubles. A large increase was also recorded in the Jewish Autonomous Region - by 2.5 thousand rubles.

Note that these regions were previously named among those where pensioners are underpaid due to the fact that the authorities set the PMP below the actual annual average.

Express seminars from “What to do Consult”, which our website is now full of, helped us write this article. Their topics and number (more than 100!) completely cover all the interests of an accountant, director or individual entrepreneur. You can view the seminars by subscribing to Clerk Premium. It's currently 50% off. For just a few more days we are giving you six months of access to our subscription for free. In addition to 107 recordings of express seminars, you will have access to 15 online courses for free (some provide a Russian IPB certificate ) and several tools for accountants. Leave your contacts below , the manager will contact you to provide access:

Insurance pension – what does it consist of?

It is considered the most common type of pension provision in the Russian Federation. All people who have SNILS are considered insured citizens. The insurer here is the Pension Fund of Russia.

To calculate insurance pensions, the number of pension points (PB) is multiplied by the price of one PB. The result obtained is added to the size of the fixed payment.

PB is credited for each year of official work of a Russian. The number of pension benefits depends on the insurance premiums received in the personal account and the selected type of pension provision. You can accumulate a maximum of 10 PB per year, and when forming a funded pension - 6.25.

A special feature of PB is that they are accrued even during non-insurance periods, for example:

- military service;

- care of minors;

- caring for a person with group 1 disability;

- caring for a minor with a disability.

Every year the price of PB is indexed. When registering pension payments, existing pension benefits are converted into rubles, taking into account their price in the year the citizen retires.

The fixed payment is guaranteed by the state and is subject to indexation. Also in the Russian Federation, increasing coefficients are provided for citizens who postponed the registration of pension benefits to a later date.

Insurance pensions include payments:

- by old age;

- on disability;

- for the loss of a breadwinner.

By old age

To start receiving old-age pension insurance, you need:

- reach the appropriate age or obtain the right to receive payments early;

- gain the necessary work experience;

- have the required number of PB.

For men, the retirement age is 60 years, for women – 55. The minimum required work experience is 15 years.

It is possible to apply for an old-age insurance pension at any time after the right to it arises. Russians who do not have enough length of service/PB are assigned social pensions.

Disabilities

To apply for disability insurance payments, you must have a document confirming the presence of disability, as well as accumulate experience (at least 1 day). With the adoption of the new bill, pensions are provided to disabled people regardless of the reason for loss of ability to work.

When determining a disability group, ITU experts provide the citizen with an extract from the examination report, which states until what date it is valid (can be issued for an indefinite period).

Survivor's loss

This insurance pension is provided to a citizen if he is a dependent of a deceased breadwinner who had work experience. An exception is situations where a dependent commits an offense/crime that leads to the death of the breadwinner.

A son/daughter, grandchildren, husband/wife, mother/father can be recognized as disabled dependents. A complete list of relatives who belong to the group of disabled people is given in Article 10 of the Federal Law “On Pension Insurance”.

For more information on the types of insurance pensions, watch the video: