FSD or RSD

The federal social supplement is paid by the territorial bodies of the Pension Fund of the Russian Federation and is established if the total amount of cash payments to a non-working pensioner does not reach the pensioner’s subsistence level established in the region of residence, which, in turn, does not reach the pensioner’s subsistence level in the whole of the Russian Federation.

That is, FSD is paid when the regional PMP is lower than the federal one (living in the region is cheaper than the average in Russia).

A regional social supplement is paid by regional social protection authorities if the cost of living of a pensioner in a constituent entity of the Russian Federation is higher than the same figure in the Russian Federation, and the total amount of cash payments to a non-working pensioner is lower than the regional subsistence minimum.

That is, RSD is paid when the regional PMP is higher than the federal one (living in the region is more expensive than the average in Russia).

Get access to 35 online courses for entrepreneurs and accountants. Connect "Clerk.Premium". You will be able not only to take courses and receive Russian IPB certificates, but also to ask Clerk experts an unlimited number of questions . We will respond within a day. It's definitely cheaper than having third-party consultants. You will be able to collect questions from all your colleagues and even give them your username and password, and they will also be able to ask questions.

Minimum social pension in 2021

Citizens who have insufficient experience or, for some reason, none at all, are assigned a minimum social pension. The social pension is established for disabled persons who do not have the right to receive another type of pension. Of course, it is less than labor, but at the same time it can be different, since it is calculated on an individual basis .

But it should be taken into account that in the end, the amount of a pensioner’s pension cannot be less than minimum subsistence level established in the region or in the country as a whole . Otherwise, the pensioner will receive a social supplement.

How is income calculated?

When calculating the total amount of material support for a non-working pensioner, the amounts of the following cash payments are taken into account:

- pensions, including in the event of a pensioner’s refusal to receive said pensions;

- urgent pension payment;

- additional material (social) support;

- monthly cash payment (including the cost of a set of social services);

- other social support measures established by the legislation of the constituent entities of the Russian Federation in monetary terms (with the exception of social support measures provided at a time).

In addition, when calculating the total amount of material support for a pensioner, the cash equivalents of the social support measures provided to him for paying for the use of a telephone, residential premises and utilities, travel on all types of passenger transport, as well as monetary compensation for the costs of paying for these services are taken into account.

How the size of social pensions is determined

In comparison with labor pensions, which represent compensation for lost earnings due to disability, social pensions are based on a completely different principle. This pension is essentially a social benefit.

It is paid in strictly defined amounts for certain categories of citizens and is established by the state, based on the cost of living .

Russian legislation allows pensioners to choose the most beneficial type of pension for them - social or insurance (labor).

Living wage and social pension

The living wage of a pensioner (PMP) in the Russian Federation is calculated on the basis of the consumer basket and statistical data on consumer prices for non-food products and food products. It is established every year by the law on the country's budget for the corresponding financial year and for the planning period.

The amount of PMP in general for the Russian Federation for determining the size of the federal social supplement to pensions is set at 9,311 rubles for 2021.

The minimum amount of an old-age pension should not be lower than the size of the PMS established in the region of residence of the pensioner. But, when such a situation does arise, the pensioner is assigned additional social benefits in such an amount that the pension payment is equal to the regional subsistence level. The additional payment is established at the request of the citizen and employed pensioners are not entitled to .

Disabled children and children receiving a pension due to the loss of a breadwinner do not need to submit an application for a social supplement to the pension, since in this case the supplement is assigned simultaneously with the assignment of the corresponding pension (Parts 6 and 7 of Article 12.1 of Law No. 178- Federal Law).

Amounts of social supplements to pensions

The size of the social supplement to the pension depends on several parameters :

- the cost of living in general for the country and in the corresponding region;

- place of residence of the citizen and time of residence in a certain area;

- the total amount of material support.

According to Law N 178-FZ “On State Social Assistance”, if the total amount of material support for a pensioner is less than that established in the region of his residence, which is lower than the PMP in Russia in general, then the citizen will be assigned a federal social supplement to his pension. In the event that the total amount of material support for a pensioner is less than the regional PMP, which exceeds the PMP in general for the Russian Federation, the citizen will be assigned a regional social supplement .

When determining the total amount of support for an unemployed pensioner, all pension payments are considered, including the cost of a set of social services, additional financial support provided monthly, and other social assistance established by the laws of the region in monetary terms, but excluding one-time measures of social support.

It should be noted that social measures. support provided to a pensioner in kind is not taken into account here. The exception is cash equivalents for payment for communication services, travel on public transport, and housing and communal services.

- To apply for a federal social supplement, you need to go to the Pension Fund .

- Regional social benefits are paid by the social protection authorities of the region.

Example

Pensioner Ivanov A. lives in the Kemerovo region and the amount of his material support in 2021 amounted to 7,500 rubles per month. The second pensioner Petrov B. lives in the Khabarovsk Territory, the total amount of his support in 2021 is 9,100 rubles per month. According to the Pension Fund of Russia, for 2021 the federal PMP is set at 8,726 rubles, for the Kemerovo region - 8,347 rubles, for the Khabarovsk Territory - 10,895 rubles.

The amount of security for citizen A. Ivanov (7,500 rubles) is less than the PMP in the Kemerovo region and at the same time, the regional PMP in the Kemerovo region is less than the federal PMP. Consequently, citizen Ivanov A. is entitled to a federal supplement to the primary medical care of his region of residence in the amount of 847 rubles.

Pensioner Petrov B. has a security amount higher than the federal PMP, but lower than the regional PMP in the Khabarovsk Territory, so he is entitled to a regional supplement to the level of PMP in the region, in the amount of 1,795 rubles.

Indexation of social pensions

Article 25 of Law No. 166-FZ obliges government officials to annually index the size of a social pension, taking into account the growth rate of PMP in our country over the past year. This coefficient is established by the Government of the Russian Federation.

The main objective of indexing social pensions is due to the need to compensate its recipients for the decrease in purchasing power due to growing inflation in the country.

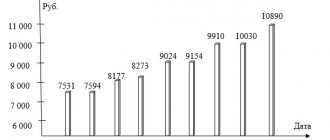

Increase in social pensions in 2021

Social pensions in 2021 were indexed by 6.1% - this is the index established by Government Resolution No. 270 of March 13, 2021. In connection with this, the sizes of all types of social pensions, as well as payments for state pensions, were increased. The increase was made automatically; there was no need to contact the Pension Fund for additional payment.

Indexed pension amounts will now be paid until the next indexation date, that is, until April 1, 2021.

Indexing

From January 1, 2021, old-age insurance pensions have been indexed by 6.3%.

Previously, the process of assigning a social supplement went like this: the pension was indexed, and if it did not reach the PMP, an additional payment was given.

The rules have changed since 2021. Now they first calculate the additional payment (before indexation), and then index the pension and add the calculated additional payment to it. That is, the minimum pension will always exceed the PMP. How much depends on the size of the pension.

Social pensions

Social pensions in their modern form were introduced in Russia by the 1990 Law, although there were analogues of such payments in Soviet social security law. A social pension is a state pension, the terms of assignment and amounts of which are provided for in Articles 11 and 18 of the Federal Law “On State Pension Provision in the Russian Federation”.

The concept of a social pension can be derived from the legal definitions contained in the Federal Law “On State Pension Provision in the Russian Federation”. In the science of social security law, it is proposed to understand social pensions as monthly cash payments financed by the state from the federal budget, provided to disabled citizens, the circle of whom is defined at the level of law, and which are the main or one of the main sources of livelihood for pensioners1. Some scientists define this pension more succinctly, pointing out that a social pension is “a payment that serves as a source of livelihood for persons who are not entitled to other types of pensions.” It is difficult to agree with this concept of a social pension for two reasons: first, there is no indication in the definition that the recipients of a social pension are only disabled persons (see subclause 8, clause 1 of article 4 of the Law on State Pension Security), and the second is that the right to this pension is conditional on the absence of the right to other pensions (Article 11 of the above-mentioned law, which establishes the conditions for assigning a social pension to disabled citizens, does not provide for such a condition).

Therefore, a social pension should be understood as a monthly cash payment, set in a fixed amount, which is assigned to disabled persons specified in the law in order to provide them with a source of livelihood.

Social pensions are proof of the implementation in the domestic pension system of the principle of universal social security, guaranteeing everyone, even those who did not participate in socially useful activities, regular assistance from the state in the event of disability without proof of need for it. Meanwhile, in the context of crisis phenomena related to the financing of the pension system, some legal scholars raise the issue of limiting access to social pensions. For example, M.L. Zakharov points out that: “the right to a social pension is not an absolute right. In many developed countries, such a pension is provided to those citizens who need social support (assistance). There are more than 20 such countries in Europe. The experience of these countries can also be used in Russia. It is hardly advisable to provide a social pension to those who are wealthy and do not need it.”

A number of experts propose introducing a “residence qualification” for recipients of social pensions, setting it, for example, at 10-15 years of permanent residence in Russia. This idea corresponds to the practice of many developed countries, however, it will strike a blow to the stability of the social world of hundreds of thousands of our citizens who, having lost the right to a pension, will not be able to legally support themselves, being, let us remind you, disabled (elderly or disabled). In this regard, the implementation of this idea should be carried out carefully, linking it with the specifics of the subject (disabled children, orphans, disabled people from childhood) and the main trends of Russian migration and social policy.

There are more than 2.9 million people in our country who receive social pensions. Among them, disabled children and adults whose disability began in childhood predominate.

The following persons permanently residing in the Russian Federation have the right to a social pension:

- disabled people of groups I, II and III, including those disabled since childhood;

- disabled children;

- children under the age of 18, as well as over this age, studying full-time in educational institutions of all types and types, regardless of their organizational and legal form, with the exception of educational institutions of additional education, until they complete such training, but not longer than they have reached the age of 23, have lost one or both parents, and are children of a deceased single mother;

- citizens from among the indigenous peoples of the North who have reached the ages of 55 and 50 years (men and women, respectively);

- citizens who have reached the ages of 65 and 60 years (men and women, respectively).

Social pension can be of three types, depending on the main legal fact affecting the pensioner’s incapacity to work.

The above-mentioned disabled people are provided with a social disability pension.

The above-mentioned children who have lost one or both parents, and the children of a deceased single mother, are entitled to a social pension in the event of the loss of a breadwinner.

Persons who have reached the age specified by law are entitled to a social old-age pension.

It should be taken into account that the old-age social pension (to citizens who have reached the age of 65 and 60 years - men and women, respectively) is not paid during the period of work and (or) other activities, when they are subject to compulsory pension insurance in accordance with the Federal Law "On compulsory pension insurance in the Russian Federation."

The conditions for assigning social pensions are more stringent than the conditions for assigning insurance pensions, as well as state pensions1. In particular, only persons permanently residing in the Russian Federation have the right to assign social pensions. The circle of persons entitled to a social pension in the event of the loss of a breadwinner does not coincide with the circle of persons entitled to an insurance pension in the event of the loss of a breadwinner, etc.

Article 18 of the Federal Law “On State Pension Provision in the Russian Federation” establishes the amount of social pensions for disabled citizens differentially.

The social pension for disabled citizens is assigned in the following amount (from 04/01/2016, in the future these amounts are subject to annual indexation):

1) citizens from among the small peoples of the North who have reached the age of 55 and 50 years (men and women, respectively), citizens who have reached the age of 65 and 60 years (men and women, respectively), disabled people of group II (except for disabled people since childhood), children in under the age of 18, as well as over this age, full-time students in educational institutions of all types and types, regardless of their organizational and legal form, with the exception of educational institutions of additional education, until they complete such training, but no longer than until they reach 23 years of age who have lost one of their parents - 8,562 rubles. per month; disabled people of group I since childhood and disabled children - 11903.51 rubles. per month;

2) disabled people of group I, disabled people of group II since childhood, children under 18 years of age, as well as over this age, full-time students in educational institutions of all types and types, regardless of their organizational and legal form, with the exception of educational institutions of additional education , until they complete such training, but no longer than until they reach the age of 23, for those who have lost both parents (children of a deceased single mother), -9919.73 rubles. per month;

4) disabled people of group III - 4215.90 rubles. per month. The size of pensions for citizens living in regions of the Far North and equivalent areas, in areas with severe climatic conditions that require additional material and physiological costs for citizens living there, determined by the Government of the Russian Federation, increases by the corresponding regional coefficient established by the Government of the Russian Federation depending from the area (locality) of residence, for the entire period of residence of the specified citizens in the specified areas (localities).

When citizens leave these districts (localities) for a new permanent place of residence, the size of the pension is determined without taking into account the regional coefficient. The size of the social old-age pension for citizens who have reached the age of 65 and 60 years (men and women, respectively) who were recipients of a disability insurance pension cannot be less than the size of the disability insurance pension that was established for these citizens as of the day on which they payment of the specified disability insurance pension was stopped due to reaching this age.

How much pay

We have prepared for you a table that shows the cost of living of a pensioner for 2021, as well as (for comparison) its level last year and the year before.

The coolest accounting channel in Telega. Hosted by the editors of The Clerk. The main news, manuals for accountants, without water and advertising. Plus we merge registrations for free webinars. Join us.

From the table you will see how much the cost of living of a pensioner in your region has increased over 1 year (from 2021 to 2021) and over 2 years (from 2019 to 2021).

| Name of the subject of the Russian Federation | PMP in 2021 | PMP in 2021 | PMP in 2021 | PMP in 2021 | Increase in PMP for 1 year (from 2021 to 2021) | PMP growth over 2 years (from 2021 to 2021) |

| In Russia as a whole | 10 022 | 9 311 | 8 846 | 8 726 | 711 | 1 176 |

| Central Federal District | ||||||

| Belgorod region | 8 659 | 8 016 | 8 016 | 8 016 | 643 | 643 |

| Bryansk region | 9 860 | 9 120 | 8 523 | 8 441 | 740 | 1 337 |

| Vladimir region | 9 800 | 9 077 | 8 526 | 8 452 | 723 | 1 274 |

| Voronezh region | 9 020 | 8 750 | 8 750 | 8 620 | 270 | 270 |

| Ivanovo region | 9 521 | 8 978 | 8 576 | 8 460 | 543 | 945 |

| Kaluga region | 10 002 | 9 303 | 8 708 | 8 547 | 699 | 1 294 |

| Kostroma region | 9 734 | 8 967 | 8 630 | 8 549 | 767 | 1104 |

| Kursk region | 9 144 | 8 600 | 8 600 | 8 600 | 544 | 544 |

| Lipetsk region | 8 811 | 8 620 | 8 620 | 8 620 | 191 | 191 |

| Oryol Region | 9 409 | 8 744 | 8 730 | 8 550 | 665 | 679 |

| Ryazan Oblast | 9 321 | 8 694 | 8 568 | 8 493 | 627 | 753 |

| Smolensk region | 9 782 | 9 460 | 8 825 | 8 674 | 322 | 957 |

| Tambov Region | 9 396 | 8 241 | 7 811 | 7 489 | 1 155 | 1 585 |

| Tver region | 9 875 | 9 302 | 8 846 | 8 726 | 573 | 1 029 |

| Tula region | 9 997 | 9 310 | 8 658 | 8 622 | 687 | 1 339 |

| Yaroslavl region | 9 231 | 8 646 | 8 163 | 8 163 | 585 | 1 068 |

| Moscow | 13 496 | 12 578 | 12 115 | 11 816 | 918 | 1 381 |

| Moscow region | 10 648 | 9 908 | 9 908 | 9 527 | 740 | 740 |

| Northwestern Federal District | ||||||

| Republic of Karelia | 12 783 | 11 840 | 8 846 | 8 726 | 943 | 3 937 |

| Komi Republic | 12 645 | 11 534 | 10 742 | 10 192 | 1 111 | 1 903 |

| Arhangelsk region | 12 014 | 10 955 | 10 258 | 10 258 | 1 059 | 1 756 |

| Nenets a.o. | 19 353 | 17 956 | 17 956 | 17 956 | 1 397 | 1 397 |

| Vologda Region | 10 221 | 9 572 | 8 846 | 8 726 | 649 | 1 375 |

| Kaliningrad region | 10 378 | 9 658 | 8 846 | 8 726 | 720 | 1 532 |

| Saint Petersburg | 10 280 | 9 514 | 8 846 | 8 726 | 766 | 1 434 |

| Leningrad region | 10 359 | 9 247 | 8 846 | 8 726 | 1 112 | 1 513 |

| Murmansk region | 15 873 | 14 354 | 12 674 | 12 523 | 1 519 | 3 199 |

| Novgorod region | 10 096 | 9 423 | 8 846 | 8 726 | 673 | 1 250 |

| Pskov region | 10 113 | 9 529 | 8 806 | 8 726 | 584 | 1 307 |

| North Caucasus Federal District | ||||||

| The Republic of Dagestan | 9 020 | 8 680 | 8 680 | 8 680 | 340 | 340 |

| The Republic of Ingushetia | 9 020 | 8 846 | 8 846 | 8 726 | 174 | 174 |

| Kabardino-Balkarian Republic | 10 198 | 9 598 | 8 846 | 8 726 | 600 | 1 352 |

| Karachay-Cherkess Republic | 9 020 | 8 846 | 8 846 | 8 618 | 174 | 174 |

| Republic of North Ossetia-Alania | 9 100 | 8 455 | 8 455 | 8 064 | 645 | 645 |

| Chechen Republic | 10 020 | 9 035 | 8 735 | 8 719 | 985 | 1 285 |

| Stavropol region | 8 646 | 8 297 | 8 297 | 8 135 | 349 | 349 |

| Southern Federal District | ||||||

| Republic of Adygea | 8 540 | 8 138 | 8 138 | 8 138 | 402 | 402 |

| Republic of Kalmykia | 8 973 | 8 242 | 8 081 | 7 755 | 731 | 892 |

| Krasnodar region | 9 922 | 9 258 | 8 657 | 8 537 | 664 | 1 265 |

| Astrakhan region | 9 621 | 8 969 | 8 352 | 7 961 | 652 | 1 269 |

| Volgograd region | 9 020 | 8 569 | 8 569 | 8 535 | 451 | 451 |

| Rostov region | 9 445 | 8 736 | 8 488 | 8 488 | 709 | 957 |

| Republic of Crimea | 9 546 | 8 912 | 8 370 | 8 530 | 634 | 1 176 |

| Sevastopol | 9 862 | 9 597 | 8 842 | 8 722 | 265 | 1 020 |

| Volga Federal District | ||||||

| Republic of Bashkortostan | 9 605 | 8 645 | 8 645 | 8 320 | 960 | 960 |

| Mari El Republic | 8 719 | 8 380 | 8 191 | 8 036 | 339 | 528 |

| The Republic of Mordovia | 9 020 | 8 522 | 8 522 | 8 194 | 498 | 498 |

| Republic of Tatarstan | 9 423 | 8 232 | 8 232 | 8 232 | 1 191 | 1 191 |

| Udmurt republic | 8 917 | 8 502 | 8 502 | 8 502 | 415 | 415 |

| Chuvash Republic | 8 466 | 7 953 | 7 953 | 7 953 | 513 | 513 |

| Kirov region | 9 348 | 8 511 | 8 474 | 8 474 | 837 | 874 |

| Nizhny Novgorod Region | 9 360 | 8 689 | 8 102 | 8 100 | 671 | 1 258 |

| Orenburg region | 9 020 | 8 252 | 8 252 | 8 059 | 768 | 768 |

| Penza region | 9 020 | 8 404 | 8 404 | 7 861 | 616 | 616 |

| Perm region | 9 613 | 8 777 | 8 539 | 8 503 | 836 | 1 074 |

| Samara Region | 9 320 | 8 690 | 8 413 | 8 413 | 630 | 907 |

| Saratov region | 8 566 | 8 278 | 8 278 | 7 990 | 288 | 288 |

| Ulyanovsk region | 9 247 | 8 574 | 8 474 | 8 474 | 673 | 773 |

| Ural federal district | ||||||

| Kurgan region | 9 248 | 8 750 | 8 750 | 8 630 | 498 | 498 |

| Sverdlovsk region | 9 521 | 9 311 | 8 846 | 8 726 | 210 | 675 |

| Tyumen region | 9 958 | 9 250 | 8 846 | 8 726 | 708 | 1 112 |

| Chelyabinsk region | 9 794 | 8 691 | 8 691 | 8 586 | 1 103 | 1 103 |

| Khanty-Mansi Autonomous Okrug-Yugra | 14 044 | 12 730 | 12 176 | 11 708 | 1 314 | 1 868 |

| Yamalo-Nenets a.o. | 14 033 | 13 510 | 13 425 | 13 425 | 523 | 608 |

| Siberian Federal District | ||||||

| Altai Republic | 9 539 | 8 753 | 8 712 | 8 594 | 786 | 827 |

| Tyva Republic | 9 485 | 8 846 | 8846 | 8 726 | 639 | 639 |

| The Republic of Khakassia | 9 986 | 8 975 | 8 782 | 8 543 | 1 011 | 1 204 |

| Altai region | 9 573 | 8 894 | 8 669 | 8 543 | 679 | 904 |

| Krasnoyarsk region | 10 963 | 10 039 | 8 846 | 8 726 | 1 828 | 3 945 |

| Irkutsk region | 10 540 | 9 497 | 8 841 | 8 723 | 1 043 | 1 699 |

| Kemerovo region | 9 147 | 8 387 | 8 387 | 8 347 | 760 | 760 |

| Novosibirsk region | 10 378 | 9 487 | 8 814 | 8 725 | 891 | 1 564 |

| Omsk region | 8 932 | 8 480 | 8 480 | 8 480 | 452 | 452 |

| Tomsk region | 10 436 | 9 546 | 8 795 | 8 561 | 890 | 1 641 |

| Far Eastern Federal District | ||||||

| The Republic of Buryatia | 10 372 | 9 207 | 8 846 | 8 726 | 1 165 | 1 526 |

| The Republic of Sakha (Yakutia) | 15 438 | 14 076 | 13 951 | 13 951 | 1 362 | 1 487 |

| Primorsky Krai | 12 119 | 10 775 | 9 988 | 9 151 | 1 344 | 2 131 |

| Khabarovsk region | 13 205 | 11 799 | 10 895 | 10 895 | 1 406 | 2 310 |

| Amur region | 11 272 | 10 018 | 8 846 | 8 726 | 1 254 | 2 426 |

| Transbaikal region | 11 256 | 9 829 | 8 846 | 8 726 | 1 427 | 2 410 |

| Kamchatka Krai | 18 148 | 16 756 | 16 543 | 16 543 | 1 392 | 1 605 |

| Magadan Region | 17 560 | 15 943 | 15 460 | 15 460 | 1 617 | 2 100 |

| Sakhalin region | 13 604 | 12 333 | 12 333 | 12 333 | 1 271 | 1 271 |

| Jewish Autonomous Region | 13 526 | 11 709 | 9 166 | 9 013 | 1 817 | 4 360 |

| Chukotka a.o. | 19 312 | 19 000 | 19 000 | 19 000 | 312 | 312 |

| Baikonur | 10 022 | 9 311 | 8 846 | 8 726 | 711 | 1 176 |

Who received how much?

This year, for the first time in several years, PMP increased in absolutely all regions. There is not a single region where PMP has remained at the level of last year, or worse (which also happened) – it has decreased.

Even in those regions where PMP previously stood still for years, in 2021 this figure has increased.

The living wage of a pensioner increased the most over the year in the Krasnoyarsk Territory (+ 1,878 rubles), Jewish A.O. (+ 1,817 rub.), Magadan region (+ 1,617 rub.)

The smallest increase is observed in Ingushetia (+ 174 rubles), Karachay-Cherkessia (+ 174 rubles), Lipetsk region (+ 191 rubles)

The highest PMP for 2021 was established in the Chukotka Autonomous Region (RUB 19,312), Kamchatka Territory (RUB 18,148), and Murmansk Region (RUB 15,873). The lowest PMP is in the Chuvash Republic (RUB 8,466), Saratov Region (RUB 8,566), and Stavropol Territory (RUB 8,646).