Disability benefits are issued to all citizens who need this benefit, regardless of age and length of service.

The main condition for this is the availability of an appropriate medical certificate.

The pension is assigned in accordance with all rules approved in Russia.

The procedure and actions for issuing are regulated by the federal law “On State Pension Security in the Russian Federation”. In addition to this legislation, there is also a column “On labor pensions in the Russian Federation,” which also affects the amount of benefits received.

In both cases, payment is due. The citizen himself chooses the most profitable option for himself. The legislation of the Russian Federation does not provide for the payment of both pensions.

Types of subsidies

Disability pension is divided into several types:

- State. Most often it is prescribed to WWII participants and military personnel who suffered during hostilities. This type is also issued to citizens affected by radiation.

- Labor. This right is issued to citizens with more than five years of work experience.

- Social. If a person did not work due to various circumstances, then he is entitled to a social pension.

In addition to this distribution, disability is divided into:

- 1 disability group;

- Disability group 2;

- 3 disability group;

- disabled children.

Deadlines for calculating and paying a pension to a disabled person

Within ten days after the transfer of all necessary documents to the Pension Fund, a decision is made on the accrual and amount of the pension, otherwise on refusal. If a positive decision is made, then pension payments begin from the day the person is recognized as disabled. Within a year, after receiving a disability certificate, a person has the opportunity to apply and receive pension benefits from the moment of examination. If this period exceeds 12 months, then the pension will be accrued from the date of application to the Pension Fund of the Russian Federation.

Pension amount

The pension payment amount in 2021 will be:

- for those in need of group 1 – 3138;

- for those in need of group 2 – 2241;

- for those in need of group 3 – 1794;

- for children – 2241.

Since 2015, residents of the annexed states of Crimea and Sevastopol also receive disability benefits in an equivalent amount.

Subsidies or, in other words, additional payments to people with disabilities are paid along with their pension. What additional amount is due to a specific category of citizens is indicated by the current law.

This kind of payment depends on many factors (including distribution by groups), but is mainly based on how much it costs another person to maintain a special person.

First group

Citizens with 1st disability group receive a guaranteed payment:

- the person does not have other persons in his care – 7820;

- if a disabled person has one non-working dependent – 9124;

- if a disabled person has two unemployed people – 10427;

- with more than three dependents – 11,731.

The pension amount for citizens who have the required work experience is slightly higher. But here, too, there are several features when paying.

If a person has received a Group 1 disability and has 20 years of work experience in a risky workplace (Far North), then the payment will be as follows:

- maintenance of the employee himself - 10166;

- disabled person and his non-working dependent – 11861;

- disabled person of the first group and two unemployed – 13555;

- if there are three dependents, monthly payments will be 15,250 rubles.

For the capital, such subsidies are lower than the cost of living. Therefore, citizens living in cities with a population of over a million are entitled to additional payments in the form of 2,974 rubles.

Second group

People with 2nd disability group receive a pension:

- for the personal maintenance of a disabled person – 3910;

- for the maintenance of two persons (disabled person and dependent) – 5213;

- disabled person and two dependents – 6517;

- more than three unemployed – 7820.

Some special features are also provided for this category of persons. If a disabled person has decent work experience, then he has the right to count on large payments. For a period of 15 years or more, a citizen can count on the following subsidies:

- providing for a disabled person – 5865;

- with one dependent – 7820;

- disabled person and two unemployed people – 9775;

- more than three unemployed citizens - 11,731.

The amount of the supplement, in the case of a lower subsistence minimum, is 2123 rubles.

You may be interested in an article about subsidies for housing and communal services.

Read an article about the features of subsidies for the purchase of housing here.

Third group

For this category of citizens the payment is slightly lower:

- providing care for disabled people - 1955;

- disabled person with one dependent – 3258;

- disabled person with two dependents – 4562;

- disabled person with three or more unemployed people – 5865.

If a man has 25 years of work experience, and a woman over 20 years, then they have the right to count on an increase in the coefficient:

- citizen lives alone – 2932;

- has one non-working family member – 4884;

- has two unemployed citizens – 6843;

- has three or more unemployed persons – 8798.

In this case, there is also a small additional payment up to the subsistence level of 1,700 rubles. In addition, payments are indexed.

How to get disability benefits

It is paid to both employed and unemployed citizens. The reason for the appointment is only the disability group officially assigned by the relevant government agencies. Where do interested parties apply for EDV? In the Pension Fund of Russia. Only here do they administer social disability benefits.

Not only disabled people receive monthly payments. Veterans and people who have received a large dose of radiation also apply for it. The benefit is paid regularly. Other social benefits additionally received by a disabled person do not cancel it.

The benefit amount is affected by:

- group appointed by the medical commission;

- status received by the disabled person;

- the number of social benefits provided to a person with partially or completely limited legal capacity, since instead of them he may demand to give the equivalent in money.

Monetization of social services has been in effect for more than 12 years. To exercise this right, you do not need to further prove loss of ability to work. However, it is necessary to visit a branch of the Russian Pension Fund, having previously written an application to exchange state-provided benefits for cash transfers. After which the requested amount will be credited to the same account as the EDV.

To receive a cash payment, you need to draw up an application and submit it, along with the documents used for registration, to the Russian Pension Fund. Then a fixed amount is calculated to transfer to the disabled person. It is indexed once a year (April 1).

Accrual

The labor pension is calculated in a certain way - according to a special formula.

To begin with, the amount of pension capital that has accumulated during the working period of the disabled person is calculated.

Then, this coefficient is divided by the age of survival (in Russia this is the figure 19 multiplied by the amount of insurance experience (no more than the figure 180) and the base rate is added to the resulting amount.

It is important to know: WWII participants also have the right to count on additional subsidies in the amount of 1000 rubles on a monthly basis.

The fixed payment is determined by the disability group and the corresponding additional payments. For disabled children, this rate will be 10,376.86 rubles.

Social pension for disabled people of group 1

Note that social the payment is tied to the minimum subsistence level (MSL) established in the region and must be equal to it or greater. But, in addition, the type of pension in question is indexed every year without fail.

| 1 group | RUB 10,567.73 |

| 1 group from childhood | 12681.09 RUR |

Important! Group 1 disabled people living in difficult climatic conditions, in the Far North or equivalent areas, can count on an increase in their pension in the form of a coefficient established in a particular region.

— lack of insurance experience, when at the time of applying to the Pension Fund for a citizen with disabilities, there are no payments or accruals from employers and there is no information about the periods of work as an individual entrepreneur;

— voluntary renunciation of other types of pension payments for the disability group;

- fact of residence in the Russian Federation.

Important! As soon as a man with a disability reaches 65 years of age, and a woman turns 60 years old, the payment stops and an old-age social pension is assigned without changing existing benefits.

If a person with a disability has never worked and does not have insurance coverage, he is assigned a social pension. Social pensions for disabled people of groups 1, 2, 3 and disabled children will be increased in 2021 from April 1. According to the law, the coefficient of annual indexation of social pensions is determined depending on how the pensioner’s cost of living has increased over the previous year.

The law on the PFR budget for 2021 provided for a preliminary indexation percentage of 7%, since the exact data on changes in the PMF for 2021 were unknown at that time. It was precisely taking into account the increase in the social pension by 7% that the money was included in the fund’s budget for 2021. However, the final calculations showed that the PMP increased by only 6.1% - and it is by this percentage that the social pension will be increased from April 1.

It should be noted that the social pension is assigned in a fixed amount depending on the disability group established for the citizen. As a result of an increase of 6.1%, the size of the social pension for disabled people will be as follows (these amounts will be paid from April 1, 2020):

- RUB 13,454.64 – disabled children and disabled people of group 1 since childhood;

- RUB 11,212.36 – disabled people of group 1 and group 2 since childhood;

- 5606.17 rub. – for disability group 2;

- RUB 4,765.27 – for group 3.

If a pensioner is not working, and the amount of the pension, monthly social assistance and other social assistance assigned to him in monetary terms is below the subsistence level of a pensioner in the region, he is assigned an additional payment up to the regional PMP.

- PMP values in the constituent entities of the Russian Federation are revised annually from January 1. New minimum pension values have also been approved for 2021 (the full table by region is presented in the article).

- Therefore, citizens receiving the “minimum wage” will feel an increase not only in April due to indexation, but also in January due to a revision of the amount of additional payment to the subsistence level.

Let us remind you that starting from 2021, pension indexation is assigned in excess of the PMP amount. Before this, citizens receiving additional payments to the minimum did not feel an increase from indexation, since the amount of the social supplement to primary care decreased by the amount of this increase.

Preferential conditions

In addition to various payments and pensions, people with disabilities have the right to receive benefits.

To begin with, they are entitled to social services, which make it possible to receive free medicines, medical devices, treatment in a sanatorium with travel expenses.

This plus will cost citizens 900 rubles. If you wish, you can refuse this service and receive this money in cash.

People with disabilities are entitled to household, legal and legal assistance. They have the right to demand technical means of rehabilitation. To do this, you just need to issue a card for an individual rehabilitation program.

All disabled people are entitled to a 50% discount on housing and communal services for housing. They are guaranteed successful admission to an educational institution without entrance exams. In addition, benefits apply to labor and entrepreneurial activities.

Documents for obtaining group 2

Earlier in this material it was already mentioned that in order to assign a group you need to undergo an MSE (medical and social examination). In order for a person’s request to be considered and their health status assessed, the following documents must be provided:

- a referral to the ITU with data on health, compensatory capabilities, the severity of disorders in the functioning of the body and rehabilitation carried out before contacting the members of the commission (a referral can only be taken if you have medical documents not only from the attending physician, but also from the Pension Fund or social security authorities, if the last two organizations refused, the person has the right to immediately go to the bureau);

- application for re-examination (filled out by the applicant himself or his representative);

- passport (copies of pages and original);

- work book (and copy) with income certificate, if the candidate has ever worked;

- outpatient card;

- characteristics issued in an educational institution or at work;

- act on an occupational disease or injury received at work, if any;

- other necessary papers depending on the specific case (the exact list is presented in the Administrative Regulations, which were approved by the Ministry of Labor dated January 29, 2014 No. 59n).

Special status of children

Special children have the right to demand all the benefits that adults are entitled to.

If a parent takes parental leave or resigns, he is paid an allowance in the amount of 5,500 rubles.

Subject to regional regulations, this amount may be increased at the discretion of the government.

Together with the child’s pension, the family will receive 18 thousand or more. The state system makes it possible to provide such children with free sections, courses and clubs. They receive education at home with the help of their parents. In return, the state pays for these services with financial resources.

Such children are entitled to benefits for attending and enrolling in a university. When passing the entrance exams, students are admitted out of competition. At the same time, they are entitled to a social scholarship and financial assistance. If the child successfully studies, he receives an academic scholarship. Disabled children are exempt from paying hostel fees.

You may also be interested in the article about subsidies for starting a small business.

Read an article about the nuances of applying for social benefits for funerals here.

After reading this article, you will learn about subsidies for the development of personal subsidiary plots.

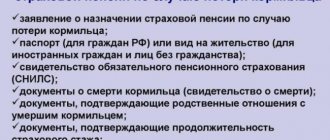

What documents are needed to apply for disability benefits?

The pension fund will require confirmation of the following data:

- personality and citizenship (naturally, only Russian is suitable);

- residential addresses;

- SNILS;

- a disability group assigned by an examination, giving the right to receive state assistance.

Benefits for disabled people are transferred together with pension payments in accordance with Law No. 400 and according to the length of service earned in civilian life, or in accordance with the years spent in civil service. The insurance pension is assigned due to the payment of social taxes during work. To complete it, it is enough to work for one day. Citizens with group 1 receive higher amounts than everyone else.

When not a single day has been worked, a social pension is assigned. In connection with this, it is paid not only to adults, but also to children under 18 years of age. Disabled civil servants who worked in the Ministry of Internal Affairs and the Armed Forces of the Russian Federation, as well as liquidators of the Chernobyl disaster, receive a state pension. Appointment requires a government resolution and a special decree of the President of Russia.

Until the disability is lifted, the money is regularly paid. After its cancellation, financial receipts will cease. Upon reaching the age of incapacity, the disability benefit will have to be changed to an old-age pension by re-issuing the necessary documents. From this moment on, the disabled person receives financial assistance for life.

What papers will be required to assign a disability pension of the second group?

In order to apply for a pension payment for disability of group 2 in 2021, a person must provide the following list of papers to the branch of the Pension Fund:

- A certificate from the Bureau of Medical and Social Expertise confirming the assignment of the second disability group;

- Passport and its photocopy with a mark on registration of place of residence;

- Pension certificate SNILS;

- Medical insurance policy;

- Other papers at the request of the fund.

The pension assigned to a disabled person of the second group is subject to mandatory annual indexation on a par with the labor pension. Persons receiving a disability pension are also entitled to a one-time payment of 5,000 rubles, introduced by the government in 2021 instead of annual indexation.

Amount of payments for disabled people

However, this pension depends on length of service and is not always enough to meet various needs. Therefore, if necessary, a citizen is provided with social state benefits.

For example, social Disability payments are minimal, constant and subject to indexation. That is, disabled people of group 3 are awarded 4,927 rubles every month. Here you can add a monthly cash payment (MCA), which is different for categories of persons with disabilities. For group 3, the benefit is 2,336 rubles. Thus, in 2021, in total, a person with disabilities assigned to group 3 can receive 7,263 rubles monthly.

Note that children are usually paid more than adults and the standard for them is generally 13,912 rubles. EDV provides an additional 2,919 thousand rubles, that is, the total payment per month for children reaches 16,831 rubles.

In addition, a maximum pension is possible if you have insurance coverage. Then a citizen, if he has dependents, can receive a basic payment in the following order:

| No dependents | 2.9 thousand |

| For one | 4.9 thousand |

| On two | 7 thousand |

| For three or more | 9 thousand |

This amount is responsible for the pension base, to which points accumulated over the entire period of work are added. Due to its unprofitability for some people, this type of pension accrual can be replaced with a fixed social benefit.