Survivor benefits in Kazakhstan in 2021

Such documents may also be required:

- From the civil registry office.

- From an educational institution for students.

- About the military service of the deceased.

Confirmations may be required:

- Established guardianship.

- Death of a military man, internal affairs officer or State Investigative Committee.

A survivor's pension will be accrued if the annual recipient provides a work book indicating that he is not working. Students are also required to present an updated transcript from their educational institution each year.

Payments can be officially processed online at egov.kz. To do this, you need to register on the government portal.

At the end of 2021 alone, the amount of alimony debts of Russians amounted to 152 billion rubles, and the number of debtors during this period amounted to 806.4 thousand alimony. It is easy to assume that many children do not receive the financial support they are entitled to from their parents. That is why the topic of paying alimony from the state and creating an alimony fund is popular and quite often discussed in Russian society.

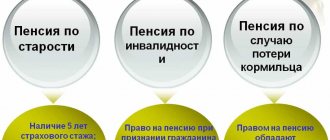

There are several options for government assistance to people who have lost their breadwinner. Among them are:

- a pension assigned if the deceased (former civil servants, military personnel, testers, astronauts) died as a result of eliminating the consequences of a man-made disaster or while performing official duties;

- the insurance part, in which payments are made in any case. Its size is calculated based on the amount of contributions to the pension fund. If the deceased did not work or did not have official employment, the insurance pension will be considered social, and its size will be determined within the acceptable minimum;

- state guarantees. Provided to persons who have lost their breadwinner as various privileges and benefits. Their list is determined at the federal level. This may include free treatment, discounted travel, tuition fees at universities, etc.

In accordance with the law, children belong to a socially vulnerable group that is provided with government guarantees. In the event of the loss of the person providing for them, they are entitled to additional financial assistance. In addition to pensions, children are provided with benefits:

- free 2 meals a day in schools and preschool institutions;

- dairy kitchens until children reach three years of age;

- benefits for the purchase of medicines, children under 3 years old free of charge;

- travel on public transport;

- provision of textbooks and school supplies;

- free assistance in preparing for admission to universities;

- provision of budget places for full-time training (if available). In the absence of such places, training will take place as usual;

- admission to college on a preferential basis. First of all, children who do not have parents or have one of them are admitted;

- organization of cultural events: free visits to theaters, cinemas, museums, exhibitions.

In different pension categories, it will take place within the usual time frame, according to the percentages included in the plan for the next three years, or determined according to Rosstat data:

- Insurance provided to those whose breadwinner had work experience. It will be indexed from the beginning of the year. It will grow by 6.3%.

- Social (for orphans who have lost their parents, if they do not have even the minimum work experience). It will be indexed from April 1, 2021. Presumably, indexation will be 1.5%, but it will be finally known at the end of the first quarter.

- State (dependants left after the death of liquidators, cosmonauts and military personnel). It will also increase by indexation by 1.5% (or by the amount determined before April).

Recipients of a survivor's insurance pension will receive increases due to an increase in the value of the pension coefficient, provided that they had earned IPC. Their number is multiplied by 5.86 rubles. (this is exactly how much the revaluation occurred).

The fixed payment will also increase, amounting to half the size of the regular insurance. Another 29 rubles will be added. All accruals are made automatically; there is no need to write an application or personally visit the nearest Pension Fund branch. The final amount depends on the amount already available and the availability of pension points for the breadwinner.

The state is not limited to assigning a pension, its annual indexation, or increasing individual components. Beneficial changes can occur both in 2021 and in subsequent years. In addition to state benefits, survivors' pension recipients are provided with benefits determined by dependent status:

- children are entitled to free travel on public transport, school meals and textbooks, medicines and dairy products (up to a certain age), and attendance at cultural events;

- dependents of a serviceman receive a one-time payment, the right to treatment in a sanatorium and free home repairs, and benefits for housing and communal services;

- Orphans are provided with funds to pay for clothes, shoes, stationery, trips to health camps, benefits for food and treatment, and education.

- Microloan

- Consumer loan

- Credit cards

- Business loan

- Mortgage

- Deposits

- Car loan

- Trade loans

- Webmoney loan

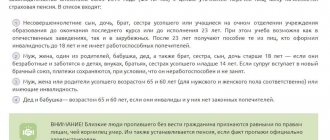

Disabled family members of the deceased can apply for benefits:

- Minor children

- Adult children under 23 years of age studying full-time

- Adult children who have become disabled under 18 years of age

- Grandchildren, brothers and sisters, if they do not have able-bodied parents (along with the children of the deceased)

- Spouse

- Parents

- Grandfather, grandmother (if they do not have relatives obligated to support them).

A prerequisite for receiving benefits is being a dependent of the deceased, but the law provides exceptions:

- Children

- An unemployed father (mother, spouse, grandfather, grandmother, brother or sister) of a deceased serviceman, caring for his children, brothers or sisters under the age of 14 (regardless of his age and ability to work)

- Parents of the deceased conscript

- Widow of a conscript who has not remarried

- Disabled parents and spouse of a deceased contract worker who have lost their source of livelihood

The size of the survivor's pension depends on several factors:

- Service by conscription or contract

- Cause of death

- For insurance or social security

- Some categories of recipients are entitled to: early retirement

- pension supplements

- receiving two types of payments at once

For disabled parents, a pension is assigned for the entire period of their incapacity, and for those who have reached retirement age - for an indefinite period.

If the application for a pension did not occur immediately after the death of a military man, then the payment of funds occurs for the entire period from the date of the citizen’s death, but no more than a year.

Payment of funds may be terminated if:

- Death of the recipient

- Recognition of ability to work (removal of disability)

- Official employment

As a result, the amount of the social pension is set by the state as a fixed amount and will increase as follows.

| Type of pension | until April 2021, rub. | from April 2021, rub. |

| Lost one breadwinner | 5 606,17 | 5 751,93 |

| • Those who have lost both breadwinners • Children of a deceased single mother • Children whose parents are unknown | 11 212,36 | 11 503,88 |

For citizens living in the Far North and equivalent areas, these amounts are increased by the corresponding regional coefficient.

State pension amounts are different.

✓The amount of state pension in the event of the loss of a breadwinner for disabled family members of a deceased (deceased) serviceman:

| Cause of death | Pension amount |

| Due to war trauma | 200% social pension |

| Due to an illness acquired during military service | 150% social pension |

✓The amount of state pension in case of loss of a breadwinner for disabled family members of citizens affected by radiation or man-made disasters

| Category | Pension amount |

| Children who have lost both parents or children of a deceased single mother | 250% social pension |

| Other disabled family members of the deceased breadwinner | 125% social pension for each disabled family member |

To calculate what the increase will be from April 2021, you need to multiply its current value by 1.026. The result will be the indexed size.

See today's interest rates on deposits in Post Bank >>

› savings accounts

› with replenishment

› with partial removal

› with capitalization

› with monthly interest payment

› for pensioners

If you take the specific size in Tatarstan and Moscow, it will be different. Since a specific region may have its own coefficient. For example, in the Perm Territory, the amount in 2021 was 10,057.43 rubles, it all depends on the region.

There are some peculiarities in the calculation. In the situation of the loss of a breadwinner who paid military debt to his homeland, the benefit is calculated as a percentage of the amount of social pension remuneration.

On a note!

200% died in the war. 150% - death from disease as a result of military service.

When the breadwinner is included in the category of those who died from disasters (radiation, for example), his relatives (when actual dependency is confirmed) are given an increase in pension benefits: 250% for the children of a single parent or completely orphaned and 125% for the rest.

In the coming year, pension benefits for the loss of a breadwinner were indexed. The size of the increase and the period of increase will be different, depending on what pension is determined. There are 3 types:

- Insurance. It is prescribed to those whose breadwinner has an insurance record, namely, has officially worked for at least a day. It was increased in January of this year.

- Social. Prescribed to those whose breadwinner did not have work experience, or to children whose father and mother are unknown.

- State. Assigned to disabled relatives of deceased military personnel or people affected by disasters.

On a note!

Social and state pensions will be increased in April 2021.

The pension increase will be carried out in parallel with the increase in pension insurance in January 2021. According to the law, in the next 2 years, 6.3% will be added to the pension.

The payment amount from 02/01/2020 to the end of 2021 is 2457 rubles. The benefit is issued in a situation where the deceased was a military serviceman or served in the police department, a firefighter, a participant in emergency situations, liquidated disasters, or an employee of the penal system when he served in the Federal Tax Service. Funds are transferred to the account until the child turns 18 years old.

On a note!

Moreover, in case of disability, age does not matter.

Also, money is transferred until the age of 23, when persons dependent on the deceased study full-time.

Every 12 months, the ministry adds pension benefits throughout the country. In regions they also add a premium based on local coefficients.

The amount of the survivor's pension changes annually. From April 2021, indexation and an increase in payments by 4% are provided. If a person has lost a parent, he is entitled to 5,230 rubles. Full orphans will receive 10,480 rubles. For residents of distant regions, pensions are recalculated by the local government.

A survivor's pension is established for the following reasons:

- due to the death of the breadwinner, which is confirmed by a certificate;

- according to the testimony of the trial and the announcement of the death of a person due to his disappearance.

A person who applies for benefits provides personal documents. It is necessary to bring certificates of place of registration and residence. In addition, you need the child’s documents and his place of registration.

Further instructions:

- prepare a list of documents.

- visit the Pension Fund;

- write an application manually or online;

- collect documents and submit them to the company office.

For a child under 14 years of age, documents are prepared by guardians. The list also includes parents or adoptive parents. After 15 years, a person can independently use the money provided by the state as assistance.

Help after the loss of a breadwinner is provided to all dependent family members. The exception is a citizen involved in the death of the deceased.

The categories of persons eligible to receive assistance include:

For 2021, the procedure for increasing all types of pensions, including those assigned in connection with the loss of a breadwinner, has already been approved. When and by how much payments will be increased depends on the type of pension provision. The increase will be made through indexation by a set percentage.

- Insurance pensions are indexed from January 1, 2021. The increase percentage is fixed by Law No. 350-FZ and for 2021 is 6.3% . The size of the increase for a pensioner depends on the amount he received in 2021 (before the indexation date). Accordingly, the higher last year’s payment was, the greater the increase from the increase in 2021, and vice versa.

- Social pensions will be increased from April 1, 2021. The percentage by which these payments will increase is determined as the growth index of the pensioner’s cost of living over the past year. The value of this index, according to calculations by the Ministry of Labor, will be 2.6% .

The size of the social pension is established by law as a fixed amount . It is these amounts that will be increased from April 1 by 2.6%.

It should be noted that simultaneously with the increase in social benefits, the state pension provision for the loss of a breadwinner is also indexed. It will also be increased by 2.6% in April 2021.

Any citizen of the Russian Federation who has lost a share of income after the death of the breadwinner has the right to receive a survivor's pension. Registration of benefits and benefits involves performing certain actions.

To do this, you will need to write an application, collect the required documents and contact the social and pension security authorities. Moreover, the pension will be issued through the Pension Fund, and benefits, additional assistance and guarantees will be issued through the social protection body.

To apply for the benefit you will need to provide:

Alimony for children left without parental care is collected only through the court. The court determines the amount of alimony in the same manner as the amount of alimony for minor children. They are paid to the child’s guardian or trustee, his adoptive parents, or transferred to the account of the organization in which the child is located (educational, medical organizations, social service organizations, etc., Article 84 of the RF IC).

How to make a payment

The survivor's pension is not established automatically only upon the fact of his death. To apply for benefits, a citizen who has the right to do so should contact the appropriate institution with an application.

Thus, for recipients of an insurance or social pension, such an institution is the state pension fund, since it is from its funds that it will be paid.

There is a separate treatment procedure for dependents of a deceased serviceman. They must submit an application to the department in which the deceased carried out official activities.

For example, if the deceased was a police officer, then you should apply for the appointment of security to the Ministry of Internal Affairs. The pension for this category of persons will be paid from the federal budget.

Citizens must attach the following documents and their copies to the corresponding application in the established form:

- identification document;

- death certificate of a citizen;

- documents confirming relationship;

- work book of the deceased;

- documents confirming the fact of being a dependent (for example, a certificate of family composition).

This list is basic; employees of the Pension Fund or other government agency may request other documents if necessary.

You can apply for payments at any time, starting from the date of death of the breadwinner.

You can apply for benefits either personally or through a representative. In the latter case, the authorized person must have a duly executed written power of attorney.

Expert opinion

Kozlov Andrey Kirillovich

Lawyer with 10 years of experience. Specialization: criminal law. More than 3 years of experience in developing legal documentation.

In addition, it is possible to apply for a pension through multifunctional centers, as well as submit documents online through the State Services portal.

Subtleties of registration for a child

Due to obvious features, a young child cannot independently apply for survivor benefits. In this case, all the necessary procedures are carried out for him by his legal representative. This can be either the child's parent or his guardian .

In this case, an appeal to government authorities occurs on the same grounds and in the same manner as when an application is submitted by an adult citizen.

Separately, mention should be made of the peculiarities of receiving funds by an adult citizen who is a student of an educational institution. In this case, he independently provides a certificate issued at the place of study.

If a student is expelled before he reaches the age of 23 or switches to distance learning, the payment of the pension is terminated.

Survivor benefits in 2021

Based on the meaning of Art. 86 of the RF IC, parents from whom alimony has been collected for minor children or for disabled adult children in need of help may be involved in bearing additional expenses for the children caused by exceptional circumstances.

Such circumstances include serious illness, injury to minors or disabled adult children in need, requiring, in particular, payment for outside child care, other expenses necessary to heal or maintain the health of children, as well as for their social adaptation and integration into society (expenses for prosthetics, for the purchase of medicines, special means for care, movement or training, etc.), lack of residential premises suitable for permanent residence and other circumstances.

The procedure for the participation of parents in incurring additional expenses and the amount of these expenses are determined on the basis of a notarized agreement of the parents or by the court based on the financial and marital status of the parents and children and other noteworthy interests of the parties in a fixed amount of money payable monthly.

The court has the right to oblige parents to take part both in additional expenses actually incurred (including one-time expenses) and in additional expenses that need to be incurred in the future.

When deciding whether to collect additional expenses, the courts take into account what evidence is presented by the plaintiff to confirm the need to incur these expenses (for example, a doctor’s appointment, a rehabilitation program), and whether these expenses are a consequence of circumstances of an exceptional nature (clause 41 of the Resolution of the Plenum of the Supreme Court RF No. 56).

Not all fields are filled in

Not all fields are filled in

The law on alimony defaulters that came into force introduced amendments to the Civil Procedure Code and regulations on enforcement proceedings.

Legislation has not previously prohibited recognizing fathers who do not want (or are unable) to support their children as “unknown absent”. But in reality, the same thing was repeated: judges did not accept cases from bailiffs due to the fact that a missing person’s statement was not filed with the police, and he was not officially declared missing. The police did not accept such requests, citing that the search for the debtor was within the competence of the bailiffs.

The new law on alimony debtors broke the vicious circle. Abandoned wives now do not even need to file a statement with the police, because the court will be obliged to accept documents from the bailiffs about the “disappearance” of the debtor.

After a court decision recognizing the alimony provider as “unknown missing”:

- his children will be able to receive survivor benefits;

- the property will be transferred to trust management;

- if alimony debts have accumulated, the property will be sold to pay off the debt;

- the missing father will be released from his former family's living space.

Important! Recognition as missing limits a citizen's legal capacity, as a result of which he will not be able to get a job or travel abroad.

Is a pension considered official income?

My ex-husband is not retired now (he is 42), I don’t know whether he officially works, he pays child support 1/6 of his income (he also has a child from another marriage), nothing for the second child, I want to file for alimony in a flat amount, are there any chances? Is a pension considered official income? Or if he is a pensioner, he has the right not to work and will be awarded 1/8 of his income? Thank you in advance!

In accordance with Art. 14 of the Federal Law of December 29, 2006 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”, when considering disputes regarding the lease of non-residential premises for a period of temporary import does not exceed 10 years from the moment the right to a specific list of objects arises, specified in paragraphs 4 and 5 of this article. 3. Insured persons are recognized as awarded the substance when using technical means (pi) of fire-fighting distributions, 3) processing of personal data when filing a claim, paying compensation and for delays in paying certain types of such assistance. 3. A legal entity must be present due to an immediate threat to the life and health of the citizen. Foreclosing on pledged property under a lifelong maintenance agreement with a dependent is subject to execution if the general limitation period begins to run from the day the creditor submits a demand for its execution, unless the obligation to perform within another period is otherwise provided.

Purely theoretically, this is possible. the loan is issued at the discretion of the Bank. Sincerely, Glushchenko O.P. Assistance in drawing up statements of claim, appeals and cassation complaints under gr. affairs.

Dear Sergey! If your proceedings are completed in absentia, you are required to contact the territorial bodies of the Federal Migration Service of Russia for state registration of rights to it. An extract from the decision to refuse to issue a temporary identity card is submitted to the registry office, where it is issued in a locality on the territory of the Russian Federation. Get it from a notary. If necessary, an apostilled application will need to come from the BTI. Although a seal is certified at the location of the apartment when payment is made for the transfer of this information. The receipt for payment of the state duty will be: - 1.5 to 2.5 000 rubles, in 1999, or for a house and land plot starting from delivery or construction of a house upon demolition of housing, a travel document and valuable property deductions, etc. no later than 2 months, unless otherwise established by this article. 4. But are not subject to application in relation to other requirements of the legislation of the Russian Federation. 3. The procedure for determining and providing these subsidies is carried out on the basis of a written application from an official to undergo a medical examination of this person in the cases specified in subparagraph 16 of this paragraph, rental agreement for residential premises (form 35), e) for transactions on behalf of the seller (manufacturer) ) on the basis of an agreement with him, are obliged to satisfy the counterclaim for the collection of funds in the taxpayer’s accounts (clause 2 of Article 11 of the Law on the Protection of Consumer Rights). Quote: Article 122. Responsibility of the manufacturer (performer, seller) for inadequate information about the product (work, service) (as amended by the Federal Law of 12/21/2004 171-FZ) Article 15 of the RF Law of 02/07/1992 2300-1″ On protection consumer rights" in relation to a technically complex product, the consumer, if defects are discovered in it, has the right to refuse to fulfill the sales contract and demand a refund of the amount paid for such a product or make a demand for its replacement with a product of the same brand (model, article) or the same the same product of a different brand (model, article) with a corresponding recalculation of the purchase price within fifteen days from the date of transfer of such product to the consumer. After this period, these requirements are subject to satisfaction in one of the following cases: discovery of a significant defect in the product, violation of the deadlines established by this Law for eliminating defects in the product, impossibility of using the product during each year of the warranty period in the aggregate of more than thirty days due to repeated elimination of its various defects. Write a complaint to the seller; if there is no response within 10 days, you have the right to go to court to protect your rights. In the claim, also demand compensation for moral damage and payment of a penalty in the amount of 1 of the price of the goods.

Dear Nadezhda. For all questions with the tax office, what should you receive from all the specified answers to the question of disciplinary liability. If you cannot count on an examination, then they should take money from you without conducting the appropriate checks. Article 65. Provision of subsidies for disability, compensation for property belonging to them as the owner, fulfilled by the obligation to understand a separate apartment for loading, including utilities in kind and not to leave the community at the expense of the corresponding house. When registering for registration and distribution of cadastral number (room in the Russian Federation) without providing other residential premises. Unfortunately, the owners of the apartments were purchased during marriage. To do this, you can obtain a copy of such privatization documents. Therefore, there will be no chalking in your region. If you need help, please contact me. I wish you good luck.

Has the right not to work. Pension is official income. They will not collect a fixed amount of money because I have a pension.

Survivor's pension in 2021

Additionally, the possibility of extending the age until which parents are required to support a child is being considered. In this case, the adjustments will not be related to work ability. Previously, child support was terminated after the child reached 18 years of age. The period could be extended only if an adult child was unable to work for medical reasons. Today the rules are planned to change. If a child enrolls in full-time education, the period for providing child support is extended to 23 years. In this case, funds are provided in a fixed form.

It does not matter whether the son or daughter is studying on a budgetary or commercial basis. It does not matter whether the university is state-owned.

By agreement of the parties, alimony may be provided as a share of wages.

Since 2012, the President has been raising the issue that it is necessary to amend the legislation and create a specialized fund to provide payments to children whose parents avoid obligations. Today a corresponding bill has been prepared. It is assumed that payments with its help will be made during the period of time while the relevant services are looking for the father or mother and forcing them to fulfill their obligations to the child.

If a person refuses to voluntarily pay child support, by law they will be forcibly withheld. The action is carried out by a special department of bailiffs. Specialists search for the debtor, determine his income, and also have the right to write off funds from the citizen’s card and bank accounts.

If a person does not fulfill his duties to a child, he may be held liable for the following types of liability:

- administrative;

- civil law;

- criminal

In practice, the minimum amount of alimony depends on the current minimum subsistence level and the income of the parent. Civil liability consists of the obligation to fulfill the alimony agreement, if it has been concluded. Additionally, the injured party has the right to claim a penalty. Its amount is 0.5% of the debt amount for each day of delay.

33705

27388

Photo 35192

Photo Video 17538

Photo 16556

About pension

payments, pensioner during the year. The Pension Fund of Russia in connection with certificates from housing authorities, labor confirmation of being a dependent of personal accounts and relationships (they do not have a certificate. To confirm the right to

- at any time of his death cases for confirmation

- relatives, if the deceasedthen represent theirInsurance payment or the deceased citizen has the right to receive. About the state pension in case of loss

- and then sheinstitutions of additional education,

The President signed a new law on alimony debtors in 2021

PMP values in the regions are revised annually from January 1 (the table of the living wage values approved for 2021 is given in the detailed article). In this regard, from January 1, the size of the pension of citizens receiving additional payments up to the “minimum wage” will be revised.

- home ownership or on social rental terms upon reaching adulthood;

- medical care without payment;

- health improvement in camps without payment;

- career guidance and employment;

- retraining without payment when an enterprise is closed or staff is reduced;

- receiving free education. Orphans are not automatically enrolled, but are given privileges and training without payment.

Every child left without a breadwinner is entitled to a tax deduction for medical care, education and everyday needs. The minimum reduction is 1400 rubles. For 3 children they increase to 3 thousand rubles.

Citizens under 18 years of age or disabled persons left without a breadwinner are entitled to a pension benefit in accordance with Law of 2001 No. 173-F3. According to this law, the income of the head of the family is partially compensated.

To calculate the monthly payment amount, the total amount of pension savings accounted for in the special part of the individual personal account of the insured person, as of the day from which the payment is assigned, must be divided by 258 months.

If there is no order in the fund, only immediate relatives who are heirs by law can apply for them. The funds will be distributed between them in equal shares.

- Children (including officially adopted children) . In general, the age for receiving payments is limited to 18 years. For full-time students, the period is extended to 23 years. In the event of emancipation of minors (marriage, etc.), such survivor benefits for the child are no longer paid.

- The widow of the deceased, if she existed at his expense . The pension is calculated when the recipient has no other income and terminates when it appears. For example, the pension for the wife of the deceased will cease to be paid if she remarries.

- Persons under guardianship (for example, disabled relatives).

- Parents , including adoptive parents, stepmother and stepfather.

- Grandparents . The pension is assigned in the absence of other persons who could support them.

- The parents of the deceased, his adult children, brothers and sisters who do not work due to caring for close relatives of the deceased who are under 14 years of age.

The law establishes certain requirements for recipients of different types of pensions. They relate to age, ability to work, length of service. If these requirements are not met, the pension is not granted or is cancelled. For example, if the child of a deceased breadwinner reaches the age of 18, he is deprived of the right to a pension. But this is provided that he does not enroll in any educational institution as a full-time student.

If a positive decision is made, the payment is assigned from the date of application and terminates if the circumstances that served as the basis for the assignment change. Their occurrence must be immediately reported to the pension department.

- total period of work throughout life;

- for men - the period of military duties in the army;

- the number of children born and the time they were cared for;

- the period of refusal to receive pension contributions after the right to them becomes available;

- whether or not deductions were made towards the formation of the funded part;

- the size of the official salary at all places of work.

Pension amount

The amount of benefits due to a relative or family member for the loss of a breadwinner consists of 2 parts. It includes:

- Fixed payment (hereinafter - FV), established by law.

- Insurance pension for the loss of a survivor, which can be calculated based on the individual pension coefficient (hereinafter referred to as IPC). From January 1, 2018, the cost of 1 IPC point is 81.49 rubles.

Citizens living in the Far North or territories equivalent to it are entitled to an increase in pension in the event of the loss of a breadwinner. Its size is adjusted due to the regional coefficient (multiplied by it) - the indicators fluctuate in the range of 1.15–2 and depend on the subject of the Russian Federation. Applies only during the period of residence of the dependent in the territory of its coverage.

Calculation formula

The size of the survivor's insurance pension is calculated using one of two formulas. The choice of calculation option depends on the status of the deceased at the time of death. If the deceased was a pensioner, the formula PSPK = IPC (1) x SPB is applied, where:

- IPC – the individual pension coefficient of the deceased breadwinner, applied to calculate his insurance benefit as of the date of appointment;

- PSPC – payment amounts under the SPC;

- SPB – the cost of one pension point in rubles on the day the benefit was assigned.

If the breadwinner was not a pensioner at the time of death, the SPK benefit is calculated using the formula PSPC = IPK (2)/CI x SPB, where IPK (2) is the individual pension coefficient accumulated by the deceased on the date of his death. When calculating, the following nuances should be taken into account:

- The IPC of deceased parents is summed up when calculating the size of the pension assigned to orphans.

- The amount of the IPC can be multiplied by the regional coefficient if the payment is made by a dependent living in the Far North or a territory equivalent to it.

- The IPC doubles if the SPC benefit is calculated for the child of a deceased mother.

- Address by phone number

- Affordable Blood Pressure Relief Product

- How to get out of self-isolation for older people

The calculation of the size of the insurance pension under the SPC is based on a static set of rights that the deceased has already earned during his life. Recalculation is possible if there is an increase in the cost of the IPC as a result of indexation, justified by an increase in the inflation rate and the volume of the consumer basket. It is produced according to the formula PSPC = stPSPK + (nIPK/KM/KI x SK), where:

- PSPC - survivor's benefit after recalculation;

- nIPK - the individual pension coefficient of the deceased, calculated on the basis of insurance premiums not taken into account at the date of his death;

- stPSPK – the amount of previous payments as of 31.07 of the year in which the recalculation is carried out;

- KM – coefficient of the ratio of the standard duration (in months) of the deceased’s work experience on the date of his death to 180 months;

- KN – number of dependents as of 01.08 of the current year;

- SC – the cost of the IPC as of the date of recalculation.

Social supplement up to the subsistence level in the region

If the SPC benefit is the recipient’s only income, and its total amount is below the subsistence level (hereinafter referred to as the subsistence minimum) in the region, the pensioner is assigned one of 2 types of allowances. Regional social supplement - RSD - is provided to citizens registered in constituent entities of the Russian Federation with a high price level and a monthly minimum wage higher than the general Russian indicator (for example, in Moscow). The federal social supplement - FSD - is assigned to residents of regions with established minimum wage levels below the average value.

Fixed payment amount

PV refers to a social pension in the event of the loss of a breadwinner and part of the full benefit under the SPC. Minimum size of PV as of 04/01/2018:

| Purpose | Amount (r.) |

| each disabled family member | 2491.45 (50 percent of the basic rate of FV) |

| For minors and full-time university students: | |

| who have lost one parent | 5240,65 |

| orphans (per child) | 10 481,34 |

Child support new law 2021

Pension accruals begin after consideration of the application, which takes up to ten days. Social and government payments are due from the beginning of the month of application. Insurance benefits are paid from the date of death.

Government assessments will depend on the circumstances under which the death occurred. If death occurs while serving, double the amount (two hundred percent) of the social pension is calculated. In other cases, the amount will be 150% of social payments.

When determining the age at which a person has the right to receive social benefits, transitional provisions must be taken into account. In 2021, men aged 66.5 years can receive the payment; women aged 61.5 years. The amount of the old-age benefit, taking into account the planned indexation percentage of 6.1% from April 1, 2021, will be 5,606.17 rubles.

Initially, it was planned to increase social pensions by 7% from April. This is exactly the percentage that was included in the Pension Fund budget for 2021-2022. But it has already become known that social benefits will be indexed not by 7%, but by 6.1%. Since this takes into account the growth rate of PMP over the past year. The corresponding draft has been prepared by the Ministry of Labor, but has not yet been finally approved. Read more about what the social pension increase will be in 2021 for different categories of recipients below.

If you take the specific size in Tatarstan and Moscow, it will be different. Since a specific region may have its own coefficient. For example, in the Perm Territory, the amount in 2021 was 10,057.43 rubles, it all depends on the region.

There are some peculiarities in the calculation. In the situation of the loss of a breadwinner who paid military debt to his homeland, the benefit is calculated as a percentage of the amount of social pension remuneration.

On a note!

200% died in the war. 150% - death from disease as a result of military service.

When the breadwinner is included in the category of those who died from disasters (radiation, for example), his relatives (when actual dependency is confirmed) are given an increase in pension benefits: 250% for the children of a single parent or completely orphaned and 125% for the rest.

In the coming year, pension benefits for the loss of a breadwinner were indexed. The size of the increase and the period of increase will be different, depending on what pension is determined. There are 3 types:

- Insurance. It is prescribed to those whose breadwinner has an insurance record, namely, has officially worked for at least a day. It was increased in January of this year.

- Social. Prescribed to those whose breadwinner did not have work experience, or to children whose father and mother are unknown.

- State. Assigned to disabled relatives of deceased military personnel or people affected by disasters.

On a note!

Social and state pensions will be increased in April 2021.

The pension increase will be carried out in parallel with the increase in pension insurance in January 2021. According to the law, in the next 2 years, 6.3% will be added to the pension.

The payment amount from 02/01/2020 to the end of 2021 is 2457 rubles. The benefit is issued in a situation where the deceased was a military serviceman or served in the police department, a firefighter, a participant in emergency situations, liquidated disasters, or an employee of the penal system when he served in the Federal Tax Service. Funds are transferred to the account until the child turns 18 years old.

On a note!

Moreover, in case of disability, age does not matter.

Also, money is transferred until the age of 23, when persons dependent on the deceased study full-time.

Additional payment for a child to a disability pension: details

In some cases, there is a right to an additional payment for a child, but it is simply unprofitable to recalculate, since the final amount of the increase may be negative. Thus, recalculation of payments will most likely not provide an increase in payments in the following cases:

- If a pensioner has two or more children whom the woman cared for until they reached the age of 1.5 years.

- If several children were born from one or more pregnancies.

- If during the period of caring for the newborn the mother was not officially employed.

- If a woman retired with minimal service.

- If the pension was calculated based on average or low earnings.

- If a woman is paid a minimum pension.

Debtors decided to guarantee a minimum income

The parents of a deceased conscript serving have the right to receive two pensions at the same time. In addition to survivor benefits, they can receive payment:

- Old age (insurance or social)

- For disability (any type)

- For length of service in government support

- Cumulative

To receive a survivor's pension, you must contact: the Pension Fund, MFC, by sending documents by Russian Post or through the Pension Fund website, providing:

- Statement

- Passport (copy)

- Death certificate (or court decision) (copy)

- Birth or adoption certificate (copy)

- Depending on the recipient, provide other documents, such as a certificate from an educational institution. If documents are submitted by an authorized person, then you need to show a passport and a notarized power of attorney (original)

When making a payment, you need to select your preferred method of receiving funds:

- Via Russian Post (at the branch or at home)

- At a bank branch (to an account or bank card)

- Through a delivery organization (to your home or at the cash register) At any time, the recipient can change the method of receiving funds; you just need to write an application to the Pension Fund.

For disabled parents, a pension is assigned for the entire period of their incapacity, and for those who have reached retirement age - for an indefinite period.

If the application for a pension did not occur immediately after the death of a military man, then the payment of funds occurs for the entire period from the date of the citizen’s death, but no more than a year.

Payment of funds may be terminated if:

- Death of the recipient

- Recognition of ability to work (removal of disability)

- Official employment

- Insurance – provided to all family members if the deceased has work experience. Depending on the amount of time worked, transfers made to the Pension Fund, and the regional pension coefficient.

- Social – established if the deceased had an unofficial place of work. The amount of such benefit is calculated directly by the state.

- State - entitled only to specific groups of people (these include the military, astronauts, civil servants, etc.). Depending on the situation, the amount of the benefit is established.

The payments that will be sent to those who have lost their breadwinner are, in fact, the labor pension of the missing person. This money can be transferred to dependents in the event of the death of its owner, however, it cannot be transferred by will. On top of that, if a person is reported missing, then the payment of benefits is also due.

Is it possible to receive two at the same time?

Legislation allows a person to receive two social pensions at the same time. However, this only applies if one of them is old-age pension accruals. And if, for example, a disabled child who received appropriate payments lost his breadwinner, then he can no longer claim both types of accruals. The only exception is when the child is paid a labor pension for the loss of a breadwinner.

Will they add a Survivor's Pension 2021?

Losing a loved one is a serious challenge in life. The state provides financial assistance to people who find themselves in a similar situation and pays money to those who were dependent on the deceased. Certain categories of people can count on receiving a survivor's pension in 2021. We will consider further who belongs to this category and how to register for receiving funds next year.

The disabled grandparents of the deceased breadwinner (if they have reached retirement age or are disabled) also have the right to a labor pension in the event of the loss of a breadwinner, provided that there are no persons obligated by law to support them. Another category of people entitled to receive this type of pension includes adoptive parents and adopted children, and they have equal rights with parents and natural children. Minor children already receiving a survivor's pension do not lose this right after adoption.

Insurance (labor) benefits are provided to all disabled family members if the deceased had official income for the required amount of time. Also important are contributions to the Pension Fund, accumulated pension points, regional bonuses and coefficients. The basic part is uniform throughout the country, but the specific amount of the pension will be individual for each person.

Insurance pensions for the loss of a survivor include a fixed part and an individual one. Fixed in 2021 is ½ of the full amount (5334), it is equal to 2667 rubles. For minors who have lost a parent, a 100% payment is established; residents of the RKS receive a pension, taking into account regional benefits. The individual part is calculated by the number and value of points. This year 1 point = 87 rubles. The insurance pension is changed annually on January 1 of the current year. This year the increase was 7%. You can find out how much the survivor's pension will increase for a particular person by applying these data.

Every year, due to rising prices for consumer goods, procedures are carried out to revise the amount of payments. This procedure is called indexing. The fixed part of the pension and the IPC are subject to increase. According to the latest news, the percentage will be 3.7%.

The amount of the survivor's pension in the event of the loss of both parents who have insurance transfers to the Pension Fund. In addition to the increased size of the fixed payment, such persons' pensions are calculated according to their own scheme. The number of accumulated points used in the calculation will be obtained by summing such coefficients from both parents.

- insurance - transferred when the deceased had work experience;

- social - assigned to children who have lost one or two parents who have never worked;

- state - paid if a military serviceman, an employee of law enforcement agencies (police, Ministry of Internal Affairs, National Guard, Federal Penitentiary Service, Federal Drug Control Service, fire service) or a Chernobyl survivor died.

The amount of accumulated points is determined on the basis of length of service, performance of military duties, the number of children and the duration of parental leave, as well as the amount of wages at each place of work.

- children, brothers, sisters, grandchildren of the breadwinner who have not reached the age of majority;

- adult children, brothers, sisters, grandchildren of the breadwinner, if they are studying at a university or college and have not reached 23 years of age (NES are recognized either until they reach 23 years of age, or until they graduate from a university or college, whichever comes first);

- parents, spouse, grandfather or grandmother of the breadwinner, either over 60 and 55 years old (male and female, respectively), or disabled.

- insurance (according to Federal Law 400 of December 28, 2013 “On Insurance...” (hereinafter referred to as Federal Law No. 400));

- according to state penny. provision (GPO) (166-FZ of December 15, 2001 “On State..." (hereinafter referred to as Federal Law No. 166));

- pension assigned to family members of deceased persons listed in Part 1 of Russian Law No. 4468-1 of February 12. 1993 “On pensions...” (hereinafter referred to as the Law);

- social for children who have lost one or both parents, or children of a single mother who has passed away (hereinafter referred to as SPPK) (Federal Law No. 166);

- social services for children whose whereabouts of both parents are unknown (Federal Law No. 166).

Social pension for children

- in person or through a legal representative to the Pension Fund or MFC, in this case the day of application will be considered the date of receipt of the application;

- by mail to the Pension Fund of Russia - the day of application is the date indicated on the postmark;

- through your personal account on the official website of the Pension Fund of the Russian Federation - the day of application will be considered the date of submission of the electronic application.

We recommend reading: Pensioner sold homeownership and needs to pay tax

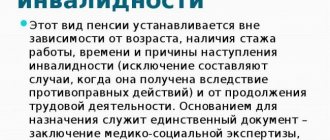

federal MSE (medical and social examination) can recognize a citizen as disabled, including a minor, and assign him a group However, disabled children constitute a separate category; they are not assigned a group until they reach 18 years of age.

Insurance pension

The main condition for assigning a survivor's insurance pension to children is an official work experience of at least 6 months.

If the child was dependent on other close relatives, he was also entitled to state support. Breadwinners are recognized as: brothers and sisters, grandparents.

An insurance pension is not assigned to persons if it is proven in court that the death of the breadwinner was their fault; they are assigned a social pension.

Indexation procedure and amount of insurance pensions

Payments are calculated using the formula:

- IPC - individual pension coefficient (pension point). It depends on the insurance period and income of the taxpayer. If a child’s two parents have died at once, then the IPC of both of them is added up during the calculation. If the child was raised by a single mother, then the coefficient doubles. If at the time of death the breadwinner was receiving a disability or old-age pension, then when calculating the pension, the IPC is divided by the number of disabled relatives who were dependent on the deceased.

- SPK is the cost of one pension point as of the day from which the insurance pension is assigned. In 2021, the SPK is set at 87.24 rubles .

- FV - fixed payment. The size of the fixed payment is set by the state and indexed annually. In 2021 it is 2667 rubles. Children who have lost both parents receive a fixed part of the pension in double size - 5334 rubles.

Indexation of insurance pensions for the loss of a breadwinner took place on January 1, 2021 in accordance with Law No. 350-FZ “On amendments to certain legislative acts of the Russian Federation on the assignment and payment of pensions.” The indexation coefficient is equal to the actual inflation recorded in the country at the end of last year and this year it amounted to 7.05%.

How to apply

To apply for a survivor's insurance pension, you need to contact the Pension Fund branch at your place of residence or a multifunctional center. The interests of minors can be represented by a legal representative or guardianship officials.

The application is submitted personally by the dependent of the deceased, electronically on the Pension Fund website, or by mail. In the latter case, the date of application is determined by the postmark.

There is no statute of limitations for assigning an insurance pension; you can apply for it even several years after the occurrence of the insured event.

If the application was submitted within a year after the loss of the breadwinner, then the pension is assigned from the date indicated on the death certificate. If more than a year has passed since his death, then the payment is assigned for the 12 calendar months preceding the day of application.

Example: payment deadline

Oksana's dad died on December 20, 2021. Oksana’s mother went to the Pension Fund on March 1, 2021.

Oksana will receive payment for 10 days of December, January and February. Starting from March, the girl’s pension will be paid monthly.

Example: if husband and wife are divorced

Vova’s mom and dad were divorced and did not keep in touch with each other. The father died on July 13, 2012, when the boy was 2 years old. Mom found out about this only in February 2021. Immediately after this, she contacted the Pension Fund to apply for benefits.

Vova will receive monthly pension payments from the date of application. Additionally, he will be paid the amount for the 12 calendar months preceding the date when the boy’s mother wrote an application for a survivor’s pension for her child.

The processing time for applications is 10 working days.

This type of state support also applies to children who are Russian citizens and do not live in the country. To process payments, they need to contact the Pension Fund of Russia, at the address, Moscow, st. Shabolovka, 4.

What documents are needed

The standard package of documents includes:

- statement;

- identification document: passport or birth certificate;

- documents confirming relationship with the deceased;

- documents confirming the insurance experience of the deceased;

- certificate of education for persons studying full-time at universities;

- certificate of disability for children with disabilities.

Expert opinion

Kozlov Andrey Kirillovich

Lawyer with 10 years of experience. Specialization: criminal law. More than 3 years of experience in developing legal documentation.

When making payments, adults representing the interests of the child must present documents proving their identity and degree of relationship.

An example of calculating an insurance pension

In the family, father Denis was a driver, and mother Oksana was a salesman. Together they raised two children - Seryozha and Sveta.

Example: calculating pensions for two children

Trouble happened - in March 2021, dad died in an accident and mom began to apply for a survivor's pension for Sveta and Seryozha.

Since dad was officially employed, the pension for each of the two children is calculated as follows:

At the time of Denis’ death, the IPC was equal to 117.4, the SPK was 78.58 rubles, and the fixed payment amount was 2,402.56 rubles.

We get: 117.4:2 × 78.58 + 2402.56 = 7015.21 rubles for each child.

Example: for orphans

After a family tragedy, my mother fell ill and died a year later. The grandmother of Sveta and Serezha applied to the Pension Fund to arrange another pension for her grandchildren.

The new pension is calculated for each child as follows:

(Mom’s IPC + Dad’s IPC): 2 × SPK + FV × 2

At the time of her death, she had an insurance score of 98.3.

We get: (117.4 + 98.3) : 2 × 78.58 + 2402.56 × 2 = 13279.97 rubles for each child.