Disability and old age pension: general provisions

The provisions of the law specifically determined when and on what grounds a citizen has the right to receive certain pension benefits. The pension is assigned on the basis of Russian Federation Law No. 400-FZ. Here are the key points for calculating the corresponding payment. In addition to this document, the issue of calculating pensions for disabled people is regulated by Russian Federation Law No. 181-FZ.

In general, both pensions (old age and disability) exist as a type of state support for socially vulnerable people who are not able to work normally and provide for their needs. At the same time, citizens with disabilities who are pensioners by age make a choice in favor of one of the pensions.

But the law makes an exception for some people who are entitled to several pension payments at once. The following can count on preference:

— participants of the Second World War;

- former siege survivors of Leningrad;

- those who participated in hostilities and received illness or injury as a result;

- parents or widow of a deceased serviceman.

These categories receive an additional state pension.

Important

! You can apply for a monthly disability and old-age pension at the Pension Fund of the Russian Federation.

Types of pensions

First, you need to understand the types of pensions that people are entitled to in various cases.

By disability

Funds paid by the state in case of disability are assigned to citizens regardless of their age. They can be received not only by adults, but also by children who have just been born. The presence of work experience for processing this type of payment also does not matter. The basis for assigning such a payment is the conclusion of a special medical commission, which records the presence of a certain dysfunction of a person and makes a decision on establishing the status of a disabled person.

The amount of payments depends directly on the established group:

- persons with disabilities belonging to group 1 receive a payment of 10,360.52 rubles ;

- for group 2 the amount will be 5180.24 rubles;

- for group 3 – 4403.24 rubles .

The fact that this dysfunction was established in childhood is also important. If disability was acquired before reaching adulthood and then extended, then the payments will be:

- Group 1 – 12,432.44 rubles;

- Group 2 - 10,360.52 rubles;

- Group 3 – 4403.24 rubles.

Payments to children are also set at the highest level. And their amount is 12,432.44 rubles.

In addition to the established amounts, it is important to know that these types of payments are of 3 types:

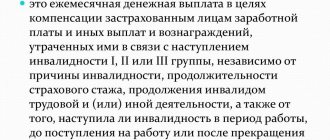

- insurance , which is paid to a person with experience (a person can work for only 1 day and will already have the right to apply for this type of payment);

- social, it is assigned to those who cannot qualify for insurance benefits, that is, for certain reasons they have not worked a single day;

- state, it is assigned to those civil servants or military personnel who become disabled while performing their duties.

A significant difference between these three types of payments is that only recipients of state pensions have the right to receive double pensions. If only an insurance or social payment is assigned, then the person has the right to choose which amount is greater, calculated based on old age or the presence of disability. Only those people who have been assigned a government payment can receive them together.

Who is eligible

Recipients of the state type of payments are:

- people who received their illnesses or injuries in military operations;

- WWII participants;

- residents of St. Petersburg who were in the city during the siege of Leningrad.

Also, as an additional incentive, such payments may be established at the discretion of military commanders:

- parents of fallen military personnel;

- their widows ;

- disabled relatives who suffered at the Chernobyl nuclear power plant.

Any assignment of a state payment gives a person the right not to refuse due payments upon reaching retirement age. But in order to assign payments based on age, it is necessary to comply with the conditions mandatory for their assignment.

By old age

In this case, the person must reach retirement age, and it is established by law. For civil servants, its increase occurred several years ago. And it continues smoothly to this day, increasing by 1 year every year. For ordinary citizens, the bill has also almost already been signed, so it will soon come into force.

Starting next year, the increase in this age will affect all citizens. It will increase annually until it reaches 65 years for men and 60 years for women. Similar standards apply for civil servants, only women must be 63 years old.

There are also 3 types of payments depending on the person’s length of service:

- insurance , the size of which directly depends on the main indicators that form this type of payment;

- social benefits are established by the state for those people who have not received the right to apply for an insurance type of payment (this year its amount was 5,240 rubles after the spring increase);

- civil servants are appointed to civil servants who have reached the appropriate age and also have the necessary experience.

To receive this type of payment, you must live to the specified age. But besides this, if you do not want to receive the established social minimum, you must work for 20 years for women and 25 years for men to receive state payments.

Registration of insurance payment is more loyal, therefore, to process it you must:

- accumulate the required number of pension points ;

- serve the required number of years ;

- reach the appropriate age .

This requirement applies to all citizens who are not engaged in public service and are considered to be the working population. But since this law was introduced recently, the increase in length of service and pension score occurs gradually. This year you must meet the following standards:

- Reach 55 years of age for the female part of the population and 60 years for the male part.

- Work for at least 9 years .

- Accumulate 13.8 points .

But every year these indicators will increase until they reach their maximum:

- The retirement age will be 60 and 65 years , respectively.

- Work for 15 years .

- Earn 30 points .

The amount of points is directly affected by the type of work activity and the amount of funds contributed to the Pension Fund. The individual pension coefficient also increases if a person does not apply for pension payments immediately, but continues to work for several years.

You can learn more about this in the following video.

Difference between old age and disability pensions

First of all, the types of pensions under consideration differ in the grounds for their assignment. For example, a disability pension is paid after assigning a group to ITU. Specialists from the Bureau of Medical and Social Expertise record the physical limitations of the subject and take into account various criteria, taking into account which they assign a special status.

After this, the disabled person can apply for a pension payment, and its amount will depend on the number of dependents, if any, in the care of the holder of a special status, as well as on the group (3, 2 or 1 - the latter, as the most difficult, allows you to take advantage of the largest pension amount possible with disabilities). The pension is paid temporarily or permanently depending on the severity of the citizen’s condition. This type of state assistance changes in the direction of decrease or increase according to the group (for example, if instead of group 2 they were given 1, the pension will become larger and vice versa).

As for the old age pension, it is due upon reaching a certain age and is provided until the end of life. The amount of the pension here is influenced by the insurance (work) length of service and the amount transferred by the employer to the Pension Fund.

Important

! Old age pensions and disability pensions have their own calculation procedure.

Types of disability

Social guarantees for citizens with disabilities are enshrined at the legislative level. There are two types of social security for disabled people:

- Social help. All payments falling into this category are temporary. This also includes the provision of basic necessities and food.

- Social security content. This category includes all types of pensions, preferential sanatorium and resort treatment, and some types of medical services.

The implementation of all types of social security is guaranteed by Federal Law No. 181-FZ of November 21, 1995 and other legislative acts. A pensioner, after being assigned a disability, is entitled to certain payments:

- Old age pension. The citizen will continue to receive it after changing his social status.

- Monthly social benefits for disability. The size of the pension depends on the disability group. The largest pensions are awarded to disabled people of group 1 and disabled children.

- Monthly cash allowance (MCB). Its size is also set in accordance with the disability group.

- Cash compensation for refusal of a set of social services (NSS). It is accrued along with the EDV.

Group assignment

The patient must undergo a medical and social examination (MSE). Based on the result of the examination, a citizen with disabilities is assigned one of three disability groups:

- Group 1: completely unemployed, the citizen needs constant accompaniment and care;

- Group 2: working and non-working;

- Group 3: working.

When assessing disturbances in the functioning of the body and a person’s ability to work, 4 degrees of disability are distinguished:

- 1st degree. Disruptions in the body's functioning are minor, the ability to work remains fully intact. Examples of diseases for which this degree of disability is established: stage 2-3 encephalopathy, stage 2 hypertension.

- 2nd degree. Moderate disturbances in the functioning of organs.

- 3rd degree. Health problems are severe, the citizen cannot work.

- 4th degree . Serious disturbances in the functioning of the entire body; the patient needs constant assistance.

- How to retire early under the new law

- Compote for the winter from ranetki without sterilization

- Why do you need travel insurance for Russia?

Passing a medical and social examination

Disability is established by decision of a medical and social examination (MSE). An examination is a procedure for assessing the health status of an individual and determining his needs for social protection. The commission includes 3 doctors, one of whom is a pharmacologist. The profile of the other two doctors depends on the citizen's disease. Algorithm for passing the examination:

- Receiving a referral to ITU. The pensioner visits the attending physician, who gives him a referral for a medical examination. Based on the examination results, a referral for examination is issued.

- Visiting the ITU office, submitting an application for examination. For bedridden pensioners, all documents and certificates are submitted by their official representative. Such patients undergo examination at home or in the hospital. The date of the examination depends on the person’s health status. In case of progressive disease, MSE will be carried out within a month. If the patient has a high chance of improving his health, the examination will be carried out in six months.

- Passing the examination. Doctors evaluate the physical and mental health of the pensioner and study the submitted documents.

- Making a decision by voting.

Based on the results of the examination, doctors draw up:

- Conclusion on assignment of a certain disability group. The document is stored in the ITU office for 10 years. In the conclusion, they must write a diagnosis listing all the diseases the pensioner has.

- Certificate with disability group. It is given to the patient. Disability can be lifelong or temporary. In the second case, the pensioner is required to undergo re-examination every 1-2 years (the date is on the certificate).

- Individual rehabilitation program (IPRA) listing the technical equipment that the patient will need.

Health problems are divided into 6 groups:

- Statodynamic. Ataxia, impairment of motor abilities due to limb amputation, complications after surgery, or congenital problems with the functions of the nervous system.

- Mental. This category includes epilepsy, mental retardation, schizophrenia, and other diseases related to neurology and psychiatry.

- Sensory. This category includes problems with vision, hearing, smell, increased sensitivity to pain or temperature fluctuations (body or environment).

- With respiratory, digestive, hematopoietic organs (asthma, tuberculosis, pulmonary heart failure, etc.).

- Speech. Nonverbal and verbal problems (with speech, self-expression).

- Physical pathologies (nanism, dwarfism, acromegaly, etc.).

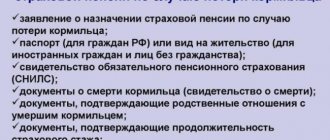

After receiving disability, an elderly citizen or his official representative must submit documents to the Pension Fund of Russia, the department of social protection of the population to obtain compensation and benefits. Payments will be scheduled after 15 days.

What kind of pension will a person who has no work experience receive?

If the amount of accumulated experience does not allow receiving an old-age pension, or it is absent altogether, a social pension is guaranteed to the recipient of retirement age. But there are some peculiarities here. For example, this type of payment is prescribed 5 years later than what happens with a labor pension.

According to the new pension reform, social pensions will be paid to women from the age of 65, and to men from the age of 70. This form of security is indexed every year and assigned in the amount established by the state. At the same time, an additional payment is due to social benefits if the pension does not reach the regional subsistence level of the pensioner. Here it is also possible to choose between pensions, focusing on benefits.

Is it possible to receive two pensions at once?

As soon as a person crosses the age limit beyond which he is officially considered a pensioner, the state, by law, can automatically transfer him from a disability group benefit to an old-age insurance pension. But this is only possible if a special status is obtained in the usual way - an illness develops, an injury occurs, etc.

State pension as a supplement is provided for such disabled people as:

- ex-participant of the Second World War or survivor of the siege;

- a serviceman who has acquired health restrictions while in service;

— injured as a result of a disaster (radiation or man-made);

— who received a disability during a space flight or preparation for it.

All of the listed beneficiaries, in addition to the disability pension, are fully guaranteed an old-age pension.

Features of the transition from a disability pension to an old-age pension

By law, the right to a disability pension ends when the recipient reaches the age at which an old-age pension is paid. As experts note, the transition is automatic, that is, the pensioner on benefits does not have to visit the Pension Fund, write an application and collect documents in order to be paid a labor pension instead of group funds.

It is noteworthy that if there is a lack of length of service or pension points, the disability pension is paid for another 5 years. Next, there will be a transition to social pensions.

Important

! Pension provision should not be less than the old-age pension.

What benefits does a disability group provide to pensioners?

The list of preferences is influenced by the citizen’s health status. For group 1 disability:

- subsidies and other pension supplements;

- 50% discount on payment for housing and communal services;

- free travel on public transport;

- free limb prosthetics;

- assistance in funeral services (if a close relative has died);

- budget education at a technical school, university, subject to successful passing of exams (even for pensioners according to Law No. 273-FZ of December 29, 2012);

- free rehabilitation means;

- free medicines from the Ministry of Health list.

Benefits for disabled people of group 2:

- various additional payments to pension;

- discounted travel ticket;

- free prosthetics;

- discounts on utility bills;

- free rehabilitation equipment (stroller, orthopedic shoes, etc.);

- free education at a university or college upon successful passing of entrance exams;

- free medications with a referral from the attending physician;

- registration at the labor exchange and assistance in finding vacancies for people with disabilities.

Benefits for disabled people of 3 groups:

- Discount when paying for housing and communal services.

- Supplement to pension, NSU.

- Queuing for improved living conditions.

- Free travel on public transport.

- 50% discount when purchasing orthopedic shoes.

- The limit on lifting loads during work is 2 kg.

- Opportunity to register at the labor exchange and look for special vacancies for pensioners with disabilities.

Benefits for parents of disabled children:

- Early retirement. The benefit is given to the mother or father of the child.

- 4 additional days off every month.

- The right to refuse business trips outside the region of employment.

- Monthly tax deduction RUB 12,000.

Pension provision

The rights of disabled people to financial support are protected by Federal Law No. 400-FZ of December 28, 2013. The pension amount is determined based on the disability group:

- 1 group assigned to an adult - 10,360.52 rubles;

- 1st group, assigned in childhood - 12,432.44 rubles;

- Group 2, assigned to an adult – 5180.24 rubles;

- Group 2, assigned in childhood – 10,360.52 rubles;

- Group 3 – 4403.24 rubles;

- disabled children – 12432.44 rub.

- Northern bonuses for those born in the north - who is eligible, registration, rules and calculation procedure

- Coronavirus has discovered another hidden symptom

- Top 3 most common complaints about housing and communal services

Social package

The NSC includes medications prescribed by a doctor, expenses for sanatorium-resort treatment and travel to the place of treatment by train. When a pension is assigned, it is issued automatically. The set of social services in monetary terms is 1075.19 rubles. You can apply for a waiver of the NSO at the Pension Fund of Russia.

Benefits for utility bills

A pensioner with a disability is given a 50 percent discount when paying:

- services with housing and communal services (taking into account current standards);

- contributions for major repairs of the building (for 1-2 disability groups);

- fuel for a home not connected to central heating;

- planned repairs of common property in an apartment building, rental of municipal housing.

Housing subsidies for disabled people to purchase apartments or improve living conditions are allocated at the regional level. To receive money or a certificate for housing, the beneficiary must get in line. The pensioner will be registered after he submits proof of disability (certificate) and a pension certificate. The local administration is responsible for the distribution of housing subsidies.

Tax preferences

Passenger cars specially equipped for use by disabled persons are not subject to any government fees. When purchasing a vehicle through the social security authorities, a pensioner with a disability receives a 50% discount on tax. Other tax benefits for people with disabilities:

- Personal income tax deduction 500 rub. for pensioners with disabilities of 1-2 groups.

- Reducing the cadastral value of the plot by 10,000 rubles. when calculating the amount of land tax.

Health Benefits

Medical preferences for pensioners with disabilities:

- Benefits for medicines. Disabled people of groups 1 and 2 and disabled children are provided with free medications from the list approved by the Ministry of Health. Pensioners with group 3 disabilities receive a 50% discount when purchasing these drugs.

- Benefits for medical care:

- Free dental prosthetics using domestic materials in public clinics.

- Free means of technical rehabilitation (adult and children's diapers, strollers, mattresses, etc.).

- Free trip to the sanatorium (provided once a year).

Employment Privileges

Disability group 1 is completely non-working; with group 2 or 3, you can get a job. Benefits for working disabled people:

- Reducing working hours to 35 hours per week (for pensioners with disability group 2).

- Day's work. The employer cannot attract such persons to work at night, but the pensioner can voluntarily agree to night shifts and overtime.

- Paid leave of at least 30 days and unpaid leave of up to 60 days.

Other types of benefits

Preferences provided at the regional level for people with disabilities:

- Discounts on medicines from 10 to 50%.

- Free rehabilitation programs. Disabled children and adults with disabilities can visit them.

- Preferential sanatorium-resort treatment for disabled people. One free voucher to a specialized health care facility is provided annually. One accompanying person is entitled to a discount on staying at the sanatorium (10-30%). When you apply for a voucher through the social security department for a disabled person to visit the sanatorium again in the same year, you can get a discount from 20 to 50%.

- Payment for travel to the place of treatment. Citizens are issued travel passes or reimbursed for the cost of bus and train tickets.

- Social taxi. You can use transport services for free 2-3 times a month.