In practice, there are often cases when the amount of pension payments is initially calculated incorrectly, without taking into account certain circumstances, as a result of which the citizen does not receive a certain amount of money. This happens for various reasons, including due to errors in calculating pensions at the time of retirement. In this regard, many current working and non-working pensioners have a question: is it possible to recalculate a pension after it has been assigned?

Does such a possibility exist, possible grounds for it and what documents need to be submitted to calculate pension payments - all this is described in detail in this article.

In what situations can a pension be recalculated after it has been assigned?

Recalculation of a pension should be understood as a change in the amount of pension payments that a pensioner can count on if there are certain circumstances for this that were absent or were not taken into account when assigning it. As a rule, clarification of payment amounts occurs on an application basis, in other words, on the initiative of the recipient himself.

Important! As a result of recalculation, the pension amount may be increased or remain the same.

Among the grounds that serve for recalculation, the following should be highlighted:

- The appearance of disabled dependents.

If a pensioner has dependents, which should be understood as disabled citizens, then the amount of the fixed payment is subject to an increase. The amount of additional payment is 1/3 FV for each disabled person. Dependents include:

- minors under the age of 18 (except in cases of emancipation);

- persons from 18 to 23 years old studying full-time in educational institutions;

- parents who are disabled.

- Confirmation of “northern” experience.

Recalculation occurs in the case when the pensioner has provided documentary evidence of work in the Far North (15 years) or areas equivalent to it (20 years).

- Confirmation of the development of preferential length of service.

Persons who worked in hazardous conditions are also entitled to an increased pension. Upon presentation of documents confirming this nature of the work, the amount of security will be increased.

- Clarification of non-insurance periods.

Adjustments occur upon presentation of documents confirming being on maternity leave, serving in the army, being with a military serviceman husband in conditions where it is virtually impossible to carry out work, etc.

- Confirmation of additional experience.

Documentary confirmation of the fact of previously unaccounted for labor relations before 2012.

- Change of disability group.

The disability group, assigned and changed on the basis of the ITU, directly affects the amount of pension payments.

In addition, the grounds for recalculation may be:

- changes to the IPC;

- moving to the Far North;

- the advanced age of the pensioner (he has reached 80 years old).

The advisability of seeking services from experts

If an error occurs in the Pension Fund, it is corrected immediately upon discovery, and the amount of the pension is changed. When the applicant points out a discrepancy, and the fund’s employees do not agree with this, the complaint is filed with a higher structure of the Pension Fund of Russia, and if unsuccessful, they turn to lawyers. With their help, sometimes the truth is restored.

More often than not you have to go through the courts. This authority does not verify the correctness of calculations, but appoints an independent examination. The decision is made at the discretion of the judge. Whether to act one by one or immediately go to court is up to everyone to decide for themselves.

Registration of recalculation

To carry out recalculation, you must contact the Pension Fund of Russia .

The application to this government body is submitted in writing, after which the pensioner should expect a response from the fund’s specialists. If there really are grounds for recalculation, then it will be made, but with prior notification to the recipient of the payments. If the Pension Fund does not consider the grounds presented sufficient for adjustment, then the applicant will receive a refusal, which, however, can be appealed in court . To prevent this from happening, you should take care in advance of collecting all the necessary documents before submitting your application.

Documentation

The list of papers that are required to be submitted to the Pension Fund for recalculation is not exhaustive, since each situation with which pensioners apply is individual, however, the fund’s specialists require:

- passport;

- SNILS;

- documents confirming work experience;

- birth certificates of children (for women);

- military ID (for men);

- documents confirming the validity of the recalculation (ITU conclusion, certificate of family composition, orders from the place of work, salary slips, etc.).

Important! In addition to the originals, it is important to have copies of the above papers.

How can I submit a request for re-registration?

The recipient of payments has the right to submit an application for recalculation of the pension in person during a visit to the Pension Fund office. Also, instead, a representative of the pensioner can draw up and submit the necessary papers, but this will require a power of attorney from a notary. In addition, both the applicant himself and his authorized representative have the right to submit documents for re-registration through the MFC.

If a pensioner is not able to come to government agencies to submit documents, then he can send them by registered mail.

The pension was assigned incorrectly, what to do?

YOU HAVE A CHANCE - SEND THE REPLY TO THE DECISION LETTER OF THE RF PF IN WRITING WITH A LINK TO THE LAWS - LET THEM THINK IN MY VIEW IN THIS CASE TO RETURN THE RF PF MONEY TO THE TREASURY THE CHANCE OF THE RF PF IS VERY LITTLE...it turns out you need to punish the RF PF employee and return the amount at his expense - he does not know the regulations on pension calculations..

— Submit an application at the place of registration addressed to the head of the Pension Fund branch with a request to double-check the correctness of pension calculation and indicating the grounds for recalculation. The application is reviewed within 5 days. Recalculation is made from the 1st day of the month following the month in which the application was accepted.

16 Mar 2021 uristlaw 221

Share this post

- Related Posts

- Where to Get a Single Mother Certificate

- Income Per Capita for 2021 in the Anninsky District of the Voronezh Region

- Does a bailiff have the right to seize drugs?

- Transport benefits for pensioners in St. Petersburg

Automatic recalculation for a person already receiving a pension

In a number of cases that are directly defined by law, the Russian Pension Fund can recalculate automatically, without the personal participation of the pensioner. These include:

- establishing a disability group, including a new one;

- reaching old age (80 years).

The legislator specifically allowed for the possibility of automatic recalculation of pensions without the participation of recipients of payments in this category, taking into account their restrictions related to age and health.

Important! Re-registration of pension payments without an application occurs only if the pensioner himself agreed to such an opportunity when initially applying to the Pension Fund for a pension.

If the recipient of the pension believes that it was accrued to him in an amount less than it should be, then he has the right to contact the Pension Fund for its recalculation. However, a positive outcome in this case is possible only if there is documentary justification for its implementation.

Calculation of pensions for those born before 1967: procedure for registering accruals

After calculating the payment, the moment of its receipt is important. If all documents are completed correctly and submitted on time, the amount will be calculated and issued within the 10th day. If the pensioner submitted bank card or account details, then the payment is made to it on the 10th day, and there is no need to apply anywhere. When receiving money by mail, there may be a delay of 1-3 days for the postal service to process the new application. If the amount is less than the subsistence minimum (it is 10-11 thousand rubles), contact the Pension Fund.

This is interesting: Benefits for Labor Veterans in the Vologda Region and how many percent of housing maintenance

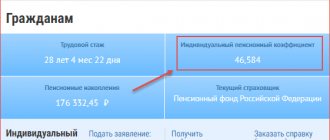

To calculate the insurance part, we only need to know the value of PC1, which can only be found in the Pension Fund of the Russian Federation (PFR). When you know all the data, you will be able to calculate the insurance share, and ultimately calculate what benefit you can count on when you retire. Every year the state increases pensions. This is affected by indexation and inflation. Indexation is an increase in the amount of payments that is made annually.

How to calculate your pension yourself

You can personally try to determine the amount of due old age pension payments if you think that your pension has been calculated incorrectly. For this you will need a calculator.

It is important to understand that the calculation will only be approximate.

Only a Pension Fund specialist can tell you the exact amount of the old-age pension after studying the payment file.

Payments are calculated by age, taking into account the following data:

- Salary data. You can get them from your employer. If the company is liquidated, you should order a certificate from the archives. To do this, you need to personally contact the appropriate organization. It is impossible to obtain such information on the Internet.

- Duration of official work activity. You can check the information using your work record book.

- The presence of non-insurance periods - times when you did not work for objective reasons. For example, they were on maternity leave or served in the army.

- Retirement age.

Old age pension formula

When calculating the old age pension, the formula is used:

SPS = FV x PC1 + IPCtot. x SPB x PK2 + NChP, where:

- SPS – the amount of accrued old-age insurance pension.

- FV - the amount of the fixed payment at the time of calculation of the pension (in 2021 - 5,334.19 rubles).

- PC1 and PC2 are increasing coefficients. Rely on later retirement. You can view them in Law No. 400-FZ “On Insurance Pensions” (December 28, 2013). When a pension is assigned at the generally established age, they are equal to 1.

- IPKobshch . – the number of pension points for the entire period of work.

- SPB - the cost of one SP at the time of recalculation of the old-age pension (in 2021 - 87.24 rubles).

- NPE is the funded part of the pension, if you formed it.

In order to calculate the pension according to the IPC, you need to know that in different periods different formulas were used to determine the number of PB. This is due to the ongoing pension reforms. Conventionally, working time is divided into 3 periods:

- until 2002;

- from 2002 to 2015;

- after 2015.

Based on this, IPKobshch. can be defined as:

IPKobshch. = IPK2001 + IPK2002–2014 + IPK2015 + IPKnon-insurance, where:

- IPK2001 - the number of PB earned during Soviet times and up to January 31, 2001 inclusive;

- IPK2002–2015 – number of points from January 1, 2002 to December 31, 2014 inclusive;

- IPK2015 – the number of PB accrued starting from 2015.

- IPC non-insurance – the number of pension points for non-insurance periods.

Calculation of points for calculating pensions

You can view your pension points online. To get started, you should go to the Pension Fund website. There you can use a special calculator. To independently determine the amount of your old-age pension, adhere to the following formulas:

- Until 2002. The amount of pension capital is divided by the cost of 1PB as of January 2015 (64.10 rubles).

- From 2002 to 2015. The insurance part of the pension is divided by the cost of 1PB as of January 2015 (64.10 rubles).

- Since 2015. All insurance contributions from your paycheck are automatically converted into points. To do this, the received amount is divided by the standard amount of contributions to the insurance pension. It is 16% of the maximum contributory earnings, which is determined by the Government of the Russian Federation annually). The total value is multiplied by 10.

Please note that the maximum IPC is limited by law. Regardless of your accrued salary, you are entitled to no more than:

- 7.39 PB for 2015;

- 7.83 for 2021;

- 8.26 for 2021;

- 8.70 for 2021;

- 9.13 for 2021

For each full year related to non-insurance periods, 1.8 PB must be accrued for the following circumstances:

- compulsory military service;

- caring for a disabled person of group I, a pensioner over 80 years old or a disabled child;

- detention if the citizen is subsequently rehabilitated;

- being with a military spouse in an area where it is impossible to get a job in your specialty (maximum 5 years);

- residence outside the borders of Russia, if the spouse is a representative of embassies, diplomatic missions (no more than 5 years).

- 10 bad habits after 50 years

- The most beneficial vitamin for the heart

- How to prepare for sudden weather changes and measure blood pressure without a tonometer

The number of PB accrued for each year of caring for a child until the child turns 1.5 years old depends on the child’s birth order:

- for the first – 1,8;

- for the second – 3,6;

- for the third and fourth – 5,2.

Where to check the accuracy of the accrual

You can find out whether your old-age pension has been calculated correctly in several ways:

- contact the relevant authorities personally or through an authorized representative;

- via the Internet;

- submit a written application (petition) by registered mail.

Where to go

Checking the accrual of old-age pensions is possible in the following organizations:

- Regional branch of the Pension Fund of Russia . You need to come to the customer service and write a corresponding statement. Among the documents you need to have with you, you must have a passport and SNILS.

- Multifunctional center (MFC) . Here you will be asked to fill out an application, to which you will need to attach your passport and SNILS.

- The bank where your pension is deposited. You need to go to the nearest branch at your place of registration. There you will be asked to write an application to gain access to this service in your personal account. You should have your passport and SNILS with you. Please note that this method is suitable if the bank has an agreement with the Pension Fund of Russia. Such institutions include Sberbank, VTB, Uralsib.

- Place of work. To obtain the correct information, you need to contact the accounting department.

- Non-state pension funds. Here, when you apply, you will be provided exclusively with information on the funded pension, which you form yourself or your employer does for you.

Application to verify the correctness of pension calculation

When you contact the Pension Fund or MFC, you will be given an application form. It must contain your personal information correctly. Next, ask to check the correctness of the pension calculations made. The specialist must make a note about acceptance of the application, after which it is sent for consideration.

5 days are allotted for this. You must be notified of the results of the inspection in the manner specified in the application. The amount is revised automatically if discrepancies are identified.

- 3 ways to pay less for car maintenance

- 7 foods that will help fight inflammation of rheumatoid arthritis

- Additional leave for combat veterans - procedure for registration and provision