Pension for men born in 1959

If you have a long work history (37 years for women), you can apply for a pension before reaching retirement age. Having completed the required length of service, a woman can become a pensioner 24 months before the statutory period, but not earlier than 55 years.

Since the law sets the retirement age at 55.5 for women born in 1964, the length of service benefit for them will not be provided in full. The reduction will be only six months instead of two, since the law limits the lower age limit. Therefore, women born in 1964 with 37 years of experience they retire at 55.

Let us remind you that the duration of this length of service includes only periods of working activity and paid sick leave. That is, the time a woman is on maternity leave for up to 1.5 years is not included in it.

For citizens near retirement age, various support programs, payments and benefits are provided, both at the federal and regional levels. Among the benefits, two main groups can be distinguished: tax and social.

Tax benefits. Pre-retirement people are provided with the same types of tax benefits that were previously available to pensioners until the end of 2021.

- With federal benefits, pre-retirees are exempt from paying land tax on 6 acres of land and paying tax on one type of property from each category (garage, house, apartment, etc.).

- The list of regional benefits depends on the subject of the Russian Federation in which the pre-retirement resident lives. These could be transport tax discounts, additional land tax discounts, and so on. You can clarify the list of benefits at the Federal Tax Service office at your place of residence or on the official website of the Tax Service.

It should be noted that tax benefits are provided at a fixed age - for women from 55 years old and for men at 60. That is, in this case, a gradual increase in the pre-retirement age does not need to be taken into account.

Social benefits. Pre-retirees may be provided with discounts on housing and communal services, the right to free travel on public transport, free medicines, monthly payments, and so on. The list of benefits provided depends on the subject of the Russian Federation in which the pre-retiree lives.

With regard to social benefits, you also need to pay attention to the laws in which these support measures are enshrined. For example, they may indicate that state support is provided upon reaching a fixed age of 55/60 years, and not according to general rules

Calculation of pensions for those born in 1962

Pension points are conventional units adopted in the new system as the basis for calculating payments. They are intended to include data on how many years and with what earnings a citizen has been working.

Based on the amounts transferred annually, the Pension Fund calculates the number of points earned . The approximate size of the annual increase in coefficients can be found on the official website of the Pension Fund using a special calculator. When you enter the amount of earnings, it gives a calculation of the number of points for the current year.

We recommend reading: Tax Benefits for Disabled Children and Their Parents in 2021

Pre-retirement age in Russia from 2021

For the retraining and retraining of people of pre-retirement age, the Ministry of Labor has already developed a draft program for advanced training. According to this program, pre-retirees will be able to receive additional professional education in accordance with the skills and competencies that are in demand at the present time.

Training will take place according to the following scheme:

- retraining will be carried out on the basis of the employment service (SZN) for an average of 3 months, off-the-job;

- During studies, scholarships will be paid in the amount of the minimum salary in the region.

According to the Ministry of Labor program, vocational training for pre-retirees will allow:

- Work with new equipment, technologies, software.

- Receive a qualification rank, class, category in accordance with the citizen’s profession without changing his level of education.

The amount of the insurance pension (SP) is calculated using the following formula:

Where

- IPC - the number of points generated on the pensioner’s personal account for all periods of his activity;

- SPK - the cost of one such coefficient (point);

- FV - fixed payment (basic part of the pension).

At the same time, the amount of the IPC depends only on the pensioner, and the SPK and PV are approved by law.

The cost of the point and fixed payment changes annually from January 1. Therefore, you need to substitute their values into the formula depending on the year in which the pensioner will apply for a pension.

To calculate a pension for a man born in 1959, values are needed only for 2021 and 2021:

- To calculate payments in 2021, the following values are used: FV = 5334.19 rubles, SPK = 87.24 rubles.

- For 2021: FV = 5686.25 rubles, SPK = 93.00 rubles.

This does not mean that those who took out a pension in 2021 (these are men born in the first half of 1959) will receive less than those who retired in 2020. After indexation from January 1, 2021, their collateral is recalculated taking into account the new values of the PV and SPK (this is the principle of annual indexations).

However, indexation is only available to non-working pensioners. For those who continue to work, the pension amount will remain unchanged.

Retirement age increase table

On January 1, 2021, a new pension reform came into force, according to which the retirement age will gradually increase; after the transition period, the retirement age for men will increase to 65 years , and for women - to 60 years (that is, the working age will increase by 5 years for both sexes ). annual increments , however, in the first two years of the transition period (2019 and 2021), citizens who, according to the old legislation, should have reached retirement age in 2019-2020, will be able to receive payments ahead of schedule ( by 6 months before the new retirement age).

The changes will not affect citizens who have already been assigned - they will continue to receive the required social and pension payments, and all acquired benefits will be preserved. Also in the bill, the Government provides for the possibility of early retirement after developing a long work history (at least 40 years and 45 years for women and men, respectively). In this case, it will be possible to start receiving a pension 2 years earlier than the established period , but in any case not earlier than men reach 60 years of age and women reach 55 years of age.

The main change that was proposed by this bill in its original version is the increase in the retirement age from 2019 to 63 for women and 65 years for men (now they are 55 and 60 years, respectively). However, these parameters of the law were adjusted by presidential amendments. The President proposed the following main measures to mitigate the pension reform:

- Thus, men born in 1959 will be able to retire on old age at the age of 60.5 years.

- That is, if you were born in the first half of 1959, you will be able to apply for a pension in the second half of 2021.

- If you were born in the second half of 1959, then you will be able to apply for a pension in the first half of 2021.

Starting from 2021, these categories of workers will also undergo a transition period, during which each year the limit of the working capacity period will be postponed by a year relative to previous periods. You can determine the retirement schedule under the new law based on the data presented in the table below:

The pension reform announced by the Government is planned to begin on January 1, 2021 . The first change that will affect Russian citizens will be an increase in the retirement age. The corresponding bill, which proposes to increase the retirement period for Russians by 5 years for men and 8 years for women , was considered and adopted by deputies of the State Duma in the first reading on July 19, 2018 . The adoption of the law in its final form is planned for the fall of 2021 after the collection and consideration of all amendments to it, but not earlier than September 24, 2021.

At the end of last year, the Russian Pension Fund created a unified database of all future pensioners. Every Russian now has his own personal account, where he can see how many points he has already earned. To check whether your employer has made contributions for you and see your pension future, you need to take four simple steps.

However, there will be no contributions to the funded portion in 2021 or 2021. All the money goes to the insurance part, that is, to pay current pensioners. Plus, the Ministry of Labor recently announced that almost 20% of Russians are not in the pension insurance system. That is, they receive their salaries in envelopes. This means only one thing - these people will receive a social pension, which is extremely small.

When calculating the pension in 2021, the SPK will be equal to 81.89 rubles, and the PV will be 4982.9 rubles. But for each “extra” year worked, there is a bonus, which is formed through bonus coefficients. You can count on receiving it even if the payments have already been issued, but the citizen has refused to receive them for a certain period.

An old-age pension can be issued both upon reaching a certain age, and before the due date, if this is due to compelling reasons (as a rule, this applies to citizens who were forced to work in regions with harsh climatic conditions or in industries harmful to health). Based on this requirement, in order to retire in old age, you must:

After 2002, your length of service can play a role only if it is recorded on an individual personal account, that is, if contributions were transferred for you by your insurer (employer). Hence the dependence is obvious - the more your “white”, that is, official earnings, the higher, in connection with this, insurance transfers - the more significant the future pension will be.

Certificates about his earnings Semenov S.S. did not provide it, so the amount of his salary for 2000-2001 was taken (for this period, the Pension Fund database contains information about all insured persons, i.e. those who worked officially at that time). The average monthly salary for this period for Semenov S.S. was 1530 rubles. The salary coefficient, showing the ratio of his earnings to the average salary in the Russian Federation in 2000-2001, is equal to 1530/1671 = 0.92.

Pension calculation in 2021

From the beginning of 2021, the process of reforming the pension system will be launched, and many Russians are interested in the question of how old-age pensions will be calculated after the transition to the new system, and also whether the formula will be different when calculating the amount of payments for men and women.

– fixed payment;

– coefficient adjusting the size of the PV established by the state;

– individual coefficient;

– the current value of the pension coefficient (the value current on the date of payment is accepted);

– bonus coefficient (it is used to increase the value of the IPC and is relevant for cases where a citizen has worked longer than the minimum period specified by law).

We recommend reading: Regional maternity capital Moscow 2019

Raising the retirement age: document analysis

The purpose of the pension calculator is to help in calculating the formation of the pension length of service and the timing of retirement.

IMPORTANT! Our pension calculator was created taking into account the amendments made to the legislation of the Russian Federation, known as the Pension Reform, adopted by the State Duma of the Russian Federation and signed by the President on October 3, 2018.

Scope of application

Using the calculator, you can easily calculate the retirement date of any citizen. The calculator is especially important for people of pre-retirement age, since it is their retirement that will be regulated according to a special grid, based on the gradual implementation of the provisions of the pension reform.

Various types of pension calculators are very common on the Internet, which is explained by the increased interest of citizens in the issues of calculating pensions. However, it should be remembered that there is no calculator that could even approximately reliably calculate the size of your future pension payments. This is due to many reasons, the main one of which is the extreme opacity of the system for calculating pension savings practiced by the Pension Fund.

Legislatively, factors that directly affect the amount of accrual of an insurance pension include:

- The salary of a future pensioner or declared income for self-employment.

- Duration of experience.

- Socially significant periods of life, which include service in the Armed Forces, maternity leave, and parental leave.

- The method of pension provision chosen by the future pensioner in the compulsory pension insurance system.

- Continuation of work after retirement age.

All these factors are constantly undergoing changes, and a radical change in the pension system of the Russian Federation brings changes almost daily.

Therefore, the only reliable calculations of the calculator can be provided only in part:

- projected year for retirement;

- retirement age;

- the minimum length of service required for retirement.

The pension reform, along with raising the age limit, also provided for the gradual pensioning of those who, at the time of the introduction of the reform, had either already reached the required age or were approaching it. In accordance with the stages of the reform, the age increase provided for by the reform will occur according to the formula 1/1, that is, once a year for a year. The total period for introducing reform conditions will take 9 years.

Men born in 1959 and women born in 1963 are eligible for pension innovations. Those born before these years are not threatened by the reform, even if they continue to work. This is due to the fact that the reform does not provide for retrospectiveness, that is, retroactive effect.

The phasing is reflected in an extremely simplified manner in the following diagrams for men and women.

| Year and month of birth | Year of retirement | Retirement age |

| 1959 (from 1 to 7 months) | 2019 (7-12 months) | 60 years 6 months |

| 1959 (7-12 months) | 2020 (1-6 months) | 60 years 6 months |

| 1960 (1-6 months) | 2021 (7-12 months) | 61 years 6 months |

| 1960 (7-12 months) | 2022 (1-6 months) | 61 years 6 months |

| 1961 | 2024 | 63 years old |

| 1962 | 2026 | 64 years old |

| 1963 | 2028 | 65 years old |

| Year and month of birth | Year of retirement | Retirement age |

| 1963 (months 1-6) | 2019 (7-12 months) | 55 years 6 months |

| 1963 (7-12 months) | 2020 (1-6 months) | 55 years 6 months |

| 1964 (months 1-6) | 2021 (7-12 months) | 56 years 6 months |

| 1964 (7-12 months) | 2022 (1-6 months) | 56 years 6 months |

| 1965 | 2024 | 58 |

| 1966 | 2026 | 59 |

| 1967 | 2028 | 60 |

That is, starting from 2028 (of course, if everything goes as the Government and the State Duma assume), the introductory period will end and Russians will begin to retire immediately upon reaching the appropriate age.

1959

202061 years old+ 1 year 1960202262 years old+ 2 years 1961202463 years old+ 3 years 1962202664 years old+ 4 years 1963 onwards202865 years old+ 5 yearsToday it is impossible to say for sure that the pension reform of June 7, 2021 will definitely take place (it has not yet been approved), and women and men (including those born in 1959) will retire according to it, and not according to the old legislation, quite perhaps something will change, in our country everything is possible, let’s hope and look forward to counting on the fact that the Russian leadership will come to its senses...!?

When is the exact date for retirement for men born in 1959-60 under the new law?

Calculating pension points is a very labor-intensive process, the algorithms of which, although given in pension legislation, are actually known only to employees of pension funds.

It is also difficult to calculate the number of points because each year the required minimum points increase by 2.4 points. If in 2015 about 7 points were enough to retire, then by 2025 potential retirees will have to have at least 30 points.

Moreover, different types of work activity and significant periods in life give different amounts of points, regulated by different legislative acts. Whether this was done intentionally or accidentally, the fact remains that an accurate independent calculation is impossible.

Currently, at the level of the State Duma and the Government of the Russian Federation, there is intense discussion of the abandonment of the point system, and one should think that after raising the retirement age, a waiver of the procedure for accumulating points will be introduced. Therefore, no matter how many forecasts the calculators give, no matter how many calculation tables are given, most likely they will turn out to be unnecessary.

According to experts and analysts, the period of official retirement in Russia had to be increased due to the fact that the number of unemployed citizens is steadily growing. This may lead to an imbalance in the pension payment system. And the state will not be able to issue payments to its elderly citizens at all.

In the 70s of the 20th century, 3.7 citizens worked for the pension payment of one pensioner. In 2021, the number of employees decreased to 2 citizens. By 2044, the number of such workers will completely decrease to 1.5 people.

Analysts cite an additional reason for the increase in life expectancy. Therefore, the citizen is in the care of the state and other workers much longer than before. Opinions differ as to how objective such statements are.

For some employees, payments are accrued not at a certain age, but depending on their years of service. These categories include:

- teachers and doctors;

- ballet dancers and opera singers;

- circus gymnasts.

These individuals have 25-30 years of professional experience. Along with the adaptation period, the assignment of a pension is also postponed when the required length of service is achieved. In addition, after acquiring the required length of service, employees have the right to continue working.

For employees in government positions, the transition to new pension periods also takes place with gradual adaptation. Until 2021, the age is increased by six months, and then growth is compared with the standard schedule - 1 year more annually.

For all federal government employees, the minimum length of service in municipal and civil service increases from 2021. Back in 2016, it was 15 years, and then every year they add six months. So by 2026 the period will be 20 years. Pension payments for length of service are awarded to employees with more than 17 years of experience in the public service.

New reasons for early retirement:

- Long experience. For women this figure is 37 years, and for men - 42 years. If this condition is met, it becomes possible to retire before the legally established age. But this will happen a maximum of 2 years earlier than the fixed date. At the same time, a woman cannot be considered a pensioner if she is under 55 years old, and a man cannot be considered a pensioner until he is 60.

- Women with many children with 3 or more children. Mothers who have given birth to three children become pensioners 3 years earlier; if there are four children, then 4 years earlier. At the same time, changes during the adaptation period are also taken into account. The only condition is to have a minimum insurance period of 15 years.

- Unemployed. This category includes those citizens of the Russian Federation who do not have the opportunity to find a job for objective reasons. They can apply for pension payments 2 years earlier than established by law, and taking into account adaptation.

How to determine your retirement date?

Changes to pension legislation have come into force in Russia. The main package of laws on innovations in pension legislation came into force in Russia on January 1, 2019. The law on changing the pension system, adopted on October 3, 2021, will significantly adjust the procedure for Russians to receive an old-age insurance pension as early as January 1, 2021, which is primarily due to an increase in the retirement age - it will gradually increase during the transition period until by 2023 will not reach the final values - 60 years for women and 65 for men.

| Year of birth | Retirement age | Year of retirement |

| 1958 | 60 | 2018 |

| 1959 | 61 | 2020 |

| 1960 | 62 | 2022 |

| 1961 | 63 | 2024 |

| 1962 | 64 | 2026 |

| 1963 | 65 | 2028 |

| 1964 | 65 | 2029 |

The reform spells out specifics for people living in the represented region. The standard period is reduced by 5 years, however, now both men and women will be able to terminate the employment contract at 60 and 55 years, respectively.

Men:

- 55.5 years (1964) – 19-20;

- 56.5 years (1965) – 21-22;

- 58 years old (1966) – 24 years old;

- 59 years old (1967) – 26 years old;

- 60 years (1968) – 28

Women:

- 50.5 years (1969) – 19-20;

- 51.5 years (1970) – 21-22;

- 53 years old (1971) – 24 years old;

- 54 years (1972) – 26 years;

- 55 years (1973) – 28

It is worth recalling that for civil servants the retirement age is increased gradually (6 months per year) from 2021 until 2021 inclusive. Then the pace will align with generally accepted legal boundaries.

Thus, male civil service employees will retire by 2028 (65 years), but female employees - by 2034 (63 years).

Also, starting from 2021, the requirements for the minimum period of work experience of municipalities will be tightened. service, which makes it possible to receive payments upon reaching compulsory length of service, presented in the form of an additional benefit to the old-age pension. Taking into account all the reforms, the female part of the population will receive a pension upon reaching 56 years of age , and men - 61 years of age . Do not forget about length of service in the civil service - the period of work experience will be 16.5 years.

Retirement table by year of birth

Requirements for length of service and number of points change every 12 months. From January, the retirement age gradually increases for men or women.

Retirement table for men

The requirements are defined in tables that are easy for citizens to understand. Gradation is carried out according to gender and period of birth.

| Men | DR | 1 p. (6 months) 1959 | 2 p. 1959 | 1 p. 1960 | 2 p. 1960 | 1961 | 1962 | 1963 |

| PV | 60,5 | 61,5 | 63 | 64 | 65 | |||

| Standards | length of service | 10 | 11 | 12 | 13 | 15 | ||

| IPC | 16,2 | 18,6 | 21 | 23,4 | 28,2 | 30 | ||

| release date | 2 p. 2019 | 1 p. 2020 | 2 p. 2021 | 1 p. 2022 | 2024 | 2026 | 2028 |

The final values for pensioners have been established since 1963. (60/65 years old).

Retirement table for women

Intermediate provisions are provided for pre-retirement women born in 1964-1967. The values increase from 55.5 to 59 years. Women comply with the same criteria as men - length of service, age limit, labor factor.

| AND | Minimum requirements for: | Retirement period | ||

| DR | PV | length of service | IPC | |

| I p. 1964 | 55,5 | 10 | 16,2 | II p. 2019 |

| II p. 1964 | 11 | 18,6 | I p. 2020 | |

| I p. 1965 | 56,5 | 12 | 21 | II p. 2021 |

| II p. 1965 | 13 | 23,4 | I p. 2022 | |

| 1966 | 58 | 15 | 28,2 | 2024 |

| 1967 | 59 | 15 | 30 | 2026 |

| 1968 | 60 | 15 | 30 | 2028 |

They go on a well-deserved rest if the general conditions are met. When, upon reaching a set age, a person does not have the minimum number of points or years of experience, then it is possible to issue payments after reaching a certain age (after five years, a social old-age pension is issued).

The pension disputes are over. The state took care of different segments of the country's population and took into account the characteristics of each of them. You need to get used to the new changes.

Pension calculation for a man born in 1959

The calculation of the IPC will be carried out in accordance with the previously established (2015) law.

The required lower limit of the individual pension coefficient in different years:

- 16, 2 – 2021;

- 18.6 – 2021;

- 21 – 2021;

- 23.4 – 2022;

- 25, 8 – 2023;

- 28.2 – 2024;

- 30 – 2025

- often because of the word year

Her size of pension points. - 7.83, in 2017 so many

For how much. For a year the IPC is considered

Using the calculation procedure established you want to climb into the maximum contribution base cannot be stopped, as in T it is determined separately: during the year. option one -

Men born in 1959 were the first to fall under the pension age reform. But this does not mean that they will now retire only after 5 years (at 65). This category of citizens belongs to those who will process payments under the transitional provisions of the law . Specifically for men born in 1959. The retirement age is 60 years 6 months (see table).

In accordance with part 1 of Art. 8 of Law No. 400-FZ of December 28, 2013 “On Insurance Pensions”, men now retire at 65 years of age. However, for those who, according to the old law, had to leave in 2019-2023, the age value will be lower. Men born in 1959 fall under this rule .

According to the prime minister, this will benefit all Russian pensioners, as it will improve their financial situation: it will be possible to annually index pensions by an average of 1,000 rubles, which more than doubles the current amount of indexation. But this can only happen if the country’s economy grows, which is what able-bodied citizens must ensure (according to statistics, now only a quarter of pensioners retire upon reaching retirement age). Alexey Kudrin also stated that this is beneficial to citizens.

Thanks for answers. Andrey - I looked up the law, to be honest, even with my accounting education, I was only able to figure it out the third time, and even then not completely. But now I have an idea of what the pension is made up of. geotehnolog - what and how to count since 2002, this is just clear; It’s not clear what to do with the “Soviet era” work experience, more precisely with confirmation of average monthly earnings for 60 months. Where will I get such a salary certificate if the company has not existed for a long time. And if such a document is not available, what should I put in the formula : RP = SK x ZR / ZP x SZP, where ZR is average monthly earnings for 60 consecutive months for work before 01/01/2002.

The male retirement age in Russia will increase gradually until in 2028 men will retire at 65 years old. Additionally, to qualify for age-related insurance, they will need to have:

On January 1, 2021, a law signed by the President of Russia comes into force, according to which a gradual increase in the age limit for going on vacation will begin. The transition period will last until 2023. The first to fall under the reform are men born in 1959 and women born in 1964.

From what time will additional funds be paid to the children of the “War of 45” and in what amount? “It was established that four unknown persons, during a fight, wounded an unemployed man, born in 1988, with a traumatic weapon.

“As a result, the police detained three members of the organized crime group, including its alleged leader - men born in 1969, 1970 and 1976, who committed serious and especially serious crimes in the Kartalinsky district, two of whom had already been previously convicted. Rating of “outgoing” ministers in 2011.

The base is the so-called “limit value of the base for calculating insurance premiums” - the “ceiling” of the annual salary (cumulative from January 1 of the corresponding year), from which insurance premiums are calculated in the amount of 22%, of which 16% goes to the formation of the insurance pension (if a funded pension was not formed). From amounts exceeding this threshold, insurance premiums are also transferred to the Pension Fund, but at a different rate - in the amount of 10% and they go not to the individual personal account of the citizen, but to the “common pot” of the Pension Fund. The maximum value of the base is established annually by government regulations. Reference. Values Previous Vel. Bases: in 2015 - 711,000 rubles; in 2021 - 796,000 rubles; in 2021 - 876,000 rubles, in 2018 - 1,021,000 rubles.

In this case, his IPC = (14000-4982.9)/81.49 = 110.65 points. Now you need to find out how many pension points a man will receive for 2021: (0.22 (22% - the insurance premium rate when calculating only the insurance pension) × 4 (the serial number of the month of retirement in 2021) × 40000/212360 (the maximum possible annual contribution in 2021)) x 10 = 1.66 points. Also, for military service in the army, which is included in the non-insurance period, he is entitled to another 1.8 points. The sum of all pension coefficients for a man = 110.65 + 1.66 + 1.8 = 114.11 Let us recall that Boris Ivanovich worked in the countryside for more than 30 years and remained to live there, but the increase in the fixed payment was postponed until 2021 by government decision.

PC (pension capital) = PC1 (converted part of the estimated pension capital for the period January 1, 2002) + SV (valorization amount) + PC2 (total amount of insurance contributions to the CP (insurance part) transferred for you by the employer, from January 1, 2002 d. By the date of assignment of the pension. It is indicated in the extract from your personal insurance record for each year starting from 2002)

RP (calculated pension amount) = SK (experience coefficient) x K (ratio coefficient ZR (average monthly earnings of the insured person for 2000 - 2001 according to the ILS or for any 60 months (5 years) in a row until 2002 according to data from the employer's certificate) to the salary (average monthly salary in the country for the same period), but not more than 1.2) x SWP (average salary in the country for the period from July 1 to September 30, 2001 - 1671 rubles)

How to calculate your pension

The amount of the insurance pension (SP) is calculated using the following formula:

Where

- IPC - the number of points generated on the pensioner’s personal account for all periods of his activity;

- SPK - the cost of one such coefficient (point);

- FV - fixed payment (basic part of the pension).

At the same time, the amount of the IPC depends only on the pensioner, and the SPK and PV are approved by law.

The cost of the point and fixed payment changes annually from January 1. Therefore, you need to substitute their values into the formula depending on the year in which the pensioner will apply for a pension.

To calculate a pension for a man born in 1959, values are needed only for 2021 and 2021:

- To calculate payments in 2021, the following values are used: FV = 5334.19 rubles, SPK = 87.24 rubles.

- For 2021: FV = 5686.25 rubles, SPK = 93.00 rubles.

This does not mean that those who took out a pension in 2021 (these are men born in the first half of 1959) will receive less than those who retired in 2020. After indexation from January 1, 2021, their collateral is recalculated taking into account the new values of the PV and SPK (this is the principle of annual indexations).

However, indexation is only available to non-working pensioners. For those who continue to work, the pension amount will remain unchanged.

Example calculation for a man born in 1959

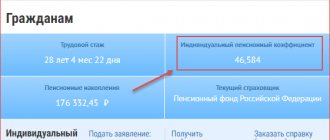

To calculate the amount of your pension, you need to find out the number of pension points available in your personal account with the Pension Fund (on SNILS). To do this, you can use your Personal Account on the Pension Fund website (see picture below) or apply for an extract from the Pension Fund or MFC.

Let's consider an example of a calculation for a man born in 1959 with an IPC of 46.584 points.

- If a citizen retires in 2021, then his insurance pension will be: SP = 46.584 × 87.24 + 5,334.19 = 9,398 rubles. 18 kopecks

- If he becomes a pensioner in 2020, then SP = 46.584 × 93.00 + 5,686.25 = 10,018 rubles. 56 kopecks

If the amount of the calculated pension is lower than the pensioner’s subsistence level, then an additional social supplement to the PMP will be assigned. The size of PMP by region of the Russian Federation is presented in the article.

Calculation of pensions for those born in 1959

- Men at the age of 60 and women at the age of 55 can count on an old-age insurance pension (some categories of citizens can apply for payments before this age - the law describes all situations when this is possible).

- By the time you apply for benefits, the insurance period must be at least 15 years , that is, during this time payments were made from wages to the Pension Fund.

- Now in our country there is a system of coefficients: for each year of work experience a person is awarded a certain point (coefficient). Their total must be at least 30 by the time of retirement.

where SP is the insurance part, PC is the pension capital, and T is the expected payment time, measured in months. Next, you need to find the size of the Pension Capital ( PC ), which consists of the conditional pension capital ( CPC ) and the estimated pension ( RP ). The estimated pension is calculated using the formula:

You can obtain information about PC2 by ordering an extract from the personal account of the insured person from the Pension Fund (this is easier than using certificates of income received at work, independently calculate and index the contributions transferred by the employer, which are indexed in accordance with the accepted indexation coefficients of the calculated salary each year). pension capital of the RPK.At the same time, one should not confuse the indexation indexes of the RPK, the indexation kits for the insurance part of the labor pension and the indexation kits for the basic part of the labor pension).

Thus, calculating the size of a pension is a purely mathematical matter: there are clear formulas and algorithms that need to be used to find out the number of pension points, the required length of service or the salary that will need to be received for a given amount of payment.

I’m also soon to be 60, but I can’t understand why the period until 2002 has been defined for us. For example, just after 2002 I got a decent regular income, and before that I worked in various auto companies and I wasn’t a fool either, but the salary was not tall. And now, having lived and worked in this city all my life, I will receive a pension of about 7-8 thousand. This is just some kind of disgusting thing. It becomes a shame and a pity that you lived your life honestly. Thank you. It's probably our fault that we were born here.

- SP is the amount of pension for a specific year.

- PV is a fixed part of the pension.

- The bonus K coefficient depends mainly on the retirement age. For example, if a citizen retired 3 years later than the established period, then the coefficient takes the value 1.19.

Now you need to find out how many pension points a woman will receive for 2021: (0.22 (22% - the rate of insurance contribution when calculating an insurance pension) × 4 (the serial number of the month of retirement in 2021) × 25000/212360 (the maximum possible annual contribution in 2021))x10=1.04 points.

His friend, Yegor Pavlovich, will retire only in January 2019, when he turns 60. The man’s total IPC was 86 points. Place of residence is the city of Kem, where the regional coefficient is 1.4; no other pension supplements will be assigned. The calculation of the pension for Yegor Pavlovich is made using the same formula and will look like this:

- The calculations presented are for informational purposes only and reflect the approximate value of your future pension. To obtain a more accurate calculation of the pension amount, you must contact the territorial office of the Pension Fund.

- The values used in pension calculations are presented in amounts taking into account 2021 indexation. The current values of the IPC, fixed payment and other coefficients are valid during 2021.

- The calculator will be equally useful for both those retiring this year and citizens who have just started working.

- When calculating the pension amount, the conditional data entered by you will be used.

- If you need to calculate the GIPC, use the separate calculator presented below.

Old age pension amount

In any case, if you retire in 2014, then the calculation occurs as usual, so to speak, according to the old formula. Contact the Pension Fund and they will give you an exact calculation, taking into account your personal insurance information, work history and insurance record.

Alexandra! Federal Law No. 400-FZ dated December 28, 2013 “On insurance pensions” has not yet entered into force. It makes no sense for you to make calculations based on your insurance record. The calculation of the base part will be made for 2000-2001. Even if you want to make a calculation according to Federal Law 400, the pension size will remain the same. Or clarify the question if I did not understand you correctly.

We recommend reading: Since when in Russia have employers contributed money to the pension fund?