By the way: We provide online consultations. Reliable, expert, confidential. More details

The case of a distant relative who died somewhere in Los Angeles and left a multimillion-dollar inheritance is not always a work of fiction; this also happens in real life. The main thing is to enter into inheritance on time and be able to confirm the fact of kinship. If time has already been lost, it is almost impossible to do without qualified legal assistance; moreover, an amateurish approach can provoke a complete loss of chances of inheritance.

Features of a will

A will is a document that reflects the will of a person to transfer his property after his death to the persons specified in the document.

Expert commentary

Shadrin Alexey

Lawyer

It is customary to draw up a will at a notary, then the document will take on official status. Moreover, the document can be changed or canceled completely while the person is alive. If there are several versions of a will, the document that is most recent is considered valid.

According to Article 1126 of the Civil Code of the Russian Federation, two types of testamentary dispositions, open and closed, are allowed:

- The closed will, sealed in an envelope with the seal of the notary, is transferred to him for safekeeping. At least two disinterested witnesses must be present during this action. The envelope containing the will is opened in the presence of the heirs after the death of the testator. Until this moment, they do not know the contents of the document.

- An open will is handed over to the testator after it is signed by a notary. He can make copies of it and give it to his heirs for review. He is not obliged to familiarize the heirs with the contents of the will. At the same time, for the convenience of registering an inheritance after his death, it is better if the heirs know that there is a will and it was drawn up by a notary designated by the testator.

Change of will, revocation and non-application

When challenging an open will with judicial recognition of its invalidity, the legal order of inheritance is applied (Civil Code, Chapter 62, Article 1131). Non-enforcement of a will (its invalidity) is possible due to the nullity of the document (incorrect execution) or by a court decision (if the will violates the legal rights of any citizens).

The testator has the right to change the contents of the will, or completely cancel its effect (Civil Code, Chapter 62, Article 1130). The testator can change the will an unlimited number of times; there is no need for him to indicate the reasons for his decisions (the same applies to the cancellation of a will). It is impossible to indicate in a testamentary document a condition regarding the inadmissibility of changing the will, because this is a direct contradiction to the norms of the Civil Code. Any changes to the will or cancellation of its validity occur upon certification by a notary and with a note in the inheritance file.

Having executed a new will, the testator automatically cancels the validity of the previous testamentary document in some part or completely (Civil Code, Chapter 62, Article 1130, paragraph 2). Considering the admissibility of certification of a will both by a notary and by certain officials (listed in the Civil Code, Chapter 62, Article 1127), it is possible that the heirs under the first will and the notary who executed it are unaware of the second testamentary document. However, it is the last statement of the will of the testator, when properly executed, that is recognized by law as having the highest priority.

Stages of registration of apartment ownership

In order for heirs to navigate the procedure for registering ownership of an inherited apartment, it is better to become familiar with the sequence of stages of its acceptance. Their essence is as follows:

| Search for a testamentary document | First you need to decide on the document that provides the basis for inheritance. This is a will. It’s good if the heirs have copies of it. If they are not aware of the presence of this document, then after they have a certificate of the death of the testator in their hands, they can contact the nearest notary with it. They can ask him to check the existence of a will. At the same time, the heirs must have documents confirming their relationship with the testator so that the notary can search for the will legally. The search for this document is being carried out in Russia in the existing unified database for electronic registration of testamentary dispositions. Having learned the address of the notary who issued the will, the heirs must then contact him for a copy of this document. The document must be marked with a mark indicating its legality. |

| Opening an inheritance case | A notary located at the place of registration and residence of the testator, or at the address of his apartment being inherited, must open an inheritance case based on the heirs’ application for its acceptance and presentation of the following documents:

|

| Determining the appraised value of an apartment | You need to know the cost of the apartment so that the notary can calculate the amount of the fee payable upon receipt of the owner’s certificate. For this procedure, you should contact an organization licensed for this activity. The assessment is carried out in such organizations based on the market value of real estate. You can also provide the notary with information about the cadastral value of the apartment taken from Rosreestr or the inventory value obtained from the BTI. |

| Obtaining a Certificate of Title to an Apartment | The notary may request other documents so as not to doubt the issuance of a Certificate of Inheritance. This document is issued six months from the date recorded in the documents of the testator’s death. From this date, the allotted time for entering into inheritance is counted. To obtain a certificate, the heir must pay a fee established by the state. |

| Apartment registration | To fully dispose of the inherited apartment, it must be re-registered to the new owner. To do this, you need to contact the authorities of Rosreestr or the MFC, where you can submit a package of documents and a Certificate issued by a notary. All documents are attached to the application requesting the re-registration of the apartment in the name of the heir. Based on the submitted documents, no later than a month later, the applicant is issued an extract from the unified real estate registration register. |

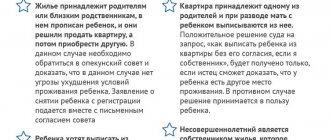

Limitation of the rights of heirs to a privatized apartment

Inheriting a privatized apartment has its own characteristics. In accordance with the law, the rights of heirs may be limited on the following grounds:

- the right of a citizen who has formalized a refusal to privatize;

- the right to an obligatory share in the inheritance;

- the right of the testator to establish a testamentary refusal.

Let's take a closer look.

Refusal from privatization

When privatization is completed, every citizen registered in it at the time of submitting documents to the district administration receives the right to a share in the apartment. The following citizens are excluded:

- who used the right to privatization as an adult;

- who voluntarily renounced the right to privatization.

Persons of the first category do not receive the right to an apartment, since they used their opportunity earlier. And citizens who issued a refusal, although they had the right to a share, receive a lifelong right to live in an apartment.

Moreover, the right is retained even if the owner changes. That is, if an apartment is inherited, then the successor receives a room with a permanent tenant, who cannot be evicted.

Mandatory share

Another limitation is the right to a mandatory share. If there is a will, disabled and minor dependents of the deceased have the right to ½ share of the property due by law.

The testator is obliged to protect their interests in the will. If he has not done this, then the obligatory heir may apply to the court to allocate the obligatory share from the inheritance.

Mandatory heirs include:

- children under 18 years of age;

- children (disabled or pensioners);

- parents and adoptive parents (disabled or pensioners);

- citizens who were supported by the deceased for more than 1 year, lived together with him and ran a common household.

Example. Ilya privatized the apartment. A year later he got married. And after the death of his sister, he took custody of his 3-year-old niece. When Ilya died, his niece was 10 years old. The man left a will in which he planned to give everything to his mother. Thus, the niece, as a compulsory heir, received the right to a 1/6 share in the apartment. The rest went to the mother. Ilya's wife was deprived of her inheritance.

Testamentary refusal

The testator can independently set restrictions for heirs. To do this, it is necessary to formalize a testamentary refusal. This is a property condition that the heir must fulfill or he loses his rights to inheritance.

In relation to a privatized apartment, a popular restriction is the granting of the right of lifelong or temporary residence to a person established by the testator.

Example. Valentina drew up a will in which she transferred her apartment to her son. But she established a will in favor of her disabled daughter. To obtain ownership of the apartment, the son had to give his sister the right to live in his mother’s apartment for life.

The cost of registering an inherited apartment as a property

The cost of registering ownership of an apartment consists of the costs incurred at each stage of the registration procedure.

Basic payments are due for the following actions:

- when contacting a notary to search for a will, open an inheritance case and obtain a Certificate of Ownership;

- when assessing the cost of an apartment;

- when registering real estate with the Unified State Register authorities.

The bulk of the costs will have to be borne by the notary. There you will have to pay:

- for searching for a will and (in the case of a closed will) opening the envelope and announcing the contents of the document, about 400 - 500 rubles;

- for opening a inheritance case and filling out an electronic application – 300 rubles;

- state duty, the amount of which for close relatives is 0.3%, and for other citizens 0.6% of the appraised value of the apartment.

Expert commentary

Kolesnikova Anna

Lawyer

When assessing the value of an inherited apartment, if you contact commercial structures, you will have to pay an amount that is influenced by the characteristics of the object, the location of the apartment and other factors. The assessment will cost from 5 thousand rubles and more. If you contact the BTI or Rosreestr, a certificate of appraised value will cost less. For the services of re-registration of an object, the heir will be charged a fee of 2 thousand rubles and 200 rubles for an extract from the register of owners.

Who can challenge, when and within what time frame?

If the deceased made a will, he thereby expressed his will. Sometimes his relatives do not agree with this.

In this case, they try to challenge the will for the apartment after the death of the testator and file a lawsuit. In which they want to return the property of a deceased relative or recover financial compensation for it.

If there are further heirs, they can also challenge the will, but only if there are no other heirs.

The law also provides time limits within which a will can be contested. The court can be filed within three years after the defendant’s inheritance or from the moment it became known about the violated rights.

A will can be contested only on the grounds specified in the law. If the deceased did not transfer part of the property under the will, the heirs of the first priority claim it.

They can assert a priority right in court and file a claim for the return of their share due by law. These could be children, parents, or a wife or husband.

Let's give an example

The son was in prison and did not know about his mother’s death. Having been released after 5 years and returning home, I learned that the apartment had been sold to other people by those who had inherited it. Thus, despite the fact that the three-year period has been missed, he has the right to go to court to protect his interests.

This can only be done when the will was executed incorrectly, it was not certified according to the law, or the court declared the testator incompetent.

It is also possible to challenge a document if it was drawn up under the influence of outsiders, that is, not voluntarily. In this case, all formalities must be resolved within a year.

It is believed that the optimal period for resolving all disputes is the first six months after the death of the testator. Then there is an opportunity to preserve the property of a loved one. Otherwise, it may be sold, and you will have to sue all areas of the transaction.

Exemption from duties for certain categories of citizens

The fee provided for by the Tax Code of the Russian Federation for registering ownership of an apartment with a notary is not payable by all citizens who received real estate under a will.

The law lists citizens exempt from paying tax. These include:

- persons who lived permanently with the testator until he died and after the death of the owner;

- persons who are not adults at the time of the death of the testator;

- incompetent citizens in need of guardianship;

- persons who have the status of Hero and have received the highest awards of the Union and Russia;

Citizens with disabilities of groups I and II are exempted by half from paying the fee.

Important! Since the beginning of 2006, for citizens who received an apartment under a will, the previously provided tax was completely abolished. This resolution is reflected in Article 217 of the Tax Code of the Russian Federation.

Where is the document located?

Many people are interested in how to find out whether there is a will and whether this can be done in the case when the testator did not tell about his last will. Actually it is possible.

In Russia there is a register of the Ministry of Justice. It indicates the presence or absence of a will according to the deceased. But this can only be done after his death.

To do this, the notary must provide documents certifying the relationship and a death certificate. Only in this case does he have the right to see whether a will has been drawn up.

By the way, the text reflecting the will of the deceased will be unknown. Therefore, if the will is not in the personal belongings of the deceased, the heirs will not find out what is written in it until a certain moment.

So, the content can be learned exclusively in two ways. The first is that the testator himself spoke about it before his death. And the second can be opened only after his death and the beginning of the inheritance case.

If a will has been lost, its text can be restored from the register at the request of a notary, as part of an inheritance case.

Question answer

The two-room apartment was owned by me (2/3 part) and my daughter (1/3 part). In December 2020, the daughter died. There is a will, in which my daughter bequeaths her share (1/3) to me. Where should I go, within what time frame and what documents should I provide to re-register an apartment as a property?

Contact a notary with an application to accept the inheritance within 6 months from the date of your daughter’s death. You also need to collect a list of documents: death certificate; documents confirming relationship with the deceased (daughter’s birth certificate); extract from the house register; title documents for the apartment.

What to do after receiving a certificate of right to inherit a house? What is the deadline for registering it as property (there is a certificate of inheritance)?

After receiving a certificate of inheritance, you need to contact Rosreestr with this certificate and submit an application for registration of property rights. The deadlines for such treatment are not established by law.

How is an apartment inherited by law?

If the testator does not draw up a will, or the testamentary document is declared void (incorrectly executed), his property (we mean an apartment) is inherited by law (Civil Code, Chapter 62).

The heirs are the relatives of the testator, whose order of access to the inherited property is tied to the degree of relationship (including the “right of representation”, see below).

Relatives of the deceased owner of the house are called upon to receive the inheritance in this order of priority (Civil Code, Chapter 63, Articles 1141-1145):

- 1st priority – offspring, spouse, parents (grandchildren have the right of representation);

- 2nd priority – sisters-brothers, grandparents (nephews have the right of representation);

- 3rd priority – aunts and uncles (cousins have the right of representation);

- 4th stage – great-grandparents;

- 5th stage – cousins’ granddaughters and grandsons, also grandparents;

- 6th stage - cousins, also uncles and aunts;

- 7th stage – stepdaughters-stepsons, stepmother-stepfather.

The apartment is inherited by law precisely in the order of kinship described above. Those. If there are heirs in the first line, then the property will be divided in shares between them, and the other lines will receive nothing. In a situation where there are no relatives in the first stage, the apartment is divided between the relatives of the testator from the second stage, respectively, citizens from the third stage do not get anything. Further (in the absence of heirs of the next order), the order of inheritance belongs to the next order, etc.

Let us note that the law separately takes into account in the right of inheritance the category of disabled dependents provided by the testator (Civil Code, Chapter 63, Article 1148). Provided that the testator has been dependent on him for more than a year, these persons have the right to participate in the inheritance, regardless of the order of legal heirs. Such dependents do not even need to be relatives of the deceased; it is enough for them to be supported by him for the last year of their life.

Now about the right of representation, which is taken into account when inheriting living space. It arises if the legal heir dies before the actual registration of the inheritance - then the apartment will be inherited by the heir of the deceased heir, being his representative. For example, the primary heir was the testator's daughter, but she died without accepting the inheritance and left a son (the testator's grandson). Then, according to the right of representation, the grandson of the testator receives the entire inheritance.

The right of representation occurs if there are no other living heirs of the deceased in the same queue. If there are several heirs in line (for example, 1st or 2nd), the apartment is subject to shared division equally, and the right of representation will not be applied.

New changes

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The main changes that the new law introduced to the inheritance process in 2020 include giving heirs the opportunity to refuse inherited property in favor of other persons. This is enshrined in Article 1158 of the Civil Code of the Russian Federation.

Article 1158. Refusal of inheritance in favor of other persons and renunciation of part of the inheritance

From the analysis of the norms of civil legislation on inheritance, the following main features can be identified that are used when entering into inheritance of various categories of citizens:

| Category of heirs | Basic conditions for entering into inheritance |

| Spouses |

|

| Parents |

|

| Grandmothers and grandfathers |

|

| Children |

|

| Grandchildren |

|

| Brothers and sisters | Step-siblings if they are dependents and disabled. Cousins:

|

| Nephews and nephews | Part of the deceased's inheritance equally is only by right of representation. |

| Adopted children and their children | If legal ties are preserved by a judicial act. |

To whom will non-privatized housing be transferred in the event of the death of the responsible tenant?

Since only the personal property of the deceased is inherited , a non-privatized apartment, which he did not manage to register in his name during his lifetime, cannot become such an object. It can still be rented out under the DSN (social tenancy agreement) to the relatives of the deceased employer (Article 672 of the Civil Code of the Russian Federation).

There are cases when the responsible employer initiated the privatization procedure before his death and carried out:

- submitting a statement of intention to privatize housing to the authorized bodies;

- providing a package of necessary documents (read more about what documents you need to collect to inherit an apartment).

At the same time, an important circumstance for the heirs is that he does not change his mind and does not withdraw his application , since on the basis of these documents, the heirs will legally be able to achieve inclusion of the apartment in the heritage list . The basis is the norm of the Resolution of the Plenum of the Supreme Council No. 8 / 08/24/1993.

Attention! Persons who are relatives of the deceased person, who were registered and lived in this apartment with him before his death, have the right to re-register the DSN for one of them. Such an employer will be able to carry out the process of privatization of real estate in accordance with the provisions of Law No. 1541-1, dated 07/04/1991.

You can find out whether it is possible to inherit a privatized apartment without a will and how to obtain housing according to the law here.