When is division of inheritance allowed?

One of the most common situations when a division of inheritance occurs is that a testamentary document is missing or has been declared invalid. In this case, the rule of inheritance by law comes into force. Applicants receive inheritance in the established order of priority.

If the will was drawn up according to all the rules, the division of the inheritance can also be initiated. This happens if among the persons not mentioned in the document, there are those who have the right to receive a mandatory share. In this case, the candidates specified in the will receive their parts, taking into account the deduction of the obligatory share.

When the testator has taken into account the presence of applicants for the obligatory share and independently separated their part of the inheritance, the division of property cannot be made according to other criteria. This is due to the fact that the will of the testator, from the point of view of the law, is considered acquired.

Division of inheritance is also possible if an individual agreement on the division of inherited property is concluded between the heirs, the provisions of which provide for such a possibility.

Terms of partition by agreement

There are situations when heirs are not satisfied with the legal distribution. For example, subjects of inheritance want to individually possess a specific item from the inheritance. Such disputes are regulated by the norms of the Civil Code of the Russian Federation. The inherited share is divided by concluding an agreement between the persons claiming this property. All heirs can take part in the agreement. In this case, it is not necessary that, according to the decision made, everyone’s shares should be equal. The principle of freedom of agreement allows the heirs to settle the issue as they wish. However, a civil contract must comply with the requirements of the Civil Code of the Russian Federation. There are several section rules:

- The apartment can be divided only after receiving a certificate from a notary office;

- A conceived but unborn child of the testator at the time of division of property is not a subject of inheritance. However, his rights must be protected. The law comes to protect his interests as a potential heir. A separation agreement concluded before the birth of the child is invalid;

- When concluding an agreement between heirs, the obligatory share of incapacitated and minor persons must be taken into account.

The procedure for dividing the inheritance

The division of inherited property is carried out taking into account the standards governing the distribution of shared property. This rule applies in the case of inheritance, since property transferred by inheritance into the possession of several persons, from the point of view of the law, is considered shared.

If there is no disagreement between the recipients of the inheritance regarding the division, the distribution of property can be carried out on a general basis in accordance with the individual agreement of the parties. Any disputes in this matter are resolved through the courts.

Each of the legal heirs has the right to receive a share in an amount not less than the size of the shares of other participants in the division. It is also possible to demand payment of material compensation, the amount of which is equal to the total value of the share.

Applicants also have the right to divide the inheritance not in equal shares, but in accordance with the needs of each of them. In this case, their decision is recorded in an individual agreement, which is notarized. Unequal distribution of inheritance cannot extend to the obligatory share. The law protects the rights and interests of citizens in need.

Agreement on the division of inherited property

A written agreement on the procedure and rules for the division of inherited property is drawn up when expensive property becomes the object of distribution. Household items that are not of great value can be divided without drawing up an agreement.

The agreement must be concluded on a mandatory basis if the case involves property that has a high market value, as well as the ownership rights to which must be registered with state regulatory authorities. Such property includes: residential/non-residential real estate, car, intellectual property, bank accounts, etc.

Sample agreement on division of inherited property

There is no fixed sample agreement on the division of inherited property. The document can be compiled in any format and form. For a document to have legal force, it must contain a certain list of mandatory information, signatures of the parties and a notary’s mark.

The agreement may be typed or handwritten. In the latter case, special requirements are imposed on the clarity of writing and style of presentation. Corrections, errors, colloquial and obscene language are unacceptable.

If there are no disagreements between the parties to the issue regarding the division of property, it is recommended to still draw up an agreement on the distribution of shares. The document is required to be submitted during the process of re-registration of property rights in Rosreestr or another regulatory service, and will serve as evidence of mutual agreement if any disputes subsequently arise.

Heirs have the right to independently draw up such documents. They can also apply for this service to a local notary office. In this case, paperwork will be paid.

Contents of the agreement

List of mandatory information that must be indicated in the agreement on the division of inherited property:

- the name of the locality in which the document was drawn up (indication of a specific address is allowed);

- identification data of all participants in the issue (full name, address and contacts);

- statement of the essence of the document (title);

- list of property to be divided;

- indication of the legal basis for inheritance (will, legislative provisions, etc.);

- ownership status (equity, non-equity);

- estimated value of division objects;

- indication of the rules of division and share of each participant;

- other provisions providing for the procedure for refusal of inheritance, rules for paying debts, etc.;

- list of attached documents;

- signatures of the parties (with transcript);

- seal and signature of the notary.

Agreement on the division of inherited property - download a sample

Terms of drawing up the agreement

An agreement on the rules for dividing the inheritance mass is drawn up after all the heirs, within six months, have formalized their legal right with a notary and received the appropriate certificate.

The agreement is drawn up before the re-registration of property rights is carried out through Rosreestr or another regulatory service. Changing an entry in the register is impossible without an agreement on the division of shares of the inheritance or without another document of title.

Theoretically, the agreement can be drawn up before the death of the testator. But, it will have legal force only after the occurrence of appropriate circumstances.

Division of inheritance upon divorce of spouses

It's no secret that the division of jointly acquired property of spouses is carried out equally.

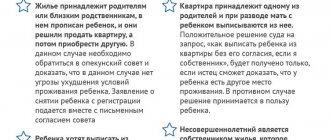

But the question arises: is the inheritance received by one of the spouses during a marriage divided? The Family Code of the Russian Federation does not say how property is divided during a divorce. However, Article 36 of the RF IC regulates the rules regarding things acquired during marriage. A certificate of inheritance confirms the fact of receipt of property. Therefore, if during the marriage one of the spouses received an inheritance, then during a divorce the question of its ownership does not arise. According to the law, the division of property of spouses during a divorce does not apply to inheritance. The only case when inherited wealth can be divided during a divorce is if both spouses are designated as heirs in the text of the will.

In the absence of a will, division of inherited property received during marriage is impossible.

Preemptive rights when dividing property between heirs

The agreement on the division of the inheritance cannot violate the preferential rights of some claimants. This applies to situations where one of the heirs had equal rights to own property simultaneously with the testator (was in a marital relationship with him, etc.). In such a situation, the remaining applicants receive the right to allocate a share only after the main heir uses their preemptive right.

If the case is complicated by additional circumstances, for example, the question arises of dividing real estate as an inheritance, which is the only home for one of the heirs, it is considered in court. In this case, a preemptive right can also be applied when dividing property between applicants.

Section methods

The distribution of inherited property between the parties to the issue can be carried out in several ways:

- through exchange;

- by sale;

- allocation of natural share;

- with material compensation;

- within the framework of joint operation.

Exchange

In this case, the heirs exchange shares among themselves. To do this, an assessment of the material value of each share must be carried out.

Sharing

The ownership of the object of inheritance is registered with all heirs. In this case, the property receives the status of shared property. Operation of inherited objects in a joint mode is carried out on the basis of the rules established by the agreement.

Sale

Applicants may decide to sell the inherited property. If the heritage property is a property purchased with a mortgage, permission from the controlling bank must be obtained.

When a credit institution gives the go-ahead for the sale of real estate, the heirs have the right to sell it, pay off the balance of the debt, and divide the remaining funds equally.

Allocation of share in kind

The allocation of a part of the property in kind implies that each of the parties to the agreement is allocated a physical part of the property. This is most relevant for the division of residential real estate. As part of this division, each applicant receives a certain part of the space in the room.

Financial compensation

Monetary compensation is relevant in cases where one of the heirs renounces his actual share and agrees to transfer it to other applicants. In such a situation, the recipients of this share must reimburse its value in the form of an equivalent amount.

Agreement on the division of inherited property

In order to carry out the division of inherited property assets remaining after the death of the testator in the manner prescribed by law, several solutions can be used:

- Acceptance of inheritance by all relatives and subsequent termination of joint ownership of the object. None of the heirs has the preemptive right to make such a decision. We'll have to negotiate. After receiving the consent of all heirs, a purchase and sale agreement is drawn up and the property is sold. Each of the participants in the transaction is informed about the cost of sale and receives the cash equivalent of its share;

- In the second option, a specific share is allocated to one or more owners. The remaining participants remain co-owners.

The law does not prevent persons from among the heirs from dividing the inheritance mass not by shares, but by mutual agreement. The main thing is that the consent of all other participants in the process is clearly expressed both in word and in deed. This rule is mandatory, since with this form of division one or more heirs may receive rights that are less than the required share.

Features of the section in court

The division of inherited property can be carried out in court. This is possible if the heirs have a legal basis for demanding compliance with their right to inheritance. A will or legal provision is considered as such a basis.

In law

If property is inherited by law, claimants and those entitled to the obligatory share, if they are within the same line, will receive equal inheritance shares. In this case, the matter is complicated by the fact that the law does not stipulate the division of property according to the name of heritage objects. From a legal point of view, only the size of the share matters. To resolve the issue, taking into account the names of the items of inheritance, a judicial authority is involved.

By will

The presence of a testamentary document greatly simplifies the inheritance procedure. By the will of the testator, shares of the inheritance can be distributed among the heirs not only in terms of equal parts, but also taking into account the name of the object of inheritance. The testator has the right to independently determine who gets what.

Court proceedings are carried out if the will does not indicate the parts of the property allocated as a mandatory share for a specific category of heirs. Also, transferring the case to court may be necessary if the testator indicated only a list of heirs, but did not provide for the rules for dividing property between them. Disputes may arise regarding the distribution of parts of the inheritance, which can only be resolved in court proceedings.

Preemptive right of inheritance

Art. 1168 of the Civil Code of the Russian Federation establishes the recipient’s preemptive right to a share in real estate.

If the inherited property includes real estate or a share in it, then it is transferred:

- To the co-owner. Moreover, it does not matter whether he used this thing during the life of the testator. The main thing is that he owns a share in it.

- To the user. If the heirs do not include co-owners, then the share or real estate is completely transferred to the person who used it during the owner’s lifetime.

- Citizens who do not have their own living space. This rule only applies to inheritance of housing.

Art. 1169 of the Civil Code of the Russian Federation establishes a preemptive right to receive household items (furniture, dishes and other property of the deceased) on account of the inheritance for the heirs who lived together with the testator at the time of his death.

Other restrictions on division

The law establishes the following restrictions when dividing inherited property:

- The right to inherit an enterprise is vested in the legal successor, who is an individual entrepreneur or the founder of a legal entity at the time of opening the inheritance.

- When inheriting a weapon, the successor who has a special license has the priority right to receive it. If the heir refuses to obtain a license, then the weapon is subject to sale, and the money is transferred to the recipient (except for the costs of sale).

Algorithm for judicial division

The division of inherited property between heirs in court is carried out in accordance with the established algorithm:

- documentation is collected;

- a statement of claim is filed;

- documents and application are sent to the court office;

- a trial is underway;

- a decision is made;

- the verdict will be squeezed out in writing.

To achieve full compliance with your own inheritance rights, it is recommended to involve a qualified lawyer in the case. A specialist will help you prepare a list of title documents and defend your interests in court.

Collection of documents

To initiate a trial, you must collect the following package of documents:

- statement;

- identification;

- testamentary document (if available);

- legal documents (marriage certificate, birth certificate, etc.);

- conclusion of the evaluation commission;

- property documents;

- death certificate;

- extract from the Unified State Register of Real Estate;

- receipt for payment of state duty;

- an extract from the house register;

- pending court conclusions;

- documents confirming the status of a person entitled to a mandatory share;

- evidence of actual inheritance.

To confirm the fact of residence and registration at the address of the location of the divided real estate, the plaintiff can submit an extract from the house register. This certificate confirms that a person has been officially registered at a specific address on a permanent or temporary basis.

Medical reports, payment documents, written statements of witnesses and other materials are presented as additional evidence.

Filing a claim

The statement of claim is drawn up in free form, but must contain a list of mandatory information:

- the name of the judicial authority to which it is sent;

- identification data of the applicant (full name, address and contacts);

- identification data of other participants in the case (full name, address and contacts);

- statement of the essence of the document (title);

- fundamental data - an indication of the fact of the death of the testator;

- description of the inherited property;

- an indication of the total estimated value of the estate;

- mention of legal factors (documents and legislative provisions);

- clarification of the essence of the controversial issue;

- proposal of a solution (indicating legal means of settlement);

- list of accompanying documentation;

- dating and signature.

The statement of claim is filed by one of the heirs. Other claimants may file an appeal or counterclaim.

Statement of claim for division of inherited property –

Sending documents to court

Since the situation is related to the settlement of controversial property issues, when filing a claim, jurisdiction must be respected. Documents are submitted to the district (city) court.

According to the instructions of the law, the proceedings must be initiated in the territorial representation of the court, which is located at the place of permanent registration of the defendant. If there are several participants in the case, the plaintiff independently chooses the name of the judicial body corresponding to the place of residence of a particular defendant.

In exceptional situations, it is allowed to file a claim at the place of registration of the plaintiff or the location of the object of inheritance. In such a case, the impossibility of complying with standard filing rules must be proven by the plaintiff.

The statement of claim and a package of documents can be sent to the court by personal visit to the territorial representative office, by mail or through a legal representative. In the latter case, the presentation of the corresponding power of attorney is mandatory.

Obtaining a court decision

The court verdict is issued in the form of a paper document. The plaintiff in the case receives it. If a proper request is made, the defendant can also obtain a court decision.

Based on the verdict, the plaintiff can begin re-registration of property rights. During this procedure, all government fees are paid separately.

The court's decision

If drawing up an agreement (agreement) on the division of inherited property becomes impossible, a completely logical solution to this issue would be to turn to the courts. The court will take into account all the circumstances of the inheritance case. Among the tasks that the court must decide are the following:

- Determining the composition of the hereditary mass, which is the object of the claims;

- Determination of the condition and ownership of property in the category of divisible;

- In case of inheritance of a plot of land, house or apartment, the court will determine the possibility of joint use by several heirs;

- The possibility of receiving compensation commensurate with the share of each heir.

During the work, the court takes into account the opinions of the participants, after which an object that cannot be divided between the heirs is put up for auction (for example, a car).

Proceedings regarding apartments are particularly difficult. It often happens that each of the heirs wants the same thing: to retain the preferential right to the residential premises for themselves, and to pay monetary compensation to the other participants. Here, the property rights of the heirs and the fact of living in the apartment at the time of opening of the inheritance are already taken into account.

Author of the article: Petr Romanovsky, lawyer Work experience 15 years, specialization - housing, family, inheritance, land, criminal cases.

Useful information on inheritance

- Entry into inheritance

- What documents are needed to enter into an inheritance?

- Inheriting an apartment

- Inheritance after the death of a relative

- Mandatory share in inheritance

- How to register an inheritance

- Certificate of right to inheritance

- Establishment of the fact of inheritance and recognition of property rights

- Restoring deadlines

- Opening time and place

- List of documents for opening an inheritance case

- Refusal of inheritance

- Application for acceptance of inheritance

- Selling an inherited car

- Opening an inheritance case

- Inheritance after wife's death

- Joint inheritance

- Escheated inheritance

- Documents for registration of inheritance

- Inheritance after mother's death

- Inheritance after the death of a husband

- Inheritance after the death of parents

- Registration of inheritance for an apartment

- Inheritance after father's death

- Protection of inherited property

- Division of inherited property

- Documents for inheriting an apartment

- The procedure for inheriting an apartment by law after death

- Inheritance of a non-privatized apartment

- Inheritance of a privatized apartment

- Application to establish the fact of acceptance of inheritance

- Inheritance without a will

- Limitation period for inheritance cases

- Application for inheritance

- Valuation of a plot for inheritance

- Disinheritance

- Car valuation for inheritance

- Inheritance by adopted children and adoptive parents

- Inheritance by right of representation

- Inheritance after the death of a son

- The procedure for inheriting cash deposits

- Inheritance of land plots

- Inheritance of loan debts

- Inheritance of unpaid amounts

- Actual acceptance of inheritance

Expenses

Judicial proceedings are carried out only if the fact of payment of the state duty is confirmed. When considering issues of division of inherited property, the amount of payment is established taking into account the value of the subject of division.

There is a table for calculating the percentage amount that makes up the state duty:

- property value up to 20 tr. – payment 4%;

- cost of inheritance from 20 to 100 tr. – payment 3%, but not less than 800 rubles;

- property price from 100 to 200 tr. – duty 2%, but not less than 3200 rubles;

- property value from 200 to 1 ml. R. – payment of 1%, but not less than 5200 TR;

- price above 1 ml. R. – duty fee 0.5% but not less than 13,200 rubles.

When resolving non-property disputes in court, the state duty fee is 300 rubles.

In what cases can an inheritance be divided?

There are several ways to divide the property received. Joint shared ownership is acceptable, determining the share in the form of monetary compensation or in kind.

Such division is possible with the mutual consent of the existing heirs or on the basis of a court decision.

Property objects that make up the inheritance estate, according to Art. 36 and art. 37 of the Family Code of the Russian Federation can be considered joint property. Property is recognized as common property if each party has made a significant contribution to improving its condition.

Division is more often used in inheritance by law , when property is distributed in equal proportions among the heirs of the same line.

When transferring property by will, division is possible if the obligatory heirs are not mentioned in the document.

If, according to the terms of the will, all property is distributed, division is unacceptable. The heirs are allocated the property specified in the will.

Deadlines

A statement of claim regarding the resolution of inheritance issues can be filed with the court within three years from the date when a violation of rights arose or the need for proceedings arose. The point at which the period is calculated can be the moment of entry into inheritance rights - the day of receipt of the certificate from the notary.

Established deadlines may be violated. In this case, their restoration is carried out in court. During the process of restoring the claim period, the validity of the circumstances due to which the deadline was missed must be fully proven.

How to apply?

Only persons who have entered into an inheritance can draw up a settlement agreement.

To do this, an application for obtaining a certificate of inheritance is submitted to the notary 6 months after the death of the testator. When the 6-month period has expired, all heirs with certificates can draw up and sign a settlement agreement. If a person does not have time to submit an application within six months, he automatically refuses the inheritance.

An exception is if each successor signs a permission to acquire such a right. Otherwise, entry into the inheritance is possible after winning the lawsuit. The division of property is postponed if the testator has a conceived but not yet born child.

The child's legal capacity will begin when he is born - only then can the process of dividing property be started. Once the above factors are taken into account, all heirs can come together and enter into a settlement agreement.

Form and requirements for the contract

An agreement can be concluded after each potential successor has submitted an application to participate in the division of property (6 months).

The form of the agreement is determined by the type of property:

- notarized - for real estate, shares in enterprises or cooperatives;

- written - for movable property;

- oral - if the value of the property is below 10 times the minimum wage, it is rarely found in practice.

When a transaction on division of property is concluded, the general requirements of the Civil Code of the Russian Federation apply. The agreement must be concluded with the consent of all parties; no party can force it to be drawn up or signed.

If among the heirs there is an incapacitated and/or a minor, he is represented by guardians or representatives. In the case where the guardian has family ties to the ward, the right to represent the interests of the latter is transferred to the court or guardianship authorities.

A notarized agreement must be presented to Rosreestr to record the transfer of ownership to the new owner. A written form of the agreement is necessary for the tax authorities to determine the level of income.

What needs to be specified?

The legislation does not regulate the content of the agreement on the division of property, therefore it is enough that it does not violate general laws and the rights of 3 persons.

In the provisions and clauses of the agreement, the heirs can fill in the size of the shares of each participant and determine what compensation will be in the event of the transfer of property to one of the parties.

The size of the shares and their disproportionality in the concluded agreement are undeniable in court.

Results

An agreement on the division of inherited property is concluded only with the consent of all heirs participating in the transaction. If there are any disputes between them, the problematic issue is resolved through the court. The property bequeathed to the successors by the testator is divided between them in equal shares. If one of the heirs receives the majority of the property benefits, then he pays the remaining heirs compensation in cash equivalent or transfers to them his share in another type of property.

Inheritance cases and related issues are a complex category of inheritance law with many pitfalls. Therefore, if disputes arise between heirs and it is impossible to divide the property bequeathed to them by agreement, it is best to seek help from lawyers.

Read: Registration of inheritance under a will

Nuances of dividing property between heirs

When dividing objects of inheritance, Art. 117-121 of the Civil Code of the Russian Federation, defining joint shared ownership. The inheritance is divided if the claimants have no disputes among themselves.

In other situations, it is necessary to go to court.

Each heir has the right to count on part of the property or appropriate compensation in cash.

Division is allowed at the request of the heirs; the inherited property does not necessarily correspond to the original share. It is only necessary to obtain the written consent of all participants in the section.

If the inheritance is shared with a minor heir, then it is necessary to coordinate the procedure with the guardianship and trusteeship authorities; this is required by Art. 1167 Civil Code of the Russian Federation. At the same time, parents, guardians or trustees do not have the right to conduct any transactions, including the division of property, without the appropriate permission of the guardianship and trusteeship authorities.

Any transactions with the property of minor citizens must be beneficial for them.

Parents or other legal representatives must submit documents confirming that the division of the inheritance was carried out taking into account the benefit of the minor.

In this case, it is necessary to collect the following package of documents:

- statement from parents or legal representatives;

- if the child has reached the age of ten, then his written consent to draw up such an agreement is also required;

- a copy of the child's birth document. If the child is 14 years old or older, a copy of the passport is also required;

- a copy of the parent's ID;

- a copy of the document on the death of the testator;

- document confirming the place of residence of a minor citizen;

- papers reflecting the value and composition of the inherited property.

The period for reviewing the submitted documentation is 15 days. The refusal of the guardianship authorities must be motivated and can be challenged in court.