- home

- Reference

- Non-state pension provision

The number of non-state pension funds actively operating in the Russian Federation still remains large. The basic rule is to receive payments only upon reaching retirement age. Termination of a contract is a standard procedure, but it is better for a citizen to familiarize himself with some of the nuances in advance.

We will discuss in the article what methods you can use to withdraw the funded part of your pension from a non-state pension fund and where to send it after processing the return.

Is it possible to terminate an agreement with a non-state pension fund?

Most often, the reasons are the conditions specified in the agreement itself. For example, the presence of conditions under which all obligations between the parties are canceled. And in this case, a person really has the right to terminate a contract in which he is not satisfied with something.

There are other situations in which such actions become acceptable:

- Problems with the reliability of the organization. Reorganization and liquidation are procedures faced by a large number of small organizations. Therefore, when choosing, the main factor should be the position in the rating related to reliability.

- Profit. It affects how much money the client himself receives. For example, you should not trust a company if the indicated level is lower than current inflation.

What is the funded part of a pension?

In the Pension Fund of Russia, contributions towards the future pension of citizens are made by the employer. He contributes 22% of his employee’s salary, of which 16% goes to the insurance part of the future pension, and 6% to the funded one . For those who transferred their pension savings to a non-state pension fund, this 6% is transferred there.

Another option is to voluntarily contribute funds to the funded part of your future pension. This can be done through any bank; just take a receipt with the details from the pension fund branch. Or transfer it to the accounting department at your place of work, so that the accountant makes voluntary contributions on his own.

Thanks to the new regulations, citizens have the opportunity to independently control the size of their future pension. After all, savings are indexed every year, so the money is reliably protected from inflation and will not lose its value for a long time. By the way, recipients of maternity capital can also transfer the money allocated to them towards a future pension.

In simple words, the funded part of a labor pension is money that rightfully belongs to the payer; according to the law, he can receive his money immediately, without waiting for retirement age.

Many people are naturally interested in how to receive the funded part of their pension in a lump sum. To whom this payment is due and in what amount is strictly regulated by law, this will be discussed further.

How much money can you get:

- the full amount of savings;

- part of the funds;

- monthly payment from savings;

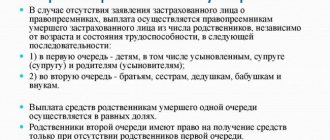

- payment in the event of the death of a citizen before he reaches retirement age.

Next, we will consider all the nuances of payments, who is entitled to them and how to receive them.

Procedure for terminating the contract

The first step is a detailed study of the agreement itself, for which the non-state pension fund is the second party. Sometimes the documents do not describe any special conditions, so it is enough just to tell the partners about the desire that has arisen.

Citizens can withdraw funds and change NPFs, but not more than once a year.

The client must write a statement stating what needs to be done with the money stored in the current account.

Events can develop according to two scenarios:

- Transfer of funds to an account in another NPF.

- Transfer of money to a bank account owned by the client.

The application must accurately indicate the details used for the transfer. Then the NPF will not have problems or delays with the operation. Refunds must be completed no later than three months after all documents have been submitted. No matter what stage the contractual relationship is terminated, the rules remain the same.

Reference! All costs associated with such transfer are borne by the depositor. Additional payment of personal income tax is one of the responsibilities that almost everyone faces.

Is it possible to withdraw all pension savings from a non-state pension fund at once?

Our officials were in such a hurry to raise the retirement age that they completely forgot about those who decided not to rely on the state, but to save for retirement on their own. And what? Just think! What do some 6 million citizens mean for a great country? It is precisely this many people who are now forming a voluntary pension in private pension funds, and by law they must receive it not from the age of 65 and 60, but “in the old style.”

Everything would be fine, but it only turned out that by this time nothing would work out for them. Because in order to receive a non-state pension (it doesn’t matter whether you saved it yourself or your employer contributed money for you), you need so-called “pension grounds”. This is the language of bureaucrats that describes the conditions under which in our country the Pension Fund will calculate and begin paying you your pension. And since the retirement age has been raised, a curious incident arises - the NPF can and would like to pay you a pension, as provided for in the agreement, but there is only a risk that the state will require you to pay tax on this.

The situation with pension savings is even funnier. Almost 36 million Russians have this money (not counting the “silent ones” whose money is managed by VEB.RF), and if you look at the total amount - 4.7 trillion rubles - it seems like a lot of money. But the balance in the accounts of the majority of those who have savings accounts is so small that they will not provide any tangible increase in income in old age. For example, if the amount of your pension savings is at least 200 thousand rubles (and this is much higher than the market average), then the maximum you can count on per month is a little over 800 rubles.

Another thing is that this pension money can be taken all at once . But there is a big “BUT”! You can withdraw your savings only if the amount of your monthly pension from the NPF does not exceed 5% of the state pension. Judging by the size of the pension in the Russian Federation now, then those whose monthly payments to the NPF do not exceed 700 rubles can qualify for such payments. per month. Or in other words, people who have less than 170 thousand rubles in their pension accounts. And judging by the statistics of pension funds, these are the majority - on average, each Russian has saved about 75 thousand rubles for his retirement.

But getting this money can also be difficult. Because in order for the NPF to understand whether to give you money or not, you will have to apply for a certificate from the Pension Fund. Now imagine the eyes of Pension Fund employees, from whom citizens will begin to demand to calculate the amount of payments 5 years before retirement

What documents will be needed

The secretary must receive the following set of papers from the investor:

- SNILS.

- Passport or other identification documents.

- An order from another government fund for transfer if necessary.

Additionally, fill out a form with personal and contact information to date. Only after filling out this document can you sign an agreement with the new organization when the need arises.

Two copies of the termination agreement are required. One of them is given to the applicant.

Some organizations provide an option in which documents automatically expire. For example, if a citizen has not fulfilled his obligations by refusing to visit the institution to renew an existing contract.

Then the documents automatically lose their validity. There is no need to specifically contact the organization’s employees to complete the procedure. All previously accumulated amounts are transferred to the account specified in advance.

On the general procedure for paying out savings when participating in a non-state pension fund

There is Federal Law No. 360-FZ, issued back in 2011. It is this law that establishes the specific procedure according to which the funded part of pensions is paid. If a citizen has concluded a corresponding agreement, then he can send the first demands for payment of his funds after two months, but not earlier.

Pensioners can submit the same request after the second month from the moment the transfer of accumulated funds began.

The law allows for a situation where a so-called urgent payment is issued. The duration of receipt is chosen by the citizen, depending on the following characteristics:

- Accumulation amount.

- Amount of monthly payments.

Together with the labor component of the pension, the insurance can be paid indefinitely. The specific amount in this case depends on the decision made by the Government of the Russian Federation.

Where to send funds after receiving

A citizen has the right to choose any management company for his transfers. If necessary, we also allow a reverse transfer of savings in favor of the Pension Fund. In this case, a trust management agreement is drawn up.

In this case, documents must be submitted no later than December 31 of the current year. Let’s assume the option of submitting documents through the State Services electronic portal, then you will need a passport and SNILS. But to fully confirm your identity, it is still recommended to visit the offices of regulatory organizations.

The procedure in the case of State Services will look like this:

- Register on the portal, or visit your Personal Account.

- Next, go to the services tab.

- Using the "Authorities" tab.

- Selecting the Pension Fund icon.

- Next, we need a section with the acceptance and consideration of applications from individuals.

- Another point is the transfer of savings from one management organization to another.

- All you have to do is click one button to receive services.

Next, an inscription appears informing you of the need to use an enhanced qualified electronic signature. Personal data in the following questionnaire is almost always entered automatically. You just need to select the division of the Pension Fund responsible for control in a particular case.

Another option is to visit the MFC. The procedure is slightly different from the previous one:

- Fill out an application with all the necessary details, including information on the current service organization and the company where the money is planned to be transferred.

- The documents are sent to specialists for further consideration.

- All you have to do is wait until the procedure is completed.

The transition to a new non-state pension fund also takes place without problems. The main thing is to choose an organization that fully complies with the requirements at the legislative level. On the PFR website you can always study registers that remain relevant at the moment.

Next, a new contract is concluded with the selected organization. It is enough to have a passport with SNILS to draw up a standard form of documentation.

The document becomes valid only after the full amount is transferred from the old management company. There are no restrictions unless the regulator imposes them in advance.

Important! In any case, the replacement of the insurer is carried out with the participation of the Pension Fund. An application signed with a qualified electronic signature must be submitted. The application is considered until March 1 of the following year maximum, although a longer period is possible. Notifications of a positive decision are sent to both insurers.

About customer reviews

Most opinions on this organization remain positive. Among the main advantages, citizens note:

- High ranking positions.

- Excellent level of profitability.

- Fund stability.

Separately, they note the high level of service, even for specific branches located in small towns. There is only one drawback - forced entry into this fund for those who work for Russian Railways.

But everyone has the opportunity to choose individual terms of service. Deposit amounts and profitability depend on gender, as well as age at the time of conclusion of the agreements. In addition, the so-called compensation social package is added to the funded part. You can choose either the complete set or its individual parts.

Each citizen, when participating in programs from the NPF “Blagosostoyanie,” retains the right to receive a tax refund in the amount of 13 percent for serious expenses for the purchase of real estate, treatment, training, and so on. The pension is retained even upon dismissal, if the insurance period is at least five years. And after dismissal, individuals have the right to increase their security. It’s just that contributions become individual rather than corporate.

This is interesting: Labor Code of the Russian Federation 2021 vacation

NPF Blagostostoyanie is a reliable fund to which more than a million people have already entrusted their savings. They adhere to an integrated approach to investing funds. This ensures a high level of profitability for any investment. At the same time, the risks remain minimal. The average industry pension for Russian Railways employees reaches 90 thousand rubles.

If there is a need to terminate the contract, this can be done in a matter of minutes. Funds and savings are returned to the depositor or transferred to representatives of another organization. The employer's contribution remains in the company's accounts. The money can be withdrawn when the citizen reaches retirement age. You just need to competently assess your capabilities and understand how profitable this or that solution is.

About the Merger of NPF StalFond and NPF Blagosostyanie in the following video:

Noticed a mistake? Select it and press Ctrl+Enter to let us know.