Citizens of Russia, upon reaching a certain age, have the right to stop working and count on material support for their needs in the form of a pension. However, it is known that cash payments to pensioners in our country remain quite low.

The average pension in the country is, according to statistical authorities, 14,100 rubles, but it should be borne in mind that the calculation method used is not perfect, so the vast majority of the population can count on a significantly smaller amount.

In this regard, many able-bodied people, including relatively young people, are beginning to think about how they can increase the amount of their security in old age. One of these methods is the formation of a funded pension, the calculation details of which are given in the article below.

What is the funded part of a pension?

The formation of pension savings in Russia is based on insurance principles. This is expressed in the fact that for each working citizen, the employer contributes a certain amount of money to the Pension Fund or Non-State Pension Fund, amounting to 22% of the employee’s salary. These funds, called insurance contributions, are used to form the pension rights of citizens, expressed in the parameter of the individual pension coefficient.

However, certain categories of employees can choose how to distribute the amounts of insurance premiums. Thus, they can use part of them (6%) to form a savings part, while it is not converted into an individual investment complex, but is accumulated in a special account in the Pension Fund of the Russian Federation or in a non-state pension fund (at the citizen’s choice).

Important! Today, the country has a moratorium on the formation of the funded part, which will last until 2021 inclusive. This means that the contribution funds are sent only to the insurance part, even if the citizen has expressed a desire to form a savings account.

Why insure a funded pension?

Each employer makes contributions to the Pension Fund of Russia (PFR) for its employees for the funded part of the pension (CPP) at a rate of 6%. Since 2014, there has been a temporary moratorium on the transfer of funds, so all the money goes to the insurance part.

Citizens who have savings for private private enterprises can insure them and transfer them to a non-state pension fund account.

Funded pension insurance has a number of advantages:

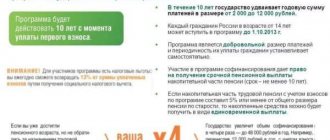

- Money is not just kept in a personal account. They work because the management company invests them in profitable assets. Each citizen is awarded a certain percentage. Its size depends on the selected non-state pension fund and the terms of the contract.

- Even if the pension fund goes bankrupt or its license is revoked, the investor will receive back all the money transferred, with the exception of interest. The Deposit Insurance Agency (DIA) is responsible for this.

- The generated pension savings can be passed on by inheritance. To do this, when concluding an agreement, you must indicate information about the legal successor.

- What pension will an individual entrepreneur receive?

- How to find out your registration number in the Pension Fund of Russia and receive an extract

- Russian citizens can insure themselves against the risks of vaccination against coronavirus

How to calculate the funded part of a pension

Persons who formed this type of pension provision can apply for payment of funds if they have the corresponding right. It occurs when they reach the age established in the country for retirement.

Reference! If a citizen has the right to early assignment of a pension, then the funded one will be assigned to him along with the insurance one.

The law provides for three forms of payment of the funded portion:

Indefinite

It is made in equal payments throughout the pensioner’s life or until the funds in the pension account are exhausted. In this case, to calculate the specific amount that will be paid to an elderly person, a parameter such as the “survival period”, calculated in calendar months, is used. It should be understood as the life expectancy of a pensioner after the assignment of funds to him.

This parameter depends on many factors and is subject to annual change. In 2021, the survival period is 252 months.

Urgent

In this case, funds are paid within 10 years after the pension is assigned. As soon as the specified period expires, transfers will be stopped in full.

One-time

In this case, the pensioner is paid the entire amount accumulated by him. However, this is possible only if certain conditions are met that do not depend on the will of the person himself.

Formula and example

In practice, most often citizens receive unlimited transfers, which are calculated taking into account the survival period.

They are calculated using the following formula:

NP = PN/T

Where:

NP – the amount of pension payments made monthly.

PN – the amount accumulated by the citizen.

T – survival period.

For clarity, an example should be given.

Citizen Petrov will retire in 2021. There is an amount of 300 thousand rubles in his pension account.

Respectively:

300000/252 = 1190,47.

Thus, the amount of Petrov’s accumulated pension will be 1190 rubles, 47 kopecks.

If a term payment is expected, for example, 10 years (120 months), then the calculation procedure is the same:

300000/120 = 2500.

Accordingly, the amount of security will be 2,500 rubles. The period of urgent payment can be any, but not less than 10 years.

OPS agreement with NPF

To transfer the funded portion from the Pension Fund to a non-state fund, it is necessary to conclude a Compulsory Pension Insurance (OPI) agreement. A new agreement is also concluded when transferring funds from one NPF to another. You can change the management company once per calendar year by sending a corresponding application through your personal account or the State Services portal to the address of the territorial office of the Pension Fund before December 1.

You only need to have two documents with you: a passport and SNILS.

- How to disable ads in Google Chrome

- There may be penalties for early loan repayment

- Zucchini pancakes with cheese

When transferring funds more than once every 5 years, the accrued interest is lost unless other conditions are specified in the Agreement. The endowment insurance agreement has a standard form approved by the Central Bank of Russia. When signing the Agreement, it is important to consider a number of points:

- The agreement is concluded with only one non-state fund. All NPFs are accredited. Information about them is entered into a special register. You can view the list on the website of the Central Bank, the Pension Fund or the Deposit Insurance Agency.

- The choice of an insurer is an individual decision of the citizen himself. Before signing a document, you need to pay attention to the reputation of the fund, its ratings, and liability measures.

- When submitting an application to the Pension Fund, there is a 20-day cooling-off period. During this time, the future pensioner can unilaterally refuse to transfer funds to the NPF and terminate the agreement without loss of investment income.

- In the event of the death of the policyholder, all of his pension savings are inherited in accordance with the law , unless the Agreement contains an indication of a legal successor.

How to calculate the size of a lump sum payment

All accumulated funds can be paid at once only if the amount of the unlimited payment is less than 5% of the total amount of the person’s financial support.

This becomes clearer with an example:

Pensioner Ivanov, whose corresponding payments amount to 1,190.47 rubles, also receives an insurance pension of 11 thousand rubles. Respectively,

11000+1190,47 = 12190,47.

The total amount of material support is 12,190.47 rubles.

Next, you should calculate the percentage of the amount of the monthly pension of the type in question to the total amount of material support:

12190,47/1190,47 = 10,24.

Accordingly, the amount of perpetual payments is 10.24% of the total pension provision. This means that Ivanov is not entitled to receive a lump sum payment.

What it is?

Any citizen of our country who was born after 1967 can insure the funded part of his pension.

Insurance of this type should be considered as a type of savings. This is a targeted transfer of part of pension savings to the account of non-state insurance companies.

You choose one company, notify the pension fund about it and transfer the accumulative part of the pension to the account [/anchor].

The funds will be kept in this account and the main feature is that the money is fully insured.

The risk that your pension will “burn out” or be lost during the next coup d’état is minimized.

You can receive additional income - a percentage of funds stored in the insurance fund.

How to transfer the funded part of a pension to a non-state pension fund?

For further transfers of savings to a non-state pension fund, a citizen must notify the state pension fund about this. To do this, you need to submit an application, the form of which can be downloaded on the official resource of the Pension Fund of the Russian Federation or obtained from a local branch. This is done after concluding an agreement with the selected institution. When signing a contract with a non-state pension fund, it is important to first carefully study all the clauses and provisions of the document.

Example of an application for transfer of funds to a non-state pension fund

You can submit your application in person, via the Internet (Gosuslugi portal) or by mail (registered mail with an inventory). If a trusted person acts on behalf of a citizen, it is necessary to notarize the power of attorney.

It is advisable to find out whether the selected NPF has an agreement with the Pension Fund on mutual certification of signatures. If it is available, when applying to a non-state pension fund with a passport and SNILS, a citizen can sign an agreement on compulsory pension insurance (compulsory pension insurance) and then no longer submit an application to the state pension fund.

The transfer of the funded part of the pension is carried out free of charge; it is possible to issue a receipt confirming the acceptance of the citizen’s application. After receiving the information, the Pension Fund is obliged to:

- before the end of the current year, process the application for transfer of savings;

- make appropriate amendments to the register by March 1;

- by April, transfer money to the specified NPF.

Where can I transfer the funded part of my pension?

If a person leaves money in a state pension fund, it is managed by Vnesheconombank. The positive side is the guaranteed return of funds, but you can hardly count on a significant increase in them. Therefore, future retirees prefer to transfer amounts to third-party organizations. Two main options for transferring accumulated funds are presented in the table. Both institutions operate a mechanism for calculating interest on client deposits, that is, on the specified part of the pension.

Table 1. Options for transferring pension savings

| Organization | Description |

| Management Company (Management Company) | The functions of the institution include trust management of clients' benefits. Activities are regulated by Federal Law No. 156 of November 29, 2001 (as amended on December 30, 2015) |

| NPF (Non-state pension fund) | It is mainly created on the basis of an industrial or credit institution. Operation is regulated by Federal Law No. 75 of 05/07/98 (as amended on 12/30/15) |

The options differ in that the citizen enters into an agreement with the NPF, but this is not required with the management company. In the latter case, an application is submitted to the Pension Fund with a request to transfer funds to a financial institution.

Example of an application for transfer of funds to the management company