What is the pension co-financing program and until what year is it valid?

The state is actively trying to involve citizens themselves in the formation of future pensions. To achieve this, various methods are used to encourage those who decide to independently save for subsequent payments upon reaching retirement age. One of these measures was the co-financing program.

As part of the program, a person was invited to begin independently forming his own funded pension by making additional contributions. At the same time, the state guaranteed doubling the additional amount. contributions, and in some cases a 4-fold increase in the amount contributed is provided.

It is also useful to read: How to find out the funded part of a pension

In fact, if a person joined the program and deposited 5,000 rubles. to the account for the formation of a future funded pension, the state also added 5,000 rubles to his personal account, and in some cases – 20,000 rubles. At the same time, it is established at the legislative level that for co-financing the amount of additional. contributions must be at least 2000 rubles. and no more than 12,000 rubles.

The program is financed by the National Welfare Fund. All savings in a personal account can be transferred under the management of a management company or non-state pension fund to generate income and increase this amount.

The program first started working in 2008. It was in October of this year that the Pension Fund began accepting applications from citizens to participate in the program. Acceptance of applications ended on December 31, 2014, and the participant had to make the first payment by the end of January 2015.

The duration of a person’s participation in the project is 10 years. Thus, it will completely finish its work by 2025.

Important! It is not possible to apply now and become a member. But the state still invites citizens to independently take care of future pension payments and make additional payments. contributions, but no longer proposes an increase in the transferred amounts. Before making additional contributions, you must contact the Pension Fund branch and submit the appropriate application. You cannot simply transfer money to the Pension Fund account.

What is the state pension co-financing program, you will learn from this video:

Who can take part in the co-financing program?

The group of people who can take part in this program can be divided into three specific groups, namely:

- Those citizens who would like to increase their future pension payments.

- Those employers who decided to take care of their employees and voluntarily agreed to help them.

- The state that is the funder of the pension.

Despite the fact that the program was adopted in 2008, it ceased to operate in 2014. However, in 2015 they decided to resume it again, and to test it, they found voluntary participants who would like to take part in it.

The main condition was at first:

- Apply for participation in the program.

- Make a minimum contribution to the program.

Good to know! If one of the conditions is not met, the citizen did not have the right to participate in co-financing, and his candidacy was no longer considered.

As previously mentioned in the article, anyone could take part. The main and only condition was that he was required to make at least minimal contributions to this program.

Who could take part in the state pension co-financing program

Every citizen participating in the pension insurance system could join the program. In fact, all officially working Russians, entrepreneurs, etc. fall into this category. If the participant had the right to an insurance pension and did not apply for it or other types of pension payments, then special conditions are provided for him - the amount of co-financing is equal to personal contributions increased by 4 times .

Participation in the program was accepted by persons meeting the following conditions:

- The application for connection to the project was submitted until December 31, 2014. It could be issued through the State Services service, by personally contacting the Pension Fund and in other ways.

- The first voluntary contribution in the amount of 2000 rubles. made before January 31, 2015. If it was done later, then even if the application was submitted, the person could no longer take part in the project.

- No more than 10 years have passed since joining the project. It is during this time that co-financing is provided by the state.

To receive co-financing, it is additionally necessary that the additional amount. contributions for last year were more than 2000 rubles. If it turns out to be lower, the state will not credit the co-financing amount to the person’s personal account.

State pension co-financing program 2021

Contributions received under the Program, including funds from state co-financing, are transferred by a citizen of the Russian Federation to the investment management of his choice - either a state management company - Vnesheconombank, or a private management company, or a non-state pension fund. These funds, as well as the investment income received, are reflected in the individual personal pension account of a citizen of the Russian Federation. Detailed information can also be obtained by calling the hotline 8 (800) 510-55-55.

Documents for registration

Representatives of the Ministry of Finance must make additional adjustments to the pension program, which currently continues to operate. The new mechanism provides for the automatic connection of the entire population who will get a job. Participants in this program can independently choose the amount of contribution, which cannot exceed 6% of their salary. As part of the funds paid, you can receive a tax deduction, which will be an additional benefit for citizens.

If a citizen’s insurance contributions are transferred to the state pension fund, then in order to receive them early, he needs to come to the fund’s branch at his place of residence and write an application addressed to its head with a request to give him the funds accumulated under the state pension co-financing program. According to the rules in force in the Pension Fund of Russia, this can be done no more than once every five years.

- Unfavorable economic situation in the country. Due to the economic crisis, the budget did not have enough money for additional payments to future retirees.

- A large number of citizens applied to participate. A fairly large number of people decided to participate in the program, and many of them contributed amounts close to the maximum possible 12,000 rubles. Doubling these funds also placed a strong strain on the state budget.

How can pensioners get money?

All citizens of the Russian Federation registered as payers of insurance premiums who wrote a corresponding application during the period from October 1, 2008 to October 1, 2013 were eligible to take part in the program. There is no need to specifically register as a payer of insurance premiums - the Russian Pension Fund registers in this capacity all citizens who officially work and for whom the employer pays insurance premiums (this also includes individual entrepreneurs and the self-employed).

Payment of contributions can be made in two ways: through the employer or through the bank. Contributions can be transferred either in equal amounts throughout the year or in one-time payments

It is important to keep a copy of the payment document when paying yourself to reconcile payments with the Pension Fund and to receive a tax deduction. The opportunity to join the program is clearly limited by current law - this is the period from October 1 of the year to December 31 of the year

Therefore, it is not possible to become a participant this year.

Methods for making a voluntary insurance contribution

The Russian state offers project participants to make voluntary pension contributions independently or through an employer. A citizen can choose any of these methods, but it must be taken into account that each of them has certain characteristics.

Main features of self-contribution:

- You can transfer money using a payment order or receipt through any bank (including Sberbank). At the same time, it is important to carefully check all the details and especially your full name, as well as your SNILS number.

- Instead of contacting a branch of a credit institution, you can use Internet banking. Russian online wallets also allow you to transfer contributions to the Pension Fund from your account.

- It is allowed to make either one or several contributions during the year. There are no restrictions on amounts, but the state will co-finance savings only if the amount exceeds 2,000 rubles.

- A copy of payment documents must be kept. They will be required if you want to get a tax deduction.

Features of payment of contributions through the employer:

- The application must be submitted once, in it you must indicate your desire to make additional requests. contributions from your own funds to your pension. But first you had to contact the Pension Fund and become a participant in the project.

- The employer makes all transfers in separate payment orders along with the payment of wages. There is no need to constantly monitor the need to transfer money and waste time on making the transfer.

- The employer will submit reports to the Pension Fund. Registers, reports, etc. must be presented to him.

- Refuse to transfer funds to additional The employer cannot finance a future pension. Moreover, some organizations are introducing their own programs for co-financing future pensions of employees, including those who participate in state pensions. projects.

Regardless of the chosen method of transferring contributions, they are not subject to personal income tax. A person has the right to receive a social tax deduction for them. For example, if 10,000 rubles were transferred to the Pension Fund for the year, then the amount of the deduction will be 1,300 rubles.

You can apply for a deduction yourself by submitting a declaration to the tax office at the end of the year, or you can also receive a deduction through your employer, having first received a certificate about the possibility of receiving it from the Federal Tax Service.

Important! If the employing organization also co-finances pension savings, then deductions are possible only for the amount of contributions transferred from the employee’s funds. The benefit does not apply to contributions (including additional ones) transferred by the employer at the expense of the company.

The possibility of using deductions further increases the attractiveness of the project for state co-financing of savings. But this opportunity is available only to those who have relevant income subject to personal income tax at a rate of 13%. In the absence of such income, there will be no deductions.

A citizen can at any time reconcile received payments with the Pension Fund. To do this, you need to contact a convenient branch of the Fund and submit documents on making payments (copies or printouts from online banking are possible). It is recommended to periodically reconcile, since errors when crediting funds sometimes occur, and the sooner they are detected, the easier it will be to correct them in the PFR information system.

Second payment option

The amount of funds under the Co-financing Program can be transferred through the employer.

In this case, you write an application addressed to the employer and indicate how much money you want to transfer to the Pension Fund. It is also worth indicating the frequency of this monetary transaction. After this, the employer will transfer the withheld amount of the insurance premium from the employee’s salary.

You can find out the personal account number where you need to transfer funds using the official Internet resource of the Russian Pension Fund.

When and how can pensioners receive money accumulated under the pension co-financing program?

A person can receive money accumulated in a personal account through personal contributions, co-financing from the state and investment income upon retirement. This usually happens upon reaching the statutory retirement age. But in some cases, early retirement is possible.

There are 3 schemes for paying out accumulated funds:

- Urgent payment. Every month the pensioner will receive a certain part of the funds in the form of an additional amount to the pension. The citizen chooses the payment period independently, but the state establishes that it cannot be less than 10 years (120 months).

- Payment of funded pension. The pensioner will receive monthly cash payments for the rest of his life, determined based on the expected period. In 2021, the expected payment period is 21 years. The amount of monthly payments will be less than if they were assigned for a certain period, but they will be paid for life.

- One-time payment. This option can be used by those who have not acquired the right to a funded pension, or its amount will be 5% or less of the calculated amount of the insurance pension.

Payments under the pension co-financing program are described in this video:

Pension co-financing program innovations in 2021

This year, no significant changes have been made to the program. Only those citizens who managed to join it before 2015 can participate in the program. In this case, the following requirements are imposed on participants:

- Citizens had to express their desire to participate by December 31, 2014;

- Until the end of 2015, a citizen had to make the first voluntary contribution to confirm participation in the program.

If a citizen has fulfilled both conditions, he can continue to participate in the pension co-financing program. Exit from it is carried out automatically after reaching retirement age.

At the time of participation in the program, a person must be working. If a citizen already receives a pension, the state will not double the amount of voluntary contributions.

The Federal Law was designed for five years, but based on numerous responses from citizens, it was decided to extend its validity.

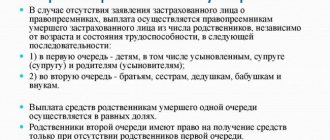

Are the savings of a deceased participant in the pension co-financing program inherited, and how to get them?

According to the law, the savings of a deceased project participant are not inherited, but are transferred to legal successors. In fact, there are few differences in these 2 procedures. In advance, the participant can leave a statement about the distribution of funds between legal successors, indicate a specific recipient, etc.

Depending on the situation, the savings of the deceased participant are transferred according to the following rules:

- If the participant dies before reaching pension payments, then all funds are transferred to legal successors.

- If the participant had already been awarded term payments before death, then the successors receive only the remaining (unpaid) portion of the savings.

- If the participant was assigned a lifelong funded pension, then the legal successors do not receive any funds.

To receive funds, the legal successor must contact the Pension Fund or Non-State Pension Fund with a corresponding application. The decision on payment will be made within the 7th month from the date of death of the citizen.

Latest news and changes on the pension co-financing program

In 2021, the program ends for those who joined immediately after the start of accepting applications. If the application was submitted in 2008, then the state will credit the last additional funds during 2021, and they will appear on personal accounts.

Participants who applied in 2009 and made the first contribution to the project in 2010 still have the opportunity to make contributions with co-financing until the end of 2021. The funds received will appear on the account in 2021, along with additional funds from the state.

All participants can continue to contribute towards their pension even if the period of participation in the project has ended. But after the expiration of the 10-year period, additional funds will no longer be accrued at the expense of the state.

Currently, the state is considering various innovations in the pension system. In particular, it is planned to introduce investment pension capital and provide a number of benefits for contributions to it. But there is no final decision yet.

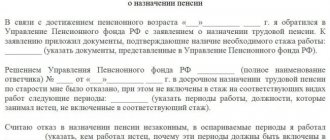

How to join the program

To become a participant in the program you need:

- submit an application to the Pension Fund branch at the place of registration;

- or a multifunctional center for the provision of public services;

- or by contacting your employer.

The employer is obliged to submit the application to its destination within 3 days : the territorial body of the Pension Fund.

The applicant must have a personal retirement account. In its absence, simultaneously with the application for participation in the program, you must submit documents to open an account.

When contacting the Pension Fund body, the future participant presents originals and copies of the passport, SNILS to confirm the specified data. The processing time for the application is 10 days . Employees of the pension department are required to notify the applicant in writing about participation in co-financing.

You can apply:

- persons entitled to an insurance pension;

- from 55/60 years and older, continuing to work and not receiving any type of security;

- non-working pensioners.

Citizens could become full participants if they met the following conditions: submit an application before the end of 2014, the first payment – until January 31, 2015. If an application has been submitted, but the funds have not been transferred, then the possibility of individual deductions without budgetary additional payment remains possible.

Important! Citizens who are working and receiving a pension of any type are not eligible to participate in the program.

Reviews about the pension co-financing program

Most participants note the positive aspects of the co-financing program offered by the state. Pensioners who continue to work were especially pleased with it. But there are also some negative reviews, which mainly come from those who receive a pension below the subsistence level.

I became a member of the program in 2013 and still continue to contribute to my pension. Although I have already retired, I continue to work as before. The possibility of doubling savings at the expense of the state really helped me out. The only negative for me is the ability to receive a lump sum payment only once every 5 years. But even with him, the program turned out to be profitable.

Tatiana

For me, the pension co-financing program was an excellent option. Based on the year of birth, I was not among those for whom a funded pension is formed. But then a project from the state appeared on voluntary contributions and their increase. I took part in the program, made contributions, and the state doubled them. As a result, upon retirement, I was able to receive a fairly significant lump sum payment.

Michael

Due to family circumstances, I couldn’t work for a long time and, accordingly, I couldn’t count on a large pension either. For this reason, I was forced to look for options so that in old age I would not be left without money. One of the ways to solve the problem was to co-finance my pension. Of course, in order to make contributions I had to save, but then I was able to get an increase through lump sum payments. Moreover, my investments there were only half.

Elena

In general, the population generally assessed the co-financing program positively. Millions of people took part in it, and many continue to make contributions, receive payments, etc. But due to frequent changes in pension legislation, confidence in the project and its analogues has been significantly undermined.

Pension co-financing program

The project is based on the principle of a citizen transferring additional insurance contributions (hereinafter - DSV) to form the funded part of the insurance benefit and directly proportional to its increase at public expense. The program works like this:

- The insured person transfers DSV to the Pension Fund of Russia (hereinafter referred to as the Pension Fund) to the account of the funded part of his old-age insurance benefit.

- The state doubles this amount, and if certain conditions are met, quadruples it.

Participation in the program is carried out on a voluntary basis upon the personal application of the applicant. Conditions:

- Before December 31, 2014, it was necessary to submit an application to join the program.

- Make your first payment before 01/31/2015.

- Pay DSA in accordance with the rules of the state co-financing program for at least 1 year. For example, citizen Ivanova transferred 12,000 rubles for 2015. She is 54 and plans to retire in 2021. After registering for an old-age insurance benefit, in addition to it, she will receive her DSV (12,000 rubles) and state co-financing in the amount of 12,000 rubles, because she has fulfilled the minimum requirements of the program.

- A person receiving any other type of software and submitting a statement of intent to participate in the project will increase his accumulative pension capital, but his voluntary insurance contributions will not be doubled;

- State-co-financed payments can be received after applying for old-age insurance benefits.

Amount of contributions

The minimum amount of insurance contributions that a future recipient of benefits must transfer to the Pension Fund or Non-State Pension Fund is 2,000 rubles per year, the maximum is 12,000 rubles. The state doubles it and transfers it to an individual pension account. Amounts transferred to the Pension Fund or Non-State Pension Fund to the account of future DSVs that are below or above the limits provided for by the program are not co-financed. Examples:

- Citizen Petrova transferred 17,000 rubles. for the past year to the account of the insurance part of your pension. The state will make an additional payment of 12,000 rubles. The following will be credited to Petrova’s account: RUB 17,000. (from personal savings) + 12,000 rub. (state co-financing according to the upper threshold of DSA provided for by the program) = 29,000 rub.

- Citizen Vasiliev contributed 2,500 rubles to the account of his future insurance pension. The state will double this amount. Vasiliev will receive: 2,500 rubles. + 5,000 rub. = 7,500 rub.

- A citizen of Nikolaev transferred 1,800 rubles. to the account of a future insurance pension and then refused to participate in the program. When she retires, she will receive only her 1,800 rubles.

The state co-financing program provides 2 options for increasing the daily allowance. Nuances:

- contributions of a program participant who contributed from 2 thousand to 12 thousand rubles for 1 year are doubled;

- a fourfold increase in own funds transferred to the future benefit account in the same range (RUB 2,000–12,000) is provided for persons who have reached retirement age but have not received an insurance or any other pension.

Duration of the program

The Russian government developed a program for co-financing insurance pension benefits in 2008. It was designed for 5 years. You could submit an application to join the program from 10/01/2008 to 12/31/2014, and make the first payment until 01/31/2015. At the moment, registration for participation in the project is not available, but due to its popularity, its renewal is not excluded . In 2013, the program was extended for another 5 years and will continue to operate for participating participants for 10 years - until 2025.