Law No. 424-FZ “On Cumulative Pension”, adopted by the government on December 28, 2013, provides for the right of citizens of the Russian Federation to receive, in addition to the basic pension, its funded part, formed from the total amount of insurance contributions, and its monthly, lifetime payment upon reaching the basic pension. pension.

How to refuse the funded part of a pension in favor of an insurance one

The type of savings established by law has both its advantages and disadvantages, and those who have made a choice in its favor may change their minds and abandon this option.

How is the storage part formed?

For an officially employed person, his employer monthly transfers 22% of his salary to the Pension Fund to form a pension. These transfers go either entirely to the insurance pension, or 6% of them are redirected to the funded part established by law No. 424-FZ.

Formation of the funded and insurance part of the pension

The funded part can be formed in persons born in 1967. and younger if they opted for this opportunity before 2021 by submitting a written application to the Pension Fund dealing with their savings (NPF or Pension Fund).

If 22% of transfers began to be transferred to a person after 01/01/14, he is given the right to make this choice within 5 years following the first transfer. If a citizen is not yet twenty-three years old, the specified range expands until the end of the year in which his 23rd birthday occurs.

Accumulations under Federal Law No. 424-FZ can be formed from:

- insurance transfers;

- personal contributions of citizens;

- co-financing of pensions;

- maternity capital funds.

Pension savings can be formed from maternity capital funds

Reference! The 6% of insurance funds received as a result of deductions are subsequently invested in operations on the credit market with the help of the Pension Fund.

For persons born in 1966 and older age, this part can be formed only from financial capital and pension co-financing. If these persons are employed, their insurance contributions are transferred exclusively to the main part of the pension.

The part specified in Federal Law No. 424-FZ, in turn, can be awarded to men born in 1953-1966. and women born in 1957-1966, if the indicated accruals were transferred for them in 2002-2004.

Important! The law provides that the presented type of contributions can be made only to persons entitled to the basic pension.

Choice of pension provision

In 2015, a reform of the pension system was carried out. Its result was the division of labor pensions into 2 types: funded and insurance. The latter is formed only from funds transferred by the employer for the citizen.

The funded part of the labor pension is the personal investment of future retirees. A person can manage such money independently within the framework of the law.

Savings, at the employee’s discretion, can be invested as follows:

- Sent to the selected NPF (Non-State Pension Fund), registered in the compulsory pension insurance system.

- Left in the Pension Fund of Russia (PFR). Then you can select from the proposed list a Management Company (MC) that has a license to carry out investment activities. You can also determine savings in the state management company (Vnesheconombank).

Currently, you cannot choose the savings option and make payments from your employer’s funds. From 2014 to 2021, a moratorium on savings was introduced and all 22 percent of salary deductions are allocated to insurance premiums. The restriction does not apply to the use of maternal capital.

The moratorium does not apply to citizens who have started working for the first time in 2021 and for whom insurance premiums are also being charged for the first time. These people can exercise their right and, before reaching the age of 23, choose to simultaneously generate two payments from employer contributions.

- 8 signs you can tell you're an alcoholic

- Plastic cellar - advantages and disadvantages, varieties with description, size and cost

- Pension of a disabled person of group 3 - the amount of insurance, social, state, subsidies and allowances

Pros and cons of these types of pensions

Labor pension structure

These types of pensions have both positive features and disadvantages. The positive properties of the storage part include:

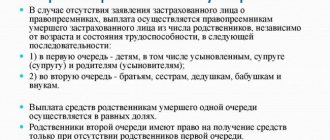

- the funds specified in Federal Law No. 424-FZ can be left to your heirs;

- savings can be financed from additional sources of citizens;

- the accumulated amount can be requested in a single payment (clause 1, clause 1, article 4 of Federal Law No. 360-ФЗ dated November 30, 2011).

Disadvantages of the savings part:

- lack of guarantees of profitability of investing these funds in the credit market;

- lack of annual indexation of these funds established in Federal Law No. 400-FZ dated December 28, 2013;

- the agreement under the savings program can be drawn up with scammers or the pension fund can be terminated ahead of schedule.

The advantages of the insurance part include:

- its annual indexation depending on the level of monetary inflation over the past year;

- an additional increase in the amount of payments if the state budget can afford it.

Federal Law N 400-FZ “On Insurance Pensions”. Article 7

Disadvantages of insurance savings:

- the amount of profitability on the insurance part is lower, because funds invest them at low interest rates;

- As a result of the previous point, insurance pensions often do not exceed the subsistence level.

Which pension option is preferable?

According to Rosstat, today for every person of retirement age there are 2.5 employed people paying pension contributions. It is expected that in 2040 there will be only 1.5 such persons, which will reduce the amount of contributions to the Pension Fund and affect the amount of basic pensions of citizens.

According to experts, giving preference to the savings option guarantees a person in the future, in addition to payment of the total amount of funds invested by him, cash savings in kind.

How to make the right choice when choosing a pension

Since the amount of the insurance pension is directly related to the points awarded to citizens, and the accumulative part of it is related to the investment of funds, the combined option (16% + 6%) will most fully correspond to the economic realities at the time of a person’s retirement.

However, it is most favorable to accumulate funds in relatively stable economic years. In times of crisis, investments often do not bring the desired results or cause losses.

Reference! If, as a result of investing the funds specified in Federal Law No. 424-FZ, the PF does not achieve the desired result, their owner will return only the amount transferred for him by the employer.

It should also be noted that according to Article 1 of Federal Law No. 447-FZ dated December 19, 2016, a moratorium was established in 2014, redirecting the contributions specified in Federal Law No. 424-FZ entirely to the insurance part. At the current stage, the moratorium has been extended until 2021.

Information comparison of pensions with each other

How to cancel the funded part in Russia

If a person has chosen the option of insurance transfers in accordance with Federal Law No. 424-FZ, he has every right to stop using this opportunity at any time convenient for him.

At the same time, 6% of the specified contributions for the employee will be redirected entirely to the insurance pension, and the funds accumulated in the account will continue to be invested in financial transactions for their growth with the help of the pension fund chosen by the citizen.

When choosing an insurance pension, 6% of the specified contributions for the employee will be redirected entirely to the insurance pension

The savings accumulated in the account can also continue to be replenished with your own contributions and the transfer of part of the financial capital. When a basic pension is assigned, these funds will be reimbursed to the person in the aggregate amount.

To refuse payments specified in Federal Law No. 424-FZ, you must submit a written application to the Pension Fund. The application form can be found on the Internet (or you can use the application form for refusal to receive the assigned insurance pension here).

Reference! If a citizen refuses to transfer funds specified in Federal Law No. 424-FZ at the request of a citizen, this refusal is considered final. It will no longer be possible to apply for a funded pension again.

Those who have submitted an application for refusal to the Pension Fund have the right to continue the formation of the specified type of pension by withdrawing the application until the end of the year in which it was submitted.

Those who submitted an application for refusal to the Pension Fund retain the right to continue the formation of the specified type of pension by withdrawing the application

Is it possible to cancel the funded portion in 2021?

Regardless of which PF a citizen has entered into an agreement on the transfer of funds under Federal Law No. 424-FZ, he has the full right to cancel this part at any time.

Reference! After rejecting this part, all 22% of the funds paid for the employee by the employer will be allocated only to the insurance pension.

Is it possible to refuse

A person has the right to refuse already formed savings at any time. Then funds from the pensioner’s individual tariff will be directed to insurance payments. Refusal to form a funded pension does not prevent a person from voluntarily depositing funds into an NPF account.

All savings already made will, as before, be invested by the management company or non-state pension fund. These savings are paid in full when a person applies for a payment assignment. The citizen can continue to manage the money and choose who to entrust its investment.

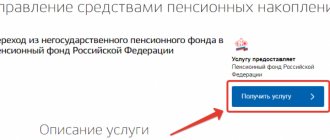

Where to contact

To issue a refusal, you need to submit an application to the Pension Fund. You can do this in several ways:

- through the portal “State Services”;

- using your personal account on the official website of the Pension Fund;

- send a document by mail;

- through the MFC (Multifunctional Center);

- personally visit a branch of the Pension Fund of the Russian Federation;

- with the help of a representative (a notarized power of attorney is required).

During the year in which the application is submitted, the person has the right to withdraw the document. After 12 months, you will no longer be able to change your mind. The refusal is final, since it is not possible to choose a formation with accumulative collateral again.

Declaration of refusal

An application for rejection of the transfer of funds in accordance with Federal Law No. 424-FZ is filled out in the form established by the order of the Pension Fund of the Russian Federation No. 849p dated 09.09.16.

When writing it, you must indicate:

- name of the local PFR body;

- the person who submitted the application or his attorney (you can apply here);

- Full name of the applicant, gender, date of birth, SNILS;

- date of filing and autograph of the person submitting the application.

If the application is submitted by a representative of the person, it is also required to indicate his passport and information about the power of attorney or additional document giving him the right to represent the applicant.

Application for rejection of the transfer of funded pension funds and direction for financing the insurance part

Is it possible not to pay into the Pension Fund at all?

According to Art. 14 Federal Law No. 167-FZ dated December 15, 2001, employers are required to transfer contributions to the Pension Fund. In another situation, this threatens him with fines.

The application form for renunciation of the funded part of the pension has been approved

For certain categories of workers, the law establishes an obligation to undergo medical examinations. Moreover, in some cases, the results of the examination are reflected in medical reports or certificates, and in others they are entered into medical books. For which categories of workers are medical books issued? What is the procedure for filling them out? At whose expense are they purchased, how are they accounted for and where are they stored? We will answer these and other questions in the article.

Having the status of a legal entity, a budgetary institution is generally recognized as a VAT payer. True, not all institutions calculate and pay VAT to the budget on a quarterly basis. Most use the preferences established by Ch. 21 of the Tax Code of the Russian Federation, allowing them not to charge or pay indirect tax. Meanwhile, in a number of cases, institutions still carry out transactions that are recognized as subject to VAT, and institutions, in turn, are VAT payers. In such cases, they are required to present VAT to the counterparty to the transaction, which is indicated as a separate line in the source documents and, of course, in the invoice.

Refusal of the Pension Fund to grant a pension

Federal Law No. 400-FZ (dated December 28, 2013), which regulates the assignment of pensions, establishes a number of conditions for its receipt:

- age . Workers 60 years old and female workers 55 years old, except for citizens with the right to early retirement;

- experience _ The minimum level of experience in 2021 was 9 years. The norm does not apply to disabled people and those receiving survivors' pensions;

- points . A pension coefficient calculated annually based on a person’s salary and period of service. For 2018, the minimum threshold was 13.8 points.

Refusal of the Pension Fund to grant a pension

The Pension Fund of Russia can refuse to grant a pension to a person for each of the 3 listed points when it submits an application for its registration.

If a person has received an appropriate refusal, he can:

- Continue working for the next 5 years, increasing the personal indicators specified for the pension.

- If within 5 years a person cannot earn the required points, he will be given a social pension. Its size in 2021 was about 8.7 thousand rubles. (“normal” pension in the Russian Federation is 14 thousand rubles).

Appealing a refusal

If a person does not agree with the decision of the Pension Fund that refused to grant a pension, he can, having received a document on the refusal from the Pension Fund, file a complaint about its groundlessness:

- to the highest body of the Pension Fund;

- to the civil court at the location of the refused FIU.

If you disagree with the decision of the Pension Fund of Russia, a citizen can file a complaint with a civil court

Note! A copy of the citizen’s documents for calculating the pension is also attached to the complaint. It is better to submit the complaint yourself or by registered mail.

The complaint is considered within 30 days, and the decision made on it is binding on the local Pension Fund of the Russian Federation that rejected the citizen.

Sample statement of claim for a pension

The form for a claim for a pension can be found here

Example of refusal to grant a pension

District therapist Igor Sergeevich submitted documents to the Pension Fund of the Russian Federation at his place of residence for the early accrual of his long-service pension after 25 years of work.

As a result of the presentation of documents, it turned out that for 1.5 years out of the 25 years he worked, he worked with a load less than the norms established by law.

This became the basis for the Pension Fund to issue a refusal to Igor Sergeevich, because These years are not counted towards special experience.

Igor Sergeevich did not file a complaint with the highest body of the Pension Fund, and completed the missing deadline for assigning a pension.

Reasons for refusal to grant a pension

Is it possible to refuse a pension in the Russian Federation?

The question then arises: can a person not retire in old age, but simply refuse it for a certain period in connection with the continuation of his work activity?

In addition, during official work, a person of retirement age can increase his insurance period, which in turn will allow him to increase the future amount of his pension.

In order to refuse pension payments, you must inform the Pension Fund of your intention. There you will need to write a statement stating that you wish to continue your work activity. In this case, the Pension Fund will make a corresponding note, and the pension will not be assigned.

If the pension has already been accrued and the person simply wants to interrupt receiving it, then it is also necessary to contact the Pension Fund and write an application. There should be no difficulties in resuming payments. When a person of retirement age wishes to stop working, he will quit his job and report this to the Pension Fund. Payments will be restored immediately.

In case of refusal, you must write a written complaint to the Labor Inspectorate. The main thing is that the work book must contain a note that “dismissed due to retirement.” No other reason should be given.

If a person works more than 2 months after the due retirement date, then he will automatically, regardless of the length of work, receive a 1% bonus to his pension. If the work period is less than 2 months, then there will be no increase.

Many pensioners are also concerned about the question: is it possible to receive two pensions at once, for example, a long-service pension or an old-age pension? Of course not. The citizen must choose what payment he wants to receive. For example, if a subject has reached retirement age and he wants to receive security in connection with the onset of old age, then he must contact the Pension Fund and write a refusal to pay for length of service. If such a refusal is not written, then the Pension Fund will continue to accrue a pension based on length of service, but not old age.

Read more: Do they take away your work book when applying for a pension?

Voluntary temporary refusal

As mentioned above, the requirements for calculating a pension include the required number of points, which is directly related to its size.

A person who believes that he does not have enough points to accrue the pension he desires has the opportunity to earn bonus points by temporarily refusing to accrue it.

The amount of bonus points when a citizen delays applying for a pension upon reaching retirement age:

| Delay of treatment, years | Increase in fixed payment | Increase in points |

| 5 | 36% | 45% |

| 10 | 2.11 times | 2.32 times |

Reference! Due to the shortfall in receiving the required funds during delayed retirement, the benefit from increasing pension coefficients will only appear if the person lives a long life.

Conditions for granting an increased pension

Balashikha - Microdistrict Aviatorov (No. 30)

You need to come to the pension office and select in the application the option “I refuse to finance a funded pension and ask that 6.0 percent of the individual part of the insurance contribution rate be allocated for the formation of an insurance pension.” Let’s try to describe what and how in a simple form. 1. We are given a choice only until the end of this year. 2. There are two types of pensions, insurance without funded (silent) and insurance with funded. 3. When choosing the funded part of the pension, fewer points will be awarded, as if you are saving, so the savings should cover this difference. Let's look at the table.

So, we will be able to receive the maximum 10 points only from 2021 if we remain silent. And only 6.25 each if you don’t go back to being silent. Let's take a person with a salary of 60 thousand before personal income tax. This is the salary at which it will be possible to get the maximum 10 points starting in 2021. Or rather, there is something around 52021 to get 10 points, but let’s take a salary of 60 thousand. So, I have already accumulated 30 points in terms of conversion. I will have to work for another 26 years before I retire, if they don’t make it to 65 years. We count. In the first option, with a good salary, I can accumulate 260 points, plus the 30 I already have, which gives me 290 points in total! With the second option, I can only get 165 points and plus the 30 I already have, I get 195 points in total. We calculate using the pension formula. The cost of a point today is 71.41 rubles. And the fixed minimum for today is 4383.59 rubles. Option 1, 71.41*290=20708.9 rubles and adding the fixed minimum, we get a pension of 25092.49. Option 2, 71.41*195=13924.95 and add the minimum = 18308.54. The difference is 11,168 rubles. Not weak, yes. But you will say, with the second option, we will have to add more savings. Yes, they will))) We count them too! The state divides the accumulated amount by 228 months and adds 18,308 rubles to those received. So, how much savings should there be to cover at least this difference? Not to mention receiving a pension greater than what the silent ones will have. So, we multiply the difference of 11,168 rubles by 228 months, it turns out that the savings for retirement should be as much as 2,546,304 TWO and a half million. With my good white salary, I now only have 193 thousand. And how much should I receive to save 2.5 million? Let me remind you that only 6% of my salary before personal income tax goes into that piggy bank. It turns out that 2.5 million is 6%, what is 100% then? That's 240 million! Gentlemen, 26 years before retirement I should earn 240 million. This is 923 thousand per year, 77,000 per month. It would seem that it might be possible, but there are nuances. The government will increase the value of 1 point annually. And therefore the difference in pensions will become greater and greater. And what will happen to the savings themselves before retirement is unknown. For example, the ruble will depreciate, the point will be worth adequately to the situation, but no one will convert the accumulated money into fortune. So my advice to you all is; It turns out that today the formation of a funded pension is beneficial ONLY to THOSE who have a small salary. What salary earns 1 point? This is approximately 6,000 rubles. So, if your salary is, for example, 24,000 rubles, then you can only get 4 points per year! Then you do not lose from the formation of the funded part of the pension, but on the contrary, you win! As soon as your salary in terms of points turns out to be higher than the maximum amount proposed when forming the funded part of the pension - that’s it, it’s more profitable to be silent. You can check how many points you are entitled to by following the link.

We recommend reading: If a pensioner has two apartments, does he pay tax?

Oh, and the most interesting thing. Everyone has savings, both those who are silent and those who left them. But for the third year in a row, the State has not credited the silent people with anything in their savings. And those who are not silent are charged 6%. So, if the government suddenly changes its mind, then the silent ones will again receive 2% and what they once accumulated will also be added to their pension. This makes the difference in pensions even greater) PS I am not agitating or forcing anyone, you decide everything at your own peril and risk! Today, it’s good to be silent, what will happen tomorrow is unknown!

Refusal of pension from Germany

Citizens of the Russian Federation have the opportunity to receive an old-age pension earned in Russia in Germany. However, when calculating a pension in Germany, the pension received in the Russian Federation reduces these accruals. For transferring a pension from the Russian Federation, an additional bank interest is also charged, which reduces its size.

a corresponding application, a certificate of pension accrual for the last year, a foreign passport and deutsche Rente.

You can find the application form for refusal to receive an assigned pension here, and an example of how to fill it out here.

A package of documents will be sent to the Pension Fund, which will allow the Russian pension to be completely canceled within 10 days.

To refuse a Russian pension in favor of a German one, you must provide a package of documents to the Russian Embassy in Germany

The Pension Fund will send a certificate of refusal, with which you must contact the appropriate authority in Germany to recalculate payments.

Important! Before performing these actions, you need to consult with all the authorities involved in calculating the pension, having considered all the pros and cons of this decision.

Refusal to form the funded part of the pension

Natalie, insurance contributions received for the formation of the funded part (funded pension) are not taken into account when determining the size of the insurance pension. Depending on the amount of insurance contributions received for the formation of a funded pension, as well as other funds of pension savings (SPN), a one-time payment of SPN, an urgent pension payment or a funded pension can be established. At the same time, only those citizens whose funded pension amount is 5 percent or less in relation to the amount of the old-age insurance pension have the right to a one-time payment of SPT, including taking into account the fixed payment to the old-age insurance pension and the amount of the funded pension calculated as of the day the funded pension was assigned

We recommend reading: Will the size of the pension of a group 1 disabled person change when he reaches the age of 80?

Pension savings funds are the totality of funds accounted for in a special part of the individual personal account of the insured person or in the pension account of the insured person’s funded pension, formed from received insurance contributions to finance the funded pension, as well as the result of their investment, additional insurance contributions for the funded pension, employer contributions paid in favor of the insured person, contributions for co-financing the formation of pension savings, as well as the result of their investment and funds (part of the funds) of maternal (family) capital aimed at forming a funded pension, as well as the result of their investment;

Pension news in 2021

In 2021, a reform of pensions was announced in the Russian Federation, as a result of which the government promises their faster growth than in previous years, for the first time in a long time, actually increasing their content.

Indexation of pensions until 2024. prescribed in Federal Law No. 350-ФЗ dated October 3, 2018. In 2021, the pension increased by an average of 1 thousand rubles, and its indexation was carried out a month earlier, i.e. 1st of January.

Reference! The specified indexation in 2021 is not carried out for pensioners who continue to work.

Increase in pension increases and points cost

Popular question

Question: My name is Igor. I lived and worked in Uzbekistan for 10 years, then moved to the Russian Federation, where I have already lived for about 25 years. Since I will soon be 60 years old, I submitted an application to the Pension Fund for a pension. The Pension Fund informed me that they would calculate my pension only from the length of service accumulated in Russia and would not take into account my foreign experience. Is it possible to appeal this action?

Answer: Good afternoon, Igor. The employee who provided this information acted unlawfully. This situation falls under the “Agreement on the Rights of Citizens in the Field of Pensions” dated March 13, 1992. According to this agreement, a citizen’s full length of service earned during Soviet times is taken into account, even if it was obtained in the Union republics. However, length of service after 1991 is not counted when calculating pensions.

Funded pension: take and cancel

The Federation of Independent Trade Unions of Russia suggested that Mikhail Mishustin refuse the funded part of his pension. In a letter to the Prime Minister, the FNPR reports possible legal conflicts if this is not done. The State Duma supports the idea of trade unions. NEWS.ru finds out whether the government will decide to take such a measure.

The FNPR finds a legal contradiction in the fact that the parameter of the period of expected pension payment has been removed from the state compulsory pension insurance system, but it is still used to calculate the funded part of the pension. This practice, the letter says, discredits the very idea of a funded pension.

Let us remind you that the period of expected payment determines the duration of transfer of the funded part of the pension. A gloomy synonym for this term is “survival time.” This time is calculated annually based on Rosstat data and is constantly increasing. The larger it is, the smaller the monthly payments from the funded part: the amount of funds accumulated by the pensioner is divided by the size of the survival period.

FNPR emphasizes that when the law “On Funded Pension” was adopted, the expected period was 12 years for men and 15 years for women. In 2021 it will be 22 years. This means that the monthly payment of the savings portion is reduced.

The head of the State Duma Committee on Labor and Social Policy, Yaroslav Nilov, supported the idea of trade unions to abolish the funded part, because citizens have distrust in the pension system, there are no serious guarantees and attractive conditions for the voluntary formation of their own pension. According to him, the decision to include the funded part in the compulsory pension insurance system was initially erroneous.

Sergey Bulkin/NEWS.ru

As you know, this part is made up of payments from employers, personal contributions and income from investing in pension funds, including non-state ones. If you deprive future pensioners of the funded portion, this will greatly reduce their motivation to earn money for their old age and receive a white salary. The future belongs to funded pensions, says Alexey Zubets, director of the Institute of Socio-Economic Research at the Financial University under the Government of the Russian Federation.

The state does not have the ability to increase pensions at the pace the population wants. The poverty level in our country starts at 12 thousand rubles, but in fact this is the threshold of poverty. Even 20–25 thousand a month is also poverty, but not in its brightest form: it is enough for a person to live, but not for large purchases. But the state cannot provide such a pension either, because it is impossible to collect so many taxes.

Alexey Zubets

Director of the Institute of Socio-Economic Research of the Financial University under the Government of the Russian Federation

Not everyone working today is concerned about their future pension, which they still have to live to see, and it is unknown what laws will be in force at that time. Long-term financial planning is difficult to achieve in an unpredictable world, and people have long been accustomed to relying more on themselves than on the state. Alexey Zubets believes that it is necessary to explain to people the need to think about their pensions themselves from a young age, because the state will not let you die of hunger, but will not provide a normal life.

According to the expert, the abolition of the funded part of the pension will lead to the closure of insurance companies and non-state pension funds, which will be beneficial to the Russian Pension Fund. But it is in the interests of the state and in the interests of the people, Zubets believes, to revive the funded component of pensions and stimulate non-state pension provision.

I think that the government will not comply with the ideas of this letter, because they contradict the logic of the country’s socio-economic development. It’s just that the part of the financial lobby that benefits from the liquidation of frozen pension savings of the non-state part of the pension is interested in the appropriate decision ,” Zubets emphasized.

The abolition of the funded part of the pension may also provoke an increase in gray wages, which will negatively affect the filling of the country’s budget. During the pandemic, every tenth citizen was transferred to a gray salary. And investments in old age will not be finances, but large long-term acquisitions (from real estate to household appliances, whatever you can do); future retirees will begin to place money in bank deposits or simply store it in their nightstands.

Pension savings funds have been paid to citizens since 2012. You can use not only part of your salary, but also maternity capital, to create pension savings. True, there are few mothers who want to do this.

However, FNPR’s letter to Mishustin is for information only, to draw attention to the problem. In order for it to be resolved, the current legislation needs to be changed.

Let us remind you that next year pension payments in Russia will be indexed by 6.3%. According to the Ministry of Labor, the average annual pension in 2021 will be 17 thousand 443 rubles.