The funded part of the pension is the amount of money that the employee can directly or indirectly influence. This differs from the insurance portion of funds, which are entirely spent on payments to pensioners today. A funded pension represents real money that is invested and receives income from it. The increase in this part depends on the specific organization to which the client has entrusted the management of his funds. With the reform of pension legislation, a working person has the opportunity to independently choose his own pension formation tariff.

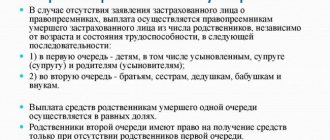

If a person does not try to manage his pension, it will be of an insurance nature. Those who have transferred the management of pension funds to the non-state fund of Sberbank have a real opportunity to receive an increase in money to the base accrual upon retirement. It is worth adding that this part of the funds can be inherited by relatives in the event of the death of an employee. If you do not choose a funded pension today, you will no longer be able to influence the amount of payments after retirement.

Individual plan of the Sberbank Pension Fund

The Sberbank Non-State Pension Fund offers clients to take care of their future by concluding an agreement on an individual plan. The prospects for the future retiree are very pleasant:

- Receiving a guaranteed additional pension supplement.

- The client independently determines the amount of contributions, while their frequency is also set personally by the subscriber.

- A convenient form of adding funds and monitoring investment income online.

- The profitability of the balance is increased due to the social tax deduction.

- Funds collected are not subject to taxes.

Important. An individual plan provides basic rules that the client must follow.

The limit for the initial payment is agreed upon, but the frequency of further payments depends entirely on the wishes of the client. The option of an additional investment has also been considered, for which a limit is also set. A person receives the accumulated funds only after official registration of pensions within the established time frame.

Types of individual plan

There are currently three types of individual plans:

- The universal plan consists of specific parameters, involves early return of savings, and has additional benefits for the client. Apply on the website online, at a Sberbank branch or at the fund’s office.

- The guaranteed plan provides for contributions adjusted to the size of the desired pension (size and schedule), payment of a non-state pension, and an increase in savings from investment profits. The amount of the desired pension is fixed in the Agreement.

- Comprehensive plan.

The latter includes:

- your transfer of a funded pension to Sberbank NPF;

- registration of an individual pension plan;

- make contributions arbitrarily, both in size and schedule;

- both funded and non-state pensions are paid;

- the increase in savings occurs due to investment income;

- The size of the pension depends on specific savings.

Terms and rates

Depositors of NPF Sberbank can choose one of 3 individual plans (TP) offered by the financial institution:

| No. | TP name | Down payment amount (RUB) | Amount of periodic contributions | Contribution schedule | Pension payment terms (years) |

| 1. | "Complex" | from 1,000.00 | from 500.00 | arbitrarily | from 5 |

| 2. | "Guaranteed" | regular contribution amount | determined by contract | determined by contract | from 10 |

| 3. | "Universal" | from 1,500.00 | from 500.00 | arbitrarily | from 5 |

If you withdraw the deferred amount urgently after 2 years, the depositor will receive the following:

- 100% of the principal amount;

- 50% of investment income.

The state provides the opportunity to obtain a tax deduction. Its size is equal to 13% of what was deposited into the account, but not more than RUB 15,600.00. during a year.

Sberbank also provides programs for non-state pension provision:

- "Our Heritage";

- “I am a mentor”;

- "Your future";

- "Big Start";

- "Parity".

The Security Council establishes age conditions for citizens to transfer to NPFs. This:

- for men, the year of birth is no later than 1953;

- for women, the year of birth is no later than 1957.

Is it possible to link two phone numbers to a Sberbank card?

Procedure for drawing up a contract

Transferring the funded part of your pension to Sberbank is quite simple, if you know the registration procedure (at a bank branch or on the company’s website). When visiting the office of a financial institution, you must have with you and present to the company manager your passport and insurance certificate. The procedure does not take much time, and the client will receive qualified advice and find out all the questions that interest him. In a few days the agreement will be ready for signing. On the fund’s website, the subscriber is invited to register and open a personal account. Here you can easily find out what the funded part of the pension is contained in Sberbank, and study all the possible nuances:

- the total amount of the balance;

- amounts deposited into this account and the dates of their deposit;

- the proceeds received from the investment programs of the non-state pension fund of Sberbank.

How is the transition processed?

If you decide to switch from a state fund to a non-state fund, then there is nothing difficult about it. The main thing is to understand the order of this procedure. For such cases, step-by-step instructions have been compiled:

- Find your nearest Sberbank branch. This can be done on the official website of the financial institution npfsberbanka.ru).

- Take with you a passport confirming that you are a citizen of the Russian Federation. Don't forget your insurance policy - you will need your insurance account number.

- Contact the operator, take the application form for Mandatory Pension Insurance and fill it out. All unclear points should be clarified by a specialist - do not hesitate to ask questions.

- Based on the signed agreement, they will open an account with Sberbank and provide you with its details.

- Next, you need to visit the state pension fund at your place of residence and write another application. In the document you will indicate that you want to partially transfer the accumulated funds (6%) to an account opened with another organization. In this place, indicate the name of the fund and its details.

- Pension Fund inspectors will need time to review such an application and check the new details. Expect a written notification that your application has been approved and the funds will be transferred to your new account.

You can also use an additional service from Sberbank NPF - open a Social Card. It opens for a period of 3 years, with free reissue. It can be used to pay only in the Russian Federation when making purchases in supermarkets and retail stores. Payment of utilities through terminals or personal accounts is also provided. But you won’t be able to pay for goods purchased online. Also, you will not be able to use plastic when traveling abroad.

- The card is serviced for free, but receiving SMS notifications is paid.

- If there are funds remaining in your account, they can be kept at 3.5% per annum.

- The Pension Plus program will increase your Social Card savings.

All transactions on this card will be reflected in your Personal Account. To do this, an NPF employee will help you register on the organization’s official website.

Termination of an agreement

The concluded agreement with Sberbank, like any analogue, can be terminated. Anyone wishing to carry out this procedure should know that upon termination, the amounts paid will be returned to him, but in different quantities:

- If at the time of cancellation of the contract less than two years of its existence have passed, you will be returned only 80% of the amounts you contributed.

- After the two-year term of the agreement, you will receive the full amount of the deposit and half of the already accrued profit.

- By terminating the contract after five years of operation, you will be paid the full amount of both contributions and income itself.

Advantages of SberNPF

This fund has existed and developed steadily since 1995. In recent years, SberNPF has taken an honorable place in the top 10 most reliable and profitable funds. It was assigned the highest level of reliability category A++, which marks the most resistant non-state pension funds to economic crises.

In addition, it is worth noting the following opportunities for fund clients:

- The minimum deposit that must be made when registering the contract is only 1,500 rubles. Subsequently, the insured person is given the opportunity to top up his account with an amount of 500 rubles or more. Thus, a funded pension in NPF Sberbank can be formed not only from funds allocated by the employer, but also from voluntary contributions of the future recipient.

- If desired, the client of the fund has the right to activate automatic payment and in this case the specified amount will be automatically debited from the card and credited to the account on a certain date.

- A convenient personal account in which you can view information on the concluded contract at any time.

- Possibility of obtaining a social tax deduction in the amount of 13% of the amount of contributions received (but not more than 120,000 rubles).

- Low risks and protection of savings, which are not subject to division during divorce and collection by creditors, but can be left as an inheritance.

- Possibility of returning contributions paid after 2 years in the amount of 100% and 50% of investment income, and after 5 years both contributions and income are returned in the amount of 100%.

Sberbank NPF funded pension: how to arrange the transition

Receiving the funded part of the pension

To receive the funded part of your pension at Sberbank, you need original documents: passport, pension certificate and insurance certificate. You should also provide details for cash receipts and a document from the pension fund confirming the availability of an acceptable insurance period. You have the right to receive your savings monthly, similar to a regular pension, but with one condition: the accumulative amount must be more than five percent of the size of the labor pension. At the end of the investment plan, the balance is adjusted. You can issue a payment over ten years, its calculation will be based on the following characteristics:

- the amount of additional contributions by the depositor;

- separate receipts from the state, in the case when the client re-registered certain benefits or subsidies to this account;

- specific maternity capital;

- income from investments.

Pros and cons of transferring payments to Sberbank

The decision about whether to make a transfer to Sberbank NPF is a purely individual matter.

This issue must be approached very carefully. The argument is the fact that the organization has the appropriate license to conduct activities. The bank owns shares in the fund, but is not responsible for its operation. This fund is reliable in the Russian Federation. The state is responsible for the safety of funds. Client funds are insured, so transferring to Sberbank Non-State Pension Fund is safe and expedient. Even if the organization ever closes, clients will be paid money by the insurance company.

Regardless of which tariff plan is chosen, all savings are inherited by legal successors. But they are not subject to collection by third parties. In case of divorce, savings are not divided. If the question arises of how to receive the savings portion of the Sberbank NPF ahead of schedule, then you can immediately say that after two years 100% of the contributions and only 50% of the profit will be paid.

Pension savings are formed in two ways:

- The employer makes contributions to the Russian Pension Fund, and all of them form an insurance pension for future retirees. The amount of transfers is 22% of the employee’s income. Points are awarded based on these contributions. They will be used as a basis when determining payments in the future.

- The employer makes contributions to the Russian Pension Fund to the account of insurance premiums in the amount of 16%. In this case, the employee remains 6%, which constitutes the cumulative part of the payments. He can leave this interest with the Pension Fund of the Pension Fund or transfer it to a non-state fund of any financial institution, in particular Sberbank. Money will not just accumulate here. Cash contributions are invested, and a person has the opportunity to pass them on to inheritance.

Transferring the funded portion of your pension to Sberbank NPF provides the following opportunities:

- receive a good increase in basic payments in the future;

- increase the profitability of the cash balance, since tax deductions will be made under the social program;

- the citizen himself determines how much money he will transfer to the fund and how often he will do this;

- transfers can be made online;

- a citizen can control investments online.

Advantages of transferring payments to Sberbank NPF:

- reliability of the organization, which is confirmed by customer reviews and agencies rating financial institutions;

- the funds are insured and in any case will be transferred to the citizen or his heirs;

- Minimal time is required to complete documents;

- the client can control deductions and monitor the investment of funds.

Disadvantages of transferring payments to Sberbank:

- there are problems with online services, due to which the client is not able to track cash receipts and investment accruals;

- a long process of preparing investment results, which takes from one to two months.

Every citizen of the Russian Federation decides for himself whether it is worth transferring the funded part of his pension to Sberbank. To make the right decision, it is recommended that you familiarize yourself with the pros and cons of saving money in this financial institution and compare the bank’s conditions with other similar institutions.

One-time receipt of the funded part of the pension

If the number of points is insufficient to assign a pension, which is why the pensioner is forced to receive only social (age-related) payments, Sberbank provides the possibility for the client to receive the funded part of the pension one-time. The same receipt is possible when applying for a pension due to the loss of a breadwinner or disability, as well as in the case when the funded part of the pension is not enough to 5% of the pension amount calculated in the pension fund. To receive a one-time payment, the pensioner can contact the bank with a request to repeat the procedure, but not earlier than after five years.

Features of NPF Sberbank

Making contributions to non-governmental organizations is another way to ensure a comfortable old age.

The Sberbank Pension Fund enjoys great trust from clients, since under its protection their material assets are multiplied and preserved: money works for its owners through accrued interest, which only grows every month. Depositors are protected from all possible risks by the guarantees of the fund, and in the event of its collapse, the organization will be able to keep its promises to reimburse contributions thanks to the state protection program. Every ruble is reliably insured. It would seem that you can simply save part of your salary at home yourself, hiding the money in a jar or under the mattress, but this only freezes the assets, and does not allow them to benefit their owner. If the depositor suddenly needs the money accumulated by a certain time, there are a number of opportunities to get it back - you just need to comply with the bank’s regulations. Even in the event of the death of the person for whom the account was registered, his immediate relatives and legal successors can notify the organization that they are claiming the deferred funds. Thanks to convenient tariffs, each citizen can determine for himself how much he should make payments.

The “Universal” tariff, the main feature of which is the size of the down payment, the amount of which must exceed 1,500 rubles, allows investors to receive payments for a period of 5 years. This duration is also valid for the “Complex” tariff, the only difference of which is the cost of the starting investment - from 1000 rubles. The third type of tariff - “Guaranteed” - provides payments for a period of 10 years, and the size of its first installment is equal to the regular payment.

If a citizen who has not completed his working career contacts the bank with a request to withdraw payments in advance, he will be denied this. Only official pensioners have the opportunity to receive previously saved money in their hands, including those who went on vacation earlier than others due to their length of service.

Advantages of the Sberbank pension fund

Today, Sberbank’s non-state pension fund has significant advantages over its peers.

The reliability of the company is confirmed by the following factors:

- has been a leader in the compulsory pension insurance market for over twenty years;

- has the highest safety rating, confirmed by the Expert RA agency;

- Clients’ pension savings are insured by the state, and the fund itself is a participant in the system;

- the interests of investors are protected at the legislative level, the fund is a member of the National Association of Non-State Pension Funds;

- The sole shareholder of Sberbank NPF is Sberbank PJSC, whose services are used by the majority of the Russian population.

Other benefits:

- Leadership in the pension structure.

- Clients’ savings are under reliable protection and are guaranteed to be paid within the agreed time frame.

- Documents are processed efficiently and quickly by qualified employees.

- Availability of remote service. A personal account allows the client to control their deposits and be aware of what is happening.

- At the request of the investor, information is provided about the location of personal pension savings, as well as about the insurer that forms these savings.

Disadvantages of the Sberbank pension fund

In customer reviews, you can also find disadvantages from deciding to transfer savings to Sberbank Non-State Pension Fund. What worries clients:

- Possible failures in the program, due to which contracts were not displayed, delay in obtaining information through online services. These problems can always be solved, however, they bring a sufficient number of unpleasant minutes and worries.

- Long waiting time for results from investments (from one to two months).

- Personal negative attitude towards Sberbank, devoid of any specifics.

A person must make a decision on placing the funded part of their pension in Sberbank independently, after weighing all the pros and cons. To dwell on an existing specific moment or to understand and accept the prospects for investment is a purely personal matter.

Recently, some enterprises have been applying to connect to the checkpoint. To do this, you must comply with the fund's requirements:

- the operation of the enterprise must be at least one year;

- Companies with various forms of ownership, both open and closed joint-stock companies, can participate in the program;

- conditions, the fulfillment of which can guarantee payments to employees, are developed by enterprise managers independently;

- making timely payments as specified in the contract.

NPF Sberbank: how to receive the accumulated part of your pension

Depending on the amount of funds accumulated by the time of retirement, the insured person has the right to submit an application:

- on the appointment of monthly payments if the amount of the funded pension in relation to the insurance amount is more than 5%;

- on a one-time payment of accumulated funds if their value is less than 5%.

Payment of a funded pension to NPF Sberbank is issued if the following grounds exist:

- obtaining the right to old age insurance payments;

- reaching the statutory retirement age.

Before submitting, it is better to check the list of required documents at the Sberbank office where you plan to submit an application for payment. But as a rule, the following is required: passport, SNILS, work book. If you have other documents confirming your work activity, it is also better to provide them when submitting your application. Receiving savings through a lump sum payment is also possible for working pensioners. The application processing period is 10 working days.

Programs for cooperation

There are three programs that allow cooperation between companies and Sberbank non-state pension funds. Parity or motivation for employees offers the opportunity to participate in the formation of the funded part of the pensions of the enterprise itself, and of each individual member of the work team. This is an effective way to motivate long-term cooperation between an employee and an enterprise, which allows them to create significant pension capital. It should be noted that in case of failure to complete the assigned tasks for the employee, funds are not withdrawn from the program. These points are specified in the contract.

By the way, the client can use the savings only three years after signing the agreement; the amount will have to be paid from the first day. The Big Start program is attractive to employees because of its loyalty: they begin to use savings two years from the moment a personal signature is placed on the contract. Another way to increase employee productivity is included in the program – Your Future. The first payments will be assigned only when the minimum savings amount for each individual employee reaches five million rubles.

In this case, the employee’s efforts will surpass themselves. By the way, the accumulated amount can be used within a year. Company control over savings accounts will allow you to effectively manage the production process, encourage employees to carefully complete assigned tasks, and guarantee a loyal attitude on your part. The profitability of the enterprise increases, working conditions improve, and the level of staff turnover decreases.