How often can I switch?

Until December 31, 2014, persons born in 1967 and younger could transfer their savings to the new fund once a year.

Currently, this opportunity can be used no more than once every 5 years.

However, the state retained the right of choice for insured persons when switching from one fund to another. There are currently two ways, namely:

- Urgent. An application to transfer savings to a non-state pension fund can be submitted once every 5 years. At the same time, investment income is completely preserved.

- Early. In this case, the insured person has the right to transfer funds according to the old scheme once a year. However, previously received investment income is not paid out. Consequently, the volume of savings does not increase, and sometimes, on the contrary, decreases. Therefore, it is more profitable to save savings in one NPF for at least 5 years so that the pension capital increases.

How to transfer pension savings from one NPF to another

An application for transfer (early transfer) from one NPF to another can be submitted electronically via the Internet by filling out an interactive form on the Unified Portal of State and Municipal Services or in your personal account on the website of the Pension Fund of the Russian Federation.

We recommend reading: Is severance pay subject to personal income tax if a layoff is made in 2021? calculation

In addition, a person has the right to submit a request to the NPF (previous or newly selected, as well as both at once). Perhaps the Pension Fund of the Russian Federation provided the necessary information to his (their) address. This follows from paragraph 7 of paragraph 4 of Article 36.4 of the Law of May 7, 2021 No. 75-FZ.

Procedure for transferring funds to a new fund

To transfer to a new NPF you must do the following:

- Step. Choose a new fund. When choosing, you should pay attention to the profitability of non-state pension funds, as well as the following criteria:

- number of insured persons;

- volume of own funds;

- the amount of net profit;

- volume of financial reserves.

A complete list of current funds can be found at the link: www.pfrf.ru.

- Step. Fill out an application. The form of the form differs depending on the method of transfer: urgent or early.

In case of an urgent transfer, savings are transferred to the NPF 5 years after the previous agreement with the NPF.

And in case of early transfer, finances are transferred to new NPFs next year after submitting an application to the corresponding fund, if the application was submitted later than March 1 of the current year. For example, the application was submitted on April 10, 2021. Consequently, the funds will be transferred to the NPF from January 1, 2021.

- Step. Submitting an application to the NPF. To transfer to a new NPF, the application must be submitted no later than March 1 of the current year or before December 31, so that the savings are transferred to the NPF from the beginning of the next year. A sample application can be found at the link: www.pfrf.ru.

It is important to know! NPF Electric Power Industry – basic information

When submitting a document in person, you need to have your passport and SNILS with you. In addition, the application can be sent by mail, by e-mail (the agreement must be signed electronically).

If a citizen has changed his decision to transfer to a non-state pension fund, he must send a notification to the local Pension Fund of Russia by December 31 to change the selected fund.

- Step. Review of the application. Based on the results of the review, the NPF inspector makes one of the following decisions:

- Consent to transfer funds. In this case, NPF employees create a separate account for the insured person, and also transmit data to the Pension Fund so that changes can be made to the register, and at the end they send a letter to the actual address of the insured person.

- Refusal to transfer to another fund. In case of a negative decision, the changes are not made to the register of the insured person, and the agreement with the existing NPF does not cease to be valid. The citizen is sent a notice of refusal indicating the reason.

The determining factor in the relationship between the insured person and the NPF is the compulsory insurance agreement.

To prepare the document, you will need a passport, as well as SNILS, pension certificate (if available).

Before signing the relevant documentation, you must carefully read all the clauses of the agreement, enter the heirs, and also study the rules of a particular NPF.

The purpose of the document is to transfer the pension savings of the insured person to the accounts of non-state pension funds, which upon retirement are returned to its owner in the form of a decent supplement to pension contributions.

You may be interested in learning important things about compulsory pension insurance.

After the contract comes into force, a personal account is opened for the insured person. The NPF has the right to invest funds in shares - no more than 75% of the total amount and 80% - in bonds and deposits.

If a non-state pension fund does not justify the invested funds, then it is obliged to compensate for losses from its own financial reserves.

The main disadvantage is that the insured person cannot independently choose the area of investment for his future pension.

How to transfer from one pension fund to another

After the pensioner is registered in the new branch, payments will be made in accordance with the changed place of residence. To transfer material assets, the method specified by the pensioner during the application process will be used after submitting it to the territorial branch of the Pension Fund. You need to understand that the transfer of any pension file and, accordingly, the transfer of pension payments is considered the right of all categories of citizens. For this reason, the authorized body must carry out all the above actions only on the basis of an application received from the pensioner. Useful information For a pensioner, completing all the necessary documentation is not so simple. When moving to a new place of residence, before changing the place of receiving pension payments, it is recommended that the citizen register with the institutions of the Ministry of Internal Affairs.

We recommend reading: application to the tax office. For income tax refund

To do this, you also need to write an application and wait for the closed pension file to be transferred to the new destination address. However, to calculate a pension, you must have Russian citizenship or a residence permit confirming the fact that the pensioner lives in the Russian Federation.

How to refuse to work with the fund?

In order to refuse NPF services, you must do the following:

- study the form of the contract, especially the clauses on termination of contractual relations;

- write a notice of termination of contractual obligations at the NPF branch (FZ-75 dated 05/07/1998) or submit an application to the Pension Fund.

The application should indicate further actions with the monetary capital - transfer to another NPF or return of funds to the Pension Fund.

It is important to know! Is it profitable to enter into an agreement with NPF Stalfond?

The form contains the following information:

- passport details;

- decision to transfer finances to a new NPF;

- data of the new fund;

- the amount of savings at the time of termination of the contract.

The transfer of funds is carried out three months from the date of application and submission of the application.

In order to notify the fund of your decision, you can use the following methods: personal contact with the NPF division (if available); sending a letter to the main address of the fund, as well as through representatives of the NPF, personal account on the official website of the NPF.

If a fund refuses to transfer funds to another fund without giving reasons, it may be fined for an unlawful act in the amount of 300,000 - 500,000 rubles.

The list of reasons for possible refusal is extremely small, these could be:

- incorrect application form;

- violation of deadlines;

- incorrect procedure for submitting an application from the insured person;

- impossibility of identifying the applicant.

Upon termination of the contractual relationship, the client suffers losses, such as:

- profit is retained for an incomplete reporting period;

- Tax payments of 13% of the invested funds are withheld from the client. If money is transferred to another NPF, then no tax is charged;

- costs of transferring funds.

To avoid losses, you must first contact the existing NPF with a request for the terms of the transfer, and then submit an application for transfer of capital to the NPF.

If the insured person resigns, he must terminate the OPS agreement in order to move to another NPF or Pension Fund. The transfer of funds is paid directly by the company employee.

If the work is completed due to the liquidation or reorganization of the company and other reasons that are not related to the personal initiative of the employee, the employer is obliged to independently pay all the costs of transferring the funds of each employee to the NPF or Pension Fund.

The ideal period for terminating a contractual relationship is the end of the year in order to preserve the interest from the investment for the last year.

The procedure for transferring from a non-state pension fund back to the State Pension Fund

After the Pension Fund has approved the applicant’s request to transfer funds, the agreement with the non-state fund is subject to cancellation. It is worth noting that all changes regarding the calculation of funded pensions should be entered into a single register.

- Contact the nearest GPF branch. Another relevant body is the MFC. Pension Fund or MFC employees will have to carry out identity verification work.

- Postal forwarding. In this case, verification of the person’s authenticity is the responsibility of the person (Article No. 185 of the Civil Code of the Russian Federation). This can also be done by an authorized person of the Russian consulate if at the time of filing the application the interested person is outside the country.

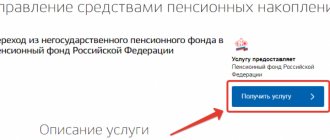

- Online electronic submission. To submit an application signed with an electronic signature for the transfer of funds, you must use the State Services website, which is located at gosuslugi.ru.

We recommend reading: How to sell a plot of land for a third child in 2021

Transfer of an organization to another NPF

Unfortunately, not all citizens and companies know about the principles of the pension system. Only every fifth citizen understands why and why they can transfer their savings to a new NPF. This points to the fact that organizations make similar mistakes by regularly changing NPFs without thinking about the consequences.

If you do not know all the features, the company may incur significant losses, such as:

- loss of part of the profit when transferring funds in the middle of the year;

- withholding tax in the amount of 13% if cash capital, by decision of management, is returned to the Pension Fund;

- costs for transferring funds to a new NPF.

Here you can find out how the funded part of the pension is formed.

The ideal option for the company is a transition no earlier than after 5 years of cooperation at the end of the financial year, so that all investment capital is preserved.

It is important to know! Do I need to switch to a non-state pension fund?

Pros and cons of switching from one fund to another

Switching to a non-state pension fund has a number of advantages and disadvantages, which we will talk about right now. Let's start with the positive characteristics:

- High interest rates.

- The right to independently form part of the pension.

- NPFs are protected from pension reforms that relate to retirement conditions, reductions in payments, etc.

- The work of NPFs is clearly regulated by law.

- Benefits when paying taxes.

- Transparency - all information about the work of a particular fund is open to the general public on the official website. In addition, you can access your account at any time, where all changes in the invested funds will be indicated.

- Low risk of fraud.

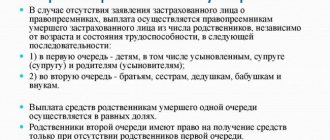

- The right to inherit part of the pension;

- The insured person can transfer capital to another fund, but it is important to take into account the disadvantages of such a transfer, which are indicated in this material in previous chapters.

- If the NPF does not make a profit for one of the reporting periods, then the fund is obliged to compensate the losses of the insured person at the expense of its own reserves.

- NPF invests funds only in reliable sources, the list of which is fixed at the legislative level.

The disadvantages include:

- There are no clear indicators for increasing pensions - the NPF interest rate is not fixed in the contract, since it changes annually.

- Low percentage of investment return.

- Invested funds cannot be withdrawn until retirement, except by heirs.

- The country's currency is used.

- The insured person cannot influence investment operations that are carried out within the fund.

- When a pension is assigned, a citizen is taxed on income from accumulated investments.

- Long term.

- Charging fees for asset management.

In this video, the President of NPF Lukoil-Garant, Erlik S.N. talks about the procedure for moving from one PF to another.

In conclusion, I would like to add that NPFs are currently operating, despite taking into account the funded part as part of the insurance share of deductions. The right to choose a non-state pension fund is assigned to every citizen despite a number of changes in the pension reform, at least in the next two years, until the pension reform is changed.

How to transfer from one NPF to another NPF

We have already figured out how often you can change NPF. Now it remains to understand how to transfer from one NPF to another NPF. It's no secret that representatives of various non-state pension funds often visit houses and apartments and offer to sign an application to transfer to their fund. If it has been more than five years since the last transition, then there is nothing to worry about - investment income will not be lost. If less than five years, income may be lost.

Transfers from one non-state pension fund to another fund will allow you to properly manage your future pension. Therefore, future pensioners need to regularly get acquainted with the offers of NPFs and manage their savings, transferring them from fund to fund. You can transfer at least every year, but not more often. Another thing is that in order not to lose money, it is necessary to make intervals between transitions with an interval of at least 5 years. If you make transfers annually, you may lose additional accrued interest received through the activities of one or another non-state pension fund.

We recommend reading: Benefits for federal labor veterans and working pensioners in 2021 in the Samara region