- home

- Reference

- Non-state pension provision

The number of non-state pension funds actively operating in the Russian Federation still remains large. The basic rule is to receive payments only upon reaching retirement age. Termination of a contract is a standard procedure, but it is better for a citizen to familiarize himself with some of the nuances in advance.

We will discuss in the article what methods you can use to withdraw the funded part of your pension from a non-state pension fund and where to send it after processing the return.

Is it possible to terminate an agreement with a non-state pension fund?

Most often, the reasons are the conditions specified in the agreement itself. For example, the presence of conditions under which all obligations between the parties are canceled. And in this case, a person really has the right to terminate a contract in which he is not satisfied with something.

There are other situations in which such actions become acceptable:

- Problems with the reliability of the organization. Reorganization and liquidation are procedures faced by a large number of small organizations. Therefore, when choosing, the main factor should be the position in the rating related to reliability.

- Profit. It affects how much money the client himself receives. For example, you should not trust a company if the indicated level is lower than current inflation.

Who can receive the funded part of the pension at a time

One-time payments can be withdrawn from a non-state pension fund if the conditions stipulated by the legislation of the Russian Federation are met. The citizen's age must meet the requirement: born in 1967 and older. The law provides for cash payments of the funded component in the event of:

- receiving a minimum old-age pension;

- participation in the savings co-financing program;

- monthly funded payment of no more than 5 percent of the old-age pension, taking into account the fixed part.

Citizens who have:

- certificate for maternity capital, used to increase private entrepreneurs;

- survivor's pension;

- disability related to disability;

- insufficient length of service for an old-age insurance pension;

- the right to social state pension provision.

- 9 medical services for which you will pay your money in vain

- Where are wages expected to rise after quarantine?

- Capital cupcake - step-by-step recipes and cooking technology with raisins according to GOST

Procedure

To withdraw the accumulated part of the funds from the NPF, you need to submit a package of documents. The list of securities is stipulated by the fund to which the citizen has entrusted the management of pension savings. To receive a one-time payment you must:

- Apply in person or through the official website of the NPF.

- Submit an application.

- Attach a package of documents.

- Register papers.

- Receive a receipt.

- Specify the deadline for making a decision.

- Wait for an answer.

Procedure for terminating the contract

The first step is a detailed study of the agreement itself, for which the non-state pension fund is the second party. Sometimes the documents do not describe any special conditions, so it is enough just to tell the partners about the desire that has arisen.

Citizens can withdraw funds and change NPFs, but not more than once a year.

The client must write a statement stating what needs to be done with the money stored in the current account.

Events can develop according to two scenarios:

- Transfer of funds to an account in another NPF.

- Transfer of money to a bank account owned by the client.

The application must accurately indicate the details used for the transfer. Then the NPF will not have problems or delays with the operation. Refunds must be completed no later than three months after all documents have been submitted. No matter what stage the contractual relationship is terminated, the rules remain the same.

Reference! All costs associated with such transfer are borne by the depositor. Additional payment of personal income tax is one of the responsibilities that almost everyone faces.

Types of payments

Federal Law No. 424 establishes the following types:

| One-time | Paid to insured persons entitled to:

|

| Urgent | Monthly payment for a period of more than 10 years with the possibility of early receipt for participants in the state co-financing program and persons who have allocated maternity capital to form a pension. |

| Cumulative | It is formed at the expense of the employer and additional contributions from the citizen himself on personal initiative. |

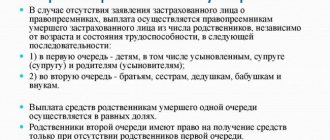

| In case of death of the recipient | You can receive funds for a deceased relative upon application or in accordance with the law. Payment of funds can also be made in accordance with the priority (first priority - children, parents, spouse, second - brothers, sisters, grandchildren, grandparents). |

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- Regions

This is interesting: Increase in social pension in 2021 for people with disabilities

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

What documents will be needed

The secretary must receive the following set of papers from the investor:

- SNILS.

- Passport or other identification documents.

- An order from another government fund for transfer if necessary.

Additionally, fill out a form with personal and contact information to date. Only after filling out this document can you sign an agreement with the new organization when the need arises.

Two copies of the termination agreement are required. One of them is given to the applicant.

Some organizations provide an option in which documents automatically expire. For example, if a citizen has not fulfilled his obligations by refusing to visit the institution to renew an existing contract.

Then the documents automatically lose their validity. There is no need to specifically contact the organization’s employees to complete the procedure. All previously accumulated amounts are transferred to the account specified in advance.

What questions are Pension Fund employees afraid of? Be sure to ask them

Summary:

Hello, dear readers!

I have a special relationship with the Pension Fund; for a long time I tried to get the pension I was entitled to, but at first they counted me almost 4 thousand rubles less than what was due. Now, having studied a lot of information, I want my knowledge and experience to be useful to others. And today I wanted to write about those questions that Pension Fund employees are afraid of like fire and really don’t like to answer. But they must be asked and a proper answer must be demanded.

Where to send funds after receiving

A citizen has the right to choose any management company for his transfers. If necessary, we also allow a reverse transfer of savings in favor of the Pension Fund. In this case, a trust management agreement is drawn up.

In this case, documents must be submitted no later than December 31 of the current year. Let’s assume the option of submitting documents through the State Services electronic portal, then you will need a passport and SNILS. But to fully confirm your identity, it is still recommended to visit the offices of regulatory organizations.

The procedure in the case of State Services will look like this:

- Register on the portal, or visit your Personal Account.

- Next, go to the services tab.

- Using the "Authorities" tab.

- Selecting the Pension Fund icon.

- Next, we need a section with the acceptance and consideration of applications from individuals.

- Another point is the transfer of savings from one management organization to another.

- All you have to do is click one button to receive services.

Next, an inscription appears informing you of the need to use an enhanced qualified electronic signature. Personal data in the following questionnaire is almost always entered automatically. You just need to select the division of the Pension Fund responsible for control in a particular case.

Another option is to visit the MFC. The procedure is slightly different from the previous one:

- Fill out an application with all the necessary details, including information on the current service organization and the company where the money is planned to be transferred.

- The documents are sent to specialists for further consideration.

- All you have to do is wait until the procedure is completed.

The transition to a new non-state pension fund also takes place without problems. The main thing is to choose an organization that fully complies with the requirements at the legislative level. On the PFR website you can always study registers that remain relevant at the moment.

Next, a new contract is concluded with the selected organization. It is enough to have a passport with SNILS to draw up a standard form of documentation.

The document becomes valid only after the full amount is transferred from the old management company. There are no restrictions unless the regulator imposes them in advance.

Important! In any case, the replacement of the insurer is carried out with the participation of the Pension Fund. An application signed with a qualified electronic signature must be submitted. The application is considered until March 1 of the following year maximum, although a longer period is possible. Notifications of a positive decision are sent to both insurers.

The procedure for paying the funded part of a pension from a non-state pension fund

Federal Law No. 360-FZ dated 07/03/16 “On the procedure for payments from pension savings” applies to citizens who have decided to form the funded part of their pension (NCP) in a non-state pension fund (NPF). The following payment options are available:

| Type of receipt | Conditions |

| Indefinite |

|

| Urgent |

|

| One-time |

|

| To the heirs of a pensioner |

|

- All elderly Russians will be tested for coronavirus

- Sodium hydroxide

- 6 ways to become slim after 50

Cumulative pension for citizens born in 1953-1967

Persons in this age group can form pension savings. These funds were formed from insurance transfers from employers made in the period 2002-2004. Previously, until 2014, the insurance premium for Russians younger than 1967 was distributed in fixed proportions:

- 6% – joint and several part (not reflected in the individual account of the insured);

- 10% – insurance part (on an individual account);

- 6% – funded part.

The funded component (6 percent) is not used to pay current pensioners; it is invested and can be transferred to legal successors. The following can receive the funded part of the pension at a time:

- Persons born in 1967 and younger when they are assigned an early insurance pension upon reaching age (old age).

- Citizens in whose favor in 2002-2004. insurance premiums have been paid for the funded part of pension deposits. Since 2005, deductions have ceased due to legislative changes. This condition applies to citizens born in 1953-1966. (male) and born 1957-1966 (female).

- Russians who participated in the state co-financing program when forming a pension. The program was open for entry during the period 01.10.2008–31.12.2014. Citizens who paid the first installment before January 31, 2015 are considered participants.

- Persons who have allocated maternity capital to form a future pension (only for women).

What payments are due?

If a Russian has savings in a pension fund, state or non-state, they can be obtained in several ways. According to Law No. 360-FZ of November 30, 2011, 3 types of payments are provided:

- unlimited (performed every month throughout the life of the pensioner);

- urgent (during the period established by the pensioner themselves);

- one-time (one-time payment).

After the death of a pensioner, his heirs can claim the funded pension of the deceased. Important: a lump sum payment is established under conditions strictly defined by legal norms. Pensioners, real and potential, born before 1967, unlike the younger generation, were deprived of the right to choose the type of pension formation.

- Which smartphones will not work with WhatsApp in 2021?

- 4 tips to combat swelling in diabetes

- Cure nail fungus quickly with folk remedies

In 2002-2005 their employers paid contributions to the funded component of the pension in accordance with the established mandatory procedure. In this category, such savings that have been accumulated for a short time are insignificant, and with a value of less than 5 percent, citizens born in 1953-1967 can receive savings provision in lump sum payments (based on Article 4 of Law No. 360-FZ of November 30, 2011).

Amount of pension savings

It is necessary to clarify the size of possible payments depending on the place of their formation. If the funds were transferred to the management of any non-state pension fund (abbreviated as NPF), then the pensioner should apply for receipt to a specific NPF.

If contributions were made to the Russian Pension Fund, this authority pays the funds. With this option, the MFC also considers the request for payment. If a pensioner does not know where the funds are located, this can be clarified at the territorial branch of the Pension Fund, through the State Services portal or the MFC.

Funded pension: how to receive a lump sum in 2020

Upon reaching the age required by law, an elderly citizen has the right to receive a pension benefit generated during working life. There are several types of pensions in the pension system, one of which is a funded pension. How to get one at a time? What conditions must be met? We will talk about this and much more in the article.

What is the funded part of a pension?

Contributions sent by the employer for the employee during the period of work, as well as investments form the funded part of the pension.

Payment of the funded component is carried out once a month from the moment the citizen officially registers the attained retirement age in a specialized organization.

Citizens are given the choice of a pension company in which savings will be created.

At the expense of the employee’s salary, funds are transferred every month in the amount of 22%, where 6% can go (if the person wishes) to savings.

A citizen has the opportunity to direct all 22% of salary deductions to form an insurance pension.

What does the law say?

The list of persons entitled to the right, conditions, terms and procedure for payment, and much more related to the funded pension is established by regulations: Federal Law No. 167-FZ, Federal Law No. 424-FZ, resolutions No. 1047 and No. 1048 (dated December 21, 2009). ). Due to numerous changes, you can familiarize yourself with the current editions on the legal systems.

Where to contact?

According to the law, each pensioner has the right to independently choose in which organization to create savings savings. This could be either the state Pension Fund or other companies that are not such.

In the case of a non-state pension fund, the funds received are used to create new profitable projects for the organization that bring profit; on the basis of this, the amount of payment for citizens is subsequently formed. Accordingly, the size of the funded pension is higher in comparison with the Pension Fund.

If funds are kept in the Pension Fund, then to make an appointment you should visit the branch of the organization at your place of residence with a package of all the required documents, and it is also possible to send it by post with registered notice.

Recently, the Multifunctional Center has become the most popular, which is also a point for accepting applications for payments.

Deadlines for receiving the lump sum funded part of the pension

The submitted application (appropriate form) for registration of the funded part is considered by employees within 10 days from the date of acceptance with a package of all required documents. If at least one is missing, a time period ( 3 months ) is allocated to provide the missing documents.

Based on positive results of consideration of the application, cash payments will be transferred within 2 months .

How much is the lump sum?

Persons whose age has reached the retirement age limit are paid at one time from their savings the amount accumulated throughout their life. However, the final decision on the amount of payment from savings remains with the Pension Fund employees.

Payment of the funded part of the pension to heirs in a lump sum

During his lifetime, every citizen has the right to choose heirs to whom savings savings will be transferred. For an official appointment, you will need to visit the Pension Fund to write a corresponding application.

If a citizen does not have time to complete these actions before biological death, then the funds, according to the normative act, will be distributed among all persons who are relatives of the deceased. The first applicants to receive payments are children and spouse.

In the absence of primary relatives, the others become successors.

In order for heirs to receive savings savings at a time, a personal (or through a representative, notarized) application to the pension organization is required no later than 6 months from the date of death of the citizen who formed the savings.

One-time payments to heirs will be made only if the insured citizen of retirement age died before the payment was made (or was issued but not realized).

Legal successors can also count on the balance of savings, which will be recalculated.

If a citizen received a pension in another form before his death (for example, an unlimited pension), the heirs in the event of the death of a relative do not receive savings in the form of cash.