So, what is the funded part of a pension? According to the reformers, NPFs and management companies should invest the received royalties in profitable projects, which will then bring profit. Typically, the rates on these deductions are higher due to rising inflation rates. This should allow not only to save the deducted funds, but also, by investing them profitably, to obtain a significant profit on them.

A little about reforms

Pension reform started in 2002. A whole package of documents was adopted to reform the Russian pension system, which was then repeatedly supplemented and changed. It was then that the term “funded pension” appeared. Until the beginning of 2008, the contribution rate was 20% and was divided into three parts: 6% - basic, 10% - insurance and 4% - cumulative. From 01/01/2008. Insurance – 8 and 6% – cumulative.

Private entrepreneurs pay 10% to insurance and 4% to savings.

- , the basic part began to be called the fixed part of the insurance - these are guaranteed payments, a kind of social standard, an obligation of the state to socially vulnerable segments of the population. Every citizen who has reached retirement age and has worked for more than 5 years can apply for this part of the pension.

- The insurance pension is that part of the contributions for the entire period of working activity, which is summed up and forms the pension capital of each worker. It is indexed annually by the state, which allows you to preserve the pension capital. This money is used to pay today's pensioners. The redirection of the base part in 2010 allowed the state to fulfill its obligations to citizens in full without attracting additional funds. Today, the amounts paid by employers do not allow it to be provided in full. And additional money is allocated from the federal budget to make payments. This is due to the difficult demographic situation, which assumes that for every 1 worker there is 1 pensioner. The reformers saw a way out of the difficult situation in transforming the insurance into a savings-insurance system.

- At the same time, such a concept as the funded part of a pension appeared. In contrast to the insurance part, which can be considered conditionally cumulative. The savings part represents “real money” that can be invested in a non-state pension fund or in a management company.

Where to transfer the funded part of the pension

Every citizen who has pension savings has the right to entrust their management to:

- Pension Fund of the Russian Federation by selecting:

- Management Company, conclude an agreement accordingly with the proposed investment program;

- Management Company - Vnesheconombank.

- Non-state pension fund (NPF).

You can easily change the Criminal Code every year, you just need to send the required request to the nearest Pension Fund branch.

What is the difference between NPF and management company? If the savings were entrusted to the management company, then the Pension Fund takes into account pension funds and determines the results of their investment. If the capital is entrusted to a non-state pension fund, then the accounting of funds, the amount and payments are regulated by the non-state pension fund itself.

Transfers of savings to a non-state pension fund may allow you to invest your savings more profitably and, accordingly, receive larger contributions in the future. Transferring money to a non-state pension fund is not that difficult; you just need to select a fund and submit an application for membership. Mainly, all NPF clients pay attention to the return on investment, this is the main indicator, and it is the most important.

NPF is obliged:

- Act in harmony with non-state pension provision on the basis of a non-state pension provision (NPO) agreement.

- Undertake the obligations of the insurer in accordance with the decree “On compulsory pension insurance in the Russian Federation.”

Many believe that joining a non-state pension fund is too risky and that this step could lead to the loss of all savings. This is not entirely true. Many non-state pension funds have been operating for quite a long time and have managed to prove themselves well and have shown their reliability over many years. In addition, the activities of NPFs are strictly controlled by the state.

NPF is called upon to:

- Improve the quality of service for pensioners and insured persons.

- Make the pension system as efficient as possible.

It is quite difficult to navigate all the funds offering their services. Having seriously studied the issue, you can make an objective, and most importantly, the right choice. The most important indicators that you should pay attention to are the reliability and profitability of the fund. If these indicators are high, then a rapid increase in savings is guaranteed.

Is it necessary to transfer the savings portion?

Such actions will not only preserve, but also increase pension savings. Here the risks of losing money increase, since if you invest it incorrectly, you can lose the entire amount of interest; the state only compensates for the money invested.

Control over the investment of deductible funds by a non-state pension fund or management company is carried out by the payer himself - these can be electronic reports, or in paper form sent once a year. Having decided to change the management company, you will need to submit an application to the Russian Pension Fund, which will become the basis for moving to another management company.

But there is one nuance here: the state annually carries out indexation for insurance contributions, aimed at increasing inflation, but for insurance deposits there is no such indexation.

And one more thing - in the event of bankruptcy of a non-state pension fund or management company, the state guarantees the return of only the invested amount. Here the payer takes on the risks. He may gain more, or he may lose.

You can receive the entire accumulated amount either immediately or in parts. So, after reaching retirement age, you can write a corresponding application and receive the entire amount within 90 days or receive it in several installments over a certain period. If, for example, the insurance pension is small, you can receive it as an additional payment to the main one.

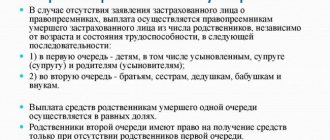

The funded part of the pension is personal funds and in the event of the death of the payer, it passes to his heirs.

To receive funds, it is enough to provide the necessary documents.

Many workers did not decide or did not want to choose. Their savings part is located in the Pension Fund. The ability to choose independently where to invest the funded portion of your pension is valid until the end of 2015. After this, by default, all funds will be sent to the Russian Pension Fund. In addition, funds from the management company will also be redirected to the Pension Fund. However, it is difficult to say what this will mean for those citizens who have entered into such agreements.

Where to transfer the funded part of the pension

It is quite difficult to navigate all the funds offering their services. Having seriously studied the issue, you can make an objective, and most importantly, the right choice. The most important indicators that you should pay attention to are the reliability and profitability of the fund. If these indicators are high, then a rapid increase in savings is guaranteed.

It is worth clarifying that the most profitable funds are not always very popular and are the most reliable. An example is the Empire fund, which offered the most attractive conditions in 2015. Their yield was 24%. But Expert RA agents withdrew their reliability rating back in 2008.

Translation methods

In the meantime, there are three options for investing the funded portion of your pension:

- Leave the deducted amounts in the Russian Pension Fund ; for this you do not need to go anywhere or write anything. True, there will be no information about where and how these amounts are invested, but there is hope that they will be saved by retirement, because the state is the guarantor of their safety.

- Not a budget pension fund. Anyone who signs an agreement with him transfers his savings into his ownership and will be able to keep the insured amount. These are reliable funds that operate with low risk, since the NPF can only invest in government and mortgage securities, it is unlikely that it will be possible to significantly increase savings. It must be remembered that the state does not guarantee the return of this money in the event of bankruptcy of the NPF.

- The most profitable, but also the most risky is to entrust your contributions to a management company , which invests them in potentially highly profitable stock market instruments. And, although there is the highest risk of non-repayment of funds, the state acts as a guarantor of the principal amount.

Who should

The Pension Fund offers the condition of payment from this part upon accumulation of an even larger amount. Thus, the funded pension will be accrued only to those pensioners whose level is 20% higher than the established minimum subsistence level for a pensioner. On average, savings should be no less than 440 thousand rubles. In addition, every year the Ministry of Labor increases the survival period. From 2021, this period will no longer be 21 years, but 27 years.

Freezing idea

This can be done by a citizen who has retired. People can retire before retirement age for various reasons, for example, military personnel or ballet dancers. In other cases, pension savings cannot be withdrawn. Due to the fact that pension funds accrue the income from the funds brought from the funded parts of pensions once a year, on March 1, it is best to withdraw money after this date.

The second method involves transferring the right to use royalties to a management company. It carries out financial management of its clients' deposits (trust management) in accordance with its charter.

About choosing a fund

The so-called “silent people” can still place their part of the funded pension on a non-state pension fund; they are given this opportunity until the end of 2015. But here you need to think about where it is better to invest your money.

When choosing a non-state fund, you need to take several indicators into account. Such funds, as a rule, make information about their activities publicly available and this is the first indicator of reliability.

Among others to consider:

- Average pension return over several years. The indicator for one year may differ significantly from its predecessor, but the average, say for 5 years, will be an indicator of successful investment.

- The reliability indicator has been calculated for more than one year. And although this is a very relative quality for people, NPFs have their own reliability rating. The highest score is A++. When considering applicants, this rating is definitely worth looking at.

- One of the important criteria is the duration of the fund’s existence in the services market. Everything is clear here: the longer a fund exists, the more reliable it is.

- It is also important to consider the amount of funds at the disposal of the fund. Thus, one of the tricks of not very honest funds is to claim high returns, but at the same time they have at their disposal the savings of only 40 clients. The more clients have already entrusted their funds to this fund, the more likely it can be trusted.

Where is the funded part of the pension transferred and where is it stored? How can I find out which fund I am in?

Also, companies with lower ratings (B+, C+) do not perform well in the market. But this indicator reflects the main shortcomings of such organizations, for example, a low reliability indicator, minimal profitability in a given reporting year, etc.

The purpose of transferring a funded pension to a non-state pension fund

The easiest way to find out where my pension money is allocated in addition to mandatory insurance payments is to send a request online. You should be careful, as there are many fictitious sites on the Internet. They ask a person to transfer a certain amount of money in exchange for information about the NPF. Non-state pension organizations also provide their clients with all the necessary data via the Internet. The client has the right to send a request to the NPF email and receive a response. Some organizations have created personal accounts on official websites where citizens can check their accounts. You can track where your pension savings money goes through government services. The government services portal contains information not only about pension savings. There you can find out about all the services provided by the state in Russia. To do this, you need to go through the registration procedure on the site. A person chooses his own login and password, which only he controls. How can I find out where my pension savings are located through the portal? To begin, enter the name “Public Services Portal” in the search engine. The registered user opens the portal start page and, following the instructions, creates a request for information.

We recommend reading: Benefits in Smolensk for Russian labor veterans

Citizens of the Russian Federation have the right to independently manage one of the parts of their pension—the funded one. By regularly transferring contributions to your account during your working life, you can increase the amount of your future benefits. Transferring pension savings to a non-state pension fund has both positive aspects and a certain risk. The choice of a financial institution must be approached responsibly, having studied the rating of funds, their reliability and profitability. Read more about this in our article.

Translation algorithm

There is very little time left to transfer the funded part of the pension and therefore you need to hurry to make it before December 31, 2015. After this date, all savings funds of the “silent people” will be added to the insurance part of the pension.

In order to still transfer funds to a non-budget fund or management company, you need to do the following:

- View the necessary information and choose where to invest your savings funds.

- Contact the selected NPF first for consultation, and after receiving all the necessary information, consider it, carefully study the draft agreement, check the availability of the necessary documentation and licenses.

- Conclude an agreement with a non-state pension fund or management company for services or compulsory pension insurance.

- Contact the client service of the Russian Pension Fund at your place of residence to submit an application for choosing a non-state pension fund or a management company.

The funded part of the pension: where is it better to transfer?

The rating we propose in this article is not advertising and is based solely on information from the Central Bank of Russia. We selected the ten largest non-state pension funds in terms of the number of depositors and the profitability of pensions out of 68 for which the financial regulator has verified data. Management companies were not taken into account in the review.

NPFs can be divided into groups depending on:

- own property;

- capital and reserves;

- property to ensure statutory activities;

- pension reserves and savings (at book value or market value);

- the number of insured citizens and the number of persons receiving pension payments;

- profitability of investing savings.

In terms of the number of clients, it is ahead of Sberbank NPF. This is explained by the fact that the company has the widest network of branches throughout the country. The ranking of the best will look like this:

Number in the rating

Number of clients (people, according to the Central Bank of the Russian Federation for 9 months of 2021)

In terms of profitability, the top 10 looks completely different. But it is by profitability that we primarily evaluate the fund, since managing the funded part of the pension is designed to generate income):

Number in the rating

NPF name

Profitability of investing pensions (%, according to the Central Bank of the Russian Federation for 9 months of 2021)

Nuances and tips

You can refuse the funded portion by default if you have not previously written an application to transfer it to a non-state pension fund or management company. In this case, it will be attached to the insurance.

If an application for transfer to a non-state pension fund has been written at least once. You need to come and write a statement refusing such transfer. And the savings part will also be attached to the insurance part.

Only persons born after 1967 can use the funded system ; citizens born earlier are deprived of this opportunity.

By remaining “silent” and allowing the transfer of the funded part of the pension to the insurance one, you can simply work longer at a higher salary - this will make it possible to receive a pension approximately 45% higher when you retire five years later. At the same time, the size of the insurance pension will also increase, because savings contributions will be transferred here.

online registration in 5 minutes

The freezing of funded pensions allowed the state to attract significant sums of money to solve current problems. It is planned to extend it for at least another couple of years. This step makes it possible to ensure the financial support of persons who have already reached retirement age. But for citizens who are of working age today, this situation does not bring anything good.

Who is entitled to the funded part of the pension?

However, in addition to the insurance pension, there is also a funded pension. It is formed from the same contributions. At the same time, funds in the amount of 6% are allocated to the funded part of the pension, while 16% goes to the insurance part. In general, citizens, with a few exceptions, choose for themselves whether to form the funded part of their pension payments or not.

This is due to the fact that on January 1, 2021, a federal law came into force, which regulates that the acceptance of applications from insured persons to transfer to a NPF or Pension Fund, including early transfer, as well as notifications about replacing an insurer and refusing to change an insurer, is now carried out by two ways. First: in the form of an electronic document through the portal of state and municipal services. Second: by contacting the client services of the Russian Pension Fund in person or through a representative. Neither NPFs nor MFCs accept applications of such content.

If you formed your pension savings in a non-state pension fund, then you should contact this fund for payment of funds. The question in what form it will be assigned - as a lump sum, fixed-term or funded - will be decided when, as a result of calculations, it becomes clear whether the size of the funded pension exceeds the 5% threshold of the total amount of the insurance and funded pension combined. If the amount of the funded pension is less than the specified share, then the amount of pension savings is assigned in the form of a lump sum payment.

Subscribe to news

Be careful! You can transfer pension savings without loss of investment income no more than once every 5 years. For example, in 2021, transferring pension savings without loss is beneficial only for those citizens who last wrote an application to choose an insurer in 2021. The same goes for “silent people”, that is, those who have never transferred their pension savings. They are recommended to apply for early transfer to the NPF only in 2021. If the decision to change insurer is made earlier than the specified period, part of the investment income will be lost.

In general, the state, private management companies and non-state pension funds worked in the same way: results fell and rose synchronously, usually along with inflation. Two crisis periods are visible when inflation rose and yields fell: 2021 and 2021.

We recommend reading: How to calculate vacation in working days

I have been working in the pension insurance system for ten years and have been following the main changes. In this article I will tell you about the results of compulsory pension insurance. I will explain why a funded pension is needed, where it is located, where and why it can be transferred in 2021, and how it affects your future pension.

What is a funded pension?

The best non-state pension funds are slightly ahead of price increases. In general, the differences are small; over a long period of time, most funds work the same - they give a return of 5-10% per annum. There is no gap of tens of percent between them. This is because non-state pension funds cannot invest all their money in shares of one company or buy as much currency as they want.

As noted earlier, employers pay 22% of their employees’ salaries to the Pension Fund, 6% of which was used to form pension savings for their employees. In 2021, the Government was forced to freeze the funded part of pensions due to sanctions imposed on the country. The freezing of funds means that now 6% is not sent to the NPF, and is also spent on payments to today's pensioners. The government plans to abandon mandatory payments for the funded part of pensions and invite citizens of the country to independently form an additional funded part of their pensions. Employers' insurance contributions will be retained to form payments to today's pensioners. The funded part will be formed by the Russians themselves.

Options for further pension reform

The IPC will be sent to non-state pension funds, which will invest money in projects that will bring additional income. The pension reform is being carried out so that the younger generation, who are just entering the workforce, understands how to form an additional pension before old age, in addition to the one that will be paid by the state. The insurance pension will continue to exist. The IPC will become an additional payment to Russians who have reached retirement age. The size of this pension will entirely depend on the citizens themselves, who will not only determine the amount of contributions, but also choose a non-state pension fund for investing funds.

Where will the IPC be sent?

The majority of the country's citizens, due to the fact that the first part of the pension reform was carried out with an increase in the retirement period, which was negatively received by the population, believes that the already accumulated part of the pensions will be reset to zero. The head of the Ministry of Finance A. Siluanov claims that nothing will be reset, and savings will be carried out to the funds already formed earlier. It is possible to carry out two options with previously accumulated funds:

Today, the old-age payment of any citizen of Russia consists of two parts: insurance and savings. And we can dispose of the latter up to certain limits. No, you won’t be able to take it home and save it there - only special organizations - non-state pension funds, each of which has a license for such activities - have the right to manage this part.

Where can you transfer pension savings: overview of the main options

1. Rules and procedure for deductions.

Before transferring pension savings to one of the funds, you should understand what stages the transfer procedure involves. It is worth noting that the procedure and rules for its implementation are different for those who have not yet managed their funds contributed to the Pension Fund and for those who have already managed to transfer the funded part of their pension to a management company or non-state pension fund.

- Citizens who are interested in the opportunity to earn money by investing pension savings can transfer the existing amount to a management company, state management company or non-state pension fund.

- The amount of contributions by the employer to the Pension Fund will remain the same - 22%. However, 6% will be sent to the organization specified by the citizen when applying for the transfer of funds.

- In order to transfer the funded part of a pension to a non-state fund or management company, the insured person must submit an application to both the Pension Fund of the Russian Federation and the organization that wants to entrust the management of their funds.

An application for the Pension Fund of the Russian Federation must contain all the details of a non-state pension fund or management company, postal and legal addresses, personal account number and other data. Therefore, you should prepare for the transfer procedure in advance by finding out the necessary information.

2. Three translation options.

In Russia, there are many organizations and funds involved in investing pension savings of citizens; we will provide a list of the most suitable companies for transferring funds below. Now let’s look at three main options where you can transfer your money.

- Non-state pension fund (NPF).

As a rule, non-state PFs create financial institutions or companies. Their activities are regulated through Federal Law No. 75, which was adopted in 1998. The latest edition of this regulatory document is dated 2015. To transfer pension savings to a non-state pension fund, you need to submit an application and conclude a contract (agreement).

- Management company (MC).

Management companies perform several functions, within the main one they control and manage assets, property, deposits and other material assets entrusted to them by clients. The document regulating the functioning of management companies is Federal Law No. 156-FZ of 2001. The latest edition was published in 2015. You can transfer the funded part of the pension to the management company by submitting an application to the Pension Fund of the Russian Federation with the personal account number of the insured person.

- State Pension Fund of the Russian Federation (PF RF).

The last option is not to arrange a transfer of funds, entrusting them to a state pension fund, which will not just store savings, but increase them by charging interest at high rates through smart investment.