What does VTB offer today?

VTB Bank is one of the largest and most reliable financial institutions in Russia. It operates with government support. For 2020, the range of deposits includes four deposits + a type of one account intended for storing money. Today they have the following names:

- Profitable;

- Refillable;

- Growth time;

- Comfortable;

- Savings account.

Before making a final choice, pensioners need to familiarize themselves with the conditions. The interest rate, term and ability to manage the account deserve special attention.

Types of deposits in VTB Bank for pensioners today

VTB Bank is one of the largest and most reliable banks in the country, as it operates with the support of the state. In 2021, VTB Bank’s line of deposits consists of four deposits, plus one type of account for storing funds. Let's list the types of deposits for pensioners.

- Maximum.

- Refillable.

- Comfortable.

- Profitable.

- Savings account.

A pensioner should review the terms of deposits before making a choice. Particular attention should be paid to interest rates, the possibility of carrying out incoming and outgoing transactions and the term of the deposit.

Advantages of VTB deposits

The reasons why pensioners should contact VTB Bank to open a deposit are as follows:

- High and favorable interest rates;

- The pensioner himself chooses the systematicity and method of receiving income from the interest received;

- Variety of amounts, terms and options for replenishing and withdrawing funds;

- 24-hour online monitoring of deposits, option for managing funds in your personal Internet banking account;

- Maximum investment protection (each deposit is insured for up to RUB 1,400,000).

In addition to all of the above, VTB 24 offers pensioners a special service - drawing up a power of attorney or testamentary disposition for a deposit. This is necessary so that another person can make a deposit.

VTB 24 deposits for individuals in 2018 for pensioners

VTB 24 offers several options for opening an account and depositing funds, each of which can be beneficial depending on certain parameters. The main ones that distinguish some deposits from others are the terms and sizes of investments, based on which the interest rate fluctuates - thus, each pensioner has the opportunity to choose the best option for himself on the conditions that will be most acceptable to him.

Free legal consultation by phone:

8

Since there are no special offers on deposits exclusively for pensioners, the most suitable options are considered in this matter: “Comfortable”, “Savings” and “Profitable”.

Interest rates on deposits

Interest on deposits in VTB 24 in 2021 for pensioners varies depending on the type chosen. The most convenient to use is “Comfortable”. Its conditions allow you to constantly have access to investments, replenish them or, conversely, withdraw funds. The interest rate on the investment in question differs depending on its size and term, as well as on the method of creating the account. Below is a table with current data for 2021.

These interest rates are relevant when opening a deposit in rubles. For US dollars, the interest rate fluctuates in the range of 0.1 - 0.6%, for the European currency - 0.1%. “Accumulative” is convenient for constant replenishment; when you move to a certain amount, the interest certificate also increases.

The interest rate in US dollars fluctuates between 0.1% and 1.3%, for euros the rate is still 0.1%.

In both cases presented, upon early closure, interest is paid at the demand rate.

The “Profitable” deposit is positioned as the most optimal for receiving passive income.

For US dollars the rate varies between 0.1 - 1.61%, for euros it remains at 0.1%. When closing an account after 181 days, the payment percentage is 0.6 of the original rate specified when opening or extending the deposit.

All submitted deposits can be registered to a third party. Also in all three options there is the possibility of automatic renewal, no more than two times.

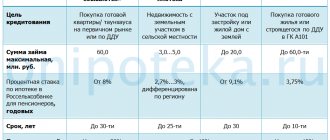

Conditions for obtaining a loan from VTB Bank for 24 pensioners

VTB 24 does not provide separate programs for people of retirement age in matters of lending. In this regard, the same principles apply that are relevant for the rest of the population, that is, the primary condition for issuing a loan is official employment, otherwise there will almost certainly be a refusal. However, there is always the opportunity to try to resolve this issue on an individual level.

The advantage will be the possibility of pledging real estate or a guarantee; in these cases, the chances of a successful loan is significantly increased.

Today, the main conditions for obtaining a loan are:

- positive credit history;

- permanent residence in the region served by the bank;

- documents confirming income - 2-NDFL certificate or completed bank form;

- the maximum age at the time of loan repayment should not exceed 70 years.

To obtain a larger loan, additional documents may be required, such as a work book. It will also become necessary to purchase one of the bank's services. The application is reviewed within one business day and if the answer is positive, the money is issued in cash or to a credit card.

For military pensioners

For military pensioners, VTB 24 provides profitable, state-regulated lending opportunities. The lending rate ranges from 8-11%, the term can be calculated from three to 25 years, provided that at the time of repayment the borrower’s age does not exceed 45 years.

This loan provides a mortgage for military personnel working on a contract basis. The initial payment under the terms of the contract must be at least 10% of the cost of the purchased housing.

Interest and conditions on VTB deposits for pensioners in 2020

The interest rate at VTB for pensioners is currently high and reaches up to 8.5% per annum. Deposit programs have flexible conditions; any individual can find something worthwhile for themselves. It is necessary to choose a program based on all characteristics, starting from the minimum amount and ending with the possibility of early termination of the contract on preferential terms.

"Profitable"

The “Profitable” deposit fully lives up to its name. The terms of the down payment amount are similar to the “Replenishable” deposit. Partial withdrawals incur a loss of interest, and replenishing the account is prohibited.

Conditions

| Deposit term | From 3 to 61 months. |

| Minimum amount | From 30,000 ₽ / 500 $/€ via VTB Online, from 100,000 ₽ / 3,000 $/€ in the branch |

| Refill | Forbidden |

| Partial withdrawal | Forbidden |

| Interest accrual | Once a month interest is paid or the rate is capitalized |

Once a month, VTB Bank will pay interest to the master account or capitalize it. The interest rate is calculated according to the data from the table:

| Currency | ₽ | $ | € |

| Term | Interest rate (nominal + capitalization) | ||

| 3-6 months | 4.65% (+0.02) | 0.30% (+0) | 0.01% |

| 6-13 months | 5.30% (+0.06) | 0.80% (+0) | |

| 13-18 months | 5.30% (+0.14) | 1.10% (+0.01) | |

| 18-24 months | 5.30% (+0.20) | ||

| 24-36 months | 5.15% (+0.26) | 0.90% (+0.01) | |

| 36-61 months | 5.05% (+0.39) | 0.75% (+0.01) | |

Note. The interest rate in European currency is always 0.01%.

"Replenishable"

The deposit is multi-currency. It can be replenished throughout the entire period, with the exception of the last month of its validity. VneshTorg Bank offers its clients the following conditions:

| Deposit term | From 3 to 61 months. |

| Minimum amount | From 30,000 ₽ / 500 $/€ via VTB Online, from 100,000 ₽ / 3,000 $/€ in the branch |

| Refill | Refills allowed. The non-cash replenishment amount starts from 1 conventional unit for a deposit opened in the Internet bank. When replenishing an account opened at a branch, the minimum amount is 15,000 ₽ or 500 $/€. |

| Partial withdrawal | Forbidden |

| Interest accrual | Once a month interest is paid or the rate is capitalized |

Interest rate

| Currency | ₽ | $ | € |

| Term | Interest rate (nominal + capitalization) | ||

| 3-6 months | 4.35% (+0.02) | 0.01% (+0) | 0.01% |

| 6-13 months | 4.90% (+0.05) | 0.35% (+0) | |

| 13-18 months | 4.80% (+0.12) | 0.70% (+0) | |

| 18-24 months | 4.80% (+0.17) | ||

| 24-36 months | 4.65% (+0.21) | 0.50% (+0) | |

| 36-61 months | 4.45% (+0.30) | 0.01% (+0) | |

"Time to Grow"

Opens exclusively in ruble currency without an account management option. The initial investment has nothing to do with this option; a pensioner can deposit any amount from 30,000 rubles into his account and receive income only at the end of the year or at the end of three years.

Conditions

| Deposit term | For 6 or 12 months. |

| Minimum amount | From 30,000 ₽, regardless of the opening method |

| Refill | Forbidden |

| Partial withdrawal | Forbidden |

Interest rate

| Opening method | 6 months | 12 months |

| VTB - Online | 6.22% (+0.08) | 6.12% (+0.18) |

| VTB Branch | 6.07% (+0.08) | 5.98% (+0.17) |

This is the most profitable deposit for pensioners among the programs provided by VTB Bank.

"Comfortable"

The deposit gives full access to the funds stored in the account. The terms of the agreement allow you to perform incoming and outgoing transactions an unlimited number of times.

Conditions

| Deposit term | From 6 to 61 months. |

| Minimum amount | From 30,000 ₽ / 3,000 $/€ via VTB Online, from 100,000 ₽ / 3,000 $/€ in the branch |

| Refill | Refills allowed. The non-cash replenishment amount starts from 1 conventional unit for a deposit opened in the Internet bank. When replenishing an account opened at a branch, the minimum amount is 15,000 ₽ or 500 $/€. Last payment one month before the end of the term. |

| Partial withdrawal | Allowed to film. Withdrawals are allowed within the amount exceeding the minimum balance. The minimum amount is 15,000 ₽/500 $/€ for a deposit opened through a branch, 1 cu. for a deposit opened through VTB - Online. |

| Interest accrual | Once a month interest is paid or the rate is capitalized |

The table contains all rates (nominal and with capitalization):

| Currency | ₽ | $ | € |

| Term | Interest rate (nominal + capitalization) | ||

| 6-13 months | 4.00% (+0.03) | 0.20% (+0) | 0.01% |

| 13-18 months | 4.00% (+0.08) | 0.55% (+0) | |

| 18-24 months | 4.00% (+0.12) | ||

| 24-36 months | 3.95% (+0.15) | 0.25% (+0) | |

| 36-61 months | 2.50% (+0.09) | 0.01% (+0) | |

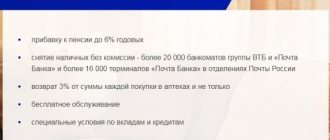

Savings account

A savings account allows a pensioner to store an unlimited amount of funds in any of three currencies to choose from. Interest will be accrued on the account balance every month. An unlimited number of deposits and withdrawals are allowed.

For people of retirement age who have a VTB Multicard, a financial organization can offer special conditions with increased rates on a savings account in ruble currency. To do this you need:

- Connect the “Savings” option to your debit Multicard;

- Open a ruble savings account;

- Place funds on it;

- Buy with a card.

The increased income on the savings account is summed up from the nominal rate. 0.5%, 1% and 1.5% per annum are added to it, depending on purchases made with the “Savings” option enabled. The nominal rate depends on the period for which the funds are placed. Without the Savings option, the bet will look like this:

| Currency | ₽ | $ | € |

| Term | Interest rate, nominal | ||

| 1 month | 4.0% | 0.01% | 0.01% |

| 3 months | 5.0% | 0.5% | |

| 6 months | 5.5% | 1.0% | |

| 12 months | 6.0% | 2.0% | |

On topic: VTB Bank Multicard - All useful information in one click.

VTB 24 website - official website of deposits for pensioners for 2021

- "Comfortable" . The most functional and convenient product presented by the bank. The minimum amount is 100 thousand rubles, the maximum is 3 million rubles. Placement for 6-50 months. Minimum balance – 200 thousand rubles. The rate depends on the terms: from 180 days - at 4.1%, from 1102 days - at 1.9%. Interest is calculated monthly. They can be capitalized or transferred to a current account. In this case, it is possible to withdraw money partially (from 15,000 rubles). In case of early closure, payment is made in accordance with accrued interest. You can deposit additional funds no later than 30 days before the end.

- "Cumulative" . Investment for persons who can afford to deposit an amount of 100 thousand rubles. maximum limits are 30 million rubles for a period of 3-60 months. The minimum balance must be at least 200 thousand rubles. Annual rate – 91 days – 6.95%, 1102 days – 2.75%. In this case, it is unacceptable to withdraw money throughout the duration of the deposit. Additional contributions can be made in an amount of at least 30,000 rubles. Capitalization and transfer to another account is provided on a monthly basis at the end of the billing period. Early payment implies the accrual of the remaining rate when the client contacts the bank.

- "Profitable" . An excellent offer through which you can accumulate money on favorable terms for clients. The size must be at least 100,000 rubles and no more than 30 million. Placement is possible for 3-60 months. Reduced balance – 200,000 rubles. Calculation of the annual rate – 91 days – 7.4%, 1102 days – 3.1%. In this case, it is also impossible to withdraw funds in advance. There are no additional fees. It is possible to capitalize funds and withdraw them to another account. If closed early, the rate is reduced to 0.6%. This is not profitable, so it is not recommended to choose this type of investment for those people who are not confident in their capabilities.

VTB deposits for individuals 2021 today for pensioners are presented on general terms. Regardless of the chosen program, you can use the additional extension function, but no more than 2 times throughout the entire period.

Conditions for early termination

After early termination of the contract, interest is paid according to the demand rate, except for the “Beneficial” deposit.

The following preferential conditions apply:

- If the funds on the account were held for less than 6 months, then interest is accrued and paid at the demand rate;

- If the funds located on the account have been in the account for 6 months or more, then interest is accrued and paid at a rate equal to 0.60% of the rate established for the deposit after the conclusion and extension of the agreement.

Main types of deposits

Available ways to save money for individuals in 2018 are no less relevant for pensioners, as they offer significant benefits to clients in the older age category. The advantages include different schemes for making a profit.

The user himself decides whether he will use interest payments during the contract period or use them to increase the main investment account.

Deposits offered for individuals in 2021 are as follows:

- "Cumulative";

- "Comfortable";

- "Profitable."

Next, we will consider in more detail the terms of registration and interest on deposits offered by VTB Bank.

"Cumulative"

The name of the deposit “Accumulative” indicates possible ways to invest funds.

The owner is allowed to replenish deposits with an amount not less than the established limit, at any time convenient for the client. At the same time, partial withdrawal of a certain amount of the deposit is not allowed.

Similar conditions apply to people under retirement age. It is known that such a scheme allows you to quickly accumulate considerable funds. This statement is one of the reasons why pensioners often like this requirement.

| Duration (days) | Interest rate |

| 181 | 6,45% |

| 395 | 6,00% |

| 546 | 5,60% |

| 732 | 5,35% |

| 1102 | 2,75% |

In order to open a “Savings” deposit in VTB, the user must adhere to certain points:

- The duration of the contract must be a minimum of 3 months (maximum 5 years);

- The down payment should be based on the amount of 200,000 rubles. If the deposit is made via the Internet, then this parameter can be 2 times less, at the request of the client;

- It is allowed to open a deposit for third parties. This opportunity is especially important for parents and grandparents who want to support their loved ones;

- Deposits to the main account should not be less than 30,000 rubles or 1,000 currency units (for a foreign currency deposit);

- Automatic prolongation of the activity of the deposit investment is possible 2 times;

- Expenditure transactions are prohibited. Since the owner will lose part of the expected savings.

If all rules are followed, the accrued interest may fluctuate between 2.75-6.69% per annum. In addition, the period for which the contract was concluded and the capitalization of monthly profits are essential.

"Comfortable"

The “Comfortable” deposit investment allows the client to easily manage the movement of his funds during the contract period. The user has the right to replenish and also withdraw the required amount upon request.

This pension contribution has its own conditions:

- The period for its registration is from 6 months to 5 years;

- The ability to withdraw funds up to a fixed balance without interest losses.

| Duration (days) | Interest rate |

| 181 | 4,10% |

| 395 | 4,00% |

| 546 | 3,85% |

| 732 | 3,80% |

| 1102 | 1,90% |

The remaining rules for drawing up the agreement are identical to the “Accumulative” deposit. But the interest rate differs. Its indicator for 2021 for this deposit accumulation of funds is in the range of 1.90-4.13% per annum. At the same time, many pensioners will appreciate the opportunity to freely use deposit funds. In addition, monthly interest payments are a pleasant addition to the budget, which will always find its use.

"Profitable"

A deposit in VTB with a high monthly interest is called “Profitable”. You can acquire this method of accumulating funds for a period from 3 months to 5 years.

The “Profitable” deposit is also the most suitable type of deposit for clients of retirement age.

It provides for capitalization, as well as regular payment of interest income to the account. The size of this amount can range from 3.1% to 7.14%.

| Duration (days) | Interest rate |

| 181 | 6,90% |

| 395 | 6,75% |

| 546 | 6,40% |

| 732 | 6,05% |

| 1102 | 3,10% |

"Investment in the future"

The deposit has a fixed income, which contributes to the accumulation of funds in 2021.

| Interest rate | 4,96% |

| Sum | from 30,000 ₽ |

| Term | 91-730 days |

| Deposit replenishment and withdrawal |

|

| Payment and capitalization % | capitalization % |

Terms and conditions of the “Investment in the Future” deposit

• Free transfer of funds to a deposit in VTB Online from a card of any bank. • There are no additional fees. • Expense transactions are not provided. • Monthly interest accrual with capitalization (interest remains on the deposit) or payment to the account. Interest is paid on the day of the month corresponding to the day the deposit is opened.