The essence of the “Pension Plus” deposit

People of the old school are accustomed to not trusting banks and keeping money at home “under the mattress.” But inflation does not stand still and money lying at home reduces its value .

So that you do not lose your savings, but, on the contrary, exaggerate them, Rosselkhozbank has created deposits for pensioners.

In essence, such a contribution is no different from any other. You, like other clients, can choose the period for which savings can be deposited, the type of deposit and the method of interest payment .

“Pension Plus” from Rosselkhozbank is very beneficial for pensioners because it has advantages over regular deposits:

- For pensioners, the minimum amount is very low .

- Such a deposit has a higher interest rate .

- After the expiration of the term, the contract is renewed automatically.

- There is no need to make a regular contribution.

What is the most profitable Rosselkhozbank deposit for pensioners - conclusions

On this page, correspondents of the Business Information Agency Top-RF.ru reviewed the deposit programs of Rosselkhozbank for pensioners and ordinary individuals. Which one is the most profitable?

If we consider only special offers for pensioners, then the choice is not great. Let us remember that there are only three of them. But they cover almost the entire range of customer needs.

1 “Income pension” has a high interest rate and a wide choice of investment terms;

2 “Pension income” gives the client the opportunity to replenish his bank account;

3 “Pension Plus” allows you to freely use money: replenish and withdraw funds without losing interest.

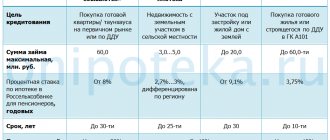

Now let’s compare their returns for the same amount and investment period. Let’s invest 100,000 rubles for 395 days and see which investment is more profitable.

| Bid | Contribution |

| 5.3% | “Profitable Pension” (interest payment at the end of the term) |

| 5.15% | “Profitable Pension” (monthly interest payment) |

| 4.3% | “Pension income” (monthly interest capitalization) |

| 4.0% | "Pension Plus" |

Accordingly, if you need the maximum percentage, then it is better to open the “Income Pension” deposit. Of course, you won’t be able to top up your account and partially withdraw money without losing income, but the interest rate is very profitable. In addition, you can choose a suitable period and method of interest payment.

See also high-interest deposits in Post Bank >>

Terms of deposit in Rosselkhozbank

If you want to make an investment in Rosselkhozbank, then find out the conditions for the “Pension Plus” deposit:

- Bring your passport if you are a woman and you are already 55 years old or if you are a man, then you must be 60 years old . If there are two months left before your birthday, then you can also use the deposit service.

- If you have not reached retirement age, but are already a pensioner, you will simply need to present a pension certificate .

- The minimum down payment amount is not large - only 500 rubles .

- You can withdraw money during the validity period , but the minimum amount of RUB 500 must always remain in the account.

- Partially withdraw money, possibly without losing the accumulated interest.

- You can deposit money from a minimum of 1 ruble .

- If you terminate the contract before the end of its term, you will only receive the “On Demand” rate, which is 0.01% .

- The contract is renewed automatically , maintaining the conditions under which the deposit was originally opened.

- You can top it up throughout the validity period.

- The deposit can be opened for a period of one or two years.

- The maximum deposit amount cannot exceed 10,000,000 rubles.

- You can draw up an agreement in the name of a minor child .

Article on the topic: Interest rates and conditions for the “Replenishable” deposit in Rosselkhozbank

Contribution Pension income (up to 4.10%)

This personal deposit is offered for pensioners. It is opened in the name of the investor, including in the name of a minor child upon presentation of a pension certificate. If you have a deposit of 50,000 rubles or more, you will be issued a free card with the tariff plan “Amur Tiger - card for deposit”.

Terms of deposit Pension income

- The deposit is opened in the name of the depositor, including a minor child, upon presentation of a pension certificate or a document from the Pension Fund of the Russian Federation on the establishment or assignment of an insurance pension or a document on the assignment of monthly lifelong maintenance from the courts of the Russian Federation;

- Deposit term – 395, 540 or 730 days;

- The minimum opening amount is 500 rubles;

- The maximum deposit amount is 2,000,000 rubles;

- Replenishment is allowed, accepted throughout the entire deposit period (minimum replenishment amount is 1 ruble);

- Expense transactions with maintaining the interest rate are not provided for by the terms of the agreement;

- Interest is paid monthly or at the end of the term;

- Prolongation is automatic;

- Capitalization - yes;

- In case of early termination of the contract, the rate is recalculated on the terms of the “On Demand” program.

| Deposit amount | 395 days | 540 days | 730 days |

| from 500 rubles | 3,90 | 4,00 | 4,10 |

Deposit of Rosselkhozbank “On demand”

Can be opened through Internet Banking and Mobile Banking.

Conditions

- Amount: from 10 rubles / 5 US dollars

- Amount of additional contributions: accepted in any amounts, both in cash and by non-cash transfer of funds.

- Expense transactions: allowed up to a minimum balance of 10 rubles / 5 US dollars.

- Interest payment: quarterly

Interest rates

| Ruble | Dollar | Euro |

| 0,01% | 0,01% | — |

Deposits for individuals at Rosselkhozbank today can be made in offices, as well as through remote service channels: Internet Bank and Mobile Bank. Deposits are opened in the name of the depositor, as well as in favor of a third party. The initial contribution to the deposit can be made to the deposit account within 10 calendar days from the date of signing the application for placing the deposit.

For a deposit amount of 50,000 rubles or more, the bank, as a rule, offers to issue a free card with the tariff plan “Amur Tiger - card to deposit” of the international payment system MasterCard or the National payment system “MIR”. The client will receive additional income on the account balance and protect nature: from each transaction of payment for a purchase using a card, Rosselkhozbank will transfer part of its income to the Center for the Study and Conservation of the Amur Tiger Population.

All deposits of Rosselkhozbank are insured in accordance with the Federal Law “On Insurance of Individuals’ Deposits in Banks of the Russian Federation” No. 177-FZ dated December 23, 2003. The total amount of compensation for deposits in the event of an insured event is today no more than 1.4 million rubles, including interest.

Interest rates on the Pension Plus deposit in 2021

You can find out at Rosselkhozbank what percentage “Pension Plus” has by contacting the manager at a bank branch or on the bank’s website.

Interest accrued on a deposit can be capitalized, that is, interest will also be accrued on interest already accrued .

Since Rosselkhozbank cares about pensioners, the rates on deposits with the bank are very attractive :

- For a deposit opened for 365 days, 7.80% is accrued for an amount of 500 rubles or more.

- A deposit opened for 730 days will be accrued a higher percentage - 8.00% , for a minimum of 500 rubles.

“Pension Plus” is a very promising investment for clients - pensioners. Rosselkhozbank is constantly growing and developing, and always tries to provide its clients with the most favorable and high interest rates for funds.

Which ones does the bank offer?

The opportunity to take advantage of several profitable investments is open. Among the numerous offers, the following deposits are especially in demand:

| Deposit | Term | Sum | Percent |

| "Classical" | from 91 to 730 | from 3000 rub | up to 6.7% |

| "Pension Income" | from 395 to 730 | from 500 rub | up to 7.1% |

| "Pension Plus" | 395 or 730 | from 500 rub | up to 7% |

Among the listed deposits, Classic is very popular. Payment of interest in this deposit is made at the request of clients. Users choose the following methods:

- The general end of the time for placing an account through its transfer and automatic accrual of interest to the RSHB account.

- You can withdraw funds every month or submit an application to transfer them to an account at the institution. Payment in such a case is made on the last day of the reporting time period established by the bank.

- The maximum amount is not limited in any way, and there is no possibility of replenishing it independently.

All investments have fairly high interest rates. In addition, there are no restrictions on the maximum investment size. Among the advantageous conditions, one can highlight the inability to carry out various expense transactions while the deposit is valid. If you need to urgently withdraw money, the rate will be reduced to the level established for the “On demand” category.

Amount and benefits of the deposit

Rosselkhozbank has established the most convenient and profitable amounts for the minimum and maximum contributions. The minimum you need to initially deposit is 500 rubles, the maximum you can deposit is 10,000,000 rubles .

You don’t need to collect large sums to deposit them later; you can deposit 1 ruble.

Article on the topic: Detailed review of the “Accumulative” deposit in Rosselkhozbank in [y] year

Very favorable interest rates on deposits. These rates are among the best for similar deposits in other banks.

The advantage of opening a Pension Plus deposit at Rosselkhozbank will be:

- Rosselkhozbank is a state bank, which speaks of its reliability and stability. Such a bank will not suddenly leave, taking your savings with it .

- There is no need to collect and carry a huge package of documents with you. All you need is a passport or pension certificate .

- There is no required monthly contribution amount , deposit funds whenever you want and as much as you want.

- If you urgently need to withdraw money, then you can do it easily and painlessly. You only need to have 500 rubles left in your account.

- To extend the term of the contract after its expiration, it is not necessary to come to the bank. The system will do this for you automatically.

- If you are afraid that something will happen to you and the bank will take your money, then you can safely open a deposit in the name of a minor child .

Recommended video for viewing:

Savings account for individuals at Rosselkhozbank

A perpetual savings account at the Russian Agricultural Bank is opened only in the name of an individual who is a depositor (that is, it cannot be registered in the name of a third party). The minimum balance amount does not matter. Interest on such a deposit at Rosselkhozbank is accrued daily on the remaining amount. You can replenish and spend funds from your savings account at any time. Income is paid at the end of the month to an account opened with a bank.

Interest rates on a savings account at Rosselkhozbank for individuals depend on the chosen currency (rubles or US dollars), as well as the amount of money on deposit. If you have up to 100 rubles on your account, the rate will be 0.01% per annum. If more than 100 rubles - 5.0%. When opening a deposit of less than $100, the rate will be 0.01%. If more than $100 - 1.0% per annum, respectively.

You can open a savings account and invest free funds through online banking or a mobile application.

Let's sum it up

Depositing money into the Pension Plus deposit at Rosselkhozbank is much more profitable than keeping it at home.

You keep the principal amount of your funds, plus you can spend the accrued interest. Many pensioners are afraid that they will die and the bank will take their money. No need to worry, because you can simply draw up a notarized will, providing which your heirs will calmly take your savings.

Rosselkhozbank necessarily insures all contributions brought by depositors . Be sure that your funds are reliably protected from adverse circumstances and you will not suffer any losses.

Come to a branch of Rosselkhozbank - specialists will advise you on the terms of “Pension Plus” and answer all your questions. With this bank, your money will be in safe hands.

Rosselkhozbank deposits

Conditions for opening and servicing deposits in Rosselkhozbank

Rosselkhozbank offers the registration of time deposits - savings (replenishment and partial withdrawal are not available), savings (replenishment of the main account is allowed) and expenditure-cumulative (increase in the principal amount and partial withdrawal of money is available).

Any individual can open a deposit within the framework of the above programs. The minimum initial deposit amount is 3,000 rubles/100 dollars. or euro. The term of a savings deposit is up to 3 years, a savings deposit is from 1 month to 4 years. Interest capitalization applies. For people of retirement age, Rosselkhozbank has developed a special program of expense-savings deposits. The deposit can be made only in Russian rubles, the minimum amount is 500 rubles. It is allowed to open a deposit in the name of a minor child.

Current clients of the Bank who are owners of the package can open a savings, savings or spending-cumulative deposit with increased interest. Deposit term – from 1 month to 3 years (savings – up to 4 years). The starting amount is 1.5 million rubles. (or equivalent amount in foreign currency). The savings deposit can be placed in rubles, the rest can also be placed in dollars and euros.

Package holders, in addition to the 3 above-mentioned programs, have access to opening deposits (savings/accumulation/expenditure-accumulation) on more comfortable conditions: increased interest, initial deposit size - 500,000 rubles. Making any type of Ultra class deposit is possible in rubles, dollars and euros. The term of deposits is from 3 months to 3 years. Also, clients of the “Ultra” category can open a spending and savings deposit in Russian rubles with the highest percentage, the starting amount of which is 50,000 rubles. (for up to 1 month with the possibility of up to 10 extensions).

Features of deposits.

Rosselkhozbank allows you to open a deposit both in your own name and in the name of a third party (Profitable), including in favor of a minor child (Pension Plus). Most of the Bank's programs provide the opportunity to open deposits in national and foreign currencies (US dollars and euros), however, some deposits can be opened exclusively in rubles. Rosselkhozbank deposits have the following features:

- The size of the bet depends on the parameters of the deposit, as well as on the method of its execution (when placing remotely, a lower percentage applies);

- It is possible to terminate the contract early and return the money without loss of interest - the amount of profit will depend on the actual period the money is in the account (available as part of a savings deposit, provided that at least 90% of the funds from the deposit are used to make the initial payment on a mortgage/car loan at the Bank). In case of early withdrawal of the full amount of funds under other deposit programs, interest is recalculated according to the terms of a perpetual deposit;

- For some programs (both for Bank clients and for any individuals) there are no restrictions on the maximum deposit size;

- The bank provides non-clients who open a deposit in the amount of RUB 50,000 or more with a card with the “Amur Tiger” tariff plan (no additional fees are charged for issuing and servicing the card);

- For most programs, the depositor has the right to choose the method of accrual of interest (to a separate card account or to the principal amount with further capitalization), as well as the frequency of their accrual (monthly or lump sum, at the end of the deposit term);

- The depositor can draw up a power of attorney with the Bank to carry out the main set of actions on the deposit, as well as a testamentary disposition regarding the money stored on the deposit.

How to make a deposit?

You can open a deposit in Rosselkhozbank in the following ways:

- At the Bank office. To conclude a deposit agreement, the client must have with him an identification document: a civil passport, an identity card of a Russian military serviceman (military ID), a temporary identity card of a citizen of the Russian Federation (form N 2P);

- Remotely – using online banking or mobile banking. It is not possible to place a deposit remotely using all Bank programs. When placing a deposit remotely, the Bank sets a reduced interest rate on it.

Closing the deposit and withdrawing funds.

The client can close a deposit with Rosselkhozbank ahead of schedule - in this case, according to the terms of most programs, interest is recalculated in accordance with the rate of a permanent deposit. If the amount to be paid upon early termination of the deposit exceeds RUB 100,000. (equivalent in foreign currency), the depositor is obliged to submit a written notification to the Bank about the planned return of funds.

In the absence of demand from the depositor, the deposit (under most programs) is automatically extended under the terms of the primary agreement. To return the money, the client must contact the Bank's office at the end of the agreement. Refunds can be made either in cash or by bank transfer.

Rosselkhozbank deposits 2021: conditions and interest rates

Deposit conditions for pensioners at Rosselkhozbank are among the most favorable in 2021. In this case, for registration you only need to provide a passport and a pension certificate. In some cases, the bank manager may ask for additional documents, but this is not common practice. You can open a deposit in one of three ways:

- At the RSHB branch. Money is transferred to the bank from an account owned by the depositor or deposited in cash through a cash desk.

- Through a virtual personal account. To do this, you need to go to the official website of Rosselkhozbank, log in to the system and select a suitable deposit. This method is suitable only for those individuals who are already clients of the bank and have at least one valid card.

- Through an ATM. Proof of opening a deposit is a cash receipt issued by the device after completion of the operation.

Rosselkhozbank increased the percentage of deposits for pensioners in 2021

This personal deposit is offered for pensioners only. It is opened in the name of the investor, including in the name of a minor child upon presentation of a pension certificate.

Rosselkhozbank today offers the population a large number of different deposits for various periods in rubles, US dollars and euros. Their terms and interest rates can be viewed here.

This deposit is also provided only for pensioners. But its conditions are more flexible compared to the previous contribution. The account can be replenished, as well as partially withdraw money if you suddenly need it.

How to open a Pension Plus deposit

To open a deposit, contact the RSHB branch. There you provide a package of documents and fill out an application. You will receive a response regarding your invoice within 5 business days from the date of submission. Almost always, a financial institution gives a positive result when opening a balance at the “Pension Plus” tariff.

Rosselkhozbank, Deposits of individuals 2021

The “Profitable” deposit is one of the most profitable programs of Rosselkhozbank. Maximum rates: up to 8.00% per annum in rubles, up to 4.00% per annum in dollars, and up to 1.10% per annum in euros.

The interest rate on the deposit will depend on the following factors: the placement period (the longer the deposit term, the higher the rate is assigned), the deposit amount (the larger the amount, the higher the rate), the opening method (opening a deposit through remote channels is encouraged by increased rates), from method of withdrawal of interest (if interest is paid at the end of the term, the rate is higher).

All deposits of Rosselkhozbank are insured by the state for an amount of up to 1.4 million rubles. In this case, the Federal Law will reliably protect the savings of depositors. Deposit rates, when compared with 2021, have increased slightly (especially in foreign currency).

Rosselkhozbank: deposits for pensioners 2021 at favorable interest rates

Elderly people today can open any deposits of individuals of Rosselkhozbank in rubles, US dollars with favorable rates and conditions, and we will begin our review with special pension deposits.

1. Rosselkhozbank contribution “Pension income”

This deposit is opened only upon presentation of a pension certificate. If you have a deposit of 50,000 rubles or more, you will be issued a free card with the tariff plan “Amur Tiger - card for deposit”.

Conditions

- Duration – 395, 540 and 730 days

- Amount – from 500 to 2 million rubles.

- Deposit replenishment is provided.

- Expense transactions with the same interest rate are not provided.

- Payment of interest monthly: to the account or capitalization

Interest rate of the “Pension income” deposit

Deposits for Rosselkhozbank pensioners in 2021 will be presented in two offers