In connection with recent events and changes affecting the operation of the pension system, a new program - the Sberbank individual pension plan - has become very popular and relevant. The financial institution offers its clients, after retirement, to take advantage of one of the unique pension programs and start receiving additional income.

Despite the bright prospects, every pensioner wants to understand this proposal in more detail, namely under what conditions they can take part in the project and how to cash out the savings placed in the account in the future. All these points will be described in the article further.

What is an individual pension plan at Sberbank?

Before moving on to the conditions and main points regarding working with an IPP (individual pension plan), it is worth understanding what the client will have to deal with. In fact, we are talking about a special agreement that is concluded between the bank and the new participant of the NPF (non-state pension fund) in relation to its pension savings.

According to the rules of participation in the project, the client is obliged to deposit the required amount of money no later than the specified deadlines determined by the contract. In turn, Sberbank invests funds in reliable areas so that in the future the pensioner can receive additional profit. After receiving a pension benefit, the program participant can return their own savings together with the accrued profitability. The main features of the IPP include the following:

- all funds can be transferred by inheritance, which cannot be done with an insurance pension;

- savings belong only to the project participant and cannot be divided with the spouse in the event of divorce;

- the funds cannot be seized, and they are also exempt from any penalties.

The accrued profit is regularly added to the total amount of savings, and the interest rate on income depends on how wisely the citizen’s funds were invested. The investment portfolio consists of: corporate bonds (49-50%) and federal loan securities (29-30%).

Irina Bolshakova

Bank loan officer

In 1 minute! Let's calculate overpayments using a calculator. We will offer a sea of profitable offers on loans, credits and cards, very flexible conditions. Shall we try?)

Important! Even if a citizen does not have additional investments, interest is still accrued on the money already placed in the account.

This type of investment option can be beneficial for individuals belonging to self-employed groups of the population, since their pension is formed in a completely different manner than that of ordinary pensioners.

Pension plan terms

It is no secret that the amount of a non-state pension that a client of the fund can apply for directly depends on the total amount of savings. When it comes to the individual “Universal” plan, there are several main conditions for its use:

- The first payment is not less than 1.5 thousand rubles;

- The minimum amount to top up your account is 500 rubles;

- Lack of a strict schedule for making pension contributions;

- The minimum period for payment of savings is 60 months;

- Upon the death of a client of NPF Sberbank, his savings are inherited (by will or by law);

- The amount accumulated in the account remains inviolable for other persons, regardless of life situation and various circumstances.

Types of current programs

The development of the IPP areas currently offered to Russians was carried out by specialists from a Russian financial institution. The variety of offers was necessary so that each retiree could look at different options and choose the one that would satisfy all his needs. Let's consider each of the directions in more detail.

Universal

When studying current offers, the client should pay attention to what the profitability is and what the percentage is in a certain direction. The most comfortable option is the Universal IPP. There is only one fixed payment here, and the client can make other payments at his own discretion.

The initial investment amount should be 1,500 rubles, and subsequent replenishments should be 500 rubles. The transfer schedule, the system allows the user to set independently. This option provides for special conditions for terminating the agreement, which can be read in more detail on the bank’s website. It will be possible to withdraw money, but only with certain restrictions.

Target

As part of this option, the client gets the opportunity to independently form pension savings, taking into account the frequency and amount of payments, the interest rate and the period for placing the amount. The result should be a monthly amount that will be enough to live on. The initial payment is from 3 thousand rubles, and subsequent payments are from 1000 rubles.

Important! The deposit period cannot be less than five years.

Guaranteed

Until 2021, this option was available to pensioners. The citizen independently determined the size of the pension for 10 years, taking into account which, the program performed all the necessary calculations. The program is not working today.

Complex

This option is also not available today, but was previously used by pensioners to make their own contributions.

Individual investment plan Universal

In Sberbank today only the specified program operates, the conditions for it are the most loyal - only one fixed payment, and the terms and additional payments are at the discretion of the client, this plan is called Universal. Until 2021, clients could choose between two more IPP options:

- Guaranteed: a citizen assigns the desired amount of pension for a certain period (from 10 years). Based on this, a replenishment schedule is drawn up with specific numbers and frequency.

- Complex: the citizen transfers the funded part of the pension to Sberbank and independently forms contributions. At the end of the contract, he receives two types of pension benefits.

Conditions of the IPP Universal

You can register with a non-state fund of Sberbank under the following conditions:

- Initial deposit: from 1,500 rubles, if you plan to save for just a year - at least 60 thousand rubles;

- Top-ups: from 500 rubles;

- Schedule: at the discretion of the client;

- Pension payment period: from 5 years.

Managing savings in the Personal Account of NPF Sberbank is as easy as registering it there.

The universal IPP, like others, provides for the right of inheritance, but prohibits the transfer of savings to third parties, for example, in the event of a divorce. Also, funds under the Universal Plan cannot be seized or collected by bailiffs.

If the client wishes to terminate the contract under the Universal Plan early, the refund is carried out according to the following principles:

- After less than 2 years: up to 80% of your own investments;

- 2-5 years: all your contributions and half of the income accrued during this period;

- Over 5 years: savings and income in full.

Other individual plans have similar early termination provisions.

How to calculate a pension plan

To decide whether it is worth contacting the IPP, it is recommended to first calculate using the Sberbank calculator how much you can receive at the end of the contract.

You can calculate Sberbank’s individual pension plan using the service located on the website. You must indicate age, gender, salary and monthly contributions.

You can calculate the non-state pension and funded pension, which will begin to accrue after the end of the moratorium. The first is formed from your own deductions, the second from the employer - this is a feature of the Sberbank calculator.

Please note that when you sign up for the Universal individual pension plan, you are not required to transfer your funded pension to Sberbank NPF.

Inflation growth according to long-term forecasts, the current profit of the fund and other necessary parameters are included in the calculator, which allows you to calculate the result as accurately as possible. It cannot be taken as a definite answer, but it allows you to navigate what amounts you should expect.

How to connect a pension plan

You can apply for an individual pension plan of Sberbank through several structures:

- Sberbank offices;

- Offices of NPF Sberbank;

- Online.

When applying in person, you should take your passport and SNILS, which are needed to fill out the application and confirm your identity.

To connect an individual plan online, you should define the program on the website and click Apply

In the form that appears, indicate:

- Passport information;

- Phone and contact information;

- Information about yourself;

- First payment amount.

Afterwards confirmation occurs via SMS (entering the received code). Next, they suggest studying the cooperation agreement and checking that you agree with its terms. The next step is to pay the fee by transfer from the card. The transfer is performed on a separate page using 3D-Secure technology, where you need to provide card details and confirm with a password sent from the bank.

If desired, at the next stage you can activate automatic payment from a Sberbank card. To do this, indicate the amount and frequency of debits from the Sberbank card. If this is not done, you will need to pay yourself through Sberbank Online, an ATM, on the NPF website, or at Sberbank cash desks. You can also arrange salary transfers in the accounting department at your place of work.

Amounts and frequency of contributions

The bank provides various options for depositing money for IPP owners. Each option involves performing certain actions:

- transfer from a bank card or through the personal account of the Sberbank individual pension plan;

- through a cash desk, at a bank branch;

- by contacting the accountant at your place of employment so that the savings amounts are credited to the Sberbank Non-State Pension Fund.

The amount to be deposited is determined by the individual plan that was initially selected by the client.

Reliable investments on the Internet

Views: 841

On the relevance of pension savings

It is very important to think about your future in advance, which is why I decided to raise the current topic of pension savings.

Individual pension plan (IPP). What is this?

An Individual Pension Plan, or IPP for short, is a unique way to continue your lifestyle even after retirement and retirement. With its help, you can create a pension, the amount of which you choose yourself, through personal contributions and investment income.

Advantages of an individual pension plan

A simple and clear way to create a decent pension

- The ability to independently choose the most convenient mode for making savings.

- Creating collateral for the future.

- Possibility of transferring savings by inheritance.

- Possibility of obtaining a tax deduction.

- Complete openness and transparency, thanks to tracking of contributions in the user’s personal account.

- Accrual of investment income on the accumulated amount by the Fund.

- Possibility of fully automating the savings process by connecting automatic payment.

You can pay regular contributions in any convenient way from the three available options -

- Using a bank card, in a personal account or through the bank’s mobile application.

- Through Sberbank Online.

- Through any bank branch.

The Bank offers two types of individual pension plans – a universal and a targeted plan. I'll tell you what the features of each of them are.

- Universal plan.

This plan requires you to make your own contributions, the amount of which is not regulated. You receive a non-state pension. The Bank's fund increases existing savings thanks to the income received from investments. The final pension amount depends on the amount of accumulated funds.

The universal plan is characterized by the following parameters:

The down payment amount is at least 1,500 rubles.

The amount of periodic contributions is at least 500 rubles.

The frequency of payment of the contribution is not regulated.

The pension payment period is 5 years or more.

Features - accumulated funds can be inherited; they are not subject to division in the event of divorce.

Possibility of early return of deposited funds - after two years you can return the entire amount of contributions made and half of the investment income. After five years - the entire volume of contributions made and investment income.

- Target plan.

This plan provides for the possibility of independently forming a pension. You can make contributions in any amount and as often as you wish.

If the total amount of contributions paid is more than twelve thousand rubles per year, then the amount of the minimum pension will be calculated taking into account the standard return.

The Bank's fund will increase savings due to investment income.

The target plan is characterized by the following parameters:

The down payment amount is at least 2,000 rubles.

The amount of periodic contributions is at least 1,000 rubles.

Amount of contributions for the formation of own funds – 1,5%.

The pension payment period is 15 years.

Features - accumulated funds can be inherited; they are not subject to division in the event of divorce.

Possibility of early return of deposited funds - if you want to return the funds in less than two years, you will receive 80% of the contribution amount. After two years, you can return 98.5% of your contributions and half of your investment income. After five years – 98.5% of contributions made and 80% of investment income.

Investment activities of Sberbank NPF

Sberbank strictly adheres to an investment strategy, the main goal of which is to achieve the optimal level of profitability and reliability.

In addition, the bank regularly publishes all performance indicators on the official website. The work of the Fund is under the control of supervisory organizations, including the Board of Directors of the Fund, management companies, and so on.

In addition, the Fund is distinguished by its reliability and high degree of professionalism. The bank's fund sees among its partners exclusively reliable management companies that are approved by the fund's board.

It is also impossible not to note the reliability of storage of funds and their profitability. The entire strategy that the Fund follows in its work is aimed at preserving capital and its profitability.

How to apply for a non-state pension

To transfer the funded part of your pension, you need to follow a few simple steps:

- Enter into a contract. To do this, you need to contact the office of the bank's non-state pension fund . To complete the documents you will need a passport and SNILS.

- Fill out an application for transfer to the bank’s non-state pension fund. This can be done either at the Pension Fund branch or using the State Services portal.

- To find out the status of the agreement, register in your personal account on the official website of the Foundation.

Detailed conditions and sample applications are presented on the official website of the Foundation.

Reasons for choosing NPF bank

- A large number of citizens trust the bank.

- High reliability rating.

- The bank's investments are exclusively in reliable securities.

Conditions for early termination of the NPO contract

If you decide to terminate the NGO contract and receive the redemption amount back, then this can be done before the non-state pension is assigned. To do this, you need to contact the Bank Fund and provide the necessary documents. The amount of the redemption amount depends on the volume of contributions made and the duration of the contract. However, before you decide to terminate the contract, it is important to seriously consider all your actions.

Conclusion

Sberbank NPF is one of the options for forming your future pension. It is very important to think about this issue in advance to ensure confidence in the future.

(Visited 135 times, 1 visits today)

Please rate the article and leave your opinion in the comments

[Total: 1 Average: 5]

This might be interesting:

Sberbank of Russia | How the largest credit and financial organization in the Russian Federation and the CIS developed

Alfa Travel debit card review and reviews

Debit cards with cashback at gas stations

Credit cards with cashback at gas stations

Inflation | Types and causes of inflation | Consequences of inflation in Russia and the world economy

Where to quickly borrow money up to 100,000 rubles | TOP 10 microloans up to 100,000 rubles

Opencard Debit Card | 3% cashback on everything + free service

Sberbank investments reviews and review | Online investments in stocks, bonds, funds and precious metals

How to register an IIP in Sberbank?

To register an IPP at Sberbank, you will need to perform several simple steps, but first you need to decide on the appropriate method:

- Personally contact the bank branch at your place of residence.

- Visit a branch of Sberbank NPF. Such offices are not available everywhere, so this option is not available to all Russians.

- Use the Sberbank NPF website and register your participation in the project online. You need a bank card and Internet access.

Important! Sberbank as an additional bonuses insures all invested funds of clients. This acts as an additional guarantee for the safety of money.

Documentation

To obtain an IPP, additional documents are required. In particular, you need to prepare the following documents:

- Passport of a citizen of the Russian Federation.

- Pensioner's certificate.

- Statement.

After completing the contract, the client will have to sign this document. Additional papers from the Pension Fund may be required, but usually the list provided is sufficient.

Fund work after 2021: changes

There are a lot of negative reviews on the Internet related to a technical glitch in the system. It was observed in the period from 2015 to 2021, when Sberbank NPF switched to the technology of automatic transfer of the funded part of the pension from the Pension Fund (without a visit to the Pension Fund branch).

Until 2021, after concluding an agreement at the bank office, clients had to come to the Pension Fund and write an application for the final transfer of savings to a non-state company. But more than 1/4 of the investors ignored this step. As a result, their contracts remained at the formalization stage.

Reviews about the transfer of pensions to Sberbank NPF in this case indicate that not all clients were informed about the need to visit the Pension Fund after concluding the agreement. This is a disadvantage in the work of Sberbank employees.

In 2021, there were practically no problems with the transition to a non-state pension fund, since the fund began to automatically transfer data after concluding an agreement with a client. This improved citizens' opinions about transferring to a non-state pension organization.

How are payments made?

After reaching a certain age, the client can already apply for pension savings. The standard application form is located in the NPF personal account. All you have to do is download it and fill it out. It is important to indicate your passport details and the number of the cooperation agreement.

Amounts of money accumulated by a citizen must be transferred to the account or card specified in the appeal. The payment procedure is as follows:

- the first payment will be made within a month after submitting the application;

- subsequent payments are received monthly;

- when the payment is less than the minimum pension, payments are made quarterly;

- The client can also receive a pension card from Sberbank.

In general, participation in the project is very beneficial for future retirees and allows them to accumulate a sufficient amount of money for a comfortable life.

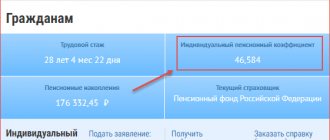

Personal Area

For clients who enter into an agreement with Sberbank for an individual pension account, employees connect:

- Sberbank Online mobile application;

- NPF mobile application;

- Personal account of Sberbank NPF.

In any of these services it is convenient to replenish your personal pension fund and control the growth of your future pension. Login is available via email, by mobile phone number or by entering SNILS.

For IPP owners in Sberbank in the Personal Account or mobile application the following is available:

- replenish an account;

- track the history of replenishment operations;

- activation of the autopayment service to pay periodic contributions automatically in equal amounts;

- access your account from a mobile phone, tablet, laptop or computer from anywhere in the world.

You can top up your Sberbank individual pension account:

- non-cash transfer between your accounts in Sberbank;

- using auto payment;

- from a card through self-service terminals, ATMs or at a cashier;

- transfer through the accountant of the organization where the future pensioner is employed;

- transfer of funds held in an account in another bank.

Sberbank clients can track the profitability of their IPP in their personal account. Data for the previous year are posted before the end of the second quarter of the current year.

Registration of a tax deduction

Every bank client who owns an IPP should know that he has the right to receive a tax deduction. The amount to be returned is 13% of the value of the deposited funds. The maximum possible payment that a depositor can receive is 15,600 rubles, based on the calculation that in a year the client will deposit about 120 thousand rubles into the account.

The tax deduction is issued at the place of official employment, and in addition to the application, you will also have to submit an additional package of documentation, including a certificate in the form of 3NDFL.

Important! The tax amount is paid according to the bank details specified by the applicant in the submitted application.

Sberbank individual investment plan - what is it

This is an agreement with a non-state pension fund, within the framework of which a personal pension account is opened for the client, into which he deposits his own funds within the time frame and in the amounts established by the agreement of a specific program.

The money that Sberbank receives from individuals is invested for profit in market instruments with minimal risk - this guarantees additional, so-called investment income.

Having issued a pension, the client returns his savings, as well as accumulated income in the form of monthly payments. This allows him to receive additional financial support when he retires. Whether it is worth turning to this method of financing your future, everyone has the right to decide for themselves.

Funds placed under Sberbank’s individual pension plan:

- Inherited by law - unlike an insurance pension;

- Not subject to division in case of divorce;

- They cannot be arrested and penalties cannot be brought against them.

You can manage your savings through your Personal Account on the website of NPF Sberbank.

Good to know: Insurance and funded pensions - what is the difference.

Profitability of Sberbank IPP in 2021

How beneficial an individual pension plan is depends on a number of reasons:

- First of all, it depends on the size of your own investments and the duration of their placement. The sooner a person begins to form savings, the greater the amount will be in his account in old age.

- Secondly, it depends on the success of the investment strategy. Everything that she can earn during the billing period (usually a calendar year) is added to the investor’s own funds placed in the individual investment account of Sberbank.

According to forecasts, by 2021 the average percentage return of non-state pension funds will be at least 8% per year. The trend of investment activity indicates a stable annual increase.

Tax deduction for an individual pension plan

Each owner of a pension account within the Sberbank IPP has the right to receive a tax deduction in the amount of 13% of the deposited funds - this is another advantage of independently forming a pension:

- The maximum amount of deduction per year is 15.6 thousand rubles per year (i.e. from 120,000 deposited into the account);

- The deduction is issued to citizens who have an official place of work based on a package of documents (including the 3-NDFL declaration) at the end of the year:

Payment will be made in a one-time transfer to a bank account.

Please note two restrictions:

- In a year you cannot return more than a person pays in taxes (13% of wages).

- The amount of 120 thousand is the total limit for all types of deductions (including for education and treatment), so in reality you may receive less:

Payment of funded pension

Despite the fact that payments of pension savings from non-state pension funds have so far been made to a small number of citizens, attention should be paid to the negative aspects associated with this aspect. Client claims against the fund are often due to delays in payments due. It should be taken into account that such problems arise not only at Sberbank NPF. Almost all leaders of this market sometimes experience some difficulties in meeting the deadlines for making payments. However, the funded pension is still paid to policyholders - without any deception.

How and where to apply

There are several options for registering an individual plan in the NPF SB RF. Transferring the funded part of the benefit to a non-state corporation of the Security Council of the Russian Federation is not difficult. Future retirees can open a deposit account through the following organizations:

- any branch of the Security Council of the Russian Federation;

- nearby office of NPF SB RF;

- official page of the company, with authorization in your Personal Account.

NPF Sberbank office

If there is an office of Sberbank - Pension Non-State Fund in the city, the procedure for opening an individual business enterprise and transferring money is simple. To transfer the funded part of the benefit, you need to fill out an application to the Pension Fund of the Russian Federation and take it to the local branch of the organization . After making a positive decision to transfer funds to the NPF SB RF, you need to act in the following sequence:

- Personally visit a branch of the corporation, having your passport and SNILS with you.

- Together with a company employee, select the most profitable plan.

- Develop a payment schedule and set the amount of contributions.

- Draw up and sign the document.

Online on the official website

Citizens saving time can enter into an agreement on transferring finances and forming a future pension on the official page of the organization. To do this, you need to follow the following algorithm:

- Go to the organization's website.

- Complete the registration procedure in your Personal Account.

- Choose the most profitable IPP.

- Create a contract form by filling out the required form.

- Fill out an application for the transfer of funds.

- Send money and track its accumulation in your account.

Sberbank branch

If it is not possible to use remote access or there is no NPF branch at the citizen’s place of residence, then you can go to the nearby office of the Security Council of the Russian Federation. Qualified employees will help you choose the optimal IPP, a suitable schedule for transferring money and the amount of payments. To draw up a contract, you will need the same set of documents as when visiting the office of the NPF SB RF. The procedure for concluding an agreement is similar to the protocol adopted by the fund.