Login to your personal account

NPF Sberbank is a non-state structure that allows you to form pension savings. The organization has existed for more than 20 years, since 1995, and offers its clients compulsory insurance services: you can form a funded part of pension savings, use the capabilities of individual programs, and also receive corporate services for legal entities and employees. The convenience of interaction with Sberbank NPF lies in the extensive geography of the fund’s branches and a functional personal account.

Profitability of Sberbank NPF

An indicator such as the fund's profitability tells how much the organization earned on investments, which means how much profit clients received. Yield by year is reflected on the official portal of Sberban NPF in the form of convenient charts. According to the data, the interest rate is rising.

A constant analysis of the fund's profitability over 8 years shows that in 2014-2017 there was an increase in the number of people insured under compulsory pension insurance programs with non-state financing. It was then that the accumulated profitability began to grow from 62 to 115%.

| Year | Accumulated profitability, % |

| 2014 | 66.2 |

| 2015 | 82 |

| 2016 | 99.2 |

| 2017 | 115.7 |

What can you do in your personal account?

In your personal account you can not only monitor information on your personal account, but also manage pension savings, namely:

- Change the pension insurance program.

- Make contributions according to an individually drawn up plan.

- Receive an account statement showing the movements of the depositor's funds during the specified period.

- You can make an approximate calculation of your future pension using a special online calculator.

- Monitor contributions from the employer to the funded part of the pension in the Sberbank Non-State Pension Fund.

How to register in your personal account of Sberbank NPF

All clients of the Sberbank non-state pension fund can log into their personal account. However, it is worth noting that all the features of the online account can be used by those who:

- entered into an agreement;

- opened a pension savings account;

- consented to the processing of personal information.

Registration of a remote account is available on the official page of the fund.

Registration

How to submit an application

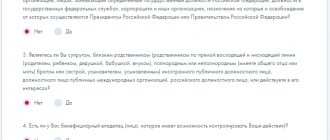

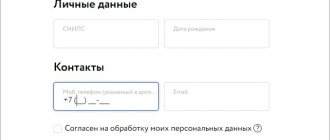

To register a personal account, you must fill out an online application using the form provided on the page.

- Phone number to which the system can send messages with an authorization code in the personal account.

- Create a password to access your account and repeat it. If the passwords do not match, the user will see a warning. Check the combinations are correct.

Important! The security system requires you to create a password consisting of 6 or more characters, including Latin characters and numbers.

- Indicate personal information in the appropriate lines: information from your passport, as well as the insurance number of your individual personal account.

- Enter your email - it will be needed to confirm registration actions on the site.

- Consent with the processing of personal data is expressed by checking the appropriate box.

- Additionally, you can express your desire to receive informational messages.

Confirmation of registration is carried out by entering a combination of characters, which is automatically generated and sent to the phone number specified in the application form.

Hotline and other fund contacts

There are several ways to contact specialists:

- Contact phone number 900 . To quickly contact a specialist and not answer many unnecessary questions, you need to tell the voice assistant the phrase “Non-state pension fund.”

- If the call is made while roaming, then you need to dial the number +7(495)5005550. With this phone, calls can be made anywhere in the world. However, you should remember that the call is paid and is made at the rates of the operator from which the call is made.

You can also ask your question on the official website https://npfsberbanka.ru/. To do this, click on “Support Chat” in the lower right corner. Specialists respond in real time, so you won’t have to wait long for an answer.

The company also has many branches in almost all cities of Russia. Their full list is presented on the page https://npfsberbanka.ru/contacts/. And the head office is located at: Moscow, st. Shabolovka, 31G, entrance 4.

Login to your personal account of Sberbank NPF on lk.npfsb.ru

Authorization in the online account of Sberbank NPF can be done on the page. It is possible to authorize in different ways, which we will discuss below. Select the appropriate method, provide authorization information and log into your personal account.

Login to your personal account

Please note that any method of logging into your personal account requires entering the password set at the time of registration.

Login for individuals by phone number

- Enter the phone number you provided in the registration form.

- Enter your password.

You can also choose the option of authorization using your email address.

Login using SNILS

The insurance certificate number is entered in the first line, and the password is entered in the next line.

How to log in through Sberbank Online

The founder of Sberbank NPF is the bank of the same name, therefore, for the convenience of clients, authorization has been implemented through Sberbank’s remote banking service system. Login to the personal account of Sberbank NPF through Sberbank Online is carried out after specifying authorization data.

Login through Sberbank Online

If the policyholder does not have a Sberbank personal account connected, then you can create a Sberbank ID:

- indicate the numbers from the Sberbank card to which the Mobile Bank service is connected;

- confirm ID registration;

- the system will send personal login information.

Now you can log into your personal account of Sberbank NPF.

Login through State Services

The State Services portal interacts with an increasing number of companies every year and allows you to log in with a single login and password in different systems. Select the authorization method through State Services and use the password of this portal.

Login through State Services

Recovering lost login and password

Lost authorization data can be restored without visiting offices. Click the “Forgot password” button and enter any data of your choice to identify the user: email, phone number, SNILS. Confirmation of the operation consists of the verification code from the picture.

Password recovery

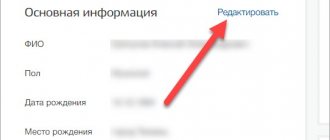

Features of your personal account lk.npfsb.ru

Providing a user with access to their personal account makes it possible to perform the following operations:

- Manage retirement savings.

- Receive information on the movement of funds in a pension account, order account details.

- Choose pension programs and change them if necessary.

- Pay online service fees for individual plans.

- The presence of an online calculator allows you to calculate your future pension.

- The ability to control contributions to the pension fund from the employer.

Autopay settings

Persons insured by Sberbank NPF have the opportunity not to miss contributions to their pension account using the automatic payment service. It is available for connection after the contract is loaded into the database. The user independently sets the transfer amount and frequency. The operation is not subject to commission if carried out from a Sberbank account or card. When auto-replenishing an NPF account from a card of another bank, you should clarify the amount of the commission.

Important! Autopay is available to those who have already made the initial funds transfer.

Transfer of savings

When placing a funded pension in Sberbank, you will be able to receive more income into your account, because the capabilities of the main bank of Russia are greater than those of most other organizations, and the financial profile of the activity allows you to successfully invest.

How to transfer the funded part of a pension to Sberbank? To do this, you need to go to the bank office, taking with you the necessary documents, the list of which can be clarified in advance. There, sign an agreement and write a statement to the Pension Fund that you are transferring your funds. Thus, your pension savings (not all, but just the funded pension) will end up in the Sberbank Non-State Pension Fund, which will invest and increase them. Transferring a pension to Sberbank turned out to be very simple, and the question of how to transfer a pension to Sberbank no longer faces us.

Section of contracts and statements

In the corresponding section of the online account of NPF Sberbank, you can view all the documentation. If the client does not see the documents in the personal account, this is most likely due to the fact that the contract was not concluded or the client’s personal data has been changed since its conclusion. Sometimes the absence of a contract is due to the fact that personal information was entered incorrectly during registration. If there are no reasons for the absence of documents, then they are available online - they can be viewed and printed.

How to terminate an agreement with NPF Sberbank

The law establishes a restriction that allows you to terminate cooperation with a non-state pension fund only once a year. It is worth noting that you cannot refuse service within the framework of state pension insurance, but the funded part can be transferred to another fund. Termination of the contract is stated in the document itself and consists of a written notification of such a desire.

Attention! Do not forget to indicate in the application for termination of the agreement with Sberbank NPF the details by which funds should be transferred from the account.

Customer reviews about the personal account of Sberbank NPF

Clients of Sberbank NPF on various forums and websites note that their personal account does not always provide data on contracts. Very often you can see a message indicating that there is no concluded contract and no data in the system. Users of the review service under the nicknames Larisa Gavrikova and Koliyadinr and many others encountered this problem.

Those clients who have installed the mobile application, for example, Alexander Gultyaev, note the attractive design, easy navigation, but pay attention to the fact that the account balance in the personal account on the mobile device does not always coincide with the balance displayed on the site.

A user with the nickname Afonasei Afonasiev proposes to introduce a display of payment history and a functional calculator for calculating savings into the Sberbank NPF mobile application.

Are you a client of Sberbank NPF? Do you like your personal account and its functionality? Share your experience of interacting with a non-state pension fund with our readers.

2.9 / 5 ( 57 votes)

How to get to the NPF personal account?

Any participant in the pension insurance program from Sberbank can access their personal account on the NPF website. To do this you need:

- Sign an agreement on non-state pension insurance at any branch of Sberbank and wait until it takes effect.

- A special account must be opened at Sberbank for transferring the funded part of the pension and further contributions.

- You must also agree to the processing of your personal data by the bank. There is also a hotline for Sberbank NPF.