general information

The start of activity of the non-state pension fund "Socium" dates back to 1994.

Since 2004, it has been managing citizens’ funds within the framework of compulsory pension insurance and non-state pension provision, on the basis of license No. 320/2 dated April 26, 2004. The fund manages the funded pension, calculates income based on the results of each year and pays the pension. It is also possible to form an additional, non-state pension by concluding a non-state pension agreement. Today NPF "Socium" is:

- 35,000 citizens receiving pensions.

- 25.7 billion rubles - personal assets

- 100 corporate pension programs of organizations.

- 380,000 clients for compulsory pension insurance and non-state pension provision

Official website of NPF "Socium"

For more detailed information, you can always refer to the official website of the organization, where the entire history of the company is presented in detail. We will briefly tell you what kind of organization this is and what it does.

NPF "Socium" has existed on the stock market for a long time, or to be more precise, since 1994 it began its legal activities and continues to function to this day, but under a different name.

Initially, it was a company that provided compulsory pension insurance services for pensioners. After several years, several more organizations joined it, which later created their own non-state pension fund under the current name. Today it is the most reliable and profitable fund among the others. As for the specific data, namely profitability and reliability rating, they are very high.

Profitability

Return – Before choosing a pension fund in which you would like to start investing, you need to familiarize yourself with the data in this category. If the numbers are high, it means that this fund is quite profitable. As for this fund, the yield level is 8.22%.

Reliability rating

Reliability rating – it also plays an important role in the decision and choice of location. The more reliable the fund, the less chance that all your funds will be lost and the level of return will be insignificant. The Sotsium fund has a reliability rating of A+, which is a high level and promises stability in the future.

Place in the ranking

the Expert RA audit, the following data was prepared:

- the fund has been assigned A++ status

- by the number of NGO participants - 10th place

- 10th place in terms of the amount of obligations under compulsory pension insurance

- in terms of the amount of obligations for NGOs - 25th place

- in terms of assets - 16th place

- by the number of insured persons - 10th place

"Expert RA" is a Russian rating agency engaged in assigning ratings, the decision of which determines the admission of a financial organization to certain types of activities.

Pension accumulation programs

Benefits for individuals:

- It is calculated in rubles (₽), an absolutely “transparent” system.

- Savings are inherited by close relatives and cannot be lost

- Formed from employer contributions

- The safety of savings is guaranteed by the state

- Thanks to investments, the amount increases every 5 years

The official website of NPF “Socium” has a built-in pension calculator designed to calculate your future pension.

The following advantages are provided for legal entities:

- Early non-state pension provision, which allows organizations to generate funds to pay additional pensions to workers whose activities involve hazardous and harmful production.

- Corporate pension provision is intended to motivate the most significant categories of personnel, allowing to reduce staff turnover due to high social security for employees.

- Providing tax benefits to company employees with its participation in non-state pension funds

Personal account features

Using the functions of your personal account allows you not only to control the amount of pension accruals, but also the total amount of contributions. On the company's website you can view suitable pension programs, print or save insurance contracts to your computer, and also calculate the amount of future pension savings. This can be done using a special program “pension calculator”. It should be noted that such services do not provide 100% accuracy and cannot be used as official information.

Socium non-state pension fund

Clients of the fund registered in their “personal account” have the opportunity to seek advice on all pension issues. This function will be available in the “feedback” section. As of 2021, the “personal account” options are in test mode, so its functionality will still be further developed and promises many prospects. Now, for example, a mobile application is being developed so that data can be accessed at any time.

Foundation statistics

Reference. The graphs and tables are based on data and reports from the website of the Central Bank of the Russian Federation. 2021 data available for 9 months

In 2021, the fund ranked 3rd among other funds in terms of income. By size of assets 16. By number of participants 10.

View fund ratings

| Year | Assets | Capital | Number of participants | Profitability |

| 2020 | 26,063,704 t. rub. +4% | 2,988,031 t. rub. +57% | 128 981 | 9.6% |

| 2019 | 24,919,381 t. rub. +28% | 1,297,187 t. rub. +30% | 130 199 | 10.8% |

| 2017 | 18,023,388 t. rub. +4% | 905,278 t. rub. +48% | 136 828 | 10.27% |

| 2016 | 17,366,084 t. rub. +11% | 469,012 t. rub. +9% | 142 070 | 7.66% |

| 2015 | 15,475,468 t. rub. +6% | 426,771 t. rub. +22% | 142 563 | 12.25% |

| 2014 | 14,487,697 t. rub. +6% | 333,840 t. rub. +100% | 110 156 | 5.78% |

| 2013 | 13,673,042 t. rub. +18% | 0 thousand rub. | 113 062 | 6.27% |

| 2012 | 11,214,902 t. rub. +16% | 0 thousand rub. | 117 129 | — |

| 2011 | 9,383,040 t. rub. | 0 thousand rub. | 122 068 | — |

By assets

By capital

Fund compared to top 10 funds for 2021.

Personal account functionality

In their personal account, all clients of the company have access to:

- Changing a previously received password for your own convenience.

- The ability to indicate your email to which notifications from the Foundation will be sent.

- Client questionnaires that must be filled out in case of personal data changes.

- Information on already entered user data.

- Notifications in the forms established by law.

- Statements from your own savings account. The option of forming is available both for an arbitrary period and for the entire period of work with the Fund or for 1 year.

- Information about the current agreement concluded with Sotsium.

The company did a good job on the personal account interface. While it was in test mode, the developers listened to the wishes of users, and the end result was a very easy-to-manage system. All elements are obvious and understandable. The office can be used without problems even with a minimum level of computer literacy.

Profitability

In 2021, the fund ranked 3rd among other funds in terms of income. By asset size 16. By number of participants 10. View fund rankings by profitability

| Year | Pension reserves minus remuneration | Pension reserves before remuneration is paid | Investments of pension savings minus remuneration | Investing pension savings before payment of interest |

| 2020 | 8.57% | 9.60% | 8.15% | 9.09% |

| 2019 | 7.85% | 10.80% | 8.71% | 11.19% |

| 2017 | 7.74% | 10.27% | 8.93% | 10.33% |

| 2016 | — | 7.66% | — | 10.62% |

| 2015 | — | 12.25% | — | 12.43% |

| 2014 | — | 5.78% | — | 7.10% |

| 2013 | — | 6.27% | — | 8.53% |

| 2012 | — | — | — | — |

| 2011 | — | — | — | — |

Yield on pension reserves before payment of remuneration

Profitability of investing pension savings before payment of remuneration

Fund compared to top 10 funds for 2021.

Login to your personal account

The user will receive a message stating that his personal account has been activated. Then you can begin remote control according to your contract. To carry out any actions in your account, you must download a special section of the main website of the NPF “Socium”.

Let's look at the client authorization procedure in more detail:

- On the official website of the fund, in the menu on the main page or in the right side pop-up menu, click on the “Personal Account” icon.

- At the moment, the LC is running in test mode, so the system will ask you to follow the link https://lk.npfsocium.ru/lk/index.php. In the near future, the service will be completely improved and this action will not be required. It will be enough just to go to the “Personal Account” section.

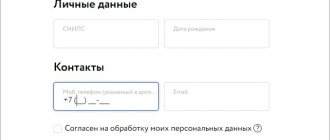

- Fill out the form that appears. As the account name, the user must use the number of the pension insurance certificate (SNILS - green laminated card) in the format ХХХ-ХХХ-ХХХ-ХХ.

- The access code is the series and passport number of the owner of the personal account. To enter correctly, enter this data together without using spaces.

- You need to enter the characters from the encoded image (they will be different each time you log in).

- Click the "Login" button.

Savings and reserves

The average percentage increase in pension savings for the entire period of work is 11%, reserves 6%. The fund ranks 10th in pension savings and 27th in reserves for 2021. View the full table of NPFs on pension savings and reserves

| Year | Pension savings (market value) | Pension reserves |

| 2020 | 23,152,009 t. rub. +5% | 2,198,833 t. rub. +5% |

| 2019 | 22,050,046 t. rub. +30% | 2,088,218 t. rub. +6% |

| 2017 | 15,373,553 t. rub. +3% | 1,953,560 t. rub. +9% |

| 2016 | 14,884,439 t. rub. +12% | 1,786,488 t. rub. +9% |

| 2015 | 13,144,879 t. rub. +5% | 1,626,276 t. rub. +9% |

| 2014 | 12,548,472 t. rub. +5% | 1,473,420 t. rub. +5% |

| 2013 | 11,902,258 t. rub. +21% | 1,396,003 t. rub. +3% |

| 2012 | 9,453,175 t. rub. +15% | 1,353,562 t. rub. +7% |

| 2011 | 8,003,603 t. rub. | 1,252,886 t. rub. |

Savings and reserves on the chart

Liabilities

In 2021, the fund paid out 232,531 thousand rubles. pensions under compulsory pension insurance and NPO. And it took 25th place among other funds in terms of payments to NGOs, and 11th place in terms of payments to OPS. View full table of funds by liabilities

NPO - Obligations under non-state pension agreements. OPS - Obligations under contracts on compulsory pension insurance.

| Year | Under NGO agreements | Under OPS agreements | With the exception of NGOs and public associations | Payments of pensions under compulsory pension insurance | Payments of pensions through non-governmental organizations |

| 2020 | RUR 2,073,897 | RUB 20,937,256 | 64,519 tr. | 105,268 tr. | 127,263 tr. |

| 2019 | RUR 2,084,667 | RUR 21,369,646 | RUB 167,880 | RUB 115,914 | RUB 175,137 |

| 2017 | 1,864,421 tr. | RUB 14,972,927 | 280,762 tr. | 83,635 tr. | RUB 174,507 |

| 2016 | 0 | 0 | 0 | 69,830 tr. | 178,246 tr. |

| 2015 | 0 | 0 | 0 | 81,339 tr. | RUB 170,738 |

| 2014 | 0 | 0 | 0 | 56,613 tr. | 164,306 tr. |

| 2013 | 0 | 0 | 0 | RUB 52,075 | RUB 153,796 |

| 2012 | 0 | 0 | 0 | RUR 27,269 | RUB 160,517 |

| 2011 | 0 | 0 | 0 | 0 | RUB 145,366 |

Amount of payments under compulsory pension insurance and non-profit organization by year

Registration of a personal account

The non-state pension fund "Socium" offers the population a full range of pension products.

The formation of pension savings (PSS) and several options for NGO pension programs are available, which can be used by both private clients and legal entities. Official documents confirming the right to provide services can be found at https://npfsocium.ru/info/documents/.

Important! Citizens who enter into an agreement with the fund have the opportunity to use the “Personal Account” service. There is no need to create an account yourself. Access to the personal account is granted to the user after all the necessary applicant data appears in the general system.

To join the Socium Foundation, you must draw up and sign an agreement, as well as provide your consent to the transfer and processing of personal data. If a client is transferred from another NPF, then one more condition must be met. The contract will come into force only after funds from the previous insurer arrive at the account of the Sotsium fund. Once all conditions are met, the client will receive a notification to activate the account.

To conclude an OPS agreement with the fund, you can:

- Fill out an application electronically so that the specialists of NPF Sotsium will draw up an agreement for you and send it by email. The applicant card form can be filled out by following the link: https://npfsocium.ru/for-private-clients/join/online/. All fields marked with an asterisk “*” are required. Before sending, carefully check that the lines are filled out correctly. Based on the received questionnaire, a set of documents will be prepared. If an error is made somewhere, the filling out procedure will have to be repeated completely.

- Request a call back using the feedback form on the official website. They will advise you, write down your contact details and send all the necessary forms by e-mail.

- Contact the convenient office of NPF Sotsium JSC in person and fill out the documents at the fund’s branch, immediately picking up your originals and activating the client’s personal account.

Login to your personal account

Insured persons and participants

The number of participants in 2021 was 128,981. By this indicator, the fund ranks 10th among other funds. View the full table of funds by number of participants

| Year | Insured persons | Stuck persons receiving a pension | Number of participants | Number of participants receiving pension |

| 2020 | 304 089 | 5 333 | 128 981 | 30 771 |

| 2019 | 307 047 | 6 492 | 130 199 | 31 180 |

| 2017 | 238 387 | 6 769 | 136 828 | 34 973 |

| 2016 | 243 337 | 7 551 | 142 070 | 36 139 |

| 2015 | 243 248 | 7 548 | 142 563 | 36 769 |

| 2014 | 275 770 | 7 473 | 110 156 | 38 162 |

| 2013 | 277 333 | 7 465 | 113 062 | 38 528 |

| 2012 | 271 407 | 3 411 | 117 129 | 39 857 |

| 2011 | 301 341 | 0 | 122 068 | 40 179 |

Number of fund participants by year