NPF Magnit is a full participant in the pension services market. The foundation began its work in 1995 in the format of the Virtue organization, changing its name to its current name in 2009.

At first, the fund specialized in non-state support. After the pension reform, the structure is also engaged in compulsory insurance in this area.

NPF Magnit website

Now Magnit is an excellent alternative for people who do not want to accumulate savings in a government structure. On the official website of NPF Magnit you can find all the information about the fund’s activities:

- Direction of work;

- Divisions and management structure;

- Investment policy;

- Basic indicators;

- Programs.

The goal of the Magnit organization is to effectively manage the target savings of the personnel of the company of the same name, as well as other citizens. The work is aimed at minimizing investment risks.

To accomplish these tasks, the fund invests money in securities, various programs, foreign exchange and other instruments that provide increased profitability. Savings continue to be invested even after citizens retire. Accordingly, their income increases.

Official site

The official website of NPF Magnit gives citizens the opportunity to gain access to a pension calculator and a large volume of reports during the operation of the NPF. An important point is that the portal does not allow you to use your personal account.

The official website provides information:

- areas of activity;

- NPF branches;

- company structure;

- key indicators;

- program;

- investment type policy.

Magnit's goal is to effectively manage target types of savings with employees of the organization of the same name. NPF works towards reducing risks.

In order to fulfill these tasks, the fund's management invests in securities, currencies and other areas, which helps to increase the level of profitability.

Is it possible to register a personal account and find out about your savings?

As already mentioned above, the official website of the non-state pension fund does not provide the possibility of using a personal account. This means that it will not be possible to register a personal account on the website without drawing up an agreement with the NPF.

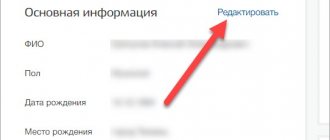

After completing the contract, a Magnit employee issues data for access to the personal account. This service helps to obtain information about the account status and conduct transactions.

NPF rating

Every future retiree is interested in choosing a structure with the most attractive conditions. As of last year, 69 non-state funds officially operated in the Russian Federation. However, more than 90% of all savings of the country's citizens are managed by the ten most successful organizations.

Ratings help you understand the situation in a given market and make the right choice.

One of the key indicators of fund performance are reliability ratings. Russians especially trust data from the well-known agency “Expert RA” and the National Rating Agency. In 2021, NPF Magnit did not take part in the formation of these ratings.

Contact information of NPF "Magnit" in case of questions

If you have any questions or for additional information on the tariffs of the Non-State Pension Fund "Magnit", you can contact the company's employees in one of the following ways:

- Contact the head office, which is located at: Krasnodar, st. Moskovskaya, 95B, office No. 1 (350072).

- Call the phone number (extensions 16110, 16112).

- Send an email

- Use the feedback form by following the link: https://www.npfmagnit.ru/contacts/.

Please note that the “Personal Account” of the Magnit pension fund is not publicly available, and this organization also does not have regional branches.

Services of NPF Magnit

JSC NPF Magnit provides services to citizens and employers who seek to increase the attractiveness of their organization for potential employees and attract valuable specialists. The fund's activities extend to additional pension provision, including early, as well as compulsory insurance.

In essence, NPF clients transfer the savings portion from the Pension Fund to the management of a non-state structure. At the same time, the citizen remains part of the state system and does not suffer any financial losses.

By voluntarily depositing funds into an individual account, the client can count on additional payments to his pension throughout his life or for a specified period.

Personal account of NPF “Magnit”

Get qualified help right now!

Our pension lawyers will advise you on any issues. Founded in 1995, the NPF fund “KhPF “Dobrodetel”” provided services to NGOs. In 2006, the programs were expanded: OPS was added to them. In 2010, the organization was given its current name. Read below about the Magnit pension fund: official website, personal account, reliability.

NPF Magnit is a full participant in the pension services market. The foundation began its work in 1995 in the format of the Virtue organization, changing its name to its current name in 2009.

At first, the fund specialized in non-state support. After the pension reform, the structure is also engaged in compulsory insurance in this area.

Consultation with a pension lawyer by phone In Moscow and the Moscow region St. Petersburg and the region

The non-state pension fund "Magnit" as such began its work in 2010. It was founded in 1995 and previously bore the name “Virtue Christian Pension Fund”. Its owner all this time has been Tander CJSC.

Many companies that work in the field of pension financing give their clients access to a service for viewing available savings.

The Magnit pension fund does not have a “Personal Account” in the public domain on its official website. That is, it is not possible for clients to register and log into the personal account of NPF Magnit.

A new loyalty program from a well-known chain of hyper and supermarkets has begun testing in several regions of the country. In the future, it is planned to distribute it to all retail outlets.

The point is to use savings cards when purchasing goods to receive and later sell discounts on purchases.

The size of the payment in this case depends on the amount of contributions, as well as on the effective management of funds. We are talking about annual interest on the amount. By default, the Pension Fund transfers funds to Vnesheconombank for management. Each employee has the opportunity to increase the size of the funded part of the pension by transferring funds to the management of a non-state pension fund.

NPF "Magnit" provides compulsory pension insurance. The country has a two-tier pension system. It consists of savings and insurance parts. Let's look at the first level. The insurance part of the pension provides a person's basic income. It is a solidarity payment system. Contributions to it are paid by all employers for the people they hire.

people, The volume of pension savings is over 7 billion rubles, The yield is at the level of 11.77% per annum, The accumulated yield as of the end of 2021 is 107.21%, Pension savings are reliably insured by the state (cooperates with the DIA).

It’s not true, several years ago, or rather 6 years ago, I wanted to leave NPF Magnit, transfer to a pension fund, so they demanded an agreement with NPF Magnit from me, but they didn’t give us anything, they waved us documents and that’s it. and I stayed there.

Now I’m retired and I have a savings portion there in the amount of 2,750 rubles.

at the pension they said, you need to demand from your nickname that they pay, but where to write a request to Krasnodar? Oh, a familiar situation!

My friend was told almost the same thing. They hired her to work at the magnet, but they presented her with a fact: either you voluntarily transfer your savings to the NPF magnet, or we will force you

More on the topic Kachkanar Pension Fund official website personal account

Non-state pension funds were formed to invest pension savings in order to increase them.

You should trust those that were created by large companies a long time ago, they survived financial crises and currently have a stable income. NPF "Magnit" belongs to this category.

Login to your personal account

The SNILS card serves as a citizen’s insurance certificate and confirms his registration with the Pension Fund. It contains an 11-digit code. To register in the user account, you will also need authorization in the Unified Identification and Autonomy system. As part of this procedure, you need to enter personal data, phone number and email.

Expert opinion

Elena Koshereva

Pension lawyer, ready to answer your questions.

Ask me a question

Important! The website provides a special calculator with which you can calculate the approximate size of future payments.

To register you need:

- Select the appropriate section on the State Services website.

- Enter the required data.

- Click the “Register” link.

- Receive the code on your mobile phone and enter it.

Next, you need to set a login password. If this password is lost in the future, it can be recovered.

Hello, in this article we will try to answer the question “Non-state pension fund magnet personal account.” You can also consult with lawyers online for free directly on the website.

Shareholders of the Company who opposed or did not participate in the discussion on the issue of placement through a closed subscription of shares have a preemptive right to acquire additional ordinary registered shares placed through a closed subscription, in an amount proportional to the number of ordinary shares of this category owned by them based on the data of the register of shareholders on the date of determination (fixation) of persons entitled to participate in the General Meeting of Shareholders, at which a decision was made to increase the authorized capital of NPF Volga-Capital JSC by placing additional shares.

The funded part of a pension is, in fact, a long-term investment. All funds are invested in various enterprises and financial assets. Possible risks have been calculated and minimized, and the profitability of NPF "Magnit" as well as NPF "EDUCATION" has consistently exceeded inflation for many years.

Thus, in the period from 2009 to 2014, the total return was 54.06% (10.81% annual average), which is almost 6% higher than the inflation rate for the same period.

The legality of operations and control over the quality of service is carried out at the highest level - by the Bank of Russia, the Pension Fund of Russia, the board of trustees and a specially created audit commission.

The goal of the NPF was to manage the pension savings of employees and other citizens, achieve higher efficiency results compared to the Pension Fund and ensure minimal risks for investments.

Reliability of the Magnit pension fund

The reliability of the fund is ensured by the competent investment of pension savings and reserves. Three management companies are responsible for these issues.

Good to know! The Central Bank of the Russian Federation considers excessive returns on funds as evidence of investing in too risky assets. However, some excess of the indicator above the inflation rate is regarded as normal.

True, this does not apply to 2021 with inflation below 3%; the profit of all non-profit enterprises that operated without losses significantly exceeded this level.

Profitability of the Magnit pension fund

As for the profitability of NPF Magnit, according to the Central Bank, it amounted to 9.37% at the beginning of this year. According to this indicator, the fund took 23rd position among all non-state structures.

At the same time, the fund demonstrates fairly high performance. During his work, profitability was close to 100% per annum. Data for the end of 2021 can be found in the public domain. For this period, the indicators were as follows:

- The volume of savings exceeded 7 billion rubles;

- The yield was 11.77% per annum;

- The level of accumulated profitability is 107.21%.

The organization's strategy is focused on exceeding the inflation level, as well as using the safest financial instruments. Important! Savings are under reliable state protection through cooperation with the DIA.

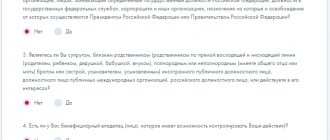

Procedure for registration and termination of an agreement with the fund. List of documents

Drawing up an agreement with a non-state pension fund serves as a guarantor of an increased pension. The document indicates the size of payments, terms of contributions, their total quantity. NPF representatives draw up a pension accumulation plan based on these data. Investments go to a personal account, which is opened for each investor.

Helpful information! A citizen must write an application to the Pension Fund to transfer money to the NFP. For applications written before the end of the calendar year, changes are made to the register three months in advance. After this, the savings are transferred to a non-state fund.

To complete the contract, you must provide:

- Depositor's passports;

- SNILS;

- Statements;

- Client questionnaire;

- Consent to work with personal information.

In case of termination of the contract, you will have to submit an application to the new NPF, indicating the option for subsequent management of the funds.

About the fund

NPF "Electroenergetics" was registered in 1994. The fund was created for the energy industry and energy workers. Nothing unusual. In those years, management (or people close to them) opened “pocket” funds as a source of inexhaustible personal resources. Investors were then promised: “if you save monthly for old age in 2021, you will receive more than a million in your account.”

Someone decided that energy workers cannot remain without work, and the non-state pension fund will always be full of money. Others looked at the fund's large clients (their names were associated with industrial giants).

There was enough money for NPF Elektroenergetiki to join in 2010:

- Wimm-Bill-Dann;

- "Loyalty";

- "Promregionsvyaz".

Then one of the oldest and largest funds in Russia “ate” NPF Lukoil Garant. Today, Otkrytie is considered the final legal successor of NPF Elektroenergetiki.

I wonder what role Irina Lisitsina played here:

- President of NPF "Electroenergetics" since 2012 and member of the board of directors since 2015;

- from 2004 to 2012, director of financial consulting, department director, managing director, head of the Otkritie investment group.

On the official website of NPF "Electroenergetics" the basic information was removed, leaving a message on the reorganization. But some data has been preserved on the network.

INFORMATION

STATISTICS

| Volume penny savings/reserves, thousand rubles* | 497999707,29586/ 66293673,99788 |

| Amount of pensions paid, thousand rubles* | 3207948,34707 |

| Number of clients* | 7131435 |

| Profitability* | 11.5 minus all remunerations (Central Bank data for Q2 2019) |

| Reliability rating | AAA until 2021 |

| Awards | Award winner: “Financial Elite of Russia”, nomination “Reliability” (2011); “Financial Elite of Russia”, nomination “Fund of the Year for NGOs” (2014); “Russian Financial Elite 2015”, nomination “Fund of the Year in the NGO Sector”. The Grand Prix: Best Five Year Fund (2005–2010); “Non-state pension fund of the year” (2013). Award “Financial Olympus 2010”, nomination “National Pension Fund Management Strategy. Dynamics and efficiency." |

TERMS AND SERVICE *

| Foundation programs | Funded pension Non-state pension Co-financing |

| Conditions of entry | There are no requirements |

| Types of payments | Lifetime, fixed-term, to legal successors |

| User's personal account on the official website | https://lk.open-npf.ru |

| Mobile app | No |

*NPF Otkritie

You can become a client of the legal successor of NPF Elektroenergetiki:

How to transfer pension

Proceed according to the scheme: “conclude an agreement with NPF Otkritie - terminate the agreement with another fund - notify the Pension Fund.” Moreover, all this is easier to do through the State Services website (if you have an electronic signature).

How to find out your savings

You can independently check your pension savings on the website of the successor NPF Elektroenergetiki (Otkritie) in your personal account. Or request written notification by calling the hotline.

I look at the situation: due to all the “marriage games” of funds, investors risk losing control over their money. Therefore, I advise you to register on the State Services website. Up-to-date information is provided there.

How to terminate an agreement with a non-state pension fund

Details of the procedure are specified in the contract. Taking into account changes in legislation, you need to:

- Write a statement to terminate the contract with NPF "Electroenergetics". There are different types of applications: early - with loss of investment income, unlimited - once every 5 years without loss.

- Conclude an agreement with a new fund.

- Notify the Pension Fund (submit a transfer application in person or through a notarized representative).

An important nuance: in order not to lose income (fixed once every 5 years), the application must be written in the year of recording before November 30.

On the website "State. But this will require an electronic digital signature.

Early retirement

...our native legislation is not considered a basis for starting payments. But if the agreement with NPF Elektroenergetiki stipulates that payments will begin from the moment of retirement (without specifying all the details), you can count on cash receipts.

Payment of fees

As NPF "Electroenergetics" paid, so you pay:

- through the accounting department where you work;

- through the Otkritie website in LC;

- make the transfers yourself.

The number of annual payments is specified in the contract.

Pros and cons of the fund

The decision to change the fund should not be made hastily. It is necessary to analyze all the pros and cons of the organization. For example, the advantages of NPF Magnit include access to information about the account status, programs in which funds are invested, and investment performance for a certain period.

After the client retires, his funds are still invested, and an annual recalculation is made to account for profits.

The downsides are the inability to predict the level of profitability and the theoretical possibility of losing the NPF license.

How to register a personal account

To take advantage of the Personal Account service, you need to join the loyalty program. The program is for those buyers who already have a bonus card.

You can join the program online on the official website of the retail chain:

- Follow the link https://moy.magnit.ru/enrollment ;

- Click on the only red button “Join us (Registration)”;

- You can see that creating an account is divided into 5 steps. First of all, you need to enter the full card number (16 digits in total).

- Next, click on the “Next” button, entering your personal and contact information (be sure to include your phone number);

- Confirm your agreement with the terms of the trading network and click on the “Register” button;

- To confirm the creation of an account, you need to enter a 4-digit code in one column. It is sent to you at the specified number.

An alternative way to create an account is to install the Magnit mobile application. It has been released for Android and iOS devices:

- Download the program from the Play Market or App Store, depending on the system of your smartphone;

- After launching the application, open the “My Magnet” category. Buyers are given two options - receiving a virtual card or activating a physical one. Select the option you are interested in;

- As on the website moy.magnit.ru , you provide personal data;

- All you have to do is specify the desired password that will protect your personal data, and click the “Finish” button;

- Confirmation of account creation occurs by specifying a 4-digit code sent to your smartphone in the form of SMS.