Merger of NPF Raiffeisen with Safmar

This company began its work in the 1990s. Therefore, we can say that the population of the country has managed to make sure that the organization fulfills its obligations in good faith. Over time, the quality of the services provided does not decrease; verification activities are constantly carried out to confirm professionalism.

At the beginning of 2014, this fund was reorganized , as a result of which it became part of ]Samfar[/anchor], which is also represented by a non-state pension fund.

All acts and funds, obligations of Raiffeisen, as well as clients were transferred to this organization. Then the Regionfond, the European Foundation and Education and Science joined this company.

Raiffeisenbank for pensioners: savings program. Customer service of NPF "SAFMAR"

Several companies under the Raiffeisen name were initially opened in Austria. Only in the mid-2000s did the leadership begin to provide citizens of Russia with non-state pension provision and compulsory insurance, because a branch of the organization was opened in the country.

The financial company has been operating since the mid-nineties. Citizens managed to verify that the organization fulfilled its duties conscientiously, the quality remains at a high level, and the professionalism of specialists is confirmed by numerous inspections.

The organization confidently occupies a position in the Russian market and hopes for long-term cooperation with its clients.

Reorganization and merger of NPF Raiffeisen

NPF Raiffeisen began to undergo a reorganization in 2014; it was subsequently sold to Mikhail Shishkanov and his group for more than 3.5 million rubles. Last year, the financial organization received the name JSC NPF Samfar, and all assets, funds, liabilities and clients were transferred to the new company.

After this, Raiffeisen was joined by the Regionfond, the European Foundation and Education and Science.

Merger of NPF Raiffeisen with Safmar

At the beginning of 2014, this fund was reorganized , as a result of which it became part of the fund, which is also represented by a non-state pension fund.

All acts and funds, obligations of Raiffeisen, as well as clients were transferred to this organization. Then the Regionfond, the European Foundation and Education and Science joined this company.

Profitability of an individual pension plan

Individual plans at NPF Raiffeisen allow you to independently select parameters to influence profitability:

- Amount of contributions;

- Periodicity;

- The duration of the accumulation;

- Appointment of a successor, if desired.

Find out about the possible profitability of the individual pension plan of NPF Safmar by calling

All client contributions are accumulated on his balance, which can be seen in the Personal Account. The profitability of NPF Raiffeisen is ensured through the participation of participant contributions in investing. The growth of the investment balance can also be traced in the transparent Raiffeisen system.

The contract displays the method of receiving savings according to one of the options:

- Lifetime;

- For life with the appointment of a successor;

- Urgent: payments within a specified period (at least 5 years);

- Receiving payments before the balance is reset in the amount of funds contained on it.

Today, NPF Raiffeisen has the following tariffs:

- First installment: from 30 thousand rubles;

- Subsequent: from 5000;

- Fund administrative fee: 3% of each receipt;

- Insurance fee (to form a reserve): 1%.

It is worth noting the availability of tariffs, according to which, until 2015, the initial receipt had to exceed 300 thousand rubles, and the amount of fees depended on the amount.

Management of the Raiffeisen fund and its assets

The fund's shares belong to JSC Raiffeisenbank.

The investment portfolio is managed by companies with the most reliable A++ ratings, also confirmed by Expert RA in recent years. This:

- Raiffeisen Capital Management LLC;

- JSC "UralSib Management Company";

- LLC "UK "Kapital";

- OJSC TKB BNP Paribas Investment Partners;

- CJSC "UK "TRANSFINGROUP";

- OTKRITIE UK LLC.

Co-financing in NPF Raiffeisen

An additional opportunity to increase profitability is the government co-financing program. The client needs to transfer 2-12 thousand rubles per year to his pension account. The state will double this amount.

The procedure follows this order:

- Receive a receipt on the PF website or at the Pension Fund at your place of residence.

- Pay it at a branch of Raiffeisen, BINBANK or any institution.

- Provide a copy of the receipt with a note about payment to the Pension Fund. This must be done up to 20 days before the end of the quarter in which the payment occurred.

A similar procedure can be carried out through your employer’s accounting department through an appropriate application.

- https://ru-NPF.ru/rayffayzen/

- https://pfrp.ru/faq/npf-rajffajzen.html

- https://bankclick.ru/info/npf-rajffajzen.html

- https://pensionnyj-fond.ru/npf/raiffeisen/

- https://raiffinfo.ru/ladi/rayffayzenbank-pensioneram-nakopitelnaya-programma

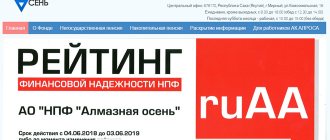

Reliability rating as part of Sofmar

In 2012, the Raiffeisen fund was assigned a positive degree of reliability, which indicates trust from users. As a result, the company's profitability increased. In 2013, experts recognized the level of the company’s activities as reliable and gave it a high rating.

In addition to the fact that the organization in question pursues the goal of preserving funds, it strives to adhere to a minimum level of risks and ensure increased income. Therefore, savings are invested on an ongoing basis, and reserve savings are used.

Non-state pension fund programs

A mandatory condition for the organization in question is pension insurance. Therefore, Raffeisen offers its clients, at their own discretion, to manage their assets that have accumulated in the account. Due to the fact that the pensioner makes a contribution to the organization, he manages finances and plans for future activities.

The amount of the funded part of the pension will depend on how much money is constantly transferred to the fund. If a citizen wants to become a client of Raiffeisen, he will need to contact NPF Samfar, since these institutions have merged. Citizens are served at a Raiffeisenbank branch.

Certain categories of citizens can take advantage of savings programs:

- persons born in 1967 and later. In this case, the contribution amount is about 6% of income. Savings are formed from contributions made by the company where the citizen works;

- participants in a program that provides co-financing of a pension;

- owners of maternal capital funds.

The program of this fund assumes that funds will be accumulated in an account opened with a banking organization. At the same time, the contribution has some positive aspects.

Including:

- opening is made in rubles;

- with the use of a co-financing program it is possible to increase income;

- funds can be transferred to heirs;

- ability to manage money.

Reference! The program is selected individually, depending on the citizen’s income level.

How to become a member of NPF Raiffeisen

Citizens can apply for participation in this pension fund either independently or through authorized representatives. However, it is worth considering that in the second case, the package of documents that will need to be provided to the organization will be slightly different.

The applicant himself or his official representative is allowed to transfer documents to the company office. Or you can send the collected papers to the address: 111250 Moscow, Serp and Molot Zavoda proezd, 10, JSC NPF "SAFMAR". The fund operates from nine in the morning to six in the evening. When sending via Russian Post, it is necessary to notarize the signatures of copies of the attached documents and the authenticity of the signature on the application.

NPF contacts can be found on the organization’s official website

The organization also allows the transfer of packages of documents through partners, who can be found at HKFBank LLC or at Raiffeisenbank branches. Their opening hours are also limited to weekdays from 9 a.m. to 6 p.m. In this case, you will have to fill out an application in electronic form in advance, which is available on the official website of the fund.

If the list of documents received turns out to be complete and sufficient, then a notification in the form of a receipt will be sent in response to the applicant’s specified address. It will indicate the date of reception and registration number. The decision to assign a pension or payment will be notified within 10 working days.

When documents are submitted personally by the applicant, the following package must be submitted:

- ID card (passport);

- standard form application;

- confirmation of the processing of personal data;

- SNILS;

- certificate from the Pension Fund;

- pension certificate (if any);

- Bank details.

When transferring documents by an intermediary, you will need documents that confirm his legal authority. This will be the original power of attorney, identification card, proof of residence.

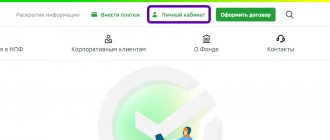

Official website of the company

The company in question has developed its own website, which is designed for the convenience of clients.

It consists of the following:

- the opportunity to obtain information about programs at NPFs;

- placement of contact information on the portal, which helps to know where to go to resolve the issue;

- registration in your personal account.

Having an account in your personal account allows a person to always be up to date with his funds.

Is it possible to create a personal account and how to do it

Only those citizens who have entered into agreements with the fund can use the service in question. Therefore, you do not need to register on the NPF portal; it is enough to use the login data that will be provided by a company employee when concluding an agreement.

If a person forgets his password, he can recover it himself by using the “Forgot Password” button. The system will ask you to enter an email address that is associated with the agreement. A letter is sent to this address containing a link that you need to follow to recover.

Attention! If a citizen did not indicate an email when concluding an agreement, he will need to contact the fund’s branch to do this. In addition, information can be sent by mail.

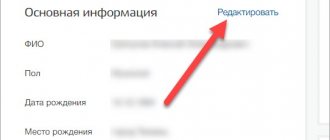

Personal account functions

The personal account is designed to provide clients with convenient use of NPF services. A citizen has the opportunity to carry out transactions related to a funded pension around the clock and using any device with Internet access.

Including, information is provided about:

- the state of the citizen’s current account;

- information about transactions carried out on the account;

- personal data verification;

- alteration;

- contact support service.

In addition, the ability to generate a pension account statement or set up notifications can be used.