Due to the recent numerous reforms of the pension system, many answers have developed around it. And this material briefly but succinctly gives answers to the most common of them. The assistance of a lawyer in Moscow on the most common problems that arise for pensioners will also be considered.

- Questions about applying for a pension Retirement age

- Where to submit documents

- How is the pension calculated?

- How to increase your pension

Questions about applying for a pension

Opens a category of frequently asked questions – formal, related to concepts such as:

- retirement age;

- where to submit documents;

- What are pension points and how to earn them.

Such questions are asked not only by people who are about to retire, but also by those who have just started their working lives. Therefore, such a short educational program will be useful to everyone.

Retirement age

Since the times of the USSR and until 2021, the age when a person could leave work and enjoy rest has not changed and was 60/55 years for men/women, respectively. However, as a result of pension reform, justified partly by demography and partly by increasing life expectancy, the retirement age has been shifted up to 65/60 years for men and women.

The transition period to the new age is 5 years and will end only in 2024. Up to this point, from 2021, 1 year is added to the previous values, but a number of benefits apply:

- after completing 42/37 years of service, men/women can retire 2 years earlier than the “standard” retirement age, but the pensioner cannot be younger than 60/55 years, respectively;

- for the first 2 years, there is a preferential retirement 0.5 year earlier (if a person was planning to retire in the first half of 2019, then he will be able to apply for state support in the second half of 2021).

However, when applying to the Pension Fund, you should keep in mind that a person must have a minimum amount of experience and accumulate a minimum number of points. Since 2015, the requirements have increased every year. In 2019, at least 10 years of experience 16.2 pension points are required. And from 2025, you will need 15 years of experience and at least 30 pension points.

Muscovite Nina S. turned to a lawyer for help. The woman was wondering what she should do - she has the required 10 years of experience, but due to her small salary, she earned only 14.5 points. During the conversation, the lawyer found out that the woman has a child, the period of care for which is not included in the length of service. Since this period is not an insurance period, but pension points are awarded for it, the woman can claim an additional 2.7 points for child care, and therefore, the Pension Fund of the Russian Federation is obliged to grant Nina an old-age pension.

Where to submit documents

To assign a pension, a citizen must contact the territorial office of the Pension Fund at his place of residence. You can send documents in any of 4 ways:

- in person at the Pension Fund branch or through the MFC;

- with the help of an authorized person who represents the interests of the applicant on the basis of a power of attorney;

- via Russian Post;

- via the Internet on the State Services portal or on the Pension Fund website.

The package of documents consists of papers confirming the applicant’s experience and salary. If necessary, the Fund's specialists may request additional documents. The pension is assigned from the day the application is accepted.

How is the pension calculated?

The calculation of pensions in 2021 does not change compared to the provisions in force since 2015. The amount is still determined by length of service and salary, which are converted into pension points. Moreover, the pension itself consists of 2 parts.

- Fixed payment, which is determined by the state (RUB 5,334.19 in 2021).

- The amount of pension points multiplied by the cost of 1 point (RUB 87.24 in 2021).

The third part is the amount of savings in the funded pension system. The monthly amount paid depends on which form of receipt the pensioner chooses. There are 3 options possible.

- One-time payment of savings (no more than once every 5 years);

- Urgent pension payment.

- Indefinite payment.

Sanitated by the Central Bank through the mechanism of the Fund for Consolidation of the Banking Sector (FCBS), Promsvyazbank filed a lawsuit against non-state pension funds (NPF) “Future”, “Safmar”, “Doverie”, the management companies of these funds - EG Capital Partners, IQG Asset Management, “Investment Management” , as well as to the former controlling shareholder of the bank - the company Promsvyaz Capital BV, follows from the file of cases of the Moscow Arbitration Court. The third parties are the Bank of Russia, the Moscow Exchange and the National Settlement Depository (NSD).

The subject of the claim and the claims are not disclosed. “The subject of the claim is not clear, we have not received a copy of the claim,” said the press service of the NPF Future. “As of January 22, the funds of the Safmar pension group did not receive statements of claim from Promsvyazbank or rulings of the arbitration court to accept such a statement of claim for proceedings,” said Mikhail Gutseriev, a representative of the pension division of the industrial and financial group Safmar, which unites the NPF of the same name and the Trust Foundation.

Previously, the pension funds mentioned in the lawsuit reported that they sold the shares the day before the announcement of the reorganization of Promsvyazbank - December 14 last year. NPF "Future" of Boris Mints owned 10% of the shares, NPF "Safmar" - 6.2%, and the fund "Doverie" - 3.8% (see "Kommersant" dated December 18, 2017). “The managers and NPF Doverie sold shares of Promsvyazbank on the stock exchange on December 14, 2021,” said a representative of the pension division of PFG Safmar. According to her, in accordance with the rules, the exchanges and funds received notification of the sale of Promsvyazbank shares on December 18, 2021. “The decision [to sell the shares] was made because information appeared in the public sphere about the necessary additional capitalization of Promsvyazbank and a possible transfer to the FCBS. As part of portfolio risk management, we made this decision,” said earlier a representative of the Future financial group, which owns the NPF of the same name (quote from RNS).

lowsrc() How investors parted with Promsvyazbank

In the second half of December, Deputy Chairman of the Bank of Russia Vasily Pozdyshev said that the regulator had identified manipulations with the sale of Promsvyazbank shares to the management company (MC) of several NPFs the day before the reorganization. According to him, on December 14, the bank’s shares were sold to the management company, which manages the funds of several non-state pension funds. Presumably, to finance these transactions, the fund management company placed several deposits with the bank on December 14 for a period of one week. “On the same day, an equivalent amount of funds was transferred to the account of Promsvyaz Capital BV (an offshore company of the bank’s owner), which on the same day paid the management company of the NPF for the sale of shares. To hide the manipulations, share purchase and sale transactions were carried out through the stock exchange. Exactly a week later, the management company of the NPF turned to the temporary administration of the bank with a demand to return the deposits placed on December 14,” said the deputy chairman (quoted by TASS).

How Promsvyazbank will become an “anti-sanction” bank

At the end of December, the provisional administration of Promsvyazbank asked Prosecutor General Yuri Chaika to initiate a criminal case in connection with the purchase of bank shares by a non-resident company on the over-the-counter market. The Central Bank asked the Prosecutor General's Office to conduct an investigation into this fact. A representative of the pension division of PFG Safmar stated that the management companies of the group’s funds did not place deposits with Promsvyazbank.

The Moscow Exchange, the Central Bank, NSD, EG Capital Partners, IQG Asset Management, and Investment Management did not respond to Kommersant’s request on Monday evening. Promsvyaz Capital BV could not be contacted.

Ilya Usov

Pension questions

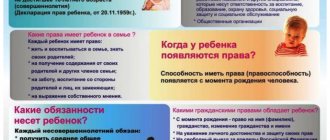

The second large group of questions comes from those who have already retired. Naturally, pensioners are concerned about:

- is it possible to increase the pension;

- will social supplement be abolished from 2021;

- Will the pension decrease if the pensioner goes back to work?

Let's look at each of them in a little more detail.

How to increase your pension

It is believed that the Pension Fund accrues the maximum possible pension to a citizen. However, the Fund takes into account only the data that it has. In addition, the fund’s specialists do not track who is entitled to what bonuses.

Therefore, the insurance pension in 2021 can only increase if the citizen independently determines the possibility of calculating additional payments. The basis may be:

- caring for a disabled person;

- having a dependent;

- own disability;

- obtaining information about unaccounted experience.

But unfortunately, not everyone knows the list of reasons for increasing pensions, and even the Fund’s specialists are sometimes powerless to help. Therefore, a pensioner should contact a lawyer who, with the help of leading questions, will determine the existence of facts according to which the citizen will be entitled to a recalculation or additional payment. Consultations with specialists are mostly free.

If the pension is small

It is legally established that pension benefits should not be lower than the pensioner’s subsistence level. Consequently, a citizen is entitled to an additional payment if his pension is too low. In 2019, an additional payment up to the pensioner’s subsistence level is calculated in accordance with the amount accepted in the region. For example, for Moscow pensioners the minimum pension will be 12,115 rubles, but in the Kamchatka Territory a pensioner can count on 16,543 rubles.

The specific amount of the social supplement depends on the pension assigned to the pensioner. It represents the difference between the level of the pensioner’s subsistence level in the region and the actual amount of maintenance assigned.

A pensioner is about to get a job

For some reason, many citizens who have already retired, think that if they have to get a job in retirement, then all the indexations made will be canceled and they will receive mere pennies. But this is not true; the Pension Fund does not have the right to reduce the size of the pension simply because a pensioner decided to go to work.

Another issue is indexing. Unfortunately, the economic situation in the country excludes indexation for working pensioners. And here the citizen will have to choose - receive a salary and a pension, or live only on a pension, which will be indexed annually.

However, working pensioners who missed indexation will receive an increased pension 3 months after dismissal. At the same time, they will make all missed indexations.

Due to frequent updates to legislation and the legal uniqueness of each situation, we recommend obtaining a free telephone consultation with a lawyer. You can ask your question by calling the hotline number 8 (800) 555-40-36 or write it in the form below.

Pension FAQs

The head of the Office of the Pension Fund of the Russian Federation in the Volkhov district of the Leningrad region (inter-district) Kuzina Natalya Vyacheslavovna answers citizens' questions regarding

pension provision. QUESTION: Can I take care of my husband's mother and receive a compensation payment if in a month I am assigned an old-age pension?

ANSWER: Compensation payment for care is made to a non-working able-bodied person caring for a disabled citizen. Pensioners are considered disabled citizens, therefore, when a pension is assigned, the payment of compensation stops. Any non-working, able-bodied person, regardless of family relationships, can apply for care compensation.

QUESTION: A granddaughter takes care of her grandmother and receives a compensation payment; if she goes to work, will the additional payment be stopped?

ANSWER: Compensation payment is made to an able-bodied non-working caregiver. If the granddaughter goes to work, she will no longer have the right to this compensation, and the payment will be stopped. The granddaughter must immediately report her work to the Pension Fund Office so that there is no overpayment.

QUESTION: Recipients of pensions whose pension amount is less than the subsistence minimum are paid a federal social supplement to their pension. Who sets the cost of living, and how often can it change?

ANSWER: The minimum subsistence level for a pensioner in each subject of the Russian Federation in order to establish a social supplement to the pension is annually established by the law of the subject of the Russian Federation. This year the cost of living is 8,726 rubles.

QUESTION: How to get a set of social services?

ANSWER: The citizen decides in what form it is convenient for him to receive social services: in kind or in cash equivalent, and submits a corresponding application to the territorial body of the Pension Fund of Russia at the place of registration or actual residence or through the multifunctional center for the provision of state and municipal services before 01 October of this year. The submitted application will be valid until the citizen changes his choice.

QUESTION: Can I get a job when receiving a survivor's pension and child care?

ANSWER: According to current legislation, disabled family members of a deceased breadwinner who were his dependents are entitled to a survivor's pension. The spouse of the deceased breadwinner is recognized as a disabled family member, regardless of age and ability to work, if he is caring for the children of the deceased breadwinner under 14 years of age and does not work. That is, when you get a job, the right to receive a survivor's pension is lost.

QUESTION: What document must be submitted to the Pension Fund to extend the payment of a pension if a citizen lives abroad?

ANSWER: Payment of pensions to persons living outside the Russian Federation is made subject to the submission to the Pension Fund (its territorial body) of a document confirming the fact that the citizen is alive, or subject to the annual personal appearance of the pensioner. A document confirming the fact that a citizen is alive is issued by a notary on the territory of the Russian Federation or by a competent body (official) of a foreign state.

Confirmation of the fact that a citizen is alive can be carried out by his personal appearance at a diplomatic mission or consular office of the Russian Federation, or at the Pension Fund of the Russian Federation (its territorial body). In this case, an act of personal appearance of the citizen (his legal representative) is drawn up in order to continue payment of the pension during the appropriate period.

QUESTION: Is the right to payment of a survivor's pension retained until graduation if the child turned 18 years old in May and will there be a right to receive a pension in the summer before entering university?

ANSWER: In accordance with the law, disabled dependent family members of the deceased breadwinner have the right to a survivor's pension. Disabled family members are children of a deceased breadwinner who have not reached the age of 18, as well as children studying full-time in basic educational programs in organizations engaged in educational activities until they complete such training, but no longer than until they reach the age of 23. If a certificate containing information about the vacation period is provided, the survivor's pension will be paid until the end of the vacation period.

QUESTION: What documents must be provided to extend the payment of a survivor's pension after reaching 18 years of age?

ANSWER: To extend the payment of a survivor's pension after reaching the age of 18, it is necessary to submit a certificate from the place of study to the territorial body of the Pension Fund at the place of residence. The pension will be paid until completion of studies at the educational institution. If a certificate containing information about the vacation period is provided, the survivor's pension will be paid until the end of the vacation period.

Procedure for consideration and resolution of disputes on pension issues

According to Art. 31 Federal Law No. 167-FZ “On compulsory pension insurance in the Russian Federation” provides for the resolution of a pension dispute in pre-trial (administrative) and judicial proceedings.

Administrative procedure means consideration of the issue by the insurer's body - the Pension Fund of Russia. Citizens have the right to submit applications both individually and collectively, and the review itself is free of charge. Anonymous complaints are not subject to consideration, so the applicant is required to indicate his last name, first name, patronymic and address to send a written response. The submitted document must have a personal signature and the date indicated so that the insurer cannot refuse a response due to formal circumstances.

An appeal to the insurer's authority may be submitted:

- personally, i.e. directly to the office of the authority;

- by Russian post or by courier delivery;

- through the State Services website;

- through your personal account on the official website of the pension fund;

- via email to the address specified for feedback on the official website of the pension fund.

It is worth noting that officials do not have the right to consider complaints against their own actions. If this prohibition is violated, a citizen has the right to appeal to a higher authority of the insurer or to court.

The legislator has established a deadline for providing a response - one month from the date of receipt. In exceptional cases, it may be extended, but not more than 30 days. There is no time limit for sending an application from the moment of violation by current legislation.

If an unsatisfactory response is received, the citizen can contact the insurer's higher authority and file a complaint in court.

Judicial procedure means that an appeal against a decision of a pension authority or a specific official will be considered through the legal process. This is the most effective way to resolve a dispute, since the court can not only cancel the illegal decision of the pension fund, but also directly restore the violated right of the applicant. If the application is submitted by an individual, the dispute will be considered by the court at the location of the territorial body of the pension fund. As a rule, the location of the territorial insurance body and the citizen’s place of residence coincide. The amount of the state duty depends on the subject of the dispute and the applicant himself, since, for example, pensioners to whom a pension was assigned in accordance with the procedure established by law for property and administrative claims arising from property relations with the Pension Fund of the Russian Federation and non-state pension funds are exempt from its payment.

The judicial review of a pension dispute can be conditionally divided into several stages, the total duration of which is on average two months:

- Filing a claim . After filing the statement of claim, the court will have 5 days to make a decision on whether to accept the statement of claim for proceedings or leave it without progress. The court leaves the claim without progress if there are deficiencies that require correction, after which they are eliminated, it orders a preliminary trial.

- Preliminary trial . It is a survey of the parties in which the plaintiff sets out his demands and the defendant presents his objections. At this stage, it is useful for the applicant to file a petition with the court to request from the opposing party documents and information that it is not possible for him to obtain without the help of the court. You can also make a request to attract witnesses, since such a statement during the main trial may lead to its postponement.

- Court hearing . During the main court hearing, the court considers the case on its merits. The parties state their positions on the dispute and provide additional evidence. After the court has examined all the materials of the case, the parties participate in debates, then with closing remarks, after which the court retires to the deliberation room.

- Making a decision . The court announces to the parties the decision made, the procedure for appealing and the period for entry into legal force.

If you receive a positive decision, you must wait until it comes into force, and then contact the pension fund. For the insurance authority, the court decision is binding.

ATTENTION: watch the video about the assignment of preferential pensions to teachers, medical workers, lists No. 1, No. 2, and also subscribe to our YouTube channel. Then you will be the first to see new videos and will be able to ask a lawyer a question in the comments for free.