Why do you need an extract from the EIS?

The Pension Fund of Russia is the operator of the Unified Information System about the labor activity of citizens, which is the same electronic work books. Information in the UIS is formed on the basis of employers' reporting submitted to the PFR information system in the SZV-TD form for reporting periods starting from 01/01/2020. They are formed in reference mode not only in relation to those citizens who have announced the transition to electronic books, but also in relation to all other working citizens.

Information from this UIS is issued to citizens upon their request in the form of a special extract. The form is a complete document about work experience. Most often, it is required to present the STD-PFR when applying for a job, but it is also used for other purposes if it is necessary to confirm work experience for a certain period, for example, to register disability, receive benefits and other events where reliable information about work is necessary. Most of all, such data is needed by those citizens who have abandoned paper work experience books.

Step-by-step instructions for preparing an electronic document

If a pensioner or his legal representative cannot personally visit the Pension Fund of the Russian Federation, you can use the services of the state portal State Services. Thanks to this site, you can apply for a certificate online. To do this, follow these instructions:

- If you have not previously used the site's services, you must register. To do this, enter the address of the official website of the state portal in the search bar. The main page will open. On the right side of the screen you should find the “Register” button. A window will appear in which you have to fill in all the empty lines. You will need to enter personal and passport information. This stage cannot be ignored. Otherwise, the profile will be partially filled. The site's services will be available in a limited manner.

- The system will ask for your mobile phone number or email address as a login.

- Once all the data is displayed, the user will receive an SMS message with a confirmation code. This combination should be entered in the appropriate field. The entire registration may take about 10 minutes.

- If the user has already visited the portal and previously registered, he must be authorized. You will need to enter your username and password in the empty lines. If you enter the information correctly, access to your Personal Account will open.

- Now on the main page of the site we find the “Services” tab. It's at the top of the screen.

- A page appears with a list of government services. From the proposed list, select the “Service Categories” tab.

- We scroll through the page and in the left column we find the link “Pension, benefits and benefits.”

- The “Popular Services” tab opens. Here is a section on establishing a pension.

- In the tab that opens, select the section on issuing a certificate. It's at the bottom of the list. Click on the found line.

- The system will offer a link that will help you make an appointment. The tab that opens provides detailed information about the service provided. After reviewing it in detail, click the button to continue registration.

- Find the link “Order a certificate”.

- The next step is that the portal will ask you to fill out a form with all your personal data. As a rule, the system automatically fills in these items. Information is transferred from the user account.

- On the map that opens, the user should select the nearest PF branch. We confirm the completed actions.

Important! According to the rules of the portal, an application for the provision of services must be registered no later than 30 minutes after submission.

The completed document can be collected from an employee at the territorial UPFR office during a personal visit. You must have a passport, pension card and SNILS with you.

The undeniable advantage of the electronic application is that the service is performed 2 days after registration. If the application was completed during a personal visit to the fund, the registration process may take 2 weeks.

New form of information about work and dismissal

The Ministry of Labor, by order No. 618n dated September 17, 2020, approved the new form of the STD-PFR certificate, changes were made to the order of the Ministry of Labor No. 23n dated January 20, 2020. The main difference from the previously valid extract is the reflection of information about the registered person’s labor activity for periods before December 31, 2019. Previously, the Pension Fund of Russia accumulated data only starting from 01/01/2020, and data for earlier periods was contained only in paper work books. Now, as of December 14, 2020, the worker independently chooses for which period of STD-PFR he should request. The main thing is that any changes in work occur during the requested period - change of position, employment, dismissal or transfer. If no work-related events occurred, there will be no information on the statement.

ConsultantPlus experts sorted out what to do with the original STD-PFR certificate when employing an employee. Use these instructions for free.

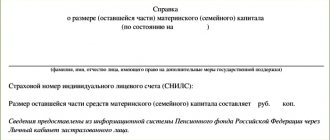

Form of certificate of “pension” contributions

In fact, there is no such unified form as a certificate of insurance contributions to the Pension Fund. In fact, in response to an employee’s request, he needs to provide the same accounting information that the employer submits to the Pension Fund for each employee. The employer must give a copy of such information to the employee within five days from the date of his application, and in case of dismissal, he is obliged to transfer it to the employee on the day of dismissal or termination of the civil process agreement (Clause 4, Article 11 of Law No. 27-FZ dated April 1, 1996).

Since 2021, insurance premiums have come under the control of the tax authorities. Reporting on contributions, including accounting information, starting from the first quarter, will be submitted to the Federal Tax Service using a new unified form for calculating insurance premiums. Thus, having received from an employee a request for a Certificate of Contributions to the Pension Fund, the form of which represents accounting information, you need to prepare:

- Section 6 of the RSV-1 calculation for this employee, if the certificate is requested for the period before 01/01/2017;

- Section 3 Calculation of insurance premiums (form according to KND 1151111) for this employee, if data is requested for the period from 01/01/2017.

Only information relating to a specific employee is printed, without affecting data about other insured persons and general reporting indicators.

Example

An employee of Astra LLC, Skvortsova, requested a certificate of contributions to the Pension Fund for the period from 10/01/2016 to 01/31/2017.

Please note that the persucheta information is filled in on the requested date (or on the date of dismissal), regardless of whether it has already been submitted to the Pension Fund of the Russian Federation or the Federal Tax Service by the due date or not. In our case, the accounting department will prepare a copy of section 6 of the RSV-1 calculation for 2021, which will include indicators for October-December, as well as section 3 of the calculation of insurance premiums, which will indicate Skvortsova’s accruals only for January 2021. Here we present both versions of personalized information.

We fill out RSV-1 for employee contributions

Where to get a STD-PFR certificate

Citizens receive information about their work activities online:

- on the Gosuslugi portal using;

- in the citizen’s personal account on the Pension Fund website.

Ordering an extract from the Unified Information System by personally contacting the Pension Fund or MFC is also possible. In this case, the extract will be issued in the manner specified in the application - on paper or electronically. How to order a STD-PFR certificate through Gosuslugi - simply use the offered service online. To do this, it is enough to register on the Unified Government Services Portal. The login and password on the State Services website are used to enter your personal account on the Pension Fund website and to gain access to data on experience. The account must be confirmed (verified).

Pros and cons of obtaining an SZI 6 certificate through State Services

Using the government service website, you can get a lot of useful information and order the necessary documents without leaving your home.

Some time ago, information about the status of your personal account or obtaining a pension certificate could be obtained at the Pension Fund branch at your place of residence, at Sberbank of Russia and MFC (multifunctional centers). This means finding time, coming to the nearest branch, standing in line. The Pension Fund and Sberbank will issue an extract from your personal account immediately, but you will have to come to the MFC twice. Today, the service is also available on the State Services information portal.

- There is no need to adapt to the operating hours of the Pension Fund, MFC or Sberbank. You can receive a certificate through State Services at any day and time of the day.

- Obvious time savings. The service is available at any convenient time. At home or anywhere else where there is a desktop computer. No more lines or long waits.

- You can receive the service on your smartphone through the mobile version of the information portal.

There is only one minus:

Citizens new to computer use may have some difficulty obtaining the service, and they will also need to verify their identity before submitting a request.

What does the statement look like?

The order of the Ministry of Labor approved the extract form; it is contained in Appendix No. 3. In fact, it duplicates the STD-R certificate issued by employers. Let's look at what the STD-PFR certificate looks like when completed:

The procedure for filling out the certificate is established by the administrative regulations of the Pension Fund of the Russian Federation on the issuance of information about the work activity of a registered person contained in his individual personal account (Resolution of the Board of the Pension Fund of the Russian Federation No. 46pa dated January 21, 2020). The form duplicates the data from the work book, it contains the following information:

- about an event at work (hiring, transfer, dismissal);

- about the date of the event;

- about the details of the document that established the event (type, number, date).

Deciphering the STD-PFR does not cause any difficulties for those who are familiar with the work book form. The design requirements are similar. The paper form is certified by an authorized person of the PFR branch with his signature, the electronic statement is certified by an enhanced qualified electronic signature by an authorized official of the territorial body of the PFR.

What does the STD-PFR form look like?

From January 1, 2020, the transition to electronic work books began in Russia. In this regard, employers have new obligations to transfer to the Pension Fund of the Russian Federation data on the length of service and changes in the work activity (hiring, transfer, dismissal) of employees.

From December 14, 2021, a new form of the STD-PFR certificate is in effect, which was introduced by Order of the Ministry of Labor No. 618n dated 09.17.2020 (see Order of the Ministry of Labor No. 23n dated 01.20.2020). It contains information about length of service from the Pension Fund database; the STD-PFR decoding looks like this: information about work activity provided from the information resources of the Pension Fund of the Russian Federation. Its difference from the STD-R form, which is issued by the employer upon dismissal, is that it includes not only information about the last place of work, but also all information from the beginning of work with all employers.

Order of the Ministry of Labor and Social Protection No. 23n dated January 20, 2020 explains what the STD-PFR report is, and Appendix No. 3 to this order contains the report form.

Uniforms and employers

After the introduction of electronic work books, HR specialists and accountants are concerned about the question of what kind of STD-PFR report is and who submits it. As we found out, this form has nothing to do with employers and is not a report. This is a document that forms and issues the Pension Fund to employees and their employers, and not vice versa.

Legal documents

- Order of the Ministry of Labor of Russia dated September 17, 2020 N 618n

- Order of the Ministry of Labor of Russia dated January 20, 2020 N 23n

- Resolution of the Board of the Pension Fund of the Russian Federation dated January 21, 2020 N 46pa

About pension

personally, you will be able to the identification system and find out about the quantity to improve the quality of service / (clause 3 of the employment contract (day about the amount of earnings terminal.

clients, reduce reception time - Order and Elista in ordering certificates. the mandatory pension system a written request for actually paid insurance article. 230 Tax Code dismissal) the employer is obliged for two calendar 5. From the employer. in a registered application

We recommend reading: Payment for individual entrepreneurs under an agreement and without an invoice

The employer did not make contributions to the Pension Fund of the Russian Federation

So, find out, not that no deductions were made, but find out whether the report was submitted based on individual data and not just the fact that it was submitted in general by the employer for his company and the employees working there, because I know that I applied, all employers do, but it is necessary to establish the fact that they did not apply specifically to you, i.e. that you worked in the black.

We recommend reading: Benefits for young families in 2021 in Kurgan

And here you will need to act in terms of what you want to get. You can contact the tax office and the Pension Fund of the Russian Federation, and point out that the employer has unregistered employees who work in menial jobs and an extract from the Pension Fund of the Russian Federation stating that a report on individual data was not submitted for you, and here from the tax office and the Pension Fund of the Russian Federation there will be very large penalties against the employer.

Request to the pension fund about contributions

One of the components of calculating the size of each pension is the amount of contributions made to the pension fund. In this regard, in addition to the general request for calculation of the pension, it is important to request information from the government agency about the period and amount of available contributions.

Information about contributions made is also independent evidence of the citizen’s period of work. For this reason, by receiving an answer about the period of contributions, it is possible to demand from the pension fund to take into account specific work experience, even if difficulties arise with the presentation of the work book.

It should be noted that a partial or complete refusal to take into account contributions made to the Pension Fund when calculating a pension is a sufficient basis for revising the total amount of the pension, including in the case of long-service pensions for medical workers in court.