Payment source

Funds to supplement miners' pensions come from contributions made by coal industry enterprises to the budget of the Russian Pension Fund.

Note that the additional payment in question is an independent social payment. Its value does not depend on the type and size of the pension to which it is assigned.

Average payout

Contributions for persons who were employed in mining are paid by the employer every month. The mining company sends funds to the pension fund where the employee has entered into an insurance contract. The amount of payment for such persons is indexed annually. This is necessary due to increasing amounts of employer contributions.

The benefit is determined only for persons who work full time - 8 hours. Otherwise, the citizen will not be able to count on additional benefits. The average pension payment for miners is about 17,000 rubles.

A list with all professions for which early payment of a pension can be issued is contained in PSM of the RSFSR No. 481. The list has not undergone changes since the law came into force.

Formula and example of calculating a pension for a miner in Russia

The payment is calculated according to the following formula:

The cost of a pension point in 2021 is 87.24 rubles. It is by this amount that all points earned by the pensioner will be multiplied.

The fixed payment amount in 2021 is 5334.19 rubles. Next year the amount will be indexed, and the percentage of the increase will depend on the economic situation in the country.

Knowing the initial data, you can calculate the size of the pension payment. As an example, let's take a man who worked in hazardous enterprises for 20 years, served in the army and worked in other fields for about 5 years. Over the course of his life, his contributions have accumulated 138 pension points. Then the size of the final pension will be:

The total amount may be increased due to additional tariffs and factors:

- duration of work;

- average salary;

- the amount of funds transferred as insurance premiums.

If the bonus is based on the number of years of service on which the person has earned seniority, the bonus will be increased by 55%. And for each year that a person continues to work after the potentially acceptable retirement age, 1% is added to the payment.

The size of the pension payment for miners will not be affected by periods of sick leave and leave taken to care for a child.

Pension recalculation

Receiving additional payment is possible only after submitting a corresponding application to the Pension Fund of the Russian Federation. The department must be selected depending on the place of temporary registration or permanent registration.

A package of additional documents must be attached to the application:

- military ID;

- family composition certificate;

- salary certificate from the accounting department;

- confirmation of the required work experience.

The pensioner will be given several ways to receive a pension to choose from, from which he can choose whichever one is most suitable for the citizen.

The law allows you to submit documents through a third party. But in this case, a notarized power of attorney must be attached to the papers.

The preferential system operates in such a way that when a pensioner returns to official work, he will stop receiving payments until he leaves the company. To re-issue the payment, you will need to collect a complete set of documentation again.

Possible additional payments and benefits for miners

Miners have the opportunity to obtain additional benefits. Citizens who were employed in hazardous and difficult types of production will be able to receive:

- free medical care;

- free dentures;

- discounted travel on public transport.

Not only the workers themselves, but also their children can count on benefits. The child is entitled to free breakfast at school and enrollment in educational institutions on a first-come, first-served basis.

Reference! The listed list of benefits is mandatory for assignment. Additionally, local authorities may introduce new types of incentives for miners.

The legislation clearly defines the categories of citizens who have the right to receive a pension under special conditions. To do this, you need to be a beneficiary, which includes miners. As a main benefit, citizens receive a reduced age limit for retirement. The amount of payment will be determined for each miner individually depending on the number of accumulated pension points.

Who is entitled to additional payment?

According to the law, the following have the right to additional payment to the coal industry pension:

- Persons who worked at coal enterprises full time in underground and open-pit mining operations (including personnel of mine rescue units) in the extraction of coal and shale and in the construction of mines for at least 25 years;

- Or from 20 years as workers in leading professions and currently receiving a pension:

- longwall miners;

- miners;

- cutters using jackhammers;

- drivers of mining excavation machines.

The length of service that gives the right to an additional payment to the pension includes periods counted towards the length of service in the relevant types of work that give the right to early assignment of an old-age insurance pension (clause 11, part 1, article 30 of the Law of December 28, 2013 No. 400- Federal Law “On Insurance Pensions”).

Federal Law of May 10, 2010 “On additional social security for certain categories of employees of coal industry organizations” (hereinafter referred to as Law No. 84-FZ) extends the conditions, norms and procedures for additional social security to those who worked in the coal industry during the USSR.

When this surcharge is established, the following also applies:

- List of jobs and professions that give the right to a pension for long service, regardless of age, if employed in coal work for at least 25 years (approved by Resolution of the Council of Ministers of the RSFSR dated September 13, 1991 No. 481;

- Rules for calculating periods of work giving the right to early assignment of an old-age labor pension under Art. 27 and 28 of the Federal Law “On Labor Pensions in the Russian Federation” (approved by Decree of the Government of the Russian Federation of July 11, 2002 No. 516).

Benefits for miners in Russia in 2021

General terms and Conditions. Some pensioners receive a portion of their housing and communal expenses and major repairs back every month. These are elderly people over 70 years old and pensioners of preferential categories: disabled people of the first and second groups, disabled children, Chernobyl victims, heroes of the USSR and the Russian Federation, full holders of the Order of Glory, disabled people and participants of the Second World War, disabled people and combat veterans and members of their families.

Benefits are regional and federal. Federal - for preferential categories, regional - for citizens over 70 years of age. Subjects of the Russian Federation may introduce some additional benefits that are not available in other subjects. Or do not give benefits for paying for major repairs to elderly pensioners. It is best to check with your local social security office for a complete list of possible payments.

Legal regulation of the issue is carried out by Federal Law No. 400 of December 28, 2013, by-laws, in particular by Resolution No. 665 of the Government of the Russian Federation.

Important! The right to apply for assistance before the generally established retirement age is one of the main guarantees of state protection for miners. The age limit for finishing work is 45 years for women and 50 years for men.

The ability to take advantage of privileges directly depends on the length of time during which the person worked.

Retirement of miners in Russia is possible if the following indicators are available:

- age;

- duration of work;

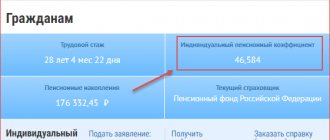

- individual pension coefficient IPC.

In general, special work experience should not be less than 25 years. The requirement is relevant for persons who have experience working at underground and open-pit coal mining facilities. The rule also provides for full-time employment.

25 years of experience is required for specialists in mining, installation of mine communications, and mine rescue measures.

A reduction in the length of work experience by 5 years is fixed for representatives of leading specialties. A 20-year working life is established for machinists, miners, and miners.

The value of the IPC indicator increases every 12 months. In 2021 the coefficient is 16.2.

A miner's pension in Russia is subject to accrual and payment if:

- the woman has reached 45 years of age, has 15 years of total work experience, of which 7.5 years have been in hazardous work;

- the man has reached 50 years of age and has 20 years of total work experience, of which 10 years were in conditions hazardous to health.

Question:

What is included in the period of working activity?

Answer:

In addition to the time spent directly performing duties, an additional 1 year is included in the length of service if the employee suffered as a result of an industrial accident. When calculating the length of work required for a pension, miners add time spent on training and military service.

In addition to early retirement, miners are entitled to receive some preferential payments. Federal Law No. 84 states that this category of workers can count on an addition to the amount of pension benefits every month. It is worth noting that benefits can be either expressed in monetary terms or provide certain advantages to miners and members of their families. Examples include benefits in healthcare and education.

Deadlines for establishing additional payments to pensions

The table below shows the procedure for assigning and renewing payment of a pension supplement, as well as recalculating its amount.

| When did the Pension Fund accept the application? | Deadline for additional payment |

| From January 1 to March 31 | From May 1st |

| From April 1 to June 30 | From August 1 |

| From July 1 to September 30 | From November 1 |

| From October 1 to December 31 of the previous year | From February 1 |

How is the surcharge calculated: formula

The so-called Putin supplement to miners’ pensions is determined by the formula (Part 1, Article 2 of Law No. 84-FZ):

| RD = SZP × (ZR / ZP) × K × (SV / SVD) |

Where:

| RD | Amount of supplement to pension |

| SZP | Average monthly salary in Russia from July 1 to September 30, 2001 for calculating and increasing the size of state pensions, approved by the Government of the Russian Federation, consistently increased by all annual growth indices of the average monthly salary determined by the Government in accordance with the 2001 Law “On Labor Pensions in the Russian Federation” , and from January 1, 2015 - to the annual growth indices of the average monthly salary, approved by the Government for the purposes of Law No. 84-FZ. |

| ZR | Average monthly earnings of an employee of a coal industry organization, calculated according to his choice:

|

| Salary | Average monthly salary in the Russian Federation for the same period |

| TO | A coefficient that takes into account the share of the average monthly earnings of an employee of a coal industry organization with at least 25 years of work experience in underground and open-pit mining (including personnel of mine rescue units) in coal and shale mining and mine construction, or at least 20 years of work experience in leading professions - longwall miners, miners, jackhammer operators, mining machine operators, is 0.55. Please note that for each full year worked in excess of the specified length of service in such jobs, K increases by 0.01, but cannot exceed 0.75. |

| NE | Average monthly amount of contributions, penalties and fines actually received by the Pension Fund budget in the previous quarter from contribution payers |

| SVD | The amount of funds necessary to financially cover the costs of paying a pension supplement at the beginning of the payment period |

Additional payment to miners for pensions in 2021

When miners retire and payments are made, they are entitled to an additional payment accrued every month. Many people are interested in how the surcharge is calculated in Russia and its size.

The calculation of the amount of the surcharge is made by multiplying the values:

- average wages for the period July-September 2001;

- quotient from dividing the average monthly salary for 24 months of work in hazardous conditions (60 months of work in another position) and the average salary in the Russian Federation for the same period of time;

- private, obtained by dividing the average amount of contributions to the Russian Pension Fund and the total amount of money in the form of additional payments to pension provision;

- coefficient of average employee payments.

A revision of the formula according to which the miners' pension supplement is calculated is planned for November 2021.

Perhaps after this the surcharge will be increased.

Size

What additional payment to the miner's pension will be does not depend on the amount of security, but it is approved specifically for it.

Factors on which the size of pension benefits depends:

- duration of work in the coal mining industry;

- average monthly salary of a former miner;

- contributions transferred by the employer to the Russian Pension Fund.

In the case where the bonus is calculated based on the amount of security for length of service, its value in 2021 will be 55%. If a citizen works for one year in excess of the required length of service, then another percentage (56%) is added to the amount due to him.

Interest accrual above 55% continues until the value of 75%, calculated from the pension provision, is reached.

Parental leave and sick leave are excluded from the list of factors influencing additional payments.

The average monthly salary of an employee applying for a security supplement includes:

- bonuses;

- government cash rewards.

Design features

It is impossible to accrue additional payments to miners' pensions in 2021 by default.

To receive money, a citizen must write an application to the Pension Fund of the Russian Federation and attach a package of documentation to it:

- papers confirming the duration of work activity, according to which it is possible to receive a bonus;

- a document containing information about the average monthly salary for the last 24 months.

The interests of the pensioner can be represented by a representative, provided that a notarized power of attorney is issued in his name.

Privileges

If in the past a pensioner was a miner and he has papers that confirm this, then such a citizen has the right to benefits at the federal and regional level.

List of benefits at the federal level in 2020:

- medical care in state hospitals for a former miner will be free;

- prostheses made from inexpensive materials are installed free of charge;

- state pharmacies provide preferential distribution of medicines (but there are few such points left in the Russian Federation, so a limited number of pensioners can take advantage of this benefit).

Will there be an increase in pensions for orphans? Does a pension depend on the minimum wage? Find out here.

Regional benefits include free travel for pensioners on public transport.

If a citizen does not want to receive medicines for free, then he has the right to submit an application to the Pension Fund with a request to receive this amount in cash equivalent.

Preferential medical care includes:

- insurance;

- free diagnostics;

- free prosthetics and dental checks;

- free treatment for work-related injuries.

List of benefits for children of miners:

- free breakfasts at school twice a week;

- provision of new school uniforms free of charge;

- priority admission to educational institutions.

Miners are rewarded for their length of service or quality of work done - a lump sum payment is made once a year.

Former miners have the right to choose this or a pension supplement.

If injured or disabled, a miner has the right to receive financial assistance.

If a miner dies, his family members have the right to receive the following assistance:

- from an insurance company (500 thousand rubles);

- benefits in the amount of one million rubles from the government;

- free funeral of the deceased is provided.

Upon receipt of disability, a miner has the right to choose a specialty and study for free in order to subsequently work elsewhere.

After the official assignment of a disability group, the former miner becomes entitled to benefits for the disabled.

Is it possible for a wife to transfer to her deceased husband’s pension? Who retires at 50? Find out here.

What is the pension of deputies? Read on.

Payment terms

The calculation of the additional payment to the security is based on the fact that the miner has already retired; for a pensioner who returns to work, the payment of the additional payment stops. This is done from the first day following the month of employment.

- From October 1, 2021, pension provision will be recalculated (updated) in Ukraine. According to the new reform adopted by the Verkhovna Rada on July 13, 2017, pensions will be calculated using a single indicator of the average salary of UAH 3,764.4.

- In the Russian Federation, in accordance with Decree No. 610 of December 9, 2015, there is a “Putin bonus” to the pensions of firefighters, military personnel, former employees of the penal system, and internal affairs bodies.

From February 1, 2021, the amount of the supplement is 4900 rubles. per month.