Increase in pensions for military pensioners from October 1, 2021

- since 2014, all-Russian labor pensions “grow” on January 1 by the amount of actual inflation for the past financial year;

- For the third year now, the pension content of military personnel and equivalent persons has been subject to increase at the end of the year by the projected price growth index for the next 360 days (which turns out to be lower than the change in civil old-age benefits).

In 2021, the growth of military pensions is tied to compensation for inflationary losses in employee benefits:

- The government promises to increase salaries by position, rank and monthly interest for length of service for current security forces on October 1, 2021;

- since these components make up the pension content of retired servicemen, its amount will increase on the same date;

- the increase in salaries and pensions in “pure” terms by 3.7% is not at all impressive, but this is the planned inflation included in the budget for 2022.

The required funding is included in the country's budget. In accordance with Federal Law 385 of December 8, 2021, the government will spend more than 9 billion in ruble equivalent on the annual increase in pensions of retirees in 2021.

What is the number of pensioners recorded in Russia in 2021?

As of 1981, the number of pensioners in Soviet Russia was only 27,417,000. This was practically the end of the era of L.I. Brezhnev’s reign, in just a few years. Let's look at the statistics in terms of how many representatives of various categories were recorded at that time (in thousands of people):

Interesting read: Postings for calculating tax fines

The average pension in the Russian Federation in 2021 is 12,080 rubles 90 kopecks. At the same time, old-age payments amount to 12,830 rubles, disability transfers are much smaller and amount to only 8,040 rubles. Those who have lost their breadwinner receive even less money; only 7,294 rubles are received into their accounts monthly.

Indexation of pensions for military pensioners in 2021 – 2023

Law No. 385-FZ of December 8, 2021 provides for a slight increase in pensions for retired pensioners for the upcoming three-year period from October 1:

- current year – 3.7%;

- planned 2022 and 2023 – 4% each.

Formally, the indicators correspond to estimated inflation. However, for several years now, the growth of military pensions has lagged behind changes in civilian benefits. According to experts, the “under-indexation” of provision for retired servicemen is 20-25%.

| Pension and inflation | Accounting year | ||||||

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Insurance (labor) | 11,4 | 4,0 | 5,8 | 3,7 | 7,5 | 6,6 | 6,3 |

| Military | 7,5 | 4,0 | 4,0 | 4,0 | 6,3 | 3,0 | 3,7 |

| Price growth index | 12,9 | 5,4 | 2,8 | 3,8 | 4,3 | 3,8 | 3,7 |

Despite the annual indexation planned for the period 2021-2023, the Government expects to save money on retired pensioners by reducing overall costs for military pensions:

- 2021 – less funds allocated by 58 billion rubles;

- 2022 – the reduction will be 22 billion rubles.

- 2023 – sequestration has not yet been laid down (but “necessary” amendments are adopted at any time).

This is alarming, but the Ministry of Finance assured that there will be no real deterioration in the financial situation of retired military personnel. The budgeting methodology is changing, but all pension expenses will be reimbursed.

Discussion of postponing the date of indexation of military pensions

This initiative was proposed by the head of the State Duma Defense Committee, Vladimir Shamanov. He proposed indexing the military on the same day as everyone else – January 1st. However, the proposal was not officially submitted to the State Duma for consideration, and therefore was not adopted.

Indexation of pensions for military pensioners in 2021 – 2023

In connection with the above, the deputies ask for the indexation of military pensions in 2021 to be 2% above the inflation rate, and to make this increase annual.

Expert opinion

Elena Soboleva

Personal consultations on pension legislation

Previously, a federal bill was adopted to extend the “freeze” of increasing military pensions by 2% annually until 2021. For now, the amount of monetary allowance will remain at the level of 73.68%.

On October 1, 2021, the indexation of pensions for military pensioners this year will take place. It will be 3%. Pension indexation in 2021 is also included in the budget and will amount to 3.7%.

The pay of military personnel, employees of the Ministry of Internal Affairs, the Ministry of Emergency Situations, the FSB, the Russian Guard, the Investigative Committee, the Prosecutor General's Office, the Customs Service, the Federal Security Service and a number of other departments will be increased.

According to the explanatory note to the draft budget for 2021 and beyond, the indexation of military pensions in the coming years will look like this:

- from October 1, 2021 by 3.7%

- from October 1, 2022 by 4.0%

- from October 1, 2023 by 4.0%

How many military pensioners are there in Russia in 2021?

Indexation of the social pension is carried out annually depending on the growth rate of the cost of living. The increase should take place on April 1, 2021 and amount to 4.1%. In this case, the basic size will increase from 5034.25 to 5240.65 rubles. The increase in military disability pensions in 2021 will be made to the following indicators: If disability occurs after a complex course of a disease acquired during service, the pension amount will be: For military pensions of another type, which are calculated on the basis of the basic indicator - social pension, the increase will also be will be held on April 1.

Over the period from 2021, that is, for the entire time until the amount of monetary allowance was indexed, the basic price level increased by 46%, and the price of the food basket increased by 60%. Such data was published by the Ministry of Defense of the Russian Federation.

Interesting read: Minimum alimony in Voronezh

Reduction coefficient for military pensioners in 2021

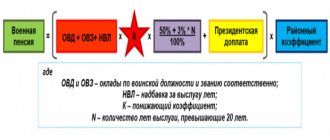

When registering a pension for a retiree, the employee’s allowance at the time of resignation is taken as the calculation basis (salaries according to rank and position, percentage bonus for length of service).

Initially, a decent base is obtained, but it is cut down by a reduction factor (the same “castration” factor, which was already mentioned above). At the start of the global reform of law enforcement agencies in January 2012, this indicator was set at 0.54. The legislation provides for an annual increase of 2% in this indicator.

However, due to the economic recession in the country, the coefficient “grows” with periodic freezing of the regulatory norm (while the changes correspond to the plan provided by the government). The coefficient was last revised in 2021: from 0.7223 to 0.7368. The next increase in the coefficient will occur no earlier than January 1, 2022.

In 2021 and 2021, in accordance with No. 397-FZ dated December 8, 2020, the “old” indicator is maintained. This means that in 2021, military pensions will pay 73.68% of the full pension.

Indexation of pensions for military pensioners in 2021 - when is the increase and by how much?

- It was originally planned that in 2021 the reduction factor would be 0.7223.

- Vladimir Putin personally introduced an amendment that increases the coefficient to 0,7368.

- As a result, the actual size will increase by 6.3% (by 4.3% due to indexation, another 2% due to an increase in the reduction factor).

Raising the retirement age is one of the most resonant and discussed events of 2021 in Russia. After the law came into force, many unpleasant rumors spread. One of them was the assumption that there would be a freeze on pensions for military pensioners in 2021.

Military pension supplements

According to the terms of Article 46 of Law No. 4468-1 of February 12, 1993, additional allowances for former military personnel are calculated as a percentage of the calculated pension amount (hereinafter referred to as the RRP ). The calculation is based on the social pension for disabled citizens established by the government.

Expert opinion

Elena Soboleva

Personal consultations on pension legislation

Increases in military pension supplements are calculated by indexing the RRP. According to the law, this happens on April 1, along with the recalculation of social benefits for the entire population of the Russian Federation. In 2021, the increase is symbolic - only 2.6%. As a result, the base for calculating allowances will increase from 5606.17 to 5751.9 rubles . There is no need to apply to the military pension department. Indexing occurs automatically.

Additional payments to retired security officials and military personnel include allowances for age, for service in special conditions, health status, and the presence of dependent elderly, incapacitated persons or children. The grounds for appointment depend on the nature of the pension received (for length of service, disability, loss of a survivor) and the type of bonus.

If the requirements are met, the retiree may receive the following allowances for long service (Article 17 of Federal Law 4468-1):

- for disability of the 1st group or reaching 80 years of age - 100% of the RRP;

- for providing for disabled dependents (provided that these persons do not receive an insurance or social pension) - for one such family member 32% of the RRP, for two - 64%, for three - 100%;

- allowance for parents/children of deceased military personnel (for the loss of a breadwinner) – up to 200% of the RRP;

- WWII participants who do not have disabilities - 32% of the RRP, and after reaching 80 years of age - 64% of the RRP.

For combat veterans (VVD), the federal law established not bonuses, but an increase in the basic security for length of service by 32% of the salary (clause “d” of Article 45 of Federal Law 4468-1). This part of the income increases on October 1 along with the basic pension (in 2021 it is 3.7%).

If a retiree receives a disability, his income will increase. The amount of the long-service pension supplement depends on the conditions of loss of ability to work (calculated from the RRP):

| Disability category | Disability was granted due to illness resulting from injuries in the service | Restriction due to illness acquired during service |

| I | 300% | 250% |

| II | 250% | 150 |

| III | 175% | 100 |

If a pensioner switches from a long-service pension to a departmental disability pension, he also has the right to apply for allowances for group I disability, advanced age over 80 years, and maintenance of dependents (only for non-working disabled people of groups I and II).

Military pensions from April 1, 2021

Article 43 of Law No. 4468-1 of 02/12/1993 establishes that from January 1, 2021, monetary allowance when calculating pension benefits is taken into account in the amount of 54%, and from 01/01/2021 this standard increases annually by 2%, until will not reach 100%. Federal laws may establish an annual increase in this coefficient by a larger amount (more than 2%) depending on the level of inflation, therefore, starting from 2021, the following reducing coefficients were applied to the amount of monetary allowance:

Thus, the last time the reduction factor was adjusted was from February 1, 2021, when it was set at 0.7223 by Law No. 430-FZ of December 19, 2021. Starting from 2021, the required increase in pensions due to adjustment of the reduction factor was not carried out (as of 2021, by Law No. 365-FZ dated December 5, 2021, the coefficient was set the same as in 2021 - 72.23%). According to Government Bill No. 556372-7, it was planned to maintain this approach for 2021, but by decision of the President, the coefficient will be increased from October 1, 2021 to 73.68%.

03 Aug 2021 uristland 2012

Share this post

- Related Posts

- Sample statement of claim for exemption from alimony payments

- What does an accountant need to do to withhold alimony from an employee?

- Is it possible to send a Birth Certificate by Mail?

- Sample application for alimony in Sterlitamak

Monetary allowances for military personnel in 2021 for calculating pensions

Due to the performance of special actions that are aimed at protecting the state or performing strategic tasks, military personnel have a number of privileges. One of the granted prerogatives for these individuals and members of their families is pension provision, calculated in a special manner and depending on monetary allowance.

A serviceman's monetary allowance (MSS) , in other words his earnings, consists of a monthly salary by rank, a monthly salary by position and additional cash payments.

To become a military pensioner in 2021, a citizen must meet a number of requirements:

- Reach retirement age – 45 years .

- Be dismissed from the Armed Forces for the following reasons: reaching retirement age; reorganization of the military unit, health problems.

- Have a total work experience of at least 25 years at least 12.5 years are devoted to military service .

It is also possible to apply for a military pension without meeting these requirements. But for this, a citizen must have at least 20 years .

In addition to the long-service military pension, Russian legislation provides for military pensions:

- For disability . The payment is received by military personnel who contracted a disease that led to disability during military service.

- Due to the loss of a breadwinner. This payment is assigned to persons who were dependent on a former military personnel who received a military pension.

What is military pay?

When a person enlists in the military, he is required to sign a contract. According to this document, he bears certain obligations to his country, which are paid financially . It seems, what is the difference from ordinary wages? But there are quite a lot of differences. Of course, after military pay was equated to the official salaries of civil servants in 2012, the differences became somewhat smaller, but they still exist.

The monetary allowance of a serviceman is the main means of material support and incentives for the performance of duties related to military service.

How is the amount of allowance determined?

According to Russian legislation, the salary amount within the framework of military personnel’s wages is uniform, it is established by the Government of the Russian Federation. This body is generally responsible for all major changes in the DDV. In some situations, part of the powers is distributed among other executive power structures. Also, in accordance with the legal norms contained in the law “On the Salary of Military Personnel,” wages during service must be indexed on an annual basis. The basic criterion is the dynamics of inflation.

How is it taken into account when calculating pensions?

Military pensions are regulated by Russian Law No. 4468-1. It describes all the provisions relating to pensions: the procedure and conditions for appointment, categories of persons who are entitled to a military pension, etc.

The current legislation distinguishes several types of pensions for military personnel (or their families):

- for length of service;

- on disability;

- upon the loss of a breadwinner.

Expert opinion

Elena Soboleva

Personal consultations on pension legislation

The conditions of appointment depend on what payment the pensioner (his family) receives, however, the calculation of the military pension itself, regardless of its type, is based on the amount of additional income .

In the table you can see how the amount of pension provision depends on the nature of the payment (the amount is indicated as a percentage of the amount of additional income):

| Nature of payment | Pension amount |

| For years of service (at least 20 years of service) | 50% + 3% for each year of service after 20 years |

| For length of service (with a total experience of at least 25 years, including at least 12 years of service) | 50% + 1% for each year of service after 25 years |

| For disability* 1 and 2 gr. | 85% |

| For disability** 1 and 2 gr. | 75% |

| For disability* 3 gr. | 50% |

| For disability** 3 gr. | 40% |

| Upon loss of a breadwinner* | 50% (for each disabled family member) |

| Upon loss of a breadwinner** | 40% (for each disabled family member) |

* - disability (death) of a military man occurred due to a military injury;

** - the cause of disability (death) is a disease acquired during service, but not related to the performance of military duties.

Articles 37, 23 and 15 stipulate the minimum amounts of pension payments to military personnel:

- By length of service - 100% of the calculated amount of the social pension.

- For disability - 150% - 300% of the calculated amount , depending on the conditions for obtaining disability and the disability group.

- For the loss of a breadwinner - 150% - 200% for each disabled family member, depending on the category marked with an asterisk (see table).

Latest news from the State Duma on pensions for military pensioners in 2021

News today claims that this was previously argued by the lack of paid funds. However, military pensioners themselves, under the leadership of V.A. Shamanov, spoke out for the abolition of the regressive coefficient. - Hero of Russia, retired Colonel General of the Russian Army.

- service life exceeds 20 years;

- service in the army for more than 13 years, provided: civilian work experience is 25 years;

- removal from military service before the age of 45 for health reasons (for example, the presence of a disease incompatible with the performance of military duties);

- military service before the maximum permitted service age and dismissal from the armed forces based on length of service.

Second pension for military pensioners in 2021

A military pensioner has the right to apply for a “regular” pension if, after leaving service, he continues to work in civilian occupations. However, there is no fixed part. Benefits are provided through the Pension Fund of the Russian Federation.

In legal essence, this is an insurance pension, therefore the benefit is indexed along with civil security on January 1, 2021. As for all Russian old-age pensioners, the increase in the “civilian” military pension will be 6.3% (which is higher than the inflation rate). But only on the condition that the applicant does not work.

Conditions for assigning old-age pension benefits to military personnel:

- Age. Reaching the generally established age - 65 years for men, 60 years for women (age is determined taking into account the gradual increase in the retirement age).

- Availability of the required insurance experience (years of service are not taken into account). In 2021 it is 11 years and will increase by 1 year annually to 15 years in 2024;

- Official employment with the transfer of insurance contributions to the Pension Fund (produced by the employer);

- Accumulation of pension points on a pensioner’s personal account. For 2020, the bar is set at 18.6 and will increase annually to 30 in 2025;

- The time spent working “in civilian life” before entering the service is taken into account when calculating the insurance period with documentary confirmation.

Until 2021, a retiree was required to work for at least 5 years. In 2021 it is already 12 years. Now this period is increasing along with the national retirement age, and by the end of the pension reform in 2024 it will be 15 years.

Second pension for military pensioners in 2021

With the implementation of the pension reform in 2021, the conditions for receiving a second pension for military pensioners - those dismissed from the military or other equivalent service (Ministry of Emergency Situations, Ministry of Internal Affairs, National Guard, Federal Penitentiary Service and others) will change. This change will consist of raising the retirement age to 65 for men and 60 for women, but in 2021 the intermediate provisions of the new law will still be in effect, so these standards will be lower - 55.5 and 60.5 for women and men .

The procedure for calculating the second civil pension for military pensioners will not change - the amount of payment will still depend on the number of points accumulated during their working career. An increase in the amount of pension benefits is planned for 2021 - the amount of the increase will depend on the status of the pensioner:

What does the new Constitution say about the indexation of military pensions?

The Constitution guarantees state support for various categories of the population of the Russian Federation. Social security by age, state pensions and benefits are established by law (Article 39 of the Constitution). That is, a citizen’s pension is guaranteed by the Constitution, and the rules for assignment and payments themselves are determined by the relevant federal laws, Government Resolutions and Presidential Decrees.

Expert opinion

Elena Soboleva

Personal consultations on pension legislation

There are no separate provisions for military pensioners in the Constitution. However, amendments to the basic law of the country legislated the need for indexation of pensions and social benefits at least once a year for all citizens of the Russian Federation. That is, annual indexation is mandatory, but repeated increases in benefits are not excluded. The norm also applies to retired security officials and military personnel. The procedure for increase, including the time and percentage of indexation, is established by federal laws.

Why are military pensioners not paid full pensions?

Russian legislation stipulates that military pensions, as well as pay, are reviewed every year, starting from January 1, 2013, and the increase reaches two percent.

Cash allowance, which is taken into account when calculating pension payments, should have gradually reached the 100% level from 54% as of 2012. But in 2015, parliamentarians decided to suspend this rule. In 2020, the “freeze” was extended until 2022 .

Increasing pensions for military pensioners in 2021: latest changes

As we have already said, this year the increase in military pension payments will occur in October of this year. The percentage increase will be 6.3. This will be ensured through the indexation of pay for army employees and their equal citizens (Ministry of Internal Affairs, Russian Guard, Federal Penitentiary Service, and so on). At first it would be 4.3%, and then by decision of the president another 2% was added. This will happen due to an increase in the reduction coefficient from 72.23% to 73.68% (from 10/1/19).

Naturally, the reaction of the people is ambiguous. Some people think that this is a completely logical decision, because officers and warrant officers do not need additional privileges. And the rest believe that military service is not an easy matter, so it is important to provide army personnel with a dignified old age.

How does indexing work?

The estimated indexation amount is approved annually by the relevant Government Resolution. This year it is fixed at 2.6%. Who will be affected and to what extent – see the tables below.

Table 1.1. By length of service

Table 1.2. By disability

Table 1.3. By loss of a breadwinner

Table 1.4. Other preferential categories of military pensioners

As for the October indexation, it will depend on changes in military salaries. This will affect pensioners of the Ministry of Internal Affairs, the Federal Penitentiary Service, the Ministry of Emergency Situations, the Russian Guard, the FSB, customs officers, fire service employees and other categories. Salaries will be increased by 3.7% .

Which categories will have their pensions increased?

The law on payments to military pensioners has several categories for which these same payments are made, namely:

- for service;

- for disability;

- for the loss of a breadwinner.

The last payment is assigned to disabled family members of a deceased serviceman.

Payments based on length of service were thoroughly discussed in the previous sections of the article. The procedure for calculating disability benefits is also determined by Law No. 4468-1.

Without going into details, let's just say the main points:

- the amount of military disability benefits depends on the monetary allowance (MSA) and is determined as a percentage (the percentage depends on the nature of the injury and the disability group);

- The amount of payments in case of loss of a breadwinner is also determined. Therefore, an increase in payments in 2021 will also affect these benefits. They will grow.

What other ideas were there for increasing military pensions?

In 2021, military pensions will increase the least in recent years - by only 3%. But at the beginning of the year there were hopes that pensions would grow a little more and a little earlier

(not October 1st). Thus, back in early March, the State Duma adopted amendments to the budget for the current year, which included proposals for social support, which were initiated by President Vladimir Putin during his annual address to the Federal Assembly.

Expert opinion

Elena Soboleva

Personal consultations on pension legislation

But then some deputies (including those associated with the Armed Forces) criticized the pension system for military pensioners. They recalled that in 2015-2018 such pensions were not fully indexed, which is why pensions were “under-indexed” by 20%. As a result, former private and non-commissioned soldiers receive approximately the same amount as recipients of regular insurance pensions.

In addition, the deputies recalled that military pensions and salaries are increased only from October 1 - and over 9 months the increase is practically leveled out by inflation

already of the current year (while salaries are indexed to the inflation of the previous year). Deputies proposed moving the date of increasing salaries and pensions to an earlier date.

However, in the end, the State Duma did not support these initiatives: there will be no additional indexation, the date will not be moved, and the reduction factor will be frozen until at least 2021.

Among the initiatives of State Duma deputies there are also more recent ones - for example, just the other day it became known that A Just Russia had developed a bill on indexation of pensions. This law, as its authors suggest, will be aimed at implementing amendments to the Russian Constitution (which talk about annual indexation). There is no text of the document yet, but journalists learned that deputies propose to include in it the indexation of all types of pensions, including military ones.

How exactly they propose to index military pensions is unknown. But it is already known that the Ministry of Labor most likely will not support the bill - they generally do not see the need to adopt a separate law on indexation, since it is already included in the Constitution and federal laws.

Working military retirees

The most pressing question for most military personnel who have retired but continue to work is whether they will receive a pension in the future.

If for a long period of time working pensioners had the right to receive both cash allowance paid by the employer and pension payments, now this practice is planned to be abolished .

The latest news suggests that employed citizens may completely lose their second, that is, military pension, if they continue to work.

Accordingly, they will not receive a pension supplement. Currently, changes to this plan, dictated by the need to reduce budget expenditures, are at the adoption stage.

Expert opinion

Elena Soboleva

Personal consultations on pension legislation

So, military personnel with both low and high salaries may lose their pensions. In general, changes in this plan are rational in nature, as they will significantly save the state budget.

Military personnel who have reached retirement age will be given the opportunity to independently choose whether to stay at work and lose their pension or retire.

As for citizens who have already retired, no changes will be made in relation to them, other than the indexation of due payments.

The abolition of pension payments is relevant only for persons who combine retirement and official employment, including in the field of law enforcement agencies.

The abolition of pensions for non-workers, that is, retired military personnel, means the need to go to work in order to ensure a decent life and receive cash payments.

However, the majority of citizens who have reached retirement age have insufficient skills to obtain a new job.

That is, to acquire a job, they may need to take courses provided by the state, which is also irrational in relation to the federal budget.