When can we expect the indexation and increase of military pensions - in the summer or only in October 2021 and has this already been approved by the Russian Government? According to the Parliamentary Gazette, the Russian Ministry of Defense proposes to increase the salaries of military personnel and employees of some federal authorities by 4.9 percent from October 1, 2021, and as RIA Novosti recalls, the State Duma of the Federal Assembly of the Russian Federation at the next plenary meeting adopted a law on the extension until 2022, a “freeze” of the annual increase in the amount of monetary allowance taken into account when calculating pensions by 2%, on the basis of which pensions for military pensioners are calculated. Until October 1, 2021, military pensions will be accrued in the same amount. The head of the Defense Committee of the State Duma of the Federal Assembly of the Russian Federation, Vladimir Shamanov, made a proposal to postpone the indexation period to an earlier date so that inflation does not outpace the growth of payments. However, this proposal was not officially submitted to the lower house of parliament. ABOUT THE CONDITIONS FOR RECEIVING MILITARY PENSIONS AND HOW TO CALCULATE THEIR SIZE IN 2021 - READ BELOW.

Second pension for a military pensioner

An old-age insurance pension can become a second pension for a retiree. This right will come to him if, upon his retirement, he gets a job in civilian life. — At the same time, employment must be official. If the employer does not make pension contributions, the right to an insurance pension will not arise, experts explain to RIA Novosti. In order to simultaneously receive a military and insurance pension, the following requirements must be met: - reaching retirement age; — the presence of a certain civilian length of service (it does not include periods of military service or work, which are taken into account when calculating a military pension); — presence of the required number of pension points. In connection with the adopted pension reform, the requirements for these indicators will increase annually. In 2021, an insurance pension is assigned to citizens who have reached the age of 56.5 years for women and 61.5 years for men, with a total length of service of 12 years and 21 IPC. In 2025, you will need to have 30 points and at least 15 years of experience. These numbers will not grow in the future. But the retirement age will stop increasing only in 2028. Starting this year, women will retire at age 60, and men at age 65.

Amount of pension for military personnel

The size of the long-service pension for military personnel is set as follows: - for 20 years of service - 50% of the corresponding amounts of monetary allowance, and for each year of service over 20 years - 3%, but in total no more than 85 percent of these amounts; - having a total work experience of 25 calendar years or more, of which at least 12.5 years is military service: for a total work experience of 25 years - 50% of the corresponding amounts of salary and for each year of service over 25 years - 1%. The long-service pension for disabled people is higher than usual. The increase is calculated as a percentage of the social pension and depends on the group - first, second or third. Based on this, the size of the military pension assigned due to disability is calculated. The amount is also influenced by the reasons themselves. The size of the survivor's pension depends on the cause of his death. If a military man served under a contract, then a pension is given to each disabled family member as a percentage of the breadwinner’s salary. 50% is due to: -families of those who died as a result of military trauma; — families of deceased military invalids; -children who have lost both parents; -children of a deceased single mother. If a military man dies due to an illness acquired in service, his family will be paid 40% of the military man's allowance. If the military man served in conscription, the pension will be calculated as a percentage of the social pension. It will be assigned to each disabled family member in an amount that depends on the cause of death of the conscript: - death due to military injury - 200%; —death due to a disease acquired during service—150%.

Calculation of pensions for military personnel

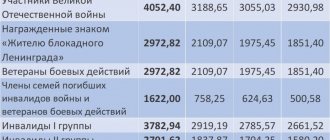

The formula for calculating a military pension based on length of service: ((OD + OS) x 50% + (OD + OS +) x 3% x 7)) x PC, where OD is the employee’s rate provided for the position; OZ - rate accrued in accordance with rank; PC - reduction factor. The increase in pension for long service for disabled people is calculated as a percentage of the social pension. For military personnel injured in service:—for first group disability—300%; - second group - 250%; - third - 175%. For military personnel with illness, work injury, as well as for WWII participants:—for first group disability—250%; - second group - 200%; - third - 150%. For those awarded the “Resident of Siege Leningrad” badge:—for first group disability—200%; - second group - 150%; — third — 100%. The military disability pension for conscripts is calculated as a percentage of the social pension. Size due to military trauma:—for the first group—300%; — for the second — 250%; - for the third - 175%. Size due to illness acquired during service:—for the first group—250%; — for the second — 200%; - for thirds - 150%. Military disability pension for officers, warrant officers, midshipmen and contract soldiers, law enforcement officers is calculated as a percentage of their salary. Amount due to injury:—for the first group—85%; — for the second — 85%; - for the third - 50%. Size due to illness acquired during service:—for the first group—75%; — for the second — 75%; - for thirds - 40%. The size of the military survivor's pension depends on the cause of his death. If a military man served under a contract, then a pension of 50% of his salary is given to each disabled family member. It applies to the following categories of citizens: - families of those who died as a result of military trauma; — families of deceased military invalids; -children who have lost both parents; -children of a deceased single mother. If a military man dies due to an illness contracted in service, his family will be paid 40% of his salary. If the military man served in conscription, the pension will be calculated as a percentage of the social pension. It will be paid to each disabled family member in an amount that depends on the cause of death of the conscript: - death due to military injury - 200%; —death due to a disease acquired during military service—150%.

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Services » Legal consultations » Labor disputes » On the dismissal of a military pensioner at his own request

An employee who previously served in the Federal Penitentiary Service is now retired (his age is 36 years old) and wants to resign, while stating that, as a long-service pensioner, he is entitled to 3 days of work upon dismissal, not two weeks.

Questions

How is this situation spelled out in law?

Lawyer's answer

In our opinion, a military pensioner has the right to resign without warning the employer two weeks in advance if the reason for retirement is indicated in the resignation letter.

An employee has the right to terminate an employment contract by notifying the employer in writing no later than two weeks in advance (Article 80 of the Labor Code of the Russian Federation).

In cases where an employee’s application for dismissal on his initiative (at his own request) is due to the impossibility of continuing his work (for example, retirement), the employer is obliged to terminate the employment contract within the period specified in the employee’s application (Part 3 of Article 80 of the Labor Code of the Russian Federation , paragraph 2, paragraph “b”, paragraph 22 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 N 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation”).

It is necessary to pay attention to the fact that Part 3 of Art. 80 of the Labor Code of the Russian Federation provides for retirement as one of the reasons for an employee’s inability to continue working. At the same time, the legislator does not disclose what is meant by retirement in this norm, in particular, does not indicate the type of pension.

There is an opinion that retirement should be understood simply as retirees leaving work. In this case, the employer has no legal grounds to refuse to re-dismiss a pensioner who has previously resigned from work at his own request due to retirement for the same reason.

According to another opinion, retirement can be understood as a change in the social status of a citizen: after retirement, he becomes a pensioner, that is, a person receiving a monthly cash payment to compensate for wages or other income that he received before the establishment of a labor pension. Since the right to a pension, like the status of a pensioner, is acquired only once, according to this point of view, this is retirement, which implies a one-time application of the guarantee established by Part 3 of Art. 80 Labor Code of the Russian Federation.

So, for example, the Moscow City Court’s Decision No. 33-38420 dated December 8, 2010 states that an employee who has the right to a pension (regardless of when he received this right - just recently or some time ago) has the right to resign. at his own request at any time convenient for him, which he indicates in his application.

In the situation under consideration, we are talking about a military pensioner who received a pension for long service.

The long-service pension is one of the types of pensions under state pension provision in the Russian Federation (Article 5 of the Federal Law of December 15, 2001 N 166-FZ “On State Pension Security in the Russian Federation”).

Within the meaning of Part 3 of Art. 80 of the Labor Code of the Russian Federation, the basis for dismissing an employee at his own request due to the impossibility of continuing his work is the employee’s exercise of his right to retire, and, given that the legislator does not indicate the type of pension, this right can be used for any type of pension provided by law ( including long-service pensions).

In our opinion, a working military pensioner retains the status of a pensioner and a different interpretation of the law entails a violation of the labor rights of this category of workers. According to Part 2 of Art. 3 of the Labor Code of the Russian Federation, no one can be limited in labor rights and freedoms or receive any advantages depending on age.

Based on the above, if a working military pensioner’s application for voluntary dismissal indicates the reason - in connection with retirement, the employer is obliged to comply with the requirements of Part 3 of Art. 80 of the Labor Code of the Russian Federation, that is, dismiss the employee within the period specified in the application. If such a reason is not specified, the employer has the right to require the employee to work for two weeks.

Accordingly, if a military pensioner resigns before reaching old age retirement age, then in his resignation letter he must indicate the reason for his dismissal - in connection with retirement due to length of service.

However, judicial practice on this issue is contradictory. Thus, the court in the Appeal ruling of the Altai Regional Court dated May 12, 2015 in case No. 33-4283-15 indicated that the military pensioner had previously been dismissed from service. This circumstance did not prevent him from continuing his career through employment. At the time of his voluntary dismissal, the plaintiff had not reached retirement age, therefore the guarantee established by Part 3 of Art. 80 Labor Code of the Russian Federation.

The Determination of the St. Petersburg City Court dated June 18, 2013 N 33-7386/13 states that an employee who quit his job due to retirement has the right to continue his work activity by getting another job. In this case, he will already be a pensioner and will not be able to resign of his own free will due to retirement, since it is impossible to retire a second time while already a pensioner. The employer’s obligation to terminate the contract within the period specified in the employee’s application is not applicable in this case, since at the time of dismissal he was already a pensioner, but did not quit due to retirement.

In addition, the Murmansk Regional Court believes that an employee can exercise the right to dismissal in connection with retirement only once. Reaching the retirement age of an employee does not mean retirement (Appeal ruling of the Murmansk Regional Court dated April 11, 2012 in case No. 33-842).

However, we note that the law does not establish how many times an employee can resign at his own request in connection with retirement. The Resolution of the Presidium of the Tver Regional Court dated July 16, 2012 N 44-g-37 states that in Part 3 of Art. 80 of the Labor Code of the Russian Federation does not indicate that an employee can use the corresponding right only once. Within the meaning of this rule, an employee who has the right to a pension (regardless of when he received this right - just recently or some time ago) has the right to resign of his own free will at any time convenient for him, which he indicates in his application .

The status of a pensioner is not a one-time status, but lasts a lifetime, therefore, if a working pensioner in the application indicates retirement as the reason for dismissal, the employer will be obliged to terminate the employment contract under clause 3 of part 1 of Art. 77 of the Labor Code of the Russian Federation within the period specified in the application, even if this employee had previously been dismissed for a similar reason. Since the Labor Code of the Russian Federation does not establish otherwise, an employment contract can be terminated by a pensioner an unlimited number of times, and therefore the benefit provided for in Art. 80 of the Labor Code of the Russian Federation, can be implemented more than once (Cassation ruling of the Khabarovsk Regional Court dated 04/06/2011 N 33-2143).

In our opinion, since Art. 80 of the Labor Code of the Russian Federation does not contain references to specific norms of pension legislation, nor does it contain restrictions on the number of dismissals in connection with retirement; this norm should be interpreted in favor of the employee, therefore, based on the general meaning of labor legislation, the employee has the right to exercise this right more than once.

In the case where a military pensioner wants to resign of his own free will in connection with old-age retirement, we also recommend that the employer dismiss him on the day specified in his application. This is due to the fact that long-service pension and old-age pension are two different types of pension provision, and therefore two different grounds for dismissal at one’s own request without working off.

{Question: Does a military pensioner have the right to resign without warning the employer (commercial organization) two weeks in advance? (Expert consultation, State Labor Inspectorate in the Nizhny Novgorod region, 2020) {ConsultantPlus}}

The explanation was given by Igor Borisovich Makshakov, legal consultant of LLC NTVP Kedr-Consultant, September 2020.

When preparing the answer, SPS ConsultantPlus was used

This clarification is not official and does not entail legal consequences; it is provided in accordance with the Regulations of the CONSULTATION LINE (www.ntvpkedr.ru).

How to apply?

To receive a long-service pension, you need to submit a package of documents to the pension authority of the law enforcement agency in which the military man served (Ministry of Defense, Ministry of Internal Affairs, FSIN, FSB, etc.). Documents can be sent in person or sent by mail. Their consideration usually takes from 2 to 3 months and depends on the timing of receipt by the military registration and enlistment office or other authorized body of the military personnel’s personal file with a monetary certificate. The day of application for a military pension is the date of filing the application for its appointment. The package of documents required to apply for a long-service pension includes:—an application for a pension; - monetary certificate - a document about all types of allowances that a military man received during his service (kept by personnel employees or in the accounting department); —copy of passport with a mark of registration at the place of residence; —extract from the dismissal order; — a copy of the service record from the personal file; —calculation of length of service for retirement (it is calculated by the pension authority on the basis of a personal file). For a disability pension, the following will be added to this list:—a copy of the conclusion of the military medical commission from the personal file; —extract from the examination report of the medical and social examination commission. For a survivor's pension, the following will be added to the list:—copies of certificates from the registry office about the birth of children, marriage, death. — certificate from the educational institution about the children’s studies.

Conditions of appointment

Citizens can receive a military pension after leaving service for reasons established in the federal law on pensions for persons who served in military service. A long-service pension is awarded when a military personnel reaches a specified length of service and age. According to the law, such a pension is due if: - upon dismissal, the specialized experience is 20 years or more; - the military man’s age is at least 45 years, and his total work experience is at least 25 years, of which at least 12.5 years must be spent in military service. “In this case, payments are available to those dismissed from service after reaching the age limit for service, for health reasons or in connection with organizational and staffing events,” lawyer Olga Skobtseva told RIA Novosti. Military experience includes years of work in the Russian Guard, the Ministry of Emergency Situations, the Ministry of Internal Affairs, the FSB, the Federal Penitentiary Service, in civilian ministries and organizations, if the military man remained in military service or as part of law enforcement agencies, as well as other periods specified in the law. For officers and military commanders, up to 5 years of study before entering service are counted toward their length of service. One year of study will be equal to 6 months of service. Service under special conditions is counted toward length of service at a preferential rate. For example, a month of work in countries where hostilities took place is counted as two. Also, special conditions include service in the Far North and in positions associated with an increased danger to life and health. A disability pension is awarded to a military man if he suffered serious health damage during service or within three months after dismissal. In this case, disability must be a consequence of an illness or injury acquired at work, in accordance with paragraph 2 of Article 8 of the Federal Law “On State Pension Provision in the Russian Federation”. It does not matter how many years the pensioner served in the government structure. Disability is determined by a medical and social examination or a military medical commission of the military district where the military man served. Disabled members of a military family are entitled to a survivor's pension in the event of their: death during service or within three months after dismissal due to injury or illness received during service; —death while receiving a pension; —death within 5 years after termination of pension payments; - death in captivity, if you did not go there voluntarily. —unknown disappearance during hostilities. The following may apply for monthly payments for the loss of a military breadwinner: - children under 18 years of age, and if studying full-time, then up to 23 years of age; —parents or spouse, if after the death of the breadwinner they have lost their source of income, reached retirement age or are disabled; - parents or spouses, if they do not work and care for the children, brothers, sisters, and grandchildren of the breadwinner until the latter are 14 years old; -grandmother or grandfather, if there are no other persons who must support them by law. Widows of military personnel who died under certain conditions can apply for two pensions at once: for the loss of a breadwinner and any other (for old age, for disability). This right is granted to women who have not entered into a new marriage. “After concluding a new marriage, the right to receive a survivor’s pension will remain, but the right to a second pension will be cancelled,” lawyers say.

Is it possible to work and receive a military pension?

In accordance with the law of the Russian Federation, number 4468-1 dated February 12, 1993, military pensioners who have completed their service have the right to continue working in the civilian sphere (Article 57).

Pension payments are made in full, with the exception of persons receiving a disability pension who have their own business or other type of income .

For this category of citizens, financial support for the maintenance of family members who are limited in their physical or mental capabilities is terminated (Article 24 and paragraph “b” of Article 17). State allowances are resumed immediately after the complete cessation of business activity.

What are the requirements for the length of service and age of a military pensioner for calculating pension benefits?

In order for a serviceman to be able to claim his rights to a military pension, he must reach 45 years of age ; in some cases, based on the conclusion of a medical commission, an earlier age for retirement (due to disability) is allowed.

According to the Federal Law “On Military Pensions”, military personnel can receive a long-service pension after 20 years of service, or after 12 and a half years of service in the Armed Forces of the Russian Federation with a total length of service of at least 25 years.

How to apply for a pension?

In order to begin the process of accruing pension money, a military man discharged from service will need:

- Register with the military commissariat at your place of residence (register).

- Provide documents confirming the grounds for receiving a pension (based on length of service or disability).

- Indicate the transfer of the monetary certificate in the place where the service took place, if it was not transferred to the military registration and enlistment office by default.

- Obtain a certificate from the Pension Fund of the Russian Federation, which confirms the absence of any financial transfers.

- Fill out an application at the military registration and enlistment office, attaching to it the entire package of required papers to obtain a pension certificate.

- After completing the above actions, pension payments will begin to accrue after 2-3 months of consideration of a particular case.

What documents will you need to provide?

A complete package of documents required to apply for a military pension:

- Identity passport.

- Military ID, which contains a mark on the completion of service and the date of dismissal.

- An order from the military unit where the service took place under orders.

- The applicant’s personal file, taken from the archives of the unit in which the former military man was stationed.

- Cash and clothing certificates.

- A photograph, the requirements for which are established by the administration of the military registration and enlistment office.

- SNILS.

- Employment history.

- Certificate from the Pension Fund of the Russian Federation.

How is pension provision calculated?

The procedure for calculating pension payments is governed by Articles 7, 14 and 22 of Law No. 4468-1, as well as Article 15 of the Federal Law “On State Pension Provision in the Russian Federation” for conscripts.

What is taken into account:

- Duration of experience.

- The salary of a former serviceman, taking into account allowances for ranks received (military allowance).

- Indexation of monetary allowance.

- The rank held at the time of separation from service.

How is the payment made?

According to Decree of the President of the Russian Federation No. 1609 of December 7, 2012, all payments related to the pension of military pensioners are required to be made by military commissariats.

Where does the money come from:

- To the branches of the Russian Post, where the pensioner himself has the right to receive pension transfers, or the postman will bring the pension to the place of residence of the former military man.

- To a Sberbank bank account.

- If a pensioner due to health reasons is unable to receive a pension on his own, then in this case a power of attorney must be issued to a third party. This intermediary is required to present his own passport, a copy of the pensioner’s passport, as well as a notarized power of attorney.