Every year, for non-working pensioners, pension payments are indexed, depending on the level of inflation and other modifiers. For working pensioners, indexation has been frozen for several years, starting in 2021. Those who are not working receive payments annually in full.

What are the features of freezing payments for pensioners with work and how have they changed in 2021? Let’s try to cover the topic of social benefits and pensions in as much detail as possible.

Pensions for working pensioners in 2021, latest news from the State Duma

Reasons for freezing and legislation

The stop of indexation of pensions for working pensioners is directly related to the crisis of the end of 2014 and the collapse of the economy. The ban on increasing payments is in effect until the end of 2021, and current trends indicate that it will be extended further.

The basis for stopping payments was Law No. 385-FZ. It contained a number of amendments, including for No. 400-FZ, adding Article 26.1 to it. This article indicates that if the pensioner continues to work, the basic part of the pension does not increase annually. The saved funds are spent on increasing the pensions of non-working pensioners ahead of inflation, as indicated in recent changes to Law No. 350-FZ.

Federal Law “On Insurance Pensions”

In 2021, indexation could be resumed, but the State Duma at its January meeting was unable to resolve the issue in three readings. As Finance Minister Siluanov says, this was done for several reasons:

- active growth of citizens' salaries, exceeding the rate of pension indexation;

- material benefits provided to working pensioners (such as tax deductions);

- immediate recalculation of pension to the general level after dismissal.

The Ministry of Finance believes that the salaries and benefits of working pensioners are quite enough to completely close the issue of indexation, and upon dismissal, recalculation will painlessly return the citizen’s pension to the general level. At the same time, the saved funds were used to pay a more vulnerable category of citizens - non-working pensioners, for whom social benefits are the only source of income.

Latest news about indexing

Latest news about indexing

The State Duma participated in the discussion of pension payments on January 9, 2020. This time, the opposition factions of the Communist Party of the Russian Federation, A Just Russia and the Liberal Democrats proposed returning indexation for working pensioners. The bill itself was based on the fact that the Pension Fund has been showing positive dynamics in its funds for several years, and the 963 billion rubles required to resume indexation will not have to be taken from the budget.

The authors of the bill pointed out the positive aspects of the impact on the economy - the money should have been primarily directed to low-income citizens, which would lead to their use and growth in consumer demand. In turn, the Government and the Central Bank were sharply against such a measure: the budget surplus for 2021 amounted to only about 1.8 trillion rubles and the payment of funds would have spent more than half of this amount.

Anton Drozdov, head of the Pension Fund, also said in February of this year that in addition to one-time expenses of a trillion rubles to bring citizens’ pensions to the general form, about 260 billion rubles will be required annually to maintain it.

As a result, the parliamentary majority won, which considered that a one-time large-scale injection of such a sum of money into the economy would be instantly eaten up by inflation. For 2021, indexation of pensions for working citizens is still frozen.

For 2021, indexation of pensions for working citizens is still frozen

Indexation procedure

Indexation is carried out several times a year, at different times for all categories of pensions. This is done due to the fact that each social benefit is formed according to its own rules, and in order to calculate the necessary statistics, recalculation must be carried out at different times of the year.

Let's look at indexation using the current year as an example. The first change was made back in January; basic payments to non-working pensioners were increased by 7.05%. Also, since the new year, the value of the pension point has increased, which also entailed a recalculation of payments. The basic amount of the insurance pension was declared in the amount of 5334.19 rubles.

In February, payments to federal beneficiaries were increased, and in April, an increase in social pensions was implemented: assistance to the disabled, those who have lost their breadwinner, and elderly people who have not earned an insurance pension until the age of 70.

Indexation of old-age insurance pensions for non-working pensioners

Finally, from August 1, pensions for working citizens will be recalculated. Pension points earned during the year will be added to their pensions. The procedure, like all others, is carried out without an application - there is no need to contact the Pension Fund or other social security organizations to carry out a recalculation.

Indexation and recalculation of pensions in the Russian Federation in 2020: legal aspects and grounds

Pension recalculation is an adjustment to the benefit amount, which depends on government policy, changes in legislation or a person’s life circumstances. Regular planned increases in pension payments (indexation) are due to inflation. This government measure is aimed at maintaining the same standard of living of a person, despite the increase in prices. In 2021, adjustments related to rising prices were carried out three times: in January, February and April. The payment increase coefficient is established by the Government of the Russian Federation.

Table 1. Indexation of accruals in 2020

| Type of pension provision | Promotion date | Magnification factor |

| Insurance payment (price of one IPC and the basic part) | 1st of January | 1.0705 (by 7.05%) |

| Social payments (EDV, NSO and others) | 1st of February | 1,043 (up 4.3%) |

| Social | April 1 | 1.02 (by 2%) |

ATTENTION! Accumulative pension provision is not subject to indexation.

It should be noted that people with accruals below the pensioner's subsistence level (PSL) until January 2021 received an increase to achieve the required level in the region. The indexation had virtually no effect on this category of people. Therefore, the Government of the Russian Federation decided to make a retroactive adjustment for them, taking into account this shortcoming. The accruals will first be brought to the PMP level and then indexed.

Table 2. Amount of benefits after increase in 2020

| Payments | Amount in 2021 | Amount after increase in 2021 |

| Price of 1 pension point | 81,49 | 87,24 |

| Basic part | 4982,90 | 5334,19 |

| Old age insurance benefit (average annual) | 14414 | 15430 |

Recalculation is carried out not only during indexation, but also based on other factors. Types of pensions may be subject to adjustment for various reasons:

- upon loss of a breadwinner;

- on disability;

- labor;

- insurance part.

The grounds for increasing the labor part of the pension provision are:

- assignment or change of disability group;

- execution of a person 80 years old;

- moving to the Far North and other difficult climatic territories, obtaining work experience there;

- the appearance or addition of dependents to the family;

- change in pensioner status.

ATTENTION! Payments for the loss of a breadwinner may be revised upon confirmation of his additional length of service, the cause of death, and the number of dependents in the family.

The main regulatory documents regulating the issue of accruals are the laws on labor and insurance pensions: Federal Law No. 173 of December 17, 2001 and Federal Law No. 400 of December 28, 2013.

Article 17. Increasing the fixed payment to the insurance pension (Federal Law No. 400)

Video - Pension increase schedule

Losses compared to unemployed pensioners

In 2021, indexation for working pensioners was cancelled. This happened the very next year after the largest increase in insurance pensions in the history of Russia - 11.4% for 2015. After this, the additional coefficient was:

| Year | Pension increase |

| 2016 | 4% |

| 2017 | 5,8% |

| 2018 | 3,7% |

| 2019 | 7,05% |

Despite the relatively small numbers, the increase gradually accumulates, creating a noticeable difference between a retiree who has been working since 2021 and who is on a well-deserved rest.

Let’s say that a working pensioner received a pension of exactly 10,000 rubles in 2021. In this case, after dismissal and recalculation, the increase will be:

10000*1.04*1.058*1.037*1.0705 = 12214.7 rubles.

This is more than a 20% increase overall in just four years. Is this amount worth losing your job? In most cases, no, but a retiree can count on an extra few thousand after leaving the job, which will help him keep his monthly budget in line.

Differences between indexation and recalculation

Recalculation of pensions for working pensioners in 2021

In order to move forward, it is important to distinguish between both of these concepts. Indexation is an annual recalculation of pensions on the initiative of the Pension Fund, funds for which are taken from the budget. It is carried out for all unemployed pensioners at once, on April 1 of each year.

Recalculation is the addition of additionally earned pension points to an existing pension; it depends only on the value of pension points and their annual limits.

The cost of a pension point for 2021 is 87.24 rubles, and the maximum number of points scored per year ranges from 5.71 to 9.13, depending on the type of pension. This means that a working pensioner can receive an increase in pension in the amount of 796.5 rubles when recalculated at the end of the year. This amount does not interfere with indexation in any way and is the citizen’s earned pension.

The points themselves were introduced in 2015, a year before the indexation freeze.

| Year | Point cost | Maximum for insurance pension | Limit for insurance and savings |

| 2016 | 74,27 | 7,83 | 4,90 |

| 2017 | 78,58 | 8,26 | 5,16 |

| 2018 | 81,49 | 8,70 | 5,43 |

| 2019 | 87,24 | 9,13 | 5,71 |

Important! Starting in 2021, the annual point caps will level out at 10 and 6.25. The current growth is associated with the transition period after the pension reform.

With the maximum transfer of points, the recalculation could increase the pension of a working pensioner by the following amount:

74.27*7.83 + 78.58*8.26 + 81.49*8.70 + 87.24*9.13 = 2736 rubles.

For working pensioners there is a three-point limit

It turns out that for the size of the current pension, being a working pensioner is more profitable than simply waiting for indexation? Unfortunately, no - for working pensioners there is a three-point limit. This means that at the next recalculation in August, a citizen can receive a maximum increase of 261 rubles, 72 kopecks. The logic of the pension fund here is clear - to get 9.13 points you need to have a salary of about 88,000 rubles (before deduction of personal income tax), which deprives any sense of an increase of 800 rubles instead of 250. For example, with an average salary of 30,000 rubles, the number of points will be 3 ,13. Will an immediate increase in pension of ~100 rubles for every 10,000 of income be important for a working pensioner?

In general, with active work and the first indexation in 2021, a pensioner can receive a maximum increase of 5 thousand rubles per month. Perhaps these extra five thousand will at least slightly brighten up the loss of a salary close to one hundred thousand.

Tax deduction for personal income tax

Sample application for personal income tax refund

A sample form with an example of filling out for a tax refund when buying a home can be found here, as well as for a tax refund when buying a home and a mortgage here.

The advantage of a working pensioner is an additional tax deduction. A pensioner who has official taxable income can apply for a deduction when purchasing property, for example, a house or a summer cottage. This makes it possible to get a significant discount on housing transactions, as well as simplify some procedures, such as renting out residential premises.

The maximum amount from which a tax deduction is made is 2 million rubles. This means that when buying a house, a working pensioner will be able to return up to 260 thousand taxes (aka 13% personal income tax) to their account. The details of the mechanisms for regulating and processing the deduction are quite extensive; practical implementation details can be clarified at the nearest tax office.

Indexation of pensions for working pensioners in 2021

Starting from 2021, the country has a moratorium on indexation of payments for employed pensioners. Accordingly, an increase of one thousand rubles will not be provided for working pensioners.

The government considers this approach to be fair, since, in addition to pensions, working pensioners also have a salary. In addition, according to information provided by Rosstat, a stable increase in wages in the regions of the country has been established.

Accordingly, the abolition of indexation for pensioners, according to the authorities, does not imply a serious deterioration in their financial situation.

According to Deputy Prime Minister Golikov, in recent months in 2018, wages have increased by 8.8%; overall, for the year such growth could reach 6.9%. By 2021, this figure will increase by 2.5% if specialists’ forecasts come true, which does not imply any guarantees.

The Minister of Finance also stated that there is no need to abolish the existing pension system for working pensioners. At the same time, one should not think that indexation is lost by such citizens. All additional payments will be provided upon the retiree’s dismissal from work.

As a result, the conclusion is the following: indexation for 2021 will not affect pension payments of working pensioners, and the amount is 7.05%. For this category of citizens, only one increase is possible in August after an undeclared recalculation.

Other social benefits

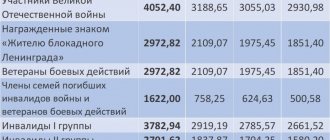

All additional federal benefits have already been indexed in February of this year. Payments were raised for veterans, disabled people, rehabilitated citizens, as well as families with two or more children. The total amount of funds budgeted for payments will be 25.9 billion rubles.

Advantages of pre-retirement people

Indexation of social benefits in this case is strictly tied to annual inflation. This year the change rate was 1.043 compared to the previous year. The amount of monetization of benefits (EBV) has also increased, which in 2021 will amount to 1,121 rubles monthly.

Maternity capital will remain at the current level of 453 thousand rubles and, according to the bill on the planned budget for 2021 and 2020, will not be indexed.

Additional payment for Muscovites

The Moscow pension can be understood as both the standard pension for visiting citizens and the city social standard of minimum income (hereinafter referred to as the GSSM).

The standard pension is limited below by the pensioner's subsistence level. In 2021 it will be 12,115 rubles, and citizens whose payments are below this amount will receive an additional increase from the budget. This applies to all visitors with official registration.

Important! Citizens with temporary registration will receive a pension that is accepted in their home region.

For those who live in the city for 10 years or more, the administration pays the so-called “Luzhkov premium”, limited by the State Duma. The last time the limit was raised was in 2021, stopping at 17,500 rubles. There were no increases in 2021, and the city administration also did not announce plans for next year.

Video - Benefits for Moscow pensioners

FAQ

Will pensions for working pensioners be abolished?

A question that arises almost every year, starting with the announcement of an indexation freeze at the end of 2015. This year, rumors about the abolition of pensions were once again denied by the government with reference to Article 39 of the Constitution.

Why do rumors arise every year about the return of indexing?

Bills on the return of annual indexation of pensions will be submitted to the State Duma for consideration starting in 2021. To date, three projects have been considered, the first by the Communist Party of the Russian Federation (October 2017), the second by Mironov, the leader of A Just Russia (December 2017) and the current one by the head of the LDPR Vladimir Zhirinovsky and Yaroslav Nilov.

When will indexation for working citizens be resumed?

Despite the constant pressure from opposition parties, there is only one reason for the refusal - there is no money in the budget. Indexation will cost the country almost a trillion rubles, and the authorities do not believe that it would be better to use them for more targeted tasks. The Minister of Finance personally stated a year ago that it was inappropriate to make significant changes in the current pension policy during the reform.

The Minister of Finance personally stated a year ago that it was inappropriate to make significant changes in the current pension policy during the reform.

According to independent experts, the “freeze” will last either until stable and significant budget revenues appear, or at any convenient time until 2024, to the end of the transition period of pension reform. Most sources now state 2021 as a possible repeal date (the original bill expires), but if the current economic situation continues, it will be extended for several more years.

Where can I go to calculate my pension taking into account all the changes?

You can consult about the current state of your pension account at the nearest Pension Fund branch - its employees will not only help you draw up an application to receive an account statement, but will also come to your aid if any difficulties related to your pension arise.

You can also obtain information by registering on the official website of the Pension Fund https://www.pfrf.ru/, going to the citizen’s personal account, or on the all-Russian State Services portal - https://www.gosuslugi.ru/.

To calculate your pension taking into account all changes, you can contact the Pension Fund of Russia

So what is more profitable: working or receiving a pension?

At the moment, it is still more profitable to work - even the minimum wage is many times higher than what indexation and recalculation can provide. But over the course of ten or more years, the situation may change: the constant accumulation of pension points and annual coefficients can lead to the fact that a pensioner who continues to work in 2021 will receive an increase of 10 thousand or more rubles in 2026 simply by quitting his job.

The ideal situation includes a position with a salary of 90 thousand rubles or more to maximize pension accruals, but few retirees succeed in this. Another compromise option is to work with earnings of 25 thousand and above, which will allow you to annually receive three additional points “for the piggy bank”, smoothing out the lack of annual indexation with a truncated recalculation.

Today, it is still more profitable for pensioners to work

What awaits working pensioners in 2021 (latest news)

Due to reforms in the field of pension provision for 2021, the possibility of changing payments, that is, indexing them, is not established for working pensioners. At the same time, there are no plans to cancel pension contributions for employed citizens.

The procedure for calculating pensions does not change; moreover, for working citizens of retirement age there are no changes at all.

Notice! There are also a number of caveats:

- payments of working citizens will not be indexed. The cost of the coefficient necessary for calculating the pension and the fixed amount of contributions for these citizens is not subject to annual change, that is, increase;

- the envisaged increase in pensions from August for working citizens will be determined by contributions paid for the past year of employment.

The situation with working pensioners was discussed again in February 2021. Based on the results, it was established that the Government was instructed to change the procedure for determining the amount of payments to working pensioners so that they could exceed at least the minimum wage.

In addition to negative news about the abolition of pensions, false information is also being spread about the full indexation of payments for working pensioners or, conversely, the abolition of such a procedure. However, the situation does not provide for negative or positive changes.