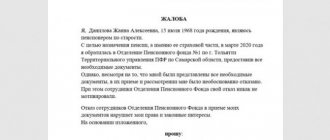

Application to the Pension Fund for pension recalculation

The pension legislation of the Russian Federation includes several laws, which are sometimes difficult to understand even for a lawyer. That is why, if you want to get full advice on pension issues, you should contact not just a lawyer, but a lawyer specializing in pension law.

As a rule, disagreement with the amount of the accrued pension payment appears immediately after retirement. That is, in order to assess the correctness of the calculation, you should receive this pension at least once.

Application form for preferential old-age pension sample 2021

The Pension Fund of Russia will warn about the approach of pre-retirement age. The pensions of working pensioners will increase from August 1. Articles on the topic. Early retirement. Insurance experience. Dismissal of a pensioner at his own request. Raising the retirement age in Russia.

In order to temporarily obtain a work permit, you need to write a separate application in free form, Art. The document cannot be delayed. Within three days after the work book is returned by the body implementing compulsory social insurance, it must be returned to the personnel department.

We recommend reading: Turning 90 years old, what is the increase in pension

Sample application to the Pension Fund for clarification

The amount of pension payments will be calculated and established based on the current law. Sometimes a person entering a well-deserved retirement may have the right to increase pension payments, for example, when his length of service increases.

To clarify this problem, you need to submit an application addressed to the management of the Pension Fund of the Russian Federation with a request to provide a detailed explanation of the revision of deductions with references to the case materials and legal standards, and forward it by mail.

Application for pension recalculation sample

According to Article 20 of the Federal Law “On Labor Pensions” dated December 17, 2001 No. 173, the recalculation of the size of the labor pension (the insurance part of the old-age labor pension) is carried out: from the 1st day of the month following the month in which the circumstances causing represents a recalculation of the size of the labor pension downwards; from the 1st day of the month following the month in which the pensioner’s application for an upward recalculation of the amount of the labor pension (the insurance part of the old-age labor pension) was accepted. A pensioner’s application for recalculation of the size of the labor pension (the insurance part of the old-age labor pension) is accepted subject to the simultaneous submission of the documents necessary for such recalculation, the obligation to submit which is assigned to the applicant. The recalculation of the amount of the insurance part of an old-age labor pension and the size of a labor disability pension is carried out in the following order: when establishing a disability group that gives the right to a higher amount of the insurance part of an old-age labor pension or a labor disability pension - from the date the federal institution issues a medical social examination of the relevant decision; when establishing a disability group that gives the right to a lower amount of the insurance part of an old-age labor pension or a labor disability pension - from the 1st day of the month following the month for which the previous disability group was established. The recalculation of the amount of the insurance part of the old-age labor pension in connection with the pensioner reaching the age of 80 is carried out from the day the pensioner reaches the specified age. A pensioner’s application for recalculation of the size of the labor pension (the insurance part of the old-age labor pension) is considered no later than five days from the date of receipt of the said application with all the necessary documents, the obligation to submit which is assigned to the applicant. In case of refusal to satisfy this application, the body providing pension provision, no later than five days from the date of the relevant decision, notifies the applicant about this, indicating the reason for the refusal and the procedure for appealing and at the same time returns all documents. I undertake to immediately notify the body providing pensions of the occurrence of all circumstances entailing a change in the amount of the pension or termination of its payment. I agree to recalculate the amount of the pension in connection with the establishment of a higher disability group or reaching the age of 80 years without submitting an additional application. I have been warned that in the event of providing false information that affects the amount of the pension, the perpetrators will compensate the damage caused to the bodies of the Pension Fund of the Russian Federation.

I, ___________________, ____ born based on the work book, he was in labor activity from “___” ________ to the present. According to the work book, the work experience is __ years. I have been a pensioner since _____ years, I submitted an application to the Pension Fund No. __ to assign me a pension in the amount of _____ rubles __ kopecks. According to Article 19 of the Federal Law “On Labor Pensions” dated December 17, 2001 No. 173, a labor pension (part of the old-age labor pension) is assigned from the date of application for the specified pension (for the specified part of the old-age labor pension), but in all cases not earlier than from the date the right to the specified pension (the specified part of the old-age labor pension) arises. The day of application for a labor pension (part of the old-age labor pension) is considered to be the day the body providing pensions receives the corresponding application with all the necessary documents. If the specified application is sent by mail and all the necessary documents are attached to it, then the day of application for a labor pension (part of the old-age labor pension) is considered to be the date indicated on the postmark of the federal postal service organization at the place of departure of this application. I do not agree with the assigned pension amount determined by the Pension Fund No. __ district of ____________. The pension was assigned in the amount of _____ rubles __ kopecks. Currently working. According to Article 18 of the Federal Law “On Labor Pensions” dated December 17, 2001 No. 173, the assignment, recalculation of amounts and payment of labor pensions, including the organization of their delivery, are carried out by the body providing pensions in accordance with the Federal Law “On Compulsory Pension Insurance in the Russian Federation” , at the place of residence of the person applying for a labor pension.

This is interesting: If I Don’t Pay My Loan My Husband’s Car Can Be Seized

Who has the right to apply for pension recalculation?

Recalculation is the procedure for clarifying the amount of a previously assigned pension benefit in favor of a specific citizen, that is, the applicant. Not all Russians can apply for recalculation. Here are the conditions when you can recalculate pension payments:

- Only a pensioner can do this. That is, a citizen who has previously been assigned an amount of pension payments. Therefore, if you are not a pensioner, then you have no right to demand recalculation. First you will have to apply for the state pension itself, and only then demand a recalculation.

- The recipient does not agree with the assigned payment amount. Simple dissatisfaction with the size of government provision is clearly not enough. Documentary evidence will be required: the applicant will have to confirm to the Pension Fund the illegality of the calculation.

- Evidence and documents have been presented. For example, if the calculation of the pension does not take into account working periods, then the applicant must provide evidence. These may be employment contracts, work books, certificates and extracts and other documentation.

- Exceptional grounds for recalculation. All grounds for recalculation should be divided into general and exceptional. Under general conditions, the Pension Fund recalculates pensions without an application. For example, when indexing pension points. But exceptional grounds are a set of individual circumstances from the lives of citizens that directly affect the amount of pension payments.

This is interesting: Application up to 3 years sample 2021

The instructions on how to apply for pension recalculation are simple:

- Assemble the bases.

- Fill out an application.

- Collect additional documents.

- Contact the Pension Fund.

How to correctly draw up and submit an application for recalculation of the pension amount in 2021

An application for recalculation of an old-age pension (as well as an application for recalculation of other types of payments) must contain the following information, without which the Pension Fund simply will not accept it:

If circumstances arise that entail an increase in the amount of pension payments, their recipient has the right to apply to the authorized bodies for a recalculation. To do this, you must send an application in the established form to the Pension Fund. The document form can be downloaded from the official website of the department.

How is recalculation done?

To carry out the recalculation, the pensioner will need:

- collect documentation that confirms the need for recalculation,

- make a statement,

- submit an application and attached documents to the Pension Fund branch or MFC.

After submitting the documentation, you should expect a decision. If the applicant has submitted an incomplete list of documents, recalculation will be denied. There is no recalculation, as a result of which the amount of the assigned pension will be reduced.

Sample application to the Pension Fund for the funded part of a pension.

The following documentation is required:

- identification document of the applicant,

- employment history,

- certificate of pension amount at the time of application,

- death certificate of the breadwinner,

- documents confirming a change in disability group,

- children's birth certificates.

Watch the video. Table of pensions by region:

Sample application to the pension fund for a pension calculation

Good afternoon. To check the correctness of pension calculation, you need to know what periods and what salary amounts were taken by the Pension Fund of the Russian Federation to calculate the pension; maybe you asked to take into account certain periods. Submit a written application to the Pension Fund of the Russian Federation (a copy for yourself with a mark of receipt) for an explanation of the procedure for calculating your pension - which years were taken for calculation, whether your northern experience was taken into account, etc. After receiving a written response, it will be possible to judge the legality of accruing a pension and to go to court, if necessary, a written response from the Pension Fund of the Russian Federation is required.

Good afternoon In order to understand whether all periods of work are included in the length of service for calculating the old-age pension, you need to request a desk audit report from the pension fund. It will reflect all periods of work experience accepted by the pension fund. In the absence of any of them, it is possible to file a corresponding statement of claim in court.

Application for old-age pension to the pension fund in 2021

From the last place of work Certificate of compulsory pension insurance (SNILS) Pension Fund of the Russian Federation Certificate of earnings for the previous 5 years From employers Certificate, diploma and other documents confirming education At the place of study Birth certificates of children Civil registry office Military ID (for men) Military registration and enlistment office Certificate of employment in regions of the Far North and equivalent areas (when working in harsh climatic conditions) At the place of work Marriage certificate, certificate of name change (if personal data has changed) Civil registry office bodies Resolution of some controversial issues It happens that employers incorrectly enter an entry into the labor record employee’s book or violate the rules for processing wages and insurance contributions - in such a situation, Pension Fund specialists need to obtain additional documents or correct the employer’s mistakes. Using a sample, you can prepare an application faster and fewer mistakes are made. It is for this reason that samples of the document can be found in most territorial branches of the Pension Fund of Russia; one of them can also be downloaded here. Do not forget that the data in the sample is given as an example and information must be entered regarding a specific applicant. List of attached documents Along with the application, you will need to submit a whole package of documents.

If the pensioner does not have a passport, then you can indicate the name and details of another identification document. The procedure for applying for an old-age pension in 2021 Reaching a certain age makes it possible to receive a payment from the state. In this case, the pensioner can count on receiving both an insurance pension and a long-service pension. Applying for an old-age pension in 2021 is a labor-intensive process that involves providing a large number of documents and several minutes of time.

How to write an application to the Pension Fund if I do not agree with the amount of the assigned pension

I retired from old age in 2013. How to correctly write an application to the Pension Fund if I do not agree with the amount of the pension assigned to me? My pension is already small, and in January of this year it was reduced by 130 rubles. I would like to know based on what? Thanks in advance for your answer.

I ask you, within the period established by law, to inform me in writing at the address indicated by me in detail how the amount of my pension for January 2021 was calculated and for what reason the amount of the pension paid to me was reduced.

Termination of Disability Pension Payments in 2021

The innovation corrects the injustice faced by low-income pensioners. On average, social pensions in Russia will increase by one ruble from April 1, after which their average size will be 9 rubles.

We recommend reading: Ltncrbq cfl d 2021

Payment of social old-age pension to persons who have reached the age of 70 and 65 years, respectively, men and women, as well as citizens from among the indigenous peoples of the North, is suspended for the period of their paid work. Payment of the pension ceases on the 1st day of the month following the month in which the death of the pensioner occurred or the court decision to declare him dead or to recognize him as missing came into legal force; If a pensioner loses the right to the pension assigned to him, the payment of the pension ceases from the 1st day of the month following the month in which the above circumstances or documents were discovered, or the period of disability expired, or the person concerned became unable to work. By continuing to use our website, you consent to the processing of user data. More details IP address; OS version; web browser version; information about the device type, manufacturer, model; screen resolution and number of screen colors; Flash version; Silverlight version; Availability of ad blocking software, availability of Cookies, availability of JavaScript; OS and Browser language; time spent on the site; user actions on the site in order to determine site traffic.

Sample Application to the Pension Fund for Clarification of Pension Calculation Sample

Based on the foregoing, I consider it necessary to submit this application regarding the issue of providing me with information about the pension assigned to me, namely, the insurance period taken into account when assigning the pension, what amount of wages was taken into account, and the coefficients for calculating the pension.

According to paragraph 1 of Art. 18 Federal Law “On Labor Pensions in the Russian Federation”, the assignment, recalculation of amounts and payment of labor pensions, including the organization of their delivery, are carried out by the body providing pensions in accordance with the Federal Law “On Compulsory Pension Insurance in the Russian Federation”, at the person’s place of residence who applied for a labor pension. When a pensioner changes his place of residence, the payment of a labor pension, including the organization of its delivery, is carried out at his new place of residence or place of stay on the basis of the pension file and registration documents issued in the prescribed manner by the registration authorities.

Application for a pension

After 3 months, the Pension Fund has the right to establish the amount of the pension based on the documents it has from the applicant, but with his consent, if he does not bring the missing ones. In the future, if after the appointment of payments the papers are presented at any time, the Pension Fund branch will calculate the difference for the previous months and make an additional payment.

An employee can file an application if circumstances specified in the law arise. The standard form of the petition is determined by Russian laws - Federal Law No. 166 (12/15/01) on state pension provision and Federal Law No. 173 (12/17/01) on labor pensions.

We recommend reading: How to change gears in a Priora when driving on the road

Application for pension recalculation

First, the citizen will need to go through the standard registration procedure. You should select the item “Submission of an application for pension recalculation” and fill out the electronic form. All mandatory information must be entered (personal data of the citizen, name of the Pension Fund branch to which he belongs, etc.), because otherwise, the document will not be sent to the recipient.

You can also use the official website of the Pension Fund. To do this, the pensioner needs to visit the resource and find the “Appeals from Citizens” menu item. Next, you need to follow the system prompts and select the regional branch of the fund where the application is sent, formulate the subject of the request and carry out other necessary actions.

This is interesting: Veteran of Labor in the Vladimir Region Travel on Electric Trains

Application for pension recalculation with sample

After selecting the item “Submitting an application for pension recalculation,” you can begin filling out the electronic form proposed by the system. Absolutely all required information must be entered there, otherwise the document cannot be sent to the addressee. Basic information includes the personal data of the pensioner, the name of the territorial branch of the pension organization to which he belongs, etc. From the proposed list, it is also necessary to select the actual reasons that will be the main grounds for the recalculation.

However, in some situations, in order to increase the current size of a regular cash payment, a citizen will need to contact the pension organization in person. There he must express in writing his desire to carry out the recalculation.

How to write an application for pension recalculation: sample, submission

Please note: if employees of the local Pension Fund refuse to accept papers and confirmations, then you should write a statement of claim for recalculation of the pension. A sample statement of claim is always provided at the court secretariat.

It should be remembered that any requirement to increase pension payments must be accompanied by a package of documents providing a legal basis for recalculating the old-age pension. Otherwise, he will not be accepted. By law, all paperwork for increasing pension payments must be provided by the pensioner himself.

Application to the pension fund

- Contact the service at your place of residence. A written statement must be written and registered.

- Send your request by registered mail. The territorial branch is on the official website of the Pension Fund.

- Create a request through the online reception. Both residents of our country and citizens living abroad can receive help in this way.

When receiving a package of documents and an application to the Pension Fund for a pension, the employee checks the accuracy of the information presented and makes copies of official papers. The appeal is registered and a receipt-notification is issued. It contains the date of reception. If any documents are missing, they are indicated with the deadline for their presentation.

Application for long service pension sample 2021

As a rule, the personnel service itself contacts the local branch of the pension fund and sends them copies of all the necessary documents. Pension fund specialists involved in assessing citizens' rights to pensions review the documents and make a conclusion. The teaching worker is sent a letter indicating the preliminary date for assigning a pension and giving appropriate instructions regarding the next application to the pension fund.

But in the above-mentioned letter from the pension fund there may be the following wording: “The preliminary date for assigning a pension is 10/01/2021. Having completed your experience in connection with teaching activities in institutions for children of the required duration, you can again apply for determination of the right to early assignment of an insurance pension...” That is, it is proposed to complete the experience, and then apply for a pension, which misleads the client (add This includes the workload of teaching staff, which leads to additional delays). And in accordance with the law, you need to apply a month before the expected date of completion of your work experience .

We recommend reading: What photo do you need for a health certificate?

Application to the Pension Fund for pension recalculation

I, born ____________________ _________, am the recipient of a pension, the amount of which I currently consider unreasonably low. I have been granted a pension since _________. in the amount of _______ rubles, which is confirmed by certificate No. _______, issued in _________. State Pension Fund of Russia No.__ for Moscow and the Moscow Region Office of the Pension Fund of the Russian Federation No.1. I carried out my labor activity from ____ to ____ year, as evidenced by the corresponding entry in the work book. From ____ to ____ I was on the labor exchange. During the existence of the USSR, I carried out my labor activity in a state organization and had a high level of earnings. However, at present the pension I receive is so low that I am unable to provide myself with a decent living. I believe that the Pension Fund of Russia calculated the amount of the labor pension due to me and the length of service from which it is calculated, were made incorrectly. I have every reason to believe that the Pension Fund, when assigning me a pension, did not include all my positions in my work experience and did not take into account the working conditions that would allow me to receive an increased pension. At the same time, according to the information I have, one of my friends receives the same pension as me, although her salary was several times lower than mine. In addition, I am a labor veteran, which is confirmed by the certificate series B number _______, issued _________. Prefecture of the Eastern Administrative District of Moscow. In accordance with Art. 39 of the Constitution of the Russian Federation, everyone is guaranteed social security by age, in case of illness, disability, loss of a breadwinner, for raising children and in other cases established by law. State pensions and social benefits are established by law. Article 24 of the Federal Law of December 15, 2001 N 166-FZ (as amended on April 5, 2013) “On State Pension Provision in the Russian Federation” directly provides that the assignment, recalculation of the amount, payment and organization of delivery of pensions for state pension provision are carried out by the body determined by the Government of the Russian Federation, at the place of residence of the person applying for a pension. Also, in accordance with Art. 2 Federal Law of December 15, 2001 No. 166 “On state pension provision in the Russian Federation” average monthly earnings - salary, monetary remuneration, monetary allowance, wages and other income that are taken into account to calculate the amount of the state pension provision of the citizen who applied for the appointment of this pension, expressed in monetary units of the Russian Federation and falling on periods of service and other activities included in his length of service or work experience. In accordance with Art. 20 of the Federal Law of December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation”, the recalculation of the size of the labor pension (the insurance part of the old-age labor pension), except for the cases provided for in paragraph 3 of this article, is carried out: from the 1st the date of the month following the month in which circumstances occurred that entailed a recalculation of the amount of the labor pension downwards; from the 1st day of the month following the month in which the pensioner’s application for an upward recalculation of the amount of the labor pension (the insurance part of the old-age labor pension) was accepted. A pensioner’s application for recalculation of the size of the labor pension (the insurance part of the old-age labor pension) is accepted subject to the simultaneous submission of the documents necessary for such recalculation, the obligation to submit which is assigned to the applicant. The recalculation of the amount of the insurance part of an old-age labor pension and the size of a labor disability pension is carried out in the following order: when establishing a disability group that gives the right to a higher amount of the insurance part of an old-age labor pension or a labor disability pension - from the date the federal institution issues a medical social examination of the relevant decision; when establishing a disability group that gives the right to a lower amount of the insurance part of an old-age labor pension or a labor disability pension - from the 1st day of the month following the month for which the previous disability group was established. A pensioner’s application for recalculation of the size of the labor pension (the insurance part of the old-age labor pension) is considered no later than five days from the date of receipt of the said application with all the necessary documents, the obligation to submit which is assigned to the applicant. In case of refusal to satisfy this application, the body providing pension provision, no later than five days from the date of the relevant decision, notifies the applicant about this, indicating the reason for the refusal and the procedure for appealing and at the same time returns all documents. I believe that the Pension Fund is obliged to accept the documents provided by me and recalculate the pension paid to me. Otherwise, I will be forced to file a claim in court. So, in accordance with Art. 2 of the Federal Law of the Russian Federation of May 2, 2006 “On the procedure for considering appeals from citizens of the Russian Federation,” citizens have the right to apply personally, as well as send individual and collective appeals to state bodies, local governments and officials. Based on the aforesaid and guided by Article. 2 Federal Law “On the procedure for considering appeals from citizens of the Russian Federation”,

This is interesting: Benefits are provided to veterans of labor

1. Accept this application for consideration. 2. Recalculate the Applicant’s pension - ___________________________. 3. Please inform me of the results of the consideration of this application in writing at the above address.

Sample preferential certificate to the Pension Fund in 2021

The employer should help with the preparation of the benefit certificate, since this is the authority that prepares this kind of documents. If an employee requires a preferential certificate, you need to contact the personnel department of your enterprise, writing an application for the issuance of the document. The certificate must be prepared within three days, after which the employee will be able to pick it up.

A preferential certificate is an official document confirming a certain length of service and its preferential nature. Without providing it, it is sometimes impossible to prove the fact of carrying out labor activities under certain conditions, which is especially important in the event of loss, damage to the work book or the presence of errors in it.

Forms and samples of applications to the pension fund

To get advice about a particular situation, it is enough to call the reception desk of the Pension Fund of Russia (PFR). But based on this appeal, it is impossible to make a definite decision regarding a specific person. You can apply for a pension only by contacting:

- You can independently regulate the amount of payments;

- accumulated funds are inherited by relatives;

- at the same time you can receive a state pension;

- You can transfer your deposit to another fund at any time.

How to find out what was calculated for my pension at the Pension Fund

Which document receptionist? Send it to the address of the regional branch of the Pension Fund by registered mail with acknowledgment of receipt, receive a notification - call the secretary, find out the incoming number and wait 30 days. They are obliged to respond to citizens' requests. Or you write an application in two copies and hand it over to the office for signature and registration, one copy for yourself.

You need to understand the listed and accounted contributions. Get a document from the accounting department with all the amounts listed in the Pension Fund. Next, calculate on your own what amounts should be taken into account. If there are discrepancies, look into it and write a complaint or something similar. All proceedings must be in writing, with signatures and seals.

Application to the Russian Federation for pension recalculation

In accordance with Art. 39 of the Constitution of the Russian Federation, everyone is guaranteed social security by age, in case of illness, disability, loss of a breadwinner, for raising children and in other cases established by law.

I believe that the Pension Fund of Russia calculated the amount of the labor pension due to me and the length of service from which it is calculated, were made incorrectly. I have every reason to believe that the Pension Fund, when assigning me a pension, did not include all my positions in my work experience and did not take into account the working conditions that would allow me to receive an increased pension.

09 Jun 2021 uristlaw 678

Share this post

- Related Posts

- Rules for Living in a Communal Apartment and the Rights of Neighbors 2020

- Is it possible to register property rights in another city?

- One day off per week with a five-day work week, paid according to average income.

- Are there any changes to Article 2 2 8 Part 2

Everything about registration, payment and delivery of pensions

- discovery of circumstances or documents disproving the accuracy of the information presented in confirmation of the right to the specified pension;

- expiration of the term for recognizing a person as disabled;

- acquisition of working capacity by a person receiving a survivor's pension;

- employment of a disabled family member of the deceased breadwinner, if this is one of the parents or spouse or grandfather, grandmother of the deceased breadwinner, regardless of age and ability to work, as well as a brother, sister or child of the deceased breadwinner who has reached the age of 18 years, if they are caring for children, brothers, sisters or grandchildren of the deceased breadwinner who have not reached 14 years of age and are entitled to a labor pension in the event of the loss of a breadwinner.

We recommend reading: Supplement to pension for length of service for military personnel, amounts and payments to military pensioners

However, the Pension Fund of Russia has the right to demand from individuals and legal entities documents and information, the timely failure of which or their unreliability may lead to overspending on pension payments.