- home

- Services

- Personalized accounting

- Definition of personalized accounting

- The procedure for maintaining and providing personalized accounting information

- Deadlines for submitting a report on personalized accounting

- Responsibility for violation of the procedure for providing personalized accounting information

- Assistance in maintaining personalized records

- Our tariffs

According to current legislation, all employers are required to provide information about their employees to the Pension Fund of the Russian Federation. They relate to accrued amounts transferred to individual personal accounts of employees of the enterprise. The law determines the rules for recording data regarding pension savings for each citizen individually.

Definition of personalized accounting

Personalized accounting in our country is a system that collects all information about the funded and insurance parts of future pensions. It was created by the Pension Fund of the Russian Federation, so it is also managed by it. Relevant reports must also be submitted here.

From the moment a person begins his working activity, an individual personal account is opened for him in the Pension Fund of the Russian Federation. It collects data about a person’s length of service throughout their entire career. Thus, the employee is in the hands of managing his own account. When calculating a pension, the following principle will apply: the more funds accumulated, the larger the pension.

All activities and management are regulated by Federal Law No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system.”

The main tasks assigned to the organization and maintenance of personalized records are:

- the formation of a unified information system in the country that contains the most up-to-date information about insured persons;

- ensuring transparency of information on the calculation of savings and insurance contributions;

- Constant updating of the database with current reliable data received from employers.

The main functions of personalized pension accounting are:

- reliable provision of pension rights of citizens of the Russian Federation;

- prompt notification to insured persons of the current status of their personal accounts;

- effective control over the receipt of mandatory insurance contributions, which are transferred by employers in the compulsory health insurance system.

Personalized accounting: what to consider and why

The procedure by which organizations and individual entrepreneurs must keep personalized records of their employees is established by Federal Law No. 27-FZ of April 1, 1996 “On individual (personalized) records in the compulsory pension insurance system.”

The Pension Fund opens an individual personal account for each insured person. This account is needed to record and control the insurance premiums that are received for the employee from the employer. And this, in turn, allows us to simplify the procedure and speed up the process of assigning a labor pension.

Here is a list of information that the organization submits to the Pension Fund about each of its employees:

- insurance number of an individual personal account;

- Full Name;

- date of employment in the organization or date of conclusion of the GPC agreement;

- date of dismissal or date of termination of the GPC agreement;

- periods of activity included in the length of service in the relevant types of work (work in the Far North, work in special working conditions);

- the amount of earnings for which contributions to the Pension Fund are calculated;

- the amount of accrued insurance premiums;

- periods of work included in the employee’s professional experience;

- other information necessary for the correct assignment of a pension.

All this information is provided in forms approved by the Pension Fund.

The procedure for maintaining and providing personalized accounting information

Currently, the procedure for maintaining personalized records of information about insured persons is established by Federal Law No. 27-FZ and the Instruction approved by Order of the Ministry of Labor and Social Protection of the Russian Federation dated December 21, 2016 No. 766n

The instructions set:

· the procedure for registration in the compulsory pension insurance system;

· the procedure for providing information about insured persons to the territorial bodies of the Pension Fund of the Russian Federation and the procedure for receiving this information by responsible officials of the Fund;

· the procedure for checking and monitoring the accuracy of information provided to the Fund;

· rules for document management, storage and destruction of documents containing personalized accounting information.

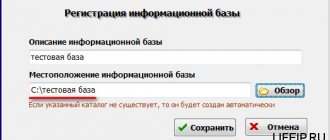

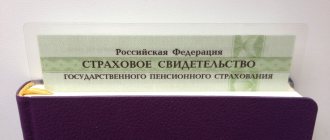

Registration with the Pension Fund of the Russian Federation is carried out by a citizen (his representative) personally or through the policyholder by filling out a questionnaire of the insured person. After checking the personal data, the insured person is issued an insurance certificate of compulsory pension insurance.

Policyholders are required to provide the territorial bodies of the Pension Fund with information about employees (insured persons) necessary for maintaining personalized records. In accordance with Federal Law No. 27-FZ, policyholders are all legal entities (including foreign ones), their separate divisions, as well as individual entrepreneurs and citizens operating in the territory of the Russian Federation and hiring under employment contracts or concluding civil contracts for which insurance premiums are charged in accordance with the legislation of the Russian Federation.

According to Article 11 of the Law, the policyholder is obliged to provide information to the Pension Fund of the Russian Federation regarding each insured person working for him (including those receiving remuneration under civil law contracts). This information includes:

- the amount of wages (income) on which contributions to compulsory pension insurance were calculated;

- amounts of accrued insurance premiums.

Information is provided on paper (by the policyholder in person or by mail) or in the form of an electronic document.

The Board of the Pension Fund of the Russian Federation has adopted a number of regulations approving the forms of documents for registration and maintaining personalized records, and also established the procedure for filling them out and sending them to the Fund’s bodies.

The form for providing information about insured persons was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated February 1, 2016 No. 83p (Form SZV-M).

Form SZV-M includes:

- information about the policyholder (details, registration number in the Pension Fund of the Russian Federation, name, TIN, KPP, reporting period, type of form);

- information of the insured persons - last name, first name, patronymic, insurance number, TIN (if available).

Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 2p approved the forms of documents for registration of citizens in the compulsory pension insurance system and Instructions for filling them out.

In particular, the Resolution approved:

· Questionnaire of the insured person (ADV-1);

· Insurance certificate of state pension (ADI-1) and compulsory pension insurance (ADI-7);

· List of documents submitted by the policyholder to the Pension Fund (ADV-6-1);

· Information about the work experience of the insured person for the period before registration in the compulsory pension insurance system (SZV-K) and others.

The instructions for filling out personalized accounting document forms establish a detailed procedure for filling out and transmitting data to the territorial bodies of the Pension Fund of the Russian Federation and contains more than 80 different tables.

The procedure for registration and provision of personalized accounting information for the 1st quarter of 2013

For the 1st quarter, policyholders must submit reports to the Pension Fund in the following forms:

- ADV-6-2,

- ADV-6-5,

- SZV-6-4.

Individual information is provided no later than May 15, 2013.

Please note: The legislation defines the simultaneous presentation of:

- calculations for accrued and paid insurance premiums (RSV-1),

- individual personalized accounting information (ADV-6-2, ADV-6-5, SZV-6-4).

In accordance with the provisions of the current legislation, personalized accounting documents can be submitted:

- On paper accompanied by a file on magnetic media.

- Via telecommunication channels (electronically) through a certification center, if the policyholder enters into an agreement with the certification center and the Pension Fund of Russia, or through an authorized representative in the prescribed manner.

Please note: For policyholders with more than 50 employees, it is mandatory to submit reports electronically.

Due to the fact that companies are required to provide calculations of accrued and paid insurance premiums simultaneously with individual personalized accounting information, for the 1st quarter of 2013. The following package of documents is submitted to the Pension Fund branches:

- RSV-1 “Calculation of accrued and paid insurance premiums for compulsory pension insurance in the Pension Fund of the Russian Federation, insurance contributions for compulsory medical insurance insurance to the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds by payers of insurance premiums making payments and other benefits to individuals.”

- ADV-6-2 “Inventory of information transmitted by the policyholder to the Pension Fund of the Russian Federation.”

- ADV-6-5 “Inventory of documents with information on the amount of payments and other remunerations, on accrued and paid insurance premiums and the insurance period of the AP, transferred by the policyholder to the Pension Fund of the Russian Federation” (submitted as part of a bundle with form SZV-6-4 (the first sheet in the bundle) ).

- SZV-6-4 “Information on the amount of payments and other remuneration, on accrued and paid insurance premiums for compulsory health insurance and the insurance period of the AP is provided by the insured for all those working for him under an employment contract, as well as those who have concluded civil contracts, for which remuneration is in in accordance with the legislation of the Russian Federation, insurance premiums are calculated for compulsory pension insurance, for which he pays insurance premiums.”

At the same time, information about the insured persons in the personalized accounting documents submitted by the policyholder is indicated:

- for the last 3 months of the reporting period (i.e. 1st quarter of 2013).

Personalized accounting forms ADV-6-2, ADV-6-5, SZV-6-4 are filled out in accordance with the Instructions for filling out individual (personalized) accounting document forms in the compulsory pension insurance system, approved by Resolution No. 192p as amended by Resolution No. 17p.

Readers can find both of these resolutions on the PFR website: www.pfrf.ru

Main changes in the details of individual information and in the rules for filling them out:

Form SZV-6-4 contains the following details that were not present in forms SZV-6-1(2) submitted to the Pension Fund for the periods from 2010 to 2012.

- The contract (type of contract) concluded with the insured person is indicated:

- "Labor",

- or "Civil Law".

Please note: Separate packs of individual information are generated for each type of contract.

- “PFR registration number during the adjusted period” must be filled in in case of re-registration of the policyholder when submitting the corrective (cancellation) form.

- Information on the amount of payments and other remuneration accrued in favor of an individual.

- Information on the amount of payments and other remunerations of the insured person employed in the relevant types of work for which insurance premiums are calculated at an additional rate.

The amounts of payments and other remunerations accrued by payers of insurance premiums - policyholders in favor of an individual for the last three months of the reporting period with a monthly breakdown in rubles and kopecks are indicated.

In addition, in the SZV-6-4 there is no detail “Address for sending information about the status of an individual personal account”, which was contained in the SZV-6-1(2) forms.

In the “Period of Work” section of the SZV-6-4 form, codes of special working conditions and (or) grounds for early assignment of a labor pension are indicated for insured persons employed in work with harmful, dangerous, difficult working conditions (clauses 1-18 clauses. 1, Article 27 of Law No. 173-FZ) only in the case of accrual (payment) of insurance premiums at additional rates.

Personalized accounting document forms reflect information on accrued and paid insurance premiums for compulsory pension insurance for the last three months of the reporting period within the established maximum base* for the calculation of insurance premiums.

*In 2013, the maximum value of the base was 568,000 rubles.

In excess of the established maximum value of the base for calculating insurance premiums, the rate of insurance premiums is:

- 10% - joint part of the tariff of insurance premiums to finance the insurance part of the labor pension (for all categories of insured persons).

Please note: Amounts of insurance premiums accrued for payments in excess of the established maximum base for calculating insurance premiums are not reflected .

At the same time, insurance premiums at the additional tariff are calculated without taking into account the maximum value of the base for calculating insurance premiums (Article 8 of Law No. 212-FZ).

Responsibility for violation of the procedure for providing personalized accounting information

The employees responsible for submitting this information are responsible for their correctness and reliability.

Control over the accuracy of the information provided is carried out by the territorial bodies of the Pension Fund. If errors are detected and (or) their inconsistency with the information available to the Pension Fund of Russia, as well as if they do not comply with the established forms and formats, the policyholder is given a notice that the errors have been corrected (in person against signature, by registered mail or electronically). The policyholder is given 5 working days to eliminate these errors.

For failure to provide information within the established time frame or provision of incomplete (inaccurate) information, as well as failure to eliminate errors, managers and officials of the policyholders bear financial responsibility established by Article 17 of Federal Law No. 27-FZ.

From 2021, a fine will be imposed on employers who:

- failed to submit a report on time - in the amount of 5% of the amount of all insurance premiums that were accrued for the reporting period. The fine is charged for each month of delay. Its amount cannot be less than 1000 rubles and cannot exceed 30% of the accrual amount;

- submitted false information - in the amount of 5% of quarterly deductions. But this fine is collected through the court.

Therefore, the report must be kept correctly and correctly.

In addition to financial responsibility, it is worth noting that those involved in this at the enterprise, as well as responsible employees of the pension fund who painstakingly enter data into the database, decide the fate of future pensions. Both the correctness of the accruals and the correctness of the input, and therefore the management of pension savings, depend on them. In the future, this will directly affect the size of pensions.

A detailed study of numerous regulatory documents does not always guarantee the correct, timely preparation and submission of personalized accounting information. It is impossible to know all the nuances “from scratch”, and experience, as a rule, is gained through trial and error. Therefore, it will be most effective to transfer such a critical area of work to professionals specializing in the provision of these services.

Individual personalized accounting - what is it?

Enterprises have the responsibility to send the necessary information about citizens to the pension authorities. The main responsibility of the organization's management is to report information about the citizen's income level. In addition, information about funds received into accounts is reflected. This legal act defines the rules regarding data about a person, including savings.

Previously, the specified accounting scheme was not applied, but since the beginning of 1997 these provisions have become mandatory for all employers. The reason is that certain factors must be taken into account when assigning pension-type contributions. In particular, this is the amount of production and the amount of funds allocated to the Pension Fund.

The legislation indicates the need to conclude a special agreement in the following situations:

- when a citizen works under an employment agreement;

- works under a civil contract;

- works in a correctional facility;

- the person has been registered with the Center for Significance.

Attention! Specialists have developed a system of information about persons who have been registered in this accounting.

Why is it necessary?

The legislation indicates that it is mandatory for a citizen to be insured. Depending on how timely information on the payment of such contributions for labor activities is provided, which simplifies the process of assigning payments to citizens of sufficient security after registration of pension status.

The accounting system allows us to take into account the powers of each citizen who carries out labor activities. Accounting allows you to determine the amount of insurance coverage in order to calculate future pension payments.

Regardless of where a citizen works, his personal data is stored in a personalized accounting system.

What year was it introduced?

The concept in question began to be applied in 1998. From this moment on, bodies and organizations became obligated to keep records of citizens who do not carry out labor activities and those for whom contributions to the relevant bodies are paid.

This system made it possible to simplify the reform in the pension sector in 2002. In addition, we managed to complete the task regarding insurance. In accordance with Federal Law No. 27, it was proposed to introduce a personalized accounting system in 1996.

By introducing such a system, the movement of funds accrued to a citizen for carrying out work activities can be easily tracked. From the beginning of April 2021, organizations are obliged to transfer information of individual significance , which is reflected in personnel documentation.

Assistance in maintaining personalized records

Having worked in the consulting services market for more than 15 years, she professionally provides personalized accounting services in Moscow and the Moscow region to enterprises and individual entrepreneurs.

The company's specialists are highly qualified professionals in the field of accounting, taxation, labor legislation and law. Having extensive experience in maintaining personalized records, we guarantee the correctness and accuracy of its preparation at your enterprise and timely submission to the Pension Fund authorities. By transferring this work to us, you can be sure that maintaining personalized records at your enterprise will comply with all the requirements of current legislation.

How is personalized accounting carried out?

To enter this system, namely to form their future pension, every citizen must register in the individual accounting system of the Russian Pension Fund. The entire period of each person’s working life, the system records all the data that is necessary for a future pension: length of service, all places of work with specific periods and the amount of contributions sent to the pension fund for a future pension, as well as earned pension points.

Even if the future pensioner changed jobs throughout his entire career, or worked part-time, all information was received by the pension fund in the form of individual information. All this information is kept strictly confidential. Currently, the Pension Fund registers absolutely every Russian citizen, including children, teenagers, foreigners and stateless persons. Each person registered in the OPS system receives an individual insurance number with a personal account (SNILS).

SNILS is an identifier of information about an individual in the individual personalized accounting system. All information provided is confidential information. They are stored in compliance with all rules governing the collection, storage, processing and protection of personal information. This information can only be obtained by the insured person himself and only by contacting the Pension Fund in person.

What is personalized accounting

The appearance of this term is inextricably linked with the decision of the Government of the Russian Federation in 1998 to create a unified registration database intended for collecting, storing and processing information about policyholders and insured persons, in particular, those data relating to their length of service and the amount of transferred contributions. Moreover, not only officially employed persons, but also the unemployed are subject to registration in the system.

According to the norms of pension legislation, the latter have the right to receive social benefits to cover minimum expenses; the amount of payments is established in accordance with current regulations. The implementation of accounting actions is carried out in accordance with the requirements of Federal Law No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system,” dated April 1, 1996.

Download for viewing and printing:

Federal Law of April 1, 1996 N 27-FZ (as amended on December 28, 2016) “On individual (personalized) registration in the compulsory pension insurance system”

Tasks and goals of the IPU

The primary objective of personalized accounting is to simplify the procedure for assigning payments to persons entitled to software. In addition, there are a number of secondary goals, the implementation of which can significantly expand the functionality of the fire alarm system.

These include:

- collection of reliable information about employees, its targeted use;

- informing a person participating in the operation of the OPS system about the status of his individual personal account (l/s);

- formation of a common database;

- ensuring the principle of transparency, thanks to which information regarding the establishment of pension payments and determining their size has become more open;

- carrying out verification activities in order to monitor compliance with the legality of the procedure for transferring insurance payments.

Important!

According to the law, not only citizens of the Russian Federation, but also foreigners carrying out labor activities within the country are subject to registration in the OPS system. The registration procedure involves:

- Assigning a citizen an individual number (SNILS).

- Creation of an individual personal account, to which funds are subsequently transferred aimed at creating software.