Who grants the right to property tax exemption?

Some categories of taxpayers are entitled to tax benefits.

This benefit allows you to pay only part of the tax or exempts you from it completely (Clause 1, Article 56 of the Tax Code of the Russian Federation). Legislatively, the rights to benefits and tax exemptions are enshrined in the Tax Code, and are also established by acts of the constituent entities of the Russian Federation (Article 56, Article 372 of the Tax Code of the Russian Federation).

Conventionally, property tax benefits can be divided into 2 groups:

- the benefits contained in the provisions of the Tax Code are valid in all constituent entities of the Russian Federation where property tax is established;

- benefits introduced by local authorities and valid only in the territory of the corresponding region (municipality).

The benefits established by the Tax Code are valid throughout Russia and do not require additional approval in the laws of the constituent entities of the Russian Federation (decision of the Supreme Court of the Russian Federation dated July 5, 2006 No. 74-G06-11).

Procedure for making advance tax payments

The organization independently calculates the amount of tax payments using the following formulas: Amount of tax for the tax period = tax rate * tax base.

The amount of tax to be transferred to the budget at the end of the tax period = Tax rate * Tax base - advance payments.

It is easy to make a mistake when calculating tax payments. Especially if you have property in different constituent entities of the Russian Federation and their regulations differ from each other. Seek help from a specialist.

If an organization has property in different regions, it must determine the fee for the property according to the rules of the region in which it is located. The fee must be paid according to the procedure approved there. Companies must submit a declaration and calculations for advance payments to the Federal Tax Service at the end of each reporting and tax period. Calculations are provided by the 30th of April, July and October. The declaration must be submitted by March 30 of the following year.

Property tax: preferential taxation in the constituent entities of the Russian Federation

The powers of local governments include the independent establishment of benefits. According to the Tax Code, property tax benefits are not individual in nature and are not established depending on the form of ownership of the organization (Article 3, 56 of the Tax Code of the Russian Federation).

In accordance with the ruling of the Supreme Court of the Russian Federation dated 06/07/2006 No. 59-G06-9, it is impossible to establish a property tax benefit if its use depends on the share of foreign participation in the authorized capital of the taxpayer, since there is a dependence on the place of origin of the capital, which is contrary to Russian tax legislation .

The legislation of the constituent entities of the Russian Federation cannot contradict the Tax Code; accordingly, property tax benefits cannot be established as a change in the elements of property tax (Chapter 30 of the Tax Code of the Russian Federation).

Legislative bodies of constituent entities of the Russian Federation can create additional conditions allowing the use of benefits.

An example is the Moscow region, where taxpayers, when using benefits, are required to provide a calculation of the amount of released funds at the end of the tax period and a report on their use. This provision is enshrined in paragraph 3 of Art. 4 of the Law of the Moscow Region “On Preferential Taxation...” dated November 24, 2004 No. 151/2004-OZ.

Tax benefits for organizations

The property tax may not be paid:

- penal organizations;

- religious institutions;

- associations of people with disabilities;

- pharmaceutical manufacturers;

- prosthetic and orthopedic companies;

- bar associations, legal bureaus;

- innovation and research centers;

- representatives of a special or free economic zone;

- ;

- shipbuilding organizations;

- institutes involved in offshore exploration;

- companies with high energy efficiency.

Regions may include other preferential organizations in the list. To find out if tax benefits are available for your association, contact your local tax authority.

Who is exempt from property tax according to regional legislation?

Let's look at examples of property benefits for organizations that operate in the constituent entities of the Russian Federation:

1. Certain categories of taxpayers are exempt from taxation of all owned property.

This benefit is presented in St. Petersburg. Organizations whose main activity is the manufacture of special equipment to support the life and rehabilitation of disabled people are exempt from tax (subclause 1, clause 1, article 4.1 of the St. Petersburg Law “On Organizational Property Tax” dated November 26, 2003 No. 684-96).

In Krasnoyarsk, a similar benefit is provided to organizations engaged in the production of primary aluminum in the region in relation to newly created or acquired property accepted for accounting as fixed assets after 2012 (sub-clause “t”, paragraph 3, article 2 of the law of the Krasnoyarsk Territory “On Tax” on the property of organizations" dated November 8, 2007 No. 3-674).

2. When using property for the intended purpose, it is permissible to use benefits.

For example, Moscow adopted the Law “On Organizational Property Tax” dated November 5, 2003 No. 64, which exempts public railway transport organizations from paying property tax in relation to movable and immovable property used for transportation along the Small Ring of the Moscow Railway (sub. 28 paragraph 1 article 4). The list of such property is established by the Moscow government.

3. Taxpayers are exempt from taxation in relation to a certain type of property.

This benefit, for example, was introduced for property used to carry out activities to organize recreation and health improvement for children under 18 years of age in the Leningrad Region (subparagraph “e”, paragraph 1, Article 3_1 of the Law of the Leningrad Region “On Organizational Property Tax” dated November 25. 2003 No. 98-oz) and the Khabarovsk Territory (clause 12 of Article 3 of the Law of the Khabarovsk Territory “On regional taxes and tax benefits...” dated November 10, 2005 No. 308). In the latter case, it is applicable provided that in other periods the property falling under it is under conservation.

In the Vladimir region, a benefit has been established for public roads of regional and intermunicipal importance (clause 2 of article 2.1 of the law of the Vladimir region “On the property tax of organizations” dated November 12, 2003 No. 110-OZ).

4. Certain categories of taxpayers have the right to a reduction in the amount of tax.

Examples include:

- Moscow region, where organizations that are members of religious associations are allowed to pay 50% of the calculated tax amount (clause 2 of article 14 of the law of the Moscow region “On preferential taxation...” dated November 24, 2004 No. 151/2004-OZ);

- Chelyabinsk region in terms of charitable activities. The amount of the benefit is also 50% (Clause 2, Article 3 of the Law of the Chelyabinsk Region “On Organizational Property Tax” dated November 27, 2003 No. 189-ZO).

In accordance with the Tax Code, in the constituent entities of the Russian Federation it is permissible to use reduced property tax rates (clause 2 of Article 372, clause 2 of Article 380 of the Tax Code of the Russian Federation). However, the reduced rate cannot be considered a benefit.

The use of tax benefits is the right of the taxpayer, therefore it is necessary to have undeniable grounds for the use of this right. Tax authorities may request from the taxpayer supporting and supporting documents for the application of property benefits (Articles 88, 89, 93 of the Tax Code of the Russian Federation).

To find out whether documents will be requested when applying reduced rates, read the material “A differentiated tax rate is not a benefit.”

TIP from “ConsultantPlus” In 2021, additional benefits can be received by property owners who have provided tenants with a deferment in the payment of rental payments in accordance with the Requirements approved by Decree of the Government of the Russian Federation dated 04/03/2020 N 439. The benefits consist of... (for more details, see K+) .

Is there an exemption from property tax for individual entrepreneurs and LLCs under special regimes?

Yes, it exists. Among those who are exempt from property tax are organizations and individual entrepreneurs with special regimes. In this case, the following conditions must be met:

| No. | Condition | IP | Organization |

| 1 | The tax regime chosen is | STS, UST, UTII or patent (only for individual entrepreneurs) | |

| 2 | Property in use | As part of business activities | Ownership of the company |

| 3 | Special conditions | There are available documents confirming the use of property in work (lease agreement, agreement with suppliers, payment documents, etc.) | It is on the balance sheet of the enterprise |

However, we note that starting from 01/01/2015, individual entrepreneurs and companies in special regimes must pay tax on the real estate they own for a specific purpose based on its cadastral value (Article 378.2 of the Tax Code of the Russian Federation).

What categories of individuals do not pay property tax?

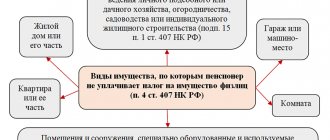

Since 2015, Chapter 32 of the Tax Code has come into force, according to which property tax for individuals is generally calculated based on cadastral value.

Tax payers are owners of residential real estate, garages, parking spaces, etc.

Find out how personal property tax is calculated here .

According to Art. 407 of the Tax Code of the Russian Federation the following categories of individuals are not payers of property tax:

- Heroes of the USSR and the Russian Federation;

- participants in the Great Patriotic War and other military operations;

- disabled people of groups I or II, as well as disabled people since childhood;

- military personnel;

- family members of military personnel in the event of loss of a breadwinner;

- pensioners;

- persons exposed to radiation as a result of nuclear tests at the Semipalatinsk test site, the disaster at the Chernobyl nuclear power plant, as well as at the Mayak production association, etc.

Also exempt from paying tax are owners of outbuildings located within the boundaries of dacha farms, gardening, individual housing construction, the area of which does not exceed 50 square meters.

Individuals entitled to tax benefits should submit a corresponding application and documents confirming their right to the benefit to the Federal Tax Service at their place of residence.

A tax benefit is provided to an individual in relation to 1 property. The taxpayer should be notified of his decision to select a preferential asset no later than November 1 of the year that is the tax period. If notification of the selected property is not provided, the benefit is provided in relation to the asset with the maximum amount of calculated tax.

Results

Benefits for corporate property tax are established by the Tax Code and can also be introduced at the regional level.

The right to a benefit must be documented. Persons exempt from property tax include special regime residents, for whom, since 2015, the obligation to pay this tax on real estate for a certain purpose has been introduced with a tax base in the form of cadastral value. There are also benefits for property taxes paid by individuals. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Which organizations pay the property tax?

Tax payers include domestic companies and foreign firms that have branches or real estate in Russia. Legal entities with the simplified tax system or a single tax on imputed income are exempt. FIFA and its subsidiaries and football associations do not pay the fee. The levy is levied on: fixed assets of an enterprise, investments in material assets, and residential premises. In order for property to fall into the category of fixed assets, it must be used by the company for more than a year, be more expensive than ten thousand rubles, be involved in production and bring financial benefit to the company. Land plots are not subject to tax.