What taxes do pensioners pay and what benefits do they have?

In accordance with paragraph 2 of Art. 217 of the Tax Code of the Russian Federation, state pension provision does not fall under the group of taxable income. No tax is paid on the pension and is not deducted when calculating its amount.

The current tax legislation distinguishes between several main categories of taxes paid by individuals: federal, regional, local. These categories include all obligations that individuals, including pensioners, are required to comply with.

For convenience, each of these categories will be considered separately. It will also be determined whether pensioners are required to pay this type of tax, or have the right to receive benefits or a complete exemption.

What are working pensioners entitled to in Russia?

Labor legislation provides guarantees for working pensioners, which are often intertwined with the rights of an ordinary employee

. In particular, working pensioners have the following rights:

- the right to receive a pension without restrictions in the manner prescribed by law;

- can get a job according to an employment contract;

- have the right to receive annual paid leave;

- can work part-time;

- cannot be forcibly dismissed due to the onset of retirement age (and if you fire a pre-retirement person, you may even find yourself subject to criminal liability);

- sick leave is provided legally;

- Every year you can take 2 additional paid days off

to undergo medical examination; - can quit their job upon reaching retirement age without working 14 days;

- have the right to an additional unpaid leave

of 14 days within one year, while a working pensioner can interrupt it at any time, and the employer does not have the right to force him to go on unpaid leave. - have the right to submit property deductions for the construction and purchase of new housing with confirmed expenses, the right to a property tax benefit.

Other rights of working pensioners are the same as those of other employees. Such a pensioner can work overtime, like an ordinary employee, can be legally laid off, and can also enter into a fixed-term employment contract.

Personal income tax

In terms of income received by pensioners, with the exception of the state pension, no benefits are provided. For working pensioners, employers pay personal income tax in the same manner as for other employees.

If a pensioner is engaged in any income-generating activity, then he is obliged to pay personal income tax on time in the amount of 13% of income. The tax is classified as federal, so regional and local authorities cannot in any way influence the fulfillment of this obligation.

This obligation applies to all other types of income, including lottery winnings. Therefore, any income must be taxed. Here, pensioners are treated the same as all other citizens of the Russian Federation. Summary: pensioners pay income tax on income not specified in Art. 217 Tax Code of the Russian Federation.

There are no benefits for individuals, including pensioners. This rule most affects working pensioners, whose taxes are actually paid by the employer. Pensioners pay all federal taxes that apply to individual entrepreneurs and individuals, and specified in Article 13 of the Tax Code of the Russian Federation.

Transport tax benefits for pensioners

Transport tax is regional and is regulated by Ch. 28 of the Tax Code of the Russian Federation. The rates, as well as benefits for this tax, are enshrined in the legislation of each region, and therefore differ from each other. In some areas, pensioners may be provided with benefits, in others - not.

For example, in the Moscow region there are no transport tax benefits for old-age pensioners. But there are disabled people of groups I and II who do not pay it in full, and group III, among whom there may be workers, pay only 50% of the amount. But no more than one vehicle at a time.

And in the Krasnodar Territory, pensioners aged 55 years (women) and 60 years old (men) pay 50% of the amount of transport tax on passenger cars with an engine power of up to 150 l/s.

You can find out what transport tax benefits for pensioners are available in your region at your local Federal Tax Service office.

Transport tax

This type of tax is included in the regional category. That is, there is no single tax rate, as is the case with income tax. The final rate is set at the regional level, so this indicator may differ in two different regions of the Federation.

Therefore, the transport tax does not fall under federal incentive programs. If benefits are provided, then only at the regional level. As practice shows, in a number of regions of the Russian Federation, concessions on this tax are provided for WWII veterans, labor veterans, heroes of the USSR (Russian Federation), and disabled people of certain groups.

For example, in Moscow, ordinary pensioners who are not included in the list of beneficiaries pay transport tax on the same basis as other categories of citizens. Therefore, to clarify this information, the pensioner needs to contact the territorial tax authorities at the place of residence (permanent registration).

The remaining regional taxes are the gambling business tax and the corporate property tax. They apply to legal entities and do not affect pensioners in any way. As a result: pensioners pay only transport tax among regional taxes. If a pensioner can count on a benefit, then for this he needs to submit an application to the tax authorities: these preferences are of a purely declarative nature.

Property tax for individuals

This type is included in the category of local taxes. Taxpayers here are individuals who have ownership rights to property recognized as an object of taxation. Despite the fact that the tax is recognized as local, tax benefits introduced by Federal Law dated October 4, 2014 N 284-FZ are common to all.

Pensioners who have the right to receive a state pension, regardless of the circumstances, as well as persons who have reached 55 and 60 years of age (men and women). In addition to pensioners, federal legislation provides for a number of preferential categories (Article 407 of the Tax Code of the Russian Federation).

Personal property tax for pensioners: what are the benefits?

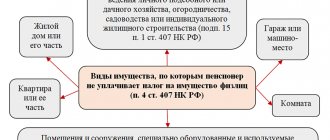

The benefit for pensioners is not expressed in a reduction in the tax rate or any other components of this tax. Federal legislation exempts pensioners from paying personal property taxes in respect of only one item of each type of property subject to taxation.

In accordance with paragraph 4 of Art. 407 of the Tax Code of the Russian Federation, the following types of taxable objects are recognized:

- Apartment, part of an apartment (share), room.

- Private house or part of a house.

- Premises used for professional creative activities - ateliers, workshops, studios, libraries, open thematic museums.

- Garage, parking space, parking space.

- Outbuildings whose area does not exceed 50 square meters. meters, and which are used for personal farming, individual housing construction, summer cottage farming, and gardening.

The bottom line is that one object from each category of property is exempt from tax. That is, this is one apartment, one residential building, one garage, and then on the same principle. If a pensioner has one house and one garage, then in both these areas he is completely exempt from paying taxes.

If there are two apartments and several parking spaces, then the pensioner chooses one apartment and one space for which he will not pay tax. The tax base will be calculated for the other apartment and other parking spaces. The same applies to all other categories: a pensioner can choose only one object from each category. For the rest you will have to pay tax in accordance with local regulations.

A benefit is provided only if the object is not used by the taxpayer for business purposes. The use of benefits is of a declarative nature. The pensioner must submit an application in the prescribed form to receive the benefit to the territorial tax authorities.

If a pensioner has not notified the tax authorities of his right to receive a benefit, the Federal Tax Service, upon receiving relevant information from other sources, receives grounds to apply the benefit unilaterally, without the knowledge of the taxpayer. In this case, the benefit applies to the object in respect of which the maximum tax amount is calculated. And such a mechanism is provided for all categories of taxable objects.

List of benefits for working pensioners in 2021

As mentioned earlier, working pensioners who have the status of Russian citizens can receive benefits in the following areas:

- labor code;

- tax rules;

- regulations for travel on public transport;

- payment for utility services;

- obtaining vouchers to sanatoriums;

- payment for medications and medicines.

Most of the presented preferences are granted not only to disabled pensioners, but also to persons of retirement age who are in the status of active employees of private or public companies.

Labor

Citizens of the Russian Federation who are of retirement age but continue to work have the right to receive all kinds of benefits. Such relaxations apply to additional leave, as well as the possibility of receiving a dismissal order without prior notice and work off.

Additional paid leave

Receiving additional leave without pay. Vacation days are provided for 14 calendar days for people on old-age pensions, as well as for 60 days for citizens of retirement age who have disabled status.

Dismissal without notice to the employer

According to current labor legislation, when any employees are dismissed, they remain obligated to perform mandatory work and perform all previous functions within 2 weeks. Pensioners are exempt from such obligations and can resign without working off.

Tax

Tax benefits for working pensioners in 2021 are all kinds of preferences available to citizens of the Russian Federation who have reached retirement age.

Exemption from real estate tax

According to Russian legislation, every citizen who owns real estate is required to pay a tax on its maintenance. However, some categories of citizens, including pensioners, are exempt from such obligations.

Corresponding benefits are provided to owners of the following real estate:

- apartments in multi-apartment buildings;

- private houses or cottages;

- garages or parking spaces;

- premises for workshops and studios;

- outbuildings with an area of less than 50 square meters.

In addition, working pensioners are exempt from paying land tax on their dacha plots. The only condition regarding this law is that the size of the property should not exceed 6 standard acres.

Compensation for the purchase of property

According to paragraph 10 of Article 220 of the Tax Code of the Russian Federation, working pensioners have priority rights to receive a property deduction for expenses on the purchase of real estate. In accordance with the law, the deduction is provided to citizens of retirement age in 3 stages, the periods of which preceded the time of formation of carryover balances on property payments.

Social

As mentioned earlier, working pensioners, in addition to labor benefits and preferences for travel on public transport, are entitled to all kinds of social benefits. These, in addition to compensation for utility services, include material subsidies for the purchase of medicines and visits to paid medical centers or medical sanatoriums. Thus, the question of what benefits are available to working pensioners is answered by various articles of the Russian labor and tax code.

Reimbursement for utility bills and transport

Issues related to the provision of benefits for utility bills and public transport are reflected in detail in the housing legislation of the Russian Federation. However, the list of federal regulations does not include clear recommendations regarding such preferences. Due to this state of affairs, the nature of such benefits may differ in different regions of our country, being of a regional nature.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

As a rule, working pensioners receive the opportunity to receive a targeted discount or full compensation of costs related to payment for housing and communal services. Also, Russian regional authorities are introducing a number of measures to allow citizens of retirement age to use city minibuses, buses, trolleybuses and trams at more pleasant and affordable prices.

Payment for medicines and medical services

As with previous benefits, preferences for payment for medicines and medical services are also regional in nature, differing from each other in different regions of the country.

Such reliefs include:

- free receipt of medicines and other medical supplies;

- providing discounts on medicines and medical products;

- free dental procedures, in particular prosthetics;

- preferential specialized medical services.

Land tax

Land tax is included in the group of local taxes. Federal legislation establishes a list of benefits that reduce the tax base or completely exempt subjects from paying land tax.

Pensioners are entitled to receive such benefits. The mechanism for providing it is to reduce the tax base, based on a decrease in the area of the land plot by 600 square meters. meters. Land tax for individuals is calculated based on the area of the plot, therefore, if the total area is, for example, 1000 sq. meters, then the tax base will be calculated only on 400 square meters. meters (4 acres). Consequently, here we are talking, rather, not about complete exemption, but only about a reduction in the tax base.

Full exemption is due only if the tax base is 0, ― if the area of the plot is equal to or less than 600 square meters. meters. These amendments apply to areas located:

- Owned by the taxpayer.

- In lifelong inheritable ownership.

- For permanent (indefinite) use.

Regardless of the number of plots that a taxpayer owns or uses, the reduction in the tax base applies to only one of them. The pensioner independently sends a notification to the tax authorities, which marks one of the areas for which the benefit will be applied.

If the notification is not received, the Federal Tax Service has the right to obtain such information independently. If a pensioner owns several objects, the tax authorities apply the benefit to the one in respect of which the maximum tax amount is calculated.

Complete list of taxes paid by pensioners

These are the main taxes that pensioners are required to pay on an equal basis with other citizens. For each of the regional and local taxes, benefits may be provided. Where and exactly what benefits apply should be clarified locally. At the same time, a non-exhaustive list of mandatory taxes is as follows:

- Income tax - on all sources of income not expressly specified in Art. 217 Tax Code of the Russian Federation.

- Property tax for individuals.

- Transport tax.

- Land tax.

In addition to these payments, there is payment for utilities, which are commonly called taxes. Still, this is not an entirely correct point of view: utilities should be considered separately from taxes.

about the author

Anatoly Darchiev - higher education in economics with a specialty in “Finance and Credit” and higher education in law in the direction of “Criminal Law and Criminology” at the Russian State Social University (RGSU). Worked for more than 7 years at Sberbank of Russia and Credit Europe Bank. He is a financial advisor to large financial and consulting organizations. Engaged in improving the financial literacy of visitors to the Brobank service. Analyst and banking expert. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Legal regulation

The updated law on the protection of pensioners from dismissal (Article No. 145 of the Criminal Code of the Russian Federation) comes into force in 2021.

According to the changes made, employers will bear administrative and criminal liability for layoffs of older citizens.

The rights of pensioners are protected by:

- Article No. 3 of the Labor Code of the Russian Federation;

- Article No. 25.1 of Federal Law No. 79-FZ dated July 27, 2004;

- Article No. 3 No. 385-FZ dated December 29, 2015

- Jellied pie with egg and green onions

- Sberbank introduced a commission for transfers via ATM

- Guryev porridge - history of origin and step-by-step recipes for cooking at home with photos

Comments: 2

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Anatoly Darchiev

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Sergey

07/01/2021 at 15:59 Tax levied by a foreign hoster ————————————————————————— Hello, I am a non-working pensioner, and I have a personal website on a foreign hosting . A hosting company wants to charge me 20% VAT for purchasing hosting services from them. I explained to them that pensioners of the Russian Federation are not taxed, they are private individuals, there is not a single advertising banner or money collection on my website, and that having been with them for many years, I have not earned a penny from my website. Then how much profit do they want to tax? I showed them a photo of my social security pension card, and now they want to see a document according to which I am exempt from these taxes as a pensioner. Which document can I refer to?

Reply ↓ Anna Popovich

07/04/2021 at 21:58Dear Sergey, taxation in your case will be regulated by the country where you purchase the service. Which tax exemption are you interested in?

Reply ↓