No reason to worry

Only in our topic with taxes, pensioners can be immediately reassured, because, despite the changes that were adopted, tax benefits have been preserved to this day. So property taxes are still not due for retirees. The most important innovation must be attributed to the fact that today such a tax is calculated from the cadastral value of the object, which is a couple of times higher than the inventory value.

Property tax benefits for pensioners

For trouble-free use of property tax benefits for pensioners, it is necessary to prepare all documents in advance and submit the appropriate application before November 1 of the year following the reporting period. The contributions themselves are transferred until December 1.

If at least one day has already passed since November 1, you will not be able to obtain exemption for the past period. The property tax benefit for pensioners in such a situation is issued for a future time period.

Receipts with calculated amounts to be paid are sent to citizens by tax authorities themselves before November 1.

If payers have not received notifications, they need to apply for documents from the Federal Tax Service themselves, otherwise penalties will begin to accrue from December 1. It is almost impossible to prove the fact of non-receipt.

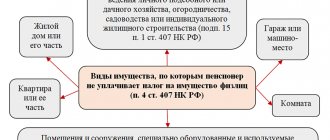

Which objects are exempt from taxes in 2021

Taking into account the new provisions, tax benefits are provided in relation to:

- residential buildings;

- rooms and apartments;

- garages and parking spaces;

- structures and premises that are used in professional creative activities;

- utility structures and buildings, the area of which is no more than 50 sq.m., located on garden, country and other land plots.

Other types of real estate are taxed in accordance with the general procedure. The benefit also does not apply to expensive real estate properties, the cadastral value of which is more than 300 million rubles. There are also two conditions under which real estate is exempt from taxation:

- it should not be used in business activities;

- it must be located in the property of the taxpayer.

It is also worth understanding that according to the new rules, tax benefits are given in relation to only one object of each type of property at the choice of the pensioner. Therefore, if a pensioner owns several dachas or apartments, then the benefit can only be applied to one dacha or apartment.

Objects covered by the benefit

The regulatory legal act on exemption from tax obligations applies to real estate owned by pensioners. These include:

- apartments;

- rooms;

- houses classified as residential;

- premises and structures intended for professional activities;

- outbuildings located on lands intended for gardening, provided that their area does not exceed 50 square meters;

- garages;

- parking spaces.

Pensioners who own expensive real estate, the cadastral value of which exceeds 3 million rubles, must pay taxes in accordance with the general procedure regulated by the Tax Code. Objects not included in the regulated preferential list are subject to taxation according to the general scheme.

Procedure for providing benefits

In order to receive a property tax benefit for pensioners, they must submit an application for the benefit to the tax office. You must also attach documents to the application that confirm this right of the pensioner, the main one of which is a pension certificate. It is also necessary to pay attention to the fact that in order for the benefit not to be applied to specific real estate objects, people must submit a corresponding notification to the tax authority about the selected objects.

But this must be done before November 1 of the year, which is the tax period. In other words, if the tax is paid for 2021, then the papers must be submitted before November 1, 2021. But after this date, it will not be possible to change property in respect of which property tax should not be paid. If a person has not shown any notice at all, the tax authority itself will make the choice of objects for him.

But you don’t have to worry right away, since the property for which the maximum tax amount has been calculated will be exempt from tax. In any case, the pensioner does not lose anything. We can also add that this category of citizens can receive land tax benefits, but on the condition that they are established on the territory of a specific municipality.

Want to know how to earn over 450% per annum in the stock market?

Get a free course on investing in high-yield instruments that brought in more than $1 million in 2021.

I, Andrey Abrechko, an investment expert with 12 years of experience and the founder of the Academy of High Profit Investments, invite you to take part in my free course, where you will learn:

— which instruments are the most profitable in 2021;

— what are IPOs and SPACs and how to start making money on them from 100% per annum;

I will analyze my real case, where I will show with a clear example how I managed to make more than 450% per annum for 2020.

The course consists of 5 small lessons that will be sent to you via Telegram and you can watch them at any convenient time.

Follow the link and start free training