Are there property tax benefits?

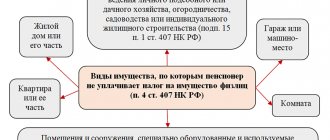

Property tax applies to residential buildings, apartments, rooms, cottages, and garages that are owned. Shares of this property are also subject to tax.

Both working and non-working pensioners are exempt from tax - this is stated in Articles 401 and 407 of the Tax Code - but only for one piece of real estate in each category .

It turns out that if you own two apartments and one dacha, then the pensioner may not pay tax on one apartment and one dacha; You will have to pay in full for the second apartment. The number of grounds for applying benefits (for example, retirement age and disability) will not increase the benefit - it will be calculated based on one of the grounds.

What taxes must a pensioner pay when selling real estate?

Should pensioners pay tax when renting out an apartment?

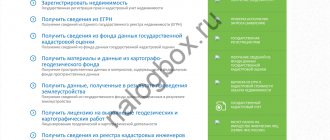

An important point: benefits are not automatically provided, and this applies to any of the points discussed in this article. All benefits for pensioners are of a declarative nature. This means that a person must provide the local tax office with an application, passport and documents confirming his belonging to a preferential category (usually a copy of a pension certificate is sufficient).

The rules for providing “age” benefits may be set by regional or local legislation, so it is worth visiting your local tax office and studying the rules that apply specifically to you and for you.

From time to time, situations arise when preferential payment terms are not reflected in the notifications sent by tax authorities, although they were issued.

In this case, the blank form enclosed in the envelope will be useful: it is needed to dispute the specified amount. The form must be filled out, a copy of the document that gives the right to receive the benefit must be attached to the letter, and these documents must be submitted to the tax office. The amount must be recalculated and a new tax notice must be generated, which will be sent to you again by mail. If you are not ready to enter into correspondence with local tax authorities, use the official website of the Tax Service, section “Applying to the Federal Tax Service (UFTS)”.

blinow61/Depositphotos

Are pensioners required to pay property taxes?

Until 2014, citizens of retirement age were completely exempt from tax payments on property. And it didn’t matter at all how many such objects were owned by one taxpayer. Today, also, all categories of citizens of retirement age have the right to property tax benefits (clause 10. clause 1 of article 407 N of the Russian Federation).

Pensioners receiving pensions in the manner established by pension legislation, as well as persons who have reached the ages of 60 and 55 years (men and women, respectively), who, in accordance with the legislation of the Russian Federation, are paid a monthly lifelong allowance.

Moreover, in 2021, if there are grounds, both non-working and officially employed pensioners will be exempt from property tax. However, with amendments to the Tax Code of the Russian Federation in 2014, benefits are applied differently.

The most pressing changes for pensioners:

- not every object falls under the tax moratorium;

- from 01/01/2015, the rate for the property remaining under taxation is calculated according to the cadastral value of the property, and this is almost a market valuation.

Let's see what the features of the new format of tax breaks are and how to properly take advantage of such opportunities.

What are the benefits for housing and communal services?

For almost any pensioner, paying for housing and communal services is a heavy burden. But there are also certain benefits. When a family of pensioners (or a single pensioner) has utility costs exceeding 22% of income, you can count on partial compensation. This benefit can be provided both as a discount and in the form of material assistance (that is, money). This takes into account all possible expense items - electricity, gas, water supply and sewerage, heating, garbage removal and the use of a television antenna.

Another option is to apply for a subsidy. This is financial compensation that is needed to help low-income pensioners pay for utilities. It does not matter whether they live in their own house or apartment, in a housing cooperative or under a rental agreement. The subsidy amount is calculated monthly and must be reconfirmed every six months. An important nuance: the subsidy will not be given if there are any arrears in paying housing and communal services. You will be asked for a certificate stating that you have no debts.

Do labor veterans have benefits for housing and communal services?

Benefits for paying utility bills. When, to whom, how much?

When choosing which is better, a benefit or a subsidy, you need to consider the following. To receive a subsidy, you will have to indicate the income of all people who are permanently registered in the apartment. A pensioner can receive the benefit regardless of this.

Suppose parents of retirement age and their adult working child permanently live in the apartment. In this case, a subsidy can be issued only if the child has a low income. But benefits will not depend on the child’s income.

Tax base, property tax rates and benefits

The tax base for property tax for individuals is determined based on the cadastral value of the object, with the exception of those constituent entities of the Russian Federation where a law has not yet been adopted establishing a single start date for determining the tax base for property tax for individuals based on the cadastral value of taxable objects.

In such regions, the tax base is determined for each taxable item as its inventory value, calculated taking into account the deflator coefficient based on the latest data on inventory value submitted in the prescribed manner to the tax authorities before March 1, 2013.

As of 2021, laws have not been adopted on determining the tax base for the property of individuals, based on cadastral value, in the following regions: Altai Republic, Dagestan Republic, Krasnoyarsk Territory, Primorsky Territory, Volgograd Region, Irkutsk Region, Kurgan Region, Tomsk Region, Republic of Crimea, Sevastopol.

Starting from January 1, 2021, the tax base for real estate tax for individuals is not determined based on the inventory value of real estate, even if a constituent entity of the Russian Federation has not adopted the corresponding law. Thus, the procedure for determining the tax base based on cadastral value will be in effect from January 1, 2021 throughout the Russian Federation, without exceptions.

Property tax rates

Tax rates are established by regulatory legal acts of representative bodies of municipalities (laws of the federal cities of Moscow, St. Petersburg and Sevastopol).

In constituent entities of the Russian Federation that apply the procedure for determining the tax base based on the cadastral value of real estate, rates are set in amounts not exceeding the following values: - tax rate 0.1%

for residential buildings, parts of residential buildings, apartments, parts of apartments, rooms, garages and parking spaces;

economic buildings or structures, the area of each of which does not exceed 50 square meters and which are located on land plots provided for personal subsidiary farming, dacha farming, vegetable gardening, horticulture or individual housing construction; — tax rate 2%

In relation to taxable objects included in the list determined in accordance with paragraph 7 of Article 378.2 of the Code, in relation to taxable objects provided for in paragraph two of paragraph 10 of Article 378.2 of the Code, as well as in relation to taxable objects, the cadastral value of each of which exceeds 300 million rubles

- tax rate 0.5%

Other objects of taxation

For objects that fall under the base rate of 0.1% of the cadastral value, tax rates can be reduced to zero or increased, but not more than three times, by regulatory legal acts of representative bodies of municipalities (laws of federal cities of Moscow, St. Petersburg and Sevastopol)

For example, in Moscow, tax rates on property of individuals (apartment, room, residential building) are differentiated depending on the cadastral value: - 0.1% - up to 10 million rubles. — 0.15% — from 10 to 20 million rubles. — 0.2% — from 20 to 50 million rubles. — 0.3% — from 50 to 300 million rubles. For any real estate with a cadastral value of more than 300 million rubles. a tax rate of 2% applies. You can find out tax rates in any region of the Russian Federation on the tax service website. It is necessary to select the type of tax, in this case – personal property tax, tax period and region. As a result, detailed information about rates in a specific region will be displayed.

Benefits for property tax for individuals

15 categories of taxpayers have the right to federal benefits, among them the following: pensioners, disabled people of groups I and II, as well as disabled children, participants of the Second World War and other military operations, heroes of the USSR and the Russian Federation, military personnel (the full list of preferential categories is indicated on the tax website services).

Tax benefits are provided for the following types of real estate:

- apartment, part of an apartment or room;

- residential building or part of a residential building;

- premises or structures specified in subparagraph 14 of paragraph 1 of Article 407 of the Tax Code of the Russian Federation;

- economic building or structure specified in subparagraph 15 of paragraph 1 of Article 407 of the Tax Code of the Russian Federation;

- garage or parking space.

Tax benefits are provided in respect of one taxable object of each type

at the choice of the taxpayer, regardless of the number of grounds for applying tax benefits. This point requires a separate explanation. For example, a pensioner owns two apartments, one house and one garage. In this case, only one apartment is subject to taxation, i.e. an apartment, a residential building and a garage are different types of taxable objects.

The tax benefit does not apply to real estate used by the taxpayer in business activities.

The taxpayer must independently notify the Federal Tax Service that he has a benefit.

If the taxpayer-owner of several real estate objects of the same type fails to provide notice of the selected taxable object, a tax benefit is provided in respect of one taxable object of each type with the maximum calculated tax amount.

In addition to benefits at the federal level, there are regional (local) benefits. Information about all types of benefits can be found by contacting the tax authorities or the contact center of the Federal Tax Service of Russia.

Tax deductions for personal property tax

In those regions of the Russian Federation where the tax base is calculated based on the cadastral value of real estate, the following tax deductions are applied when calculating the tax:

- for an apartment

, part of a residential building, the cadastral value is reduced by the cadastral value of

20 square meters

of the total area of this apartment, part of a residential building; - for a room

, part of an apartment, the cadastral value is reduced by the cadastral value of

10 square meters

of the total area of this room, part of an apartment; - for a residential building,

the cadastral value is reduced by the cadastral value of

50 square meters

of the total area of this residential building (at the same time, for tax purposes, houses and residential buildings located on land plots provided for personal subsidiary farming, dacha farming, vegetable gardening, gardening, individual housing construction , refer to residential buildings);

Municipal authorities (legislative bodies of state power of the federal cities of Moscow, St. Petersburg and Sevastopol) have the right to increase the amount of deductions provided for by the Tax Code.

Are there tax breaks on the sale of real estate?

A burning question: should a pensioner pay taxes on the sale of real estate in full? Alas, yes, it should - there are no benefits provided here. On January 1, 2021, the minimum period of tax-free ownership of residential properties was increased from three to five years (for properties that were registered in ownership starting in 2021). If a retiree received property after 2021, the easiest way to avoid paying tax on the sale of such property is to wait until five years have passed. After this period, you will not be required to pay tax or file a tax return.

You will find detailed rules and examples in this article.

tashka2000/Depositphotos

What is Seniors Property Tax?

Property tax is a mandatory contribution to the budget, the tax base for which is the cost of real estate owned by individuals and enterprises.

After acquiring pensioner status, the main income of a non-working citizen is a pension assigned by the state. In the Russian Federation, pensioners, as one of the socially vulnerable segments of the population, are provided with benefits when calculating mandatory duties and fees for individuals or a complete exemption from payment in order to reduce the financial burden.

Are there any tax breaks on income from renting out an apartment?

Pensioners who have the opportunity to rent out an apartment, house or room in order to generate additional income, like other citizens, are required by law to do so officially. Therefore, the question often arises: are there any tax breaks for pensioners on income from renting an apartment? The answer is simple: no benefits are provided for pensioners in this case.

Can a pensioner get a tax deduction by buying a house?

Can a non-working pensioner receive a tax deduction?

Are pensioners entitled to a tax deduction?

Working pensioners can claim a personal income tax refund, but non-working ones cannot, because in order to partially compensate, for example, medical expenses and return a personal income tax of 13%, you must first pay this income tax, and the pensions themselves are not taxed. However, there is a nuance for non-working pensioners. The most important thing in this scheme is to receive any official income from which personal income tax is withheld. So

- if the pensioner has official income from renting a car, apartment, cottage,

- or if he recently sold the property and paid the tax,

- or if he has any other earnings from which personal income tax was deducted,

then the pensioner has the right to apply for a tax deduction.

We wrote in detail about the tax refund rules in this article.

What amount is not taxed?

If the transaction amount does not exceed one million rubles, then the seller is not required to pay income tax on the funds received. If the price is higher than the specified value, then when calculating the taxable base, a deduction of 1 million rubles is made from it.

Please note! The buyer of real estate in the Russian Federation is exempt from paying personal income tax on the funds spent. The maximum tax-free amount is 2,000,000 rubles.

Having purchased an apartment, the buyer submits a tax return and an application for a tax deduction. He will receive back 13% of the funds paid, a maximum of 260,000 rubles. Each citizen can take advantage of this opportunity only once.