Land tax privileges

A citizen can obtain information about mandatory fees by contacting the tax office. Privileges will not apply automatically. They are provided on the basis of an application and a package of documents confirming the resident’s right to receive them.

Tax benefits for military personnel on land have changed slightly since 2021 - the fee is levied on the cadastral value (before this, the inventory indicator was taken into account). For each type of property there is a certain rate - from 0.1 to 2%.

Land tax benefits are divided into several types:

- exemption from fees in full;

- reduction of the tax base by 10 thousand rubles;

- privileges established at the regional level.

After accepting the application and documents, an employee of the Federal Tax Service checks their authenticity. Then the inspectorate decides to provide one of the bonuses. From this moment, the land tax is recalculated taking into account the benefit received for the entire period of its validity.

The Supreme Court of the Russian Federation clarified under what conditions land plots are not subject to tax

The Supreme Court of the Russian Federation clarified that land tax is not imposed on lands that are limited in circulation, provided to meet the needs of defense and security, and are in state or municipal ownership. This was reported by the press service of the Federal Tax Service of the Russian Federation. During an on-site inspection, the inspection found that the taxpayer had unreasonably claimed a land tax benefit. According to the tax authority, the disputed land plot is subject to land tax because it does not meet the requirements of subparagraph 3 of paragraph 2 of Article 389 of the Tax Code of the Russian Federation, namely: it does not apply to land plots limited in circulation, since it is not in state or municipal ownership, is not intended to meet defense needs. Based on the results of the audit, the inspection made a decision according to which the taxpayer was assessed land tax, as well as corresponding penalties and fines. The taxpayer, not agreeing with this decision, went to court. The courts of three instances supported the taxpayer's claims. They proceeded from the fact that the disputed land plot was part of the property transferred to the organization through privatization. The taxpayer's main activity is related to ensuring military security. The disputed land plot is actually classified as limited in circulation, since it is used to meet defense needs. Therefore, it is not subject to land tax. As a result, the inspection filed a cassation appeal with the Supreme Court of the Russian Federation, which overturned the decisions of the courts of three lower instances. The Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation pointed out that the position of the lower courts was erroneous in view of the fact that the current legislation establishes a set of necessary conditions for excluding land plots from the objects of land tax: firstly, the status of land plots with limited circulation; secondly, the provision of these land plots to meet the needs of defense and security, and only land plots that are in state or municipal ownership meet these requirements.

Upcoming free webinars

- 10.08.2021

What to do if you are summoned to the Federal Tax Service's commission on problem counterparties? - 13.08.2021

Working with foreign counterparties: what is important to know - 17.08.2021

Criminal legal and tax risks when participating in state tenders

Additional concessions for the military

For transport tax, the indicators of individual regions are taken into account - in each locality they are established at the discretion of self-government bodies. The only limitation is that the rate cannot exceed 10 times the base rate provided for by the Tax Code of the Russian Federation, Art. 356 FZ-202.

Additionally, military personnel can count on the following bonuses:

- in the event of the death of an Armed Forces employee, the family is paid financial assistance in the amount of 3 million rubles (distributed among all family members);

- 2 million rubles provided in case of dismissal earlier than due date and injuries during performance;

- at the birth of the 2nd child, a military man may retire earlier;

- living space or compensation for its cost.

Persons who conscientiously fulfill their duties to the state and people can use these bonuses at their discretion. The legislation of the Russian Federation guarantees support and provision for military personnel.

How to use your right to benefit

Military personnel are not required to pay property taxes. Citizens who have retired due to age, medical conditions or due to staff reduction can also count on a similar bonus. The total military experience is 20 years or more.

To receive relief, a serviceman must contact the Federal Tax Service at the place of registration and write an application. The following package of documents must be attached to the request:

- official military uniform identification card/ticket with all details, photograph;

- a certificate with information about the employee’s rank, full name and position.

Expert opinion

Egorov Mikhail Mikhailovich

Lawyer with 8 years of experience. Specializes in family law. Legal expert.

Family members of a contract serviceman who have lost their sole breadwinner can also count on tax benefits. To do this, the Federal Tax Service will need to provide:

- HF certificate;

- certificate from the Military Commissariat;

- a pensioner’s ID with the appropriate mark, stamp, certified by the “autograph” of the manager, a seal imprint.

There are no regional specifics for applying for property relief for military personnel and reserve citizens. By law, they are issued in all constituent entities of the Russian Federation. The state policy regarding retired military personnel covers key areas, developing the country's potential.

The only problem is whether tax breaks are provided by tax inspectorates, and whether beneficiaries apply for them, because due to lack of knowledge of certain issues, many citizens do not use their privileges.

Citizens with the official status of military personnel, members of their families, as well as military pensioners, according to the letter of the law, have a number of benefits and privileges, including tax preferences. Thus, property tax for military personnel can be significantly reduced or even abolished, in addition, citizens may be exempt from paying certain duties.

To find out what property tax benefits should be provided to military personnel, you should refer to the current legislation.

Right to tax benefits

Such social benefits apply only to certain categories of citizens, and can also be issued with a special status of the object of taxation.

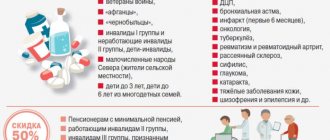

The current tax system establishes benefits for the following categories of individuals:

- Citizens of retirement age receiving pension payments;

- Active military personnel and military retirees;

- Families with large status;

- Heroes of the Russian Federation, or the Soviet Union;

- People with disabilities;

- Labor veterans;

- Those who took part in military operations;

- Liquidators of the consequences of nuclear disasters (Chernobyl Nuclear Power Plant,);

- Widows or widowers of citizens who died while performing military duty, etc.

As for the special statuses of taxable objects, these include:

- Living space purchased with a mortgage. Fees are not imposed on all mortgage loan amounts up to three million rubles. If the cost of housing exceeds the mentioned one, the fee falls exclusively on the amount that is above the norm;

- A preferential offer is issued for any living space and their shares, only if the citizen who acquired them did not receive such compensation after two thousand and thirteen and did not exceed the amount of two million rubles;

- In some regions, motor vehicles with a certain amount of horsepower are exempt from tax, and the profit tax on the sale of a car is also removed if it meets the following criteria:

- Cost no more than two hundred and fifty thousand rubles;

- The car was owned by the citizen for at least three years;

- The sale amount is less than or equal to the amount of money that this car cost when purchased.

At the regional level, the list of beneficiaries may expand, depending on the decisions of local authorities.

Who is eligible to receive benefits

The very concept of military service is established in Art. 2 No. 53-FZ , from this legal norm it follows that this includes not only the performance of duties in the RF Armed Forces, but also in the National Guard troops, in the FSB, the military prosecutor's office, in the military investigative bodies of the RF IC, etc.

According to Art. 56 of the Tax Code of the Russian Federation , for military pensioners and military personnel of the bodies listed above, tax benefits are established that allow you not to pay a tax or fee, or to contribute a smaller amount than that paid by other taxpayers.

All persons who have tax preferences in the Russian Federation are established by the legislator in Art. 407 Tax Code of the Russian Federation . Within the meaning of this article, these include two categories of citizens:

- Contract employees and citizens serving under conscription.

- Persons who have reached the maximum age for carrying out activities in military service (for example, for women it is equal to 45 years according to Part 2 of Article 45 No. 53-FZ of March 28, 1998). As well as those dismissed from service due to deteriorating health, and citizens whose contract was terminated due to organizational measures.

At the same time, according to paragraphs. 7 clause 1 art. 407 of the Tax Code of the Russian Federation, the group of persons listed in the second paragraph has the right to receive tax benefits only if the duration of their service in a paramilitary organization was at least 20 years.

In addition, military family members can apply for tax preferences in the event of the loss of a breadwinner. These include the spouses of the deceased and his parents.

Property tax for military personnel

The above groups of persons are given the privilege of paying property tax. According to clause

2 tbsp. 407 of the Tax Code of the Russian Federation, a military man has the right to receive a benefit of 100% of the tax amount for the taxable object of which he is the owner.

However, this property should not be used for business purposes. Also, benefits can be established by the laws of the constituent entities of the Russian Federation at the location of the taxable real estate.

In paragraph 4 of Art. 407 of the Tax Code of the Russian Federation lists those objects for which this benefit applies:

- apartment or part;

- a residential building or part of it, for example, a room;

- used according to paragraphs. 14 clause 1 art. 407 of the Tax Code of the Russian Federation, premises, for example, private libraries, non-state museums;

- construction, in accordance with paragraph 15, paragraph 1, art. 407 of the Tax Code of the Russian Federation, in particular, structures on land intended for farming, a summer cottage;

- garage.

From this we can conclude that a serviceman has the right to receive a tax privilege on one or another property listed above. It should be taken into account that, according to clause 3 of Art. 407 of the Tax Code of the Russian Federation , this preference can be applied only to one object of each type.

This means that a person who has 2 apartments has the right to receive benefits only for one of them. At the same time, for example, he can also simultaneously receive a benefit for a garage, a residential building and an outbuilding at his dacha, if this structure is less than 50 square meters.

All other objects will be taxed on a general basis, such as a second apartment or another garage.

Therefore, when applying for a benefit, it is best for the taxpayer to choose the most expensive property, since the amount of tax is calculated based on its cadastral value, as established in Art. 408 Tax Code of the Russian Federation .

Expert opinion

Egorov Mikhail Mikhailovich

Lawyer with 8 years of experience. Specializes in family law. Legal expert.

Many active military personnel and military retirees are interested in whether they can receive benefits for land plots. The list of persons who do not need to pay this type of tax is given in Art. 395 Tax Code of the Russian Federation .

Unfortunately, at the federal level, this category of persons is not exempt from land tax, since military personnel are not included in the list of persons of the specified legal norm.

In particular, mainly legal entities, for example, institutions of the Federal Penitentiary Service, as well as some categories of individuals, in particular, these include the indigenous peoples of Siberia and the Far East, can count on benefits for collecting land tax.

According to Art. 378 of the Tax Code of the Russian Federation , land tax is established by the constituent entities of the Russian Federation, therefore, to clarify the information, interested parties should contact the competent authority at the location of a specific plot of land.

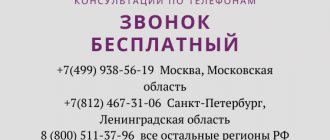

We remind you that even if you thoroughly study all the data that is in the public domain, this will not replace the experience of professional lawyers! To get a detailed free consultation and resolve your issue as reliably as possible, you can contact specialists through the online form .

Are military personnel exempt from paying personal property taxes?

Lawyer Bakumenko Igor Aleksandrovich

Call now and get a preliminary consultation:

8-919-865-42-20 8

According to Article 15 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), property tax for individuals refers to local taxes.

This tax is one of the main sources of formation of the revenue base of local budgets, funds from the payment of which are directed to solving socio-economic problems facing local governments.

The provisions of Article 407 of the Tax Code of the Russian Federation define categories of taxpayers who are exempt from paying property tax for individuals.

According to Article 401 of the Tax Code of the Russian Federation, the object of taxation for the property tax of individuals is a residential building located within the municipality; living space (apartment, room); garage, parking place; single real estate complex; unfinished construction project; other building, structure, structure, premises.

At the same time, for the purposes of applying the property tax for individuals, residential buildings located on land plots provided for personal subsidiary plots, dacha farming, vegetable gardening, horticulture, and individual housing construction are classified as residential buildings.

In accordance with subparagraph 7 of paragraph 1 of Article 407 of the Tax Code of the Russian Federation, military personnel, as well as citizens discharged from military service upon reaching the age limit for military service, health conditions or in connection with organizational and staffing issues, have the right to a benefit in paying personal property tax. activities with a total duration of military service of 20 years or more.

A tax benefit is provided in the amount of the amount of personal property tax payable by the taxpayer in relation to an object of taxation that is owned by the taxpayer and is not used by the taxpayer in business activities.

According to paragraphs 2, 3, 6 of Article 407 of the Tax Code of the Russian Federation, when determining the amount of tax payable by a taxpayer, a tax benefit is provided in respect of one taxable item of each type at the taxpayer’s choice, regardless of the number of grounds for applying tax benefits.

A person entitled to a tax benefit submits an application for the benefit and documents confirming the taxpayer's right to a tax benefit to the tax authority of his choice.

This legal position is confirmed by Letter of the Ministry of Finance of Russia dated December 24, 2015 No. 03-05-06-02/75897.

Thus, a military serviceman is exempt from paying personal property tax.

Additionally, we inform you that a notification about the selected objects of taxation in respect of which a tax benefit is granted is submitted by the taxpayer to the tax authority of his choice before November 1 of the year, which is the tax period from which the tax benefit is applied to these objects.

Attention! The information provided in the article is current at the time of publication.

How to get benefits

The right to receive a benefit in the amount of 100% of the tax amount must be independently confirmed by the military personnel with the relevant documents. In particular, in order to be exempt from paying property tax, a person who is entitled to receive the corresponding benefit must contact the Federal Tax Service at their place of residence and submit an appropriate written application.

How to write an application ? Simple enough. As a rule, in the Federal Tax Service department you can get the appropriate application form, in which you will need to indicate the passport details, full name, date of birth of the applicant, details of the document under which this benefit should be provided, the type of property, and the period for granting the benefit.

Along with the application, a document is submitted that confirms its official status, for example, a military unit certificate or a certificate issued by a military commissariat, military unit or specialized educational institution.

Members of the family of a deceased soldier will need a pension certificate with the appropriate label “widow of a deceased soldier” to receive the appropriate benefit. It should be ensured that this crust is properly certified with the signature of the head of the organization and a seal.

If the family members of the deceased are not pensioners, then they will have to bring a certificate of death to the tax authority instead of a certificate. In addition, citizens must bring their passport with them to apply.

Citizens with 20 years of service or more who resigned for health reasons must also provide a certificate of disability.

At the same time, the Federal Tax Service of the Russian Federation recommends sending applications for benefits before May 1, so that tax notices are generated taking into account the benefits provided. It should be noted that applicants for benefits can submit such an application without leaving home through their personal account on the official website of the Federal Tax Service of the Russian Federation.

Registration procedure

Expert opinion

Grigoriev Pavel Kirillovich

Head of the department for conscription of citizens for military service of the Russian Federation

Receiving benefits from the state does not occur automatically, through filing an application of the appropriate type. At the same time, the recipient of the petition is different.

This is important to know: How to submit a report

So, in order to receive benefits for paying income tax, a military serviceman turns to his immediate superiors. A military man can receive other types of benefits by taking the form to the tax authorities at his place of residence.

Documents are submitted to military personnel only in personal presence with a voluntary expression of will.

When applying for state privileges, the necessary documents must be attached to the application. The list of these papers is regulated by the Tax Code, namely Art. 361/1, Article 396, Article 407 of the specified standard, these include:

- Copy of civil passport.

- Military man.

- Tax ID.

- Copies of documents that confirm ownership rights to the subject of benefits.

- Confirmation of place of residence in the form of a certificate.

- Pensioners present their ID issued by the Pension Fund.

The specified list of papers is the same for both contract soldiers and conscripted army personnel.

There are several ways to provide evidence:

- Submit the completed application form with attachments through the officially functioning tax website. But before you carry out these actions on the site, you need to register. The website has the following address https://www.nalog.ru.

- Use the Gosuslugi portal. It is recommended to verify in advance. Further actions are the same as with the Federal Tax Service website. The website address is esia.gosuslugi.ru.

- Submit the required certificates and certificates through the multifunctional center (MFC). If it is available in the applicant’s area of residence.

Tax officers are authorized to send an official request paper to the place of duty. The purpose of such letters is to obtain complete information about the applicant.

This can happen if the respondent himself did not provide them to the extent necessary to assign the benefit. Requests may also be sent to other organizations.

The goal is similar - that is, obtaining the necessary information about the applicant. The recipient of the request is required to send the requested information.

According to the law, the structure that received the request must send a notification (in paper form) about the presence or absence of information about the requested person. The deadline for completion is 7 days from the date of registration of the request.

Then, within 3 days, the applicant-beneficiary is informed by the responsible tax official about the status of the case regarding his application.

The final verdict must be ready within the next 30 calendar days. Notification of the assigned amount of taxes to be paid by the fighter is made in any way convenient for both parties. This could be a telephone call, a notification letter, an electronic file. The method is specified when submitting documents.

DB veterans go through these events differently. The algorithm for them is as follows:

- An application for housing privileges should be submitted to the local administration, and not to the tax authorities.

- The appeal is addressed to the head of the local administration.

- Veteran identification must be presented.

An important point in the issue of benefits is that the veteran must officially be on the housing queue.

The timing of granting privileges to veterans largely overlaps with the initiatives of local governments. After the death of a BD veteran, their family members can take advantage of the right to subsidized housing.

For all types of benefits, it is important to keep in mind that you must apply before November 1 of the current year. This date is indicative for the start of the next tax period and it is from this date that the preference will begin to be counted.

Summary

Thus, benefits for military personnel are established both at the federal level and at the level of Russian constituent entities. As for property tax benefits, they are provided to active military personnel and military pensioners with at least 20 years of service.

To receive this privilege, citizens with military status must contact the Federal Tax Service, write an application for the benefit and provide documentation confirming the right to receive it.

There are the following types of tax benefits for military personnel:

- Exemption from property tax.

- Exemption from land tax (not all regions).

- Reduced transport tax (not all regions).

- Special tax on home purchases.

Benefits are provided for military personnel who have been transferred to the reserve or have served for at least twenty years (according to Article 407 of the Tax Code of the Russian Federation).

In 2021, the military, with certain exceptions, is required to pay the following taxes:

- Land tax – up to 1.5%.

- Property tax – up to 2.0%.

- Transport tax - at least 2.5 rubles per horsepower.

- Taxes on personal income – 13.0%.

Contract military personnel pay the following taxes:

- all of the above taxes;

- tax on children - on a general basis;

- tax on purchased real estate.

- residential apartment or room;

- a private house;

- special premises for various types of use;

- outbuildings with an area of up to 50 square meters. m;

- technical structures (garage, parking space).

Article 407 exempts conscripts from real estate tax (53-FZ)

Conscripts (Article 276-FZ):

- Personal income tax is not paid.

- Land tax - on a general basis.

- Property taxes are not paid.

- Transport tax – on a general basis.

For retired military personnel, retirement by age:

- women – 55 years old;

- men – 60 years old.

- According to Art. 217 of the Tax Code do not pay personal income tax.

- Exempt from paying land tax.

Benefits for widows and dependents of military pensioners, which include (76-FZ dated July 27, 1998):

- spouses;

- minors.

- dependent persons.

Social guarantees for the above persons after the death of the breadwinner remain in full:

- Assistance in connection with the loss of a breadwinner.

- Once a year, one relative is compensated for the costs incurred to travel to the burial site.

- For medical services.

Basic conditions for receiving benefits:

- Personal presence.

- Presentation of passport.

- Submitting an application in the prescribed form.

- Providing a military ID.

- Providing an identification number.

- Providing documents confirming ownership.

- Provide an extract on family composition.

What benefits do you think are still needed to further motivate military personnel?

Military personnel have a special status on the territory of the Russian Federation. In connection with the performance of their official duties, the state provides them with certain rights and benefits. The article will discuss tax benefits for military personnel, as well as preferential terms for mortgage lending.

Benefits for military personnel under contract

There are many benefits for the military, but you need to understand that the list of them is different for each individual person. It depends on the set of requirements provided for in the current legislation.

The Tax Code of the Russian Federation defines different types of concessions, the registration of which becomes one of the motivating factors when entering the service and makes it possible to save considerable financial resources.

Property tax

The benefit is given to those who are active military personnel at the time of application.

Objects for which you can apply for exemption from payment of the fee are:

- apartment or room;

- House;

- a room or structure that is specially equipped and used as creative workshops, ateliers, studios, residential buildings, apartments, rooms used to organize non-state museums, galleries, libraries open to the public - for the period of such use;

- an economic building or structure, the area of each of which does not exceed 50 square meters and which are located on land plots provided for personal subsidiary farming, dacha farming, vegetable gardening, horticulture or individual housing construction;

- garage or parking space.

The benefit is valid only for one object of each type. As a general rule, the one with the higher amount to be paid is selected.

Land tax

In accordance with current legislation, property is divided into real estate and land. The algorithm for paying such a tax is established by Chapter 32 of the Tax Code of the Russian Federation, and the list of exempt persons is Art.

395. The military is not included in such a list.

Moreover, the current version of 76-FZ has canceled the previous one, in article 17 of which land benefits were provided. By introducing amendments, the legislator changed the benefit to compensation payment of funds.

This is important to know: Military nacessor: equipment for contract soldiers

Thus, land tax payments for the military follow the general algorithm of tax legislation.

Income tax

Personal income tax is calculated for military personnel in the same way as for other residents of our country, taking into account deductions for children.

Deduction when purchasing real estate

For contract workers, the standard option applies, in which the tax base is reduced by the amount of actual expenses, but not more than 2 million rubles. When purchasing real estate using funds that include both your own and the budget, a deduction is provided only for part of the expenses from the personal component.

Transport tax

This type of deduction is under the jurisdiction of the regions and is established in accordance with the legislation of the subject. For the military, this tax can be reduced even to the point of complete exemption.

When determining the amount of tax, the power of the machine must be taken into account. For example, in some areas, reduced rates have been established for vehicles with a capacity of less than 150 horsepower.

Deduction for treatment

Tax deduction for education

Tax benefits for military personnel

The provision of military benefits by the state is influenced by several factors:

- Work experience.

- Length of service.

- Military rank.

The greater the length of service in the country's Armed Forces, the more benefits the state provides.

The procedure for providing tax benefits is regulated by the Tax Code of the Russian Federation (TC RF), Federal Law No. 76-FZ “On the Status of Military Personnel”, Federal Law No. 5-FZ “On Veterans”.

Local regulations of local government bodies may determine a separate list of benefits provided.

Depending on the type of service, the procedure for providing benefits will be different. Thus, the Tax Code of the Russian Federation distinguishes between tax benefits provided:

- Conscript soldiers undergoing military service upon conscription.

- Military personnel working in the Armed Forces of the Russian Federation under a contract.

- Combat veterans.

- Pensioners who retired due to length of service, as well as in connection with the onset of retirement age.

The minimum service requirement for military retirement is 20 years. In this case, the total work experience must be 25 years, and service in the Armed Forces must be at least half of the total length of service - i.e. 12.5 years old.

Please note that according to the amendments introduced to the Tax Code of the Russian Federation, from January 1, 2019, the following will also have the right to tax benefits:

- Citizens discharged from military service or called up for military training who performed international duty in Afghanistan and other countries where hostilities were taking place.

- Parents, as well as spouses of military personnel who died in the line of duty.

We will talk further about the list of benefits provided for each category.

List of tax benefits

For conscripted military personnel, as well as for contract employees of the Russian Armed Forces, the following types of tax benefits exist:

- Property tax. Tax on real estate owned by a military personnel is not subject to payment during the period of service. Legislation establishes restrictions on obtaining tax benefits for only one piece of real estate: an apartment, a house, a garage. Generally, property taxes are not due on the property with the highest value. The list of tax benefits for employees of the RF Armed Forces is supplemented by the provision of the right of tax deduction for the purchase of housing. In this case, only the amount of own expenses for its purchase is compensated, up to the cost of living space of 2 million rubles. 13% of this amount will be 260 thousand rubles - this is the maximum possible payment from the state.

- Transport and land tax. Tax on transport and land is paid in accordance with the general procedure, in accordance with current legislation. It should be remembered that local legislative acts of constituent entities of the Russian Federation may establish their own lists of beneficiaries, including military personnel. You can clarify the list of benefits due yourself at the local branch of the Federal Tax Service.

- Income tax. Payment of personal income tax (NDFL) in the amount of 13% of income, provided for other categories of citizens of the Russian Federation, is levied on the salary of a military personnel in the general manner.

Military personnel with children in their families are entitled to tax benefits:

- In the amount of 1,400 rubles – if you have one or two children (the benefit amount will be 182 rubles).

- 3000 rubles - for the 3rd and subsequent children (the amount of the benefit will be 390 rubles).

If the military personnel specified in Art. have no children. 218 of the Tax Code of the Russian Federation, a standard tax deduction of 3,000 rubles is provided.

Benefits for combat veterans:

- Part of the income received in the amount of 500 rubles is not taxed. The benefit for a veteran will be 65 rubles monthly.

- Veterans of military operations are exempt from paying state duty on claims for violation of rights determined by the Federal Law “On Veterans” (clause 2 of Article 333.36 of the Tax Code of the Russian Federation).

- Tax is not paid on a vehicle if it meets the requirements provided for by law.

Benefits for military pensioners are as follows:

- All types of pensions are not subject to personal income tax.

- Pensioners do not pay state fees when filing claims related to violation of their pension rights.

- From 2021, pensioners have the right to exemption from paying land tax on a plot of 600 square meters. meters (clause 5 of article 391 of the Tax Code of the Russian Federation).

- Pensioners who retired due to disability received while performing official duties are exempt from paying transport tax.

Personal income tax on 1 real estate property for military veterans and pensioners is also not charged. Benefits for transport and land taxes are established by each subject of the Russian Federation individually.

Registration procedure

Receipt of income tax benefits is carried out by submitting an application to the employer.

Other types of benefits - property, land, transport, social - are formalized by applying to the tax authority at the place of residence of the military personnel. Documents are submitted by the citizen independently on a voluntary basis.

In order to receive the benefits required by law, combat veterans apply to the administration at their place of residence.

To speed up the procedure for obtaining the due privileges (according to paragraph 3 of Article 361.1, paragraph 10 of Article 396, paragraph 6 of Article 407 of the Tax Code of the Russian Federation), you can submit documents as follows:

- Fill out an application and send documents through the official website of the Federal Tax Service after registering on it - https://www.nalog.ru.

- Submit documents through the State Services portal, going through the identification procedure - https://esia.gosuslugi.ru.

- Provide the necessary data through the nearest multifunctional center (MFC) for the provision of services in your region.

In case of failure to provide the data necessary to receive a certain type of benefit, the tax office has the right to make an official request at the place of service, as well as to other organizations in order to obtain the necessary information. The body that received the request is obliged to send a written notification within 7 days from the date of receipt of the request about the presence or absence of data about the military personnel.

Next, the applicant for the benefit is informed within 3 days by the responsible official of the tax authority if the required information is not available.

Expert opinion

Egorov Mikhail Mikhailovich

Lawyer with 8 years of experience. Specializes in family law. Legal expert.

Within 30 calendar days, a final decision is made on granting the benefit and the serviceman is notified in any available way: by telephone, written notice, email.

Required Documentation

In addition to the application for a tax benefit, in order to speed up the process of its consideration, the military personnel must provide the following documents to the tax authority:

- A copy of the passport of a citizen of the Russian Federation.

- Military ID or military ID.

- A copy of the Taxpayer Identification Number.

- Copies of documents confirming ownership of movable and immovable property.

- Certificate of place of residence.

The above list is general and applies to contract employees and conscripts.

Combat veterans go through the benefits process a little differently:

- Documents for receiving housing benefits should be submitted to the local administration, and not to the Federal Tax Service.

- The application is written to the head of the administration.

- Veteran's certification must be provided.

- The veteran must get on the waiting list for housing.

The period for providing benefits to veterans directly depends on the initiative of local governments. A response to your request will be given within 30 days. It is important to know that after the death of a veteran, their family members can take advantage of the right to receive housing benefits.

Military pensioners provide a pension certificate.

Tax benefits

Tax benefits for military personnel are a rather specific and complex issue . This fact leads to the fact that many people, having repaid their debt to their Motherland, remain completely unaware of the possibility of significantly saving material resources. In fact, many military personnel, both active and retired, have multiple tax privileges.

In order to more accurately understand who exactly is entitled to tax benefits, it is necessary to determine who is meant by the concept of “military personnel”. Not everyone who wears a camouflage uniform is automatically a soldier. A person acquires the status of a military personnel with the beginning of service, both compulsory and contractual, and loses it only upon its completion. Based on this, it can be determined that any person with a military specialty is guaranteed to have a fairly wide range of privileges. Tax benefits are not an exception to the general rules and are provided on an equal basis with others.

Benefits when applying for a military mortgage

Applicants wishing to purchase housing under the military mortgage program are subject to the following requirements:

- At least 22 years of age.

- Minimum work experience of at least 3 years and registration in the military savings mortgage system (NIS) program for the same period.

- Availability of a valid contract for military service, as well as further service in the RF Armed Forces before the expiration of the mortgage loan payments.

Advantages of a military mortgage:

- Minimum requirements for age, work experience, and documents provided for obtaining a mortgage.

- Good support from the state, which consists in the accumulation of funds from the federal budget in the account of a serviceman in the amount of up to 3 million rubles.

- Possibility of using your own funds to purchase housing.

- The program even applies to homeowners, as well as to those military personnel who live under a social tenancy agreement.

- Possibility of using maternity capital funds.

- Possibility of re-receiving benefits on a military mortgage when repaying an existing one.

- For military pensioners, unified cash payments (USB) are provided for the purchase of housing, the calculation of which is made taking into account length of service and the number of family members.

- If the funds accumulated on the NIS personal account are not used for the purchase of housing, the serviceman has the right to receive funds before his dismissal.

By granting the right to receive tax benefits, the state thus encourages citizens to perform military service. Military personnel can significantly save their budget by being exempt from paying property, land, and income taxes, as well as reduce the costs of education and treatment for themselves and their children.

Substantial material support in the amount of 3 million rubles will also serve as motivation for serving in the RF Armed Forces.

when purchasing housing.

7 minutes Author: Elena Pavlova 411

- Legislation on tax benefits for military personnel

- To whom can it be provided?

- What preferences exist for army personnel?

- Registration procedure

- Video on the topic

Citizens who have dedicated their lives to serving the Fatherland have the right to special status. After all, their life practically does not belong to them. At any moment, their duty of service can send them into conditions that are not only comfortable, but can also be hazardous to health and life-threatening.

The state, in turn, tries to be as attentive as possible to people with this profession. The availability of benefits and preferences for military personnel is reviewed annually. There are also tax breaks for military personnel

Legislation on tax benefits for military personnel

The procedure for granting tax benefits is regulated by the following regulatory documents:

- Tax Code of the Russian Federation.

- Federal Law No. 76-FZ “On the status of military personnel.”

- Federal Law No. 5-FZ “On Veterans”.

- Local regulations of local governments. This means that local administrations can determine a separate list of benefits for military personnel.

Existing laws are measures of state support for social activities. And also a certain means of motivation for all applicants to become an army member. Such benefits do provide some relief in the social side of life for military personnel and their families.

In order to receive benefits, the state imposes certain requirements on the army soldier, enshrined in law. So, the amount of benefits is influenced by several factors:

- Work experience.

- Military length of service.

- Military rank.

Tax breaks for military retirees

Let's consider the required tax breaks for military pensioners for property and land taxes in 2021. Just like ordinary military pensioners, they do not pay taxes on real estate (clause 7, article 407 of the Tax Code of the Russian Federation), and on amounts of financial assistance issued at work.

Military personnel who, due to retirement, were expelled from service but continue to work, also have the right to receive a tax deduction when selling or purchasing housing with a maximum amount of 2 million rubles for purchase, and up to 1 million rubles for sale.

There are no reliefs on transport and land taxes for the VP at the moment. Such a benefit was available at the state level until 2004, but unfortunately, due to the adoption of the Federal Law “On Social Assistance for Pensioners and Disabled Persons” dated 08/02/1995 No. 122, this provision was abolished for all elderly people, regardless of the status of VP. Therefore, to clarify tax breaks, you need to contact the administration; perhaps in your region there are special conditions for this category of persons.

To whom can it be provided?

Thus, according to the Tax Code, there are tax benefits that are provided to the following categories of military personnel:

- Conscript soldiers serving on conscription.

- Army contract soldiers.

- Combat veterans.

- Pensioners who retired due to length of service.

- Military personnel who have retired. The condition for retirement is reaching the age prescribed by law.

Some amendments have been made to the Tax Code since January 1, 2021. According to the fixed changes, the following categories of persons also began to claim the right to tax privileges:

- citizens discharged from the army or previously called up for military training in Afghanistan and other countries in which databases were conducted;

- parents and spouses of soldiers killed in the line of duty.

Military status

Who is a soldier?

According to the law, the status of “military personnel” includes both those in service and those who have left it, namely:

- so-called “conscripts” serving under combined arms conscription;

- contract workers;

- reservists who have already served their allotted term and left the army due to age or length of service.

Additional information: This division is valid for all military personnel, regardless of their rank or rank.

The basis for confirming the position of a military personnel, as well as the benefits that he can count on, are such legislative acts as the Constitution and the Federal Law (No. 141-F3, dated November 11, 2003).

What laws regulate the status of military personnel?

Military service itself refers to a type of national activity related to the protection of the interests of the country in which it is organized.

In 1999, by order of the President, an amendment was made to the regulation “On the procedure for performing service”, according to which foreign citizens who speak Russian and have no criminal record can serve in the Russian army. These persons can be called up only under a contract and only for private and sergeant positions.

To confirm the assigned military status, he is issued a corresponding document (military ID), certifying his rank and position and remaining with him until the end of his service.

This document is the basis for receiving benefits provided to military personnel in accordance with the Constitution.

What preferences exist for army personnel?

Various types of tax concessions are predetermined for the specified list of military personnel. Each benefit deserves separate consideration.

Property tax

This type of fee is a property tax levied on property owned by individuals and companies. Tax is paid at rates determined by the subject of the Russian Federation, but does not exceed the limits specified in the Tax Code. The size is determined based on the cadastral value, and not the residual value, as it was before.

Contract servicemen currently serving in the army are exempt from paying this fee. If a military man has property, then, according to Article 407 of the Tax Code, he may not pay the property tax.

Implied property includes:

- Apartment in a multi-storey building.

- Vacation home

- Country house building.

- Garage space, provided that it is officially registered.

But such a privilege on the property of military personnel applies to only one piece of real estate. For example, if you own 2 houses and several permanent garages, you can not pay tax on only one unit of real estate.

In this case, preference is given to the property that has a greater value and is accordingly subject to an appropriate tax. The fee is not payable during the period of military service.

The list of tax preferences for army personnel is supplemented by the provision of the right to a tax deduction for the purchase of housing. The mechanism of such a privilege is as follows: the amount of personal funds of a military man spent on the purchase of a home must be compensated.

There is a limit set within the possible cost of 2 million rubles.

That is, the maximum you can expect from the state to return 260 thousand rubles (that is, 13% of the regulatory amount).

Tax benefits for education and treatment

Expert opinion

Egorov Mikhail Mikhailovich

Lawyer with 8 years of experience. Specializes in family law. Legal expert.

This section is dedicated to obtaining tuition privileges. Such preferences are provided for by the rules of Art. 119 of the Tax Code of the Russian Federation. The same article establishes a tax concession for treatment. Benefits are awarded in the general manner.

The maximum deduction amount is 13% of the allowed amount of expenses in the current year. In a situation where, during the reporting period, an army member spent personal funds on the purchase of medicines or prescribed medical procedures, he has the right to count on reimbursement of part of the expenses incurred.

This is provided for in Art. 210 Tax Code of the Russian Federation.

The amount of deduction is limited and does not exceed 50 thousand rubles.

Preferences apply not only to military personnel, but also to their family members.

When spending funds on the education of his child, a serviceman may have partial compensation for the funds spent on this event. The limit on the amount is also no more than 50 thousand rubles.

Income tax

Personal income tax in the amount of 13% of income is levied on the salary of a military personnel in the general manner, as well as on all citizens of the Russian Federation.

Tax benefits for contract military personnel who raise children are collected in the table:

For a student child under 24 years of age, if he is a disabled person of the first or second group.

When a military personnel receives a monthly income exceeding 350 thousand rubles, the tax deduction assigned to the military as a preference is terminated. The benefit stops starting from the month in which the serviceman received the maximum possible amount.

Benefits for combat veterans

Combat veterans have a small range of privileges. They concern the following:

- They are exempt from paying state fees for claims of violation of rights - this is prescribed by Article 333.36 of the Tax Code.

- This category of former military personnel does not pay transport tax. Provided that the vehicle does not violate legal requirements regarding its condition.

Tax breaks for military retirees

In our country, all types of earnings and various government incentives are subject to personal income tax. Military pensions are not subject to any fees.

Military pensioners, when filing claims related to violation of their pension rights, do not pay a court fee.

According to Article 391 of the Tax Code, pensioners are exempt from paying land tax. The condition is the size of the plot. Allotments with an area of 600 square meters are not subject to tax. meters. The concession was introduced in 2021.

Former military personnel who have received a disability pension are exempt from paying transport tax. The condition is that the disability was acquired while performing official duties.

There is no fee charged on the property. This rule works for 1 piece of property and can be used by military veterans and retirees.

Benefits for transport and land taxes are established by each subject of the Russian Federation individually.

Tax breaks for military retirees

All-Russian preferences for former military personnel are established in paragraphs of the Tax Code. There are many of them. In particular, a reduction in the tax base or the complete exclusion of one object applies to the following types of property:

Also, this category of citizens has the right to transfer the balance of the property deduction to previous tax periods (clause 10 of Article 220 of the Tax Code of the Russian Federation).

A property deduction is provided not only for the purchase of real estate and land, but also for the payment of interest on a loan/credit provided for the purchase/construction of housing and land for housing.

Hint: the applicant must declare each type of concession separately. No benefits are provided in aggregate.

Thus, the beneficiary’s action algorithm is as follows:

- Independently determine one piece of property for each category for which preferences are granted;

- Collect the necessary documents and make copies;

- Submit an application to the Federal Tax Service office for each position separately.

Property tax benefits

Each owner annually pays a mandatory tax to the budget for the objects they own. A preference for a former soldier is the exemption of one of the objects from taxation (Art.

401, para. 10 p.

1, paragraph 4 art.

407 Tax Code of the Russian Federation; Letter of the Federal Tax Service of Russia dated 01/09/2017 N BS-4-21/ [email protected] ). It is provided on a proactive basis.

Therefore, the applicant must:

In addition, regional laws establish other privileges for certain groups of the population. As a rule, they are provided in the form of deductions (refunds of taxes paid). Details should be found in the regulatory framework of the region of residence.

This is important to know: Is it possible to join the army under a contract without military service?

The general rules for obtaining benefits are to exempt one taxable item of each type at the taxpayer's choice. That is, if a military pensioner has an apartment, a garage and a country house, then he is exempt from paying tax on all three objects.

But if he owns two apartments and a garage, then he is exempt from paying tax on one apartment and garage, and for the second he will have to pay tax (clause 3 of Art.

407 of the Tax Code of the Russian Federation).

And in addition to these benefits, tax deductions are also provided taking into account the type of residential premises. The parameters laid down in the legislation are as follows:

- apartment - reduced by 20 sq. m.;

- house - 50 sq. m.;

- room - 10 sq. m.

Attention! To avoid any misunderstandings, it is better to apply for the benefit, otherwise the tax authority will provide this benefit based on its data.

Also, if notification is not provided in respect of which object the benefit is used before December 31 of the year that is the tax period, then the tax benefit will be provided in relation to one object with the maximum accrued tax amount (clause 7 of Article 407 of the Tax Code of the Russian Federation)

Relief on land tax

All-Russian legislation does not explicitly indicate preferences for former soldiers in land tax. The tax base can be reduced by 6 acres for certain categories, which may include former soldiers. These include:

- veterans and disabled people of the Great Patriotic War;

- veterans, disabled combat veterans;

- military pensioners with a disability group (group 1 or group 2);

- citizens of special risk who participated in nuclear weapons testing, liquidation of accidents at weapons and military facilities.

In general, the privilege does not extend to the number of objects. It is calculated in monetary terms.

The applicant must attach documents on ownership to the application indicating the addresses of the plots. Notification of the selected site is also provided to the tax authority no later than December 31 of the year from which you intend to use the deduction.

In some regions of the federation, former soldiers are provided with benefits. They are expressed in:

The amount of the tax deduction may be set in a different amount, as well as other tax advantages at the regional level.

Relief on transport tax

In accordance with Article 356 of the Tax Code, the establishment of transport tax rates is the responsibility of the regions. This means that privileges for former soldiers are also assigned by the Legislative Assemblies of the constituent entities of the federation. Everyone identifies their own benefit groups, and also develops a methodology for calculating privileges.

In general, you should follow this algorithm:

In other regions, work is organized with its own subtleties and nuances. Thus, in St. Petersburg, one domestically produced car with a capacity of up to 150 hp is exempt from the transport tax.

Expert opinion

Grigoriev Pavel Kirillovich

Head of the department for conscription of citizens for military service of the Russian Federation

s., the owner of which is a pensioner (any). Moscow residents may qualify for exemption from the transport tax if they belong to the category of combatants.

This preferential category is also taken into account in the following areas:

- Novosibirsk;

- Yaroslavl;

- Sakhalinskaya.

Important: when establishing preferences, regional authorities focus on the vehicle’s power. In addition, the exemption is provided for one vehicle owned by the applicant with an engine power of up to 150 hp. With. (down to zero).