January 28, 2021

Employees of the Armed Forces of the Russian Federation, the Ministry of Internal Affairs, the Federal Penitentiary Service and other government departments have the right to retire earlier than civilians. But their pension is paid with a reduction factor , that is, it is incomplete. Why is this happening and are they planning to cancel this coefficient in 2021?

Reduction factor for military pensioners in 2021

In 2021, the reduction factor for military pensioners is 0.7368 . That is, former employees of the armed forces of the Russian Federation, the Ministry of Internal Affairs, the National Guard and other law enforcement agencies receive only part of the pension. When calculating and calculating the monthly benefit, only 73.68% of the total amount due is taken into account.

This coefficient applies from 10/01/2019. For the entire 2020, it was “frozen” at 0.7368, then the moratorium was extended for 2021. That is, consideration of the initiative to cancel the reduction coefficient will take place no earlier than 01/01/2022.

Law on reduction coefficient in 2021

On September 30, 2020, the Government prepared a bill to extend the “freeze” of the reduction coefficient for the next year 2021. The legislative initiative was submitted for discussion to the State Duma. In November, it was already approved in the third reading, and on December 8, 2020, the bill was signed by the President. This means that in 2021, military retirees can expect to receive only part of their pension again, namely 73.68% percent of it. No. 397-FZ dated 12/08/2020.

The explanatory note to the bill states that against the backdrop of a “freezing” of the reduction coefficient, a gradual increase in military pensions is planned in 2021. This will happen due to the indexation of salaries by position and rank . The increase will be 3.7%, which corresponds to the inflation rate that was officially recorded last year 2021.

Who is promised more? Increase in pension

If we talk about such categories of citizens as working military pensioners, then things are more optimistic. The fact is that such citizens, in addition to military benefits, also receive civilian benefits.

Upon completion of a certain (established) number of years, provided that the employer has faithfully transferred money to the Pension Fund, the retired military man will be awarded a second pension.

In 2021, the insurance pension is expected to increase by 6.3%. Therefore, working retirees can also count on this increase.

Graph of coefficient changes in previous years

The procedure for applying the payment of partial pensions to military pensioners has been applied since 01.01. 2012. During this period, only half of the pension was paid - the reduction factor was set at 0.54. This was stated in paragraph 2 of Art. 43 of Law No. 4468-1. It was planned that each year the figure would increase by 2% until it reached 100%.

The actual change in the reduction factor is presented in the table below:

| Period | Reduction factor value |

| From 01/01/2015 | 0,6212 |

| From 10/01/2015 | 0,6678 |

| From 02/01/2016 | 0,6975 |

| From 02/01/2017 | 0,7223 |

| From 10/01/2019 to present | 0,7368 |

The last increase in the indicator was carried out in October 2019, after which it was “frozen” until 2021.

We have already written about what awaits military pensioners in 2021: indexation and reduction coefficient

Calculation of military pensions

Each military personnel receives a salary, the amount of which depends on rank and position . This amount includes salary and various monthly bonuses and payments. Based on these values, the future pension of the serviceman is calculated.

When calculating a military pension, the following indicators are taken into account:

- salary for the position held by the serviceman before retiring;

- salary according to the rank that the serviceman had before entering his well-deserved retirement;

- bonuses that are paid every month while the service is in progress;

- the number of years of “overtime” in excess of the minimum length of service that a serviceman needs to retire;

- reduction factor established at the federal level;

- reduction coefficient, which is established at the federal level by region;

- percentage of salary - this indicator depends on the basis on which the military pensioner retired.

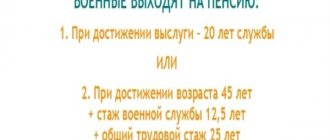

Conditions for granting pensions to military personnel:

- for length of service of at least 20 years - payments are assigned if the former military man served in the department for a certain time period;

- reach 45 years of age , have a total work experience of at least 25 years, of which at least 12.5 years are military service; in this case, the person must resign upon reaching the age limit for service, for health reasons or in connection with organizational and staffing measures

- disability - assigned if a serviceman became disabled during service or within 3 months after dismissal;

- loss of a breadwinner - assigned to the relatives of a deceased serviceman. Paid while family members are considered disabled.

If a military pensioner retires on the basis of disability or loss of a breadwinner, his immediate family and dependent relatives will also receive payments. Depending on the basis for retirement, a coefficient is used in calculating payments. Its minimum value is 50% of the salary for position and rank, the maximum is 85%.

In addition, a serviceman has the right to a second civilian pension:

A second pension through the Pension Fund of Russia can be assigned to a military pensioner if the following conditions are simultaneously met:

- Age. Reaching the generally established age - 65 years for men, 60 years for women (age is determined taking into account the gradual increase in the retirement age). Thus, in 2021, women born in the second half of 1964 and men born in the second half of 1959 will reach retirement age. Certain categories of military pensioners are assigned an old-age insurance pension before reaching the generally established retirement age, subject to the conditions for early assignment. For example, in the case of working in the North, working in difficult conditions, etc.

- Experience. The presence of the required insurance experience, which is not taken into account when assigning a pension through the law enforcement department (in other words, length of service in civilian life). In 2021 it is 11 years and will increase by 1 year annually to 15 years in 2024.

- Odds. The presence of a minimum amount of individual pension coefficients - for 2021 it is set at 18.6 and will increase annually to 30 in 2025.

Cancellation of the 0.54 reduction factor for military pensioners, latest news for today

A reduction factor for military pensions was introduced in 2012. Today, taking into account indexation, its size is 72.23%. Review or cancellation of this coefficient in 2021. not planned.

According to a number of online sources, the chairman of the State Duma committee of the Russian Federation, Hero of Russia, retired Colonel General V.A. Shamanov, on September 2, 2021, at a meeting with veterans of military service, combat operations, active military personnel and civilian personnel at the Volsky Military Institute of Material Support ( according to information from the official website of the WVIMO, such a meeting actually took place on September 2, 2017) assured that he intends to achieve the abolition of the reduction factor in military pensions.

We would like to remind you that, according to part two of Article 43 of the Law On Pension Provision for Persons Who Have Served in Military Service... the specified monetary allowance is taken into account when calculating pensions from January 1, 2012 in the amount of 54 percent and starting from January 1, 2013 it increases annually by 2 percent until it reaches 100 percent of its size. Taking into account the level of inflation (consumer prices) by the federal law on the federal budget for the next financial year and planning period, the specified annual increase may be established for the next financial year in an amount exceeding 2 percent. The effect of the specified part two of Article 43 of the Law is suspended:

- from January 1, 2015 to January 1, 2021 (Federal Law of December 1, 2014 No. 397-FZ) from January 1, 2015, the amount of monetary allowance taken into account when calculating pensions in accordance with Article 43 of the Law is 62.12 percent , from October 1, 2015 - 66.78 percent of the specified monetary allowance.

- from January 1, 2021 to January 1, 2021 (Federal Law of December 14, 2015 No. 367-FZ) from February 1, 2021, the amount of monetary allowance taken into account when calculating pensions in accordance with Article 43 of the Law is 69.45 percent from the amount of the specified monetary allowance.

- from January 1, 2021 to January 1, 2021 - (Federal Law of December 19, 2021 No. 430-FZ) from February 1, 2021, the amount of monetary allowance taken into account when calculating the pension in accordance with Article 43 of the Law is 72.23 percentage of the specified monetary allowance.

It should be especially noted that the provisions of part two of Article 43 of the Law on Pension Provision of Persons (as amended by Federal Law No. 309-FZ of November 8, 2011) do not apply to judges of the Military Collegium of the Supreme Court of the Russian Federation and military courts, prosecutors (including including military personnel of the military prosecutor's office) and employees of the Investigative Committee of the Russian Federation (including military investigative bodies of the Investigative Committee of the Russian Federation), pensioners from among these persons and members of their families, which many retirees consider unfair.

Why did the maximum percentage bonus for length of service decrease after the adoption of Federal laws on reforming the pay of military personnel? Previously the size was 70% now 40%.

In the new structure of pay for military personnel, with a decrease in the amount of additional payment in percentage terms in absolute terms, there is a significant increase in its size (more than 2.5 times) due to a significant (more than 3 times) increase in salaries for military personnel.

Why will the pay of military personnel from January 1, 2012 increase by 2-2.5 times, but pensions only by 60%? This violates the rights of military pensioners and is contrary to the Constitution of the Russian Federation. What is the reason for the 60% increase?

An increase in the size of military pensions by 60% was determined based on the economic capabilities of the state; such an increase, as well as the procedure for indexing military pensions, will ensure that the average size of military pensions exceeds the average size of a labor pension by an average of 80% and further supports the material security of military pensioners at the proper level due to the annual guaranteed increase in the size of military pensions, including regardless of the indexation of military pay.

As the Constitutional Court of the Russian Federation has repeatedly emphasized in its decisions, compliance with the constitutional principle of equality, which guarantees protection against all forms of discrimination, means, among other things, a prohibition to introduce such differences in the rights of persons belonging to the same category that do not have an objective and reasonable justification ( prohibition of different treatment of persons in the same or similar situations); under equal conditions, subjects of law must be in an equal position; if the conditions are not equal, the federal legislator has the right to establish different amounts of social guarantees, taking into account differences in their actual situation.

Taking into account the above, the establishment of different levels of increase in pay for military personnel and pensions for citizens discharged from military service is in accordance with the Constitution of the Russian Federation.

Why is the 54% reduction factor for pensions not applied to pensions assigned to employees of the Prosecutor's Office and the Investigative Committee of the Russian Federation?

Why can’t a reduction factor of 100% be established for military pensioners who have reached the age of 60?

Establishing 100% of the pension amount for persons who have reached the age of 60 (i.e., without applying a reduction factor of 54%), will lead to the division of military pensioners into categories depending on the date of their separation from service (for example, a 60-year-old pensioner, retired with the military rank of lieutenant, the pension amount will be greater than that of a 50-year-old colonel).

We propose to compare the size of the military pension of a citizen discharged from military service from a military position as a platoon commander, with the military rank of lieutenant with 25 years of service without applying a reduction factor (who reached the age of 60), and the size of the military pension of a citizen discharged from military service from a military position regiment commander, with the military rank of colonel with 40 years of service in preferential terms (who retired at the age of 50) using a reduction factor.

A pension for citizens discharged from military service (service) is assigned not for age, but for length of service.

Its size depends only on three parameters at the time of discharge from military service:

1) position held;

2) assigned military rank;

3) duration of service.

The existing pension system should encourage military personnel to advance in their careers, including to receive a higher pension.

The State Duma adopted and entered into force the Federal Law of July 22, 2008 No. 156-FZ “On Amendments to Certain Legislative Acts of the Russian Federation on Pension Issues,” which granted military pensioners who continued to work after leaving military service the right to receive old-age labor pension (less the fixed base amount of the insurance part of the old-age labor pension) through the Pension Fund of the Russian Federation, simultaneously with receiving a military pension. The old-age labor pension is assigned to men upon reaching 60 years of age and to women at 55 years of age.

Why was it that military pensioners were given a reduction factor for their pensions, while other pensioners do not have it?

The legislation of the Russian Federation, in particular Federal Law No. 58-FZ “On the civil service system of the Russian Federation,” by establishing the various types of civil service that make up the system, defines uniform approaches to the organization, functioning and performance of the civil service. At the same time, it is possible to normatively highlight the features, principles and differences that determine the specifics of each type of public service in a given system.

Consequently, when legislatively establishing the basic conditions for performing public service, the possibility of introducing differences in the legal status of persons serving in public service in civil service positions of various types is not excluded, including the definition of special rules regarding the conditions of state pension provision for citizens who served in public service, in for the purposes of fair, reasonable consideration of specific factors in the performance of civil servants.

For example, for federal civil servants there are restrictions on the size of the pension and the timing of pension payment.

To calculate the pensions of federal civil servants, all types of wages are taken into account, however, in accordance with Article 21 of the Federal Law of December 15, 2001 No. 166-FZ “On State Pension Provision in the Russian Federation”, the amount from which their pensions are calculated ( average monthly earnings) cannot exceed 2.8 times the official salary.

Why did the State Duma adopt Federal laws on reforming the pay of military personnel without establishing salaries for the pay of military personnel, because in such a situation it is impossible to determine the level of increase in the pay of military personnel and the pensions of military retirees?

When the bills on reforming the pay of military personnel were adopted in the second reading by the Government of the Russian Federation, deputies of the State Duma were presented with draft resolutions of the Government of the Russian Federation, which contained data, among other things, on the size of salaries for military pay.

Calculation of military pensions until the end of the freeze

The reduction factor negatively affects payments to military pensioners. They receive only part of the pension they deserve. Therefore, indexation of salary is important! By 2035, it is planned to increase the pay of active military personnel to 100%.

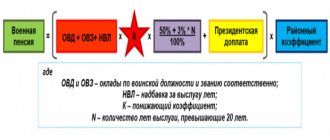

When calculating the pension, the following formula is used:

P=((OKD+OKZ)*0.5+(OKD+OKZ)*0.03*T)*k,

where OKD is salary according to position, OKZ is salary according to rank, T is the period of overtime in excess of the minimum period required to assign a pension to a military personnel, k is the reduction factor.

For clarity, it is necessary to give an example of a calculation: A serviceman holds the rank of colonel in the position of deputy unit. His salary by position is 22 thousand rubles, and by rank - 18 thousand rubles. He is about to retire after 27 years of service. This is 7 years more than the minimum established. He is assigned a pension of 50%, with 3% added for each year of service. As a result of his retirement, he will receive ((22000+18000)*0.5+(22000+18000)*0.03*7)*0.7368=20,925.12 rubles the colonel will receive monthly.

If the reduction factor had not been applied (absent at all or equal to 100%), the former colonel would have received a pension in the amount of 28,400 rubles, which is almost 7.5 thousand rubles more than the current one. This formula, together with the coefficient, will be applied for another whole year - until the end of 2021.

How is pension calculated for former military personnel?

According to Art. 43 of the legislative act of February 12, 1993 number 4468, the amount of payments to former army employees and their relatives is determined by taking into account monetary allowances. In addition, the size of the pension depends on:

Pension coverage for army employees is divided into 4 types:

- For 20 years of service.

- For 12.5 years of service, with the recipient’s total experience of at least 25 years.

- For the loss of a breadwinner for disabled relatives: sons/daughters; mother/father with a disability or retired; a wife who is caring for a child under fourteen years of age.

- Due to disability that occurred during military service or due to illness during this period.

Salary is the salary of an army employee, including salary and allowances. According to Art. 2 of the legislative act of November 7, 2011 number 306, military personnel receive bonuses for:

- rank - 5-30 percent;

- access to classified information – up to 65 percent;

- service under special conditions; performing tasks that are dangerous to life and health; achievements in service – up to 100 percent;

- conscientious performance of official duty - up to 300 percent of the annual salary.

Graph of coefficient changes in previous years

Incomplete accounting of the amount of allowance when determining the amount of pension payments has been carried out since January 1, 2012. Then a reduction factor of 0.54 in part 2 of Art. 43 of Law No. 4468-1 of 02/12/1993. Then its value should have increased annually by 2% until it was brought to 100%. However, in fact, the scheme for changing it looked different - the table is presented below:

| Period | from 01/01/2015 | from 01.10.2015 | from 01.02.2016 | from 02/01/2017 | from 01.10.2019 |

| PC value | 0.6212 (62.12%) | 0.6678 (66.78%) | 0.6945 (69.45%) | 0.7223 (72.23%) | 0.7368 (73.68%) |

The table shows that the last time the PC value was adjusted was on October 1, 2021. Then it was “frozen” for the entire 2021, and now they plan to use it in calculations throughout 2021.

Calculation of military pensions until the end of the freeze

First, let’s explain why freezing the coefficient has a negative impact on payments. Since the amount of monetary allowance is multiplied by a percentage, the amount of accruals is reduced by a certain proportion. That is why the annual indexation of allowances, which is planned to be increased to 100% by 2035, is so important. It is better to demonstrate this with an example that shows how long-service military pensions will be calculated until the end of the freeze.

So, the formula is ((i+s) x 0.5 + (i+s) x 0.03 xt)) xk , where:

- i – salary according to position;

- s – salary according to rank;

- t – years of service in excess of the minimum length of service;

- k – reduction factor.

Example . In 2021, a military serviceman receives an official salary of 18,000 rubles, and a rank salary of 15,000 rubles. in total, taking into account a monthly allowance (40% of the content). He retires with 27 years of service, which is 7 years more than the minimum required. A pension was assigned in the amount of 50% of the salary, as well as 3% for each year in excess of the length of service (clause a) of Art. 14 Federal Law No. 4468-1).

Calculation : ((18,000 + 15,000) x 0.5 + (18,000 + 15,000) x 0.03 x 7)) x 0.7368 = 17,263, 23 rubles. - pension amount.

If the reduction factor were absent or increased, the pension amount would be higher.

- In the example given, without taking into account the reduction, 23,430 rubles were accrued, which is 6,167 rubles. more than actual charges.

- Since the size of the reduction factor is fixed, nothing changes in the formula.

- In this way, pensions will be accrued until the end of the freeze.

Calculation and accrual of military pensions

As with insurance pensions, military pensions are calculated based on the employee's salary. In the internal affairs bodies, it is customary to call it monetary allowance, which includes a salary and monthly allowances. In general, when calculating a military pension, the following indicators are taken into account:

- official salary;

- salary according to rank;

- monthly allowances;

- years of service in excess of the minimum length of service;

- reduction factor;

- regional coefficient;

- interest on salary depending on the basis of retirement.

In total, there are 3 grounds for retirement: length of service (from 12 or 20 years of service), disability and loss of a breadwinner (Article 13-42 of Law No. 4468-I “On Military Pensions”). In the last two cases, payments are also given to family members of the serviceman.

Depending on the type of pension, the formula includes a percentage of the salary, which is a minimum of 50%, a maximum of 85%. The formula and example of calculation will be given below.

How does PC affect military pensions?

The use of a reduction factor led to budget savings - almost 3 trillion rubles remained at the disposal of the state. But military pensioners still do not receive their full pension, which causes dissatisfaction.

Initially, the reduction factor was set at 54%, and every year it was supposed to increase by 2%. In 2021 it was supposed to be 70%, but in fact it was 73.68%. Developments are ahead of schedule.

According to the Presidential Decree, the pay of military personnel should increase by 5% every year, but in fact - by 3%. That is, military pensioners do not receive another 2% of their due payments.

Taking into account the current “freeze”, former military personnel will lose another 5% of their monthly contributions for each “frozen” year. But the probability of achieving the plan to achieve a coefficient of 100% by 2035 is quite high. But the “freeze” should be lifted next year. Otherwise, military retirees will continue to lose their money. The pensions of ordinary military personnel and non-commissioned officers are already almost equal to the insurance pensions of civilians.

In the period from 2012 to 2021, the growth dynamics of military pensions was 2.5 times, but the overall lack of indexation was 20%. That is, over these 7 years, former military personnel received almost 1/5 of their pensions. If the freeze is not lifted, military retirees will be on a par with civilian employees. This significantly reduces the state's social responsibility in relation to the military sector.