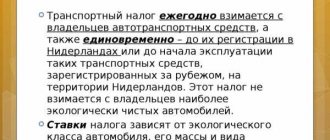

It is the regional authorities that decide issues related to car taxes. Pensioners are a preferential category, so the decision on whether or not to pay taxes is made by each individual subject of the Russian Federation.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

To do this, you need to contact the authorities at your place of residence, present your passport, registration certificate for your car, pension certificate, submit an application, wait for the authorities’ decision on granting benefits in accordance with Art. 56 Tax Code of the Russian Federation.

Lawyers advise that if controversial issues arise, you should seek help for recommendations and clarification. Federal laws do not provide for complete exemption of persons of retirement age from tax obligations, but pensioners are still entitled to privileges.

Do pensioners need to pay transport tax?

By law, all car owners must pay taxes on time. Pensioners, as socially vulnerable segments of the population, certainly have the right to receive benefits when paying taxes. The regions do the calculations, setting the amount of discounts due.

It is worth understanding that pensioners who directly own a single domestically produced car with a power of no more than 150 l/s can count on benefits. The amount of benefits directly depends on the region.

For example:

- St. Petersburg - pensioners are completely exempt from tax directly on cars with an engine power of up to 150 l/s, a motor boat (crawler tractor, moped, scooter) - 30 l/s;

- Novosibirsk - the benefit is 20% of the tax rate on cars with a power not exceeding 150 l/s. and a percentage of the tax rate on other self-propelled vehicles, mechanisms and tracked vehicles.

On a note! Discounts and benefits in percentage terms can vary significantly. This will vary by region on the ground. Only local regional authorities decide whether to give benefits to pensioners or completely exempt them from paying taxes.

List of persons who have transport tax benefits in the Leningrad region

agricultural producers who are engaged in the production of agricultural products in the crop and livestock sectors, in relation to trucks; (as amended by the Law of the Leningrad Region dated 06.06.2021 No. 49-oz);

Article 3 of the Law of the Leningrad Region “On Transport Tax” dated November 22, 2021 No. 51-oz (as amended by the Regional Law of the Leningrad Region dated November 27, 2021 No. 125-oz, dated June 6, 2021 No. 49-oz, dated November 29, 2021 N 121 -oz, dated 10/11/2021 No. 74-oz, dated 12/16/2021 No. 97-oz, dated 05/15/2021 N 54-oz) stipulates that the following are exempt from paying tax:

citizens in relation to one registered passenger car of domestic production (USSR) with an engine power of up to 80 horsepower inclusive and with a year of manufacture up to and including 1990, as well as in relation to one motorcycle or scooter of domestic production (USSR) registered on them with a year of manufacture up to 1990 inclusive;

2.

Pensioners, as well as persons who have reached the age required for the appointment of an old-age labor pension in accordance with Federal Law of December 17, 2021 No. 173-FZ “On Labor Pensions in the Russian Federation”, or the appointment of an old-age insurance pension in accordance with the Federal Law dated December 28, 2021 No. 400-FZ “On Insurance Pensions”, either receiving an old-age pension in accordance with the legislation of the Russian Federation, or having reached the age of 60 years for men, 55 years for women - owners of passenger cars with an engine power of up to 100 horsepower forces (up to 73.55 kW) and motorcycles (motor scooters) with an engine power of up to 40 horsepower (up to 29.4 kW) pay a tax in the amount of 80 percent of the established tax rate for one vehicle registered to citizens of the specified category.

- one of the parents (adoptive parents), guardians (trustees) with three or more children under the age of 18 in the family - for one vehicle (passenger car with an engine power of no more than 150 horsepower), registered to a citizen of the specified category ;

Who among pensioners receives discounts when paying transport tax?

Persons of retirement age have the right to apply for discounts. But everything will depend on budgetary capabilities in individual regions, which means that privileges for pensioners may differ significantly.

Basic conditions for providing discounts:

- availability of a pension certificate;

- belonging to a special category of citizens, owning one car (motorcycle, crawler bulldozer, truck, self-propelled boat);

- power no higher than 150 l/s, for a motor scooter – no higher than 36 l/s.

It is possible that the following will be 100% exempt from tax:

- participants and holders of the Order of Glory;

- veterans of war and labor;

- military men, also their wives, parents;

- families with a disabled child and only one car with a capacity of up to 150 l/s.

- large families with minor children living together.

Transport tax rate in St. Petersburg

The transport tax rate is determined by regional authorities at their discretion, and can change the rate at any time. The rate depends on the amount of horsepower in the car. There are 5 bets. The first is for cars up to 75 horsepower, it is equal to 0 (a nice moment), the second is for cars from 75 to 100 horsepower, the third is from 100 to 150, the fourth is for vehicles from 150 to 200, the fifth is from 200 to 250 horses and the last one is for cars over 250 horsepower. Data on base rates in the city of St. Petersburg (St. Petersburg) are presented in the table below.

| Auto power range | Transport tax rate in rubles for 2021 | Transport tax rate in rubles for 2022 |

| up to 75 hp | 0 | 0 |

| from 75 to 100 hp | 24 | 24 |

| from 100 to 150 hp | 35 | 35 |

| from 150 to 200 hp | 50 | 50 |

| from 200 to 250 hp | 75 | 75 |

| over 250 hp | 150 | 150 |

For which pensioners are benefits not provided?

Despite the fact that the pension leaves much to be desired, the tax will depend entirely on the time the car is used.

For example, if a pensioner used the car for no more than 8 months, after which he decided to sell it, then it is for this period that tax with benefits will be charged. Each specific vehicle is taken into account separately (category, year of manufacture, engine power).

The main condition for obtaining rights to benefits is local opportunities and legality in the regions. Pensioners may be left without privileges if a particular subject of the Russian Federation does not have such opportunities.

For example, pensioners in the Rostov, Smolensk, Volgograd, Kirov regions, Crimea, and the Republic of Kalmykia have to pay the tax in full.

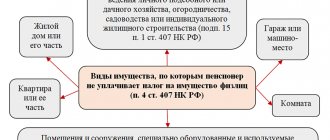

Pensioners do not have to calculate benefits if they own:

- foreign car;

- domestic vehicle, if the power exceeds 150 l/s;

- the absence of one of the statuses (veteran, disabled group 1-2, hero of the USSR, injured during testing at a nuclear test site), or the fact that the vehicle is wanted (hijacked) is recorded.

It is worth understanding that car tax, even for pensioners, is a mandatory form of payment. If there are no benefits, then questions about the size and amount to be paid are resolved by local regional offices.

Who is given a tax break and who is not - everything is decided at the regional level and exclusively vulnerable categories of citizens are provided with tax privileges.

To the attention of retired motorists! The benefits for the vehicle are not constant at all. Every year, changes and amendments are made to the budget in regional institutions. Previously adopted provisions may be revised and made in favor of pensioners.

The most favorable conditions for pensioners, when most of them are completely exempt from paying taxes as of today in 2021, are: Magadan and Sakhalin regions. But 2 conditions must be met: absence of entrepreneurial activity, personal operation of the car by a pensioner or his spouse.

Benefits for military pensioners

Military pensioners are subject to a special category, and despite consideration of the issue of taxation exclusively by region, federal standards are still provided for.

Such citizens and their wives and parents will be completely exempt from tax obligations if the car engine does not exceed 150 l/s.

In addition, compensation is due:

- disabled people (group 1-2), if the car is completely converted for these purposes;

- participants in hot spots and hostilities, and the payment of taxes will not be affected by the area of residence;

- personnel employees;

- pensioners of the Ministry of Internal Affairs, Ministry of Emergency Situations

- security forces.

In most regions of the Russian Federation, the benefit for these citizens is 100% if the engine power is not higher than 200 l/s.

On a note! Lawyers advise finding out in detail which category pensioners belong to, taking into account the region, and what rights they have to discounts. To do this, it is recommended to go to the official website of the tax service and fill out the form provided, indicating the region, information about the car, and the last period for paying the annual tax.

Pensioners must submit an application to the Tax Inspectorate, attach documents confirming the status of “military pensioner” and write an application to the Federal Tax Service. You can find out in more detail whether there are benefits for pensioners on transport tax by contacting the local branch of the Federal Tax Service of the Russian Federation.

Depending on the level of wealth in the region and the availability of the budget, regional authorities can reduce (increase) the tax rate or provide a 100% discount for a number of categories of citizens separately.

Benefits or a complete waiver of tax payment will be effective immediately from the moment the application is submitted and a positive decision is made. .

Transport tax rates in the Leningrad region

- Legal entities, more than 70% sponsored from local budgets;

- public organizations of disabled people;

- legal entities whose authorized capital is formed by public organizations of disabled people;

- regional divisions of the All-Russian Society of the Blind;

- agricultural enterprises engaged in the production of specialized products;

- Legal entities whose activities are related to folk arts and crafts;

- textile and clothing enterprises.

Benefits for legal entities

Following the norms of the Tax Code of the Russian Federation, citizens pay transport tax at the end of the reporting period. It is not necessary to calculate the amount payable on your own, although it is possible (to do this, you need to multiply the rate, tax base and holding period). All necessary calculations will be carried out by Federal Tax Service employees. The resulting results are sent to the payer’s residential address.

Law of the Leningrad Region of November 29, 2021 N 121-oz (Official website of the Administration of the Leningrad Region www.lenobl.ru, November 29, 2021) (came into force on January 1, 2021); Law of the Leningrad Region of October 11, 2021 N 74-oz (Official website of the Administration of the Leningrad Region www.lenobl.ru, October 14, 2021) (came into force on January 1, 2021); Law of the Leningrad Region of December 16, 2021 N 97-oz (Official website of the Administration of the Leningrad Region www.lenobl.ru, December 16, 2021) (came into force on January 1, 2021); Law of the Leningrad Region of May 15, 2021 N 54-oz (Official Internet portal of legal information www.pravo.gov.ru, 05.15.2021, N 4700202105150001) (applies to legal relations arising from January 1, 2021). _____________________________________________________________________

Benefits for paying car tax for pensioners by region

- Perm - payment of 50% of the total cost of the tax if you own 1 car with a power not exceeding 100 l/s, a motorcycle (power 50 l/s), a crawler bulldozer (power 50 l/s).

- Volgograd region - 100% benefit if you have a pension certificate, disability group 1-2 participants, a document certifying that you are a WWII prisoner, or a veteran with the title of Hero of the USSR.

- Sverdlovsk region - 100 benefit if you have a disability or own one of the listed vehicles (truck - 150 l/s, motorcycle, scooter - up to 36 l/s)

- Nizhny Novgorod, Chelyabinsk region - 50% of the total tax rate or in full if applied to a special category.

- Buryatia, Dagestan, Kaliningrad, Kaluga, Ivanovo, Saratov, Smolensk and Ulyanovsk regions - no benefits.

- Kemerovo region - fixed discount (1 ruble per unit l/s), the year of manufacture of the car, engine power, and the status of the pensioner are taken into account.

Necessary documents to apply for tax benefits for pensioners

The pensioner must express his desire directly to the tax office to obtain the right to receive preferential taxation.

It is necessary to confirm your intentions with relevant documents and write a statement indicating:

- reasons for receiving a discount or complete tax exemption;

- type and make of car, registration number, number of vehicles in personal possession.

A pension certificate (copy) must be attached to the application. The pensioner has the right to choose any advantageous benefit from the benefits offered by the regional authorities.

How to calculate car tax for pensioners?

The rate depends on the vehicle, 1 l/s, on average - 3.5 rubles. In cities of federal significance (Moscow, St. Petersburg) – 5-15 rubles.

Pensioners may not be afraid of inadequate increases in rates by some authorities in the regions and unnecessary overpayments. Taxation in Russia is strictly controlled by the state.

There is a formula by which the tax for pensioners is calculated:

tax = rate multiplied by the number of horsepower multiplied by the period of use of the vehicle by month.

The tax will be calculated taking into account the time of use of the vehicle and its status not registered with the traffic police. If there are benefits, then the rate will be lower than the general civil rate and in some regions simply symbolic - up to 10 rubles. for 1 l/s.

Only the provisions of the Tax Code at the local level predetermine the payment of vehicle tax for pensioners. If we talk about legal norms of federal significance, then, of course, beneficiaries who do not have to pay 100% taxes are WWII veterans, disabled people of groups 1-2, and other preferential categories.

Partial benefits and discounts are also provided if you have a different car, year of manufacture. The budget in a particular region plays a big role, so if you are suddenly denied a benefit, then pensioners should visit the tax office at their place of residence from time to time and find out about innovations and possible changes.

Our lawyers advise you to seek help if your rights are infringed or violated. We will help you solve complicated situations, we will advise you (based on the laws of 2021) on how to proceed further, which fiscal authorities you need to contact.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

Free online consultation with a car lawyer

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

Do pensioners pay transport tax in 2021?

Veterans are exempt from paying the vehicle tax if the vehicle's engine power is less than 100 hp. In other cases, depending on the characteristics of the cars, preferential conditions apply in the territory of most constituent entities of the Russian Federation, and the amount is calculated on an individual basis. If the power of the existing equipment exceeds the above level, then only the number of horsepower exceeding 100 is subject to the tax.

For example, the approved tax rate is 10 rubles per 1 hp, and a pensioner owns a car with a 110 hp engine. The fee will be 10*10=100 rubles. If there is more than one vehicle owned by a pensioner, the second vehicle is taxed as usual.

In 2021, all citizens who have reached the age of 60 (men) and 55 years (women) receiving a legal state pension have the right to use preferential conditions for car tax for pensioners. The exception is citizens who previously worked in the far north, for whom the age is reduced by five years and is 55 for men, 50 for women.

Regional legislation

The tax rate - one of the key factors influencing the amount of collection - is regulated at the regional, not federal level. In 2018, it will be 5-25 rubles per 1 hp, that is, drivers will pay differently for the same car depending on the region. In addition, there is the concept of local benefits, i.e. the rate may be reduced or increased for different categories of motorists - disabled people, veterans, etc.

Moscow pensioners in 2021 will not be included in the list of citizens whose transport is exempt from taxation. They, like other Muscovites, will be able to avoid paying only if the power of their car is less than 70 hp. Preferential terms of fees will remain only for large families. In St. Petersburg the situation is somewhat different. Pensioners of the northern capital are exempt from paying the fee for one vehicle registered in the name of an elderly St. Petersburg resident, with some reservations. The following vehicles owned by a pensioner are not subject to taxation:

- A domestically produced passenger car older than 1991, with an engine no more than 150 hp.

- Water vehicles with an engine up to 30 horsepower, except motor sailing vessels.

Residents of the Novosibirsk region who have reached retirement age will receive the following benefits:

- passenger cars with engine power up to 150 hp. are subject to 20% tax;

- motorcycles with an engine up to 40 hp does not require payment of a fee;

- Self-propelled vehicles on tracked and pneumatic tracks are subject to a tax of 5% of the rate approved by the regional authorities.

Federal regulations

Transport fees are regulated by local authorities separately for each region, but there are standards approved at the federal level. In accordance with the requirements of the federal authorities, military vehicles and passenger cars equipped for the disabled are not subject to taxation, and the age category is not limited.

A child with disabilities has the right to benefits provided to his parents if the vehicle is intended to transport him. Cars with an engine power of up to 100 hp, received with the support of social protection authorities for the disabled, also belong to the group of preferential vehicles. This rule applies to all people with disabilities.

- Pork in a slow cooker: cooking recipes with photos

- Beef soup: delicious recipes

- Stuffed peppers in the oven: recipes