This year, the land tax for some categories of citizens of the Russian Federation will shine with new colors, and all because amendments to the tax code have begun to take effect.

Now, in some cases, you won’t have to pay at all for a plot of six acres. True, such benefits will be available only to pensioners, and their state of health, age and ability to work will not be taken into account. An innovation emerged as a result of the signing of several new important bills. The state is solving the accumulated problems in the area of child benefits and land taxes, since previously some payments were too high and unaffordable for many pensioners. Despite the fact that the law came into force in mid-December last year, benefits will begin to be counted on January 1, 2017. Throughout January, retirees will be sent notices informing them how much less they will have to pay, if at all.

How it was before, and what awaits people now

Even before the amendments were made, some owners had benefits at their disposal. Thus, a tax discount was available for disabled people of all categories and combatants. There was one privilege for everyone - the cost of land was reduced by 10 thousand rubles, and a tax was charged on the rest.

There was no justice in this approach. So a beneficiary in the Moscow region received minus 10 thousand to the final amount, and so did a resident of some regional village, while the cadastral price of the plot did not play any role and could vary significantly. In addition, that benefit bypassed the usual category of pensioners.

There are also municipal benefits. For example, in the capital, similar ones are provided for foster parents, in Oryol - for people of retirement age who are left without relatives. Governing bodies are not obliged to make the tax lower for all people of retirement age, although in some areas they have done so.

Starting from 2021, the tax base for beneficiaries will be reduced by 6 acres. In addition, this applies to all pensioners without exception. Benefits are also available to those who receive a survivor's pension supplement. As an example, this also applies to a 45-year-old teacher who is retired due to length of service, but still continues to work. The privilege is also available to a 50-year-old military man who owns a country plot. If grandparents who grow vegetables and fruits have only 6 acres of land, they will not pay tax at all.

Even a student of a higher education institution who receives a pension for a deceased parent and owns a plot of land received as an inheritance is also entitled to a benefit. After the amendments, the financial situation of the pensioner and his location in the Russian Federation lost their significance.

New form for calculating land tax

Now, in order to calculate the land tax, they will first calculate the cadastral value of the plot. The next step will be to subtract the cost of 6 acres from the resulting figure and charge tax on the remaining difference. In general, from now on benefits are calculated not from a fixed amount, but for each site separately, which is much more fair. If the area of the property is less than or equal to 6 acres, land tax will not be charged. If a person has two or more plots, the benefit applies to only one of them. It follows from this that you need to choose the area for which the privilege will be more appropriate. So, if one of the available plots is less than 6 acres, and the other, on the contrary, is larger, then it is better to activate the benefits in relation to the larger plot. After making a choice, you must report it to the tax office.

Applications for property tax privileges have always been accepted until November 1st. This time, since the changes came into force only in January, the application can be submitted until July 1, 2018. If you do not inform the institution for which area a benefit is required, the tax office will make calculations everywhere, and will subtract the price of six hundred square meters from the tax that turns out to be the largest. Therefore, you can do nothing at all.

It is worth noting that when calculating for 2021, the updated privilege is also taken into account. Individuals will make payments until December 1, 2021. In almost a whole year, the tax office will have time to calculate everything, and the tax on 6 acres for pensioners will no longer be taken into account.

To prepare in advance, you can submit an application to the tax office, within which you indicate your rights to benefits. At the same time, you can select a site. In this case, there is no need for supporting documents, since the tax office itself will check all the data. You don’t have to go anywhere at all if you have access to your personal account. If initially the tax office randomly does not take into account the privilege, you should contact us again and they will recalculate everything.

This is interesting: Land tax in Crimea

How to apply the land tax benefit for pensioners 2018

Individuals do not need to calculate land tax on their own - tax specialists do this for them, using data provided to them by government agencies that conduct cadastral records and state registration of real estate rights. Taxpayers are sent notifications with the amount of tax to be paid (clause 4 of Article 391 of the Tax Code of the Russian Federation). The payment deadline is December 1 of the year following the calculation year, that is, land tax for pensioners in 2021 for the period of 2021 must be paid no later than December 1, 2018.

Plots of land owned by pensioners, the area of which is less than or equal to 600 square meters. meters are exempt from taxation. Accordingly, the size of land plots exceeding the specified area is reduced by “non-taxable 6 acres”, and only then a tax is calculated from the resulting area.

If a pensioner has several land plots registered in his name, the tax base can be reduced only in relation to one of them at the choice of the taxpayer. To do this, a notification must be sent to any Federal Tax Service Inspectorate before November 1 of the accounting year indicating the cadastral number of the plot for which “6 acres” should be deducted when calculating the tax (KND form 1150038 approved by order of the Federal Tax Service of the Russian Federation dated March 26, 2018 No. ММВ-7- 21/167). For example, to receive a deduction for a selected plot of land tax in 2021 for pensioners, a notification must be submitted before November 1, 2018 (for the tax for 2021, the choice must be made before July 1, 2018). The taxpayer cannot change his decision later. If the tax authorities do not receive any orders from the taxpayer within the specified period, the pensioner will not have any money left - they will apply the deduction to that of the plots for which the tax amount will be the largest (clause 6.1 of Article 391 of the Tax Code of the Russian Federation).

For taxpayers who previously enjoyed property tax benefits, the land tax deduction will be applied automatically. Those who received such a right for the first time in 2021 (for example, became a pensioner) will have to submit an application for benefits to the Federal Tax Service (form approved by order of the Federal Tax Service of the Russian Federation dated November 14, 2017 No. ММВ-7-21/897).

Will pensioners pay land tax in 2021 - latest news

In connection with amendments to the second part of the Tax Code of the Russian Federation, the payment of land tax by citizens from 2021 is made taking into account the new provisions on benefits. Law No. 436-FZ of December 28, 2017 introduced new rules for determining the tax base taking into account preferences that reduce the amount of tax payable.

In this article we will look at how land tax is calculated for pensioners in 2021: benefits for pensioners, a deduction of 6 acres, application problems.

Land tax for pensioners – should you pay or not?

Many citizens of the Russian Federation, including those of retirement age, own land plots, which, according to the laws of our country, are subject to taxation. Considering that the size of pension benefits is far from what we would like, the older generation is especially concerned about the question of what the land tax will be for a pensioner in 2019-2020.

In general, should a pensioner pay land tax? How and when should this be done? Is it possible to count on discounts? Are there conditions provided by law under which a pensioner is exempt from paying land taxes? Read the answers to all these questions below?

Do pensioners pay land tax in 2021?

Reports that appeared at the beginning of 2021 that pensioners are exempt from paying land taxes are untrue. Elderly citizens still have to pay for the use of land, but now they are included in the list of individuals receiving benefits. Previously, pensioners were not provided with any benefits by the Tax Code.

This provision cannot be found in the article of the Tax Code of the Russian Federation about land tax benefits. It is contained in Art. 391 on the procedure for determining the tax base.

Other categories of beneficiaries are also indicated there:

- heroes of the Russian Federation and the USSR;

- disabled people (only groups 1 and 2), as well as disabled children and people with disabilities since childhood;

- veterans, disabled people of the Second World War and other military operations;

- Chernobyl victims who suffered during the accident at the Mayak production facility and at the Semipalatinsk test site;

- persons who took part in testing nuclear and thermonuclear weapons as part of special risk units;

- persons who have become disabled as a result of such tests.

Now they include pensioners - everyone, no matter on what basis the state provides support. It also does not matter whether a citizen works; this does not affect the application of the benefit. Labor veterans are not mentioned here, but benefits may be provided to them at the local level.

Do pensioners pay land taxes?

Taxation is the main source of replenishment of the state treasury.

NOTE. The laws of the Russian Federation do not provide for the exemption of a pensioner from land tax only because he has reached retirement age. If he owns one or more land plots, then the pensioner, like all other citizens, is obliged to pay land taxes.

But not everything is so sad! Considering that for this group of the population taxes, and not only on land, often become a heavier burden, the legislation has provided for certain benefits - discounts that make it possible to reduce or, in general, cancel the amount of tax.

Since laws change periodically, we will consider the main provisions and principles of taxation of pensioners in 2019-2020.

Application procedure

The land tax benefit for 6 acres applies only to one plot. You can select it by sending a notification in the form approved by the order of the Federal Tax Service dated March 26, 2018. The document indicates the cadastral number of the selected object. After November 1st there is no possibility to change these data. If the notification is not provided, the tax authorities will make their own choice in favor of the site for which they will have to pay a large amount of tax.

If the area of the plot is less than 600 square meters, the owner is exempt from paying the fee. And the size of plots with a larger area is reduced by the non-taxable part of 600 square meters and only after that the tax is calculated.

Land tax - cost and payment features

Many summer residents immediately became concerned with the question of how to calculate land tax if the size of the plot exceeds 6 acres or if they own more than one plot. In the first case, the calculation of land tax occurs minus the area of 600 sq.m. In other words, if you have 10 acres and you are on the list of beneficiaries, then you will only pay for 4 acres.

As for the ownership of several plots, the tax deduction will be made in respect of only one of them, at the choice of the taxpayer. So if you have two plots, for example, 5 and 10 acres, then you don’t have to pay anything for the first one.

In accordance with paragraph 6.1 of Article 391 of the Tax Code of the Russian Federation, it is necessary to notify the tax authority about the selected land plot before November 1 of the year, which is the tax period from which a tax deduction is applied to the specified land plot.

Land tax calculations are made by the tax authorities, so please contact them for details regarding your specific case. The land tax rate in 2021 is set by local deputies and most often is 0.3%. The Code also allows for the use of other rates, depending on the category of land and the purposes of its use.

In question-answer format

It is not entirely clear how to pay land tax for pensioners. Benefits in the Moscow region (full list) where can I find them?

In accordance with the Tax Code, all citizens receiving maintenance from the state, assigned in the manner prescribed by pension legislation, as well as men and women upon reaching 60 and 55 years of age and, accordingly, (receiving lifelong maintenance from the state) have the right to count on a reduction in tax on one plot of land . The benefit is as follows: 6 acres are not taxed. One hundred square meters is 100 square meters, 6 is 600.

This is a preference established at the federal level. Land tax is local, therefore Art. 387 of the Tax Code of the Russian Federation establishes that municipalities have the right to introduce their own benefits. Thus, it is necessary to learn about benefits in the Moscow region from the legislative acts of municipalities: city, rural, urban settlement.

How to calculate dacha tax, how to get benefits? How are land tax benefits applied to pensioners? Do I need to write a separate application?

Citizens do not calculate taxes themselves; this is done by tax officials. This is established in Art. 396 Tax Code of the Russian Federation. Tax authorities send out notices demanding payment and a receipt.

To receive a “discount”, you must fill out a notification and indicate the object of its application, submit it to the INFS before November 1st. Thus, if there is only one plot, filing an application is not mandatory. However, if the right to receive benefits arose for the first time, it is necessary to submit an application, the form was approved by order of the Federal Tax Service dated November 14, 2017. For payers who have previously enjoyed benefits, the deduction will be applied automatically.

I heard that 6 acres are not subject to property taxes starting this year. Can I take advantage of this benefit when paying taxes for 2021?

Yes, this is possible, in accordance with Art. 13 Federal Law-436 dated December 28, 2017 However, the land plot to which it applies must have been selected before July 1, 2021. Further, notification of site selection must be submitted before November 1.

Will there be a separate land tax benefit for pre-retirees in 2021?

In accordance with the draft law on benefits for pre-retirees, which has already passed the first reading in the State Duma, all tax benefits for pensioners apply to pre-retirees, that is, to men and women who have reached the ages of 60 and 55 years, respectively. Thus, after the law is adopted in all three readings and signed by the President of the Russian Federation, and there is no doubt that this will happen in the near future, pre-retirees will also be able to take advantage of the benefit in the form of a tax deduction for 6 acres of the cadastral value of a land plot.

Land tax benefits for pensioners

In order to reduce the tax burden for socially vulnerable categories of citizens, Russian legislation provides land tax benefits for pensioners:

- Federal. They are provided regardless of the location of the land plot within the Russian Federation. For pensioners, such a federal benefit is provided in the form of a tax deduction for 6 acres of land (600 square meters).

- Local. Determined depending on the region and municipality in which the plot of land is located. That is, only a pensioner who has a plot of land in a specific region or urban district can receive it.

The local benefits provided differ in different regions, so a certain benefit may be provided in one region, but not in another. You can find out whether a pensioner is entitled to a land tax benefit at your local tax office.

You can also determine the availability of land tax benefits through the help system on the official website of the Federal Tax Service by selecting the type of tax “land” and the subject of the Russian Federation. This reference service displays the entire list of both federal and local benefits.

Benefit for pensioners on land tax for 6 acres in 2020

Since 2021 (when property tax was paid for the tax period of 2021), in Russia as a whole, a land tax deduction has been in force for pensioners, which consists of reducing the tax base by an amount equal to the cadastral value of 600 square meters of land. This benefit is federal and is provided in relation to any one plot of land on the territory of the Russian Federation, regardless of the region.

A tax deduction for 6 acres is provided in accordance with clause 5 of Art. 391 of the Tax Code of the Russian Federation to the following citizens:

- Pensioners who receive pensions in accordance with the current pension legislation (it does not matter whether the pensioner is a working pensioner or not, and regardless of the type of pension received).

- Those who have reached the age of 55 years for women and 60 years for men (retirement age according to the legislation in force until December 31, 2018). Until the end of 2021, the benefit was provided precisely upon reaching retirement age, but from 2021 it increases to 60/65 years. But the right to tax benefits was retained upon reaching a fixed age - 55 and 60 years.

- Veterans and disabled people of the Great Patriotic War, veterans and disabled people of military operations.

- Disabled people of groups I and II, disabled people since childhood, disabled children.

- Heroes of the Soviet Union, Russian Federation, full holders of the Order of Glory.

- Those receiving social support as victims of the disaster at the Chernobyl nuclear power plant, PA Mayak, and the discharge of radioactive waste into the river. Tech, nuclear tests at the Semipalatinsk test site, etc.

Such a tax deduction is made in relation to only one plot of land (at the choice of the citizen). You can choose any plot of land, regardless of its location within the Russian Federation, type of permitted use and category.

This means that for a pensioner who has only one plot of land with an area of up to 6 acres, after providing such a benefit, the tax base will be taken equal to zero, respectively, according to the above formula, the land tax will also be 0 rubles. Those. plots of land owned by pensioners with an area of less than 600 square meters. m are exempt from taxation (provided that there is only one plot).

Tax benefits for land plots in different regions of the Russian Federation

As noted earlier, different regions and constituent entities of the country may establish their own land tax benefits, including for pensioners. Municipal authorities independently establish the grounds, procedure and amount of tax benefits provided, which, naturally, differ in different regions.

Here are some examples of local land tax benefits in different regions of the Russian Federation in 2021:

- In Moscow No benefits are provided specifically for pensioners, but they can count on a deduction in the amount of 1 million rubles if they belong to the following categories:

- disabled people of groups I and II, disabled since childhood;

- veterans and disabled people of combat, WWII;

- victims of the accident at the Chernobyl Nuclear Power Plant, Mayak Production Association, etc.;

- parents (adoptive parents) in a large family.

- In St. Petersburg , citizens who have received a pension in accordance with pension legislation are completely exempt from land tax on a plot of up to 2,500 sq. m. m. In addition to them, persons discharged from military service and having served for more than 20 years are exempt from paying land tax.

- In the city of Sevastopol, no local benefits are provided for pensioners.

- In Chelyabinsk The following are exempt from paying land tax:

- citizens who have reached the ages of 55 and 60 years for women and men;

- Heroes of the Soviet Union or the Russian Federation, veterans and disabled people of the Second World War, military operations;

- disabled people of groups I, II, from childhood and many others. etc.

- In Ekaterinburg benefit in the amount of 800 thousand rubles. for plots used for personal farming, individual residential construction or for an existing house, and in the amount of 200 thousand rubles. for lands used for dacha farming, gardening or vegetable gardening, the following persons can receive:

- men upon reaching 60 years of age and women after 55 years of age;

- recipients of survivor's pensions;

- veterans and disabled people of the Great Patriotic War;

- Disabled people of groups I, II, from childhood and others.

The full list of recipients of land tax benefits can be clarified at local branches of the Federal Tax Service or local administration bodies, since the lists of beneficiaries are periodically adjusted and supplemented. Information on the benefits provided is also available on the official website of the Federal Tax Service in the reference section on rates and benefits for property taxes.

Terms of service

Land tax is a local fee. The procedure and conditions for its payment are fully discussed in Chapter. 31 NK.

The fee is taken from individuals who own land plots based on:

- ownership;

- permanent perpetual lease;

- inheritance as a lifelong owner.

Land tax benefits are provided on the basis of Art. 392 Tax Code for all pensioners.

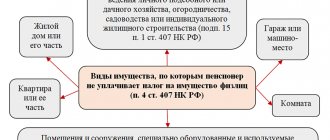

The list of objects for which payment is not charged is given in Art. 389 NK. Among them:

- lands seized or limited in circulation on the basis of Art. 27 ZK (these include territories in which cultural objects, nature reserves, etc. are located);

- areas attached to forest or water resources;

- plots included in the array of common property allocated for an apartment building.

This is interesting: Land tax in the DPR

The following persons are also exempt from payment:

- related to indigenous small northern peoples (if the site is used for fishing, economic activity or the traditional way of life for this people);

- owning a plot of land based on a lease agreement;

- received rights to free use of land (indefinite or urgent).

- having territories included in the property liability of a mutual investment fund (the tax burden falls on the management company itself).

Calculation formula

The amount of the fee is determined according to the standard formula, which is supplemented by a clause on the provision of benefits:

The base is calculated taking into account the cadastral value of the land plot established in the billing period. Its value is indicated in information from Rosreestr.

The rate varies depending on the region, but at the federal level values are established that should not be exceeded:

- not > 0.3% for agricultural plots and agricultural production (including territories occupied for housing and infrastructure, summer cottages and gardening);

- not > 1.5% for other territories.

The CPV is established in shares based on the number of full months during which the payer owned the plot in a calendar year. The value cannot be lower than one. Consequently, if the payer no longer owns the territory, then the fee is charged only for the actual period of possession or use.

If a citizen is the sole owner of a plot, he pays the fee in full. Persons who have registered land as common shared ownership pay only part of the tax equal to the size of their share.

Read the article about the conditions for providing benefits to guardians of minor children.

The privilege is set as a percentage - the values change based on the category of the payer or the type of site.

Land tax benefits for pensioners on 6 acres

The federal preference for owners of land plots for 6 acres is enshrined in Art. 392 NK. Its essence is that when calculating the land tax, the tax base is reduced by the cadastral price of a plot of 600 sq.m. Those. First, the cadastral value of 600 sq.m. is identified. plot in the current year according to the local market, and this amount is deducted from the initial tax base.

The following can take advantage of this opportunity (according to Article 391 of the Tax Code):

- pensioners (working and non-working);

- persons who are entitled to retire on special grounds;

- veterans and disabled people of WWII and other military operations;

- heroes of the USSR and the Russian Federation, holders of the Order of Glory;

- victims of man-made disasters (Chernobyl, etc.);

- disabled people of groups 1 and 2 (including disabled children).

The discount is given only for one of the available storage units. Therefore, owners of several plots will have to choose a specific plot from which a deduction will be provided (regardless of its location, category and type of use).

Those. the owner of an allotment of 10 acres (1,000 sq.m.) after deducting 600 sq.m. from it. All that remains is to pay for 400 sq.m., which is multiplied by the cadastral price of 1 sq.m. plot for a given area. The owners of territories less than 600 sq.m. are completely exempt from paying the fee (if they have one plot of land at their disposal).

How can a pensioner take advantage of land tax benefits?

To receive state benefits for land tax pensioners, you must provide the following to the Federal Tax Service:

- a completed application form for land tax benefits;

- a list of all necessary documents, thanks to which you can be classified as a beneficiary.

NOTE. If, in addition to the pension certificate, you have any other advantages that allow you to receive benefits (can you find them at the link below?), we advise you to confirm this by presenting the relevant documents.

The fact is that the local government can give additional discounts to some preferential categories, for example, the land tax from a pensioner of a labor veteran or a military pensioner can be calculated in a smaller amount than in general from citizens who have reached an honorable retirement age.

Who is eligible to receive benefits?

So, as already mentioned, pensioners were also added to the list of persons who could pay land tax at reduced rates (they are listed).

All pensioners have the right to apply for benefits:

- which the state provides for the payment of pension benefits;

- who are 60 years old (for men) and 55 years old (for women);

- regardless of their material well-being, that is, citizens who continue to work after retirement also have the right to take advantage of this benefit;

- who receive early pension payments or a pension due to the loss of a breadwinner in the family.

How is the new tax deduction calculated?

Depending on various situations, the application of changes to tax benefits for land tax for pensioners may be as follows:

- The pensioner is the owner of a land plot of 0.06 hectares or less. Then the amount of land tax is zero.

- If you own a plot of more than 600 sq. m. of land, then the amount of land tax is calculated only from the area of the plot from which 6 acres are subtracted.

- If a pensioner is the owner of two or more plots of land, then he can receive benefits only for one of them to choose from.

IMPORTANT. You can declare your choice by filling out a notification about the selected land plot to which the benefit will apply and submitting it to the Federal Tax Service before November 1. If the pensioner does not submit such a notification, the inspectorate will independently deduct it in relation to the plot of land where the tax will be the highest.

An example of how to more profitably apply the benefit received

Suppose a certain citizen has 2 plots of land: 9 and 15 acres. The tax rate for both areas is 0.3%. Moreover, the first one is located near the city, respectively - more expensive, the cadastral value of the plot is 3.06 million rubles, 1 hundred square meters, respectively, 340 thousand rubles. For another plot, the cost of one hundred square meters of land is 210 thousand rubles, and the cadastral value of the entire plot will be 3.15 million rubles.

The question is: how can a pensioner pay land tax based on the above conditions? To which land plot is it more profitable to apply the benefit?

If you apply the benefit to the first plot, then the total amount of land tax will be 3060 + 9450 = 12510 rubles. If to the second, then 9180+3780=12960 rubles.

Conclusion: it is more profitable to apply the land tax benefit to the first plot, where the cost of 1 hundred square meters of land is higher.

IMPORTANT. It is not always beneficial to apply a benefit to a plot of land that is larger in area, even if the cadastral value, and accordingly, the total tax amount of the entire land plot, is greater. You must carefully calculate everything and only then submit a notification. Since after submitting a notification, the decision cannot be changed.

You can pay taxes online - it's fast and convenient.

To summarize, we can say that the land tax for pensioners in 2019-2020 has not been canceled as such, but they do not pay it in such amounts as other citizens, since the Russian government has already classified pensioners as a special category that has the right to register benefits – reduced tariffs provided by the state.

Regional relaxations

At the discretion of regional and municipal authorities, pensioners may be offered additional tax benefits. The conditions and procedure for their use must be enshrined in local legislation.

Typically, such concessions are divided into 2 types:

- Exclusion of a certain amount from the collection (along with a deduction of 6 acres).

- Exemption from payment.

You can find out exactly what benefits a citizen is entitled to at his place of residence:

- in territorial divisions of the Federal Tax Service;

- in the reference information on the tax portal by opening the “Land” collection tab and indicating the subject where the payer lives.

In practice, pensioners are not fully exempt from paying the fee only on the basis of reaching the established retirement age or the status of the pension itself. The applicant must meet a number of other requirements, for example, be:

- labor veteran;

- former military officer or employee of another law enforcement agency;

- disabled.

As a result, it may happen that, according to federal standards, a disabled pensioner has the right to only count on a deduction of 6 acres, but local laws allow him not to pay the fee in full. Eg:

- in the Moscow region and the capital itself they do not give any discounts on land tax;

- in St. Petersburg, all pensioners are completely exempt from land tax if their plot is less than 2,500 sq.m.;

- the same preference is also given to military personnel who have retired from service or have served in the ranks of the RF Armed Forces for more than 20 years.

| The benefit is provided for land plots owned by a pensioner: | ||

| Owned | For unlimited use | In lifelong inheritable ownership |

Getting land for free

If the land was in use before the Law “On Property” came into force, was inherited, or was used for the construction of a house, then the allotment is automatically registered in the name of the owner without economic costs. An application is submitted to the local administration with a request to transfer the used land into ownership. This usually happens without difficulty.

There are certain groups of citizens who receive land ownership without paying money for it. The Land Code of the Russian Federation dated March 1, 2015 established standards for the free issuance of plots to certain categories of citizens. According to the law, free allocation includes:

- large families with three or more children;

- families with a dependent disabled child;

- WWII veterans, participants in the siege of Leningrad, workers and veterans of the home front;

- victims of repressions, concentration camp prisoners;

- full holders of the Order of Glory, Heroes of the Soviet Union and Russia;

- families who have lost their breadwinner in a zone of military conflict;

- families living in the village for at least 5 years and working in their place of residence.

In each subject, the list of preferential categories of citizens may change.

The interested party must submit an application to the local government authority dealing with the land issue.

The decision is made individually for each case. If a negative decision is made, it can be appealed in court. You must understand that the allocation of land is free, but the registration of a cadastral passport, land surveying and other services will have to be paid separately.

You can receive land for free only once and only if you do not have ownership rights to another plot of land. A prerequisite is the development of the resulting territory:

- construction;

- planting crops;

- breeding domestic animals in rural areas.

In the Far East, certain plots are allocated to everyone, the main condition being Russian citizenship.

In the Moscow region, it is more difficult to obtain a plot of land for free compared to other regions of the country.

How to apply

An application for a privilege and a number of accompanying documents must be submitted to the Federal Tax Service on behalf of the pensioner (established in Article 396 of the Tax Code).

For a list of benefits for disabled children and their parents, see the article.

Read more about benefits for movable property.

The law stipulates that if tax authorities have information about the existence of the right to discounts, they are obliged to automatically (without a citizen’s request) calculate the amount of the fee, taking into account the deduction.

The notification papers must be received by the Federal Tax Service, but they can be submitted in different ways:

- by mail;

- submitting them directly to the MFC or tax office;

- by sending documents from the payer’s personal account on the Federal Tax Service portal (to send, you need an electronic signature or an already active account on the State Services website).

What documents are needed

In addition to the application, the applicant must provide:

- passport;

- certificate of rights to the site (lease agreement, purchase and sale agreement, extract from Rosreestr, etc.);

- SNILS.

The list must be supplemented by a number of certificates, the composition of which is established on the basis of the basis giving the right to a deduction or exemption from payment. For example, the following documents may be requested:

- conclusion of a medical examination on recognition as disabled;

- a special book confirming the presentation of orders or awards.

Application for provision

The appeal states:

- address and name of the Federal Tax Service branch where documents are submitted;

- Full name and passport details of the applicant;

- request to use a deduction indicating the tax period;

- date and signature.

How to apply for a benefit for 6 acres of land for pensioners?

Owning a country plot of land brings not only the joy of growing fresh vegetables, fruits and flowers, but for it, like for other property, it is necessary to pay a tax to the state treasury. But for many categories of our citizens, the Government made a pleasant gift - it exempted them completely or partially from taxation, for example, it established a benefit for 6 acres of land for pensioners. Payment of land tax

This is interesting: The law on fences between neighbors of individual housing construction

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The Federal Tax Service (FTS) explains who is obliged to pay land taxes and the procedure for calculating them:

- All owners of land plots, regardless of the form of ownership: indefinite or lifelong inheritable ownership of the plot. With the exception of persons who own land by right of lease or executed under a transfer agreement for gratuitous use.

- The objects of tax collection include plots in the area where municipalities and cities of Federal significance are located. Lands limited in market circulation, for example, in places where the cultural heritage of different authorities or nationalities are located, do not include. Also excluded from taxation are plots that are part of historical reserves, archaeological excavations, and museums.

- The calculation of the tax base is based on the cadastral valuation of each specific plot; all information is located in a single Rosreestr database.

The exemption of persons of retirement age from tax on 6 dacha acres is prescribed in Federal Law No. 436 of December 28, 2021.

Deputies of the State Duma adopted it based on the proposal of the President of the country, since pensioners can be classified as a socially vulnerable category of people.

The tax legislation of Russia was supplemented with subsection. 8 clause 5 art. 391 of the Tax Code, which includes another category of beneficiaries - people of retirement age.

The grounds for abolishing taxation for pensioners are also indicated in the Order of the Federal Tax Service of Russia dated March 26, 2018, number MMV-7-21/167.

If the owner of the plot has not previously enjoyed benefits, then he needs to submit a notification to the tax office at the location of the plot about his new status, based on the requirements of the order of the Federal Tax Service of Russia dated November 14, 2017, number MMV-7-21/897.

Therefore, for many citizens of our country, the relevant question is how to apply for benefits for 6 acres for pensioners in 2021, where and who is involved in this registration.

Law

The exemption of persons of retirement age from tax on 6 dacha acres is prescribed in Federal Law No. 436 of December 28, 2021.

Deputies of the State Duma adopted it based on the proposal of the President of the country, since pensioners can be classified as a socially vulnerable category of people.

The tax legislation of Russia was supplemented with subsection. 8 clause 5 art. 391 of the Tax Code, which includes another category of beneficiaries - people of retirement age.

The grounds for abolishing taxation for pensioners are also indicated in the Order of the Federal Tax Service of Russia dated March 26, 2018, number MMV-7-21/167.

If the owner of the plot has not previously enjoyed benefits, then he needs to submit a notification to the tax office at the location of the plot about his new status, based on the requirements of the order of the Federal Tax Service of Russia dated November 14, 2017, number MMV-7-21/897.

For persons who previously enjoyed benefits, for example, Heroes of the Second World War and Russia, disabled people, participants in the liquidation of the Chernobyl accident, the changes will not apply; they, as before, are exempt from paying land tax.

Therefore, for many citizens of our country, the relevant question is how to apply for benefits for 6 acres for pensioners in 2021, where and who is involved in this registration.

Benefit for 6 acres of land for pensioners

The new legislative act established a tax deduction for all pensioners without exception, that is, a reduction in taxation by the amount of the cost of 6 acres of land.

If previously the authorities allowed a deduction of only 10 thousand rubles. from the total cost of the plot, and land tax was levied on the rest of the amount, then from January 2021 there is no longer a need for pensioners to pay their funds to local budgets if the dacha plot is equal to or less than 6 acres.

The benefit applies to the following categories of our citizens:

- Males over 60 years of age.

- Women who became pensioners after 55 years of age.

- In case of loss of a breadwinner.

- Persons who retired early, for example, this applies to medical staff or teaching staff.

Pensioners who continue their working activities can also take advantage of the deduction.

Are there property tax benefits for people with disabilities? See here.

If several areas

The generosity of the authorities is not immeasurable - it is only possible to take advantage of the required deduction for one of the owned plots, and the pensioner himself can choose which of them to apply the new taxation.

The notification must be submitted before the date 01.11 of the current reporting period; after preference has been given to one of the sites and the tax office has been notified about this, it will no longer be possible to change your choice.

The authorities do not insist on submitting documentation for the selected area, its cadastral value and size; all this information is located in the unified Rosreestr database, which is available to the tax authority. But to prevent confusion, you can specify it in the notification by indicating its number by

If for some reason the owner of the plot forgot to submit a notification, then the tax authorities will automatically apply a tax deduction on 6 of the land owned by the pensioner.

Here is an example of writing a notice:

- At the top, the name of the tax authority and the personal data of the pensioner are indicated.

- The text itself contains a reference to the provisions of the Law - clauses 5 and 6.1 of Art. 391 of the Tax Code of the Russian Federation, on this basis, ask for a deduction for land for the previous reporting period.

- Indicate the cadastral number of the plot.

- Provide a personal signature and date of submission.

Persons of other benefit categories should act similarly.

But if the plot exceeds 6 acres, for example, its area is 8 acres, then 6 will be subtracted during the calculation, and taxation will be calculated for the remaining 2 acres of land. For the second, owned plot, you will have to pay taxes in full.

Land tax benefits for pensioners

Tax benefits for pensioners for paying land tax can be of several levels and are prescribed not only in the Tax Code of the Russian Federation.

Federal benefits

Exemption of owners of movable and immovable property of retirement age from payment of relevant taxes can be carried out on the basis of various Federal Laws and the Tax Code of the Russian Federation. Thus, various federal laws provide exemption from land tax:

- heroes of the USSR and Russia;

- WWII participants;

- Chernobyl survivors (military, specialists and workers who participated in the liquidation of the consequences of the Chernobyl accident);

- blockade survivors - people who survived the siege of Leningrad;

- disabled people of groups 1 and 2, etc.

A complete list of persons exempt from paying all types of property taxes on the basis of the Federal Law can be viewed on the Federal Tax Service website.

In addition, representatives of small indigenous peoples living in the northern regions of the country, Siberia and the Far East, as well as their communities that use land plots to preserve and develop their ethnicity: way of life, crafts, management, but already on the basis of the Tax Code of the Russian Federation.

Also, the Tax Code of the Russian Federation provides benefits for all types of pensioners in the country in the form of reducing the area of the land plot on which the tax is calculated by 600 square meters. m (clause 5 of article 391 of the Tax Code of the Russian Federation).

A reduction in the tax base (tax authorities call a tax deduction) is carried out in relation to 1 plot of land. At the same time, the pensioner retains the right to make a choice if there are several plots of land, regardless of the category of land, type of use (ownership or perpetual free use) and location.

Let us illustrate this with several examples.

1. Pensioner L. has two plots: 500 and 700 m2 It seems more logical to make a deduction from 7 acres. But the cadastral value of a smaller plot is almost 2 times higher. Therefore, an application is submitted to deduct 5 hectares from a smaller plot and 1 hectare from a larger one. The law allows such manipulation.

2. Family couple A. of retirement age own 12.6 acres of land under a private house in a rural area. They are registered to the head of the family. You had to pay for 660 m2 of land. On the advice of the tax inspector, they re-registered the plot for two: the husband 6.6 acres, the wife exactly 6 acres. As a result of this operation, the tax base was reduced to 60 m2.

With the increase in the retirement age, from 2021, deductions for paying land tax for women will remain from the age of 55, and for men - from the age of 60.

Local benefits

Land tax is a municipal type of taxation. This means that the Legislative Assembly of federal entities, as well as the cities of Moscow, St. Petersburg and Sevastopol, can establish additional benefits for pensioners, as well as other categories of taxpayers, for example, exempt labor veterans, members of a gardening partnership, persons , over 80 years old, etc.

You can find out about the existence of additional benefits in each region here or call tel. 8 800-222-22-22 (Federal Tax Service contact center).

How to apply?

To take advantage of the tax benefit, you must submit a notification on your behalf to any tax office in your region. She will be redirected through interdepartmental channels to the location of the site.

The following types of submission are allowed:

- By sending a registered letter with a notification text in the established format.

- During a personal visit to your tax department.

- Through the taxpayer’s personal account, if the portal user previously issued permission to enter, they received a personal login and password to visit the Federal Tax Service website from the taxpayer’s personal account.

Even if the notification is not submitted in a timely manner, the benefit will be applied automatically, but to a cheaper plot assessed according to the cadastre.

Therefore, it is better not to miss the deadline, choose the most expensive plot, and send a notification about the application of the deduction to it.

List of documents

If the notification is submitted personally by the taxpayer, then he may be required to:

- Identity card of a citizen of the Russian Federation.

- Certificate of assignment of an individual identification number (TIN).

- A certificate of cadastral valuation of land indicating its registration number in the register.

- Certificate of ownership or an extract from Rosreestr about the existing land plot.

- Notification of application of deduction.

After submitting a set of documentation, take a receipt indicating their receipt with the specified date of registration of the notification. No other documents should be required.