Non-state pension

The question of whether a payment is subject to income tax or not is decided by the Tax Code of the Russian Federation - or more precisely, its Article 217. Here is an exhaustive list of cash income that is exempt from personal income tax.

These are all pensions paid by the Russian Pension Fund, as well as pension departments of law enforcement agencies and the Ministry of Defense.

But there is also the so-called. non-state pensions from non-state pension funds. And they are not provided for in Article 217 of the Tax Code of the Russian Federation. Therefore, such payments are subject to personal income tax - however, only in one case:

- if contributions to the NPF for the employee were made by the employer at one time.

Then the additional pension from the NPF is recognized as the citizen’s income (after all, he did not invest his funds in it). According to the clarification of the Ministry of Finance of the Russian Federation, personal income tax should be withheld from such a pension (letter dated May 8, 2021 N 03-04-05/30927).

If a citizen himself entered into an agreement with a non-state pension fund and paid contributions at his own expense, such a pension will not be taxed.

Property tax deductions for working pensioners

Many pensioners, even after retirement, continue to lead an active lifestyle and carry out various transactions, including with real estate and other property. In such a situation, they are entitled to property tax deductions. The basis for providing such a deduction for a working pensioner is no different from the procedure for a working citizen.

A property deduction is understood as the amount that was previously paid to the state treasury, to the buyer or builder of his home, the land plot that is purchased along with it.

The amount of compensation is only 13% of 2,000,000 rubles, that is, the amount cannot exceed 260,000 rubles spent on the acquisition of property.

Important! There is one difference between working citizens and working pensioners in the procedure for providing this deduction. For a pensioner, it can be carried forward to three tax periods (years) preceding the purchase. This means that personal income tax can be reimbursed for three previous years, and not for one as for an ordinary working citizen.

Non-working pensioners can also receive this deduction, provided that they had income in addition to pensions, which was subject to personal income tax.

Among such incomes of a non-working pensioner are considered:

- proceeds from sales;

- from renting out property and cars;

- from receiving a non-state pension;

- from other cash receipts.

Basic conditions for obtaining a property deduction for a working pensioner:

| Condition | Characteristic |

| Own funds for the purchase of property | Credit is also taken into account. Not taken into account: maternity capital, government subsidies |

| Property location | On the territory of the Russian Federation |

| Pensioner status | Tax resident of the Russian Federation |

Example No. 1. Working pensioner Ivanov A.A. I bought an apartment in 2020. In the same year, he can receive a tax deduction, as well as for the three previous years of work, that is, for 2016-2018. Thus, he returns personal income tax for 4 years.

Important! The main regulatory documents that regulate the receipt of property deductions are the following: Article 220 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated March 30, 2016 No. BS - 3-11/1367, Article 34 of the RF IC.

Targeted social assistance for pensioners

For low-income pensioners who are in difficult life situations, the law provides for targeted social assistance.

It is provided by social security authorities in the form of one-time or monthly payments, according to the rules of the relevant region.

But at the same time, Article 217 of the Tax Code of the Russian Federation (clause exempts only amounts of one-time social assistance from personal income tax. Therefore, monthly payments are subject to income tax (this is stated in the letter of the Ministry of Finance of the Russian Federation dated March 14, 2021 No. 03-04-06/15644).

exempts only amounts of one-time social assistance from personal income tax. Therefore, monthly payments are subject to income tax (this is stated in the letter of the Ministry of Finance of the Russian Federation dated March 14, 2021 No. 03-04-06/15644).

Unfortunately, no changes in this regard are expected in the law.

Tax benefits for pensioners in 2021

One of the measures to support people of retirement age is pension indexation. In 2021, the government plans to index by 6.3% .

A number of tax benefits are also considered:

- Benefits for paying property tax;

- Benefits for personal vehicles;

- Benefits for paying land tax;

- Tax deduction for acquired property;

- Social assistance (one-time payment or provision of a social worker);

- Exemption from paying for major repairs.

Property tax benefits for pensioners in 2021

Every person who has a pension certificate has the right to be exempt from paying property tax. At the same time, several types of property are considered for which a pensioner has the right not to pay taxes.

Having an apartment (room) or a private house, a pensioner may not have to pay property tax for each of these types of housing. If you own 2 apartments or 2 houses, then the exemption is given for 1 property, you will have to pay for the second.

If a pensioner has part of the property (for example, a room in an apartment), then only this part is exempt from payment, the rest must be paid. To clarify information about ownership, you must request a certificate from the Unified State Register.

A garage, a premises not used for profit-raising purposes, is also exempt from tax. Working pensioners have the opportunity to receive a tax deduction for the purchase or construction of a house. To do this, you need to come to the tax authority and fill out an application form. Persons who have reached pre-retirement age can also apply for an exemption to pay property tax.

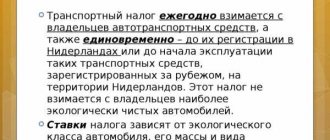

Transport tax benefits for pensioners in 2021

This legislation provides for the payment of tax for the ownership of motor vehicles, regardless of the type of activity and category of citizens. Unfortunately, tax benefits are not provided for in the law at the federal level.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

At the regional level, on the contrary, local authorities can make their own amendments to the law regarding the payment of transport taxes. This can be either partial or complete exemption. You can find out about the provision of benefits in your region on the official website of the Federal Tax Service.

Land tax benefits for pensioners in 2021

The law established in 2021 states that citizens who have reached retirement age and have a pension certificate in their hands are exempt from paying tax on a land plot of up to 6 acres.

Previously, the amount was set at 10,000 rubles. to reduce the payment of land tax, but in 2021 this law was amended.

In 2021, this type of benefit will also continue to apply. In addition, all citizens of pre-retirement age can also receive this type of benefit.

It is worth noting that if the site exceeds the standards established in the bill, the difference will need to be paid. Also, if the property has 2 plots, the benefit is provided only for an area of 600 m2 (6 acres).

To receive benefits, you must contact the Federal Tax Service with an identification document, as well as a pension certificate (if you have one).

Property tax deduction for pensioners in 2021

The legislation provides for a tax deduction in the amount of 30% of the cost of the acquired (one-time) property. Any taxpayer can receive such a payment. To do this, you need to contact the tax authorities with an application for a deduction for the acquired property.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Due to the fact that pension payments are not taxed , a retired person can receive such benefits only if he is currently officially employed.

In the event that a pensioner does not work, he can also receive a tax deduction by submitting an application to transfer the deduction to the previous 3 years.

If a citizen retired in 2021, and acquired property in 2020, then in 2021 he can receive a deduction for 2021, 2019, 2018. But since he no longer worked in 2021 and therefore did not pay taxes, no deduction is due for this year.

Municipal pension

Many municipalities have this practice: local government employees do not receive a pension for long service, but the so-called. monthly supplement to the old-age insurance pension.

And since the Tax Code of the Russian Federation exempts from personal income tax only pensions for long service, and not monthly additional payments, 13% of the amount of municipal maintenance is withheld from such pensioners. The Supreme Court of the Russian Federation has more than once recognized this practice as unlawful (for example, ruling dated November 14, 2021 No. 18-KG16-91).

However, the Ministry of Finance does not change its position, and retired employees have to go to court every time in order to be exempt from personal income tax.

Special categories of citizens

It's no secret that military personnel and employees of the Ministry of Internal Affairs are in a special place with the state. In addition to the standard old-age insurance pension, they are paid a state benefit for long service. Is the pension of the Ministry of Internal Affairs and the Ministry of Defense taxable for long service? The answer to this question can be found in Art. 217 Tax Code of the Russian Federation. In accordance with it, payments for state pensions, along with insurance pensions, are exempt from income tax for individuals. Consequently, pension payments to former military personnel and employees of the Ministry of Internal Affairs are not subject to taxation.

If the pension is saved in a bank account

The law introducing income tax on interest on deposits has already been adopted by Parliament. According to it, personal income tax will have to be paid on the amount of interest that exceeds the established maximum for the year. And it is defined like this:

— the key rate of the Central Bank as of January 1 is multiplied by 1 million rubles.

At the moment, the Central Bank rate is 6% - which means that the tax is levied, conditionally, on interest that exceeded 60,000 rubles during the calendar year. “Conditionally” - because the tax will be charged starting next year, and the key rate of the Central Bank may still change.

For tax purposes, only deposits with a rate of up to 1% are not taken into account. And since banks often charge higher interest on the balance for pension cards (3% or even higher), such accounts are not subject to personal income tax exemption.

This is worth considering for those who have large savings in bank deposits.

Types of benefits for pensioners

For pensioners, the state has provided a list of taxes for which a person can apply and receive benefits.

Land tax benefits

A pensioner has the right to a tax benefit in the form of a reduction in payment by the cadastral value of 6 acres of land owned by him/her by right of ownership/lifelong ownership. This means that a plot of land within a given area is not subject to taxation - no tax payment is provided. If the area exceeds 6 acres, the tax payment on land will be calculated only in that part that exceeds 6 acres.

A pensioner can claim a tax benefit only for the 1st section.

IMPORTANT!

The right to the plot must be registered directly in the name of the pensioner - only in this case will he be able to claim a tax benefit.

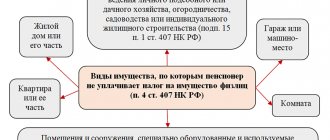

Property tax benefits

A pensioner has the right to receive an exemption from tax payments for:

- apartment;

- House;

- garage;

- parking space;

- outbuilding with an area not exceeding 50 sq.m.

IMPORTANT!

A pre-retirement person can be exempt from tax payments for only one piece of real estate. If a pensioner has two apartments and two garages, the tax exemption will be established for only one apartment and one garage.

Transport tax

Transport tax benefits for pensioners do not apply to federal legislation. Each subject of the Russian Federation, both Moscow and any other, has the right to decide independently whether to provide such a measure of support to pensioners or not. Only the regional legislator decides who, in what amounts in rubles. or percentage and in what order can one claim a benefit for reducing the transport tax rate. In those regions where there is such a benefit for pensioners, it most often amounts to a discount of 50% of the amount of payment required by the pensioner.

Property tax

From 2021, senior citizens are exempt from paying property tax on only one property.

Related article: deduction when calculating property tax.

If a citizen owns several real estate properties of the same category, then he has the right to choose one property for which the property benefit will apply.

When the apartment is in shared ownership, the pensioner does not pay his part of the tax.

In accordance with Article 407 of the Tax Code, the benefit applies to such objects as:

- Apartment.

- Homeownership.

- Garage.

- Country house.

Property benefits are not provided if real estate is used for business purposes.

In addition, real estate with a cadastral passport value of more than 300 million rubles is not subject to preferential tariffs.

It is important to know! List of preferential professions for early retirement

To receive preferential conditions , an elderly person must submit the following package of documents to the tax authorities:

- application of the established form;

- passport details;

- TIN;

- documents for real estate, namely: Certificate of ownership (or extract from the Unified State Register);

- cadastral passport;

- technical certificate;

- document - basis (for example, a contract of sale, gift, etc.);

After receiving the documents, the pensioner receives a receipt from the tax officer confirming the receipt of documents for further consideration. The deadline for submitting documentation is no later than November 1.

The benefit is assigned from the day the application is submitted to the tax office.

When contacting the tax authorities at a later date, tax payments are recalculated for no more than 3 years.