At the end of last year, a law on payments to families with children was adopted. Payments are due at the birth of the first or second child.

The right to receive a monthly payment arises if a child is born (adopted) starting from January 1, 2021, and the average per capita family income does not exceed 1.5 times the subsistence level of the working-age population established in the constituent entity of the Russian Federation for the 2nd quarter of the previous year.

Monthly payments for a second child in 2021: to whom, when and how much. Table with amounts for all regions

Let us remind you that payments for the second child are made by the Pension Fund from maternity capital funds.

Payments for the first child are made by social security authorities. In letter No. 12-1/10/P-1584 dated March 7, 2018, the Ministry of Labor explained some of the nuances of such payments.

What payments are due for the second child in 2018?

At the state level, various ways to support families raising children are being developed. Assistance is provided both in cash and in kind (food, free medicines, etc.). Such measures are beneficial both to the state itself, since they help improve the demographic situation, and to parents, because they solve the problem of temporarily lost earnings while on maternity leave.

Related articles: Single mother's allowance Monthly payment from maternity capital Pension for military pensioners upon reaching 60 years of age

The state guarantees a number of one-time and regular payments to parents and adoptive parents in connection with the arrival of a second child in the family. Legal representatives can receive them, regardless of whether they are working, studying or unemployed. In 2021, future and existing parents will be able to apply for the following types of subsidies:

- One-time:

- when registering a woman at a consultation, clinic or hospital in the early stages of pregnancy (up to 12 weeks);

- the pregnant wife of a military serviceman undergoing military service;

- at the birth of a baby;

- when transferring a minor to a family (adoption, guardianship);

- maternal capital.

- Monthly:

- caring for a newborn until he reaches the age of one and a half years;

- low-income families until the offspring reaches 16 years of age (18 if studying in a general education institution);

- compensation for children until they reach 3 years of age;

- a new allowance for low-income families for children up to 1.5 years of age;

- for a minor whose father is a conscript soldier;

- for children living in the contamination zone (accidents at the Chernobyl nuclear power plant, Mayak production association);

- for the son or daughter of a serviceman in the event of the death of the breadwinner;

- regional subsidies provided for in a particular subject of the Federation.

Indexation of monthly and one-time benefits

Law No. 444-FZ, adopted on December 19, 2016, came into force in January 2021. According to it, all social monetary guarantees are subject to indexation annually to the level of inflation based on the results of the previous year. The date is February 1, since by this time official data on the level of price increases become known. Thus, the indexation of payments for the second child in 2021 was 2.5%, although initially this figure was planned at 3.2%.

Such an increase is unlikely to ensure an increase in the real income of families raising a child. It will only preserve the purchasing power of federal benefits, although most citizens believe that the inflation data provided does not fully reflect the real situation in the economy. As for subsidies assigned at the regional level, the possibility of increasing them is directly linked to the capabilities of the local budgets from which they are financed. For example, in Moscow, assistance to low-income families doubled in 2018.

The only benefit that will not be affected by the adopted law No. 444-FZ remains maternity capital. Since 2015, its size has not been indexed and will remain unchanged until 2021, after which the issue of increasing the amount will be considered additionally. Today, the estimated growth is set at 4%. For now, these are approximate figures, and their exact value will directly depend on the level of inflation at the time the issue is considered.

Amount of benefit for the second child

The amounts of payments for a second child in 2021, in accordance with Law No. 444-FZ, have been indexed since February by the annual inflation rate for 2021. In the table below you can compare how much more money families will receive in ruble terms compared to 2021:

[TABLE IS IN THE ATTACHED FILES]

Federal child benefits in 2021

The Ministry of Labor and Social Protection of the Russian Federation announced that some legislative changes will be made on additional payments. When adopting standards, government officials will become familiar with the financial situation of families. New provisions will be adopted based on the current economic situation. Having complete information about the lives of families, government officials determine whether it is necessary to provide support to citizens and under what circumstances.

Regulations regarding support for families with children are subject to review. Often in large families, parents are unable to provide a full education to their children. To simplify the life of spouses, the Russian government decided to make some legislative changes. They will be effective on February 1, 2021. Study the amounts of benefits (“maternity” and “children’s”), which will be indexed annually taking into account the inflation rate (the indexation coefficient will be approved in January 2021):

| Name of financial assistance | Amounts in 2021 | Amounts taking into account indexation on February 1, 2021. |

| One-time payment to women who registered before the 12th week of pregnancy | 613 rub. | 632 rub. |

| One-time payment at the birth of a baby | 16350 rub. | 16873 rub. |

| Pregnancy and childbirth assistance | 100% of average earnings (at least 34,520 rubles when calculating transfers according to the minimum wage) | 100% of the average salary (not less than 43,652 rubles when calculating transfers according to the minimum wage) |

| Transfers that wives of military personnel will receive | 25892 rub. | RUR 26,720 |

| Help with baby care |

|

|

| Transfers in the presence of conscripted military fathers | 11096 rub. | 11451 rub. |

As mentioned earlier, all benefits are indexed every 12 months. From January 1, 2018, a bill to increase the minimum wage will come into force. The Ministry of Labor decided to gradually increase the existing indicators to the subsistence level. Such changes will be made until 2018. In 2018 government officials increased the minimum wage by 21.7%, subsequently the amount of wages will be equal to 9489 rubles.

One-time benefit for women registered before the 12th week of pregnancy

According to the law, the mother has the right to claim a one-time benefit (when assigning benefits, social security representatives do not get acquainted with the family’s living conditions). Funds are received until the baby is six months old. Transfers of funds are made in the same amount to officially employed and unemployed mothers. If you are not employed, then assistance is processed by the social protection authorities, and the transfer is made from the federal budget. Transfer of funds is carried out for each baby born:

- RUB 16,350.33 from January 1, 2021;

- RUB 16,873.54 from February 1, 2021 (indexation of 3.2% will be taken into account).

If a woman is officially employed, then financial assistance is issued at her place of work. For unemployed or student citizens, the standard for obtaining assistance through social protection at the place of residence or stay will apply. If the family is single-parent, then the procedure for registering a money transfer is greatly simplified. The legal parent does not need to provide a certificate indicating that the other parent has not received money from the state.

For women who have registered, an additional transfer of funds is made. These include a symbolic one-time benefit - 613.14 rubles. (with such one-time compensation you will be able to make some small purchases). From February 1, 2021, this assistance will be equal to 632.76 rubles. To receive money, a woman provides her employer with maternity leave and a certificate of registration for up to 12 weeks. If the woman is not employed, then this transfer is not made.

One-time payment upon birth of a child in 2021

At the birth of a baby, a transfer of funds in the amount of 16,873 rubles is made. Such compensation is issued until the baby is six months old. Guardians are also entitled to receive this assistance. If three or more children were born at the same time, the transfer will be made to the account of the parent or guardian, the amount will be 50,000 rubles. The legislation establishes the deadlines for contacting the authorities, the employer, to obtain assistance. All types of benefits are assigned up to 6 months after the birth of newborns.

Maternity benefit

The size of the transfer that mothers receive depends on what the salary was. The average daily salary for the two previous years is multiplied by 140 calendar days. If you have twins, the number of days increases by 54. Citizens who have not worked anywhere for a long time will be denied the transfer of funds. The argument is that the unemployed woman did not pay taxes for a long time.

Child care allowance

A mother, father, grandmother, grandfather or other relative who will care for the baby up to a certain age can receive benefits. The amount depends on the citizen’s salary and is transferred monthly. If a person is officially employed, then the benefit is calculated based on 40% of the salary received over two years.

One-time benefit upon registration

A pregnant woman who is registered at a consultation or clinic (hospital) at a period no later than 12 obstetric weeks has the right to receive additional benefits. The amount of assistance is fixed and currently amounts to 628 rubles 47 kopecks. The subsidy is not subject to income tax, and it is usually accrued simultaneously with maternity benefits, although you can receive it later - after the main maternity payments have been issued.

To make an appointment, you must take a certificate from the place of registration and submit it along with the application to:

- accounting at the place of main work;

- dean's office (if the expectant mother is a full-time student at the educational institution);

- at the place of service (for female military personnel);

- social insurance fund (individual entrepreneurs apply);

- to the local body of the Social Protection Fund (hereinafter referred to as the FSZN), if the enterprise where the woman worked was liquidated.

Maternity payments in 2021 for the second child

Maternity benefits (hereinafter referred to as Maternity Benefits) are paid to women who are subject to compulsory social insurance at their place of work or service. You have the right to receive it:

- officially employed;

- female students and students of institutions of higher, vocational or secondary vocational education;

- unemployed women who were dismissed from their place of work due to the liquidation of an enterprise, who ceased entrepreneurial activity or private practice, but registered with the Employment Center for 12 months after that.

The duration of maternity leave is not the same for everyone, so the number of days taken into account is determined as follows:

- 140 days – for normal childbirth;

- 156 days – for birth complications;

- 194 – in case of multiple pregnancy.

Officially employed citizens receive maternity benefits based on the average monthly salary for the previous 2 years. If a woman works in her last position for less than six months, accruals will be made based on the minimum wage (hereinafter referred to as the minimum wage). Its value since January 2021 is equal to 9489 rubles. Student mothers receive a B&R benefit in the amount of a scholarship, and officially registered unemployed people receive 628.47 rubles. Women military personnel are paid benefits in the amount of their salary.

The basis for charging money is a sick leave certificate, which can be obtained at a antenatal clinic or other medical institution where the woman was registered. A woman has the right to apply for benefits under the BiR within 6 months after the end of maternity leave. If she did not manage to submit the application within the established time frame, she must provide a document confirming a valid reason or a court order.

Changing the amount of the insurance base for calculating maximum maternity benefits

It is established by law that the amount of maternity benefits cannot be higher than the maximum value of the base that is used to calculate insurance premiums. Based on this value, the maximum possible amount of a lump sum benefit is calculated. From 2021, the size of the base is set at 815 thousand rubles, but to calculate maternity benefits, the value for the two previous years is used:

- 2016 – 718 thousand rubles;

- 2017 – 755 thousand rubles.

Maximum benefit amount

Maternity benefits are calculated based on the average monthly earnings for the previous two years. Along with this, the state has established restrictions on the maximum possible amounts that can be accrued to a young mother. Even if a woman earns a million, benefits will be calculated based on the insurance base for the previous two years. For ease of understanding, consider the following example.

The maximum amount of maternity benefits in 2021 will be calculated based on the amount of the insurance base for 2021 and 2021. – 718 thousand and 755 thousand. After that, it is divided by the number of calendar days – 731, since 2021 was a leap year. The total value is the maximum daily earnings:

(718000 + 755000) / 731 = 2010,05

Having this figure, you can calculate the maximum:

| Childbirth | Number of vacation days | Payment amount, rubles | Calculation |

| Standard | 140 | 282 106,70 | 140 * 2015,05 = 282106,70 |

| Passed with complications | 156 | 314 347,47 | 156 * 2015,05 = 314347,47 |

| When 2 or more babies are born at the same time | 194 | 390 919,29 | 194 * 2015,05 = 390919,29 |

Minimum payments for a second child in 2018

According to Federal Law No. 421-FZ dated December 28, 2017, from January 1, the minimum wage increased and amounted to 9,489 rubles. This amount is taken to calculate the minimum benefit for BiR. Such assistance is paid to women who:

- worked less than six months before going on maternity leave;

- the amount of allowance received was less than the minimum wage.

To calculate, the minimum wage is multiplied by the number of months for two years (24) and divided by the total number of days in 2021 and 2021. – 731, because 2021 was a leap year (365 + 366 = 731). According to calculations, the result obtained will be equal to the minimum payment for one day:

9489 * 24 / 731 = 311.54 rubles.

We multiply this value by the number of vacation days, the result is:

| Childbirth | Number of vacation days | Payment amount, rubles | Calculation |

| Standard | 140 | 43 615,65 | 140 * 311,54 = 43615,65 |

| Passed with complications | 156 | 48 600,30 | 156 * 311,54 = 48 600,30 |

| When 2 or more babies are born at the same time | 194 | 60 438,83 | 194 * 311,54 = 60438,83 |

What is required for child care in 2021

Assistance up to 1.5 years is paid immediately after sick leave for pregnancy and childbirth - maternity leave. If you are officially employed, the funds are transferred by the employer. The money comes to the account 2 months after the birth of the baby. The amount depends on the average earnings of the mother or father (if maternity leave is issued for him). There are separate standards for the payment of funds to unemployed citizens. If children are from 1.5 to 3 years old, parents have the right to claim only compensation benefits.

Up to 1.5 years

The legislation establishes specific payment amounts. Officially employed citizens have the right to claim the amount of 3163 rubles. for the first newborn, for the subsequent baby - 6327 rubles. Transfers can be up to 24,536 rubles. If the organization is liquidated, the mother will receive 40% of her salary for the last 2 years during maternity leave. The benefit is registered with the social protection authority. The limit amount is 12262 rubles.

Officially unemployed citizens of the Russian Federation have the right to apply for financial assistance - 3163 rubles. Payments for the birth of a second child in 2021 will amount to 6,327 rubles. If the mother went on maternity leave in 2014, and in 2021 another baby appeared and maternity leave was issued again, then when calculating the amount of benefits, not 2015 and 2021, but 2012 and 2013 will be taken into account.

Before reaching 3 years of age

If desired, the mother has the right to extend maternity leave until the baby reaches 3 years of age. The employer will pay compensation - 50 rubles. These transfers are made regardless of how many children there are in the family. The specified amount of compensation does not apply to citizens living where radiation has spread or who have a preferential socio-economic status. For example, residents of Chernobyl submit transfers in the amount of 6,000 rubles, military personnel have the right to submit an application in the amount of 10,528 rubles.

Deputies of the State Duma of the Russian Federation in October 2018 proposed to approve legislative changes regarding the monthly transfer of funds to new parents with children from 1.5 to 3 years old who have not received a place in a nursery or kindergarten. Deputies of the State Duma of the Russian Federation offered financial assistance equal to 3,000 rubles.

One-time payment upon the birth of a second child

At the federal level, the only benefit established is for the birth of a baby. It is paid to one of the parents (and they do not have to be officially married) or to the person replacing them. The one-time payment for the second child in 2021 is 16,759 rubles 09 kopecks. This amount is the same for all citizens, regardless of whether they are employed, students or unemployed.

For residents of some regions, the amount of the child benefit can be adjusted upward through the use of the so-called “regional coefficient”. The increase applies to those citizens who live and/or work in areas with difficult climatic conditions. The value of the indicator is different for each region. So, for example, in Kamchatka it is 1.8, while in the Krasnoyarsk Territory it is only 1.5.

Registration procedure

Birth benefits can be received until the child is 6 months old. No assistance is paid for the birth of a stillborn baby. Upon divorce, a one-time subsidy is assigned only to the parent (legal representative) with whom the newborn lives. The registration procedure consists of several interrelated stages:

- Register the newborn in the registry office and receive a certificate.

- Collect the required documents.

- Provide paperwork for calculating benefits to the appropriate authority.

Where to contact

One of the parents or a person replacing them has the right to receive a lump sum payment for a newborn - this provision is given in Law No. 81-FZ (05/19/1995). Depending on the social status of the applicant, you need to apply for the accrual:

- to the accounting department or human resources department at the place of work, or to the local branch of the Social Insurance Fund (hereinafter referred to as the Social Insurance Fund), if parents are subject to compulsory social insurance in connection with maternity or temporary disability;

- to the social protection authorities or the Multifunctional Center (MFC) - for students and unemployed citizens, regardless of whether they are registered with the Employment Service or not.

The required amount is transferred through the cash desk of the organization where the applicant works, to his bank card (account) or by money transfer. The employer pays the money no later than 10 working days from the date of application. When receiving assistance through the Federal Social Security Fund, funds are transferred no later than the 26th day of the month following the month in which the application was submitted.

What documents are required

One-time cash assistance for a newborn is paid on an application basis. This means that one of the parents or a legal representative must independently contact the body that calculates the benefits, providing a certain package of documents. The exact list of documents depends on the social status of the applicant. From the main list you need to highlight the following:

- statement;

- parents' identity documents;

- a certificate in form 24 about the birth of a baby, issued by the civil registry office;

- birth certificate;

- Marriage certificate;

- divorce certificate;

- certificate in form 25, if the paternity of the newborn has not been established;

- a certificate indicating that the second parent was not assigned such benefits;

- certificate of cohabitation with the newborn (if the parents are divorced);

- a certificate from the dean’s office that the applicant is a student or full-time student;

- parents' pension insurance certificate;

- work book (for the unemployed).

How to apply for a lump sum benefit for the birth of a child

After registration of financial assistance, funds will be transferred to you - 16,873 rubles. This monetary compensation should be issued before the baby turns 6 months old. To receive money, you need to contact the HR department at the enterprise. If a woman is not officially employed, then the social service will handle the registration of financial assistance; female students should contact the dean’s office of the educational institution.

What documents are needed

To obtain assistance, find out about the certificates that need to be prepared. Financial assistance for the birth of a newborn is possible if you have:

- Statements.

- Birth certificates.

- Parents' pension insurance certificate.

- Certificates from the housing department confirming that the applicant lives together with a minor.

- Parents' passports.

- Extracts from the work book.

- Certificates stating that assistance from the state has not been previously provided.

Unemployed citizens additionally provide a copy of their passport and work book. Amount 50,000 rub. obtained from the USZN at the place of residence upon presentation of:

- applications for the purpose of funds;

- passports;

- birth certificates;

- certificates of newborns living together with their parents or guardian.

Allowance for a second child up to 1.5 years old

While on leave to care for a newborn until he reaches the age of one and a half years, a parent, guardian or other representative directly caring for the baby (for example, a grandmother or other relative) receives a benefit, the amount of which is established by law and differs depending on the social status of the person. The amount of payment for the second child in 2021 has the following values:

- Employed citizens for whom the employer contributes funds to the Social Insurance Fund. The amount is equal to 40% of the average salary, but cannot exceed 24,536.57 rubles. Provided that care is provided simultaneously for several children under the age of 1.5 years, the benefits are summed up, but the total value cannot exceed 100% of the average earnings.

- Unemployed citizens, students and those whose last job experience does not exceed six months receive a minimum allowance for their second child. Since February 2021, the amount has increased by 2.5% compared to the previous value and amounts to 6284.65 rubles.

- For citizens dismissed due to the liquidation of an enterprise, as well as for military personnel, the maximum amount of monthly assistance is set at 12,569 rubles 33 kopecks.

- From January 1, 2021, low-income families have the right to receive a new benefit for their second child. To be calculated, it is necessary that the average monthly income for each family member (including children) is no more than one and a half times the subsistence minimum (hereinafter referred to as the subsistence minimum) established for an adult in the region of residence of the family. The amount of the subsidy is an amount equal to the minimum subsistence level for a minor, established in the 2nd quarter of the previous year in the same subject.

Regional payments

Pay attention to transfers for regional programs. Financial assistance is issued only to some Russian citizens, because it is provided in certain regions. However, if a baby or several children are born, it is important to find out in advance what regional transfers are and how such material support is processed.

One-time payments at the birth of a child in Moscow

Many young families live in the center of the country. People living in Moscow can apply for:

- transfer of the amount - 5500 rubles, if the firstborn is born.

- amount 14500 rub. at the birth of children after the firstborn.

Luzhkov payments

Not all citizens of the Russian Federation know what the Luzhkov payments are, which were established in 2004 by a decree of the Moscow Government. Luzhkov payments for the birth of a child in 2021 will be made according to the old rules (the procedure is established in a separate standard). To receive money, you must meet the following criteria:

- spouses under 30 years of age;

- Permanent residence in Moscow;

- Russian citizenship of the father or mother.

Payments upon the birth of the first child in 2021, according to the program, are made in the form of an amount equal to five times the subsistence level. When a second newborn appears, you can claim an amount equal to seven times the minimum subsistence level. The third child receives a benefit equal to ten times the minimum subsistence level. The latter option of assistance is rarely issued, because a third child is rarely born to spouses under 30 years of age. When triplets are born, benefits are accrued for each newborn.

- Cystitis - treatment at home with folk remedies and medicines

- What date and time do the clocks change to daylight saving time?

- Stevia herb for diabetes

At the birth of three or more children

Families with three or more children are rare. For exceptional cases, the government of the Russian Federation has made some changes to the legislation. These standards help families live more fully. If you have three newborns, you can count on financial assistance in the form of a one-time benefit in the amount of 50,000 rubles.

Monthly payments at the birth of a second child from maternity capital in 2021

One of the significant measures to support families where a child was born or adopted is maternal (family) capital. Certificates have been issued since 2007. Initially, it was planned that the state program would operate only for the next five years, but subsequently a decision was made to extend it. Currently, the support has been extended until 2021. Initially, funds from maternity capital were allocated to the education of the offspring, the mother’s pension, the rehabilitation of a disabled child, or the solution of a housing issue.

Starting from 2021, it was decided to add one more item - payments for a newborn until he reaches 1.5 years of age. Only low-income citizens who have cash receipts for each family member in an amount not exceeding one and a half times the monthly subsistence minimum, which was recorded as of the 2nd quarter of the previous year, can take advantage of the assistance. Monthly payments at the birth of a second child in 2021 from the family capital amount to the minimum subsistence level established by the regional authorities for a minor.

Who can apply for

According to the law, a certificate is issued to the mother, father (in case of deprivation of parental rights or death of the mother), and child (if parents are deprived of rights). To receive money, the family must not only be low-income, but also meet some other requirements:

- the baby was born after January 1, 2021;

- the baby is a citizen of the Russian Federation;

- one of the parents has a Russian passport.

To calculate the average per capita income, all revenues to the household budget are summed up without deduction of personal income tax (NDFL) for the year. The result is divided by 12 months and then by the number of members involved in the calculation (parents, children, parent's spouse). If the amount received is less than 1.5 times the minimum monthly wage, which was established in the 2nd quarter of the previous year, the family is considered low-income. The table below provides an overview of the items that are included or excluded when calculating total income:

| Turns on | Doesn't turn on |

|

|

At what age can a child spend maternity capital?

According to the information provided on the Pension Fund website, a monthly allowance is assigned until the child reaches the age of one and a half years, and every year it is necessary to write a new application to the territorial body of the Pension Fund of the Russian Federation. One month is allotted for consideration, plus a maximum of 10 working days for the transfer of money to the bank account of the applicant-owner of the certificate. Accrual is made:

- from the date of birth, if the application was submitted in the first six months after the birth of the baby, and payment will be made for all previous months;

- from the date of application, if the application was received after the newborn was 6 months old.

How to apply

If the family’s income is low-income, payments for the second child in 2021 from maternity capital funds can be arranged by following the following algorithm:

- Register the baby with the registry office and receive a birth certificate.

- Collect additional documents necessary for assigning a monetary allowance and confirming your difficult financial situation:

- identification documents of the applicant and all family members;

- documentary evidence of family income;

- Marriage certificate;

- divorce certificate;

- certificate of compulsory pension insurance for each family member;

- documentary confirmation of the citizen by the guardian;

- bank account number to which transfers will be sent.

- Submit the application and the collected package of papers to the territorial branch of the Pension Fund of the Russian Federation at your place of permanent residence.

- Wait for the results of the consideration of the appeal. The period allocated by law for this procedure is one month.

- Within five days, the applicant receives a notification of refusal or approval.

- Start receiving money. The first time – within 10 working days from the date of application.

Benefits for the first and second child in the Moscow region: how to receive and calculate the amount of payment

On January 1, 2021, the payment of new presidential benefits for the first and second child under the age of 1.5 years began in the Moscow region (from January 1, 2021 - up to 3 years). We are talking about a monthly allowance for the first child and payments from maternity capital for the second child. Before new legislative changes came into force, maternity capital could only be used when a child reached the age of 3 years. Benefits are designed only for families with low incomes who require government support. Read about how to receive new benefits and what the size of these payments is in the material of the mosreg.ru portal.

Amount of benefits and recipients

Source: Photobank of the Moscow Region, Viktor Anashkin Monthly benefits for the first and second child are paid from the federal budget and are regulated by Federal Law No. 418 “On monthly payments to families with children.”

Payments for the first child can be assigned not only to the child’s mother, but also to his father, as well as adoptive parents or guardians. At the same time, new monthly payments for the first child do not cancel the possibility of receiving other benefits.

The recipient of the payment for the second child can only be the one for whom the state certificate for maternity capital is issued - most often this is the mother of the child.

To process the payment, it is necessary that the child was born or adopted after January 1, 2021 and is a citizen of the Russian Federation. Requirements are also imposed on family income, which should not exceed 1.5 times (from January 1, 2021 - two times) the subsistence level of the working-age population established in a given subject of the Russian Federation in the second quarter of the year preceding the year of application for payment.

The transfer of benefits for the first child is carried out through the regional authorities of social protection of the population, and for the second child - through the management of the Pension Fund of the Russian Federation, since this payment is part of the maternity capital, the amount of which currently amounts to 453,026 rubles.

The benefit cannot be assigned if the children are fully supported by the state. Also, parents deprived of parental rights cannot receive payments.

Implementation of the maternity capital program in the Moscow region. Infographics>>

How to calculate family income

Money in wallet

Source: Photobank of the Moscow Region, Alexander Kozhokhin To calculate income, you need to divide the total family income for the last year by 12, then divide the resulting number by all family members, including children. You can apply for a payment if the amount received is less than 1.5 times (from January 1, 2021 - two times) the subsistence level of the working population in the region for each family member. Income includes salaries, bonuses, pensions, social benefits, scholarships and compensation. Material assistance from the federal budget in connection with emergencies or terrorist attacks, as well as income from bank deposits are not taken into account.

The amount of payment per child is equivalent to the regional child subsistence minimum.

The number of large families in the Moscow region has increased by 5 thousand in a year and a half>>

How to apply for benefits

Work of the Multifunctional Center for the Provision of State and Municipal Services

Source: Photobank of the Moscow Region, Roman Vartsev Submission of applications for payment of benefits in the Moscow region is carried out in a single manner. The set of documents may be individual for each family, so the center staff should help parents create the necessary package.

The minimum list of documents includes the following:

- passports of parents (applicants);

- birth certificate of the child (about the birth of children - if this is the second child);

- Marriage certificate;

- documents confirming family income.

If we are talking about a second child, then you can submit two applications at once: to receive a certificate for maternity capital and to establish a payment. The application review period is 30 days. The funds will be transferred to the citizen’s account in a Russian credit institution.

You can apply for a monthly payment from January 1, 2021. Moreover, it can be submitted within 1.5 years from the date of birth of the child (however, if you apply in the first 6 months, funds will be paid for all months preceding the filing of the application). If you apply later than six months, the payment will be established from the date of submission of the application.

The decision to assign payments is made for a period of one year. After this period, the applicant must submit a new application and submit documents on income. For the first baby, it can be submitted to the social protection authority or to the MFC. To apply for money for a second child, documents are sent to the Pension Fund or MFC.

How can you spend maternity capital in the Moscow region>>

Termination of payments

Visit to Mytishchi November 2, 2017

Source: Press service of the Governor of the Moscow Region, Alexander Kozlov Benefit payments are terminated in the following cases:

- upon refusal to receive payment;

- if the child has reached the age of 1.5 years (from January 1, 2021 - 3 years);

- in case of deprivation of parental rights of an applicant receiving child benefit;

- in the event of the death of a child for whom the benefit is issued;

- in the event of the death of an applicant receiving child benefit;

- when a family moves to a permanent place of residence in another subject of the Russian Federation (it is necessary to notify about the move one month in advance, and then arrange a payment at the new place of residence, if the family income is less than 1.5 times (from January 1, 2021 - two times) the subsistence minimum for an able-bodied person population in the region);

- in case of complete expenditure of maternity capital funds (in case of receiving benefits for the second child from maternity capital funds).

How to enroll a child in kindergarten in the Moscow region>>

Ivan Pyshechkin

Maternity capital in 2021

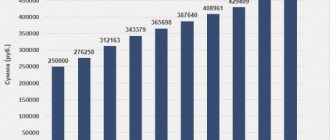

A certificate for maternal capital is issued at the birth or adoption of a second and subsequent children. The national program was first introduced in 2007 as one of the measures for social protection of families during the economic crisis. Then the amount of support provided was 250 thousand rubles. At the moment, the campaign for issuing certificates has been extended until 2021. Every year the government indexed this value, but since 2015 it was decided to freeze the amount at the level of 453,026 rubles until 2021, therefore, taking into account inflation, it depreciates every year.

Every year, rumors circulate in the press about all kinds of payments from maternity capital and its increase. For this reason, the government made a statement that one-time assistance from the family capital in the amount of 25 thousand and an increase in the amount by 3 children to 1.5 million should not be expected. In addition, all certificate holders were reminded that funds from maternity capital can only be received by non-cash means. All methods of cashing out money are illegal.

Directions for use

. According to the information provided on the Pension Fund portal, it is allowed to send money at the discretion of the recipient to:

- Improving living conditions:

- initial payment for a mortgage or shared construction;

- repayment of interest and principal on the loan;

- purchase, construction or reconstruction of residential premises.

- Education:

- for paid training;

- for use of the hostel;

- nanny payment;

- maintenance, care and supervision of a minor in an educational organization.

- Mother's funded pension by placing funds in trust for non-state pension funds and other management companies.

- Social adaptation of disabled children and their integration into society through the acquisition of necessary goods and services, a list of which can be found in Decree of the Government of the Russian Federation No. 831-r (04/30/2015).

- Monthly payments for a newborn up to 1.5 years of age in the amount of the monthly minimum established for a minor in the region of residence of the family for the 2nd quarter of the previous year. The only point of the program when funds are transferred to a bank account, and their use is not controlled.

Governor's payments for a second child

In some regions, additional one-time financial assistance is provided for the birth of a second child. This benefit is not available in all constituent entities of the Russian Federation. At the beginning of 2021, their number is about 50. Depending on the region, gubernatorial payments are assigned differently. For example, in the Moscow region, allowances are issued to all families, regardless of income level, while in the Tula region, only families whose budget is below the subsistence level can apply for support.

The amount of support also varies depending on the region and the capabilities of local budgets:

| Minimum amount | Maximum amount |

|

|

One-time assistance in Moscow and St. Petersburg in 2021

For women who became parents for the second time and live in the capital, several types of one-time payments are provided for their second child in 2021. Compared to 2021, their size has increased significantly (up to 2 times or more):

- For young families where the parents have not reached the age of 30, and one of them has Russian citizenship and a capital residence permit. You can receive an amount of 7 PM within 12 months from the date of birth of the baby.

- If a family has two or more babies at the same time during the second birth, the support will amount to 50 thousand rubles per family. You can apply for money within six months after birth.

- Compensation in the amount of 14.5 thousand rubles is paid to one of the parents. The goal is to reimburse expenses for the birth of a child.

In the northern capital, young mothers are also promised additional support. You can get it on an application basis. The money is allocated from the city budget and is intended for the purchase of food and necessary goods. The amount in 2021 is 39,788 rubles. (in 2021 - 37,678 rubles), and you can receive it within 18 months after the birth of the baby.

Social payments for a second child in 2018 for certain categories of citizens

The number of subsidies that are intended for the birth or adoption of a second child depends on the region of residence of the family and the social status of the applicant. The financial assistance provided becomes more targeted every year. This goal was set by the government to provide support to families who need it most. To receive one-time and regular subsidies, a citizen must independently contact the relevant government agency.

For military wives

The birth of a baby in a family does not exempt a man of military age from performing compulsory military service. The state understands that it will be difficult for the wives of soldiers at this time, so additional support from the federal budget is provided for expectant and established mothers. Based on Resolution No. 74, the following payment amounts have been established since February 1:

- one-time benefit to the wife of a conscript soldier with a pregnancy period of more than 180 days - 26,539 rubles 76 kopecks;

- the monthly allowance for a child of a military man while the father is serving in military service is 11,374 rubles 18 kopecks.

Single mothers

Women raising children on their own hope for additional help from the state. They are entitled to the same payments as other mothers. The only difference is the amount of the subsidy received - for single mothers it is higher. The additional payment goes through regional budgets. To receive monthly subsidies, you must contact the social security authorities to confirm your status annually. Otherwise, accruals will be suspended.

For disabled children

If a child with developmental disabilities was born or adopted into a family, mothers or legal representatives can count on, in addition to benefits, additional payments for a second child in 2021:

- Caring for a disabled child:

- parents, guardians, adoptive parents - 5500 rubles;

- legal representatives – 1200 rub.

- One-time benefit when transferring a disabled child to a family - 128,058.88 rubles.

- Regional surcharges, the size and purpose of which are strictly individual in each region.